Losing your job is stressful enough—the last thing you need to worry about is losing your health coverage, too. Fortunately, you don't have to go without. Your main lifelines for getting health insurance without a job are continuing your old plan through COBRA, finding a new one on the ACA Marketplace, or, if your income is now low enough, applying for Medicaid.

The first thing to understand is your eligibility for a Special Enrollment Period. This is your golden ticket to getting a new plan right away.

Your First Steps After Losing Job-Based Coverage

That moment when your job-based health insurance ends can feel like the floor has dropped out from under you. But take a deep breath. You have several clear pathways to get new coverage, and it's all about figuring out which one makes the most sense for your health and your wallet right now.

The good news is that it's much easier to find coverage today than it was years ago. Before 2010, the situation was tough, with nearly 49 million Americans uninsured. The Affordable Care Act (ACA) completely changed the game by creating health insurance marketplaces and expanding Medicaid, which cut the uninsured rate almost in half by 2023.

The Special Enrollment Period: Your 60-Day Window

When you lose your health insurance from an employer, it triggers what's called a Special Enrollment Period (SEP). Think of it as a crucial 60-day window that lets you sign up for a new plan outside of the usual fall Open Enrollment season.

Don't let this 60-day window close on you. If you miss it, you could be stuck waiting months for the next Open Enrollment period, leaving you completely uninsured in the meantime.

This is your chance to jump onto the official health insurance marketplace and see what's available. The federal marketplace, HealthCare.gov, is designed to make this as painless as possible.

The site walks you through checking if you qualify for a new plan, seeing if you can get financial help, and comparing all your options in one place.

Comparing Your Immediate Options

So, what are your choices? Your decision will likely boil down to a few key options, each with its own pros and cons.

Here’s a quick rundown to help you see the differences at a glance.

Quick Comparison of Your Health Insurance Options

| Option | Best For | Typical Cost | Key Feature |

|---|---|---|---|

| COBRA | Keeping your exact doctors and plan continuity. | Very High | Lets you continue your employer's plan for up to 18 months. |

| ACA Marketplace | Finding affordable, comprehensive coverage with subsidies. | Varies (often low with subsidies) | Income-based financial help can dramatically lower premiums. |

| Medicaid | Individuals and families with very low income. | Free or Very Low-Cost | Provides comprehensive benefits at little to no cost. |

| Short-Term Plan | A temporary, catastrophic-only bridge between plans. | Low | Limited coverage that doesn't meet ACA requirements. |

Each path serves a different need.

- COBRA lets you keep the health plan you know and love from your old job. This is perfect if you want to stick with your current doctors and have no interruptions in care. The catch? It's expensive, since you're now paying 100% of the premium (plus a small admin fee).

- ACA Marketplace Plans are sold on government exchanges and are often much more affordable. If your income has dropped, you’ll likely qualify for subsidies that significantly lower your monthly payments.

- Medicaid is a safety net. If your income has fallen drastically after losing your job, you may be eligible for free or very low-cost coverage through your state’s program.

Successfully navigating a health insurance gap between jobs means you have to weigh these options carefully. Understanding what each one offers is the first step toward making a confident choice that protects both your health and your finances.

Navigating the ACA Health Insurance Marketplace

If you're trying to get health insurance without a job, the Affordable Care Act (ACA) Marketplace is almost always the best place to start. It’s a government service, found at HealthCare.gov, built specifically to help people find and sign up for coverage on their own.

The single biggest reason to look here? Financial help. The Marketplace offers subsidies that can drastically lower what you pay each month, all based on what you expect your income to be for the year. In fact, 90% of people who sign up through the Marketplace get some kind of financial assistance.

How to Estimate Your Income When It's Unpredictable

This is the biggest hurdle for most people. How do you estimate your annual income when you're out of a job?

The key is to think about your total household income for the entire calendar year, not just what you were making before.

You'll need to add up all the potential money coming in for the rest of the year. This includes:

- Unemployment checks

- Any freelance or gig work you're doing

- Your spouse's income

- Money from a part-time job you might pick up

- An educated guess at your salary from a new job you hope to land

Let's imagine a real-world scenario. Sarah, a graphic designer, lost her job in March. She’s now getting $500 a week from unemployment and has picked up some freelance projects bringing in about $1,000 a month. She's hoping to be back in a full-time role by September.

To figure out her income, she’ll add it all together: her salary from January to March, her projected unemployment benefits, her freelance earnings, and a conservative guess for her salary in the last four months of the year. That final number is what she’ll use on her Marketplace application to see what kind of help she can get.

Pro Tip: It's much better to slightly underestimate your income than to overestimate it. If you end up making more money than you projected, you might have to pay back some of the subsidy when you file your taxes. But if you make less, you could get a bigger tax refund. Remember to update your application as soon as your income situation changes.

Understanding the Metal Tiers

Once you start browsing plans, you'll see them organized into metal tiers: Bronze, Silver, Gold, and Platinum. This isn't about the quality of care—every plan has to cover essential health benefits. It's about how you and the insurance company split the costs.

Here's a quick breakdown:

- Bronze: These plans have the lowest monthly payments (premiums) but the highest costs when you actually need medical care. It’s a solid choice if you're healthy and just want a safety net for a major medical emergency.

- Silver: Think of this as the middle ground—moderate monthly premiums and moderate out-of-pocket costs. This is important: Silver plans are the only ones where you can get extra savings called Cost-Sharing Reductions (CSRs), which lower your deductible and copays if your income is below a certain level.

- Gold & Platinum: You'll pay the highest monthly premiums here, but your costs will be the lowest when you go to the doctor. These plans make sense if you know you'll need frequent medical care.

Don’t just look at the monthly premium. You have to compare the plan's deductible, copays, and coinsurance. A cheap-looking Bronze plan might have a massive deductible, meaning you'd pay thousands out of your own pocket before your insurance even starts to help.

And one final, crucial step: check the plan’s network to make sure your doctors and local hospitals are included. A great plan is useless if you can't see the providers you trust.

Deciding if COBRA Coverage Is Worth the Cost

The biggest draw of COBRA is simple: continuity. You get to keep the exact same health plan you had with your old job. No scrambling to find new doctors, no worrying if your prescriptions are still covered.

If you're in the middle of medical treatment, this can feel like an absolute lifesaver.

But that continuity comes at a pretty steep price. While you were working, your employer was likely paying a big chunk of your monthly premium. Now, with COBRA, the entire bill is yours—100% of the cost, plus a small administrative fee of up to 2%. The sticker shock is real.

Calculating the True Cost

Before you write off COBRA because of that high monthly bill, it's really important to do the math for your own situation. The premium isn't the only number you need to look at.

Let’s imagine a real-world scenario. Mark lost his job in August. His family has a high-deductible plan, but they’ve already paid $4,000 toward their $5,000 family deductible this year because his son had a minor surgery back in the spring.

If Mark jumps over to a new ACA Marketplace plan, that deductible progress resets to zero. He'd have to start all over again. If another medical issue pops up before December, he could end up paying thousands more out-of-pocket. For him, paying that high COBRA premium for just a few months might actually be the cheaper choice overall.

COBRA is often a short-term strategic choice, not a long-term solution. It can be the smartest financial move if you've already met a significant portion of your deductible or expect to start a new job with benefits very soon.

When COBRA Makes Sense

Deciding on COBRA is more than just a quick premium comparison. It’s a personal calculation based on your health, your finances, and your timeline.

Here are a few situations where that high cost might be completely justified:

- You've Met Your Deductible: Just like Mark, if you're close to hitting your annual deductible or out-of-pocket maximum, sticking with your current plan saves you from starting over at square one.

- You Need Network Stability: If you or someone in your family is getting treatment for a serious condition, keeping your specific doctors and specialists is non-negotiable.

- You Have a Short Coverage Gap: Have a new job lined up to start in a month or two? COBRA can be a simple—though expensive—way to bridge that gap without disrupting your care.

In the end, while lots of people find fantastic and affordable coverage on the Marketplace, it's always smart to compare it directly against your COBRA offer. And if you find the cost is just too high, exploring COBRA insurance alternatives is the clear next step.

Exploring Medicaid And CHIP For Low-Cost Coverage

When your income drops suddenly after a job loss, programs like Medicaid and the Children's Health Insurance Program (CHIP) become a lifeline. These aren't just obscure government programs; they are a critical safety net designed to provide comprehensive health coverage for very little—or even zero—cost.

This is a huge deal for eligible adults, kids, pregnant women, and people with disabilities.

One of the best parts? You don’t have to wait for a special enrollment period. If you qualify for Medicaid or CHIP, you can sign up anytime. That’s a massive relief when you're dealing with an unexpected layoff. The eligibility is based on what you’re earning now (your current monthly household income), not what you made earlier in the year.

State Rules Make All The Difference

Here's something you absolutely need to know: the rules for Medicaid are not the same in every state. It’s not a one-size-fits-all system. Your eligibility really hinges on whether your state decided to expand its Medicaid program under the Affordable Care Act.

- In Medicaid Expansion States: Things are much more straightforward. If your household income falls below 138% of the federal poverty level, there's a very good chance you’ll qualify. It’s that simple.

- In Non-Expansion States: The rules get a lot tighter. The income limits are significantly lower, and you often have to meet other strict criteria. For example, you might only qualify if you are pregnant, have kids, or have a disability, even if your income is extremely low.

This difference is everything. You can check your state’s status and the specific income guidelines on the official Medicaid website. Or, just start an application on HealthCare.gov—the system is smart enough to flag your application for Medicaid if your income is in the right range and will send it to your state's agency.

There's a common misconception that owning a car or a home will disqualify you from Medicaid. For most people applying based on income, that’s just not true. Those assets usually aren't counted.

How To Apply And Get Covered

The process is designed to be as simple as possible. You can apply directly with your state’s Medicaid agency or fill out an application through the HealthCare.gov Marketplace. If it looks like you qualify, your application gets routed to the right place automatically.

Medicaid coverage is incredibly thorough. It typically includes everything from doctor visits and hospital stays to prescription drugs, often with no monthly premium and tiny (if any) copayments.

And for families who earn a bit too much for Medicaid but still can't afford a private plan, CHIP steps in. It provides a similar level of high-quality, low-cost coverage for kids. To see if these programs are the right path for you, you can learn more about health insurance for low-income workers.

Don't just assume you won't qualify. The only way to know for sure is to apply.

What About Short-Term Plans and Other Options?

Beyond the big players like the ACA Marketplace and COBRA, you'll almost certainly stumble upon short-term health plans. They catch your eye with those super-low monthly premiums, but you have to look closer. Before you even think about signing up, you need to understand exactly what you’re giving up for that lower price tag.

Think of these plans as a flimsy umbrella in a hurricane. They might offer a little protection in a true catastrophe, but they’re not built for real-life healthcare needs. They don't have to play by the same rules as ACA plans, which means they can—and almost always do—leave huge, costly gaps in your coverage.

Where Short-Term Plans Fall Short

These plans are famous for their limitations. When you're trying to get health insurance without a job, be warned that most short-term policies do the following:

- They can deny you coverage flat-out for pre-existing conditions.

- They often exclude essential health benefits like prescription drugs, mental health care, and maternity services.

- They might cap what they’ll pay with annual or lifetime dollar limits, leaving you with the rest of the bill.

For example, if you have a known health issue—even something as common as asthma or a past injury—a short-term plan can legally refuse to pay a single dollar for any related treatment. They’re really only built for very specific, very brief situations, like bridging a one-month gap before your new job’s benefits kick in.

For anything longer, they are a massive gamble. If you're a freelancer or gig worker needing more stable coverage, our guide on health insurance for the self-employed has options that make a lot more sense.

Short-term health insurance is not a real substitute for a comprehensive ACA plan. It's a high-risk option that should only ever be considered for a very brief period when you have absolutely no other choice.

Comparing Your Alternatives

Let's put these plans side-by-side to see the real difference. It’s one thing to hear about limitations, but seeing them compared directly makes the choice much clearer.

ACA Plans vs Short-Term Insurance

| Feature | ACA Marketplace Plan | Short-Term Plan |

|---|---|---|

| Pre-existing Conditions | Must cover them by law | Can deny coverage or exclude them |

| Essential Health Benefits | Includes all 10, like prescriptions, maternity, and mental health | Does not have to cover these benefits |

| Renewability | Guaranteed renewal each year | Not guaranteed; you can be dropped |

| Financial Help | Subsidies available based on income | No subsidies or financial assistance |

| Annual/Lifetime Limits | No limits on what the plan will pay | Can impose strict limits on coverage |

This table shows why the low monthly cost of a short-term plan can be so misleading. You might save a little each month, but one unexpected medical bill could leave you with thousands of dollars in debt.

A Safer Alternative: Catastrophic Plans

If you're under 30 or you qualify for a hardship exemption, there's a much safer choice: a catastrophic health plan. You can find these on the ACA Marketplace. Yes, they have high deductibles, but they also provide the exact same essential health benefits and consumer protections as every other ACA plan. Most importantly, they will cover you for pre-existing conditions.

Around the world, many countries make sure people aren't left in this kind of limbo. For example, many European nations have government-backed systems that prevent coverage gaps when someone loses a job, as detailed in this in-depth look at the global health insurance market. It’s a stark contrast to a system where your job and your health coverage are tied together.

Ultimately, that cheap short-term plan might seem like a quick fix, but it comes with enormous financial risks. Always weigh the limited benefits against the very real possibility of massive out-of-pocket costs before you make your decision.

So, Which Health Plan Is Right for You?

Let's be honest—staring at a list of health insurance options can feel like a chore. COBRA, ACA, short-term plans… where do you even start?

The best way to cut through the noise is to focus on what matters most for your life right now. The right choice really comes down to three things: your budget, your current health needs, and how long you think you'll be between jobs.

Think about it this way: someone managing a chronic condition has a completely different set of priorities than a healthy person who just needs an annual check-up. If you need to keep your specific doctors and specialists, the high price of COBRA might be worth it. But if you're just looking for solid, affordable coverage, an ACA Marketplace plan could be the perfect fit.

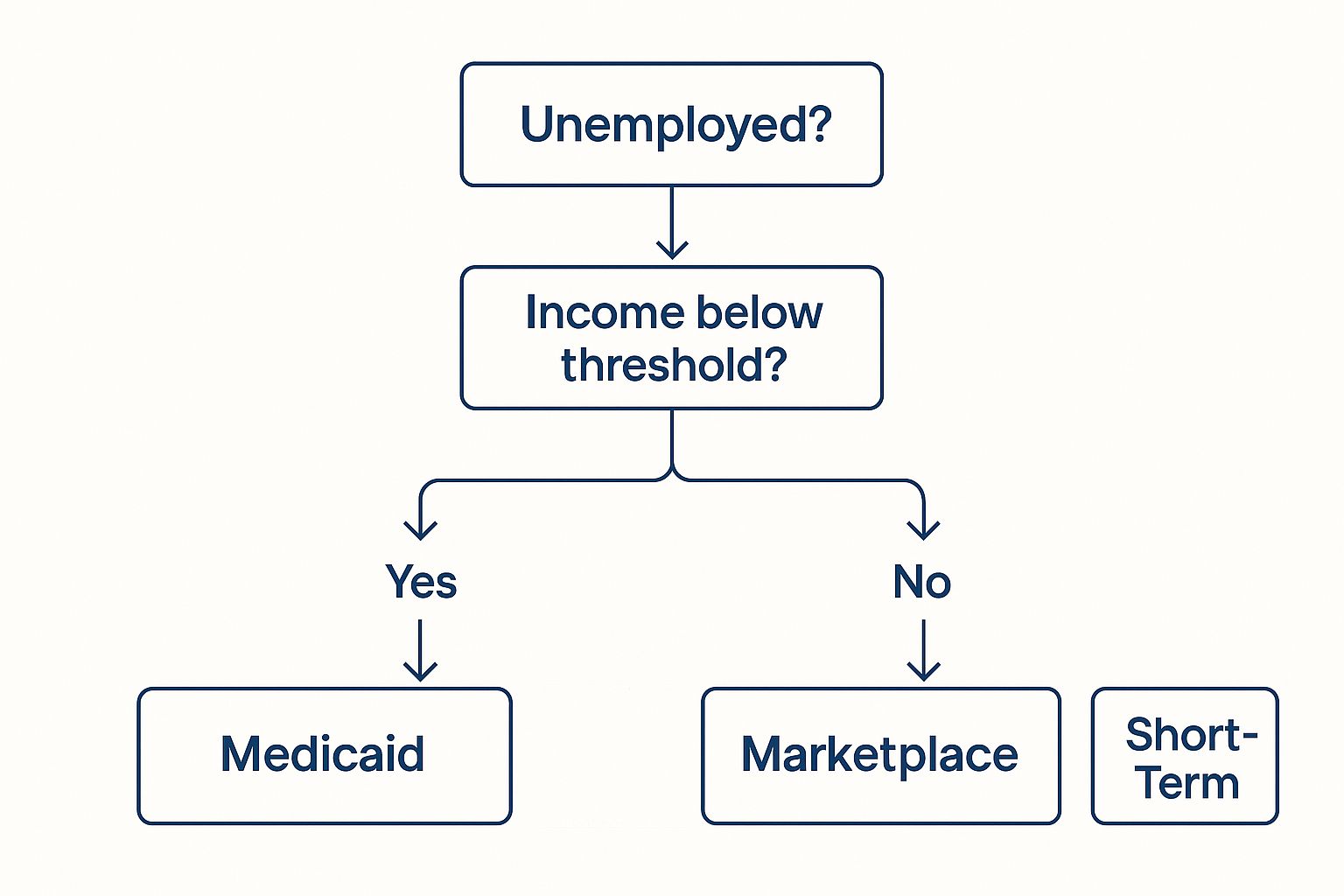

To make it a little easier, this chart breaks down the decision-making process. It walks you through the key questions, like your employment status and income, to point you toward the right type of plan.

As you can see, your current income is the biggest piece of the puzzle. It’s what will likely guide you toward Medicaid, a subsidized Marketplace plan, or other options.

A Quick Checklist for Your Decision

To feel confident in your choice, take a minute to ask yourself these questions:

- What can I actually afford each month? Don't just look at the premium. Factor in the deductible and what you might have to pay out-of-pocket for a doctor's visit or prescription.

- Do I absolutely need to keep my current doctors? If so, you'll need to check the network for any new plan you're considering. Never assume your doctor is included.

- How much have I already paid toward my deductible this year? If you're close to meeting it, sticking with COBRA could actually save you a lot of money if you need more care before the year ends.

- What does my family's health look like? If you or a family member needs regular medical care or takes prescriptions, a more comprehensive plan is a smart investment, not an expense.

Feeling stressed about finding coverage is a surprisingly common experience. A study across 100 countries revealed that health insurance coverage averaged just 31.1%. In low-income nations where steady work is hard to come by, that number plummets to a shocking 7.9%. You can read the full research on global health insurance disparities to see just how widespread this challenge is.

Here’s the bottom line: There's no single "best" plan for everyone. The right plan is the one that protects both your health and your finances while you figure out what's next.

Common Questions About Health Insurance When You're Unemployed

Figuring out health insurance when you've lost your job can bring up a lot of confusing questions. It’s a stressful time, and the last thing you need is more uncertainty.

Let's clear the air and walk through some of the most common hurdles people face.

How Do I Estimate My Income for the ACA Marketplace?

This is a tough one. How can you predict your income when you don't even have a job yet? It feels like pulling a number out of thin air, but the goal is just to give your best, most realistic guess for the entire calendar year.

It's not just about your old salary. You need to think bigger and include everything that contributes to your household income.

- Unemployment benefits you expect to get.

- Any money from freelance gigs, part-time work, or side hustles.

- Your spouse's or partner's income, if you file taxes together.

- A conservative guess of what you think you might earn from a new job later in the year.

The key is to be honest and realistic. If your income changes down the road—maybe you land a new job sooner than expected or your freelance work dries up—just log back into your Marketplace account and update it. This will automatically adjust your subsidy and keep you from having a nasty surprise at tax time.

Can I Get Coverage With a Pre-Existing Condition?

Yes. 100% yes. This is one of the most important protections built into modern health insurance.

Thanks to the Affordable Care Act, it is illegal for an insurance company to deny you coverage or jack up your rates just because you have a pre-existing condition like diabetes, asthma, or even a past cancer diagnosis.

All plans on the ACA Marketplace, as well as Medicaid and CHIP, are required to cover your pre-existing conditions from day one. This is a game-changer and a major reason to be extremely cautious with short-term plans, which often don't offer this protection.

This rule ensures you can get the care you need, when you need it, without your health history being held against you.

What if I Miss My 60-Day Enrollment Window?

Losing your job-based health insurance kicks off what’s called a Special Enrollment Period (SEP). This gives you a 60-day window to sign up for a new plan on the ACA Marketplace.

If you miss that deadline, you’re usually out of luck until the next annual Open Enrollment period in the fall. The main exceptions are Medicaid and CHIP—you can apply for those programs anytime during the year if you qualify.

So, mark your calendar. Those 60 days fly by fast.

You don't have to figure all this out by yourself. The experts at My Policy Quote are here to help you compare your options and find a plan that fits your budget and your needs. Explore your options with us today!