A spouse term rider is a type of life insurance add-on that provides affordable, temporary coverage for your partner under your primary policy. Think of it as a cost-effective way to get a "plus-one" for your family's financial security plan, all managed under a single premium.

Understanding the Spouse Term Rider

When you buy life insurance, you're building a financial safety net for the people who matter most. A spouse term rider is a simple way to extend a piece of that net to cover your partner—without the cost or complexity of buying a completely separate policy.

It's essentially an endorsement you add to your main life insurance plan. If your spouse passes away while the rider is active, it pays out a death benefit. The best part? It combines simplicity and affordability into one package. You pay a single premium that covers both you and the rider for your spouse, which is often far cheaper than juggling two different policies. This makes it a fantastic option for couples looking to protect their family during crucial financial years, like when raising kids or paying down a mortgage.

How It Works in Practice

The idea behind a spouse term rider is refreshingly simple. As the primary policyholder, you add the rider to your plan. If your spouse dies during the rider's term, you receive the death benefit from that rider.

This money is yours to use however you see fit—covering funeral expenses, replacing lost income, paying off debts, or handling any other financial challenges that come up.

But here’s the key thing to remember: the rider is tied directly to the main policy. If you, the primary policyholder, cancel your coverage or your policy's term ends, the spouse rider coverage usually ends right along with it. This dependency is a crucial detail to understand before you commit.

Key Takeaway: A spouse term rider isn’t a standalone policy. It's an extension of your primary life insurance, providing dependent coverage for your partner that can't exist on its own.

Eligibility and Coverage Details

So, who can get one? Typically, a spouse term rider is available for a policyholder’s spouse, often between the ages of 18 and 65. It provides a death benefit for a specific period—usually 10, 20, or 30 years, mirroring the term of the main policy.

Coverage amounts are flexible, with some insurers allowing you to add protection in increments of $25,000. Most policies also have a maximum age limit for the rider, commonly around 65 or 70. You can learn more about the specifics of these riders by exploring the details on Paradigm Life.

To give you a quick overview, here’s a look at the typical features of a spouse term rider.

Spouse Term Rider at a Glance

| Feature | Typical Provision |

|---|---|

| Eligibility Age | Spouses aged 18-65 |

| Coverage Type | Term life insurance |

| Typical Term Lengths | 10, 20, or 30 years |

| Common Coverage Amounts | Starting from $25,000, often up to a policy maximum |

| Dependency | Linked to the primary policy; terminates if the primary policy ends |

| Conversion Option | May allow conversion to a permanent policy without a new medical exam |

This table highlights just how straightforward these riders are, making them an accessible tool for many families.

Weighing the Benefits and Drawbacks

When you’re looking at any financial product, it’s all about balancing what you get versus what you give up. A spouse term rider is no different. It has some really compelling perks, but it's just as important to understand its limits to know if it's truly the right move for your family.

The biggest win here is cost-effectiveness. Bundling your spouse's coverage into your main policy is almost always cheaper than buying two separate ones. Think of it like a family phone plan—it’s much more affordable to add another line than to open a whole new account. This also simplifies your life with just one premium to track.

But that convenience comes with a few strings attached. In fact, the simplicity of a spouse term rider is also its biggest potential weakness.

The Upside of a Spouse Rider

The main advantages really boil down to two things: simplicity and savings. These benefits make it a go-to option for many couples, especially those trying to get the most coverage without breaking the bank.

- Significant Cost Savings: You can lock in coverage for your partner for just a fraction of what a standalone policy would cost. This frees up cash for other important financial goals.

- Convenience and Simplicity: One policy, one payment. It’s so much easier than juggling multiple accounts and due dates.

- Simplified Underwriting: Your spouse will likely need to answer some health questions, but the process is often far less intense than it is for a brand-new, primary policy.

This streamlined approach lets you add a solid layer of protection without adding a bunch of complexity to your financial life.

The Downside and Key Limitations

On the flip side, the limitations of a spouse rider are real and need to be considered carefully. The biggest one? Its dependency on the primary policy.

The spouse's coverage isn't independent. If the main policyholder's coverage ends for any reason—it’s canceled, it lapses, or the term expires—the spouse term rider disappears right along with it.

This creates a serious weak point. For example, if a couple divorces, the rider covering the ex-spouse typically ends. This can leave them without any coverage right when they might need to get a new policy on their own.

Also, the amount of coverage you can get with a spouse rider is often capped. It’s usually tied to a percentage of the main policy’s death benefit, which might not be enough for your family’s actual needs. If your spouse needs a substantial amount of coverage, a separate policy is probably the smarter choice.

This is a critical distinction to make when you're deciding between temporary protection and something more permanent. To get a better feel for these options, check out our guide on the difference between term and permanent life insurance. At the end of the day, you have to weigh whether the lower cost and convenience of a rider are worth the risk of future coverage gaps.

Unlocking the Power of Conversion Options

While the low cost of a spouse term rider is what gets most people’s attention, its most powerful feature is one you might not think about for years: the conversion privilege. This option is a critical safety net, giving you a Plan B for your spouse’s future coverage when life throws you a curveball.

Think of it as locking in an opportunity for later. With the conversion option, you have the right to change the temporary coverage from the spouse rider into a permanent life insurance policy—like whole life—down the road. Best of all, this can usually be done without a new medical exam or having to prove your spouse is still healthy.

This is where the rider’s true value shines. It protects your spouse’s ability to get lifelong coverage, no matter what health issues might come up later.

Why Conversion Is a Game Changer

Let’s walk through a real-world scenario. You and your spouse get a 20-year term rider when you’re both young and healthy. Fifteen years later, your spouse is diagnosed with a chronic illness. At that point, trying to get a new, separate life insurance policy would be incredibly difficult and expensive—if they could even qualify at all.

But because your spouse rider had a conversion option, that new diagnosis doesn't stand in your way. You have a contractual right to turn that term coverage into a permanent policy, securing their financial protection for the rest of their life.

This privilege is like a guarantee for your spouse's future insurability. It’s a powerful tool that transforms a simple, cheap rider into a smart, long-term financial strategy.

Term riders are often added to permanent policies to provide extra coverage for specific periods, like 10 or 20 years. Their standout feature is the ability to convert to a permanent policy without new medical underwriting—a huge plus, since our health can change as we age. To see how different insurers structure these options, you can explore more about term insurance riders from Western & Southern.

Putting the Conversion Option to Work

This feature isn’t just for worst-case health scenarios. It also gives you strategic flexibility as your life and financial needs change.

Here are a few moments when converting makes perfect sense:

- A Change in Health: As we discussed, if your spouse develops a health condition, converting locks in their coverage before it becomes too expensive or simply unavailable.

- Long-Term Financial Needs: Maybe your original plan was just to have coverage until the mortgage was paid off. But now, you realize you need lifelong protection for other reasons, like estate planning or covering final expenses.

- Approaching Term Expiration: As the rider's term comes to an end, you can convert it to avoid a gap in coverage. This is especially valuable if your spouse is older and would face very high premiums for a brand-new policy.

The conversion feature turns a spouse term rider from a temporary fix into a bridge to permanent security. It’s a small detail that offers enormous peace of mind for the road ahead.

Comparing Your Couple's Coverage Options

A spouse term rider is a fantastic tool for many couples, but it’s certainly not the only way to insure both partners. The key is to understand how it stacks up against the alternatives—mainly, buying two separate individual policies or getting a joint life insurance policy.

The best choice really boils down to your family's unique situation. What matters most to you? Cost? Flexibility? Long-term security? Let's break down the practical differences to help you decide.

Coverage Comparison: Spouse Rider vs. Alternatives

Choosing the right life insurance strategy as a couple can feel complex, but it's easier when you see the options side-by-side. Each approach has its own strengths and weaknesses when it comes to cost, flexibility, and what happens if your life circumstances change.

This table gives a clear snapshot of how a spouse rider compares to a joint policy and two individual policies.

| Feature | Spouse Term Rider | Joint Life Policy | Two Separate Policies |

|---|---|---|---|

| Cost | Typically the most affordable option. | Can be more affordable than two separate policies. | Generally the most expensive option upfront. |

| Structure | An add-on to a primary life insurance policy. | One policy covers two people. | Two completely independent policies. |

| Flexibility | Lower flexibility; tied to the primary policy. | Limited; often terminates after the first death. | Highest flexibility; policies are independent. |

| Best For | Budget-conscious couples needing basic coverage. | Couples with a shared major liability, like a mortgage. | Couples who want independent, customizable coverage. |

As you can see, there's a clear trade-off. A spouse rider offers simplicity and savings, but two separate policies give you complete control and independence.

Spouse Rider vs. Two Separate Policies

This is the most common comparison people make, and for good reason. A spouse term rider almost always wins on price. It’s an affordable way to add coverage for your partner, bundling everything into one policy with a single premium payment. Simple and convenient.

But what you save in money, you often give up in flexibility.

That’s where two separate policies shine. They give you the ultimate freedom. If one partner needs a much larger death benefit than the other—say, one is the primary breadwinner—separate policies make that easy to set up.

More importantly, the policies are completely independent. A major life event like a divorce won’t threaten either person’s coverage because each policy stands on its own. With a rider, if the main policy ends for any reason, the rider coverage disappears with it, potentially leaving one partner uninsured when they need it most.

The Bottom Line: A spouse rider is built for cost savings and convenience. Two separate policies are built for flexibility and long-term independence.

What About Joint Life Insurance?

Another option you might hear about is joint life insurance. This is a single policy designed to cover two people, usually a married couple, but it has a specific payout structure.

Joint policies typically come in two flavors: first-to-die or second-to-die. A first-to-die plan pays out the death benefit after the first partner passes away, which is great for covering immediate debts like a mortgage. A second-to-die policy, on the other hand, only pays out after both partners have passed away and is more commonly used for estate planning.

This is different from a spouse rider, where the payout is tied specifically to the death of the partner on the rider. While joint policies can be a cost-effective middle ground, they often have the same drawback as a rider: the policy may end after the first partner dies, leaving the survivor to find new coverage when they are older and it's more expensive.

Our guide on term life insurance for families can help you dig deeper into these broader strategies for protecting your loved ones.

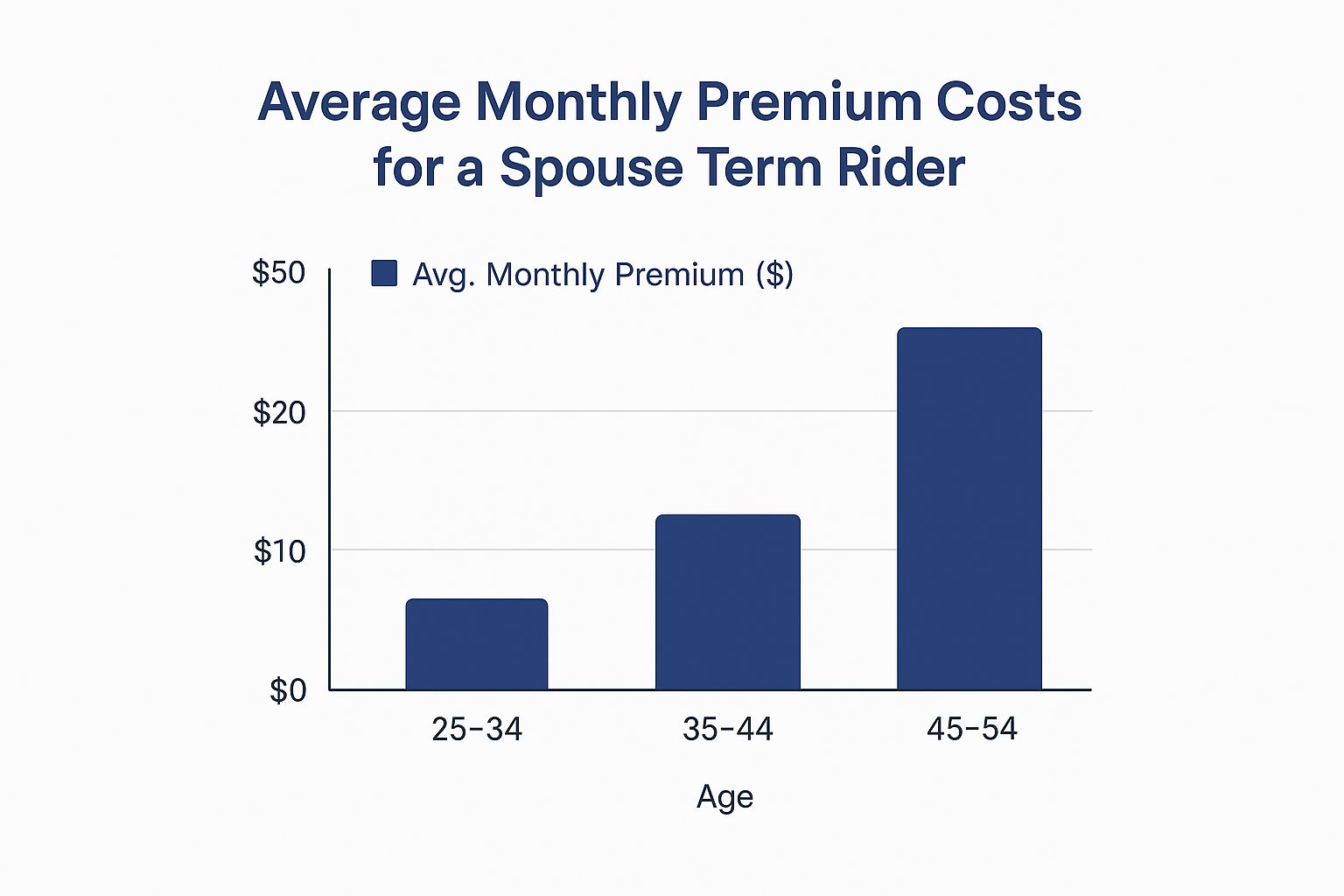

This chart shows just how affordable a spouse term rider can be, especially when you’re younger.

As you can see, the average monthly cost stays surprisingly low even as couples move into their 40s and 50s, making it a very attractive option for families watching their budget.

Navigating Eligibility and Cost Factors

Okay, let's get down to what really matters: who can get a spouse term rider, and what's it going to cost? Answering these two big questions—"Can we get one?" and "How much will it be?"—is the most important part of the decision.

The good news is, the process is usually pretty straightforward.

Even though it’s an add-on, the insurance company still needs to do some basic homework on your spouse. Their eligibility isn't automatic. The insurer needs to understand their risk profile, just like they did for you, to make sure the price is fair for the coverage you’re getting.

Who Is Eligible for a Spouse Rider?

Insurers have rules for adding a spouse, but they’re usually not as strict as you might think. While every company is a little different, the general framework is pretty consistent.

Here’s what they typically look at:

- Age Limits: Most companies offer this rider to spouses between the ages of 18 and 65. Some might have slightly different caps, so always double-check the fine print of your specific policy.

- Health Status: Your spouse will need to answer some health questions. For smaller coverage amounts, this is often just a simple questionnaire—no full medical exam needed. If you’re looking for a larger rider, though, they might ask for an exam.

- Lifestyle Factors: Expect questions about smoking, high-risk hobbies (like scuba diving or rock climbing), and their job. These details help the insurer get a clear picture of the risk involved.

The best part? The underwriting for a spouse term rider is often a simplified, less intense version of what you went through for your own policy. This makes it a great way to get coverage for a partner who might otherwise face a more complex application process.

Key Insight: Think of the spouse rider application as the "express lane" of underwriting. It's designed to be faster and simpler while still giving the insurer the essential information they need.

Understanding the Cost of the Rider

One of the biggest selling points of a spouse rider is how affordable it can be. But while it’s definitely a budget-friendly option, the final price isn't a one-size-fits-all number. It’s calculated based on your spouse's individual situation, ensuring you pay a fair premium for the protection.

This is a huge deal for many couples, especially those just starting their families, which we cover more in our guide on life insurance for young parents.

The main things that will shape the final cost are:

- Your Spouse's Age: Just like with any life insurance, age is a big factor. The younger and healthier your spouse is when you add the rider, the less you'll pay.

- Their Health and Lifestyle: A non-smoker in great health is going to get a much better rate than someone with ongoing health issues or a risky job. It’s that simple.

- The Coverage Amount: This one’s straightforward—the more coverage you want, the higher the premium. A $100,000 rider will naturally cost less than a $500,000 one.

- The Rider's Term Length: A shorter term means less risk for the insurance company. A 10-year term rider will be cheaper than a 30-year one.

Once you have a handle on these elements, you can get a realistic idea of what to expect. It empowers you to make a smart choice that fits both your family’s budget and your need for peace of mind.

Ready to Add a Spouse Rider? Here’s How.

Taking the step to add a spouse term rider to your life insurance is a smart, proactive move for your family's future. It might sound complicated, but the process is usually more straightforward than you think. It's really just a few manageable steps.

Let's walk through how to get it done with confidence.

Your first move is to get in touch with your current insurance provider or the agent who helped you set up your policy. Just let them know you're interested in adding a spouse term rider. They'll be your best guide, walking you through the specific options available, the coverage limits, and any requirements that are unique to your existing policy.

Figure Out the Right Coverage Amount

Next, it's time for you and your partner to sit down and talk about how much coverage you actually need. Look at things like your spouse's income, any shared debts (like a mortgage or car loans), and future costs you might face, such as childcare or college tuition.

A rider isn't meant to replace a full, standalone policy, but it should be enough to provide a real financial cushion when it's needed most.

Once you have a number in mind, you can move on to the application. This part is typically much less of a hassle than applying for a brand new policy.

Pro Tip: Don't just pull a number out of thin air. Take a few minutes to map out your budget and see what kind of financial gap would be left if your spouse were no longer there. This ensures the rider does the job it's meant to do.

The application for a spouse rider will ask for some basic info about your partner’s health and lifestyle. For most riders, especially those with lower coverage amounts, this is just a set of questions—no full medical exam required. Be open and honest here to keep the underwriting process moving smoothly.

If you need a quick refresher on the basics, our simple guide to life insurance for dummies is a great place to start.

After the insurer reviews the application, they’ll come back with a final offer that includes the premium cost. Make sure you read through this document carefully. If it all looks right and the price fits your budget, you can officially accept the offer. Just like that, your spouse’s coverage is added, and your family has another layer of protection.

Got Questions? We’ve Got Answers.

When you’re looking at a spouse term rider, it's totally normal for a few last-minute questions to pop up. Getting those final details straight is the key to feeling confident about protecting your family's future.

Let's clear up a couple of the most common ones.

What Happens to the Rider If We Divorce?

This is a really important question, and the answer is straightforward. Since a spouse term rider is attached to the main policy, it almost always ends if there’s a divorce.

Think of it this way: the rider's coverage is directly linked to the marriage. Once that legal relationship is over, the rider's coverage is, too. Your ex-spouse would then need to find their own, separate life insurance policy to stay covered.

Can I Add a Spouse Rider to Any Policy?

Not always. Spouse term riders are most often offered with permanent life insurance policies, like whole life or universal life.

Some companies let you add them to term life policies, but it's not a given. The best move is to check directly with your insurance provider to see what’s possible with your specific policy.

Key Takeaway: The money paid out from a life insurance policy, including a spouse term rider, is typically given to the beneficiary 100% income-tax-free. This means your loved one gets every single dollar you intended for them, right when they need it most.

At My Policy Quote, we believe finding the right coverage should be simple and clear. Explore your options and get a personalized quote today!