When it comes to life insurance, "level term" is a name you'll hear a lot. And for good reason. It’s one of the simplest, most predictable ways to protect your family’s financial future.

So, what is it? Think of it like a price lock on peace of mind. With level term life insurance, your premium payment (what you pay) and the death benefit (what your family gets) are guaranteed to stay the same for a specific period—the "term."

The amount you pay in year one is the exact same amount you'll pay in year 20. No surprises. No guesswork.

Understanding Level Term Life Insurance in Minutes

Let's break down exactly what "level term" means. This policy is built for maximum predictability, which is why it’s so popular for families who need affordable coverage during their most critical financial years—like when the kids are young or the mortgage is still looming.

Its greatest strength is its simplicity. Unlike other policies where your payments can suddenly go up or the payout amount shrinks, level term offers a stable, easy-to-understand contract. It makes budgeting a breeze and ensures your loved ones get the exact amount you planned for.

The Three Pillars of Predictability

At its heart, a level term policy stands on three unwavering pillars. Once you get these, you’ll see why so many people rely on it to protect life’s biggest milestones.

- The Level Premium: Your monthly or annual payment is locked in from day one. It will never increase for the entire term. If your premium is $30 a month today, it will still be $30 a month in year nineteen.

- The Level Death Benefit: The payout your beneficiaries would receive is also fixed. A $500,000 policy provides that same half-million-dollar safety net whether a claim is made early or late in the term.

- The Defined Term Length: You choose how long you want the coverage to last. Common options are 10, 15, 20, or 30 years, designed to match your longest financial responsibilities.

The core promise of level term life insurance is simple: No surprises. The price you agree to today is the price you'll pay for the entire term, and the coverage your family gets is set in stone.

This predictability makes it an ideal choice for pure protection, without the complex investment features you might find in other policies.

To give you a quick visual, here’s a simple breakdown of what makes a level term policy tick.

Level Term Life Insurance At a Glance

| Policy Component | What It Means For You | Key Benefit |

|---|---|---|

| Level Premiums | Your monthly or annual payments are fixed and will not change. | Easy to budget for and no unexpected cost increases. |

| Level Death Benefit | The payout amount for your beneficiaries remains the same throughout the term. | Guarantees a specific, unchanging amount of financial protection. |

| Defined Term | You choose a specific coverage period, like 10, 20, or 30 years. | Coverage is aligned with your specific financial needs, like a mortgage. |

In short, it’s all about stability when you need it most.

Of course, level term is just one piece of the puzzle. To see how it stacks up against other options, you can learn more about the different types of life insurance explained in our detailed guide.

How Level Term Life Insurance Actually Works

It’s one thing to read a definition, but it’s another to see how a policy actually protects your family in the real world. Think of level term life insurance as a financial safety net stretched over the most critical years of your life—the years when your mortgage is biggest, your kids are youngest, and your loved ones depend on you most.

At its core, the policy is built on two simple promises you control: a locked-in timeframe (term length) and a never-changing payment (fixed premium). You set the rules from day one.

You pick a term—usually 10, 20, or 30 years—to line up perfectly with a major financial responsibility. The policy then stands guard for that entire period, guaranteeing your family has a financial backstop when they're most vulnerable.

Aligning Your Term with Life Milestones

So, how do you pick the right term? It’s all about looking at your financial timeline. The goal is to keep the coverage active for as long as someone relies on your income or until your biggest debts are gone.

Here’s how people do it every day:

- Covering a Mortgage: Just signed the papers on a new home with a 30-year mortgage? A 30-year term policy ensures your family can pay it off and keep their home, no matter what.

- Raising Children: If you’re a new parent, a 20 or 25-year term acts as a financial cushion that lasts until your youngest is out of the nest, covering everything from groceries to college tuition.

- Protecting a Spouse's Retirement: Are you the main breadwinner? A 15-year term could replace your income and protect your spouse's retirement savings if they’re 15 years away from that goal.

This is what makes level term so smart. You’re not paying for insurance forever; you’re targeting a specific window of risk and covering it with absolute precision.

The Power of the Level Death Benefit

The "level" part of what is level term life insurance is its biggest strength: the death benefit never changes. A $500,000 policy is worth exactly $500,000 whether a claim is filed in year two or year twenty-two.

That consistency delivers incredible peace of mind. While other insurance products might see their payout shrink over time, a level benefit guarantees a predictable, specific sum for your beneficiaries.

The fixed payout means your financial plan works as intended. If you calculated that your family needs $750,000 to be secure, that is the exact tax-free amount they will receive, period.

Predictable Premiums for Budget Stability

This might be the most powerful feature for your day-to-day budget. Your premium is locked in on day one and will never, ever change—even if your health declines or the economy gets rocky.

For families on a tight budget or freelancers with fluctuating income, that stability is a game-changer. It’s also why these policies are so popular, especially when you consider that nearly 30% of U.S. adults have no life insurance at all.

For example, a healthy 30-year-old woman can often get $500,000 of coverage for a 20-year term for around $23 per month. A man with the same profile might pay about $29. (For more insights, check out these life insurance statistics from Policygenius.)

This structure lets you build a long-term plan without worrying about surprise cost hikes. And if your needs change down the road, many policies can adapt. You can even convert your term policy to permanent coverage if you decide you need lifelong protection.

Comparing Level Term to Other Insurance Options

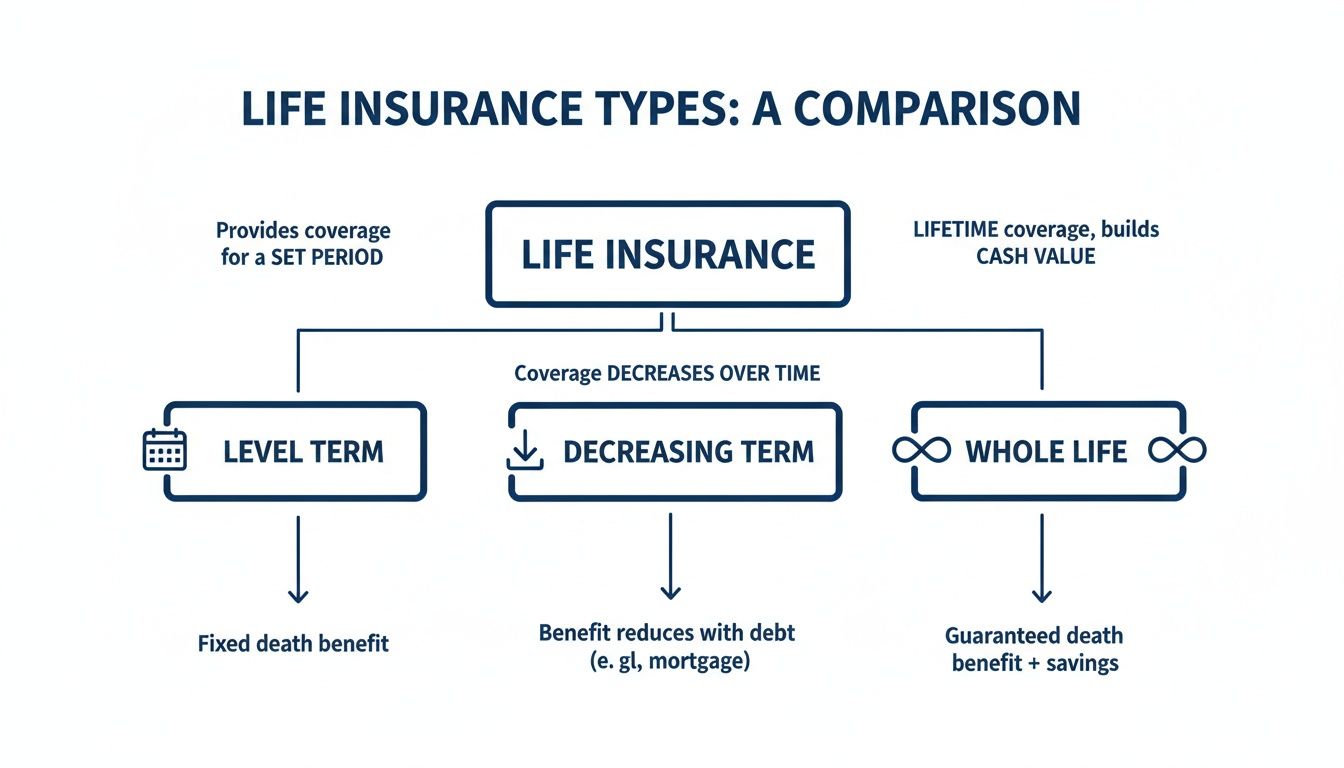

To really get why level term life insurance is so popular, it helps to see where it fits in the bigger picture. The insurance world has a lot of options, and each one is built for a different job. Seeing how level term stacks up against its main alternatives—decreasing term and whole life—makes it crystal clear why it’s the go-to choice for pure, affordable protection.

I like to use a simple housing analogy to explain it.

- Level Term Life is like leasing a great house. You get full protection for a set time at a fixed, predictable cost. No surprises.

- Decreasing Term Life is like insurance tied directly to your mortgage. As you pay down your loan, the coverage amount drops with it.

- Whole Life is like buying the house. It's a permanent asset that costs more upfront but builds equity (its cash value) and is yours forever.

Each one serves a totally different purpose. Level term shines when you need the most protection for the lowest cost during your most critical financial years—like when you're raising a family or paying off a mortgage.

Level Term vs. Decreasing Term Insurance

At first glance, level and decreasing term policies look like twins. Both cover you for a specific period and don't have a cash value component, which is what keeps them so affordable. But there’s one huge difference: the death benefit.

With a level term policy, the death benefit never changes. A $500,000 policy will pay out $500,000 whether you pass away in year one or year twenty. This consistency is perfect for replacing income and covering a family's ongoing expenses, which don't just shrink over time.

A decreasing term policy is the opposite. Its death benefit gets smaller over the life of the policy, usually on a fixed schedule. It’s a niche product designed almost exclusively to cover a specific, shrinking loan like a mortgage. While the premiums might be a tiny bit lower, its use is incredibly limited because most families need a safety net that stays strong.

A level term policy’s unwavering death benefit offers far better protection for big-picture needs like replacing your income or making sure your kids can go to college. A decreasing term policy is really just a specialized tool for a single, diminishing debt.

Level Term vs. Whole Life Insurance

Now, the gap between level term and whole life is much wider. It comes down to how long it lasts, how much it costs, and how complicated it is. As the name suggests, whole life is a permanent type of insurance designed to cover you for your entire life.

Unlike the beautiful simplicity of term insurance, whole life policies come with an investment-like savings account called cash value. This account grows at a guaranteed rate over time. That feature, plus the lifelong coverage, is why the premiums are so much higher.

In fact, level term premiums are typically 5 to 10 times less expensive than what you'd pay for a permanent policy with the same death benefit. The cost difference is massive.

This is why you’ll often hear financial experts recommend a "buy term and invest the difference" strategy. The idea is simple: get the affordable term coverage you need and invest the money you save on premiums somewhere it can grow for you. For a deeper look, check out our guide on the key differences between whole life vs term life insurance.

While you're thinking about your long-term strategy, it's also smart to understand other types of protection, like Long Term Care Insurance options, which cover different needs entirely.

Level Term vs. Other Policies: A Head-to-Head Comparison

To make it even clearer, let's put these three policy types side-by-side. Seeing the features in a simple table can help you quickly spot the best fit for your family's goals.

| Feature | Level Term Life | Decreasing Term Life | Whole Life |

|---|---|---|---|

| Coverage Duration | Fixed period (e.g., 20 years) | Fixed period (e.g., 20 years) | Lifelong/Permanent |

| Death Benefit | Stays the same (level) | Declines over time | Stays the same (level) |

| Premiums | Fixed for the term (lowest cost) | Fixed (very low cost) | Fixed for life (highest cost) |

| Cash Value | No | No | Yes, grows over time |

| Best For | Income replacement, paying off a mortgage, raising kids | Covering a specific large loan | Estate planning, lifelong dependents |

Ultimately, the right choice always comes back to your specific goals. If what you need is straightforward, high-impact protection for a set number of years without breaking the bank, level term life insurance is almost always the answer.

Who Is Level Term Life Insurance Really For?

Knowing the features of a policy is one thing, but seeing how it solves real-world problems? That’s what actually matters. Level term life insurance isn't for everyone, but its straightforward design and affordability make it the perfect solution for specific chapters in your life.

It shines brightest when you need a huge amount of protection for a fixed amount of time—without the massive price tag of permanent coverage. Let's look at a couple of real-life situations where it just makes sense.

The Freelancer Protecting an Unpredictable Income

Meet Sarah, a talented freelance graphic designer. Being self-employed is amazing, but it means no corporate benefits, no company pension, and definitely no employer-sponsored life insurance. Her income can be fantastic one quarter and slow the next, so a predictable, low-cost expense is a must for her budget.

Sarah’s biggest worry is replacing her income for her partner and young son until he’s through college. She needs a serious safety net but can’t commit to a pricey permanent policy that would squeeze her finances during leaner months.

- Her Challenge: Secure enough coverage to replace 15-20 years of future income without getting locked into high, lifelong premiums.

- The Level Term Solution: Sarah goes with a 20-year, $750,000 level term policy. Her premium is locked in at a rate she can easily afford, fitting right into her business expenses. She can now breathe easy, knowing that for the next two decades—the most critical time for her family—they are protected by a fixed, reliable benefit.

For Sarah, level term life insurance is simple: it’s affordable income protection that brings stability to a fluctuating career. It lets her protect her family's future without giving up the flexibility she needs as a business owner.

This chart shows just how different level term is from other policies.

You can see it provides consistent coverage for a specific time, which is totally different from a decreasing term policy or the lifelong commitment of whole life.

The Young Family Covering Their First Mortgage

Now, let's talk about the Jacksons. They just bought their first home and are over the moon. But they’re also feeling the weight of their new 30-year mortgage. It's their biggest debt by far, and they want to be 100% sure that if something happened to one of them, the surviving partner wouldn't be forced to sell the house their kids call home.

They're in their early 30s, healthy, and focused on building a life together. Their budget is tight—mortgage payments, childcare, and saving for college don't leave much room. They need a cost-effective way to cover their biggest financial responsibility.

For new homeowners, a level term policy acts as mortgage protection insurance that doesn't decrease in value. It guarantees that the full loan amount can be paid off, securing the family's most important asset—their home.

- Their Challenge: Cover a $400,000 mortgage for the entire 30-year loan period.

- The Level Term Solution: The Jacksons get a 30-year, $500,000 level term policy. The term length lines up perfectly with their mortgage. That extra $100,000 gives them a cushion for other debts or final expenses. Because they're young and healthy, the premium is surprisingly low—an easy addition to their monthly budget.

For families like the Jacksons, level term life insurance is the most practical and efficient tool for protecting their largest financial obligation. It gives them maximum protection right when their debt is highest and their kids are most dependent. It just fits.

How to Choose Your Coverage Amount and Term Length

Deciding to get life insurance is a big, smart move. Now for the part that makes it truly yours: figuring out exactly how much coverage you need and how long it should last.

These two decisions—the coverage amount and the term length—are what shape your policy into a shield that fits your family's unique life. There's no single right answer, but there are simple ways to get a crystal-clear picture of your needs. No guessing games here.

Calculating Your Ideal Coverage Amount

A common rule of thumb you’ll hear is to get coverage that’s 10 times your annual income. It’s a decent starting point, but a more personal approach makes sure you don’t leave any gaps. A fantastic way to do this is with the DIME formula.

The DIME formula walks you through adding up four key financial responsibilities:

- Debt: Tally up all your non-mortgage debts. Think car loans, student loans, and any credit card balances.

- Income: Multiply your annual income by the number of years your family would need your support to get back on their feet.

- Mortgage: Add the full remaining balance of your mortgage. This is about making sure your family can stay in their home, no matter what.

- Education: Estimate the future costs of your kids' college or private school tuition.

Add those four numbers together, and you've got a solid, personalized estimate of the coverage amount your family would actually need. For a deeper dive, check out our guide on how to calculate your life insurance need.

The goal isn't just to pick a number. It's to create a real financial safety net that lets your family keep their standard of living, pay off debts, and chase future goals without the weight of your lost income.

Aligning Your Term Length with Your Timeline

Once you've got your coverage amount, the next piece of the puzzle is the term length. The key is simple: match your policy’s duration to your longest financial responsibility.

Just look at your life's timeline and ask yourself, "How long will my family truly depend on my income?"

Here are a few common scenarios to get you thinking:

- New Parents: If you have a newborn, a 20 or 25-year term is perfect. It protects them all the way until they're financially independent.

- Homeowners: Just signed the papers for a 30-year mortgage? A 30-year term policy is the ideal match to make sure that debt is covered.

- Nearing Retirement: If you're 15 years away from retiring and want to protect your spouse's savings, a 15-year term can bridge that gap beautifully.

The flexibility of level term life insurance is one of its biggest strengths. Policies are usually available in 10, 15, 20, and 30-year increments, letting you tailor the protection to your life. And you might be surprised at how affordable more coverage can be. For a 30-year-old, doubling coverage from $500,000 to $1 million might only add $14-$19 to the monthly premium.

By lining up your term with your biggest financial milestones, you make sure you have powerful protection when you need it most—without paying for it long after those responsibilities are gone. It's a strategic move that makes term life insurance one of the most efficient tools in your financial toolkit.

Ready to Secure Your Family's Future? Here's What to Do Next

So, you get it now. Level term life insurance isn't some complicated financial product—it's a straightforward, affordable, and steady way to protect your family's future. It’s built for those big, messy, beautiful years when the mortgage is fresh, the kids are small, and your income holds everything together.

Knowing what to do is one thing. Doing it is another. But taking action is what transforms worry into security. The peace of mind that comes from having a real plan in place is one of the greatest gifts you can give the people you love. Now’s the time to make it happen.

From Information to Action

Taking the next step doesn’t have to feel like a huge chore. It starts with an honest look at your family's needs and ends with a clear picture of what it will take to protect them. The process is a lot simpler than you might think.

Here's a simple path forward:

- Figure Out Your Number: Use a simple guide like the DIME formula (Debt, Income, Mortgage, Education) to land on a real coverage amount. Don’t just pull a number out of thin air—calculate what your family would actually need to be okay.

- Set Your Timeline: What’s your longest-running financial responsibility? Is it that 30-year mortgage? Is it getting your youngest child through college and to age 25? Your term length should match that milestone.

- See What It Costs: Once you have your numbers, the final step is finding out what a policy will actually cost you. This is where you get a personalized quote.

Securing your family’s financial future is one of the most powerful moves you can make. It takes the big, scary "what if" and turns it into a quiet, confident sense of security for the people who matter most.

Get Your Personalized Quote Today

Getting a quote is free, simple, and comes with zero obligation. It just gives you clarity. You’ll probably be surprised at how affordable this kind of protection is, especially when you’re young and healthy. Instead of guessing what it might cost, you can see real numbers built for you in just a few minutes.

And while you're at it, it's always a good idea to consider comprehensive protection options as part of a bigger financial strategy. But for immediate, powerful, and affordable family protection, level term is the perfect place to start.

Ready to take control? Don't put it off. The best time to lock in a great rate is right now. Use a trusted tool to compare quotes from top-rated insurance companies and find a policy that fits both your life and your budget.

Take the simple step of requesting your free, personalized quote from My Policy Quote today. It’s a fast, easy way to build a powerful wall of protection around your family’s future.

Common Questions About Level Term Insurance

Even after getting the basics down, you might still have a few questions rolling around in your mind. That’s totally normal. Let’s tackle some of the most common ones to clear up any lingering confusion and help you feel confident.

What Happens If I Outlive My Level Term Policy?

This is easily one of the most popular questions, and the answer is simple: if you reach the end of your term alive and well, the policy just… ends. Your coverage stops, and so do your premium payments.

For many people, this is actually the perfect outcome. Think about it. By the time a 20 or 30-year term is up, your mortgage might be paid off and the kids are likely on their own. The major financial burdens you bought the policy to protect are gone. If you find you still need coverage, you can always apply for a new policy or, if your plan included it, convert your term policy into a permanent one.

Can I Have More Than One Life Insurance Policy?

Yes, you absolutely can. It’s a smart and surprisingly common strategy called "laddering." This just means you buy a few different policies with varying term lengths and coverage amounts to line up with how your financial needs will change over time.

For instance, you might get a big 30-year policy to cover your mortgage until it’s paid off, plus a smaller 15-year policy to make sure your kids’ college education is funded. As the smaller responsibilities fall away, those policies expire, and your total premium costs go down. It’s a really efficient way to get the right amount of coverage only when you need it. Just know that insurers do have a cap on the total amount of insurance you can own.

Is the Payout from a Level Term Policy Taxable?

Here’s one of the biggest perks of life insurance: in nearly all cases, the death benefit your beneficiaries receive is 100% income-tax-free.

The money is there to provide support, not create a new tax headache. The only real exception is for very large estates that could be subject to federal estate taxes, but this affects a tiny percentage of people. For the vast majority of families, every single dollar you planned for goes directly to them.

For most beneficiaries, the life insurance payout is a tax-free lump sum. This ensures the full amount you intended goes straight to supporting your loved ones, with no deductions for income tax.

Do I Have to Take a Medical Exam to Get a Policy?

Not necessarily. The old-school way of applying always included a medical exam, but things are changing. Many insurers now offer "no-exam" or "accelerated underwriting" policies, which are becoming more common for younger, healthier folks looking for coverage under $1 million.

These plans use data and health questionnaires to get you approved, sometimes in just a few hours. It's incredibly convenient, though you might find that the premiums are a little higher than a policy that requires a full medical exam.

Feeling clearer on how it all works? The best next step is seeing what a policy would actually cost you. At My Policy Quote, we make it easy to get a free, no-pressure quote designed for your situation. Find out just how affordable peace of mind can be by visiting https://mypolicyquote.com today.