Let's get straight to it: when your loved ones receive a life insurance payout, that money—the death benefit—is almost always income-tax-free. It's designed that way.

Think of it as a protected financial gift meant to land in your beneficiaries' hands without the IRS taking a cut, thanks to IRC Section 101(a). But "almost always" isn't the same as "always." A few specific situations can turn this tax-free gift into a taxable event.

The Short Answer on Taxable Life Insurance

Most people buy life insurance for that one core reason: leaving behind a tax-free lump sum for their family. And for the vast majority of policies, that’s exactly how it works. Your beneficiaries get the full amount, no questions asked on their tax returns. This simple, powerful feature makes life insurance a cornerstone of family protection.

But the real question isn't just about the death benefit. The tax rules get a lot more complicated when you look at the bigger picture.

Things can change depending on:

- How you use the policy while you’re alive: Tapping into your policy’s cash value through loans or withdrawals opens up a different set of tax rules.

- Who owns the policy: If the policy is owned by your estate or gets sold to someone else, that tax-free status can disappear.

- How the policy is funded: Pumping too much money in too quickly can accidentally change a policy's tax-advantaged status.

Tax-Free vs. Potentially Taxable Scenarios

The key is understanding that while the death benefit is protected, how the policy is handled during your life and transferred at death is what really matters.

The Golden Rule of Life Insurance Taxes: As long as a death benefit is paid directly to a named beneficiary (like a person or a trust), it’s almost certain to be income-tax-free. The tax headaches usually start with issues around policy ownership, cash value, or estate complications.

To make it easier, we've put together a quick cheat sheet. This table shows which common life insurance events are generally tax-free and which ones might land you with a tax bill.

Life Insurance Taxability at a Glance

| Event | Generally Tax-Free If… | Potentially Taxable If… |

|---|---|---|

| Death Benefit Payout | Paid directly to a named beneficiary (a person or trust). | The payout goes to the deceased's estate and pushes its value over the federal or state estate tax exemption limit. |

| Cash Value Growth | The gains grow tax-deferred inside the policy. | You surrender the policy, and the cash value is more than the total premiums you paid. |

| Policy Loans | You borrow against the cash value and the policy remains active. Loans are not considered income. | The policy lapses or is surrendered with an outstanding loan balance that is greater than your premium payments. |

| Withdrawals/Surrender | You withdraw an amount up to your "cost basis" (the total premiums you've paid). | You withdraw more than your cost basis, or you surrender the policy for a gain. The gains are taxed as ordinary income. |

| Policy Dividends | You receive dividends and use them to reduce premiums or buy more coverage. They're seen as a return of premium. | You take the dividends in cash, and the total amount you receive exceeds the premiums you've paid into the policy. |

By getting familiar with these differences, you'll be in a much better position to keep your policy's benefits tax-efficient. For a deeper dive, you can also explore our comprehensive guide on understanding life insurance policies to learn more about how they're structured.

Understanding Your Policy's Two Key Parts

To get a real handle on when life insurance might be taxable, you have to see that a policy has two very different sides to it, especially when we're talking about permanent life insurance.

Think of it like owning a house. You have the "roof"—that’s the death benefit. Then you have the "home equity"—that’s the cash value. Each part does a different job and, more importantly, plays by its own set of tax rules.

The death benefit is the financial roof over your family's heads. It’s the lump-sum payout your loved ones get when you pass away, and in almost every single case, it’s designed to be completely income-tax-free. This is the core reason people buy life insurance in the first place.

The cash value, on the other hand, is like building equity in your home. It's a living benefit that you can use while you're still around. It grows over time, and that growth is tax-deferred—a huge plus for long-term planning. But this is also where things can get tricky with taxes if you tap into that money.

The Two Main Flavors of Life Insurance

Once you understand those two parts, the difference between the two main categories of life insurance becomes crystal clear. Each one is built for a different purpose, and only one has the moving parts that can create a tax bill during your lifetime.

- Term Life Insurance: This is as straightforward as it gets. Think of it like renting a house. You get the "roof" (the death benefit) for a set period—maybe 20 or 30 years—but you don't build any "equity" (cash value). Since there’s no cash value, the tax questions are much simpler.

- Permanent Life Insurance: This includes policies like whole life and universal life. It gives you the "roof" (death benefit) for your entire life and helps you build "equity" (cash value). That dual purpose makes it a more powerful financial tool, but the tax rules are also a bit more complex.

If you're trying to figure out which approach is right for your family, it helps to learn more about the different types of life insurance available and how they fit different goals.

Why Cash Value Growth Is Tax-Deferred

The tax-deferred growth of your cash value is a big deal. Imagine you put money into a standard investment account. Every year, you’d probably get a tax bill for any dividends or gains, which slows down your growth.

With permanent life insurance, the gains inside your cash value account are shielded from those annual taxes. This lets your money compound much more powerfully over the years without Uncle Sam taking a cut along the way.

This tax deferral is a key reason people use life insurance to build another source of funds for long-term goals, like retirement. But there's a catch: the money isn't tax-free forever, just tax-deferred. The tax bill might come due if you access the money the wrong way.

How Each Part Creates Tax Questions

The split between the death benefit and cash value is the heart of the whole "is life insurance taxable?" question. The tax issues you might face depend entirely on which part of the policy you're using and when.

Here’s a simple way to look at it:

| Policy Component | Primary Tax Question | Typical Scenario |

|---|---|---|

| Death Benefit | Will my beneficiaries pay income tax on the payout? | The goal is for the money to pass to your heirs tax-free, which is almost always how it works. |

| Cash Value | Will I pay income tax if I use this money while I'm alive? | Taxes can pop up when you take withdrawals, let a policy loan lapse, or surrender the policy for more than you paid in. |

At its core, the death benefit is built to be a tax-free gift to your loved ones. The cash value is an asset you build for yourself, and just like any other asset, tapping into its growth can trigger a taxable event. We’ll dig into exactly how that happens next.

When a Death Benefit Becomes Taxable

The promise of a tax-free death benefit is the very foundation of life insurance. It’s the comfort of knowing that when your family is at its most vulnerable, the full amount will reach them without the IRS taking a cut.

But that tax-free status isn't invincible. A few specific situations can break that promise, creating a tax headache your beneficiaries never expected. Understanding these exceptions is key to making sure your policy actually does what you intended.

Most of these issues don’t come from the policy itself, but from how it’s owned, sold, or who you name to receive the money. Let's walk through the three main scenarios that can make a life insurance payout taxable.

The Transfer for Value Rule

Think of your life insurance policy as a special key, built to unlock a tax-free benefit for your loved ones. But what happens if you sell that key to someone else? That’s where the transfer for value rule trips people up.

If a life insurance policy is sold or transferred for anything of value—cash, property, you name it—it can lose its income-tax-free status for good.

Imagine a business owner, Sarah, has a $1 million policy on her life. She sells it to her business partner, Tom, for $50,000 to fund their buy-sell agreement. Years later, Sarah passes away. When Tom receives the $1 million death benefit, the game has changed.

Because Tom paid for the policy, the IRS no longer sees it as a simple tax-free inheritance. The payout is now potentially taxable income.

- Amount Received: $1,000,000

- Tom's Cost Basis: $50,000 (what he paid) + any future premiums he paid

- Taxable Gain: The difference between the death benefit and his total cost.

Suddenly, a huge chunk of that benefit becomes taxable income for Tom. There are a few exceptions, but this rule is a major tax trap waiting for anyone with an improperly structured plan.

Naming Your Estate as the Beneficiary

This is one of the most common—and completely avoidable—mistakes people make. Instead of naming a specific person, people, or a trust, they list "my estate" as the beneficiary. It sounds simple, like a catch-all to let your will sort things out, but it creates two massive problems.

First, it drags the life insurance money straight into probate. This is a public, often slow, and sometimes expensive court process to settle your affairs. The funds are no longer private and immediately available to your family; they’re tangled up with all your other assets.

Key Takeaway: When a life insurance policy pays into an estate, it loses its power to bypass the delays and legal mess of probate. This can leave your family waiting months for money they might need right away.

Second, and even more critical for taxes, it inflates the total value of your estate. If that bigger number pushes your estate over the federal or state estate tax exemption limits, the life insurance proceeds themselves could be hit with estate taxes.

For 2024, the federal exemption is a generous $13.61 million per person, but many states have much lower thresholds. The taxability of a death benefit can sometimes hinge on whether the life insurance proceeds and probate process makes them part of the overall estate.

The Three-Year Look-Back Rule

This rule is a crucial detail in estate planning. It’s designed to stop people from giving away assets at the last minute just to dodge estate taxes.

Here’s how it works: If you own a life insurance policy and transfer ownership to someone else (like your child or a special trust) and then pass away within three years of that transfer, the IRS gets to "look back." They will pull the full death benefit right back into your taxable estate.

Let’s say David owns a $2 million life insurance policy. To shrink his estate's size, he transfers ownership to his daughter, Emily. Sadly, David passes away just two years later. Even though Emily is the legal owner and beneficiary, the IRS will include that $2 million in David's estate when calculating taxes.

This rule proves why planning ahead is so important. Transferring a policy can be a brilliant move, but you have to give yourself enough time to clear that three-year window for it to work. These scenarios show that while life insurance is a powerful tool, its tax advantages all come down to careful setup and management.

Accessing Your Cash Value and the Tax Rules

One of the best features of permanent life insurance is something that goes way beyond the death payout: the cash value. Think of it as a savings account tucked inside your policy, quietly growing on a tax-deferred basis, year after year. This growing pool of money can be a fantastic resource, but tapping into it means you need to know the tax rules.

Your policy's cash value might feel like your own private bank, but the IRS has some very specific guidelines on how withdrawals, loans, and surrenders are handled. One wrong move could turn this tax-advantaged asset into an unexpected bill from Uncle Sam.

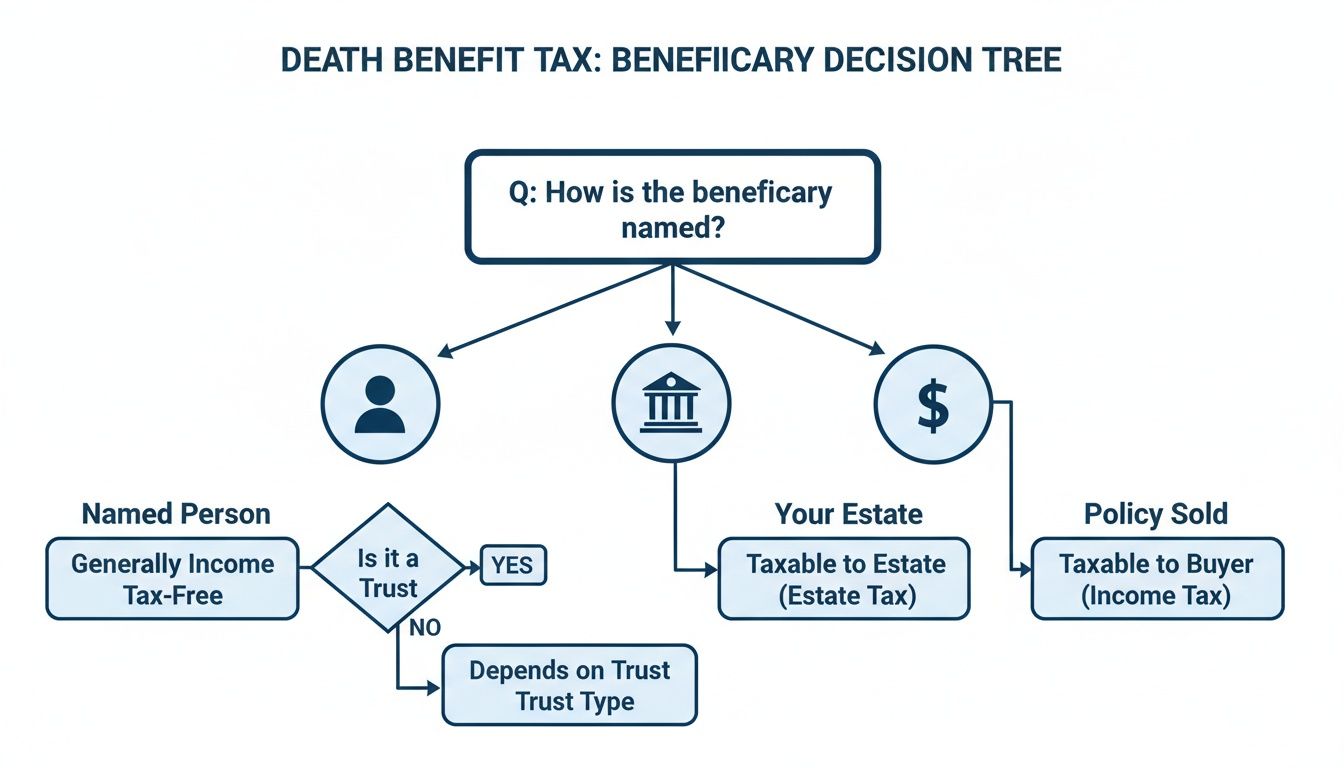

This decision tree gives you a quick visual on how your beneficiary choices can affect the tax treatment of the death benefit—a core concept to keep in mind as you plan your strategy.

As you can see, naming a person directly is the clearest path to a tax-free payout. Things get a bit more complicated when you name your estate or sell the policy, which can open the door to taxes.

Taking a Withdrawal: The FIFO Method

The most common way to get your hands on some cash is a simple withdrawal. And here's the good news: life insurance follows a “First-In, First-Out” (FIFO) rule for taxes. This means the first dollars you pull out are considered a return of the premiums you’ve already paid.

Picture your cash value as a jar. At the bottom, you have all the premiums you paid in—this is your cost basis. Layered on top are the tax-deferred gains your policy has earned over time.

When you take a withdrawal, the FIFO rule lets you take out your premium money first, completely tax-free. You only start paying income tax once you’ve pulled out your entire cost basis and start tapping into the earnings. This makes withdrawals a really efficient way to access cash without an immediate tax hit.

Borrowing Against Your Policy With a Loan

Another go-to option is taking a loan against your policy. You're essentially borrowing from the insurance company and using your cash value as collateral. The process is usually fast, there's no credit check, and the interest rates are often pretty competitive.

Crucial Tax Insight: Policy loans are generally income-tax-free. Because it’s a loan, not a distribution, the IRS doesn't see it as taxable income.

This makes loans a great choice for covering a big, one-time expense without triggering a tax event. But there’s a catch. The loan racks up interest, and if you don't pay it back, the outstanding balance gets deducted from the final death benefit. The real danger is if the policy lapses while you have a loan that's bigger than your cost basis—that can trigger a hefty tax bill on "phantom income." You can dive deeper into how this works in our guide on life insurance with a savings component.

Surrendering Your Policy: The Final Cash-Out

Surrendering your policy is the most final option. When you do this, you’re ending your contract with the insurer in exchange for the full cash surrender value. It also means your death benefit coverage is gone for good.

The tax rules here are straightforward. You’ll pay ordinary income tax on any amount you receive that is greater than your cost basis.

Let’s say you paid $30,000 in premiums over the years, and your cash surrender value is now $45,000. That means you have a taxable gain of $15,000. This gain gets taxed at your regular income tax rate, not the more favorable capital gains rate.

Which Cash Access Method Is Right for You?

So, should you take a withdrawal, a loan, or surrender your policy? The right answer really depends on your financial goals and your timeline. Each path serves a different purpose and has different consequences for your taxes and your policy.

To make it easier, here’s a table that breaks down the key differences.

Comparing Cash Value Access Methods

This table compares the tax implications and impact of loans, withdrawals, and surrenders to help you make an informed decision.

| Access Method | Tax Impact | Impact on Death Benefit | Best For… |

|---|---|---|---|

| Withdrawal | Tax-free up to your cost basis. Gains are taxed as ordinary income. | Permanently reduces the death benefit and cash value. | Accessing small to moderate amounts of cash without immediate tax consequences. |

| Policy Loan | Generally income-tax-free, as long as the policy remains in force. | Reduces the death benefit by the outstanding loan amount plus interest. | Getting a large lump sum of cash for a temporary need without triggering taxes. |

| Surrender | Gains above your cost basis are taxed as ordinary income. | Completely terminates the policy and the death benefit coverage. | When you no longer need the life insurance coverage and want to access the full cash value. |

Getting these rules right is everything. By thinking through your options carefully, you can use your policy’s cash value as the powerful financial tool it was designed to be—all while making sure your life insurance doesn’t become a taxable headache.

Advanced Tax Traps to Avoid

Beyond the basics of death benefits and cash value, a few tricky situations can pop up and create some serious tax headaches. These advanced tax traps often catch people by surprise, turning what seemed like a smart financial move into a costly mistake.

Getting a handle on these scenarios is key to protecting your policy's tax advantages. It ensures the people you love receive the full amount you intended for them. Let’s break down three of the biggest areas where life insurance can become taxable if you aren’t paying attention.

Modified Endowment Contracts (MECs)

Imagine your life insurance policy is a special bucket designed for tax-free growth. The IRS lets you fill that bucket with premiums over time. But if you fill it up too fast, the government changes the rules on you. Your policy gets reclassified as a Modified Endowment Contract (MEC), and it loses some of its best tax benefits.

This happens when the total premiums you pay in the first seven years of the policy go over certain federal tax limits. Once a policy gets flagged as a MEC, it’s a MEC for good.

The consequences are a big deal:

- Loans suddenly become taxable. Unlike a regular policy where loans are tax-free, any loan from a MEC is treated as a taxable distribution of your gains first.

- Withdrawals get taxed differently. The usual "premiums-first" rule gets flipped. All withdrawals are taxed as gains first (Last-In, First-Out) until all the earnings are gone.

- You might face penalties. If you take a loan or withdrawal before you’re 59½, you could get hit with an extra 10% tax penalty on top of everything else.

A policy can become a MEC without you even realizing it, often after making a large lump-sum payment. It's so important to work with a financial professional to make sure your payment schedule doesn't accidentally cross this line.

Employer-Provided Group Life Insurance

A lot of companies offer group-term life insurance, and it's a fantastic perk. But it's not always 100% tax-free. Under IRS Section 79, there’s a limit to how much coverage your employer can give you before it creates a little tax bill for you.

Here’s the rule: your employer can provide up to $50,000 of group-term life insurance coverage completely tax-free. If your coverage goes above that amount, the cost of the extra insurance is considered taxable income to you.

This extra taxable bit is called "imputed income." You don't actually see this money in your paycheck, but the IRS sees it as a taxable benefit, and it will show up on your W-2. The amount is figured out using an IRS table that’s based on your age. For instance, the imputed income for a 45-year-old with $150,000 in coverage would be based on the cost of the extra $100,000. The tax is usually pretty small, but it’s something you should know about.

The Federal Estate Tax

While life insurance death benefits are almost always income-tax-free, they are not automatically free from federal estate taxes. If you personally own your life insurance policy when you pass away, the entire death benefit gets included in the value of your estate.

For 2024, the federal estate tax exemption is a very high $13.61 million per person. If your total estate—including your life insurance—is under this number, you’ve got nothing to worry about. But for anyone with a larger estate, this can become a massive issue.

To get around this, many people set up something called an Irrevocable Life Insurance Trust (ILIT). By transferring ownership of the policy to the trust, you officially remove the death benefit from your taxable estate. The trust owns the policy, and when you die, the money is paid to the trust. The trust then distributes the funds to your beneficiaries just like you wanted. This one move can shield millions from estate taxes and preserve your legacy for your family. By understanding how to add features like this, you can learn more about what a rider on a life insurance policy is and how it works to customize your coverage.

Common Questions About Taxable Life Insurance

Even when you think you’ve got a handle on the rules, certain life insurance situations can still leave you scratching your head. Tax law is full of nuances, and it’s only natural to wonder how it all plays out in the real world.

Think of this section as your go-to guide for those tricky “what if” scenarios. We’ll break down the questions we hear most often, giving you the clarity you need.

If I Receive Proceeds in Installments, Are They Taxable?

Yes, but only a portion of them. While the core death benefit your loved one left you is 100% income-tax-free, any interest you earn on it is not.

Let's say you're the beneficiary of a $500,000 policy. Instead of taking it all at once, you choose to receive payments over 10 years. The insurance company doesn't just let that money sit there; it earns interest. That extra bit of money added to each payment is considered taxable income.

Always ask the insurer for a statement that clearly separates the tax-free principal from the taxable interest. It’ll make tax season much simpler.

What Happens if My Policy Lapses with a Loan?

This is a huge, often overlooked tax trap. If your policy lapses or you surrender it with an outstanding loan, the IRS doesn't just forget about the money you borrowed. They treat the loan balance as if it were paid out to you.

Here's where it gets painful: If that loan amount is more than what you paid in premiums (your cost basis), the difference is taxed as income. Imagine you paid $40,000 in premiums and had a $50,000 loan when the policy lapsed. You could get a tax bill on a $10,000 "gain"—even though you didn't see a dime when it lapsed. This is often called phantom income, and it’s a nasty surprise.

Important Takeaway: Be incredibly careful with policy loans. A lapsed policy can trigger a tax bill without giving you any cash to pay it, making it one of the riskiest situations a policyholder can face.

Can I Use a 1035 Exchange to Avoid Taxes?

You absolutely can. A 1035 exchange is one of the most powerful tools in the tax code for policyholders. It lets you swap an old life insurance policy for a new one—or even for a long-term care policy or an annuity—without having to pay taxes on any of the gains you’ve built up.

The golden rule is that the money has to move directly from one insurance company to the other. You can't touch the cash yourself. This is a brilliant way to move into a better-performing policy while keeping your tax-deferred growth intact. Just make sure you work with a financial professional to get the paperwork right.

Are My Life Insurance Premiums Tax-Deductible?

For almost everyone buying personal life insurance, the answer is a simple no. The IRS views these premiums as a personal expense, just like your home or auto insurance, so you can't write them off.

The main exception is for businesses. A company can usually deduct the premiums it pays for a group life insurance plan for its employees. But if you're buying a policy for yourself or your family, you'll be paying for it with after-tax dollars.

When planning for the future, it's also helpful to understand how other final costs are treated. Many people wonder if things like funeral expenses are tax deductible—knowing the answer can give your family a clearer financial picture during a difficult time.

Making sense of your life insurance policy’s tax rules is a critical step in protecting your family’s future. At My Policy Quote, we’re here to provide the straightforward guidance you need to feel confident in your decisions. Whether you’re looking for a new policy or trying to manage one you already have, our experts can help you find the right fit.

Compare quotes and find your ideal policy today at My Policy Quote.