For most early retirees, the single best health insurance option is usually an ACA Marketplace plan. Why? It offers solid, comprehensive benefits and, more importantly, can come with income-based subsidies that make it much more affordable. But it's not the only game in town. Depending on your specific needs, COBRA or even a short-term plan can act as a temporary bridge to get you to Medicare.

Your Guide to Pre-Medicare Health Insurance

Retiring before you hit 65 is a huge accomplishment—something you've likely worked toward for decades. You're finally trading in the daily grind for a life you've designed. But amidst the excitement, one big question looms: What do you do about health insurance during that gap before Medicare kicks in?

This period, typically from age 60 to 64, demands a real strategy. Without a job providing your health plan, the responsibility falls squarely on your shoulders. One unexpected hospital stay could put a serious dent in the retirement savings you've worked so hard to build.

Understanding Your Primary Options

Think of your pre-Medicare insurance choices as different kinds of bridges. Each one is built for a specific purpose, and your job is to pick the one that safely gets you from your last day of work to your 65th birthday.

There are really three main paths you can take, and each comes with its own set of rules, costs, and benefits:

- The ACA Marketplace: This is your go-to for a sturdy, long-term solution. Thanks to potential financial help based on your retirement income, it’s often the most affordable and reliable choice.

- COBRA Coverage: This lets you keep your old work plan for a while. It’s convenient, but you’ll be paying the full premium yourself, which can get expensive fast.

- Short-Term Health Plans: These are low-cost, bare-bones policies. They’re best for healthy people who only need to cover a very short gap, not for a multi-year stretch.

Navigating the road to Medicare is all about smart planning. The health insurance you choose in your early 60s isn't just a medical decision—it’s a crucial piece of your entire financial retirement strategy.

Here's a quick look at how these options stack up. This table summarizes the main paths for early retirees, highlighting where each one shines and what you need to know before you turn 65.

Comparing Your Health Insurance Options Before Medicare

| Insurance Option | Best For | Average Cost | Key Feature |

|---|---|---|---|

| ACA Marketplace | Retirees needing coverage for 1+ years and who may qualify for subsidies. | Varies with income; subsidies can make it very affordable. | Comprehensive coverage that can't deny you for pre-existing conditions. |

| COBRA | Those who want to keep their exact doctor network for a short period (up to 18 months). | High; you pay 100% of the premium plus an administrative fee. | Seamless continuation of your familiar employer-sponsored plan. |

| Short-Term Health Plan | Healthy individuals needing a temporary bridge for just a few months. | Low; but plans have limited benefits and many exclusions. | Inexpensive premiums, but it's not comprehensive insurance. |

Choosing the right path isn't a one-size-fits-all situation. It's about balancing the pros and cons against your unique circumstances.

Making an Informed Decision

Finding the "best" plan isn't about some magic formula. It’s about being honest about your health, your budget, and what you need from your coverage. Your current health status, how often you expect to see a doctor, and your projected retirement income will all steer you toward the right choice.

For a deeper dive into the specifics for those not yet 65, check out our complete guide on health insurance for retirees under 65.

And while you're planning, remember that your lifestyle choices matter, too. Some retirees even think bigger, exploring options like the World's Best Countries for Retirement. But for now, let's focus on getting your U.S. coverage right, so you can protect both your health and your hard-earned savings.

How the ACA Marketplace Bridges the Gap to Medicare

For most early retirees leaving an employer’s plan behind, the Affordable Care Act (ACA) Marketplace isn’t just an option—it’s the most important tool you have. Think of it less like a government program and more like a structured co-op for healthcare. It’s a platform where private insurance companies offer plans, but with crucial rules in place to protect you.

The single most powerful feature for an early retiree is that your coverage is guaranteed. Insurance companies on the Marketplace can’t deny you a plan or jack up your rates because of your health history or a pre-existing condition. This is an absolute game-changer, giving you the peace of mind you need to navigate the years before Medicare kicks in.

Deciphering the ACA Metal Tiers

When you start shopping, you’ll notice plans are sorted into four "metal tiers": Bronze, Silver, Gold, and Platinum. These names have nothing to do with the quality of care you get. Instead, they tell you how you and your insurer will share the costs.

It boils down to a simple trade-off between your monthly premium and what you pay out-of-pocket when you actually need care.

- Bronze Plans: These have the lowest monthly premiums but the highest deductibles and copays. They're a solid fit if you're in good health and mostly want a safety net for major, unexpected medical events.

- Silver Plans: Offering a nice middle ground, these plans have mid-range premiums and deductibles. They’re the most popular choice for a reason and are the only tier eligible for extra "Cost-Sharing Reductions" (more on that in a bit).

- Gold & Platinum Plans: These come with the highest monthly premiums but very low out-of-pocket costs. If you know you’ll need frequent medical care or prescriptions, one of these plans could easily be more cost-effective over the year.

Picking the right tier is a huge part of finding the best health insurance for early retirees because it lets you match your plan directly to your health needs and your budget.

The Power of Premium Tax Credits

Here’s where the ACA Marketplace becomes a true financial lifeline for early retirees: income-based subsidies, officially called Premium Tax Credits. These subsidies can slash your monthly health insurance premium, making comprehensive coverage truly affordable on a retirement income.

Your eligibility for these tax credits is based on your household's Modified Adjusted Gross Income (MAGI). For many retirees, income is lower and more predictable than during their working years, which often opens the door to significant financial help.

Think of the Premium Tax Credit as an instant discount applied directly to your monthly bill. Instead of paying the full sticker price for a plan, the government pays a portion on your behalf, and you just cover the rest.

This is a critical financial lever. Without this help, plans for someone aged 62-65 can easily cost $800 to $1,200 per month. With subsidies, those costs can be cut by hundreds of dollars. For a deeper look at the mechanics, explore our article on securing health insurance before Medicare.

Major Providers and Potential Headwinds

The ACA Marketplace is home to many trusted national and regional insurance carriers you already know. Top providers like UnitedHealthcare, which operates in over 30 states, and Ambetter from Centene, available in 29 states, offer robust networks and plans well-suited for retirees. When you use a service like My Policy Quote, you can easily compare these options side-by-side.

However, it’s vital to be aware of the financial storm brewing on the horizon. The enhanced subsidies that have made plans so affordable are set to expire at the end of 2025. For the 24 million people in ACA plans, including countless early retirees, this could mean an average premium hike of 75% or more. As retirement planning data shows, this looming "subsidy cliff" threatens to make this essential coverage unaffordable for millions. You can learn more about how this impacts retirement by reading analyses on soaring insurance costs. This makes smart income planning more important than ever before.

Preparing for the Upcoming ACA Subsidy Cliff

For today's early retirees, one of the biggest financial hurdles on the horizon is the expiration of enhanced ACA subsidies. This isn't some far-off problem; it's a fast-approaching reality that could completely upend your retirement budget. Understanding this "subsidy cliff" is the first step to protecting your financial future.

Think of your health insurance premium as a heavy weight and the ACA subsidy as a strong lever helping you lift it. For the last few years, that lever has been extra long, making the weight feel light and manageable. But at the end of 2025, that lever is scheduled to get much shorter, and you'll suddenly feel the full, unsubsidized weight of your insurance costs.

For people between 60 and 64, this could be a massive shock. The expiration of these enhanced premium tax credits could easily double health insurance costs in 2026. For millions of Americans, the average annual premium is projected to jump from $888 in 2025 to $1,904 in 2026—a staggering 114% increase.

What Is the Subsidy Cliff?

Imagine affordable healthcare is a castle, and the subsidy is a drawbridge that lets you cross the moat of high premiums. Right now, that drawbridge is down for nearly everyone, giving you a smooth path inside. The subsidy cliff is like that drawbridge being yanked up the second your income crosses a specific line.

Before these enhanced subsidies, if your income went even $1 over the limit (400% of the federal poverty level), the entire subsidy vanished. You'd literally fall off the cliff, going from a manageable monthly premium to the full, unsubsidized price overnight. While current rules have temporarily removed that harsh cutoff, the old cliff is set to return.

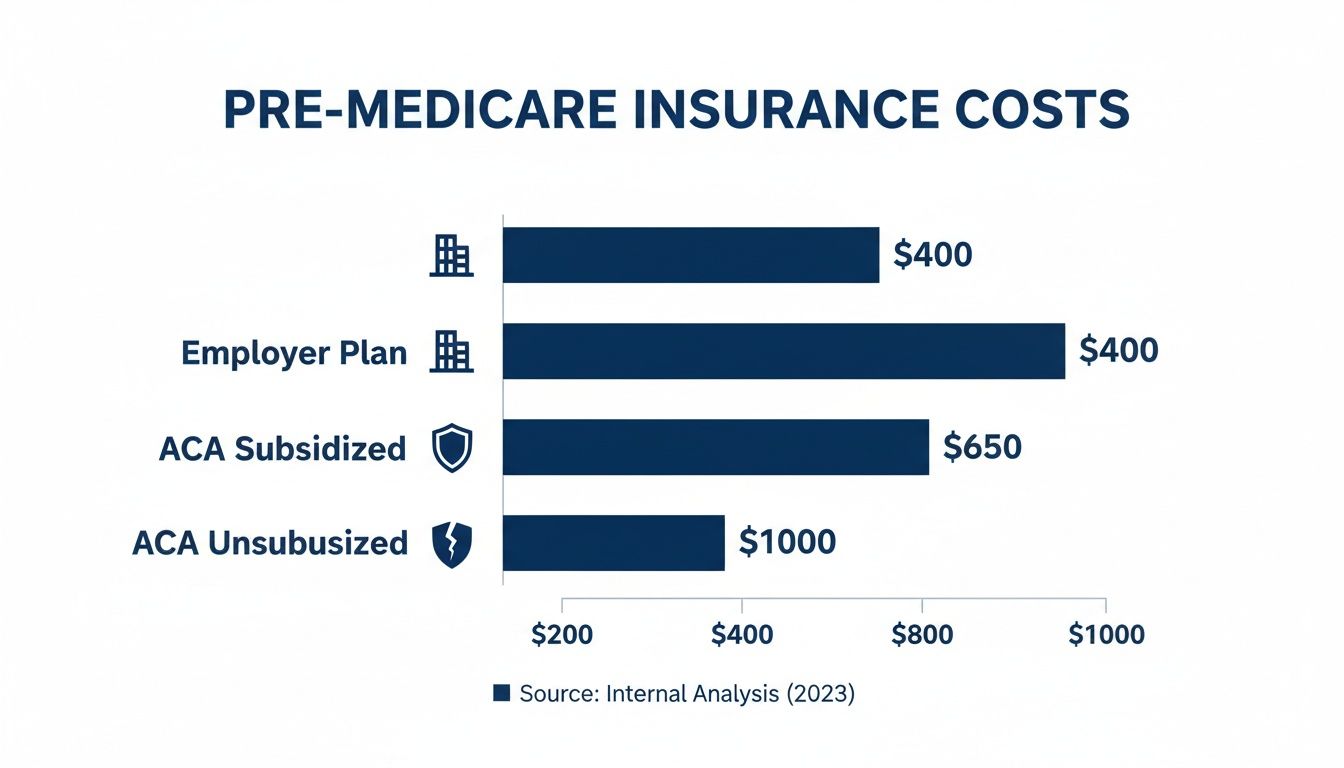

This chart shows the stark difference in costs between employer plans and ACA plans—both with and without those crucial subsidies.

As you can see, losing access to ACA subsidies can make your health insurance costs soar far beyond what you might have paid through an employer.

A Small Income Change, A Huge Cost Spike

This isn't just theory; the financial hit is very real. For a 60-year-old earning just over the subsidy threshold—say, $62,700 a year—premiums could skyrocket without warning. What was once affordable coverage can quickly become a major budget-buster.

Let's look at how this plays out for an individual retiree once the old rules return. The table below shows just how dramatic the increase can be when your income is just a little too high.

Projected Premium Hikes for a 62-Year-Old After Subsidies Expire

| Scenario | Annual Income | Estimated Monthly Premium (With Subsidy) | Estimated Monthly Premium (Without Subsidy) | Potential Annual Cost Increase |

|---|---|---|---|---|

| Just Under the Cliff | $62,000 | $450 | N/A | N/A |

| Just Over the Cliff | $63,000 | N/A | $1,200 | $9,000 |

That’s an extra $9,000 a year in healthcare costs, triggered by just $1,000 of extra income. This is the danger of the subsidy cliff, and it’s why proactive planning is absolutely essential.

How to Manage Your Income and Stay Under the Cliff

The key to navigating this challenge comes down to one number: your Modified Adjusted Gross Income (MAGI). This is the figure the ACA Marketplace uses to decide if you get a subsidy. The goal is simple: keep your MAGI below the cliff's threshold without wrecking your lifestyle.

This is where you have to shift from being a passive bill-payer to an active financial strategist. It's always best to discuss these options with a financial advisor, but here are the main levers you can pull:

- Plan Your Withdrawals: Money you pull from traditional IRAs or 401(k)s counts as income. You can control your MAGI by being very deliberate about how much you take out each year.

- Time Your Roth Conversions: Converting funds from a traditional IRA to a Roth IRA counts as taxable income in the year you do it. While it’s a powerful long-term tax strategy, a big conversion could easily push you over the subsidy cliff. Timing is everything.

- Be Smart About Capital Gains: Selling investments at a profit creates capital gains, which are part of your MAGI. If you need to sell assets, think about doing it in a year when your other income is lower or before you even retire.

Managing your investments can have a direct impact on your subsidy eligibility. Employing tax-efficient investing strategies is crucial for keeping your MAGI in check. For more ideas, you can also check out our guide on https://mypolicyquote.com/2026/01/11/how-to-find-affordable-health-insurance/ for more detailed approaches.

Evaluating COBRA and Other Insurance Alternatives

While an ACA Marketplace plan is often the go-to for early retirees, it’s not the only game in town. It's smart to look at the whole picture, especially if you only need to bridge a short gap before Medicare kicks in.

Depending on your timeline, finances, and health, other paths like COBRA or even a short-term plan might make more sense. Each one comes with its own set of pros and cons. Let's break them down so you can see where they fit into your retirement strategy and make a decision that feels right for you.

Is Keeping Your Old Plan with COBRA a Good Idea?

COBRA—short for the Consolidated Omnibus Budget Reconciliation Act—is essentially an offer to keep the exact same health plan you had with your old job. For up to 18 months, nothing has to change. You can keep your doctors, your network, and all your familiar benefits without missing a beat.

Sounds great, right? The catch is the cost. That convenience comes at a very steep price. When you were working, your employer was probably paying a big chunk of your monthly premium. Under COBRA, that support is gone. You’re on the hook for 100% of the premium, plus a 2% admin fee. It’s not uncommon for people to experience "sticker shock" when they see their monthly cost suddenly triple or quadruple.

COBRA is all about continuity, but you pay dearly for it. It can be a fantastic short-term fix if you've already hit your deductible for the year or can't bear the thought of leaving a trusted specialist. But as a long-term solution for a multi-year gap before Medicare? It's rarely financially sustainable.

To dig deeper into the numbers and rules, check out our guide on COBRA insurance for retirees.

Short-Term Health Plans: The Temporary Patch

If you think of COBRA as the expensive but reliable bridge, then short-term health plans are more like a temporary patch. They are designed for exactly what their name implies: covering you for a very short time, usually just a few months. These plans are really only suited for healthy people who just need to close a small coverage gap.

The biggest draw is their low price. The premiums are way cheaper than both COBRA and unsubsidized ACA plans. But that affordability comes with some major trade-offs.

- Pre-Existing Conditions: Forget it. Short-term plans almost never cover them.

- Limited Benefits: They often leave out essentials like prescription drugs, mental health services, and maternity care.

- No Guarantees: These plans don't have to follow ACA rules, which means they can flat-out deny you coverage based on your health history.

These plans are a stopgap, not a strategy. They are not a viable foundation for your healthcare needs in your early 60s when solid, reliable coverage matters most.

Health Sharing Ministries: A Different Model

Finally, you might run into something called a health sharing ministry. It’s really important to understand that these are not insurance. They are membership groups, usually faith-based, where members contribute monthly. That money is then pooled to help pay for other members’ medical bills.

The monthly contributions can look very attractive compared to traditional insurance premiums. But the risks here are significant.

- No Legal Guarantees: Because they aren't regulated like insurance, there is absolutely no legal guarantee that your medical claims will ever be paid.

- Coverage Exclusions: Many have strict lifestyle rules and won't cover services related to pre-existing conditions or choices they consider unhealthy.

- Payment Caps: They often put a limit on how much the ministry will pay for any single medical event, leaving you with the rest of the bill.

While this model might work for some healthy people who are comfortable with the risk, it lacks the legal protections and comprehensive benefits that are so critical for most retirees. Choosing this path means you're accepting a much, much higher level of financial risk.

A Step-By-Step Guide to Choosing and Enrolling

Knowing your options is one thing. Turning that knowledge into confident action is a whole different ballgame. This is where we move from research to reality with a clear framework for making a smart decision and sailing smoothly through enrollment.

The goal isn't just to find the cheapest plan. It’s to find the right plan for your life. A low-premium plan that doesn't cover your trusted doctor or your essential medications isn't a good deal—it's a headache waiting to happen. Let's walk through this together.

Your Personal Decision Checklist

Before you even start comparing plans, you need a clear snapshot of your own needs. Think of it as creating a blueprint for your ideal coverage. Grab a notebook and work through these points to figure out what the best health insurance for early retirees really means for you.

- Current Health Status: Be honest. Do you have chronic conditions that need regular attention from specialists? Or are you generally healthy and focused on preventive care?

- Prescription Drugs: Make a full list of every single medication you and your spouse take. This is a big one. You'll need to check if these drugs are on a plan's approved list (its formulary), because prescription costs can pile up fast.

- Doctor and Hospital Network: Do you have doctors, specialists, or a specific hospital you absolutely want to stick with? Jot them down so you can filter out any plans that don't include them in their network.

- Projected Retirement Income: Time to estimate your Modified Adjusted Gross Income (MAGI) for next year. This number is the key that can unlock ACA subsidies and dramatically slash your monthly premium.

This isn’t just busywork. This checklist is the foundation for a good decision. It takes a confusing sea of options and turns it into a manageable list of plans that actually fit your life.

Know Your Enrollment Deadlines

When it comes to health insurance, timing is everything. Miss a deadline, and you could be stuck without coverage for months, leaving you completely exposed financially. There are two main windows you need to know.

- Open Enrollment Period (OEP): This is the yearly window when anyone can sign up for an ACA Marketplace plan. It typically runs from November 1st to January 15th in most states.

- Special Enrollment Period (SEP): Losing your health insurance from your job is what’s known as a “qualifying life event.” This triggers a special 60-day window for you to enroll in a new plan, even outside of the OEP.

Don’t put this off. That 60-day clock for your Special Enrollment Period starts ticking the day your old coverage ends. Circle the date on your calendar and act fast to avoid a dangerous gap in your health coverage.

Taking Action: The Enrollment Process

Okay, you've figured out your needs and you know your deadline. The last step is to apply. If you've done your homework, this part is pretty straightforward. You'll just need to gather a few documents, compare your top choices, and submit your application.

Here’s what you’ll generally need to have handy:

- Social Security numbers for everyone being insured.

- Your projected household income details.

- Information about the employer plan you're leaving.

This is exactly where a service like My Policy Quote can be a lifesaver. Instead of trying to wrangle information from multiple websites and confusing spreadsheets, you get personalized, side-by-side plan comparisons all in one spot. We simplify the whole process, helping you find that perfect balance of cost and coverage to protect both your health and your retirement savings.

Common Questions We Hear All the Time

Even with a great roadmap, the world of pre-Medicare health insurance can throw some curveballs. This is where we tackle the questions that come up again and again for early retirees. Think of it as your quick-reference guide for those nagging "what if" scenarios.

We’ll break down everything from how your 401(k) withdrawals affect your eligibility for financial help to the real-world trade-offs between different insurance paths. The goal is to clear the fog so you can move forward feeling 100% confident in your choices.

Can I Still Get ACA Subsidies if I’m Living on a Pension or 401(k)?

Yes, absolutely. But this is where being strategic really pays off. The subsidies that make ACA plans so affordable are based on one magic number: your Modified Adjusted Gross Income (MAGI).

This is a huge detail because not all retirement income is treated the same.

- Income That Counts: Every dollar you pull from a traditional 401(k) or IRA gets counted as income, raising your MAGI. Most pension payments fall into this category, too.

- Income That Doesn't: Here's the good news. Qualified withdrawals from a Roth IRA are generally not included in your MAGI.

This means the way you structure your retirement income directly impacts how much you'll pay for health insurance. A little bit of planning on the front end can save you thousands.

Is It Better to Stick with COBRA or Just Switch to an ACA Plan?

This is probably the most common question we get, and the answer almost always comes down to cost versus convenience. For the vast majority of early retirees, an ACA Marketplace plan is going to be the more affordable route, hands down.

Why? Because with COBRA, you’re on the hook for the entire premium your employer used to pay, plus a 2% admin fee. The sticker shock is real.

Now, there are a couple of rare situations where COBRA might make sense for a short while. If you've already hit your deductible for the year on your old plan, starting over with a new one could cost more in the short term. Also, if you absolutely must keep a specific network of doctors that isn't available on the Marketplace, COBRA guarantees you can do that.

For most people, though, the savings from an ACA plan with subsidies are just too significant to pass up.

What Happens if My Income Changes in the Middle of the Year?

Life happens. Maybe you take a larger-than-planned withdrawal or do some consulting work. If your income changes during the year, it’s critical to report it to the ACA Marketplace right away. This isn’t just a friendly suggestion; it’s a step that protects your wallet.

Here’s why it’s so important:

- If Your Income Goes Up: Your subsidy will likely decrease. By reporting it now, your monthly premium gets adjusted. If you wait until tax time, you could be stuck paying back a big chunk of the subsidy you weren't actually eligible for.

- If Your Income Goes Down: You might qualify for an even bigger subsidy! Reporting the change will lower your monthly premiums for the rest of the year, putting money back in your pocket when you need it.

Keeping your income updated is the best way to avoid a nasty surprise when you file your taxes. It ensures you’re getting exactly the right amount of help—no more, no less.

Feeling a little overwhelmed by the options? You don't have to figure this out alone. The experts at My Policy Quote live and breathe this stuff, and we specialize in helping early retirees find the perfect fit. We make it simple by showing you clear, side-by-side comparisons tailored to your exact situation.

Get your personalized quotes today at https://mypolicyquote.com and take the guesswork out of your healthcare journey.