So, what exactly is an insurance binder? Think of it as a temporary, legally binding document that proves you have insurance coverage while the official, formal policy is still being prepared. It’s like a VIP pass that gives you immediate protection for big life moments, like buying a home or a new car, so you don't have to deal with costly delays.

Understanding The Insurance Binder

Picture this: you're at the dealership, keys in hand, ready to finally drive that new car off the lot. But the lender won’t let you leave without proof of insurance, and your full policy documents could take days—or even weeks—to show up. This is exactly where an insurance binder saves the day.

An insurance binder is that crucial bridge, filling the gap between when you agree to buy a policy and when you get the final contract. It acts as your official placeholder, confirming to everyone involved that you are, in fact, covered.

Key Features Of An Insurance Binder

This document is so much more than a simple piece of paper; it’s a temporary contract with some very specific traits:

- Its Purpose: To give you immediate, temporary proof that you have insurance coverage.

- Its Duration: It’s a short-term fix, typically valid for 30 to 90 days.

- Its Legal Power: It’s a legally enforceable agreement that holds the insurance company to the coverage it promises.

To give you a quick summary, here’s a breakdown of what a binder does.

Insurance Binder at a Glance

| Feature | Description |

|---|---|

| Document Type | Temporary, legally binding insurance agreement |

| Primary Use | Provides immediate proof of coverage for transactions |

| Typical Validity | 30 to 90 days (until the full policy is issued) |

| Legal Status | Enforceable in court as an interim policy |

| Common Scenarios | Home closings, auto purchases, business loans |

Essentially, this temporary coverage is vital while your application goes through the final approval stages.

The courts actually define an insurance binder as a "temporary or interim policy," which means it gives you solid legal proof of coverage until the real policy arrives. This is especially common in real estate deals, which make up about 40% of all binder requests, as they ensure there are no gaps in coverage during the closing process.

Key Takeaway: An insurance binder isn't just a summary; it's an active, temporary insurance policy. It allows major transactions to move forward by satisfying the requirements of lenders, clients, or government agencies.

If you want to get into the weeds of how this part of the process works, check out our guide on https://mypolicyquote.com/2025/08/15/what-is-underwriting-in-insurance/. For commercial drivers, it's also a good idea to know how a binder meets official rules, so it helps to be familiar with the broader FMCSA insurance requirements.

How Insurance Binders Actually Work in the Real World

Okay, let's move past the textbook definition and talk about what an insurance binder really does. Think of it as the key that unlocks major deals, cutting through the red tape when you need to prove you're covered right now.

Imagine a family has just found the perfect minivan. They’ve sorted out the price and got the loan, but the dealership won’t hand over the keys without proof of auto insurance. The official policy documents? Those won't show up for another week.

This is exactly where a binder saves the day. Their insurance agent can email a binder straight to the dealership in minutes. It’s a legally binding document confirming the new van is covered, which satisfies the lender and lets the family drive their new car home that same afternoon.

Putting Binders into Action

The process is simple, but it's what keeps life moving. Here are a couple more times a binder acts as your immediate proof of protection.

-

A Couple Refinancing Their Home: Before finalizing the new loan, the mortgage lender needs to see proof of homeowners insurance. The couple's agent issues a binder that lists the lender as an interested party. This confirms the property is protected, and the refinancing closes without a hitch.

-

A Freelancer Landing a Big Client: A self-employed graphic designer just won a contract with a huge company. But the contract says they can't start until they show proof of professional liability insurance. A binder gives them instant verification, so they can get to work instead of waiting weeks for the full policy.

These examples show you the real magic of a binder. It activates new protection on the spot. This is totally different from a Certificate of Insurance (COI), which just confirms a policy you already have. It’s why over 80% of new car loans in the U.S. require a binder—the full policy takes time, but the binder lets you drive off the lot. For a deeper dive into the legal side, Vouch.us offers some great insights.

Why This Is a Game-Changer for Contractors and Small Businesses

If you're an independent professional, knowing how to use an insurance binder is a must. Clients demand proof of coverage to protect themselves, and any delay can put a project—or even the entire client relationship—at risk.

Key Insight: For a 1099 contractor, an insurance binder is more than just paperwork; it’s a tool for closing deals. It screams professionalism and proves you’ve met the client's requirements, letting you get to work faster.

Having an agent who can send over a binder quickly is a massive advantage. It means you can meet your contractual obligations without missing a beat, which is crucial when you're running your own show. For more on what coverage you might need, check out our guide on contractor insurance requirements. Being able to provide that proof of insurance instantly can be the difference between landing a gig and losing it.

Decoding Your Insurance Binder Document

Getting an insurance binder can feel like you've been handed a document in a foreign language. It’s packed with industry terms and numbers, but cracking that code is the only way to be sure your temporary coverage is exactly what you need. Let’s walk through it, piece by piece, so you know what you’re looking at.

Think of it as a temporary ID card for your new insurance policy. It holds all the critical info a lender, landlord, or client needs to see, just in a more compact form. Your very first move should always be to confirm the basic details are spot on.

Key Information to Verify

When that binder lands in your inbox, give it a quick scan for the most important elements. A tiny mistake here can create a huge headache down the road.

- Named Insured: This sounds obvious, but you’d be surprised. Make sure your name—or your company's full legal name—is spelled perfectly. Any typo could get it rejected by the very people who asked for it.

- Policy Effective Dates: This section shows when your coverage kicks in and, just as importantly, when the binder expires. A typical binder is good for 30-90 days, which gives the insurance company enough time to issue the full, formal policy.

- Coverage Limits and Deductibles: Here’s where you’ll see the maximum your insurer will pay for a claim (limits) and what you have to pay out-of-pocket first (deductibles). Double-check that these numbers match what you and your agent agreed to.

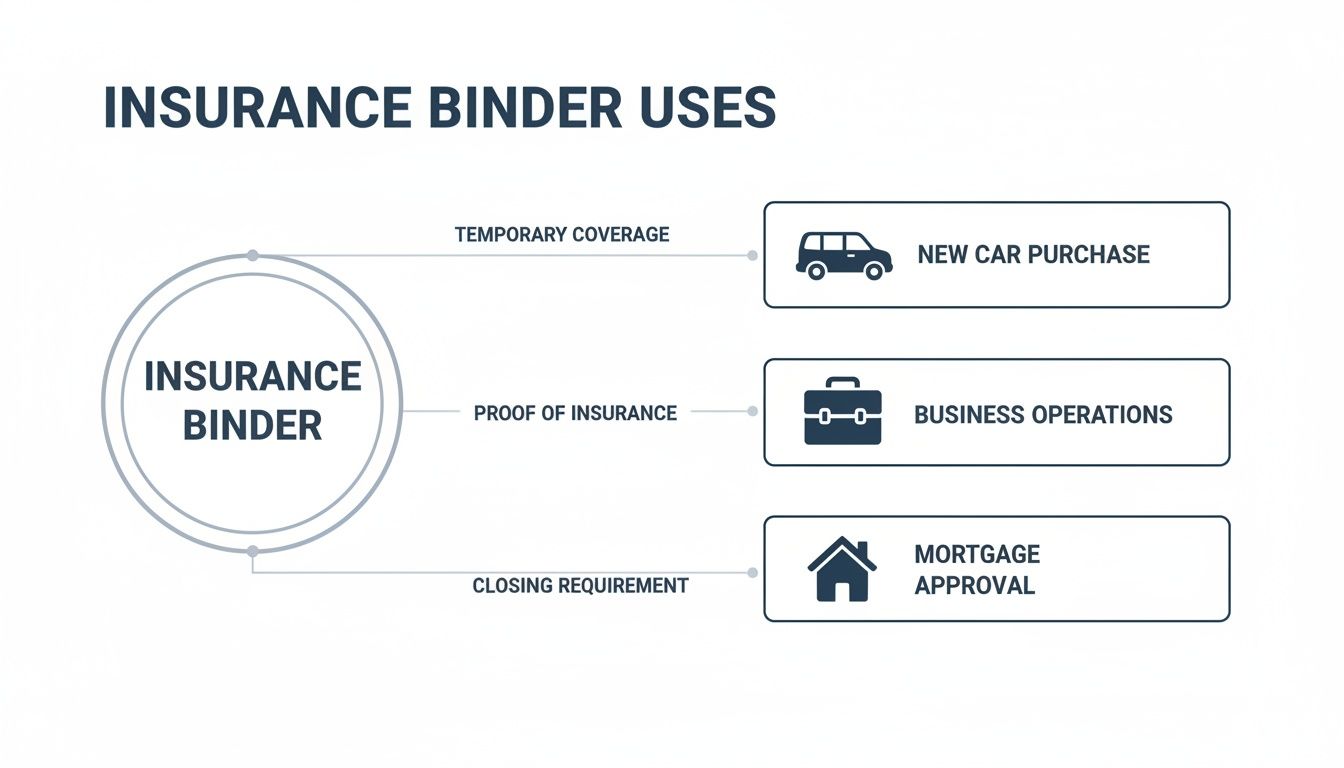

This infographic breaks down the most common reasons you’d need a binder to prove you're covered.

As you can see, binders are the green light for some of life's biggest transactions, like buying a car, signing a business contract, or closing on a home.

Understanding the Fine Print

Beyond the basics, your binder gets into the nitty-gritty of what’s actually covered. This is where the temporary document starts to look a lot like the future policy.

The binder will list the type of coverage you have—like liability, collision, or property insurance. It will also name the insurance company that’s actually underwriting the risk, not just the agent or broker you’ve been talking to.

Finally, keep an eye out for any special conditions or endorsements. These are just modifications to standard coverage. For instance, a mortgage lender will always require being listed as a "loss payee" or "additional insured" to protect their financial stake in your property.

Crucial Tip: Never just assume your binder is correct. Read every single line. If you spot a mistake, even a small one, call your agent immediately and ask for a corrected version. An inaccurate binder can be just as useless as no binder at all.

Learning to read this temporary document is a fantastic first step. For a full walkthrough of the final contract, check out our guide on how to read an insurance policy. This knowledge puts you in the driver’s seat, empowering you to manage your coverage with real confidence.

Binder vs. Certificate of Insurance vs. Policy

In the world of insurance, it’s easy to get lost in a sea of similar-sounding documents. But knowing the difference between a binder, a Certificate of Insurance (COI), and a full policy is more than just semantics—it can make or break a deal.

Each one serves a unique purpose at a different stage of your coverage journey.

Think of it this way: a binder is like a starter pistol—it kicks off new coverage immediately. A COI is like a snapshot in time—it proves you already have coverage. The final policy is the complete rulebook, detailing every single term and condition.

Mixing these up can cause serious delays, especially when a lender, landlord, or new client is waiting on you.

Distinguishing Their Core Functions

Let's break down what really separates these documents. An insurance binder is a temporary contract. It legally obligates the insurer to provide coverage while the formal policy is being finalized. It’s active, binding, and gives you real protection from day one.

A Certificate of Insurance, on the other hand, is just an informational summary. It shows an interested party—like a client who hired you—that you have existing coverage, listing things like liability limits and effective dates. But here’s the key: it does not create or change your coverage in any way.

Key Takeaway: A binder is proof of new coverage starting now. A COI is proof of existing coverage. They are not interchangeable, and providing the wrong one can halt a deal in its tracks.

Understanding this difference ensures you provide exactly what’s needed, whether you’re closing on a house or starting a new project.

Head-to-Head Document Comparison

The easiest way to see their unique roles is to compare them side-by-side. Each document answers a different question for the person who’s asking for it.

Here’s a simple table to help you keep these three critical documents straight.

Comparing Key Insurance Documents

This table clearly outlines the differences between an insurance binder, a certificate of insurance, and a full insurance policy.

| Document | Purpose | Legal Status | Provides Coverage? |

|---|---|---|---|

| Insurance Binder | To provide temporary proof of new insurance | A legally binding interim contract | Yes, it provides temporary coverage |

| Certificate of Insurance | To summarize and prove existing insurance | An informational summary (not a contract) | No, it only verifies existing coverage |

| Insurance Policy | To outline all terms of the full insurance agreement | The final, comprehensive legal contract | Yes, it is the source of all coverage |

Essentially, the binder acts as a placeholder that carries the full legal weight of a policy, but only for a short time—usually 30 to 90 days. The COI just confirms your policy is active, and the policy itself is the official, long-term agreement that replaces the binder once it’s issued.

Knowing which one to request and provide is a skill that saves time and prevents headaches with lenders, clients, and partners.

When You Absolutely Need an Insurance Binder

Knowing when to ask for an insurance binder can be the difference between a smooth transaction and a complete nightmare. In certain high-stakes moments, this temporary document isn't just a nice-to-have—it's the key that unlocks your next big move.

Think of it as your golden ticket. It’s what you show a lender, a landlord, or a client who needs to see proof you're covered right now. Waiting weeks for the full, official policy to arrive in the mail just won’t cut it.

Closing on a House

This is the big one. Mortgage lenders are meticulous, and they will not release the funds for your new home without proof that it’s insured from the second it becomes yours.

Since the final policy paperwork can take its sweet time, your insurance agent steps in and issues a binder. They send it straight to the lender, confirming the property is protected. That’s what gives the bank the confidence to let the closing happen on schedule.

Buying a Vehicle from a Dealership

You’ve found the perfect car, haggled on the price, and sorted out the financing. But you can’t just drive it off the lot. The dealership and your auto lender both need to know that new ride is insured before the keys are in your hand.

This is where an auto insurance binder saves the day. Your agent can often email one over to the dealership in minutes. Just like that, you have the green light to drive your new car home.

Crucial Insight: An insurance binder is your immediate, legally recognized proof of coverage. It’s the essential bridge between a handshake deal and the final paperwork, preventing major deals in real estate, finance, and business from hitting a wall.

Securing a Business Loan or Contract

For small business owners and independent contractors, a binder is a powerful tool. When you’re applying for a business loan, the lender will almost always ask for proof of general liability insurance to protect their investment.

Likewise, landing a big client often comes with a requirement: show us you’re insured before we sign. A binder lets you do that instantly, so you don’t miss out on a game-changing opportunity. For a deeper dive, check out our guide on business insurance for contractors.

It’s not just for business, either. Binders are also incredibly useful for both landlords and tenants who need to quickly confirm coverage when securing a rental agreement.

Common Binder Mistakes and How to Avoid Them

An insurance binder is your lifeline while you wait for your official policy, but a few simple missteps can turn that safety net into a real headache. Knowing the common pitfalls is the key to making sure your coverage is solid when you need it most.

One of the biggest mistakes is thinking the binder is the final word. It’s not. It’s a temporary bridge to get you from point A to point B. If you let it expire before your full policy is in hand, you could be left completely exposed—a huge risk if a lender or client is breathing down your neck for proof of coverage.

Another classic error? Taking your agent's word for it. A verbal "you're covered" is nice to hear, but it’s nearly impossible to prove and often holds no legal weight. Always, always insist on getting a physical or digital copy of the binder before you move forward with your home closing, car purchase, or business contract.

Underwriting Surprises After the Binder

Here’s something many people don't realize: the terms on your binder aren't set in stone. The binder is issued before the underwriter has finished their deep dive into your application. They are still actively reviewing your history and assessing the real risk involved.

During that review, they can uncover things that change the entire game.

- Your Premium Could Go Up: If the underwriter digs up something you forgot to mention, like a past driving incident, they have every right to increase your premium.

- Your Coverage Could Be Denied: In more serious cases, the insurer can pull the plug on the binder entirely and deny the policy. It happens.

Key Insight: Think of an insurance binder as a conditional agreement. The final price and even the approval itself all depend on what the underwriter finds. Be prepared for potential changes.

The Danger of Letting Your Binder Expire

That expiration date on your binder isn't a suggestion—it’s a hard stop. If your underwriting gets flagged for a history of claims (say, three or more), coverage can lapse after the typical 30-day term. This leaves you scrambling for new quotes at the worst possible time.

And this isn't a rare problem. Even though some modern insurers are moving away from them, traditional carriers still issue around 22 million binders in the U.S. each year. To avoid a dangerous gap in coverage, stay in close touch with your agent as that expiration date gets closer. You can find more details on this topic by exploring how insurance binders work on Progressive.com.

Got Questions About Insurance Binders? We've Got Answers.

Alright, let's wrap this up by hitting the questions I hear all the time about insurance binders. Think of this as a quick-fire Q&A to clear up any lingering confusion and make sure you feel totally confident in the process.

How Long Is an Insurance Binder Good For?

Think of an insurance binder as a temporary bridge—it’s only there to get you from point A (buying coverage) to point B (getting your official policy). Because of that, they don't last forever.

Typically, a binder is valid for 30 to 90 days. But that's not a hard-and-fast rule. The exact expiration date depends on the insurance company and sometimes even state law. It will always be printed clearly on the binder itself, so make sure you check it.

Does an Insurance Binder Cost Anything Extra?

Nope, you don't pay a separate fee just for the binder. When people talk about a binder payment, they’re really just talking about your first premium payment.

It’s simple: the binder is your proof of coverage, and making that first payment is what kicks everything into gear. It’s not an extra charge; it's the first step in paying your regular premium.

Heads Up: Don't skip that first payment! If you miss it, the insurer can cancel your application, and you'll be left with no coverage at all. It's the final, crucial step to seal the deal.

Can an Insurance Company Just Cancel a Binder?

Yes, they can. A binder is issued before the underwriter has finished their deep dive into your application. If they dig up something that changes your risk profile—like a past claim you forgot to mention or some incorrect info—they have every right to cancel the binder.

This is exactly why being upfront and honest on your application is so important. A binder gives you temporary protection, but it’s always conditional on that final underwriting review.

My Binder Is About to Expire, But I Still Don't Have My Policy. Now What?

Don't just sit and wait. If that expiration date is getting close and your official policy documents are nowhere in sight, get on the phone with your insurance agent right away.

They can find out what’s causing the hold-up. More importantly, they can request an extension on the binder so you don’t have a dangerous gap in your coverage. When it comes to insurance, a quick, proactive phone call is always your best bet.

Navigating the world of insurance shouldn't feel like a puzzle. At My Policy Quote, our goal is to give you clear, straightforward options to find the perfect coverage for you and your family.

Get Your Free Insurance Quote Today at https://mypolicyquote.com