The biggest difference between an insurance agent and a broker all comes down to a single question: who do they work for?

An insurance agent works for an insurance company. They're contracted to offer that specific carrier's products. On the other hand, an insurance broker works for you, the client. Their job is to search the market and find policies from many different insurance companies.

Insurance Agent Vs Broker: The Key Differences At A Glance

Choosing the right insurance professional can feel like a maze, but it really boils down to understanding their roles and loyalties. This one decision shapes the advice you receive, the policy options you see, and ultimately, how much you pay for your coverage.

The distinction is pretty straightforward: one person serves the insurer, while the other serves you.

Think of an agent as a specialist. They are experts on the policies of the one or few companies they represent. Their knowledge is deep but often narrow. A broker, however, is more like your personal shopper. They scan the entire marketplace to find a policy that fits your unique situation, without being tied to any single provider. Getting this difference is the first step in understanding how insurance works to your advantage.

This is especially important if your needs aren't "standard"—like if you're a 1099 contractor or a working family searching for affordable health coverage. A broker's ability to give unbiased advice and compare quotes can often lead to savings of 10-20% on premiums.

The brokerage model really took off in the U.S. after World War II to serve a growing middle class. Since then, the industry has exploded to over 1 million global agencies and brokerages as of 2025.

Let’s break it down to make it even clearer.

Quick Comparison: Agent Vs Broker

This table gives you a simple, side-by-side look at the core differences between an insurance agent and an insurance broker.

| Criteria | Insurance Agent | Insurance Broker |

|---|---|---|

| Allegiance | Represents the insurance company | Represents the client (you) |

| Product Access | Limited to one or a few carriers | Access to the entire insurance market |

| Role | Sells policies for the insurer | Advises and shops for the client |

| Primary Duty | Fulfills contractual obligations to the insurer | Holds a fiduciary duty to the client |

| Best For | Simple needs or preference for a specific insurer | Complex needs or desire for market comparison |

Essentially, your choice depends on what you're looking for. Do you already love a specific company, or do you want someone to check out all the options for you? Answering that will point you in the right direction.

Understanding Who They Work For: Allegiance and Representation

The biggest difference between an insurance agent and a broker comes down to one simple question: who do they actually work for? The answer changes everything—the advice you get, the policies you see, and who has your back when things go wrong.

An agent’s primary loyalty is to the insurance company they represent. A broker’s loyalty is to you.

Think of an insurance agent, especially a captive one, as a representative of a specific brand. Their job is to sell that company’s products. That means their recommendations are limited to what their employer offers, and their advice is naturally shaped by the insurer’s goals.

A broker, on the other hand, has a fiduciary duty to their clients. This is a powerful legal and ethical commitment to act in your best interest, always. They aren’t tied to any single company, so their focus is on searching the entire market to find what’s truly right for you.

How Allegiance Plays Out in the Real World

Let's make this practical. Imagine a freelance graphic designer who needs a solid health plan. An agent working for a single major insurer will show them the best options available from that one company. It might be a good plan, but is it the best plan?

A broker can pull quotes from multiple carriers side-by-side. They might find a policy with a better doctor network, a lower deductible, or more flexible prescription coverage—options the agent simply couldn't offer.

This becomes even more important with something as personal as life insurance. It's not just about getting a policy; it's about structuring it correctly. A broker is in a much better position to give objective advice, similar to the strategies found when learning how to sell life insurance based on what a client needs, not what a carrier wants to sell. To really understand this loyalty divide, it helps to explore the fundamental difference between an insurance agent and a broker.

A broker acts as your advocate, especially when you need to file a claim. Because their duty is to you, they'll help you navigate the process and push back against the insurer if needed. An agent's obligations, meanwhile, remain with the company.

The Market Is Leaning Toward Client-First Service

The numbers tell a similar story. The global insurance brokerage market is growing fast, projected to hit USD 524.80 billion by 2030. This isn't just a random trend. It’s driven by people wanting personalized, client-focused guidance.

Take a look at complex areas like workplace benefits—independent brokers handle a staggering 83% of that business. It shows a clear preference for the choice and advocacy that brokers bring to the table. You can check out more about these market trends on grandviewresearch.com.

Ultimately, choosing between an agent and a broker is about deciding who you want in your corner. Do you want someone who represents the company selling the product, or an expert who works only for you?

Comparing Your Access to Insurance Products and Choices

So, what's the biggest real-world difference between an agent and a broker? It all comes down to the number of choices they can put in front of you. This isn't just about having a longer list; it's about finding the right policy for your life, whether you're a gig worker who needs specific liability coverage or a family hunting for the perfect health plan.

Think of it this way: an agent’s product list is tied to the company they work for. A broker’s list is the entire market.

This single difference changes everything about your experience. A captive agent gives you a deep dive into one insurer's options. An independent agent opens the door to a handful of companies they’ve partnered with. A broker, however, can look everywhere.

The Limits of Working with an Agent

When you sit down with an agent, your options are already filtered. It’s just a matter of how much.

- Captive Agents: These pros work for one specific insurance company. They know that company's products inside and out, but they can’t offer you a better deal from a competitor, even if one exists.

- Independent Agents: You get more variety here, but independent agents are still limited. They only show you policies from the specific carriers they have contracts with—maybe a dozen companies, give or take.

This setup is fine if your needs are straightforward and you value simplicity. But if you have unique circumstances, like a small business owner trying to manage complex risks, this narrow view can be a real roadblock.

The real power of a broker is their freedom to search the entire market without bias. They aren't tied to any contracts, which means they can find specialized policies or better rates that agents can't even see.

The Broker's Advantage: The Whole Market at Your Fingertips

A broker works for you, not an insurance company. That gives them the freedom to shop across the entire landscape of available policies, which is a game-changer when your needs aren't cookie-cutter. A nonprofit on a tight budget, for example, could benefit from a broker who can dig up specialized plans like an Individual Coverage HRA (ICHRA), which offers a level of flexibility and cost control that most traditional group plans can't match.

To really appreciate the difference, it helps to have a baseline for understanding common types of auto insurance coverage like bodily injury liability and what they do. A broker can compare how dozens of different carriers structure these core coverages, spotting subtle differences in limits or exclusions that could save you thousands if you ever have to file a claim.

This wide-open access is just as critical for health insurance. If you have unique family needs or pre-existing conditions, a broker can sift through countless plans to find the right one. Our guide on how to compare health insurance plans walks you through the details a broker reviews for you. In the end, a broker's 360-degree view of the market almost always translates into more personalized—and often more affordable—coverage for you.

How Insurance Agents and Brokers Get Paid

To really get the difference between an insurance agent and a broker, it helps to follow the money. How each one gets paid says a lot about who they truly work for, and it can shape the advice you end up getting.

For both agents and brokers, the most common way they earn a living is through commissions. When you buy a policy, the insurance company pays them a cut of your premium. This is great for you because it means you usually don’t have to pay anything directly out of your pocket for their help.

But the story doesn’t end there. The incentives behind those commissions can be very different.

The Commission Structure Explained

Let's start with an insurance agent, especially a captive one who works for a single company. Their paycheck is tied directly to selling policies from that one carrier. This can create a tricky situation—a potential conflict of interest. An agent might be nudged to recommend a policy that pays them a higher commission, even if another option might have been a slightly better fit for you.

An independent agent or a broker also works on commission, but they have a bit more freedom. Because they represent multiple insurance companies, that pressure gets spread out. They can shop around on your behalf, focusing on finding the right coverage knowing they'll be paid by whichever carrier you ultimately choose. The commission is just part of the premium you were going to pay anyway.

The key takeaway is that commissions are standard in the industry. The important distinction is whether the professional's compensation structure limits your options or aligns with your best interests.

Fee-Based Models: A Sign of True Advocacy

While commissions are the norm, some brokers offer a fee-for-service model. You’ll see this more often for complex situations, like a business needing specialized benefits consulting. In these cases, you pay the broker a flat fee directly for their time and expertise.

This setup strips away any potential conflict of interest tied to which policy you buy. A fee-based broker’s only incentive is to give you the best advice possible and find the most effective coverage, no matter which company provides it. It reinforces their role as a true advocate acting in your best interest.

Here’s a simple way to think about it:

-

Commission-Based (Most Common)

- How it works: The insurance company pays the agent or broker a percentage of your premium.

- Direct cost to you: None. The fee is baked into the policy's price.

- Potential conflict: Can be higher for captive agents tied to one company.

-

Fee-Based (Less Common)

- How it works: You pay the broker a direct, predetermined fee for their advisory services.

- Direct cost to you: Yes, you pay a fee for their expert consultation.

- Potential conflict: Very low. Their pay isn't tied to selling a specific product.

At the end of the day, understanding how they’re paid empowers you to ask better questions. Any transparent agent or broker will be happy to explain exactly how they make their money. That openness gives you the confidence you need to move forward.

Choosing the Right Professional for Your Situation

Figuring out if you need an insurance agent or a broker isn't just a technical question—it's about matching the right professional to your life right now. The best choice really boils down to what you need, how complicated your situation is, and how much help you want.

There’s no single "better" option here. It’s all about what fits you.

For simpler, more straightforward needs, an agent can be a fantastic choice. If you already trust a specific insurance company and you're just looking for a standard auto or home policy, a captive agent's deep knowledge of their products makes the whole process quick and direct.

But when things get a little more complex, a broker really starts to shine. Their power lies in scanning the entire market, which is a game-changer when an off-the-shelf policy just won't do.

Scenario 1: The Young Family Needing Life Insurance

Think about a young family getting their first term life insurance policy. Their goals are usually pretty clear: get enough coverage to protect the kids and the mortgage, without breaking the bank. Nothing too complicated here.

In this situation, either a captive or independent agent is a solid bet. A captive agent from a well-known life insurance company can walk them through every detail of their term products, riders, and future options. An independent agent can pull quotes from a few great carriers, giving the family strong choices without overwhelming them.

Recommendation: An agent is often the perfect starting point. The process is clean and simple. Since term life is a fairly standard product, you don't lose much by not seeing every single option out there.

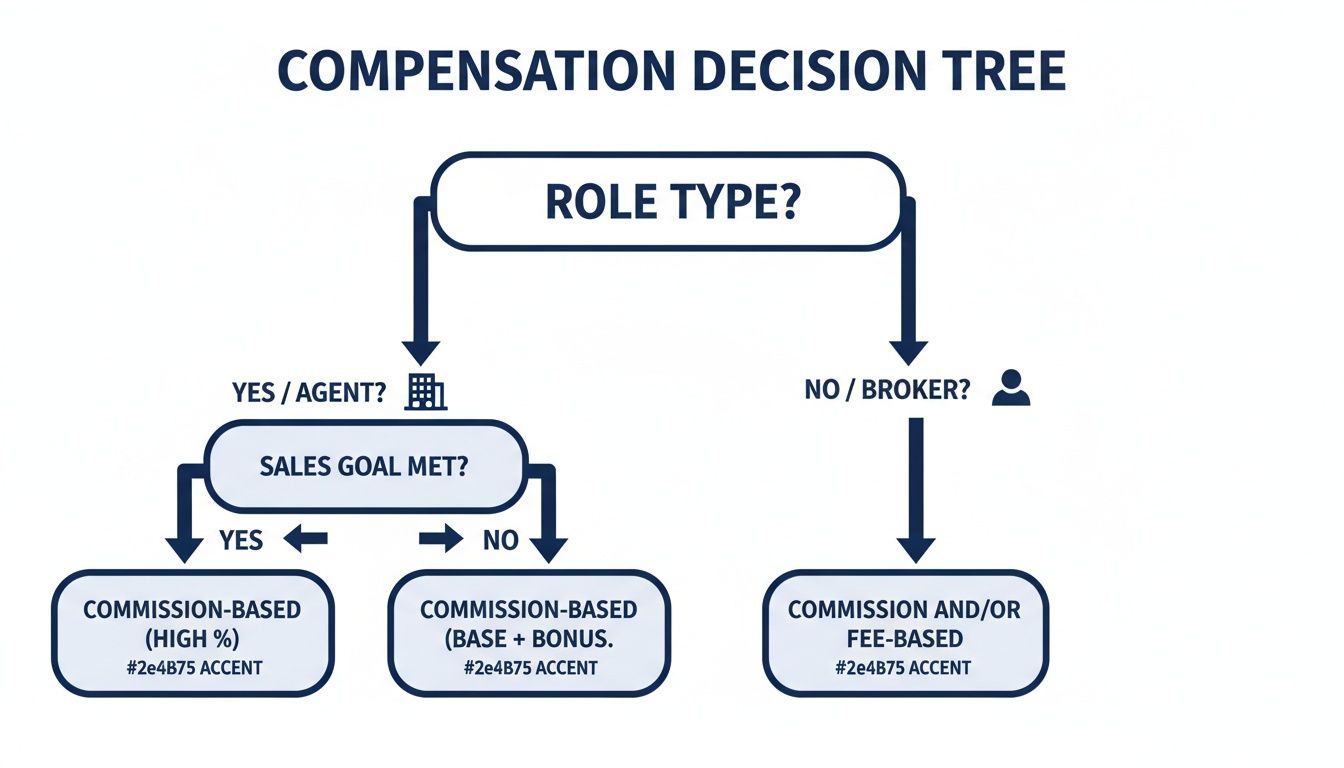

This diagram breaks down how agents and brokers get paid, which gives you a peek into how their service models are built.

As you can see, both are typically paid a commission by the insurer. However, a broker might also work for a direct fee, which really cements their role as your advocate.

Scenario 2: The Small Business with Specialized Risks

Now, let's switch gears to a small business owner—maybe a contractor or a tech startup. Their needs are a world away from simple. They need general liability, professional liability (also known as errors and omissions), workers' comp, and maybe even cyber insurance. A one-size-fits-all policy would be a disaster.

This is exactly where a broker becomes your most valuable player. They have access to specialty insurance markets that most agents can't even touch. They can find policies designed for unique industries or source coverage from surplus lines carriers for high-risk businesses.

For a business, a broker’s biggest strength is risk assessment. They dig into your operations to find coverage gaps an agent might overlook, making sure you’re protected from every angle.

Recommendation: A broker is the clear winner here. Their market access and legal duty to put your interests first are non-negotiable for navigating the tricky world of commercial insurance. Their expertise can save your business from devastating coverage gaps you didn't even know existed.

How to Verify Credentials and Avoid Red Flags

Choosing an agent or broker is a big decision. You're not just buying a policy; you're trusting someone with your financial security. So before you sign anything, it’s smart to do a little homework. A few minutes of due diligence can save you from a world of headaches down the road.

The absolute first thing to check is their license. Every single insurance professional is required to be licensed by the state they do business in. This isn't just a piece of paper—it's proof that they’ve met the state's minimum standards for knowledge and ethical conduct.

Checking State Licenses and Designations

The easiest way to do this is by visiting your state's Department of Insurance website. Another fantastic resource is the National Association of Insurance Commissioners (NAIC). Their site lets you look up agents, brokers, and insurance companies to see if there have been any complaints or disciplinary actions filed against them. It’s an unbiased, official record of their professional history.

Here’s a look at the NAIC’s consumer information source page, which is surprisingly easy to use.

This tool gives you direct access to their records, so you can see any public actions for yourself.

Beyond the basic license, keep an eye out for professional designations. These aren't required, but they show a real commitment to the craft. Credentials like Chartered Life Underwriter (CLU) or Chartered Financial Consultant (ChFC) mean that person has gone through advanced, rigorous coursework. It’s a good sign they’re serious about their expertise.

A true professional will be completely open about their credentials and will often encourage you to look them up. If someone gets defensive or vague when you ask about their license, that’s a massive red flag.

Spotting Potential Red Flags

Knowing what to look for is only half the battle; you also need to know what to avoid. Always trust your gut. If something feels off, it probably is. And learning how to verify insurance coverage on your own is a great way to empower yourself.

Here are a few common warning signs to watch for:

- High-Pressure Sales Tactics: A good advisor educates you and gives you space to think. If you feel like you're being pushed into a corner or forced to make a snap decision, walk away.

- Evasiveness About Fees: They should be able to clearly and simply explain how they get paid. Whether it's commissions from the insurer or a fee you pay directly, you have a right to know.

- Failure to Present Multiple Options: This is a huge red flag, especially for a broker. Their entire job is to shop the market for you, not to steer you toward one specific product.

- Lack of a Needs Analysis: A professional will start by asking a ton of questions about you—your family, your finances, your goals, and your worries. If they jump straight to recommending a policy without understanding your life, they’re just a salesperson, not an advisor.

A Few Common Questions About Agents and Brokers

Choosing between an insurance agent and a broker can feel a little confusing, but a few straightforward answers can make the decision much clearer. Let’s tackle the questions that come up most often.

Does It Cost More to Use an Insurance Broker?

Not really. This is a common myth, but the idea that a broker’s extra service comes with a higher price tag is almost always untrue. Brokers, like agents, are typically paid a commission by the insurance company you end up choosing. That commission is already factored into the policy’s price from the start.

Here's the thing: because brokers can search the whole market for you, they often uncover better rates or more generous coverage than you'd find otherwise. Those long-term savings usually make their expertise an incredible value.

A broker's biggest advantage? They work for you, not the insurance company. When it’s time to file a claim, they become your advocate, making sure everything is handled fairly and smoothly.

Who Do I Call If I Need to Make a Claim?

It all comes down to who you bought the policy from. If you went through an agent, you’ll usually contact them or the insurance company’s claims line directly to get the ball rolling.

But if you have a broker, they should be your very first call. They’ll walk you through what to do, handle the communication with the insurer, and step in to fix any problems that pop up.

Can an Independent Agent Offer as Many Choices as a Broker?

While an independent agent definitely gives you more options than a captive agent, they’re still working with a specific set of insurance companies they have contracts with. Think of it as a curated menu.

A broker, on the other hand, isn’t tied down by those agreements. They have access to the entire market. This freedom gives them a much wider, unbiased perspective to find the perfect policy for what you actually need, without any limitations.

Finding the right coverage shouldn't be a struggle. At My Policy Quote, we connect you with professionals who can navigate the market and find a plan that works for you. Get your personalized quote today.