Picking the right term life insurance is about more than just finding the cheapest monthly payment. It’s about getting real financial protection for the people you love. A true term life insurance quote comparison looks past the price tag to uncover what really counts: the policy details, rider options, and conversion rights that define its actual value.

Why a True Term Life Insurance Quote Comparison Matters

When you first start shopping for term life, the premium is the number that jumps out. It’s natural to think the lowest quote is the best deal, but that’s a common—and sometimes costly—mistake. The initial quote you get online is just an estimate, not a guaranteed offer.

A real comparison means digging into the policy’s bones and the promises the insurer makes. For self-employed professionals, growing families, or those nearing retirement, getting these details right is the only way to avoid major gaps in your coverage down the road.

Beyond the Premium Price Tag

Focusing only on the price is like picking a car just for its color. You have to look under the hood. A smart term life insurance quote comparison checks several critical pieces that determine what the policy is really worth over time.

These factors include things like:

- Rider Availability: Can you add extras, like an accelerated death benefit if you become terminally ill or a waiver of premium if you’re disabled and can’t work?

- Conversion Options: Does the policy let you switch your term coverage to a permanent one later on, without needing a new medical exam? This can be a lifesaver.

- Insurer Financial Strength: How solid is the company? Ratings from agencies like A.M. Best show how likely an insurer is to be able to pay claims decades from now.

- Underwriting Nuances: Every carrier looks at health and lifestyle risks differently. One might give you a "Preferred" rate for a well-managed health condition, while another bumps you to a pricier "Standard" class for the same thing.

A lower initial premium can be seriously misleading. A policy that costs a little more but comes with better conversion rights or essential riders often delivers far more value and security over its entire term.

Comparing Key Policy Features

To make a confident choice, you need to line up policies side-by-side using the same checklist. The table below shows how two quotes that look similar at first glance can be worlds apart where it counts.

| Feature | Quote A (Budget Carrier) | Quote B (Premier Carrier) |

|---|---|---|

| Monthly Premium | $35 | $42 |

| Conversion Option | Available for first 10 years only | Available for the entire 20-year term |

| Available Riders | Limited; no child rider | Comprehensive; includes child and waiver riders |

| A.M. Best Rating | A (Excellent) | A++ (Superior) |

In this case, Quote B is just $7 more a month, but it’s backed by a top-tier financial rating and offers much more flexibility for the future. For a family building a life together, that extra peace of mind is easily worth the small difference in price. It’s also important to get the basics right; you can learn more about term versus whole life insurance to see why these details are so crucial. This is how you make sure your policy actually comes through when you need it most.

Decoding What Shapes Your Premium

When you start comparing term life insurance quotes, you’ll see right away that the prices can be all over the place. One company might offer you a rate that’s half of another’s. This isn’t just random—it’s the result of a deep-dive risk assessment called underwriting, where insurers look at a ton of personal factors to figure out how likely they are to pay out a claim. Getting a handle on these factors is your first step to landing a great rate.

The two biggest players are your age and health. It’s just a statistical fact: younger, healthier people are less of a risk, and that means lower premiums. Insurers will dig into your medical history, your family’s health history, your weight, blood pressure, and cholesterol to build a complete picture of you.

But it’s not just about what’s in your medical files. Your lifestyle choices matter, a lot. For instance, being a non-smoker is one of the single biggest things you can do to get a lower premium. It’s a huge win.

Your Underwriting Health Classification

After looking at everything, insurers assign you an underwriting or "health" class. This is what really drives your final price. The names might vary a bit, but they generally boil down to these tiers:

- Preferred Plus (or Elite/Super Preferred): This is for the gold-standard applicants—people in amazing health with a squeaky-clean family medical history and zero risky habits. They get the absolute best rates.

- Preferred: You’re in great health, but maybe you have a minor, well-managed issue like slightly high cholesterol. The rates here are still fantastic.

- Standard Plus: This is for people in better-than-average health who might have a more common condition or a family history of certain illnesses.

- Standard: This is the baseline for an average person with average health. A lot of people land right here, and that’s perfectly fine.

- Substandard (or Table Ratings): This is for applicants with more significant health issues or high-risk factors. Premiums are higher, calculated using a special rating system.

Here's the kicker: two different companies can look at the exact same application and put you in two different classes. One might see your well-managed condition and offer you a "Preferred" rate, while another bumps you down to "Standard." That one little difference can mean a huge price gap.

Beyond Health: Your Job and Hobbies Matter, Too

While your health is front and center, insurers also want to know about other risks. Your job can make a difference, especially if it’s considered dangerous. A freelance construction worker or a pilot might see higher rates than a self-employed graphic designer who works from home.

It’s the same story with high-risk hobbies like skydiving or scuba diving. These can lead to higher premiums or even specific exclusions in your policy. It’s so important to be upfront about these things when you apply. Being honest ensures your policy will be there for your family when they need it. Knowing these details helps you understand the complete picture of the various costs of term life insurance.

The key thing to remember is that your first quote is just an estimate. Your final, locked-in premium only comes after the underwriting is done. That’s why giving accurate info from the start is so crucial for a real comparison.

This detailed look at your life is more important than ever. Globally, life insurance premiums jumped 10.4% in 2024, and in North America, that number was 14.4%. This shows a huge demand for protection, especially for term life products, which are a smart, affordable choice for people without work-sponsored plans, like 1099 contractors or early retirees. You can read more about these global insurance market trends to see the bigger picture. Once you understand what the insurance companies are looking for, you’re in a much better position to get the best rate possible.

An Actionable Framework for Comparing Quotes

Okay, you've got a stack of life insurance quotes. Now what? Just picking the cheapest one is a rookie mistake that can cost you dearly down the road. Moving from a pile of numbers to a confident decision requires a real plan.

The secret to a smart term life insurance quote comparison is creating a simple, repeatable process. This helps you compare apples to apples and see beyond the price tag to what really matters.

First things first: make sure every quote is for the exact same thing. You can't compare a 20-year, $500,000 policy from one company to a 30-year, $750,000 policy from another. It just doesn't work. Before you even start, decide on your ideal term length and coverage amount and ask every insurer for that specific combination. That’s how you level the playing field.

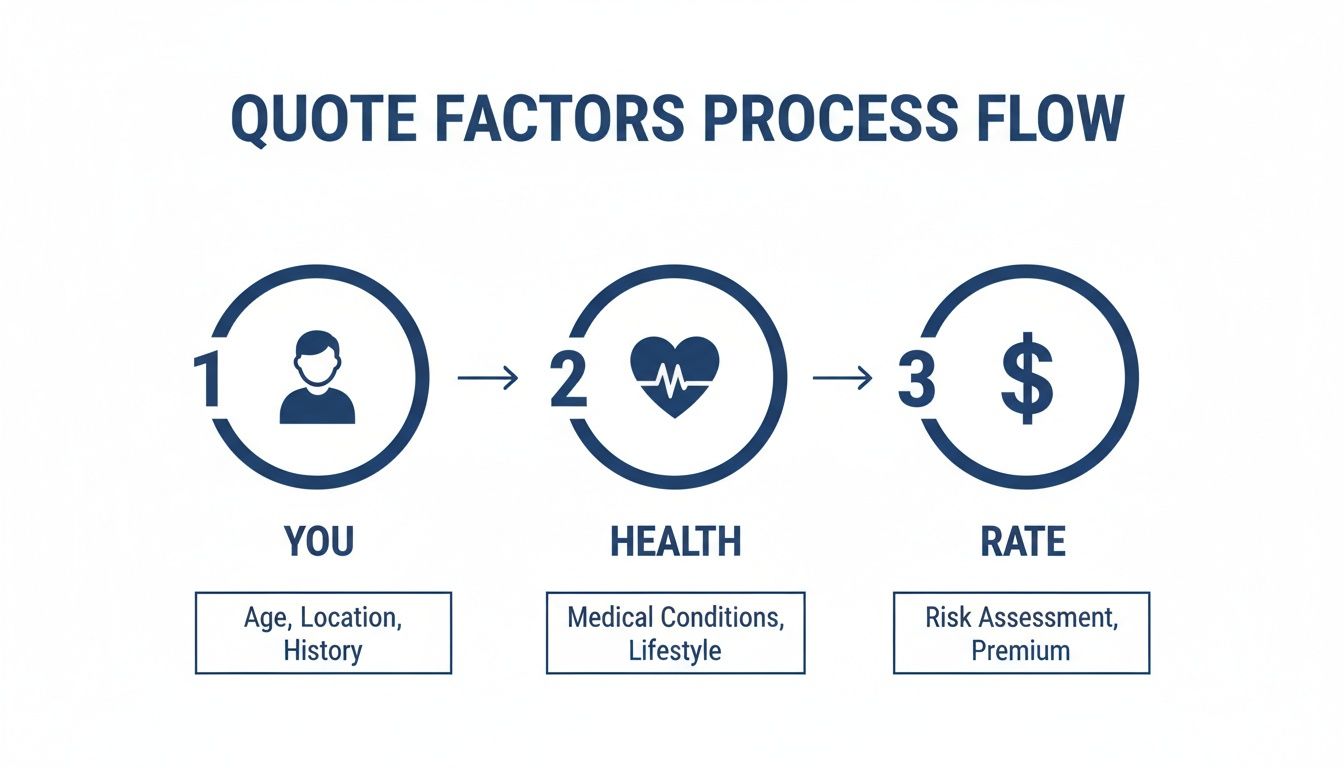

This flowchart shows how your personal details are the building blocks of the final premium you're offered. It’s why getting custom quotes is the only way to get an accurate picture.

As you can see, the rate you get is a direct result of your unique profile.

Structuring Your Policy Evaluation

With your standardized quotes in hand, it’s time to get organized. A simple table or spreadsheet is your best friend here. It forces you to look at each policy through the same lens, so you won’t get distracted by a low price while missing a critical weakness.

This comparison table will be your command center. It goes way beyond the monthly premium to track the details that truly count.

Here’s a template you can use to structure your comparison and make an informed choice.

Side-by-Side Quote Comparison Template

| Comparison Point | Quote 1 (Carrier A) | Quote 2 (Carrier B) | Quote 3 (Carrier C) |

|---|---|---|---|

| Insurance Carrier Name | |||

| Monthly Premium | |||

| A.M. Best Rating | |||

| Conversion Options | |||

| Included Riders | |||

| Optional Riders & Costs |

Using a structured approach like this turns a confusing mess of papers into a clear, organized dataset. It makes your decision objective and a whole lot less stressful. And before you lock anything in, double-check your numbers with a good life insurance needs calculator to be sure your family is truly protected.

Remember, the goal isn't just to find the cheapest quote. It’s about finding the best value. A slightly higher premium might be well worth it for a company with rock-solid financials or flexible options that protect your future.

Beyond the Numbers: Policy Details Matter

Once your data is organized, you can dig into the finer points.

The A.M. Best rating is a big one. It’s a grade that reflects an insurer’s financial strength and its ability to pay claims decades from now. You’re looking for a carrier with a rating of A- or better. Don't gloss over this—your policy is a promise that needs to be kept.

Next, look closely at the conversion privilege. This is a powerful feature that lets you convert your term policy into a permanent one later on without another medical exam. Some policies only let you do this in the first 5 or 10 years, while others allow it for the full term. That extra flexibility can be a lifesaver if your health changes unexpectedly.

Finally, check out the riders. Many policies include an accelerated death benefit rider at no extra cost, which lets you access your death benefit early if you're diagnosed with a terminal illness. Other riders, like a waiver of premium if you become disabled, can add another layer of security. See what’s included and what costs extra, because that can seriously change the overall value you’re getting.

Comparing Policies for Real-World Scenarios

Theory is one thing, but a real term life insurance quote comparison only makes sense when you see it in action. The best policy is never one-size-fits-all. It's about finding the perfect fit for a specific person, at a specific moment in their life.

Let’s walk through a few practical examples. You'll see how different priorities—from the lowest possible monthly payment to the most flexibility for the future—lead to completely different choices.

Case Study One: The Freelancer

Meet Alex, a 35-year-old freelance graphic designer. As a contractor, Alex has no life insurance through an employer but needs to protect a spouse and young child. The goal is simple: get the most coverage for the lowest cost over the next 20 years, until the child is independent.

Alex gets quotes for a 20-year, $750,000 term policy.

- Quote A (Budget Insurer): Comes in at $38 per month. It’s bare-bones—no significant riders and only a 5-year window to convert to a permanent policy.

- Quote B (Mid-Tier Insurer): Priced at $45 per month. This one includes an accelerated death benefit rider for free and lets you convert for the first 15 years.

- Quote C (Premier Insurer): Costs $52 per month. It offers a full conversion option for the entire 20-year term and a waiver of premium rider for an extra $6 a month.

For Alex, whose top priority is affordability, Quote A is the clear winner. The lower premium provides essential protection when the family is most vulnerable. The limited conversion option is a small price to pay for significant monthly savings.

Case Study Two: The Pre-Retiree

Now, let's look at Brenda. She's a healthy 62-year-old planning to retire in three years. Her house is paid off, and her savings are solid. Her main goal? A smaller policy to cover final expenses and leave a little inheritance, so those costs don't dip into her spouse's retirement fund.

Brenda is looking for a 10-year, $100,000 term policy.

- Quote A: Offers a premium of $75 per month but demands a full medical exam.

- Quote B: Is a bit higher at $85 per month. But it comes from a carrier known for being lenient with older applicants and offers a quick, no-exam process.

- Quote C: Comes from a top-rated carrier at $92 per month. It includes a great conversion option to a permanent policy, which could be useful if Brenda’s needs change.

Here, Quote B is the right call. The convenience of skipping the medical exam and the insurer's friendly underwriting for her age group make the small extra cost worth it. She just needs simple, guaranteed coverage—not long-term flexibility—making the pricier Quote C unnecessary.

Case Study Three: The Young Family

Finally, we have Mark and Sarah. They're both 28, have a toddler, and are planning for another baby. They're just starting their careers, so their budget is tight, but they also want options that can grow with them.

They're comparing quotes for a 30-year, $500,000 policy.

- Quote A: The cheapest at $31 per month. But it doesn't offer a child rider and has very restrictive conversion terms.

- Quote B: Costs $36 per month. This policy lets them add a child rider for just $5 more a month, which covers all their kids, present and future. It also allows conversion for the full 30-year term. You can learn more about what a rider on life insurance is in our guide.

- Quote C: Is $42 per month. It comes from a carrier with an A++ rating and includes multiple living benefits, but the child rider costs more.

For Mark and Sarah, Quote B delivers the best value. The affordable child rider and the excellent conversion option give them the perfect blend of what they need now and what they'll want later. It hits that sweet spot between their current budget and future security.

The global life insurance market is huge, projected to reach $4 trillion by 2028. This growth shows how much people need reliable coverage, especially freelancers and blue-collar workers without employer plans. Shopping around is crucial, as premiums can vary by up to 40% between companies for the same person.

As you can see, the 'best' policy is all about your life. Your age, your goals, your family, and what helps you sleep at night—these are what guide you to the right choice. A good comparison isn't about finding the universally best policy. It's about finding what's best for you.

Common Pitfalls to Avoid in Your Quote Comparison

Knowing what not to do is just as important as knowing what to do when you're comparing term life insurance quotes. It's easy to make small mistakes that can lead to choosing a policy that either doesn't fully protect your family or ends up costing you more down the road. Let’s walk through the common traps so you can sidestep them and make a choice that’s both smart and secure.

That first number you see—the advertised rate—is just an estimate. It's a starting point based on minimal information. The biggest mistake people make is falling in love with that initial low price. The final, official premium only comes after the underwriting process, where the insurer gets the full story from your medical records and history.

A low initial quote can easily jump by 25% or more once everything is on the table. Think of the first quote as the opening bid, not the final price.

Overlooking an Insurer’s Financial Stability

It's so tempting to just grab the cheapest policy, but the company standing behind that policy is what really counts. An insurer’s financial health is the ultimate measure of its ability to pay out a claim 10, 20, or even 30 years from now. A policy from a shaky company is a risky bet, no matter how low the premium feels today.

Always check the financial strength ratings from independent agencies. A quick look for carriers with a rating of A- or higher from A.M. Best gives you peace of mind. It confirms the company will be there to fulfill its promise when your family needs it most.

Comparing Policies with Mismatched Terms

Another common slip-up is comparing quotes for policies that aren't the same. A 10-year, $250,000 policy will always look cheaper than a 30-year, $1,000,000 policy. It’s like comparing the cost of leasing a car for a year to buying it outright—they're just not the same thing.

To get a real, honest comparison, you have to standardize your request. Decide on the exact term length and face amount you need before you start shopping, and ask for identical quotes from every provider.

This is the only way to make an apples-to-apples comparison of what each company truly charges for the exact same protection.

Misinterpreting Riders and Conversion Options

Finally, don't just gloss over the fine print on riders and conversion privileges. It’s these details that often create a false sense of security.

Here are a few specifics to watch for:

- Conversion Window: Some policies only let you convert your term coverage to a permanent policy within the first few years. Others give you that option for the entire term—a far more valuable feature if your health changes unexpectedly.

- Rider Definitions: Not all riders are created equal. An "accelerated death benefit" rider from one company might have different triggers or payout limits than a rider with the same name from another.

When you don't dig into these nuances, you might discover you don't have the flexibility or coverage you thought you did. Always read the specifics to ensure the policy’s features actually align with what you need long-term. Avoiding these pitfalls turns a simple price check into a truly effective comparison.

Making Sense of Your Term Life Insurance Quotes

You’ve done the hard work—you’ve looked at the underwriting factors, organized your data, and even walked through a few real-world examples. The path is getting clearer, but let's be honest, staring at a dozen different quotes can still feel like a puzzle. This is where a little modern tech can make all the difference, cutting through the noise and getting you to the finish line faster.

Think of a great comparison tool as your personal assistant. Instead of you chasing down quotes one by one, it gathers them all for you, lining them up in one clean, easy-to-read view. It makes sure every quote is for the same term length and coverage amount, so you're always comparing apples to apples.

Let Technology Do the Heavy Lifting

These comparison platforms aren't just for one type of person. Whether you're a gig worker without a company plan, someone nearing retirement and wanting to protect what you’ve built, or even a financial advisor doing research for a client, these tools give you the data you need, right when you need it.

They take all the complicated jargon and lay it out simply, side-by-side. You can see crucial details like:

- An insurer's financial strength rating (from places like A.M. Best).

- Optional riders you can add and what they'll cost.

- The nitty-gritty details of the policy's conversion options.

This is especially important in today's market. The global term life insurance market is set to hit a massive USD 1,219.22 billion by 2032. With North America holding a 37.51% market share, a lot of people are shopping for coverage. The smart ones are using comparison tools and saving anywhere from 20-50% on their premiums just by looking at more than one option. You can see more on this incredible growth in the term insurance market.

Making a good decision starts with having good information. Using a comparison tool isn’t about taking a shortcut; it's about being smarter and more efficient with your time.

If you want to make the initial quote-gathering process even smoother, you can utilize a well-structured quote request form.

Find Your Perfect Policy With Confidence

At the end of the day, this is all about moving from research to real-world action. When you use the strategies in this guide, you’re no longer just guessing—you're navigating the insurance world with a clear map. A tool like My Policy Quote pulls everything together, giving you a personalized comparison that fits your life.

Don't just grab the first quote that lands in your inbox. Take charge of the search, compare your options with intention, and find a policy that brings real peace of mind to you and the people you love.

Still Have Questions? Let's Clear Things Up

Getting to the finish line of comparing term life insurance quotes usually brings up a few last-minute questions. It's totally normal. Getting straight answers is the key to choosing a policy you'll feel good about for years. Let's tackle some of the most common things people ask.

This part of the process can feel a bit tangled. If you need quick answers on policy details or how comparisons work, talking with an AI-powered Insurance Guide can offer some helpful, on-the-spot insights.

How Many Quotes Should I Really Compare?

You might think more is always better, but you can definitely hit a point of "analysis paralysis." You don't need to sift through dozens of quotes to find a great policy.

A smart move is to get and compare three to five competitive quotes from financially solid insurance companies. That’s enough to give you a real sense of the market rates without overwhelming you. It lets you see what's out there for someone with your health profile and coverage goals, so you can spot the best value without getting lost in the weeds.

The goal isn't just the lowest price—it's the best overall value. Comparing a handful of top-tier options is way more effective than drowning in a sea of mediocre ones.

Can My Final Price Be Different From the Quote?

Yes, absolutely. And it’s super important to understand why. The first quote you get is really just an estimate based on the info you gave them. Your final premium is set only after the underwriting process is complete.

Underwriting is when the insurer does a deep dive into your medical records and, in many cases, has you do a medical exam. If they find health issues or lifestyle factors you didn't mention upfront, your rate could go up. But here's the flip side: if you're healthier than they expected, your rate could actually go down.

What's Most Important Besides the Price?

Beyond the monthly payment, the financial strength of the insurance company is probably the most important thing to look at. A life insurance policy is a long-term promise. You're counting on it to be there for your family, maybe decades from now.

You need to know the company will still be standing and able to pay the claim when the time comes. Look for insurers with high marks from rating agencies like A.M. Best—an "A" rating or higher is what you should aim for. Other huge factors are the policy's conversion options and the fine print on any riders you add.

How Often Should I Revisit My Policy?

Your life doesn’t stand still, and neither should your insurance plan. It’s a good habit to review your policy every few years, and definitely after any major life event.

Think about pulling out your policy for a check-up when big things happen, like:

- Getting married or divorced

- Having a baby or adopting

- Buying a new house with a bigger mortgage

- Getting a big promotion or raise

These moments can completely change how much coverage your family actually needs. A quick review makes sure your policy is still doing its job.

Ready to stop guessing and start comparing with confidence? At My Policy Quote, we make the whole process simple, giving you clear, side-by-side comparisons from top-rated carriers. Find the right term life insurance policy for your unique needs today by visiting https://mypolicyquote.com.