When it comes to your healthcare, the choice between private insurance and Medicare feels like standing at a crossroads. They aren't just different plans; they're entirely different systems.

The simplest way to think about it is this: private insurance is designed for flexibility for those under 65, while Medicare is the government's promise of stable healthcare for Americans 65 and older or those with qualifying disabilities. Your age, your job, and your health will ultimately point you in the right direction.

Choosing Your Path: Private Insurance vs. Medicare

Deciding between private insurance and Medicare isn't just about comparing numbers. It’s about understanding two completely different philosophies of care. Private insurance—whether it’s from your employer or the ACA Marketplace—is all about choice in a competitive market. You pick the plan that fits your life right now.

Medicare, on the other hand, is a social insurance program. It’s built to be a reliable, predictable safety net for seniors and certain individuals with disabilities. Think of it as a solid foundation, though you’ll often need to add a few pieces (like supplemental plans) to make your coverage feel truly complete.

A High-Level Comparison

To make a confident choice, you need to see how these two stack up side-by-side. Think of this as your starting point before we dive deeper into the nitty-gritty details. As you weigh your options, it's also helpful to look at real-world guides on navigating public vs. private healthcare pathways.

The right decision isn't just about finding the lowest premium today. It’s about looking ahead to your long-term costs, keeping the doctors you trust, and building a safety net that grows with you.

Here’s a quick look at the core differences. This table will give you a clear, simple snapshot of what sets these two coverage types apart.

Key Differences Between Private Insurance and Medicare

| Feature | Private Insurance (Employer or Marketplace) | Medicare (Original & Advantage) |

|---|---|---|

| Primary Eligibility | Generally available to anyone under 65, based on employment or residency. | U.S. citizens or legal residents aged 65+, or those with specific disabilities or conditions like ESRD. |

| Cost Structure | Monthly premiums, deductibles, copayments, and coinsurance. Costs vary widely by plan, age, and location. | Premiums (Part B/D), deductibles, and coinsurance. Costs are standardized but vary with your choice of supplemental coverage. |

| Provider Networks | Restricted to specific networks (HMO, PPO, EPO). Your choice of doctors is tied to your plan. | Original Medicare is accepted by most doctors nationwide. Medicare Advantage plans have local networks, much like private plans. |

Seeing it laid out like this makes the main distinctions pretty clear, doesn't it? One path offers broad market-based choice, while the other provides standardized, government-backed stability. Now, let’s get into what these differences really mean for you.

Getting to Know Your Health Coverage Options

Before you can weigh private insurance against Medicare, you have to know what you’re actually comparing. They’re built on completely different foundations, with their own rules, networks, and ways of giving you access to care. Getting these basics down is the first step to making a smart choice.

For anyone under 65, private insurance usually comes from one of three places: your job (employer-sponsored), the Affordable Care Act (ACA) Marketplace, or as a temporary extension through COBRA after you’ve left a job. Each of these paths leads to plans with different kinds of provider networks.

The World of Private Insurance Plans

When you dive into private plans, you'll hear two terms over and over: HMOs (Health Maintenance Organizations) and PPOs (Preferred Provider Organizations). Think of them as two different philosophies on how to get care.

An HMO is designed to be a closed loop. It requires you to use doctors, hospitals, and specialists that are all part of its specific network. To see a specialist, you’ll almost always need a referral from your primary care doctor. It's a structured system, but that structure helps keep your costs down.

A PPO, on the other hand, gives you more freedom. You can see providers both inside and outside the network, and you usually don’t need a referral to see a specialist. That flexibility comes at a price, though—expect higher monthly premiums and bigger bills if you decide to go out-of-network. For a deeper look at your choices, you can find helpful guidance on choosing individual health insurance plans.

The biggest trade-off with private insurance almost always boils down to cost versus flexibility. A tightly managed HMO can save you money, while a PPO offers you more choices for a higher price.

Untangling the Parts of Medicare

Medicare isn't just one plan; it's a federal program made up of several distinct parts. People often call it the "alphabet soup" of healthcare, and for good reason. Let's break it down.

- Medicare Part A (Hospital Insurance): This is your coverage for inpatient hospital stays, care at a skilled nursing facility, hospice, and certain home health services. Most people get Part A premium-free because they or their spouse paid Medicare taxes while they were working.

- Medicare Part B (Medical Insurance): This covers your everyday medical needs—doctor visits, outpatient care, medical supplies, and preventive check-ups. You will pay a monthly premium for Part B.

- Medicare Part D (Prescription Drug Coverage): This is optional coverage for your medications. It's offered by private insurance companies that have been approved by Medicare.

When you put Parts A and B together, you get what’s known as Original Medicare. This is the foundational, government-run health program. But it doesn't cover everything. It leaves some significant gaps, like the 20% you’re responsible for on most services covered by Part B, with no yearly limit.

To deal with those gaps, you have two main pathways. You can stick with Original Medicare and add a Medigap (Medicare Supplement Insurance) policy. A Medigap plan, sold by private companies, helps pay for those out-of-pocket costs like copayments and deductibles.

Your other option is to go with a Medicare Advantage Plan (Part C). These are all-in-one plans offered by private insurers who contract with Medicare. They bundle everything—Parts A, B, and usually D—into a single plan. Many also include extra perks like dental and vision coverage, all organized within a managed care network that works a lot like a private HMO or PPO.

A Realistic Look at Your Healthcare Costs

When you’re trying to understand health insurance, looking at the monthly premium is just scratching the surface. The real story is in your total out-of-pocket costs—the deductibles, copayments, and that dreaded out-of-pocket maximum. The cost structures for private insurance and Medicare are worlds apart, and those differences can easily mean thousands of dollars in your pocket each year.

A big reason for this gap comes down to what insurers pay doctors and hospitals. It’s a little-known fact, but the price for the exact same medical procedure can swing wildly depending on who’s paying the bill. And that difference trickles right down to you.

How Provider Payments Shape Your Costs

Here’s the inside scoop: private insurance companies in the U.S. pay hospitals and doctors way more than Medicare does for the same exact services. This inflates the base cost of care, which drives up premiums and out-of-pocket expenses for everyone on a private plan. One in-depth analysis found that private plans pay hospitals an average of 199% of Medicare rates, while paying physicians around 143% more. You can see the full provider payment findings from KFF to understand the numbers.

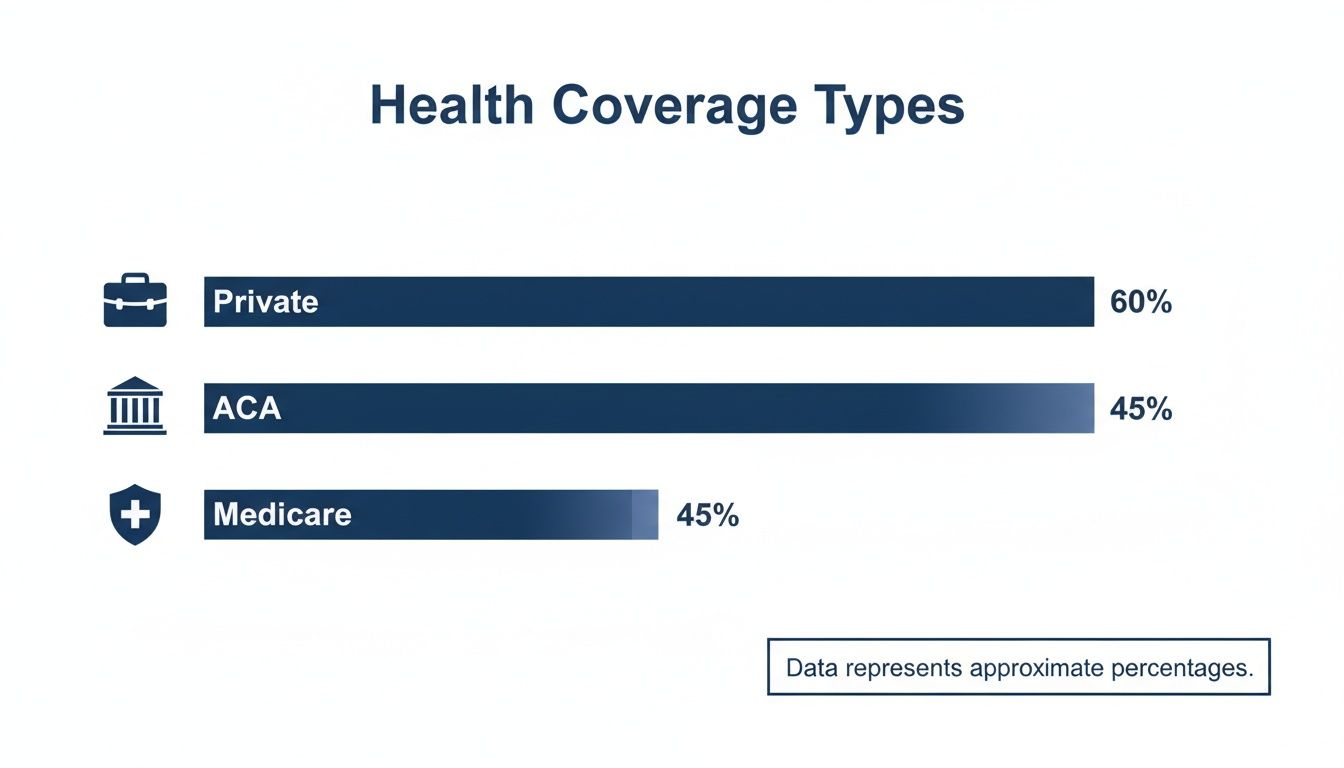

This creates totally different financial realities for each system. The chart below shows where most Americans get their coverage, setting the stage for a real cost showdown.

While private insurance is the most common, Medicare and the ACA Marketplace cover huge portions of the population, each with its own unique way of handling costs.

A Tale of Two Scenarios

Let’s put this into real-world terms. We’ll imagine a year with moderate healthcare needs for two people nearing retirement.

-

Meet Sarah: The Pre-Medicare Professional

Sarah is a 62-year-old consultant with a Silver plan from the ACA Marketplace. Her plan comes with a $5,000 deductible and an $8,500 out-of-pocket maximum. -

Meet David: The Medicare Retiree

David is 66 and retired. He’s on Original Medicare and has a Medigap Plan G policy to handle his out-of-pocket expenses.

The biggest difference here is predictability. Pairing Original Medicare with a Medigap plan locks in your financial risk, making it incredibly stable. A private plan still has safeguards, but you often face much higher costs before you hit that safety net.

Let’s say both Sarah and David need a minor outpatient surgery and a few specialist visits this year, adding up to $25,000 in medical bills before insurance kicks in.

- Sarah’s Total Cost: First, she has to meet her $5,000 deductible. After that, her plan requires 20% coinsurance on the remaining $20,000, which would be $4,000. But since her plan has an $8,500 out-of-pocket max, her total spending for the year (not including premiums) is capped right there at $8,500.

- David’s Total Cost: He only has to pay the annual Medicare Part B deductible, which is $240 for 2024. Once that’s paid, his Medigap Plan G steps in and covers the 20% coinsurance completely. His total out-of-pocket cost for all those medical services? Just $240.

To make it even clearer, let’s break down their hypothetical annual costs side-by-side.

Hypothetical Annual Healthcare Cost Comparison

This table gives a snapshot of what Sarah and David might pay over a full year, including their monthly premiums, for a year with moderate medical needs.

| Cost Component | Private Marketplace Plan (Age 62) | Original Medicare + Medigap Plan G (Age 66) |

|---|---|---|

| Monthly Premium (Est.) | $700 | $343 (Part B: $174.70 + Plan G: $168.30) |

| Annual Premiums | $8,400 | $4,116 |

| Annual Deductible | $5,000 | $240 (Part B Deductible) |

| Coinsurance/Copays | $3,500 (Capped by OOPM) | $0 (Covered by Medigap) |

| Out-of-Pocket Medical Costs | $8,500 | $240 |

| Total Annual Cost | $16,900 | $4,356 |

This example really drives home the financial stability a well-planned Medicare setup can offer. Taking the time to understand your healthcare costs in retirement is one of the most important things you can do for your future. Once you’re eligible, the numbers don’t lie—Medicare often provides a much more predictable and affordable path forward.

Comparing Coverage Benefits and Provider Access

When you're weighing your options, one of the biggest questions is: can I see my doctor? This is where the practical differences between Medicare and private insurance really start to show. Your choice directly impacts your freedom to choose who cares for you and what benefits you get along the way.

Private insurance plans, particularly PPOs, are built around networks. They give you a broad, but specific, list of doctors and hospitals. For many, this works perfectly, especially if you travel and need access to specialists in different cities. The catch? Stepping outside that pre-approved network almost always means you’ll be paying more out-of-pocket.

The Freedom to Choose Your Doctor

Original Medicare (Parts A and B) is a completely different story. It isn't built on restrictive networks. In fact, an estimated 96% of physicians in the U.S. accept Medicare. This gives you incredible freedom to see just about any doctor, anywhere in the country, without ever worrying about "in-network" versus "out-of-network" or needing a referral to see a specialist.

That level of choice is one of the most powerful features of Original Medicare. It’s a kind of access few private plans can ever hope to match.

So, what's the real trade-off? Private plans often offer managed networks that might feel limiting, while Original Medicare gives you wide-open access to nearly any provider who accepts it.

But that freedom has its limits. Original Medicare was designed back in 1965, and it hasn't kept up with everything we consider essential today. It typically doesn't cover:

- Routine dental care like cleanings, fillings, or dentures.

- Standard eye exams for glasses.

- Hearing aids or the exams needed to fit them.

Filling in the Gaps with Medicare Advantage

This is where Medicare Advantage (Part C) plans come into the picture. These plans are offered by private companies and are required to cover everything Original Medicare does, but they often bundle in those missing benefits—like dental, vision, and hearing.

In exchange for these extra perks, you usually agree to use a local, managed care network, much like a private HMO or PPO. This means giving up the vast, nationwide access of Original Medicare. To dig deeper, you can compare Advantage plans vs. Supplemental plans and see which path feels right for you.

Provider access can also play a role in how long you wait for care. International examples show how different systems can affect wait times. In Germany's mixed system, one study found privately insured patients saw a specialist in just 7.8 days, while those in the public system waited over 30 days.

Ultimately, the decision comes down to what you value more: the comprehensive benefits bundled into a managed plan or the unmatched freedom to choose your doctors without network walls.

Mastering Enrollment Rules and Deadlines

When it comes to health insurance, timing is everything. Whether you're dealing with private plans or getting ready for Medicare, missing a deadline can mean more than just a headache. It can lead to expensive gaps in your coverage and, in some cases, penalties that follow you for life.

Getting these dates right isn't just a suggestion—it's a critical part of making a smart, secure decision for your health.

The Private Insurance Clock: Open Enrollment and Life Events

For private insurance, your main opportunity is the yearly Open Enrollment Period (OEP). This is that specific time in the fall when anyone can sign up for a new plan on the ACA Marketplace or switch their current coverage for the year ahead.

But life happens, and it doesn't always stick to a calendar. If you experience a Qualifying Life Event (QLE), you get a special window to enroll.

- Losing your old coverage: This could be from leaving a job, turning 26 and aging off a parent’s plan, or no longer qualifying for Medicaid.

- A change in your family: Getting married, having a baby, adopting a child, or getting a divorce all count.

- Moving to a new area: A move to a different ZIP code or county can open up new plan options and give you a chance to enroll.

When one of these events happens, you typically get a 60-day window to pick a new plan. You have to act fast to make sure you don't find yourself uninsured.

Medicare’s Rules: Stricter and with Higher Stakes

Medicare’s enrollment rules are a different ballgame—they're far less flexible and the consequences of missing them are much more severe. Your most important deadline is your Initial Enrollment Period (IEP). It’s a seven-month window that starts three months before your 65th birthday month, includes your birthday month, and ends three months after.

If you miss your IEP and don't have other qualified health coverage, you could face a permanent late enrollment penalty for Part B. This isn't a small fee. The penalty adds 10% to your monthly premium for every full 12-month period you could have signed up but didn't.

Think about that for a moment. The Medicare late enrollment penalty isn't a one-time charge. It's a permanent increase added to your monthly premium that you will pay for the rest of your life. This makes understanding your personal timeline absolutely essential.

Just like private insurance, Medicare does offer Special Enrollment Periods (SEPs) for certain life events. The most common one is for people who keep working past 65 and stay on their employer’s health plan. This lets you delay signing up for Medicare without getting hit with a penalty.

Once you or your spouse stops working and that employer coverage ends, an eight-month SEP kicks in for you to enroll in Medicare Part B. It’s vital to have proof that you had continuous health coverage to avoid those lifelong penalties. To get a better handle on how your prior plan affects these rules, it's worth learning about what is creditable coverage and the protection it offers.

By mapping out these key dates, you can build a clear roadmap for your insurance journey. You’ll be able to move from one plan to the next without gaps, surprise bills, or financial consequences that last a lifetime.

Making the Right Call: How to Choose Your Health Insurance

Okay, you've done the research. Now it's time to turn all that information into a real decision. This isn't just about picking a plan off a list; it’s about finding coverage that actually fits your life—your health, your finances, and your future.

Choosing the right health insurance is a huge part of good financial planning for major life events, such as retirement. Let's cut through the noise with a few straightforward questions to get you to the right answer.

Your Personal Decision Checklist

Before you sign on the dotted line, take a minute for an honest gut check. Your answers to these questions will point you in the right direction.

- What's my financial reality? Are you more comfortable with a higher, predictable monthly premium but smaller costs when you need care? Or would you rather have a low monthly bill, even if it means you might face a big out-of-pocket expense someday?

- What are my health needs—now and later? Do you have a chronic condition that means regular specialist visits are a given? Or are you generally healthy and just need a safety net for the unexpected?

- How important is it to choose my own doctors? Is keeping your current team of doctors a non-negotiable? Or do you value the freedom to see any specialist in the country without getting a referral first?

- Where will I be living or traveling? Are you a snowbird who splits the year between states? Your travel plans will decide whether a local network is enough or if you need nationwide coverage.

Seeing it in Action: Real-World Scenarios

Let's put this checklist to work with two common situations. You'll see how different priorities lead to completely different choices.

Scenario One: The 58-Year-Old Small Business Owner

If you're self-employed and still a few years away from turning 65, an ACA Marketplace plan is likely your go-to. The real decision here is balancing how much you pay with how much access you get. A PPO plan might cost more each month, but if you travel for business and need the flexibility to see specialists on the road, that extra premium could be well worth it.

Scenario Two: The 64-Year-Old Leaving a Corporate Job

When you’re on the verge of 65 and saying goodbye to your employer's plan, the game changes. Now, it's all about long-term stability and predictability, which is exactly where Medicare shines.

For anyone mapping out a retirement budget, Medicare's predictable costs are a game-changer. It offers a level of financial stability that you just don't get with the volatility of private insurance.

History shows that Medicare is far better at controlling costs. Between 1997 and 2009, for instance, Medicare spending only grew by 4.3% each year. Private insurance, on the other hand, shot up by 6.5% annually. For someone on a fixed income, that difference is huge.

If you want to dig into the numbers, you can read more about Medicare's cost-control effectiveness and see why it’s such a reliable foundation for retirement. Knowing these key differences empowers you to move forward, confident you're making the best choice to protect both your health and your wallet.

Your Top Questions, Answered

Making the switch from private insurance to Medicare can feel like learning a whole new language. It’s natural to have questions. Here are some of the most common ones we hear, with straightforward answers to help clear things up.

Can I Have Both Private Insurance and Medicare?

Yes, but it's tricky. How they work together depends entirely on the type of private insurance you have.

If you’re 65 or older and still working for a company with 20 or more employees, your employer's plan pays first. Medicare then acts as a secondary safety net. But if you're on a retiree plan or COBRA, Medicare steps into the primary payer role. One huge detail people often miss: you can't contribute to a Health Savings Account (HSA) once you’ve enrolled in any part of Medicare. That can be a costly surprise if you're not prepared.

What Happens If I Miss My Medicare Initial Enrollment Window?

Honestly, the consequences are serious. Missing your seven-month Initial Enrollment Period (IEP) can leave you with a long gap in coverage. Worse, you'll likely get hit with a lifelong late enrollment penalty for Part B.

For every full year you were eligible but didn’t sign up, your Part B premium increases by 10%. That penalty sticks with you forever. The only way around it is if you have qualifying health coverage from a current employer, which gives you a Special Enrollment Period (SEP) to sign up later without getting dinged.

"The most common mistake people make is assuming they can just sign up for Medicare whenever they're ready. The penalties for late enrollment are real, permanent, and entirely avoidable with a little planning."

Knowing your personal deadline is the single most important part of making a smooth transition.

Is a Medicare Advantage Plan Just a Private Insurance Plan?

Not exactly. A Medicare Advantage plan (also called Part C) is more like a hybrid. It's offered by a private insurance company that has a contract with the government to provide your Medicare benefits.

These plans bundle everything together—your hospital coverage (Part A) and medical coverage (Part B), and usually your prescription drugs (Part D), too. They often throw in extras like dental or vision. They feel a lot like the private HMOs or PPOs you’re used to, with provider networks and rules. But at their core, they are still part of the Medicare program, not a separate private plan you'd buy before turning 65.

Should I Just Drop My Private Plan When I'm Eligible for Medicare?

For most people turning 65, yes. Once you’re eligible, Medicare is designed to be your main coverage. A private Marketplace plan, for instance, isn't built to work with Medicare, and keeping both is a recipe for overpaying and creating a paperwork nightmare.

The real decision comes if you have good health coverage from a job you're still working at. In that case, you have to do the math. Compare the costs, doctor networks, and benefits of your employer's plan side-by-side with a full Medicare setup to see which one truly works best for you.

Navigating these choices is tough, but you don't have to do it alone. At My Policy Quote, we help people find the right health coverage for their unique situation every single day. Get your free quote today and make your decision with total confidence.

Find your plan at https://mypolicyquote.com.