When you're shopping for life insurance, it's easy to get fixated on the price tag. But to truly compare rates, you have to look deeper. The secret is knowing that insurance companies are in the business of assessing risk, and your unique life story determines how much risk you represent to them.

Once you get that, you're already one step ahead in finding the best possible premium.

Understanding What Really Drives Your Insurance Rate

Before you can even begin to compare quotes, you need to understand what insurers are looking at during the underwriting process. Age and health are the big ones, of course, but a handful of other personal details come together to create a full picture of you.

And here’s the kicker: every single company weighs these factors differently. That’s why you can get wildly different quotes from multiple insurers for the exact same coverage.

Think of underwriting as a deep dive into your life. An insurer is trying to predict your longevity, and the less risky you seem, the lower your premium will be. Simple as that.

Core Factors In Your Rate Calculation

Every piece of information you share helps an insurer sort you into a specific risk class. These usually range from "Preferred Plus" for the lowest-risk applicants down to "Standard" or even "Substandard."

Here's what they're really looking at:

- Your Age and Gender: These two are the bedrock of their calculations. Statistically, women live longer, which often translates to lower premiums.

- Your Health Status: This is where they go deep. Expect them to look at your medical records and prescription history, and you’ll likely need a medical exam. It's not just about general wellness; specific assessments like understanding your cardiovascular disease risk score can have a major impact on your rate.

- Tobacco and Substance Use: Using tobacco is one of the fastest ways to see your premiums double or even triple. A history of substance abuse will also put you squarely in a high-risk category.

To give you a clearer picture, here’s a breakdown of the main variables underwriters look at and why they matter so much.

Key Factors That Influence Your Life Insurance Premium

| Factor | Why It Matters to Insurers | Potential Impact on Rates |

|---|---|---|

| Age | A primary indicator of life expectancy. | Rates increase significantly as you get older. |

| Health | Chronic conditions or poor health markers increase risk. | Can lead to much higher premiums or even denial. |

| Occupation | High-risk jobs (think pilot or logger) increase mortality risk. | May result in a "flat extra" fee on top of your base premium. |

| Lifestyle | Risky hobbies like skydiving or scuba diving are red flags. | Similar to a high-risk job, this can bump up your rate. |

| Driving Record | A history of DUIs or reckless driving suggests risky behavior. | Insurers may see this as a character risk, raising your premium. |

Getting a handle on these factors is so important because it lets you see yourself through an insurer’s eyes. This insight is your power—it helps you figure out which companies are most likely to give you favorable terms based on your specific life.

The effect of age alone is pretty dramatic. For instance, a healthy 20-year-old male might pay around $213 per month for a term policy. Fast forward to age 60, and a man in similar health could be looking at premiums of $2,346 per month.

Of course, before you dive in, you need a clear idea of how much coverage you actually need. Our life insurance needs calculator is the perfect place to get a personalized, no-nonsense starting point for your search.

A Practical Framework for Collecting Comparable Quotes

It’s easy to get a pile of life insurance quotes. The hard part? Getting quotes you can actually compare side-by-side.

Without a plan, you’ll end up with a mess of different policies, prices, and coverage amounts. It’s an impossible puzzle to solve.

To truly compare life insurance rates, you have to make sure every insurer is quoting you for the exact same thing. Think of it like a science experiment—you need to control the variables to get a clear answer.

The whole point is to cut through the confusion and see exactly how each company’s pricing works for you. This framework helps you make a true apples-to-apples comparison, every single time.

Standardize Your Request for True Comparisons

Before you even talk to an agent or fill out an online form, you need to decide on the core parts of the policy you want. This step is absolutely non-negotiable if you want to do this right.

You need to lock in three key elements:

- Policy Type: First, figure out if you need Term, Whole, or another kind of life insurance. Asking one company for a 20-year term quote and another for a whole life quote will give you numbers so different they're useless for comparison.

- Coverage Amount (Death Benefit): Decide exactly how much coverage you need—whether it's $250,000, $500,000, or $1 million. This number must stay the same for every single quote you request.

- Term Length (For Term Policies): If you're going for term life, pick your term—10, 20, or 30 years—and stick with it across the board.

And what about add-ons, or riders? If you want extras like an accelerated death benefit rider, be sure to ask for pricing on the same ones from each company. That’s the only way to know if you're getting a good deal.

Key Takeaway: Being organized is your superpower here. When you standardize your request—policy type, coverage amount, and term length—you force insurers to compete on price and value for the exact same product. That’s how you find real clarity.

How to Decipher Health Classifications

Once the quotes start rolling in, you'll see that insurers give you a health classification. This rating is what really drives your premium. It can range from "Preferred Plus" all the way down to "Standard."

A cheaper quote might just mean one company gave you a better health rating than another. Understanding these classes is vital when you compare life insurance rates.

- Preferred Plus/Elite: This is for people in perfect health with a spotless family medical history. They get the absolute best rates.

- Preferred: For very healthy folks who might have a minor, well-managed issue like slightly high cholesterol.

- Standard Plus: This is for people with above-average health but maybe a few risk factors, like being a little overweight.

- Standard: For applicants in average health, perhaps with a chronic condition that’s well-controlled.

If one insurer offers you a "Preferred" rate and another quotes you at "Standard," the price difference will be huge. So don't just stare at the premium; check the health class they assigned you. It shows you exactly how each company’s underwriters see your health profile, which is critical for finding the best long-term value.

A great way to see this in action is to get a detailed term life insurance quote to kick off your search.

Choosing the Right Policy Type: Term vs. Whole vs. Universal

Once you know how much coverage you need, the next big decision is picking the right kind of policy. It’s not about finding the "best" one out there—it's about finding the best one for you. The big three are Term, Whole, and Universal life insurance, and each one is built for a completely different job.

Choosing the wrong one can mean paying for features you'll never use or, even worse, having your coverage run out just when your family needs it. Forget a simple pro-and-con list; this is about matching a policy’s design to your actual life goals. We dig deeper into the nuances in our guide on the different types of life insurance explained.

Think of it like buying a car. A sports car is a thrill, but it's not going to work for a big family. A minivan is perfect for soccer practice but isn’t designed for off-road adventures. Each policy is a tool, and you need the right one for the task at hand.

When Term Life Insurance Is the Smartest Choice

Term life insurance is the most straightforward and usually the most affordable option. You pick an amount of coverage for a set period—most often 10, 20, or 30 years. If you pass away during that term, your beneficiaries get paid. If you outlive it, the policy simply ends.

That simplicity makes it the perfect solution for covering large debts that have an end date.

- Protecting Your Mortgage: A 30-year term policy can line up perfectly with a 30-year home loan. It guarantees your family can keep their home, no matter what happens.

- Covering Your Kids' Childhood: With young children, a 20-year term policy creates a financial safety net that lasts until they're old enough to be on their own.

- Securing Business Loans: Lenders often require small business owners to have life insurance to cover outstanding loans. Term life is a cost-effective way to check that box.

The biggest advantage of term life is its bang for your buck. Since it’s pure insurance protection with no cash value savings, you can get a lot of coverage for a small premium. It’s also important to understand how life insurance proceeds are handled to ensure the funds get to your family quickly, avoiding potential probate delays.

When Whole Life Insurance Makes Financial Sense

Whole life insurance is permanent, meaning it covers you for your entire life as long as you pay the premiums. But it does more than that. It also builds cash value that grows at a guaranteed, fixed rate.

This cash value is like a tax-deferred savings account you can borrow from. That feature turns the policy from a simple safety net into a predictable financial asset.

Situational Recommendation: Whole life is built for people who want lifelong coverage and a conservative, guaranteed asset for estate planning or to supplement their retirement. It's less about temporary problems and more about building a permanent financial legacy.

Whole life is the right fit if your goals include:

- Estate Planning: The death benefit can provide immediate cash to pay estate taxes, so your heirs don't have to sell off assets.

- Final Expense Coverage: A smaller whole life policy ensures funeral costs and medical bills are covered without draining your family's savings.

- Leaving a Guaranteed Inheritance: The death benefit is locked in, making it a reliable way to leave a specific amount of money to your loved ones or a favorite charity.

The Flexibility of Universal Life Insurance

Universal Life (UL) is another type of permanent insurance, but it offers a lot more flexibility than whole life. It also builds cash value, but it lets you adjust your premium payments and even your death benefit as your life changes.

This adaptability makes it a powerful tool if you have a fluctuating income or expect your financial needs to evolve. One of the most popular versions today is Indexed Universal Life (IUL), which links your cash value growth to a stock market index like the S&P 500. You get the potential for higher returns without the risk of losing money if the market drops.

Indexed Universal Life is one of the fastest-growing products in the industry, with new premiums recently hitting a record $3.8 billion. This trend shows that people are looking for flexible policies that offer market-linked growth. IUL policies now account for about 24% of new business, way more than the 7% share held by traditional fixed-rate universal life.

At the end of the day, the right choice comes down to your "why." Term is for temporary needs. Whole life is for permanent guarantees. And universal life is for flexible, lifelong goals.

Analyzing the Fine Print: Riders and Underwriting Nuances

When you compare life insurance rates, the lowest premium always seems to win. It’s natural to gravitate toward the best price. But the best policy isn’t just the cheapest one; it’s the one that actually delivers the protection your family needs, without any nasty surprises down the road.

This means looking past the monthly payment and into the fine print. The real value of a policy is hidden in its riders, its exclusions, and the insurer's unique approach to underwriting. These are the details that dictate how a policy works in the real world—and they can mean the difference between a paid claim and a denied one.

Getting a handle on these elements gives you a huge advantage. It lets you find an insurer that not only offers a good price but also views your specific life circumstances in the most favorable light possible.

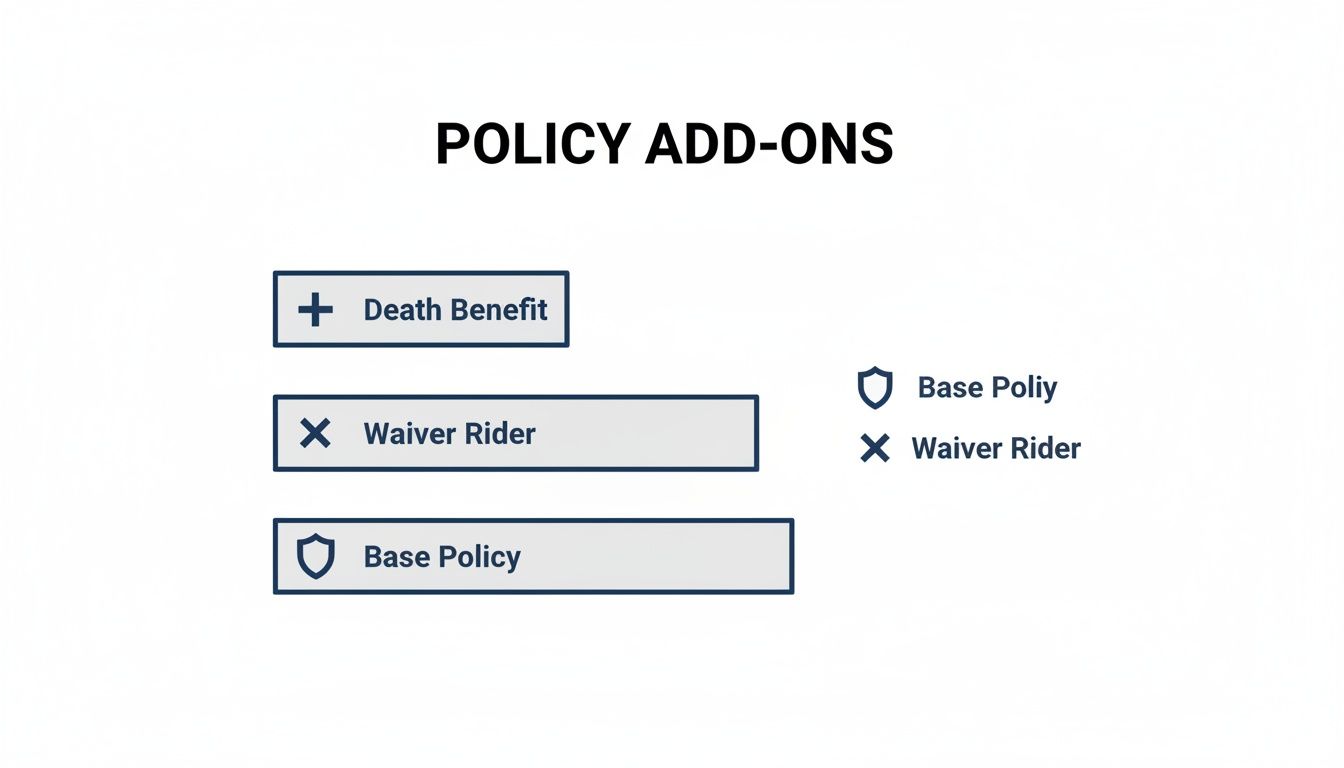

Customizing Your Coverage with Riders

Think of a life insurance policy like a base model car. Riders are the optional upgrades you add to fit your life, like all-wheel drive for snowy winters or a better sound system for long commutes. They customize the protection to what you actually need.

While some riders add a bit to the cost, many provide essential value that can become a financial lifeline. They allow you to access your policy’s benefits under specific circumstances, not just when you pass away.

Here’s a look at some common life insurance riders you’ll come across.

This image really highlights how riders act as amendments to a basic policy, offering extra benefits that match specific life events or worries you might have.

The key is to match the rider to a genuine risk in your life. Don’t just add features because they sound good; choose them because they solve a real problem for you or your family.

Here are a few of the most powerful riders to consider:

- Accelerated Death Benefit (ADB) Rider: Often included at no extra cost, this rider is incredibly valuable. It lets you access a portion of your death benefit while you're still alive if you're diagnosed with a terminal illness. These funds can be a game-changer for medical care or end-of-life expenses.

- Waiver of Premium Rider: If you become totally disabled and can't work, this rider keeps your policy going by covering the premiums for you. It ensures your life insurance doesn’t lapse when you can least afford it. This is especially important if you’re self-employed or your family’s main breadwinner.

- Child Term Rider: This lets you add a small amount of term life insurance for all of your children under one simple rider. It’s an affordable way to cover final expenses should the unthinkable happen, and it often allows your child to convert it to their own permanent policy later, no matter their health.

Expert Insight: The Accelerated Death Benefit rider transforms a policy from something that only helps after you're gone to a tool that can provide critical financial relief during a major health crisis. It's one of the most powerful features to look for when you compare life insurance rates.

Understanding Underwriting Differences and Exclusions

Not all insurance companies see risk the same way. The process they use to evaluate you is called underwriting, and the small differences between how insurers operate can save you thousands. For a deeper look, check out our guide on what underwriting in insurance really means.

One company might be really strict about a history of high blood pressure, while another might offer you preferred rates if it’s well-managed with medication. Some insurers even specialize in covering people with diabetes, offering much better terms than a generalist company would.

This is where doing your homework really pays off. If you have a specific health condition, a risky hobby like scuba diving, or a hazardous job, finding an insurer with a lenient view of your particular situation is the secret to getting the best rate.

Finally, always read the exclusions. These are the specific circumstances where the policy will not pay out. A common one is the "suicide clause," which typically states the policy won't pay if the insured dies by suicide within the first two years of the policy. Other exclusions might relate to death while committing a felony or from an act of war. Knowing these limitations is a crucial part of making a fully informed decision.

Rate Comparison Scenarios for Different Life Stages

Numbers on a quote sheet are just that—numbers. They don't really tell you what a policy is worth until you see how it fits a real person in a real-life situation. This is where the lightbulb goes on and the decision-making gets a lot clearer.

When you walk through a few practical examples, you can start to connect premium dollars to tangible protection for the people and things you care about most.

Let's look at a few common life stages and see how the right policy comes into focus.

Young Couple Buying Their First Home

Meet Sarah and Tom. They’re both 32, in excellent health, don’t smoke, and just signed the papers for their first home—complete with a $400,000, 30-year mortgage. Their biggest worry? That if something happened to one of them, the other would be stuck with a huge debt and possibly have to sell the house while grieving.

What they need: A simple, affordable policy that covers their mortgage for the next 30 years.

The best fit: A 30-year term life insurance policy is a no-brainer here. It’s designed to match the exact length of their biggest financial obligation.

Here’s what individual $500,000, 30-year term policies might look like for them:

- Sarah (32-year-old female): Roughly $28 – $35 per month

- Tom (32-year-old male): Roughly $34 – $42 per month

For a combined total of around $70 a month, they can lock in $1 million in total coverage. That’s enough to wipe out the mortgage and leave extra for income replacement or future costs. They get massive peace of mind for less than what they probably pay for internet.

Business Owner Protecting Family and Operations

Now, let's consider Maria, a 45-year-old self-employed graphic designer. She’s the primary breadwinner, and her business is carrying a $150,000 Small Business Administration (SBA) loan. If she were gone, her family would lose their main income stream, and that business loan would still be due.

What she needs: Enough coverage to replace her income for her family and satisfy the business loan. A 20-year term would protect her through her peak earning years until her kids are on their own.

The best fit: A 20-year term policy with a solid death benefit. Adding a Waiver of Premium rider would also be a smart move.

For a $1,000,000, 20-year term policy, a 45-year-old non-smoking female in good health could expect to pay:

- Estimated Monthly Premium: Roughly $65 – $80 per month

This investment ensures her family isn’t left scrambling and that her business obligations are met. The Waiver of Premium rider adds a small cost but is huge—it guarantees her coverage stays in force even if she becomes disabled and can’t work.

Situational Recommendation: For business owners and breadwinners, layering policies is a powerful strategy. Think about a 20-year term to cover the big income-replacement years, plus a smaller whole life policy for permanent needs like final expenses or leaving a small legacy.

This is a great visual of how riders work—they’re add-ons that customize your protection.

As you can see, things like a Waiver of Premium are layered on top of the base policy to make it stronger and more suited to your specific needs.

Individual Planning for Final Expenses

Finally, there’s Robert. He’s 65, retired, and in average health. His kids are grown and financially independent, and the house is paid off. His main goal now is simple: he doesn’t want to leave his wife or kids with the burden of funeral costs, which can easily top $10,000.

What he needs: A smaller, permanent policy that will never expire and is guaranteed to be there when it’s needed.

The best fit: A final expense whole life insurance policy. These plans offer smaller coverage amounts—usually $5,000 to $50,000—with fixed premiums that are designed specifically for end-of-life costs.

For a $25,000 whole life policy, a 65-year-old male in standard health might see these rates:

- Estimated Monthly Premium: Roughly $120 – $160 per month

Yes, it’s more expensive per dollar of coverage than term life. But you’re paying for a guarantee—a payout that will be there no matter what. It’s the certainty that his final wishes will be honored without creating a financial headache for his family.

These examples make one thing clear: the "best" rate is all about your personal situation. It’s a concept that’s catching on, too. The global life insurance market has ballooned, reaching $3.1 trillion from $1.9 trillion in just a few years, which shows a growing awareness of its value. You can dig into this trend and find more life insurance statistics on Feather Insurance.

Common Questions About Comparing Life Insurance Rates

Once you start comparing life insurance quotes, a few last-minute questions always seem to pop up. That’s perfectly normal. Getting clear, straightforward answers is the final step to choosing a policy with total confidence.

Think of this as tying up the loose ends. Once these questions are answered, you can move forward knowing you’ve made the right call for your family’s future.

Will My Life Insurance Rates Go Up Over Time?

This is a big one, and the answer comes down to the type of policy you have. Getting this right is key to avoiding nasty surprises down the road.

- Term Life Insurance: Nope. Your premium is locked in for the entire term. If you buy a 20-year term policy, your rate is guaranteed not to change for those 20 years.

- Whole Life Insurance: Your premiums are also fixed and guaranteed never to increase. That predictability is one of the main reasons people choose it.

- Universal Life Insurance: This is where it can get tricky. Some UL policies have flexible premiums, meaning you might pay less in some years. But if the policy's cash value doesn't perform as expected, you could have to pay more later to keep it from lapsing.

Do I Always Need a Medical Exam to Get a Good Rate?

Not anymore, but it often helps you get the best deal. Many insurers now offer "accelerated underwriting," where they use data to assess your risk without a full medical exam. Healthy applicants can get some very competitive rates this way.

That said, for the absolute lowest premiums possible, a fully underwritten policy with a medical exam is usually the winner. The exam gives the insurer the most complete picture of your health, which reduces their risk—and they often pass those savings on to you if you’re in good shape.

It's a classic trade-off: convenience versus cost. No-exam policies are fast and easy, but you might pay a bit more for that speed. If you're eligible, it’s always smart to compare quotes for both options.

What if I Want to Switch Life Insurance Policies Later?

You can absolutely switch policies, but you have to do it carefully. Never, ever cancel your old policy until your new one is officially approved and active. If you cancel first and then your new application gets denied for some reason, you could be left with no coverage at all.

The process is simple: apply for the new policy, go through underwriting again, and once it’s approved, formally accept it. Only then should you call your old insurer to cancel the previous coverage.

Does My Credit Score Affect My Life Insurance Rate?

Your FICO score doesn't directly set your life insurance premium. Insurers are actually prohibited from using it that way.

However, they often look at a "credit-based insurance score" or your broader credit history. They aren't worried about your debt-to-income ratio; they're looking for signs of financial instability, like a recent bankruptcy, which they see as a potential risk factor. A stable financial history is always a plus during underwriting.

Figuring all this out can feel like a lot, but you don’t have to do it alone. The experts at My Policy Quote are here to help you compare rates from top carriers and find the perfect policy for your life and your budget. Get your free, no-obligation quote today at mypolicyquote.com.