Normally, you can only sign up for health insurance during a specific time of year called Open Enrollment. It's like a train that only leaves the station once annually, and everyone has to get on board during that window.

But what happens if you have an urgent reason to travel after the train has already left? That’s where a Qualifying Life Event (QLE) comes in.

An insurance qualifying life event is a major change in your life—like getting married, having a baby, or losing your job—that gives you a special opportunity to enroll in a new health plan outside of the usual Open Enrollment period.

Your Special Ticket to Health Coverage

Think of a QLE as your special pass to get on the train. It kicks off what’s called a Special Enrollment Period (SEP), which is a limited-time window—usually 60 days—for you to buy a new health plan or change the one you have.

Without a QLE, you'd be stuck waiting for the next Open Enrollment, which could mean going months without the coverage you need.

Why Do QLEs Even Exist?

The system is set up this way to keep things fair and costs stable. It prevents people from waiting until they're sick to buy insurance.

But life is unpredictable. Policymakers understood that major life changes often create new and unexpected healthcare needs. QLEs act as a crucial safety net for these moments.

These events usually fall into a few main categories, giving you the flexibility you need when your world shifts.

- Changes in Your Household: Things like getting married, having a baby, or getting divorced completely change your family structure and what you need from your insurance.

- Losing Your Health Coverage: This is a big one. It includes losing a job, turning 26 and aging off a parent’s plan, or your COBRA coverage ending.

- A Change in Where You Live: If you move to a new ZIP code or county where your current plan isn't offered, you'll likely qualify for a new one.

- Other Big Changes: Certain other events, like a change in income that affects your eligibility for financial help, can also open up an enrollment window.

A qualifying life event is the system's way of acknowledging that life doesn't always stick to a schedule. It provides a crucial exception to the rule, allowing you to secure health coverage precisely when your life circumstances demand it.

Getting a handle on these concepts is the first step in taking control of your health insurance. For a deeper dive into other key terms you might run into, our health insurance glossary is a great resource.

To give you a quick overview, the table below sums up the most common qualifying life events. We'll explore each of these in more detail later on.

Common Qualifying Life Events At A Glance

| Event Category | Common Examples |

|---|---|

| Household Changes | Getting married or divorced, having a baby, adopting a child, or death in the family. |

| Loss of Coverage | Losing job-based insurance, turning 26 and aging off a parent's plan, or losing COBRA. |

| Residential Moves | Moving to a new state or a different service area that your current plan does not cover. |

| Income and Other Changes | Changes in income affecting subsidy eligibility or becoming a U.S. citizen. |

Remember, these are just the highlights. Each situation has its own specifics, so it's always a good idea to confirm if your event qualifies.

The Most Common Qualifying Life Events Explained

Trying to figure out if your situation counts as a “qualifying life event” can feel like you’re decoding a secret language. The official rules seem complicated, but the good news is that most QLEs fit into a few straightforward, widely recognized categories.

Let's walk through these common events with some real-world examples. This will help you know for sure if your big life change just opened the door to a Special Enrollment Period.

Think of these categories as different keys to the same opportunity: a chance to get or change your health coverage right when you need it most.

Changes in Your Household

This is easily one of the most common reasons for a mid-year insurance change. When your family looks different, your insurance needs almost always follow suit.

- Getting Married: Tying the knot is a classic QLE. It lets you and your new spouse get on the same health plan. You can add your spouse to your policy or find a brand-new one together. Just remember to act quickly—you typically have 30 to 60 days after your wedding to make it happen.

- Getting Divorced or Legally Separated: If you lose your health coverage because of a divorce, you qualify for an SEP. This is a critical safety net that ensures you aren't left uninsured after coming off a former spouse's plan.

- Having a Baby or Adopting a Child: Welcoming a child is a huge QLE. This event allows you to add your new little one to your plan or switch to a family plan that makes more sense. Your new coverage is often retroactive to the date of birth or adoption, so the baby is covered from day one.

Adding a dependent is a massive driver of insurance changes. In 2022, there were about 3.6 million births in the U.S., and every single one triggered a chance for parents to update their coverage. Family growth events like these account for a huge percentage of all Special Enrollment Period activity. Insurers and benefits teams even plan for these predictable yearly surges, as detailed by resources from experts like TCWGlobal.

Losing Other Health Coverage

Losing your health insurance is probably the most critical qualifying life event because it protects you from a sudden, dangerous gap in coverage. But here's the catch: this only applies to an involuntary loss. If you choose to drop your plan or lose it for not paying your premiums, that doesn't count.

Common situations include:

- Losing Job-Based Coverage: If you quit, get laid off, or your hours are cut—causing you to lose your employer-sponsored plan—you qualify for an SEP. This gives you a window to find a new plan on your own or through another job.

- Losing COBRA Coverage: Once your COBRA coverage runs out, you’re eligible for a Special Enrollment Period. But be careful—if you decide to end your COBRA coverage early, you won’t qualify.

- Aging Off a Parent's Plan: Turning 26 is a major milestone and a guaranteed QLE. Young adults can stay on a parent's health plan up until their 26th birthday. After that, they have to get their own coverage. We break this down in detail in our guide on the dependent health insurance age limit.

The whole point of this QLE is to make sure you aren't penalized with a coverage gap for something that was out of your control. It’s a safety net for anyone who involuntarily loses their main source of health insurance.

Moving to a New Area

Where you live has a huge impact on your health insurance options, since most plans are tied to specific service areas and doctor networks. A big move can absolutely be a qualifying life event.

You might qualify for an SEP if you:

- Move to a new ZIP code or county where your current plan isn't available.

- Move to the U.S. from another country or a U.S. territory.

- Are a student moving to or from where you attend school.

- Are a seasonal worker moving between the place you live and the place you work.

This rule exists so you can enroll in a new plan with a network of doctors and hospitals you can actually get to in your new community. To be eligible, you usually need to prove you had qualifying health coverage for at least one day in the 60 days before you moved.

How To Navigate Your Special Enrollment Period

Okay, so you’ve confirmed you have an insurance qualifying life event. That’s the first hurdle cleared. But what comes next is just as important: taking advantage of the window it opens. This is your Special Enrollment Period (SEP), and it's a limited-time opportunity to get new health coverage or switch your plan outside the usual yearly signup time.

Think of it like a personal boarding call for health insurance. You have to act fast, or you'll miss your chance.

Most SEPs are short, lasting just 30 to 60 days from the date of your life event. Missing this deadline is one of the easiest—and most costly—mistakes you can make. The clock starts ticking the moment it happens, whether that’s the day you say "I do," the day you bring your new baby home, or your last day of coverage from a previous job.

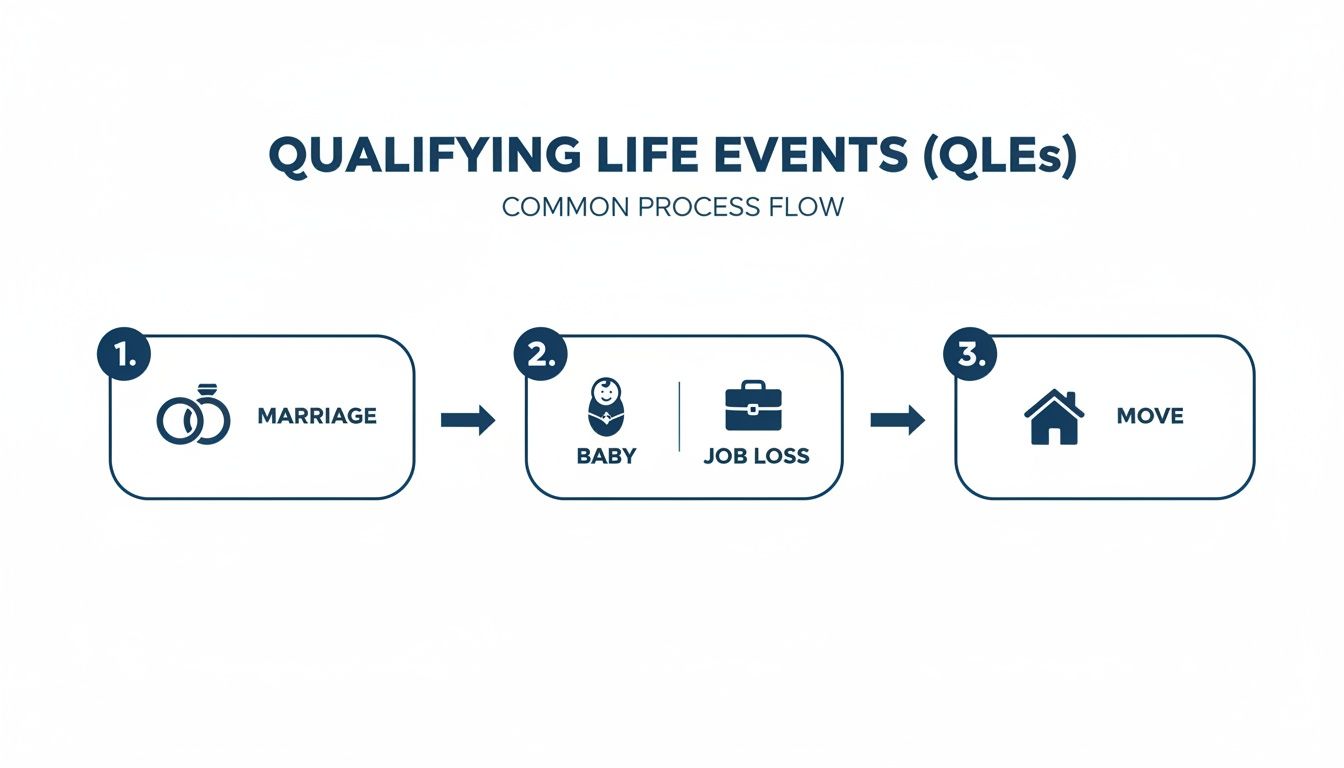

This simple graphic shows some of the most common life changes that kick off a Special Enrollment Period.

As you can see, big changes in your household or your job are the primary triggers. When one of these happens, it’s time to move quickly to get covered.

Get Your Paperwork in Order

Before you can sign up, you have to prove your QLE is legit. The Health Insurance Marketplace and private insurance companies need to see documentation to verify that you qualify for an SEP. Getting these documents ready ahead of time will save you a massive headache.

Here’s what you’ll likely need:

- Getting Married? Have a copy of your marriage certificate ready.

- New Baby or Adoption? You'll need a birth certificate or the final adoption papers.

- Lost Your Old Coverage? Get a letter from your old job or insurance company that shows when your plan ended and why.

- Moved to a New Area? You'll need proof of your new address (like a utility bill or lease) and proof you were insured before you moved.

Having these documents on hand means you won’t be scrambling at the last minute. It’s the best way to keep your application from getting delayed or, worse, denied.

Your Step-by-Step Enrollment Checklist

The process can feel like a lot to handle, especially when you're already dealing with a major life change. But if you break it down into a few simple steps, it’s much more manageable.

Follow this checklist to stay on track:

- Confirm Your QLE and Deadline: First thing’s first—make sure your event qualifies. Then, immediately mark the last day of your SEP on your calendar. Don’t put it off.

- Contact the Right People: If your insurance is through work, your first call should be to your HR department. If you need to buy your own plan, head to HealthCare.gov or your state’s specific marketplace website.

- Gather Your Documents: Pull together all the proof you need for your QLE. Scan them or make copies so they’re ready to go when you need to upload or send them in.

- Shop Around and Choose Your Plan: Don’t just grab the first option you see. A QLE is your chance to find a plan that actually fits your new circumstances. Pay attention to the deductibles, copays, and which doctors are in the network.

- Submit Your Application: Fill out the application carefully and make sure every detail is correct. Upload your documents when asked.

- Pay Your First Premium: This is critical. Your coverage isn’t active until you’ve made that first payment. Watch the payment deadline closely so your new plan doesn’t get canceled before it even begins.

Key Takeaway: Your Special Enrollment Period is a use-it-or-lose-it deal. Being proactive—from getting your documents together to hitting every deadline—is the secret to a smooth transition.

If you miss this window, you’ll probably have to wait until the next annual sign-up period. To get a better sense of that yearly timeframe, you can check out our guide on what Open Enrollment means. By acting quickly during your SEP, you make sure you don’t have any risky gaps in your health insurance, protecting both your health and your wallet when you need it most.

How QLEs Impact Different People

A qualifying life event isn't a one-size-fits-all experience. A recent grad turning 26 is navigating a totally different world than a freelancer who just lost a major contract. While the rules are the same for everyone, the best strategy depends entirely on where you are in life.

Think of it this way: the right move for you won't be the right move for your neighbor. Understanding how a QLE fits into your specific situation is the key to making a smart, confident decision.

For Young Adults Turning 26

That 26th birthday is a huge milestone—and an automatic QLE for millions. Thanks to the Affordable Care Act, you can stay on a parent’s health plan until you're 26. But the day you blow out those candles, that coverage door closes for good.

This is a massive, predictable transition. Insurers know that roughly 3.7 million people in the U.S. turn 26 every single year, triggering a wave of new enrollments. You get a 60-day Special Enrollment Period to find your own plan. Miss that window, and you could be uninsured until the next Open Enrollment period rolls around.

Pro-Tip: Don't wait until the last second. Start looking at your options—like a plan through your job or the Health Insurance Marketplace—at least three months before your birthday. A little planning now ensures you have a smooth transition with zero gaps in coverage.

For Growing Families and New Parents

Welcoming a new child is one of the most joyous QLEs there is, whether it's through birth, adoption, or foster care. This event opens the door for you to add your new little one to your current health plan or even switch to a new one that better fits your growing family's needs.

Your enrollment window usually kicks off the day your child arrives. The great thing is, coverage is often retroactive to their date of birth, so they’re protected from day one as long as you enroll within the timeframe (usually 30 or 60 days).

Here’s what to do right away:

- Tell HR Immediately: If you have insurance through work, let your human resources team know ASAP to get the ball rolling.

- Compare the Costs: Adding a child means your premium will go up. This is the perfect time to compare total costs—including deductibles and out-of-pocket maximums—across different family plans.

- Check the Pediatrician Network: Make sure your favorite pediatrician and any specialists you might need are in-network with the plan you choose.

For Freelancers and the Self-Employed

If you’re a freelancer, 1099 contractor, or gig worker, life is anything but predictable—and that includes your income and insurance. A QLE can be both a challenge and a lifeline. Losing coverage from a spouse’s job, for example, is a common trigger that opens up a Special Enrollment Period.

But for this group, there's another huge QLE: a big change in income. If your income suddenly drops, you might qualify for subsidies on the Health Insurance Marketplace that you couldn't get before. This lets you hop into a more affordable plan mid-year. On the flip side, if you land a huge project and your income jumps, you’ll need to report it to adjust your subsidy and avoid a nasty surprise at tax time.

For Those Facing Job Loss or Divorce

Losing your job is stressful enough without having to worry about losing your health insurance, too. Thankfully, this is a core qualifying life event. It gives you a critical window to get new coverage through the Marketplace, a spouse's plan, or COBRA. To figure out your next steps, check out our guide on securing insurance if you lose your job for a clear roadmap.

Divorce or legal separation can also trigger a QLE if it means you lose coverage from a former spouse’s plan. This ensures you aren't left unprotected during an already tough time. A major life change like a divorce often forces you to re-evaluate your healthcare. For a deeper dive, exploring health insurance considerations after a divorce can provide much-needed clarity. Taking the time to plan carefully here can prevent any gaps in your medical protection.

Common Mistakes To Avoid During Enrollment

Life changes are already stressful enough without throwing insurance paperwork and strict deadlines into the mix. When you're trying to navigate an insurance qualifying life event, it’s all too easy to make a small error that could leave you without the coverage you desperately need.

Think of this as a heads-up on the most common pitfalls I've seen. Knowing what to watch for can help you sidestep these mistakes and get your new plan locked in without any drama.

Missing Your Enrollment Deadline

This is the big one. Your Special Enrollment Period (SEP) isn’t a suggestion—it’s a hard and fast deadline, usually just 30 to 60 days from the date your life event happened.

Forgetting or putting it off can have serious consequences. If you miss that window, you’ll likely be stuck waiting for the next annual Open Enrollment period, which could be months away. That’s a long time to go without coverage.

Action Step: As soon as your qualifying event occurs, find out your exact deadline. Circle it on your calendar, set a phone reminder—do whatever it takes to keep that date front and center. Treat it with the urgency it deserves.

Submitting Incorrect or Incomplete Documentation

Insurance companies and the Health Insurance Marketplace need to confirm that your life event is legit. This means you have to provide official proof, and this is where a lot of applications get held up.

Sending in the wrong documents, a blurry photo of a form, or incomplete paperwork will cause delays. Worst-case scenario? Your application gets denied, and you have to start all over again, racing against that deadline you can't afford to miss.

Here’s a quick list of what you’ll likely need:

- Marriage: A copy of your marriage certificate.

- New Child: The baby's birth certificate or official adoption paperwork.

- Loss of Coverage: A letter from your old job or insurance company confirming when and why your plan ended.

- A Move: Proof of your new address (like a lease or utility bill) and confirmation that you had coverage before you moved.

Assuming Your Event Qualifies Without Checking

Not every major life change counts as a QLE in the eyes of an insurer. For example, voluntarily dropping your old health plan or losing coverage because you stopped paying the bills will not trigger a Special Enrollment Period. You can't create one by choice.

Moving is another common point of confusion. A move only qualifies if it puts you in a new area where your old plan isn't available. Moving to a new apartment across town in the same ZIP code probably won’t cut it.

Before you even start an application, double-check your situation. Talk to your HR department or use the screening tools on HealthCare.gov. It’s a simple step that can save you a lot of time and frustration.

Forgetting To Pay the First Premium

This one sounds so simple, but it’s a critical final step that people often overlook. Once you’ve picked your plan and your application is approved, you have to pay the first month's premium.

Your new health insurance doesn't actually start until that payment goes through. Many people think they’re covered the second they get approved, but that's a dangerous assumption. If you miss that first payment, your new plan can be canceled before it even begins, leaving you right back where you started—uninsured.

Your Qualifying Life Event Questions Answered

Even after you get the basics down, navigating an insurance qualifying life event can bring up some very specific, real-world questions. When you’re in the middle of a big life change, the last thing you need is confusing jargon. You just want clear, direct answers so you can feel good about your decisions.

Think of this section as your personal QLE cheat sheet. We'll tackle the most common questions people have about these events and the Special Enrollment Periods that come with them—from deadlines and plan choices to what to do when your situation feels a little unique.

What Happens if I Miss My Deadline?

This is probably the most important question, and the answer is simple: if you miss your Special Enrollment Period (SEP) deadline, you'll almost certainly have to wait until the next annual Open Enrollment to get coverage. That deadline—usually just 30 to 60 days from your event—is non-negotiable.

Missing it could mean going months without health insurance, which is a huge financial gamble. That's why it's so important to act fast as soon as your qualifying event happens.

Exceptions are incredibly rare. You might get an extension for something major, like a natural disaster or proven misconduct by an enrollment official, but you absolutely shouldn't bank on it.

Can I Switch to a Completely Different Plan?

Yes, you sure can. A qualifying life event doesn’t just let you add your new spouse or baby to your existing plan. It throws the doors wide open for you to shop for a completely new one. You can switch from an HMO to a PPO, pick a plan with a lower deductible, or even jump to a different insurance company altogether.

This is your chance to really re-evaluate what you need. For example, if you’re about to have a baby, you might want a plan with stronger maternity coverage and a lower family deductible, even if the monthly premium is a bit higher.

Your Special Enrollment Period is a genuine opportunity to find a health plan that fits your new life. Don't feel stuck with your old plan if it no longer makes sense for you.

Does a Temporary Move for Work Qualify?

This is a common mix-up, but the answer is typically no. A temporary move for a work assignment doesn't count as a QLE if you plan on returning to your permanent home.

The "change in residence" QLE is designed for permanent moves to a new ZIP code or county where your old health plan simply isn't available.

- A Qualifying Move: You sell your house in Florida and buy a new one in Texas, a state where your current insurer doesn't offer plans.

- A Non-Qualifying Move: You spend three months in another city for a special project but keep your permanent address back home.

The key is whether your permanent home has changed to a new service area, making your old plan unusable.

What Is Considered Valid Proof of Lost Coverage?

When you lose other health insurance, you've got to prove it. Insurers and the Marketplace need to see official paperwork confirming that your old coverage ended, why it ended, and the exact date it stopped.

Just saying you lost your plan won’t be enough. You’ll have to submit specific documents to verify your insurance qualifying life event.

Examples of Accepted Documentation:

| Type of Proof | What It Should Show |

|---|---|

| Letter from an Employer | A formal letter on company letterhead stating the date your job-based health plan ended. |

| Notice from an Insurer | An official letter from your previous insurance company showing the plan's termination date. |

| COBRA Documents | Paperwork showing that your COBRA benefits have run out and are officially ending. |

This paperwork is non-negotiable. Getting it ready ahead of time will prevent major delays in getting your new coverage up and running. Always keep a copy of any notice you get about your health plan ending.

Navigating health coverage during a major life change is tough, but you don't have to figure it all out alone. My Policy Quote is here to help individuals and families find the right plan for their new chapter, ensuring you get the protection you deserve without the stress. Explore your personalized insurance options today at https://mypolicyquote.com.