So, you’ve hit 62 and you're ready to trade in your work deadlines for a well-deserved life of freedom. It’s an exciting milestone, but there’s one big hurdle to clear first: that three-year gap in health insurance before Medicare starts at 65.

Figuring out how to get affordable, quality coverage during this time is a huge deal. It’s what protects your health and the retirement savings you’ve worked so hard for. This is a challenge, but it's one you can absolutely solve with a good plan.

Why Retiring at 62 Creates a Healthcare Bridge

When you leave your job at 62, you also say goodbye to that employer-sponsored health plan—the one that’s probably been your safety net for years. All of a sudden, you're on your own, needing to find and pay for a new plan until you turn 65.

Think of it like building a bridge. This three-year span is that bridge, and it needs to be strong enough to get you safely from your career to Medicare. One unexpected illness or accident without solid coverage could put everything you've saved at risk. The stakes are higher than most people think.

The Financial Reality of the Gap

Let's be real about the numbers. If you retire at 62, you could face 56% more in total healthcare expenses compared to someone who waits until 65 to start the same Medicare plan. That pre-Medicare period can run you anywhere from $800 to $1,200 a month without any subsidies.

Over three years, that could add up to $28,800 to $43,200, a cost that can seriously derail your retirement plans. This isn't just about a monthly bill; it's about protecting your entire future.

This isn't just about paying a monthly premium. It's about creating a financial shield that protects your entire retirement vision from being dismantled by one high medical bill.

Your Primary Bridge-Building Options

The good news? You have several solid ways to build that bridge to Medicare. We'll get into the details of each, but your main choices boil down to these:

- COBRA Continuation: This lets you keep your old work health plan for a while, but you have to pay the full premium yourself, plus a small admin fee.

- ACA Marketplace Plans: The Affordable Care Act (ACA) marketplace is where you can shop for private insurance plans. The best part is that you might qualify for income-based subsidies to make it much more affordable.

- Spousal or Private Plans: If your spouse still works, jumping on their plan could be a great option. Other choices, like short-term health insurance, are out there too, but they come with some important limits to be aware of.

To give you a clearer picture, here's a quick rundown of how these options stack up.

Your Early Retirement Health Insurance Options at a Glance

| Insurance Option | Typical Coverage Duration | Best For |

|---|---|---|

| COBRA | Up to 18 months | People who want to keep their current doctors and plan, and are willing to pay a higher premium for that continuity. |

| ACA Marketplace | Ongoing (Renewable Annually) | Retirees with a moderate income who can benefit from subsidies to lower their monthly premium and out-of-pocket costs. |

| Spouse's Plan | As long as your spouse is employed | Individuals whose spouse has a strong, affordable employer-sponsored plan they can join. |

| Private/Short-Term | Varies (3 months to 3 years) | Healthy individuals needing a temporary, low-cost catastrophic plan to fill a very short coverage gap. |

Getting familiar with these choices is your first big step. For an even deeper dive, our guide on health insurance for retirees under 65 has more great info to help you out.

Decoding Your Pre-Medicare Coverage Options

So, you’ve decided to retire at 62. The freedom is exhilarating, but there's one big question mark: health insurance. Your employer-sponsored plan is ending, and Medicare is still three years away. What now?

Think of this as building a bridge. You need a solid, reliable way to get from your last day at work to your 65th birthday, fully covered. Luckily, you have a few strong options, each designed for different situations. Let's walk through them.

COBRA: Your Immediate—But Temporary—Solution

The first option you’ll likely encounter is COBRA (Consolidated Omnibus Budget Reconciliation Act). It’s the most straightforward path right after you leave your job. COBRA lets you keep the exact health plan you had with your employer, usually for up to 18 months.

The beauty of COBRA is its simplicity. You keep your doctors, your network is the same, and your deductibles don't reset. No new systems to learn, no surprises.

But here’s the catch: the cost. You now have to pay 100% of the premium, plus a small 2% administrative fee. Since most employers cover a big chunk of this cost for their employees, the sticker shock is real. COBRA is a great safety net for a month or two, but it’s rarely a sustainable plan for the full three years.

The ACA Marketplace: Your Long-Term Strategy

For most early retirees, the Affordable Care Act (ACA) Marketplace is where you'll find your long-term solution. This is the official hub where you can shop for and compare private health insurance plans.

When you leave your job, you trigger what’s called a "Qualifying Life Event." This is your golden ticket. It opens a Special Enrollment Period, giving you a 60-day window to sign up for an ACA plan without having to wait for the annual Open Enrollment.

The real game-changer with the ACA is the potential for financial help.

Your eligibility for subsidies is based on your projected household income for the year—not what you used to make. For most new retirees, this lower income unlocks huge savings.

This help comes in two key forms:

- Premium Tax Credits: These credits directly reduce your monthly payment. It works on a sliding scale, so the lower your retirement income, the more you save.

- Cost-Sharing Reductions (CSRs): If your income falls below 250% of the federal poverty level, you can get a Silver plan with lower deductibles, copays, and out-of-pocket limits. This makes actually using your insurance much more affordable.

The cost difference can be staggering. Without subsidies, ACA plans for a 62-year-old might run between $800 and $1,200 per month. Compare that to the average annual premium for single employer coverage, which hit $9,325 in 2025. This just shows how much the financial landscape shifts when you retire before Medicare.

Other Pathways to Consider

While COBRA and the ACA are the main roads, don't forget to check the side streets. A better fit for your unique situation might be hiding there.

If your spouse is still working, joining their health plan could be the easiest and most affordable option. Losing your coverage qualifies as a life event for them, too, allowing them to add you to their plan outside of the normal enrollment window.

You can also look at private insurance plans sold directly by an insurer, outside the official Marketplace. These plans still meet ACA standards, but they aren't eligible for any tax credits or subsidies. This route really only makes sense for retirees with higher incomes who wouldn't qualify for financial help anyway.

Getting a full picture of all early retiree health insurance options is the key to a worry-free retirement. By carefully weighing COBRA, the ACA, and spousal plans, you can build a solid and affordable healthcare bridge to age 65.

Calculating the Real Cost of Early Retirement Healthcare

The monthly premium is the first number everyone sees, but it’s just the tip of the iceberg. Focusing only on that number when planning your healthcare from 62 to 65 is like budgeting for a road trip by only looking at the cost of gas. You’re completely ignoring the tolls, surprise repairs, and hotel stays—the expenses that can actually bust your budget.

To get the real picture, you have to look at the total cost of care. That’s your premium plus everything you pay when you actually use your insurance. For early retirees, these out-of-pocket costs are where the real financial risk is hiding.

The Big Three of Out-of-Pocket Costs

When you start comparing plans, especially on the ACA Marketplace, you’ll see three terms pop up again and again. Getting a handle on them is the key to creating a healthcare budget that won’t fall apart.

- Deductible: This is the amount you have to pay for your medical care before your insurance plan starts chipping in. Think of it as your initial buy-in. If your plan has a $5,000 deductible, you’re on the hook for the first $5,000 of your bills each year.

- Copayments and Coinsurance: Even after you’ve met your deductible, you’ll still share costs. A copayment is a flat fee (like $40) you pay for a doctor’s visit. Coinsurance is a percentage (like 20%) of a medical bill that you’re responsible for.

- Out-of-Pocket Maximum: This is your financial safety net. It’s the absolute most you will have to spend on covered medical services in a single year. Once you hit this limit through your deductible, copays, and coinsurance, your insurance plan pays 100% of your covered costs for the rest of the year.

These costs add up fast. While a 65-year-old retiring today might need $172,500 for healthcare in retirement, leaving work at 62 can inflate that figure by 56% to 90% just to cover the gap until Medicare. It's a shocking number, especially when you learn that 20% of Americans have never even thought about these expenses. If you'd like to discover more insights about retiree healthcare costs from Fidelity, it's worth a read.

To give you a clearer idea of how these costs can stack up beyond just the premium, here’s a sample budget for an unsubsidized plan.

Sample Annual Healthcare Budget for a 62 Year Old Retiree

| Expense Category | Estimated Low-End Annual Cost | Estimated High-End Annual Cost |

|---|---|---|

| Monthly Premiums | $9,600 ($800/month) | $14,400 ($1,200/month) |

| Annual Deductible | $2,500 | $7,000 |

| Copays (Specialist Visits) | $480 (8 visits @ $60) | $960 (12 visits @ $80) |

| Coinsurance (Minor Procedure) | $600 (20% of $3,000) | $1,800 (20% of $9,000) |

| Prescription Drugs | $720 | $2,400 |

| Total Estimated Annual Cost | $13,900 | $26,560 |

As you can see, the annual cost can easily double or even triple your premium amount once you factor in actually using your health plan.

How ACA Subsidies Change the Game

For most people retiring at 62, the Affordable Care Act (ACA) is the answer to managing these costs. The magic lies in the premium tax credit—a subsidy that makes your monthly premium affordable.

Here’s the best part: this subsidy isn’t based on the six-figure salary you just left behind. It’s based on your projected retirement income for the year ahead. This is a huge advantage. Your income is now likely a mix of 401(k) withdrawals, a pension, or other investments, which is probably a lot lower than what you were earning.

Your projected retirement income is the single most important factor in determining your health insurance costs from 62 to 65. A small miscalculation can lead to paying too much or, worse, having to repay thousands of dollars in subsidies at tax time.

Getting this number right is everything. If you underestimate your income, you could get hit with a nasty tax bill. If you overestimate, you could be overpaying every single month. Taking the time to accurately map out your finances is the key to unlocking affordable coverage. For a deeper dive into this, check out our guide on navigating healthcare costs in retirement.

Your HSA: The Ultimate Healthcare Savings Tool

If you were savvy enough to contribute to a Health Savings Account (HSA) during your career, you now have a powerful financial tool ready to go. Think of an HSA as a 401(k) just for healthcare, with an incredible triple tax advantage.

- Your contributions went in pre-tax, lowering your taxable income.

- The money in the account has been growing tax-free.

- Your withdrawals are tax-free as long as you use them for qualified medical expenses.

During this pre-Medicare gap, your HSA is your secret weapon for tackling those out-of-pocket costs. While you usually can't use HSA funds to pay ACA premiums, you can use them for almost everything else: your deductible, copayments, prescriptions, and even dental and vision care.

This means when you get hit with that $5,000 deductible, you can pay it straight from your HSA without that money ever touching your taxable income. Using your HSA strategically can dramatically lower the real-world cost of your healthcare, keeping your other retirement savings safe for what they were meant for.

Your Health Insurance Transition Timeline

Figuring out your health insurance when you retire at 62 isn't something you can just wing. It takes a plan. If you treat it like a project with clear deadlines, what seems complicated becomes a series of simple, manageable steps. This timeline breaks down exactly what to do and when, so you can move from your employer's plan to new coverage without any stressful gaps.

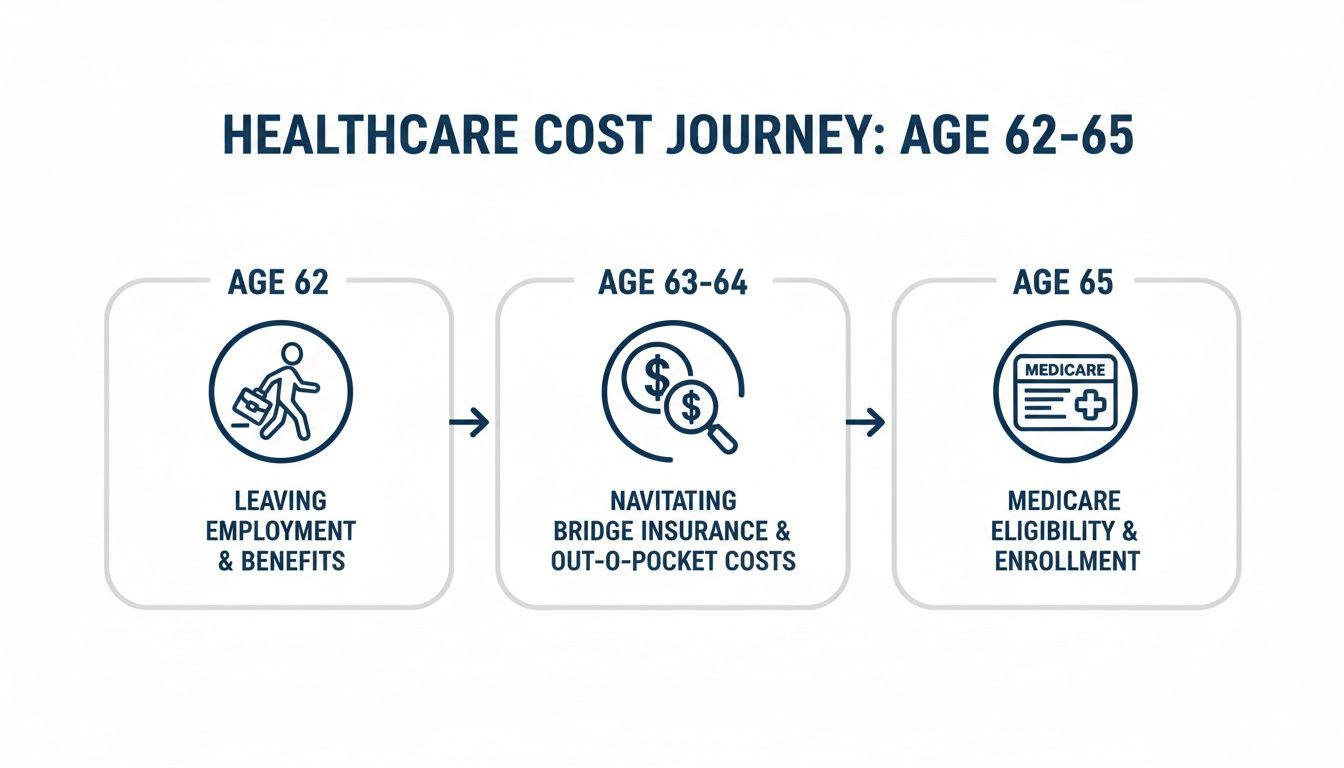

This visual shows the journey from your last day at work at 62, through the bridge years, and finally to landing on Medicare at 65.

As you can see, those years between 62 and 65 are all about active research and making smart decisions before the stability of Medicare kicks in.

6 to 12 Months Before Retiring

Think of this as your research phase. The goal here is to explore your options and gather information without the pressure of a deadline breathing down your neck. You want to walk into this decision feeling confident, not rushed.

Your most important task right now? Figure out a realistic estimate of your retirement income. This isn't just a ballpark guess—it's the single most important number for determining if you qualify for subsidies on the ACA Marketplace.

Your Checklist for This Phase:

- Estimate Your Retirement Income: Add up everything—pensions, Social Security (if you take it early), 401(k) or IRA withdrawals, and any investment income. Get as close as you can.

- Window Shop on the ACA Marketplace: Head over to HealthCare.gov (or your state’s exchange) and browse the plans. You can plug in your estimated income and see what kind of financial help you might get. It's just looking for now, no commitment.

- Talk to Your Spouse: If your spouse is still working, find out what it would cost to join their health plan. Compare that option side-by-side with what you're seeing on the Marketplace.

- Review Your Medical Needs: Make a list of your doctors, specialists, and any prescriptions you and your family rely on. You'll need this list to make sure any new plan you're considering actually covers what you need.

3 Months Before Retiring

Okay, time to shift from research into action. Your retirement date is getting closer, so it's time to lock down your budget and get your paperwork in order. This is where your plan for retiring at 62 health insurance starts feeling real.

By now, you should have a good idea of which path you'll take, whether it's an ACA plan, your spouse's insurance, or even using COBRA for a little while.

This is the critical moment to confirm costs and get ready to enroll. Waiting until your last week of work to sort this out is a recipe for rushed choices and expensive mistakes.

Reach out to your HR department. You need to know the exact date your benefits end. Ask them for the COBRA election paperwork, too—even if you don't think you'll use it. It's always good to have a backup.

Your Retirement Month

This is it—enrollment month. When you lose your job-based health coverage, it triggers what's called a Qualifying Life Event. This opens up a 60-day Special Enrollment Period for you to sign up for a new plan on the ACA Marketplace.

Don't wait until day 59 of that 60-day window. To make sure you don't have a single day without coverage, you need to enroll in your new plan before your old one ends.

Your Final Steps Checklist:

- Submit Your Application: Officially apply and enroll in the ACA Marketplace plan you chose or get signed up for your spouse's plan.

- Make Your First Premium Payment: This is key. Your coverage doesn't start until you pay that first premium. Do it right away to activate your new policy.

- Confirm Your Start Date: Double-check that your new insurance is set to begin the day after your employer coverage stops. You're aiming for a seamless handoff.

- Start Planning for Medicare: It might feel far away, but those three years will fly by. It's never too early to start learning. Our comprehensive Medicare planning guide is a great place to start understanding the next big step on your healthcare journey.

Common Health Insurance Mistakes Early Retirees Make

Figuring out health insurance when you retire at 62 isn't just about the smart moves you make—it’s also about the traps you avoid. A few seemingly small stumbles can have a massive financial impact, quickly derailing a retirement plan you’ve spent decades building.

Knowing these common pitfalls is your best defense. By seeing where others have gone wrong, you can protect your savings and make sure your transition into early retirement is as smooth as it should be.

Underestimating Your Total Healthcare Costs

This is the big one. The most common mistake is getting fixated on the monthly premium. It’s an easy trap to fall into because that number is front and center, but it’s a dangerously incomplete picture of what you’ll actually spend.

Imagine you're comparing two plans. Plan A has a $700 premium and a massive $8,000 deductible. Plan B costs more upfront at $900 a month but has a much more manageable $1,500 deductible. If you need a minor surgery that year, Plan B could literally save you thousands, even with its higher monthly bill.

You have to look at the whole picture: the premium, the deductible, and the out-of-pocket maximum. That’s the only way to understand your true financial risk.

A low premium can feel like a win, but it often comes with a high deductible that can drain your savings with just one unexpected medical event. Always calculate your worst-case scenario using the out-of-pocket maximum.

Missing Critical Enrollment Deadlines

This mistake is brutal because it can leave you completely uninsured. When you leave your job, you kick off a Special Enrollment Period. This gives you a 60-day window to sign up for an ACA Marketplace plan.

If you miss that window, that’s it. You may have to wait until the next Open Enrollment period, which could mean going months without a safety net.

The same goes for COBRA—you only have 60 days to sign up after you get the paperwork. These are not suggestions; they are hard deadlines. Put them on your calendar, set reminders, and act fast to avoid a catastrophic gap in your health coverage.

Automatically Defaulting to COBRA

COBRA feels safe. It’s familiar. It's the same plan you’ve always had, and that's comforting. But just blindly choosing it without shopping around is one of the biggest financial blunders a new retiree can make.

With COBRA, you’re suddenly on the hook for 102% of the full premium—the part you paid plus the part your employer was covering. The sticker shock is real.

For many people retiring at 62, an ACA Marketplace plan with subsidies will be dramatically more affordable. For instance, a couple staring down a $1,800 monthly COBRA bill might qualify for a fantastic ACA plan for just $400 a month, all based on their new retirement income. You owe it to yourself to compare before you commit.

Miscalculating Your Retirement Income for Subsidies

Those premium tax credits on the ACA Marketplace are a game-changer, but they’re tied directly to your Modified Adjusted Gross Income (MAGI). Guessing this number or getting it wrong can be a costly mess.

Here's how it can go wrong:

- You underestimate your income: You’ll get too much in subsidies throughout the year. The IRS will want that money back when you file your taxes, leaving you with a surprise bill that could be thousands of dollars.

- You overestimate your income: You’ll pay a higher premium than you need to every single month, unnecessarily draining money that should be funding your retirement.

Take the time to sit down and carefully project your income from every source—pensions, Social Security, 401(k) withdrawals, investments. Getting this number right ensures you get the financial help you’re entitled to without any nasty surprises come tax time.

Your Top Questions Answered: Retiring at 62 Health Insurance

Planning for early retirement brings up a ton of questions, especially around healthcare. When you’re trying to nail down your strategy, you need straightforward answers, not confusing jargon. Let's tackle the most common questions that pop up as you get ready to leave the workforce.

Can I Use My HSA to Pay for Premiums Before Age 65?

This is a fantastic question. Your Health Savings Account (HSA) is one of the best financial tools you have for medical costs, but the rules can be a little tricky. The short answer? Generally, no. The IRS doesn't let you use tax-free HSA funds for most health insurance premiums.

But there are a few important exceptions. You can use your HSA to pay for:

- COBRA premiums if you continue your old employer’s coverage.

- Health insurance premiums while you’re receiving unemployment benefits.

- Medicare premiums once you turn 65.

The one that matters most for a 62-year-old retiree is what's missing from that list: ACA Marketplace plans. You cannot use your HSA funds to pay the monthly premiums for an ACA plan.

However, you can still use that money tax-free for almost everything else—your deductible, copayments, dental bills, and any other qualified medical expenses. This makes your HSA an incredibly powerful resource for that three-year bridge to Medicare.

What Happens If I Work Part-Time After Retiring?

Picking up a part-time job is a smart move for many early retirees, but it definitely changes the health insurance math. The income you earn is a huge factor in how much you'll pay for coverage.

First, check if your part-time job offers health benefits. If it does, enrolling in their plan could be a simpler and more affordable option than getting a plan on your own.

If you stick with an ACA plan, your part-time wages get added to your other retirement income (like 401(k) withdrawals or a pension) to calculate your Modified Adjusted Gross Income (MAGI). This is the magic number that determines if you get a subsidy. More income could mean a smaller subsidy—or none at all—making your monthly premium much higher. Getting this income projection right is key to avoiding a nasty surprise.

A part-time job can be a double-edged sword. It brings in extra cash, but it can also push your income just high enough to shrink the ACA subsidies that make your health insurance affordable.

How Do I Switch From My ACA Plan to Medicare at 65?

This is a transition you have to get right. Messing up the timing can lead to coverage gaps or lifelong penalties. It all comes down to your Medicare Initial Enrollment Period (IEP).

This is your seven-month window to sign up. It starts three months before your 65th birthday month, includes your birthday month, and ends three months after. You have to sign up for Medicare Part B during this window to avoid late penalties that will stick with you forever.

Once you're enrolled in Medicare, you have one more critical job: you must personally cancel your ACA Marketplace plan. It doesn't happen automatically.

Your Medicare Transition Checklist:

- Enroll in Medicare: Sign up for Parts A and B during your IEP. Aim for your coverage to kick in on the first day of the month you turn 65.

- Call the Marketplace: Once your Medicare start date is confirmed, contact the ACA Marketplace to end your plan.

- Line Up the Dates: Make sure your ACA plan ends the day before your Medicare coverage begins. No gaps, no overlap.

If you don't cancel your ACA plan, you could run into serious trouble. You're not eligible for ACA tax credits once you're on Medicare, and if you keep getting them, you’ll have to pay them all back to the IRS. A clean handoff is the key to a stress-free switch.

Figuring out retiring at 62 health insurance doesn’t have to be overwhelming. The team at My Policy Quote helps early retirees like you find the perfect plan to bridge the gap to Medicare, protecting both your health and your savings. See what's out there and get a clear, no-obligation quote today at https://mypolicyquote.com.