So, your term life insurance policy is about to end. What now?

It can feel a little like a lease on an apartment running out. You've been paying for a specific period of time, and now that period is over. While it might seem like a dead end, it’s actually a crucial financial checkpoint. This is your moment to take stock and decide what’s next.

Your Term Life Insurance Is Ending What Happens Now

Figuring out what happens at the end of term life insurance isn't as complicated as it sounds. Think of your policy’s expiration date not as a finish line, but as a junction. The path you took for the last 10, 20, or 30 years served its purpose, but now it’s time to choose a new direction based on where you are in life today.

When your term ends, the coverage simply stops. You stop paying premiums, and the death benefit protection is gone. Unless you have a rare (and much more expensive) "return of premium" rider, there's no payout. You're not alone in reaching this point—the global term insurance market was valued at over USD 1 trillion in 2023, which shows just how many people rely on this kind of flexible protection.

Your Primary Choices at This Crossroads

As that expiration date gets closer, you're in the driver's seat. Your next move will depend on your health, your finances, and your family's needs. The good news? You have several options.

To make it simple, here’s a quick look at the main paths you can take.

Quick Summary of Your Options at Term End

| Your Option | What It Means | Best For |

|---|---|---|

| Let the Policy Lapse | You stop paying, and your coverage ends. Simple as that. | People whose kids are grown, mortgage is paid, and no longer have major financial dependents. |

| Renew Your Current Policy | You continue coverage, usually year-by-year, without a new medical exam. | Someone who needs coverage for a very short time and may have health issues that make a new policy impossible. |

| Convert to Permanent Life | You switch your term policy to a whole or universal life policy, locking in lifelong coverage. | Individuals who want permanent protection and can afford higher premiums, especially if their health has declined. |

| Buy a New Policy | You shop around for a brand new term (or permanent) policy and go through the application process again. | Healthy individuals who still need affordable coverage and want to lock in a good rate for another term. |

Each path has its own pros and cons, so it's all about matching the choice to your current situation.

The single most important thing you can do is be proactive. Don't wait until the last minute. Waiting too long can seriously limit your options, especially if your health has changed.

Pull out your policy documents well before the expiration date and get familiar with your specific terms. Understanding the fine print is crucial, which is why we put together a guide on how to read an insurance policy to help you find exactly what you need.

Navigating this moment is about more than just insurance; it's part of a bigger picture. For a broader perspective, you might find a comprehensive guide to planning for end of life helpful as you consider your next steps. Let's walk through each of these choices so you can make a decision you feel confident about.

Exploring Your Four Key Options in Detail

When your term life insurance policy reaches its final day, it’s not just an ending. It’s a fork in the road. Each path leads to a completely different financial future, so understanding where they go is the first step toward making a smart, confident decision for your family.

Let’s walk through the four main choices you have.

Path One: Let the Policy Lapse

The simplest route? Do nothing.

Once your term is up, you can just stop paying the premiums. The policy will lapse, which is just the industry term for expire. Your coverage ends completely. No more death benefit, no payout for your beneficiaries.

For a lot of people, this is exactly the plan. If the mortgage is paid off, the kids are on their own, and your retirement savings are solid, you might not need that financial safety net anymore.

Path Two: Renew the Policy Annually

Some policies come with an option to renew your coverage, usually year by year. This is often called Annual Renewable Term (ART). The biggest plus is that you get to skip a new medical exam to keep your coverage going.

But that convenience comes at a very steep price.

Think of your original 20-year term premium like a fixed-rate mortgage—predictable and stable. Renewing annually is like switching to an adjustable-rate mortgage where the rate jumps way, way up every single year. The premiums for ART policies get incredibly expensive as you age, making it an unsustainable option for most people long-term.

Path Three: Convert to a Permanent Policy

Many term policies hide a powerful feature inside called a conversion privilege. This lets you trade in all or part of your term policy for a permanent one—like whole life or universal life—without having to take another medical exam.

This is a game-changer, especially if your health has taken a turn since you first got the policy. Converting locks in coverage for the rest of your life and even starts building cash value, which is an asset you can borrow against.

Your new premiums will be higher than your old term rate, but they’ll be based on the health rating you got years ago. Our detailed guide explains more about what is convertible term insurance and how you can use this feature.

Path Four: Buy a New Policy

If you're still in good health, your best and most affordable move might be to simply shop for a brand-new life insurance policy. Yes, this means going through the application and underwriting process again, including a new medical exam.

It takes a bit more effort, but applying for a new policy can lock in premiums that are far lower than renewing. If you still have big financial responsibilities, securing a new 10, 15, or 20-year term can give you that peace of mind at a cost you can actually manage.

As you figure out how to continue your coverage, you might also want to look into more advanced ways to manage your assets. For some families, this includes setting up a life insurance trust to add another layer of protection for their future.

Understanding the Financial Impact of Your Decision

This is where the rubber meets the road. Moving from the "what" to the "how much" is when your decision starts to feel real. The financial differences between your options aren't just a few bucks—they can be thousands of dollars apart. Getting a handle on these numbers is essential when you're figuring out what to do next.

Imagine a 50-year-old in pretty good health whose 20-year, $500,000 policy is about to expire. They might have been paying around $50 per month for two decades. Now, they're facing a tough choice, and each path comes with a very different price tag.

A Real-World Cost Breakdown

Let’s look at some realistic estimates to see how these choices actually play out. The numbers can be eye-opening and really drive home why planning ahead matters so much.

- Renewing the Policy: That once-affordable premium could skyrocket. The annual renewable term (ART) premium might jump from $600 a year to over $5,000 annually. And it only gets higher from there. This path is rarely sustainable for more than a year or two.

- Converting the Policy: If they convert that same $500,000 policy to whole life, the cost could be around $10,000 to $12,000 per year. It's a big number, but it locks in lifelong coverage and builds cash value—a serious trade-off to consider.

- Buying a New Policy: If our 50-year-old is still healthy, a brand-new 20-year term policy might cost between $1,500 and $2,000 annually. It’s more than they used to pay, but it's drastically cheaper than renewing or converting the full amount.

Seeing these figures side-by-side often makes the decision crystal clear. You can explore a detailed term life insurance cost comparison to see just how much age and health can impact premiums for new policies.

The Mortality Protection Gap

Letting your policy lapse without a new plan creates what experts call a mortality protection gap. It's a technical term for a very human problem: the difference between what your family would need if you were gone and what they would actually have. It’s the raw financial risk they’re left to face alone.

Shockingly, this happens all the time. Industry data shows nearly 70% of term policies are simply not renewed or converted when they expire. This contributes to a massive global mortality protection gap, estimated at a staggering USD 414 billion in annual premium-equivalent terms.

The real cost isn't just about premiums. It's about weighing the price of coverage today against the potential financial devastation for your family tomorrow.

Ultimately, your choice is a long-term financial trade-off. Is the higher upfront cost of permanent insurance worth the lifelong peace of mind? Or does a more affordable, shorter-term policy make more sense for your current goals and timeline?

How Your Health Influences Your Next Move

More than your finances or age, your current health is the single most important factor steering the ship when your term life policy ends. It’s the one variable that can either open up a world of affordable options or narrow your path down to just one or two expensive choices.

Think back to the health rating you got when you first bought your policy. That was your ticket to great rates. Now, years later, your current health determines which tickets you can still use. This is where you need to have a really honest conversation with yourself about your physical condition.

Your health status basically splits your options into two very different scenarios.

Scenario One: The Healthy Applicant

If you’re still in great—or even just pretty good—health, you’re in the driver’s seat. For you, the smartest financial move is almost always to shop for a brand-new policy.

Why? Because you can likely qualify for a rate that’s far cheaper than renewing your old policy or converting it to a permanent one.

Going through the application process again might feel like a chore, but it could literally save you thousands of dollars a year. Insurers will see you as a low-risk applicant, giving you the chance to lock in another 10, 20, or even 30 years of affordable protection.

Scenario Two: When Your Health Has Changed

But what if you've developed a health condition since you first bought your policy? Maybe it's high blood pressure, diabetes, or something more serious. This is precisely where the conversion privilege becomes your most valuable asset.

This feature is your golden ticket. It allows you to convert your term policy into a permanent one without a new medical exam. The insurer can't deny you coverage or jack up your rates based on your new health issues. Your premium will be based on your age at conversion, but—and this is the crucial part—on the same health class you qualified for all those years ago.

For anyone whose health has taken a turn, the conversion option is a lifesaver. It guarantees you can lock in lifelong coverage when you might otherwise be uninsurable or face sky-high premiums on a new policy.

If you’ve developed a medical condition and want to test the waters for a new policy, you’ll have to go through medical underwriting again. Insurers will comb through your medical records, prescription history, and probably require a new medical exam. They’re simply trying to figure out your current risk level to see if they can offer you coverage and at what price. You can get a much clearer picture by reading our guide on the life insurance underwriting process.

Ultimately, your health is the gatekeeper. Being in good health gives you the freedom of choice and the power of the open market. A change in health, however, makes that conversion privilege one of the most important features you ever paid for.

Choosing the Right Path for Your Life Stage

There’s no one-size-fits-all answer here. The right move for your neighbor might be the wrong one for you. When your term life insurance comes to an end, your decision has to be about your life—your family, your finances, and where you’re headed next. Cookie-cutter advice just won’t work.

Let’s walk through a few common situations. Seeing yourself in these scenarios can help connect the dots and figure out what makes the most sense for your financial plan.

Young Families with Dependent Children

If your kids are still at home and rely on you financially, letting your coverage disappear probably isn’t an option. Your number one job is to keep that financial safety net strong until they’re on their own two feet and big debts, like your mortgage, are gone.

For this group, the best moves are usually:

- Buying a new term policy: If your health is still good, this is almost always the most affordable way to lock in protection for another 10 or 20 years.

- Converting a piece of your policy: You could convert a small amount into a permanent policy to cover final expenses, then buy a new, smaller term policy to bridge the gap until the kids are independent.

Nearing Retirement with Some Debt

Maybe you're getting close to retirement, but you’re still carrying a mortgage or other loans. The kids might be grown and gone, but you definitely don’t want to leave your spouse holding the bag.

In this situation, renewing at those sky-high rates or converting the whole policy is likely too expensive. A better strategy could be getting a smaller, shorter-term policy—say, a 10-year term—just long enough to pay off the house. Converting a small slice of your old policy to cover final expenses is also a really popular move for this age group.

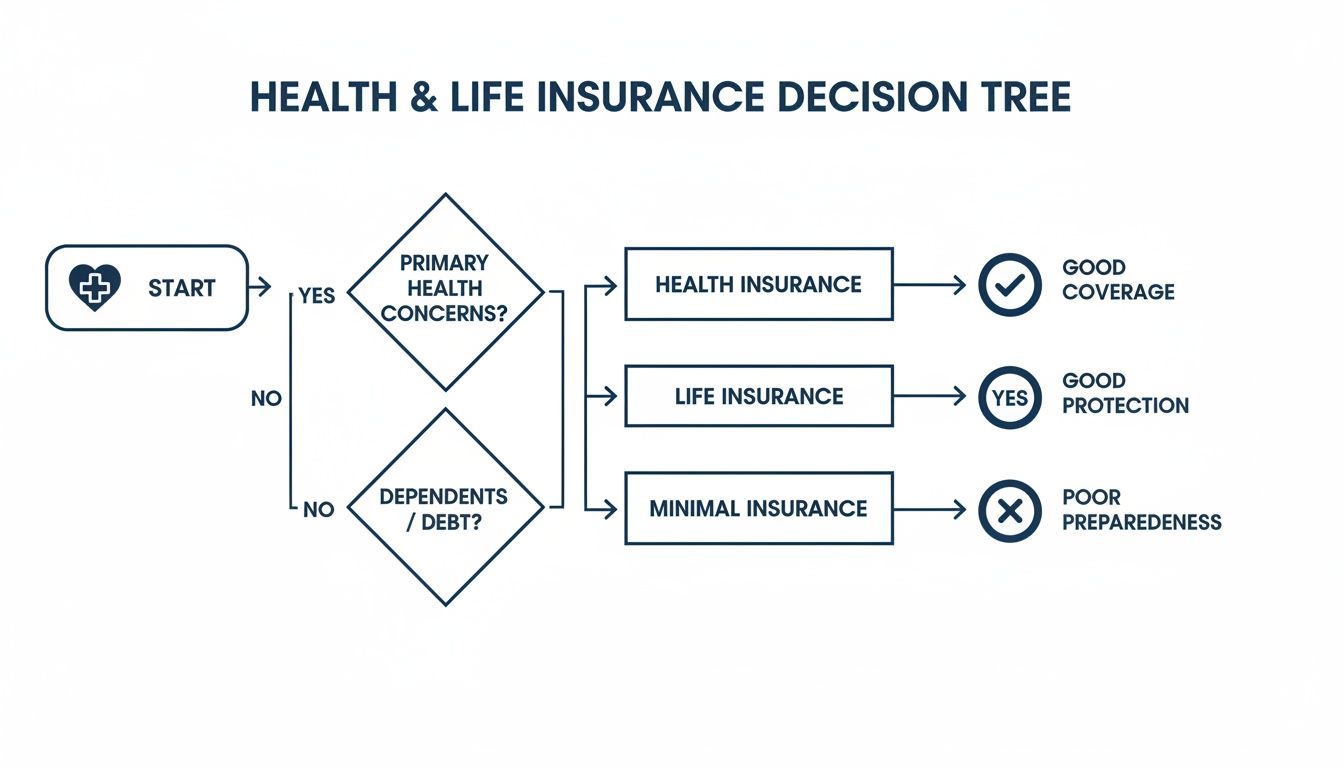

This decision tree helps visualize how your health and dependents steer your choice.

It’s clear that being in good health keeps more affordable doors open, while a decline in health makes that conversion option incredibly valuable.

Empty Nesters with Financial Security

What if you've hit that sweet spot? The mortgage is paid off, the kids are independent, and your retirement accounts are in great shape. At this point, you may have "outlived" the original need for a massive life insurance policy.

For many financially secure empty nesters, the most logical decision is to simply let the term policy expire. Your original goal—protecting your family during their most vulnerable years—has been achieved.

Letting the coverage go frees up that monthly premium payment. You can now put that money toward things you actually care about, like traveling the world or planning for long-term care.

To make it even clearer, this table matches your financial goals to the best course of action.

Decision Guide Based on Your Financial Goals

| Financial Goal | Best Option | Why It Works |

|---|---|---|

| Maximum coverage for a new, long-term need (e.g., new mortgage) | Buy a new term policy | Offers the largest death benefit for the lowest premium, but you'll need to pass medical underwriting again. |

| Guaranteed coverage without a medical exam, despite health issues | Convert to a permanent policy | Your conversion privilege lets you secure lifelong coverage without proving your insurability. It’s pricier but guaranteed. |

| Short-term coverage for a few more years (e.g., last bit of debt) | Renew your existing policy (ART) | It’s an easy, no-questions-asked way to keep coverage, but be prepared for a significant price hike each year. |

| You’re financially independent and have no more major debts | Let the policy lapse | If your financial safety net is already built, you've achieved the goal. You can stop paying premiums. |

Ultimately, the right choice aligns with what you want to protect and what you can comfortably afford.

Your Action Plan Before the Policy Expires

As your policy’s end date gets closer, the worst thing you can do is wait. It’s easy to put it off, but getting ahead of it turns a potentially stressful moment into a simple, manageable decision.

Don’t wait until the last minute. The sweet spot for starting your review is 12 to 18 months before your term officially ends. This gives you plenty of breathing room to look at all your options without feeling cornered. A rushed decision is almost always an expensive one, especially with something as important as insurance.

Your Five-Step Checklist

Feeling overwhelmed? Don't be. Just break the process down into a simple, actionable checklist. Think of this as your roadmap to a confident choice, making sure you know exactly what happens at the end of your term life insurance.

-

Dig Up Your Policy Documents: First things first, find that original paperwork. You need to know the exact expiration date and, more importantly, the deadline for your conversion privilege. That deadline often comes before your policy actually ends.

-

Rethink Your Financial Needs: Life changes, and so do your responsibilities. Take a fresh look at your debts, your income, and who depends on you. Have you paid down your mortgage? Are the kids out of the house and financially independent? The coverage you needed 20 years ago might be totally different from what you need today.

-

Call Your Current Insurance Company: Get on the phone with your insurer and ask for two specific quotes: one for renewing your current policy year-by-year, and another for converting it to a permanent plan.

These numbers are your baseline. Every other quote you get should be measured against these figures. It’s the only way to know if you’re actually getting a good deal elsewhere.

-

Shop for a New Policy: Now, it’s time to see what else is out there. Talk to an independent agent and get quotes for a brand-new term life policy. This gives you a crucial point of comparison and shows you what the open market has to offer for someone your age and health today.

-

Talk to a Financial Advisor: Finally, run everything by a financial professional. They can help you see the bigger picture—how each option fits into your retirement, estate planning, and overall financial goals. This step ensures your decision supports your entire future, not just your insurance needs.

Got Questions? We've Got Answers

When you're nearing the end of your term life policy, a lot of questions pop up. It's totally normal. Let's walk through some of the most common ones to give you clarity and confidence.

Can I Just Convert a Small Piece of My Policy?

Yes, absolutely! And honestly, this is a smart move for a lot of people. Most insurers will let you do what's called a partial conversion.

Think of it like this: maybe you have a $500,000 term policy, but converting that entire amount into a permanent policy would be way too expensive. Instead, you could convert just $100,000 to a whole life policy—enough to cover final expenses or leave a small legacy. The other $400,000 of term coverage simply expires as planned. You get the best of both worlds: a little permanent protection locked in, without breaking the bank.

What Happens If I Blow Past My Conversion Deadline?

This is a big one, so listen closely. Your right to convert isn't a forever thing. There’s a hard deadline, and it's often months, or even years, before your term policy actually ends.

If you miss that window, the door slams shut. You permanently lose your chance to convert without another medical exam.

At that point, your only options are to let the policy die, renew it at a sky-high annual rate (if your policy even allows that), or start from scratch with a brand-new application. And that means going through the whole underwriting process again. This is why you need to be proactive and check that date way ahead of time.

Missing your conversion deadline is one of the most common and expensive mistakes people make. Dig out your original policy documents and find that date today.

Is That "Return of Premium" Thing Really Worth It?

A Return of Premium (ROP) policy sounds amazing on the surface, right? If you outlive the term, you get all your money back. But here's the catch: that feature comes at a steep price.

ROP policies are way more expensive than regular term life—often costing 30-50% more. For most people, you're much better off buying a standard, more affordable term policy and investing the difference yourself. Over 20 or 30 years, that approach almost always leaves you with more money in your pocket.

At My Policy Quote, our goal is to make these decisions simple and stress-free. If you're ready to see what a new policy might cost or just need someone to help you figure out your conversion options, we're here. Get started today at https://mypolicyquote.com.