Let's be honest—that stack of insurance paperwork on your desk can feel incredibly intimidating. It’s dense, packed with legal jargon, and easy to file away and forget about. But your policy isn’t just a document; it’s a financial safety net, and understanding what’s inside is one of the most empowering things you can do for yourself.

Think of it this way: you wouldn't drive a car without knowing where the brakes are. Your policy is the same. Knowing how to read it puts you firmly in the driver’s seat.

Why You Absolutely Need to Understand Your Insurance Policy

That insurance policy is a binding contract between you and your insurer. Every sentence is there for a reason, outlining exactly what they promise to cover and what you need to do to keep that promise intact.

Making assumptions about your coverage is a recipe for disaster. So many people only find out what their policy doesn't cover after they’ve already filed a claim and had it denied. It’s a painful, and often expensive, lesson to learn.

This isn't a rare problem. The gap between the insurance people need and what they actually have is staggering—it hit a global total of $1.83 trillion in 2023. That figure, highlighted by industry experts at riskandinsurance.com, represents real people facing real financial hardship because they weren't covered for a critical risk.

Your policy isn't just a piece of paper you hope you never have to use. It’s an active tool for managing risk. Knowing what's inside transforms it from a source of confusion into a source of confidence.

A Quick Tour of Your Policy

Getting started is all about knowing what to look for. While we'll break down each part in more detail, think of your policy as having a few key "chapters." Here's a quick look at the main sections you’ll find in almost any policy, whether it's for your car, your home, or your health.

To make it even clearer, let's map out the essential parts of a policy and what each one tells you.

Key Sections of Your Insurance Policy at a Glance

| Policy Section | What It Tells You |

|---|---|

| Declarations Page | This is your policy's "cheat sheet." It summarizes who's covered, what's covered, your policy limits, and how much you pay. |

| Definitions | Think of this as the glossary. It defines key terms used throughout the policy so everyone is on the same page. |

| Insuring Agreement | The heart of the policy. This section outlines the insurer's core promise to you—what they agree to cover. |

| Exclusions | Pay close attention here. This lists everything your policy specifically will not cover. No exceptions. |

| Conditions | These are the rules of the road. It explains your responsibilities, like how to file a claim and what to do after a loss. |

| Limits of Liability | This section breaks down the maximum amount the insurer will pay for a covered loss. It's all about the numbers. |

| Endorsements/Riders | These are add-ons or modifications to the standard policy, either adding, removing, or changing your coverage. |

Knowing these basics is a fantastic foundation for your financial well-being. And if you’re in the process of choosing coverage right now, our guide on whether you need health insurance can give you more context to make a smart decision.

Finding the Key Details on Your Declarations Page

Think of your insurance policy’s Declarations Page as its one-page summary—a "cheat sheet," if you will. It’s almost always the very first page you see, and it pulls all the most important details into one scannable document. Before you even think about diving into the dense legal language of the main policy, this page gives you a powerful, high-level snapshot of your protection.

This isn’t just theory. It’s the practical starting point for anyone trying to understand their coverage. It quickly answers the most basic questions: Who's covered? What's covered? For how long? And for how much?

What to Look for First

When you first glance at the declarations page, your eyes should immediately find a few key pieces of information. These elements form the foundation of your entire contract.

- Policy Number: This is your account number. You'll need it for everything from filing a claim to just asking your agent a question. Keep it handy.

- Named Insured(s): This section lists every single person protected by the policy. If your spouse, child, or business partner needs to be covered, their name must be here.

- Policy Period: Look for an "effective date" and an "expiration date." This tells you the exact timeframe your coverage is active. No guessing.

- Property or Persons Covered: For an auto policy, you’ll see your vehicles listed (usually with their VINs). On a homeowners policy, it will be the property address.

Getting comfortable locating these details confirms the basics are correct before you even get into the numbers.

Deciphering Your Coverage Limits and Premiums

Once you've confirmed the who, what, and when, it's time for the money side of things. The declarations page clearly lays out the financial terms, showing what you pay (your premium) and what the insurer will pay if you have a claim.

This is where a lot of people get tripped up. The hard truth is that almost no one reads their policy closely. Research has shown that only a tiny 4% of consumers consistently review their insurance documents, and a shocking 32% admit the language is too complex to even try. This is a huge reason for disputes, especially when people make incorrect assumptions—like the 40% of homeowners who mistakenly believe their standard policy covers flood damage. You can read more about these common myths on Forbes.com.

Key Takeaway: The declarations page is your financial blueprint. It shows the maximum dollar amounts the insurer will pay for different types of losses. These are your coverage limits.

Here’s a simple breakdown of what you'll find:

- Coverage Types: Each kind of protection is listed as a separate line item. An auto policy, for instance, will show individual lines for things like Bodily Injury Liability, Property Damage, and Collision.

- Limits of Liability: Right next to each coverage type, you'll see a dollar amount. This is the absolute maximum the insurer will pay for a single claim under that specific coverage.

- Deductibles: This is your part of the deal—the amount you have to pay out-of-pocket before the insurance company starts paying. The dec page lists the deductible for each relevant coverage. For a deeper dive, check out our guide on what a deductible in insurance really means.

- Premium: This is the total cost for the policy term. It’s often broken down to show how much each individual coverage costs, so you can see exactly what you're paying for.

Putting It All Together: A Practical Example

Let's say you're looking at your auto policy's declarations page. You might see a line that reads:

Bodily Injury Liability: $100,000 each person / $300,000 each accident

That one line tells you so much. It means that if you cause an accident, your policy will pay up to $100,000 for injuries to any one person. The total it will pay for all injuries combined in that single accident is capped at $300,000.

Now, let's look at a homeowners policy. You might see:

- Dwelling Coverage (Coverage A): $350,000

- Personal Property (Coverage C): $175,000

- All Peril Deductible: $1,000

This tells you your home's structure is insured up to $350,000, your belongings are covered for up to $175,000, and you'll have to pay the first $1,000 of any claim yourself.

By spending just a few minutes on this single page, you can confirm your coverage amounts, verify who is insured, and understand your financial responsibility after a loss. It’s the most powerful first step you can take.

Uncovering What Your Policy Excludes

Okay, you’ve looked at the declarations page and have the big-picture view. Now it’s time to get into the nitty-gritty. This is where you find out what your policy doesn’t cover, and honestly, it’s where most of the costly mistakes happen. People just assume something is covered, only to get a claim denied when they need help the most.

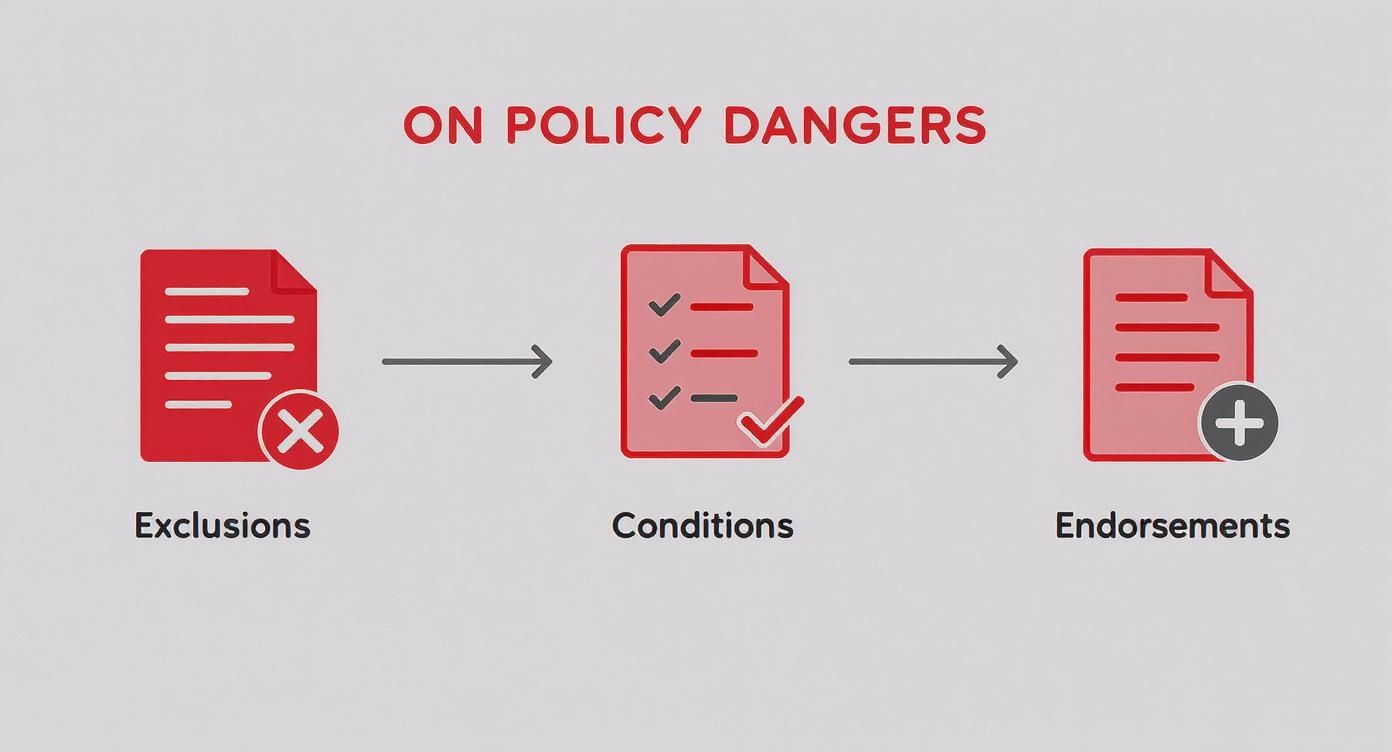

This part of your policy usually breaks down into three key areas: Exclusions, Conditions, and Endorsements. Getting a handle on how these three work together is the secret to avoiding those nasty surprises down the road.

Common Exclusions to Watch Out For

The Exclusions section is brutally honest. It’s a straight-up list of things your insurance company will not pay for, period. Reading this isn't just a good idea—it’s absolutely essential for protecting your finances.

While every policy is a bit different, some exclusions are so common they show up almost everywhere. Ignoring them is a huge gamble.

- Flood and Earthquake: Your standard homeowners policy is almost guaranteed not to cover damage from floods or earthquakes. You need separate, specific policies for these events.

- Intentional Acts: If you deliberately cause damage or hurt someone, don’t expect your liability coverage to step in. For example, if you get into a physical fight and injure the other person, your policy won’t touch their medical bills.

- Wear and Tear: Insurance is designed for sudden and accidental messes, not for things that break down over time. That leaky roof from years of neglect? That’s on you, not the insurance company.

- Business Activities: Running a business out of your home? Your homeowners policy probably won't cover any liability or property damage related to it. You’ll need a separate business insurance policy for that.

Think of it this way: your auto insurance will pay for a collision, but it won't buy you new tires just because the old ones are worn out. The exclusions section applies that same logic across the board.

Following the Rules Your Conditions Set

Next up are the Conditions. This section is the rulebook. It lays out all the duties and obligations you have to meet to keep your coverage active. If you don't follow these rules, the insurer might have grounds to deny a claim that would have otherwise been covered.

These aren't just gentle suggestions; they are your contractual obligations.

Think of the Conditions section as your side of the bargain. The insurer agrees to pay for covered losses, and in return, you agree to follow a specific set of procedures.

For instance, a classic condition is the "Notice of Loss" requirement. It means you have to report a claim "promptly" or "as soon as practicable" after something happens. Wait too long, and you could lose your right to a payout.

Here’s a real-world example:

A homeowner spots a water stain on their ceiling after a big storm but decides to wait six months to report it. By then, a tiny leak has turned into a massive mold and rot problem. The insurer could very well deny the claim, arguing that the delay violated the policy conditions and prevented them from minimizing the damage.

Modifying Your Coverage with Endorsements and Riders

Finally, we get to Endorsements, sometimes called Riders. These are basically amendments that change the standard policy. They’re incredibly useful because they can add back coverage that was excluded or even introduce brand-new protections.

This is your chance to customize your policy to fit your actual life. If you spot a critical gap in the exclusions list, an endorsement is often the perfect fix.

Here are a few ways endorsements work in the real world:

- Water Backup Coverage: A standard policy often excludes damage from a sewer or drain backup. You can add a specific endorsement to cover this messy—and expensive—headache.

- Scheduled Personal Property: Your base policy might have a pretty low limit for valuables like jewelry, often just $1,500. A "scheduled personal property" endorsement lets you insure a specific item, like an engagement ring, for its full appraised value.

- Ordinance or Law Coverage: If your older home gets damaged, new building codes might force you to upgrade things like wiring or plumbing during the repair. This endorsement helps cover those extra costs, which a standard policy usually won't touch.

By carefully reading the Exclusions, understanding your duties in the Conditions, and strategically using Endorsements, you stop being a passive policyholder. You become an active manager of your own financial risk. That proactive mindset is what ensures your safety net will actually be there when you need to fall back on it.

Assessing Your True Coverage and Finding Gaps

Okay, so you've waded through the exclusions and you know what your policy won't cover. The next question is even bigger: Is the coverage you do have actually enough?

Those big numbers on your declarations page—the policy limits—can feel abstract. But they represent the absolute maximum your insurer will pay out when things go sideways. This is your financial shield. You need to be sure it's strong enough to protect everything you've worked for.

Figuring this out means looking past that main liability number. It’s about understanding how different limits, sub-limits, and your own deductible all work together. This is how you spot dangerous coverage gaps before a crisis hits.

This whole process can feel a bit like detective work. You’re looking for clues in the fine print that could create unexpected vulnerabilities down the road.

As you can see, the exclusions take coverage away, while endorsements can add it back in. The conditions are the rules you have to follow for any of it to matter. It's a balancing act.

Differentiating Between Limit Types

Not all limits are created equal, and your policy probably has a few different kinds. Knowing the difference is crucial.

- Per-Occurrence Limit: This is the max payout for a single event or accident. It doesn't matter how many people are hurt or how much property is damaged—this is the ceiling for that one incident.

- Aggregate Limit: This is the grand total the insurer will pay across all claims during your policy period (usually one year). Once you hit this cap, your coverage is done for the year.

Think of it like this: a business liability policy might have a $1 million per-occurrence limit and a $2 million aggregate limit. That means it could handle two separate $1 million claims in one year, but it couldn't cover a single claim that costs $3 million.

The Impact of Deductibles and Sub-Limits

Your limits aren't the only numbers to watch. Your deductible is the amount you pay out-of-pocket before your insurance kicks in a single dollar. If a storm causes $10,000 in damage to your home and you have a $2,500 deductible, the check from your insurer will be for $7,500. You're on the hook for that first $2,500.

Sub-limits are another sneaky detail. These are smaller limits tucked inside your main coverage for specific items. For instance, your homeowners policy might cover $300,000 in personal property, but it could have a sub-limit of only $1,500 for jewelry. If $10,000 worth of jewelry is stolen, you're only getting back $1,500. This is a classic https://mypolicyquote.com/2025/08/01/health-insurance-gap-in-coverage/ that catches so many people by surprise.

A Real-World Car Accident Scenario

Let's see how this plays out in real life. Imagine you cause a multi-car pileup. Your auto policy has liability limits of 100/300/50. That breaks down to:

- $100,000 for bodily injury per person

- $300,000 for total bodily injury per accident

- $50,000 for property damage per accident

Three people are injured. Person A has $120,000 in medical bills, Person B has $90,000, and Person C has $70,000. The total medical bill is $280,000, which seems okay because it’s under your $300,000 accident limit, right?

Here's the problem: Your per-person limit is only $100,000. So, while Person B and C are covered, you are personally on the hook for the extra $20,000 for Person A's bills. That is a textbook coverage gap.

This is why understanding the importance of uninsured motorist coverage is so critical. The scary truth is that at least one in eight drivers in the U.S. is uninsured. In many states, countless more are underinsured, meaning their policy won't come close to covering the costs of a serious crash.

Without solid Uninsured/Underinsured Motorist coverage, you could be left paying your own medical bills and repair costs after an accident that wasn't even your fault.

Liability Limit Calculation Worksheet

Worried you might not have enough coverage? Let's walk through it. This worksheet is a simple way to get a ballpark idea of how much liability protection you really need to shield your assets. Tally up what you own and compare it to your current limits.

| Asset Type (Home, Car, Savings) | Current Value | Potential Liability Risk | Recommended Coverage |

|---|---|---|---|

| Home Equity | e.g., $250,000 | High | Should be at least equal to your net worth |

| Vehicles | e.g., $40,000 | Moderate to High | At least $250,000/$500,000 for bodily injury |

| Savings & Investments | e.g., $150,000 | High | Should be fully protected by your liability limits |

| Future Income (5-10 yrs) | e.g., $500,000 | Very High | An umbrella policy is highly recommended to protect future earnings |

This isn't an exact science, but it gives you a much clearer picture. If the total value of your assets is way higher than your liability limits, it's time to have a serious conversation with your agent about increasing your coverage or adding an umbrella policy.

Finding What Matters Most: A Tailored Policy Review

Knowing how to read an insurance policy is one thing. Knowing what to look for based on your specific situation? That's a completely different ballgame.

A generic review just doesn't cut it. The risks you face as a first-time homeowner are worlds apart from those of a renter or a small business owner. Let’s be honest, a policy that’s perfect for a single person in an apartment would be dangerously inadequate for a family buying their first home.

Let's break down what different people should be zeroing in on.

For First-Time Homebuyers

So you’ve got the keys to your new home—congratulations! Now comes the less exciting, but far more important, part: protecting it. Your standard homeowners policy will cover the big stuff like a fire, but the real financial traps are often buried in the fine print.

You need to look past the basic dwelling coverage and hunt for two critical add-ons.

First up is Water Backup Coverage. I can't stress this one enough. A standard policy almost never covers damage from a backed-up sewer or drain. Trust me, it’s a messy, emotional, and shockingly expensive nightmare you don't want to face alone.

Second, make sure you have Ordinance or Law Coverage. If your home is damaged, today’s building codes might force you to make expensive upgrades to things like wiring or plumbing during the repair. Your base policy won't pay for those required updates. This endorsement is what handles those unexpected—and mandatory—costs.

For Renters

So many renters think their landlord's insurance has them covered. It absolutely does not.

That policy is there to protect the building itself—the walls, the roof, the structure. It does nothing for your personal belongings. Your laptop, your furniture, your clothes? That’s all on you. This is exactly why a renters policy is a must-have.

When you get your policy, focus on two main areas:

- Personal Property Coverage: This is the heart and soul of your policy. Do a quick inventory of your stuff—even just a mental one—to make sure your coverage limit is high enough to replace everything if the worst happens.

- Liability Coverage: This is your financial shield. It protects you if a guest gets hurt in your apartment or if you accidentally cause damage, like a small kitchen fire that spreads to a neighbor's unit. That kind of accident could lead to astronomical costs if you’re uninsured.

For Small Business Owners

If you're an entrepreneur, you probably have a Business Owner's Policy (BOP) that bundles property and liability coverage. But the single most critical—and most often overlooked—piece is Business Interruption Insurance. This is the coverage that replaces your lost income if a disaster forces you to shut your doors temporarily.

A lot of business owners assume their property insurance covers lost income during a shutdown. It's a dangerous mistake. Business interruption is almost always a separate coverage that you have to add on purpose.

This isn't a small detail; it's a survival switch. According to the U.S. Small Business Administration, somewhere between 40% and 60% of small businesses never reopen their doors after a major disaster. The main reason? Not enough of the right insurance.

Making sure you have this specific coverage isn't just a good idea—it can be the one thing that separates rebuilding from closing down for good. You can read more about how to protect your business from disasters on FEMA's website.

Key Questions to Ask Your Insurance Agent

Your insurance agent is more than just a salesperson—they’re your guide. But the quality of their advice often hinges on the quality of your questions. Knowing what to ask can turn a routine phone call into a strategy session that ensures your policy actually protects you. Learning how to frame your concerns by asking better questions is the first step to getting real clarity.

Let's start with the big one: the claims process. This is where most of the confusion and conflict happens. In fact, the National Association of Insurance Commissioners (NAIC) consistently reports that claim handling disputes are a top reason for consumer complaints. Why? It usually boils down to a misunderstanding of the policy's fine print. Asking the right questions now can save you a world of headaches later.

Questions About Coverage and Claims

Don't settle for a simple summary of your coverage. You need to dig into specific "what if" scenarios to see how your policy holds up under pressure. This is also the perfect time to request written confirmation of your coverage, a critical step we cover in our guide on how to verify insurance coverage.

Try asking things like:

- Deductibles: "Can you walk me through exactly how my deductible works if I have a claim with multiple types of damage, like wind and water damage happening at the same time?"

- Claims Process: "What’s the step-by-step process for filing a claim? What's your agency's role versus the corporate claims department?"

- Life Events: "If I renovate my kitchen or finish my basement, how does that affect my dwelling coverage limit, and when do I need to let you know?"

Your goal isn't just to get answers but to understand the why behind them. A great agent won't just tell you what's covered; they'll explain how it aligns with your specific risks.

Questions About Costs and Discounts

Finally, you need a rock-solid understanding of the money side of things. It’s your hard-earned cash, after all.

Make sure to ask:

- Premium Calculation: "Could you break down the main factors that determine my premium? I want to understand what's driving the cost."

- Available Discounts: "Are there any discounts I'm eligible for but not getting right now? For example, for my home security system or for bundling my policies?"

Got Questions About Your Policy? We've Got Answers.

Even after you've started to get the hang of your policy documents, a few questions always seem to pop up. It's totally normal. Let's walk through some of the most common ones we hear from people just like you.

What’s the First Thing I Should Read in My Policy?

Okay, so every single page matters. But if you want to get the most important information fast, there’s a smart way to do it.

First, go straight to the Declarations Page. Think of it as your policy’s cheat sheet. It gives you the big picture—who’s covered, what’s covered, your limits, and how much you’re paying—all in one place.

Then, do something that might feel backward: jump right to the Exclusions section. This is where the insurance company spells out exactly what it won’t pay for. Knowing this from the start is the best way to avoid a nasty surprise when you actually need to file a claim.

Finally, skim the Definitions. It might sound boring, but words like "peril" or "named insured" have very specific legal meanings. A quick look ensures you're on the same page as the insurer.

My Pro Tip: I always tell clients to think of it as a 3-step scan. Declarations for the overview, Exclusions for the deal-breakers, and Definitions for the fine print. You'll know 90% of what you need to in just a few minutes.

How Often Should I Actually Review This Thing?

Set a calendar reminder to give your policy a solid look-over at least once a year, preferably about a month before it's set to renew. That gives you more than enough time to see if your rates are still competitive or if you need to make changes.

But an annual check-in isn't the only time. You absolutely need to pull out your policy after any big life change. These moments can create huge coverage gaps if you're not paying attention.

What kind of events are we talking about?

- You bought a house or a new car.

- You got married (or divorced).

- A new baby joined the family.

- You started a business from your home office.

- You finally finished that big kitchen remodel.

Can I Make Changes to My Policy Whenever I Want?

Yes, absolutely! An insurance policy isn't set in stone. It’s a living document meant to change as your life does. You don't have to wait for renewal time.

Making a change usually involves adding an endorsement or a rider, which is just a formal amendment to your original contract. Maybe you need to increase your liability limits, add your teenager to your auto policy (good luck!), or get special coverage for a new piece of jewelry.

Just call your agent. They can walk you through the options and get the updates made, often in just a few minutes.

Making sense of your insurance options shouldn't feel like a chore. At My Policy Quote, we give you the clarity and tools you need to find coverage that truly fits your life. Get your personalized quote today!