Facing a doctor's visit without insurance can be intimidating, but you absolutely have options. You can definitely get medical care—the trick is knowing where to go and how to approach it. Costs can swing wildly, from under $100 at a community clinic to over $300 at a private practice, so a little planning goes a long way.

Your Roadmap To Affordable Medical Care

Let’s be real: worrying about a medical bill is the last thing you need when you’re not feeling well. But millions of Americans are in the same boat every single year.

It’s a tough situation. A staggering 46.6% of uninsured adults admitted to skipping a doctor’s visit because they were worried about the cost, according to eye-opening research from KFF. That's nearly three times the rate of people with insurance.

But you don’t have to be a statistic. This guide is your practical roadmap to getting the care you need without a massive financial hit. It all comes down to a few simple actions: figuring out the right place to go, getting a handle on costs beforehand, and knowing how to ask for help.

Key Steps Before Your Appointment

The best way to handle a doctor's visit without insurance is to be proactive. Instead of just showing up and hoping for the best, you take charge of the process from the very beginning. A few steps ahead of time can slash your final bill and get rid of those nasty surprise costs.

We know the consequences of not having insurance can feel overwhelming, but a smart approach makes all the difference.

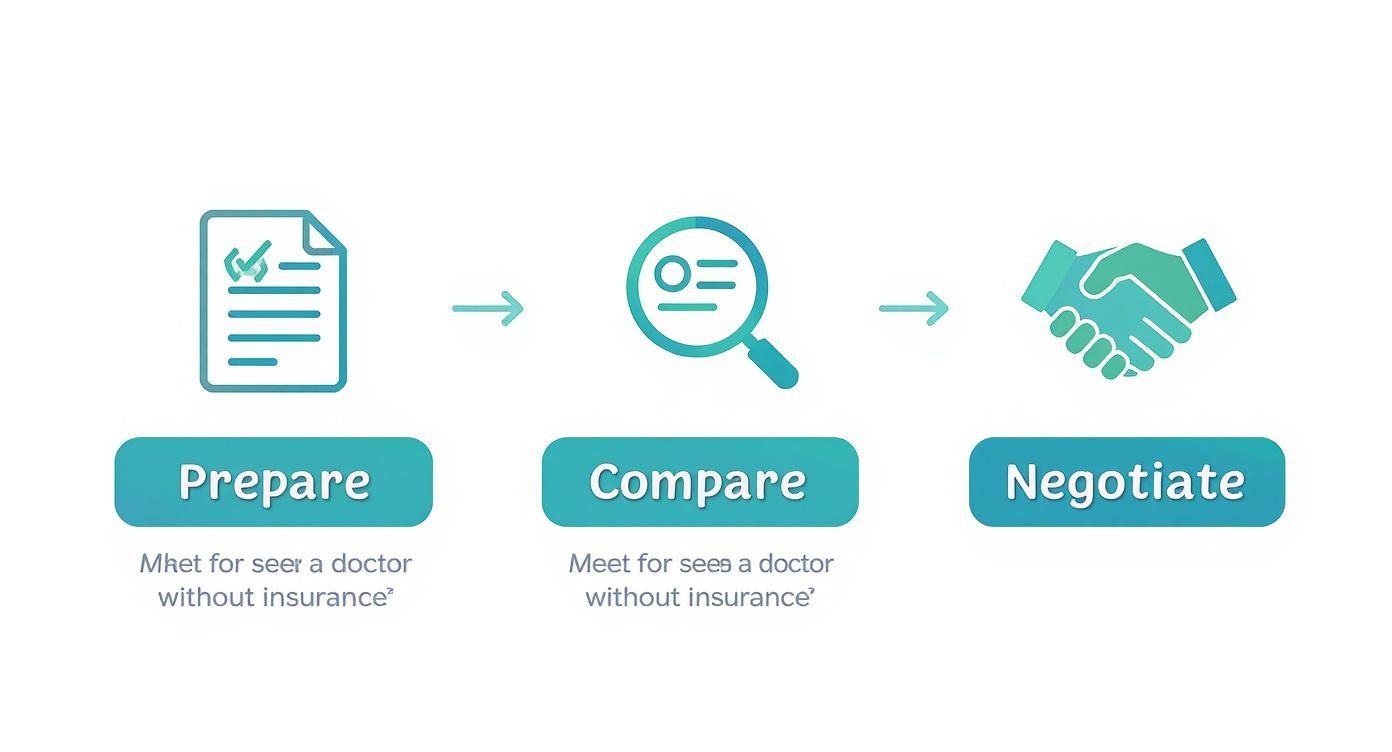

Think of it as a simple three-part strategy: Prepare, Compare, and Negotiate.

When you follow this path, you make sure you have your documents ready, find the most budget-friendly provider for your needs, and lock in the best possible price before you even walk in the door. It’s about turning a stressful situation into a manageable one.

Understanding Your Care Options Without Insurance

When you need to see a doctor but don't have insurance, just figuring out where to go can feel like half the battle. The good news? You have several solid, affordable options outside of a traditional private practice. Each one is built for a different situation, so making the right call comes down to what you need, what you can afford, and how quickly you need help.

This is a more common struggle than you might think. With medical costs soaring, a recent poll showed that nearly one in three Americans—32%—plan to skip doctor visits in 2025 just to save money. That affects everything from routine checkups to critical procedures, which is why finding affordable care is so important.

Community Health Centers: The Sliding-Scale Saviors

Your first and best bet for affordable primary care will almost always be a Federally Qualified Health Center (FQHC), also known as a community health center. These clinics are required by law to offer services on a sliding-scale fee. What does that mean? Your bill is based directly on your income and family size.

For example, a single parent managing their child's asthma might pay as little as $20 for a check-up that would cost $150 or more somewhere else.

These centers are perfect for:

- Routine physicals and annual check-ups

- Managing chronic conditions like diabetes or high blood pressure

- Vaccinations and other preventive care

Urgent Care Clinics: Fast and Transparent

Urgent care clinics are the perfect middle ground between a primary doctor and the emergency room. They handle non-life-threatening issues that pop up unexpectedly—colds, sprains, minor infections, you name it.

Most of them offer very clear self-pay pricing, often listing the costs right on their websites. No hidden fees, no mystery bills.

A remote worker with a sudden sinus infection could walk into an urgent care, pay a flat fee of $75-$125 for the visit, and walk out with a prescription. That’s a fraction of what an ER would charge for the exact same service, making them ideal for immediate, but not emergency, needs.

Telehealth: Convenient and Low-Cost

For more minor issues, telehealth is a total game-changer. Virtual visits for things like skin rashes, prescription refills, or mental health consultations can be incredibly cheap, with some platforms charging under $50 per session.

It’s the ultimate convenience—you get medical advice from your couch, saving you both time and travel costs. If you're trying to figure out how to handle different medical situations without a policy, resources on Navigating Insurance can offer some really valuable insights.

Emergency Rooms: For True Emergencies Only

The emergency room should always, always be your last resort unless you are facing a life-threatening situation. It is by far the most expensive option, and costs can skyrocket into the thousands before you even realize it.

Save the ER for severe injuries, chest pain, or difficulty breathing. While it's absolutely necessary in a crisis, it’s not the place for a routine check-up when you don't have insurance.

While these options provide immediate care, you might also want to explore our guide on short term health insurance plans for a temporary coverage solution.

Estimating And Negotiating Medical Costs

Facing a potential medical bill without insurance is scary, but you have more power than you might think. The trick is to treat healthcare like any other major purchase: do your homework beforehand and don't be afraid to talk about the price. A proactive approach to a no insurance doctor visit can save you from sticker shock and seriously lower what you end up paying.

The first move is to get informed before you even schedule anything. A lot of people don’t realize that the exact same procedure can cost hundreds, or even thousands, more at one clinic compared to another in the very same city. This lack of clear pricing is a huge problem, and learning more about the push for healthcare pricing transparency can empower you to stand up for a fair bill.

Doing Your Homework On Costs

Start by calling the billing departments of a few different clinics or urgent care centers. Be direct and explain your situation. You're not just a patient; you're a self-pay customer looking for the best value.

Ask for the self-pay rate or cash price for the specific service you need, whether it’s a new patient visit or something simple like a strep test. This rate is almost always much lower than the price they bill to insurance companies.

Pro Tip: When you call, always ask for a "Good Faith Estimate." Under federal law, if you're uninsured, you have the right to get an estimate of how much your medical care will cost. This document is your protection against surprise bills.

Once you have estimates from a couple of places, you can compare them. Don't just look at the total; check what’s included. Does one clinic’s price cover basic lab work while another charges for it on the side? These little details really matter.

Simple Scripts For Effective Negotiation

Negotiating isn't about being confrontational. It's just a conversation to find a price that works for both you and the provider. Getting a better feel for how providers manage their own expenses and learning about healthcare cost containment strategies can give you a real edge in these talks.

Here are a few proven approaches to try:

- The Prompt Payment Discount: "I'm a self-pay patient and I can pay my bill in full today. Do you offer a discount for prompt payment?" Many offices will knock off 10-30% just to avoid the headache of sending out bills and chasing payments.

- The Comparison Quote: "I have an estimate from another clinic for this service at a lower price. Is there any flexibility in your self-pay rate? I'd really prefer to come here if we can find a comparable price."

- The Hardship Request: "I'm currently uninsured and on a very tight budget. Is there a lower rate you can offer, or is there a financial assistance program I could apply for?" This question opens the door to sliding-scale fees or other support options you might not know about.

Remember, the worst thing they can say is no. By asking respectfully and having your research ready, you put yourself in the best possible spot to get the care you need at a price you can actually handle.

Exploring Payment Plans And Provider Discounts

So, you’ve managed to negotiate a better price for a no insurance doctor visit. That’s a huge win. But what if paying the entire bill in one go still feels impossible?

Don’t worry. Most healthcare providers would much rather get paid over time than not get paid at all. This is where payment plans and hidden discounts become your best friends for getting those medical costs under control.

Never assume the price you’re quoted is the final word. Many hospitals and clinics have policies that let them offer big reductions, especially for self-pay patients who are open about their financial situation. You just have to ask the right questions.

How To Request A Payment Plan

The secret to getting a payment plan approved? Be proactive and polite. The moment you get the bill—or even before your appointment if you know it’s going to be pricey—reach out to the billing department.

Start the conversation by clearly explaining your situation. You're not trying to avoid the bill; you’re asking for a reasonable way to pay it off. A simple, direct approach is usually the most effective.

For instance, you could say: "Hi, I received my bill for $600, and I'm paying without insurance. I can't cover that full amount right now, but I can definitely commit to a monthly payment. Could we set up a plan for $100 a month for the next six months?"

This approach shows you’re responsible and have a solution in mind. Most billing departments are happy to work with you because it saves them the headache of chasing payments or sending your account to collections.

Unlocking Additional Discounts

Beyond a basic payment plan, you can often find even deeper savings if you know what to ask for. A lot of people don’t even know these programs exist, but they can slash your bill significantly.

Here’s what you should ask about:

- Prompt-Pay Discount: Can you pay a chunk of the bill right now? Ask if they offer a discount for it. Some providers will knock 10-20% off the total if you can pay a lump sum immediately, even if it’s not the full balance.

- Hardship Programs: These are for people facing tough times, like losing a job or a sudden income drop. You’ll probably need to show proof, like recent pay stubs or an unemployment letter, but the savings can be substantial.

- Sliding-Scale Fees: These are standard at community health centers, but some private practices and hospitals have them too. It never hurts to ask if they can adjust your bill based on your income.

I once saw a patient get a $600 bill knocked down to $350 just by calling and explaining they had recently lost their job. The clinic not only gave them a hardship discount but also split the rest into six interest-free monthly payments.

If your first request gets a "no," don't give up. Ask to speak with a billing supervisor or a patient advocate. These folks usually have more power to approve discounts and flexible arrangements, turning a financial nightmare into something you can actually manage.

Finding Financial Assistance And Community Resources

Even after you’ve negotiated the best possible price, a big medical bill can feel like an impossible mountain to climb. I've seen it countless times—that feeling of dread when the envelope arrives. This is exactly where financial assistance programs and community resources can be a lifeline.

These aren't just small discounts. They can completely wipe out huge medical debts, but the key is knowing where to look and how to ask for help. It’s not just about the hospital’s billing department; there’s a whole network of support out there, from charity care and government grants to nonprofits dedicated to this exact problem.

And you're not alone in this. Globally, around 2 billion people face financial hardship because of healthcare costs. A stunning 1 billion of them face what’s called catastrophic spending. It’s a massive issue, which is why these programs exist. You can learn more about these global health challenges and the push for universal coverage from the World Health Organization.

Where To Find Medical Assistance Programs

Start your search close to home and then branch out. So many of these resources are designed to serve specific local communities, so checking the right places first makes all the difference.

Here’s where I always tell people to begin:

- Hospital Charity Care Programs: This is a big one. By law, non-profit hospitals have to offer financial assistance policies, often just called "charity care." If your income is below a certain level—usually 200-400% of the Federal Poverty Level—these programs can slash or even forgive your entire bill. The first thing you should always do at a hospital is ask for their "Financial Assistance Policy."

- Community Health Centers: We’ve mentioned them before, but it’s worth repeating. These centers are built to provide affordable care and are required to offer sliding-scale fees based on what you can afford. The Health Resources & Services Administration (HRSA) has a great locator tool to find one in your area.

- State and County Programs: Your state’s Department of Health website is an untapped goldmine. They often have lists of local clinics, prescription assistance programs, and other state-funded aid specifically for uninsured residents.

- Nonprofit Organizations: Groups like the Patient Advocate Foundation or the PAN Foundation can be incredible. They offer direct financial help for certain conditions, covering not just the treatment but sometimes related costs too.

Applying For Help And Writing A Hardship Letter

Once you find a program that looks promising, you’ll need to apply. Get ready to provide some paperwork to show your financial situation. This usually means gathering recent pay stubs, your last tax return, or maybe a letter from an old boss if you recently lost your job.

A really important part of your application is often the hardship letter. This is your chance to tell your story.

This isn't just about filling out forms. A powerful hardship letter is clear, honest, and straight to the point. Briefly explain what’s going on financially, why you needed medical care, and that you’re asking for their help. Attach your documents and let them know you’re willing to work with them.

This letter puts a human face to your application. It takes you from being a case number to a real person, and I’ve seen it be the one thing that gets an application approved. With a clear plan, you can tap into these resources and turn a bill that feels overwhelming into something you can actually handle.

Documentation And Billing Tips

Navigating medical care without insurance means you have to be your own best advocate, especially when the bills start arriving. A simple paperwork mix-up or a confusing billing code can quickly turn an affordable visit into a financial nightmare.

When you’re paying out-of-pocket for a no insurance doctor visit, tracking every single document isn’t just good practice—it’s essential.

Start by creating a dedicated file for all your medical paperwork. Think of it as your command center. When a billing question comes up or you need to dispute a charge, you’ll have everything you need right at your fingertips.

Here’s what should go in that file:

- Explanation of Benefits (EOB): Even without insurance, you might get a summary of services. Scrutinize every line. Does it accurately reflect the care you received?

- Itemized Statement: This is crucial. Demand one if it's not provided. Check that every test, procedure, and consultation listed actually happened.

- Receipts and Payment Proofs: Keep everything, whether it’s a printed receipt or a digital confirmation.

- Correspondence Logs: Jot down every phone call or email. Note the date, time, who you spoke with, and what was said. This log is your proof.

Spotting Billing Errors

You’d be shocked how often billing errors happen. From duplicate charges to misapplied codes, these mistakes can inflate your bill without you even realizing it. I’ve seen clients successfully slash 20-50% off their medical bills just by catching these simple slip-ups.

So, how do you find them? Start by comparing the procedure codes on your itemized bill with what actually happened during your visit. If you see a code for a test you never took, flag it immediately.

| Procedure Code | Common Error You Might Find |

|---|---|

| 99213 | Billed for a follow-up visit you never had. |

| 93000 | Charged for an EKG that was part of a package. |

| 80050 | An extra, unnecessary lab panel was added. |

How to Dispute Charges The Right Way

Don't be intimidated by the billing department. They deal with these calls all day. The key is to be polite, prepared, and persistent. A simple, direct script can work wonders.

"Hello, I’m looking at my statement from [Date of Service] and I have a question about a charge. Can you help me understand the code 99213? I want to make sure I’m not being billed for a service I didn’t receive."

If a phone call doesn't fix the problem, put it in writing. A clear, concise letter outlining the specific discrepancy is your next best step. For more on this, our article on What Is a Health Insurance Claim offers some great background info.

When It’s Time to File a Formal Appeal

What if the billing error is still there after you've called and written? It’s time for a formal appeal. Most providers give you a specific window to do this, so don't wait.

- First, call the billing office and ask for their official appeal form.

- Fill it out completely, attach copies of your evidence (like your correspondence log and itemized bill), and sign it.

- Send everything via certified mail. That little green receipt is your proof they received it.

- Follow up in about two weeks to check on the status.

Keeping a log of every step you take keeps you in control and prevents your dispute from getting lost in the shuffle.

A Quick Success Story

Jessica, a freelance graphic designer, noticed she was charged $150 for a lab test she never had. She followed these exact steps, disputed the code, and got a $75 refund credited back to her account in less than two weeks.

Your own no insurance doctor visit can have a similar positive outcome. It all comes down to staying organized and asking the right questions.

Key Takeaways To Remember

- Keep digital and paper copies of everything. You can never be too prepared.

- Question every code you don't recognize. A quick online search can tell you what it’s for.

- Remember your rights. Under federal law, you can ask for a Good Faith Estimate before receiving care.

- Track all your communications in a simple notebook or spreadsheet.

Putting these tips into practice empowers you. It helps you avoid surprise costs and gives you the confidence to manage your healthcare finances effectively.

Your Questions, Answered

Going to the doctor without insurance brings up a lot of questions, and that's completely normal. Let's walk through some of the most common ones so you can feel more prepared and in control.

How Do I Find The Lowest-Cost Clinic Near Me?

Your best first stop is almost always a Federally Qualified Health Center (FQHC). These are community-based clinics that receive federal funding, and they're required to offer sliding-scale fees based on what you can afford to pay. The government's HRSA Find a Health Center tool is the easiest way to find one in your zip code.

You can also use apps and websites to compare self-pay prices at local urgent care centers. And don't underestimate old-school resources—calling your local United Way or simply dialing 2-1-1 can connect you with people who keep updated lists of affordable healthcare providers right in your area.

What Paperwork Proves Financial Hardship?

When you’re asking for a sliding-scale fee or charity care, you'll need to show your financial situation. The exact requirements change from place to place, but having these documents ready will make the whole process go much smoother:

- Proof of Income: A few recent pay stubs, your W-2 form, or last year's tax return works perfectly.

- Proof of Hardship: This could be an unemployment benefits letter or even a simple, honest hardship letter you write yourself explaining what's going on.

- Household Info: Bring a utility bill to prove where you live and an ID for yourself and anyone else in your household you're responsible for.

Being organized is your biggest advantage here. When you walk in with your documents ready, it shows you're proactive and makes it so much easier for the staff to quickly approve you for a discount.

At My Policy Quote, we believe everyone deserves clear information and real options for their healthcare. Explore our resources, and let us help you find the right path forward. Learn more at https://mypolicyquote.com.