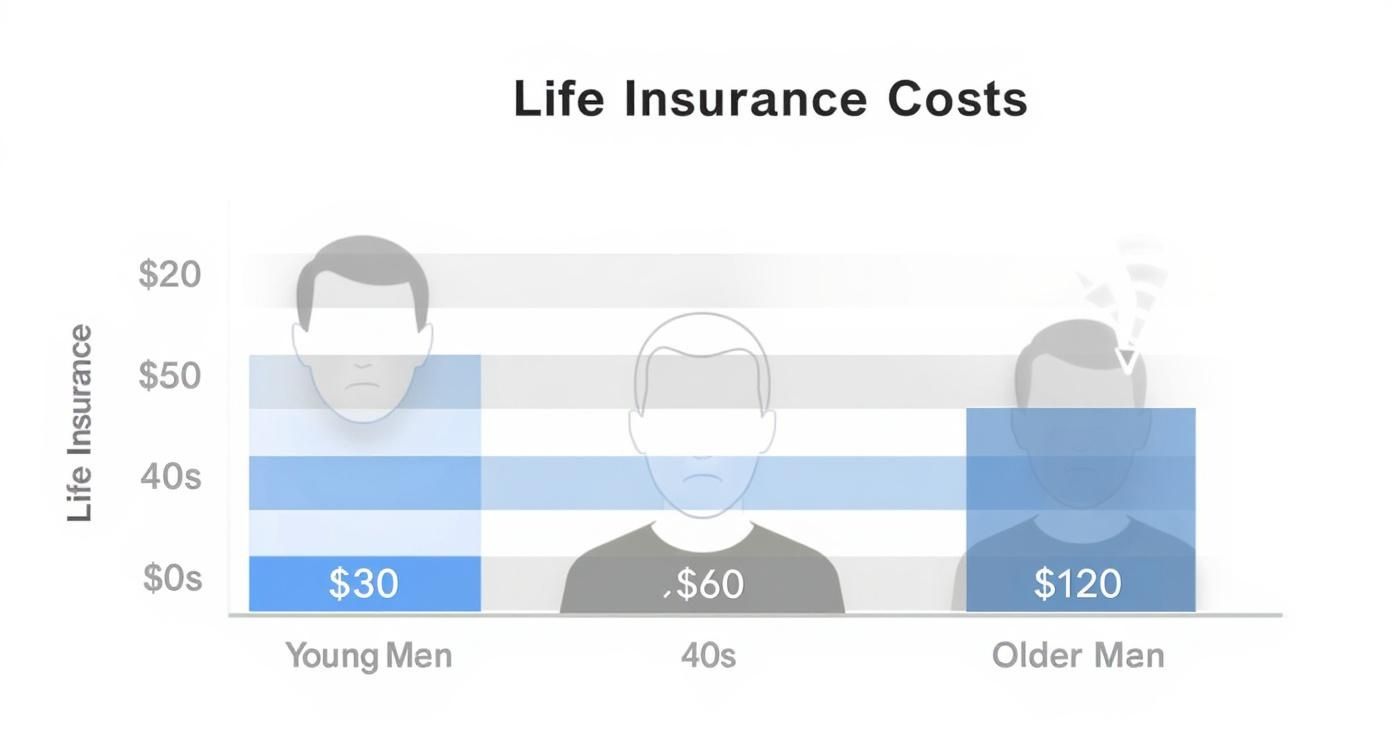

The cost of term life insurance isn't a mystery—it's actually pretty simple. Younger, healthier people always pay less. A healthy 30-year-old might find a solid policy for just $20-$30 a month. But wait until you're 50, and that same coverage could easily jump to over $100.

It’s a clear message: acting sooner saves you real money.

Why Term Life Insurance Costs What It Does

Think of your life insurance premium less as a price tag and more as a personalized risk score. Insurers are basically oddsmakers. They’re calculating the likelihood they’ll have to pay out a claim while your policy is active.

Their business model hinges on balancing the premiums they collect against the death benefits they expect to pay out. The less likely you are to pass away during the term, the lower the risk you represent. And the lower the risk, the lower your monthly premium. It’s that simple. This is why a healthy 30-year-old gets a much better deal than a 60-year-old with a few health issues—their risk profiles are worlds apart.

The Foundation of Your Premium

So, what exactly goes into that calculation? Insurers take a snapshot of your life to figure out the risk. It all boils down to a few key things:

- Your Age: This is the big one. The younger you are when you apply, the lower your statistical risk, and the cheaper your policy will be.

- Your Health: A clean bill of health is like gold. Good blood pressure, healthy cholesterol, and a non-smoker status translate directly into savings.

- Your Lifestyle: Do you have a risky job or hobby? Habits like smoking can significantly increase what you pay.

- Your Policy Choices: How much coverage do you want, and for how long? A bigger death benefit or a longer term will naturally cost more.

Gender also plays a role. Because women tend to live longer, they often get slightly lower rates than men of the same age and health status.

To give you a clearer picture, here’s a breakdown of what you might expect to pay.

Estimated Monthly Term Life Insurance Premiums

This table provides a quick overview of sample monthly costs for a 20-year term policy for non-smokers in excellent health.

| Age | Gender | $250,000 Coverage | $500,000 Coverage | $1,000,000 Coverage |

|---|---|---|---|---|

| 30 | Male | $16 | $22 | $34 |

| 30 | Female | $14 | $19 | $30 |

| 40 | Male | $21 | $33 | $55 |

| 40 | Female | $19 | $28 | $48 |

| 50 | Male | $48 | $85 | $158 |

| 50 | Female | $38 | $65 | $120 |

As you can see, the difference between buying a policy at 30 versus 50 is massive.

The chart above drives the point home: premiums can easily double or even triple as you move from one age bracket to the next.

Once you understand what an insurance premium is and how it’s set, you’re in a much better position to find affordable coverage. It's often part of smart financial planning for major life events, giving you peace of mind when it matters most.

The Key Factors That Shape Your Premiums

Think of your term life insurance premium as a personalized price tag, not a one-size-fits-all number. It's not just a random figure pulled out of a hat. Insurers use a careful, detailed process to figure out the specific risk of covering you. This process is called underwriting, and it’s how they land on the final costs of term life insurance for your policy.

It's a lot like how a car insurer looks at your driving record, age, and what kind of car you drive. They aren’t just guessing; they’re using data to build a clear picture of your unique situation. Let's pull back the curtain and see exactly what goes into that calculation.

Your Personal Profile: Health and Age

At the very top of the list are your age and health. These two factors carry the most weight when an insurer is setting your premium. It all comes down to statistics—younger, healthier people are simply less likely to pass away, making them a lower risk to insure.

-

Age: This is the absolute foundation of any life insurance quote. The older you are when you apply, the higher your rate will be. A 40-year-old will always pay more than a 30-year-old for the exact same coverage, simply because their life expectancy is statistically shorter.

-

Health History: Insurers will take a close look at your medical records. They're looking for chronic conditions like diabetes, heart disease, or a history of cancer. Having a well-managed condition doesn't mean you'll be denied, but it might mean a higher premium.

-

Family Medical History: It’s not just about you. A history of hereditary conditions like early-onset heart disease or certain cancers in your immediate family can also bump up your rates, as it could suggest a higher genetic risk.

The whole point of this evaluation is to create a clear picture of your long-term health. Understanding what underwriting in insurance is can really help you feel more prepared when you apply.

Lifestyle Choices and Habits

Beyond your medical chart, insurers want to know how you live your life day-to-day. Your habits and even your hobbies give them important clues about your overall risk profile.

The biggest lifestyle factor by far is tobacco use. Smokers and other tobacco users can expect to pay two to three times more than non-smokers for an identical policy. Why? Because smoking is directly linked to a huge range of life-threatening illnesses.

Other lifestyle factors that get a close look include:

- Dangerous Hobbies: Love to skydive, rock climb, or scuba dive? These activities are considered high-risk. If you do them regularly, you might face higher premiums or even specific exclusions in your policy.

- Driving Record: A history of DUIs, reckless driving tickets, or a string of accidents can signal risk-taking behavior, which almost always leads to higher insurance costs.

- Occupation: Some jobs are just more dangerous than others. A pilot or a construction worker, for example, might pay more than someone with a desk job because of the increased hazards they face at work.

Key Takeaway: Honesty is everything. If you don't mention a risky hobby or a smoking habit on your application, it's considered fraud. That could lead to your policy being canceled right when your family needs it most.

The Policy You Build

Finally, the details of the policy you choose have a huge impact on your premium. The good news is that you control these factors, so you can build a policy that fits both your family's needs and your budget.

Think of it like designing a custom safety net. The bigger the net and the longer you need it to last, the more it's going to cost. The two main levers you can pull are the coverage amount and the term length.

1. Coverage Amount (Death Benefit)

This is the total amount of money your loved ones will receive if you pass away while the policy is active.

- A $250,000 policy will always be much cheaper than a $1,000,000 policy.

- The right amount depends entirely on your goals. Are you trying to replace your income, pay off the mortgage, or make sure your kids can go to college?

2. Term Length

This is the number of years your coverage will be in effect. The most common term lengths are 10, 20, or 30 years.

- A 10-year term is the most affordable because the insurer's risk is limited to a shorter window of time.

- A 30-year term is more expensive because it covers you for much longer, which increases the statistical probability that a claim will eventually be made.

By carefully balancing these personal, lifestyle, and policy-specific factors, insurers arrive at a premium that truly reflects your unique situation. It's how they keep the system fair and stable for everyone.

How Term Life Insurance Costs Compare

To really understand why term life insurance costs what it does, you have to see how it stacks up against the other options out there. The price makes a lot more sense once you see the bigger picture.

Think of it like this: term life is like renting a home. It’s simple, affordable, and gives you a roof over your head for a specific amount of time. It’s the perfect tool to cover you when you need it most—like when you have a mortgage or young kids relying on you.

Permanent policies, like whole or universal life, are more like buying a home. The price tag is much, much higher. But you're paying for something that's meant to last forever and builds equity—or in this case, a cash value—along the way. This one difference in purpose is the biggest driver behind the huge gap in price.

Term vs. Permanent: The Core Difference

When you buy a term life policy, every dollar of your premium goes toward one thing and one thing only: the death benefit. It's pure, straightforward protection. No bells, no whistles, and no complicated investment accounts to fund.

Permanent policies are a different beast entirely. A chunk of your (much higher) premium pays for the insurance coverage, but another big piece gets funneled into a cash value account. This account grows over time, almost like a savings or investment vehicle you can borrow against. Because you're funding two things at once—insurance and savings—the premium has to be higher.

Key Insight: Term life's lower cost lets you buy a much larger death benefit for the same monthly budget. This makes it the perfect tool for getting maximum protection during your highest-earning, highest-debt years.

While permanent policies have their place—especially in complex estate planning or for those with lifelong dependents—term life is the go-to for most families who just need solid financial protection. Term life insurance consistently makes up about 18% to 19% of the individual life insurance market in the U.S. New premiums recently hit over $1.5 billion in just six months, showing how much people still rely on its simplicity and affordability. You can dig into these life insurance market trends and insights on LIMRA.com.

A Side-by-Side Look at Your Options

Let's break down the three most common types of life insurance side-by-side. Seeing them compared like this can make it much easier to decide if term coverage really fits your family's needs.

Term vs. Whole vs. Universal Life Insurance At a Glance

| Feature | Term Life Insurance | Whole Life Insurance | Universal Life Insurance |

|---|---|---|---|

| Primary Purpose | Provides affordable protection for a specific period (e.g., 10, 20, 30 years). | Offers lifelong coverage with a guaranteed death benefit and a cash value component. | Provides flexible lifelong coverage where premiums and death benefits can be adjusted. |

| Typical Cost | Low. The most affordable option for a high level of coverage. | High. Can be 5 to 15 times more expensive than a comparable term policy. | High, but can be more flexible than whole life. Premiums can vary. |

| Cash Value | None. It's pure insurance protection without any investment features. | Yes. A portion of the premium builds cash value at a guaranteed rate. | Yes. Cash value growth is tied to interest rates, offering more flexibility but less certainty. |

| Best For | Covering temporary needs like income replacement, mortgage debt, or college costs. | Estate planning, funding trusts for lifelong dependents, or as a forced savings tool. | Individuals who need lifelong coverage but want more flexibility than whole life provides. |

At the end of the day, the right policy comes down to your financial goals, your budget, and how long you need that protection to last. Our guide on term life insurance comparison takes an even deeper dive to help you make the right choice. By understanding these key differences, it’s easy to see why the low cost of term life makes it the solution for millions of families.

Proven Strategies to Lower Your Insurance Costs

So, you understand how term life insurance costs are calculated. Now, let’s put that knowledge to work.

Think of your premium not as a fixed price tag, but as a flexible number. With the right strategy, you can influence that number and lock in the lowest possible rate. We're talking about potential savings of thousands over the life of your policy.

This isn’t about finding loopholes. It’s about showing the insurer that you're a low-risk applicant. And the best part? Many of the things that lower your premiums also happen to be great for your overall health.

You have more control than you think.

Start with Your Health Profile

Your health is the single biggest factor an insurer looks at. They reward healthy habits with better rates, so focusing on your well-being is the most direct way to save money.

Even small, consistent improvements can make a huge difference. Here’s where to focus:

- Quit Smoking: This is the undisputed champion of premium reduction. Smokers often pay two to three times more than non-smokers. If you've recently quit, don't worry. Many insurers will re-evaluate your rate after you’ve been nicotine-free for at least one year, moving you into a much more affordable non-smoker class.

- Manage Your Weight: Keeping a healthy weight for your height is a big deal for insurers. They use Body Mass Index (BMI) as a key indicator, and dropping excess pounds can bump you into a better, cheaper rate class.

- Control Chronic Conditions: If you have something like high blood pressure or cholesterol, show that it's under control. Following your doctor’s orders, taking your medication, and having stable readings can get you much better rates than if the condition is unmanaged.

These changes don't just slash your insurance costs—they're an investment in your long-term health. It’s a true win-win. For an even deeper dive, check out our guide on how to reduce insurance premiums.

Choose the Right Policy Strategy

Beyond your health, how you buy your policy can unlock major savings. It’s all about being strategic and matching your coverage to what you actually need right now.

Strategic Insight: Your insurance needs aren't static. They’re highest when your kids are young and your mortgage is big. As you pay down debt and your kids become independent, your need for a massive death benefit shrinks.

Consider these powerful approaches:

1. Buy Young

This is the golden rule of life insurance: buy it as early as you can. A healthy 30-year-old can lock in a 30-year term policy for a fraction of what a 45-year-old would pay for the exact same coverage. You secure that low rate for decades to come.

2. Policy Laddering

This is a more advanced technique, but it's incredibly effective. Instead of one huge 30-year policy, you buy several smaller policies with different end dates. For example:

- A $500,000, 10-year policy to cover the years until your oldest child is on their own.

- A $300,000, 20-year policy to cover the rest of the mortgage.

- A $200,000, 30-year policy to provide income replacement until you retire.

As each smaller policy expires, your total coverage and your total premium drop, perfectly aligning with your shrinking financial responsibilities.

Shop Smart and Compare Aggressively

Finally, never, ever accept the first quote you see. The term life market is incredibly competitive, and prices for the same person can vary wildly between companies.

Each insurer has its own rulebook. One might be more lenient with a specific health issue, while another offers better rates for your age group. The only way to find out who sees you most favorably is to compare.

Working with an independent broker or using an online comparison tool makes this easy. They do the legwork, gathering quotes from a wide range of insurers to pinpoint the company offering you the most coverage for the least amount of money. This one step can save you hundreds of dollars a year. It's a no-brainer.

Navigating the Application and Underwriting Process

The life insurance application process can feel like a bit of a mystery, but once you know the steps, it’s actually pretty straightforward. Getting a handle on what to expect takes the anxiety out of the equation and puts you in the driver's seat. It's the best way to make sure the costs of term life insurance you’re quoted are fair and accurate.

Think of it as the insurance company simply doing its homework. They're just verifying the details you've provided. This is a standard part of the process designed to be thorough, not to trip you up.

Let's walk through it together.

The Initial Application and Medical Exam

It all starts when you submit your application, which asks for details about your health, lifestyle, and your family's medical history. For most traditional policies, the next step is a quick and simple medical exam—a key part of what they call the underwriting process.

This isn't some exhaustive, hours-long physical. A licensed medical professional, usually called a paramedical examiner, will come to you—at home or work, whenever is convenient. The whole thing usually takes less than 30 minutes.

Here’s what’s involved:

- Basic Measurements: They'll record your height, weight, and blood pressure. Simple.

- Medical History Review: The examiner will quickly go over the health info you put on your application, just to confirm everything.

- Simple Samples: You’ll provide a small blood and urine sample. They use these to screen for things like high cholesterol, blood sugar levels, or nicotine use.

One thing is non-negotiable: be completely honest. If an insurer later finds out something was misrepresented, they could deny a future claim. That would leave your family without the very protection you worked to put in place.

Underwriter's Focus: The whole point of the exam is to verify your health status and assign you an accurate "risk class." The lower your risk, the better your rates. A good exam result can directly translate into a lower premium.

The Rise of No-Exam Policies

What if you'd rather skip the medical exam completely? You're in luck. In recent years, "no-exam" or "accelerated underwriting" policies have become way more common. Instead of an in-person exam, these policies use data algorithms and third-party records (like your prescription history or driving record) to figure out your risk.

It sounds incredibly convenient, and it is. But there’s a trade-off.

- Convenience: The application process is much, much faster. Some policies get approved in a matter of days, or even hours.

- Cost: Here's the catch. Because the insurer is taking on a bit more unknown risk by skipping the exam, these policies are often more expensive than a fully underwritten one.

A no-exam policy can be a fantastic fit for healthy people who value speed and convenience above all else. But if your main goal is to lock in the absolute lowest rate possible, a traditional policy with a medical exam is almost always the way to go.

Frequently Asked Questions About Insurance Costs

When you’re this close to a decision, a few last-minute questions always seem to pop up. The details of term life insurance costs can feel a bit murky, so let's clear up the most common points of confusion with some straight-up answers.

Can I Get Term Life Insurance with a Pre-Existing Medical Condition?

Yes, in most cases, you absolutely can. Insurers are often more interested in how well you’re managing a condition than the simple fact that you have one.

Now, the final cost and even your eligibility will hinge on the specifics. For instance, well-controlled diabetes or managed high blood pressure might mean slightly higher premiums, but coverage is still very much on the table. The key is to be completely upfront about your health. Shop around, too—different carriers look at the same condition through different lenses. An independent agent can be a huge help here.

Does My Credit Score Affect My Term Life Insurance Cost?

Sometimes, but it’s not a major player like your health is. Some insurance companies use what's called a "credit-based insurance score" when they're figuring out your risk.

The thinking behind it is that some data shows a link between financial responsibility and lower-risk behaviors. So, a solid credit history might nudge your premiums down a bit with certain carriers. But this isn't universal; it varies by company and is regulated by state law, so its impact really depends on where you live and who you're getting a quote from.

Important to Know: While a great credit score could give you a small edge, a poor one isn't going to be the main reason for a high premium. Your health and lifestyle choices will always carry way more weight.

What Happens If I Outlive My Term Life Insurance Policy?

This is actually a great "problem" to have! If you outlive your policy's term, the coverage simply comes to an end. You stop making payments, and the death benefit is no longer active. From there, you've got a few choices:

- Let it Expire: If your big financial responsibilities are behind you—like the mortgage is paid off and the kids are financially independent—you might not even need the coverage anymore.

- Renew Annually: Some policies give you the option to renew year by year. Just be ready for a jump in cost, since the new premiums will be based on your current, older age.

- Convert to Permanent Insurance: Many term policies come with a conversion rider. This is a fantastic feature that lets you switch your term policy to a permanent one (like whole life) without needing a new medical exam. It’s a lifesaver if your health has changed for the worse.

Ready to see what your personalized rate could be? At My Policy Quote, we make it simple to compare quotes from top insurers to find affordable, high-quality coverage that fits your family's needs. Get your free, no-obligation quote today at https://mypolicyquote.com.