The core difference between an HRA and an HSA comes down to one simple thing: who owns and funds the account.

A Health Reimbursement Arrangement (HRA) is an account owned and funded entirely by your employer. Think of it as a promise from them to reimburse you for medical costs. On the other hand, a Health Savings Account (HSA) is a personal savings account that you own, and both you and your employer can contribute to it.

In short, HRAs give employers more control, while HSAs offer you, the employee, true portability and a powerful way to save for the long haul.

HRA vs. HSA: The Key Differences at a Glance

Getting a handle on the fundamentals of both the HRA and HSA is your first step toward picking the right strategy for your healthcare needs. It helps to see them as two different tools designed to solve the same problem—tackling healthcare costs—but from completely different angles.

An HRA is basically a reimbursement promise from your company. They set aside a specific amount for your medical expenses each year, but the money isn't actually in an account until you file a claim. This setup gives employers a predictable way to manage their budgets.

An HSA, however, is a real financial account, almost like a 401(k) but specifically for healthcare. The catch? You must be enrolled in a High-Deductible Health Plan (HDHP) to open and contribute to one. The money in an HSA is yours to keep, grow through investments, and take with you if you ever change jobs.

Primary Distinctions Summarized

Why are these accounts becoming so popular? It's all driven by rising costs. With the average premium for employer-sponsored family health coverage hitting a staggering $26,993, businesses are desperately looking for more flexible solutions.

As a result, about 4% of companies offering health benefits have already turned to an Individual Coverage HRA (ICHRA) to help employees buy their own insurance, and another 8% are seriously considering it. This shift shows just how vital both HRAs and HSAs have become in today's benefits landscape. You can explore more data on employer health benefits trends… to see how things are changing.

The most critical distinction is this: An HRA is a reimbursement tool owned by the employer, whereas an HSA is a portable savings and investment vehicle owned by the employee. This difference in ownership dictates everything from funding rules to what happens when you leave your job.

To make these differences crystal clear, let's break them down side-by-side. This table offers a quick, high-level overview before we dive deeper into the nitty-gritty of each account.

Key Differences Between HRAs and HSAs

| Feature | Health Reimbursement Arrangement (HRA) | Health Savings Account (HSA) |

|---|---|---|

| Ownership | Employer-owned. Funds are typically lost if you leave your job. | Employee-owned. The account and all funds are yours to keep, always. |

| Funding Source | Funded 100% by the employer. Employees cannot contribute. | Funded by the employee, the employer, or even family members. |

| Health Plan | Can be paired with different types of health plans, depending on the HRA. | Must be paired with a qualifying High-Deductible Health Plan (HDHP). |

| Contribution Limit | Varies by HRA type; some have no federal limit (like the ICHRA). | Annual limits are set by the IRS ($4,300 single / $8,550 family for 2025). |

| Fund Rollover | Depends on the employer's plan design; funds may or may not roll over. | Funds always roll over year after year and never expire. |

| Investment | No investment option. It’s strictly a reimbursement arrangement. | Funds can be invested in stocks, bonds, and mutual funds to grow over time. |

As you can see, while both aim to help with medical expenses, they operate in fundamentally different ways. One is a company benefit, and the other is a personal financial asset.

Getting to Know Health Reimbursement Arrangements (HRAs)

Think of a Health Reimbursement Arrangement (HRA) as an employer-funded benefit that pays you back, tax-free, for qualified medical expenses. It’s not a bank account you own. Instead, it’s a formal promise from your company to cover healthcare costs up to a specific limit each year.

The key thing to understand about an HRA is that the employer is in the driver's seat. They fund it entirely, they set the annual allowance, and they decide which medical costs are eligible for reimbursement. This gives businesses a huge advantage: predictable budgeting.

Because it’s tied so tightly to your employer, the HRA isn't portable. If you switch jobs, those funds don't come with you.

The Magic of "Use It or Lose It" Funding

For employers, one of the biggest draws is how HRAs are funded. They operate on a "notional" basis, which is a fancy way of saying the money isn't actually spent until an employee files a valid claim. The company just sets aside the total possible amount in its budget.

Let's say your company offers you a $4,000 HRA for the year. If you only have $2,500 in medical bills, your employer only pays out that $2,500. That leftover $1,500? It never leaves the company's bank account, which is a direct cost saving for them.

An HRA feels less like a personal savings plan and more like a company expense account for your health. The funds are a benefit, not an asset, and they’re only available as long as you work there under your employer's specific rules.

HRAs are becoming a go-to strategy for modern benefits. Recent data reveals that adoption of the Individual Coverage HRA (ICHRA) jumped by 34% among large employers in a single year. It’s a clear signal that companies are moving toward benefits that offer more cost control and flexibility. You can dig deeper into the HRA growth trends and employer satisfaction to see why.

The Different Flavors of HRAs

HRAs aren't a one-size-fits-all solution. They come in a few different types, each built for a different business need and insurance setup. Getting to know them helps you see just how versatile they can be.

- Individual Coverage HRA (ICHRA): This is the most flexible of the bunch. An ICHRA lets employers of any size give employees tax-free money to buy their own health insurance on the individual market. Instead of offering a one-size-fits-all group plan, the company empowers you to choose your own.

- Qualified Small Employer HRA (QSEHRA): Tailor-made for small businesses (fewer than 50 full-time employees) that don't offer a group health plan. A QSEHRA comes with annual contribution limits set by the IRS and can be used for both insurance premiums and other medical costs.

- Group Coverage HRA (GCHRA): You might hear this called an "integrated HRA" because it has to be paired with a traditional group health plan. Its job is to help employees cover the out-of-pocket costs—like deductibles, copays, and coinsurance—that come with their group coverage.

Each HRA serves a specific goal. The ICHRA gives employees freedom of choice, the QSEHRA helps small businesses stay competitive, and the GCHRA makes existing group plans more affordable. This flexibility is a big reason why both hra and hsa options are gaining so much ground in today's benefits landscape.

Mastering Health Savings Accounts (HSAs)

While an HRA is an employer-owned benefit, a Health Savings Account (HSA) is a personal financial tool that you own and control completely. Think of it less like a simple reimbursement plan and more like a 401(k) for your health—covering medical, dental, and vision costs. The real magic of an HSA is its unique blend of savings, investment potential, and tax advantages.

But there’s a non-negotiable entry ticket: you must be enrolled in a qualified High-Deductible Health Plan (HDHP) to open and contribute to an HSA. This isn't a random rule; it's by design. The HSA is meant to work alongside a lower-premium HDHP, giving you a powerful way to save for out-of-pocket costs.

The Unmatched Triple-Tax Advantage

The single most powerful feature of an HSA—and what sets it apart from every other retirement or savings account—is its triple-tax advantage. It’s structured to maximize every dollar you put in.

Here’s the breakdown:

- Tax-Deductible Contributions: The money you contribute is tax-deductible, which lowers your taxable income for the year.

- Tax-Free Growth: Your funds, including any interest or investment gains, grow entirely tax-free.

- Tax-Free Withdrawals: You can pull money out tax-free at any time to pay for qualified medical expenses.

This powerful trio means every dollar is working for you, untouched by taxes. Over the years, this can create substantial savings that blow other accounts out of the water.

True Ownership and Lifelong Portability

Unlike an HRA, which is tied to your job, an HSA is yours and only yours. This is a fundamental difference. It gives you complete control and flexibility, no matter what happens with your employment.

An HSA is a portable asset, not a temporary benefit. The account and every dollar in it stay with you if you change jobs, switch insurance plans, or retire. It’s a stable, long-term financial tool you can count on for life.

This portability is a game-changer. You’ll never have to worry about a "use-it-or-lose-it" rule. Your entire balance rolls over, year after year, and just keeps growing. It’s why so many people treat a well-funded HSA as a supplemental retirement account. After you turn 65, you can withdraw funds for any reason—not just medical costs—and only pay ordinary income tax, just like a traditional 401(k) or IRA. For a deeper dive into how these accounts work, our guide on health savings accounts in CA offers great state-specific insights.

Contribution Limits and Catch-Up Opportunities

The IRS sets annual contribution limits for HSAs, which are adjusted each year for inflation. For 2025, the limits are:

- $4,300 for self-only coverage

- $8,550 for family coverage

To qualify, your HDHP must have a minimum annual deductible of at least $1,650 for individuals or $3,300 for families in 2025.

On top of that, HSAs have a great perk for those getting closer to retirement. If you are age 55 or older, you can contribute an extra $1,000 per year as a "catch-up contribution." This helps you supercharge your savings when healthcare costs tend to rise. It's this combination of tax benefits and investment potential that makes the HSA a cornerstone for both today's health needs and tomorrow's financial security.

Comparing the Core Features of HRAs and HSAs

At a glance, an HRA and an HSA might seem like two sides of the same coin—both help you pay for healthcare. But when you look closer, you realize they’re entirely different tools, built for different purposes. Understanding how they actually work is the key to figuring out which one makes sense for your life and your wallet.

The first big difference? Who puts in the money. An HRA is funded 100% by your employer. It’s a pure company benefit. An HSA, on the other hand, is a team effort—you, your employer, or even a family member can contribute.

Funding and Contribution Dynamics

Think of an HRA as a promise from your employer, not a bank account. They set aside a certain amount for you each year, but you only get the money after you’ve paid for a medical expense and submitted a claim for reimbursement. If you don't use it all, the leftover funds stay with the company. It’s a direct way for them to manage benefit costs.

HSAs are the complete opposite. The money goes into a real, interest-bearing account that you own. Both you and your employer can add funds up to the annual IRS limits. For 2025, that’s $4,300 for an individual and $8,550 for a family. This setup isn't just about reimbursing—it's about actively saving.

Ownership and Portability

This is where the two accounts really part ways, and it's a huge deal. An HRA belongs to your employer. It’s tied directly to your job. If you leave, that money is almost always gone. It’s a temporary perk for as long as you work there.

An HSA is your personal property. The account and every dollar in it belong to you, forever. It doesn't matter if you switch jobs, retire, or start your own business—that money follows you. This portability turns the HSA from a simple benefit into a lifelong financial asset.

The core distinction boils down to this: An HRA is a benefit you use, while an HSA is an asset you own. This ownership principle dictates everything from who controls the funds to what happens when you change jobs.

To open an HSA, you need to be enrolled in a specific kind of insurance plan. You can learn more about what qualifies as a high-deductible health plan in our detailed guide. This isn’t a random rule; it’s by design. The HSA is meant to work alongside a lower-premium plan, creating a powerful one-two punch for managing costs.

To make these distinctions even clearer, here’s a simple side-by-side comparison:

Feature-by-Feature Breakdown: HRA vs. HSA

| Attribute | Health Reimbursement Arrangement (HRA) | Health Savings Account (HSA) |

|---|---|---|

| Who Owns It? | The employer. You lose it if you leave your job. | You. The account is yours forever. |

| Who Funds It? | 100% employer-funded. | You, your employer, or family can contribute. |

| Contribution Limits | Set by the employer; no federal limit. | IRS sets annual limits ($4,300 self, $8,550 family for 2025). |

| Tax Benefits | Reimbursements are tax-free for employees. | Triple-tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals. |

| Investment Option? | No. It's strictly a reimbursement account. | Yes. Funds can be invested like a 401(k). |

| Rolls Over? | Depends on the employer's plan design. | Yes, the full balance rolls over year after year. |

| Portability | No. It's tied to your current employer. | Yes. It follows you from job to job and into retirement. |

| Insurance Required | Works with any employer-offered group plan. | Must be paired with a qualified High-Deductible Health Plan (HDHP). |

This table shows just how different these accounts are in practice—one is a short-term company perk, while the other is a long-term personal asset.

Tax Treatment for Employees and Employers

Both accounts offer great tax perks, but they deliver them in very different ways.

With an HRA, any money you get back for medical costs is 100% tax-free. Simple and effective. For your employer, their contributions are a tax-deductible business expense.

The HSA, however, is famous for its “triple-tax advantage,” which is a game-changer for personal finance:

- Tax-Deductible Contributions: The money you put in lowers your taxable income for the year.

- Tax-Free Growth: Your balance grows from interest or investments without being taxed.

- Tax-Free Withdrawals: You can pull money out for qualified medical expenses at any time, completely tax-free.

This triple-play makes the HSA one of the most powerful savings tools available, period.

Using Your Funds for Qualified Expenses

You can use both HRA and HSA funds for a huge list of IRS-approved medical costs, from doctor visits and prescriptions to dental and vision care. But there’s a key difference when it comes to paying for health insurance itself.

HSAs generally cannot be used to pay for your regular health insurance premiums. An HRA, however, can be much more flexible. Certain types, like the Individual Coverage HRA (ICHRA), are specifically designed to reimburse you for the cost of your own health plan.

Investment Potential: The Ultimate Game Changer

Here, it's not even a fair fight. An HRA has zero investment potential. It's just a reimbursement setup—like a company expense account for your health. There’s no balance to manage or grow.

An HSA, however, is like a 401(k) for your healthcare. Once your balance hits a certain amount (often around $1,000), you can invest your money in mutual funds, stocks, and other assets. This feature completely transforms the HSA from a simple spending account into a powerful tool for building wealth that can grow for decades, supporting you long into retirement.

Which Account Is Right for You? Real-World Scenarios

Deciding between an HRA and an HSA isn't just about comparing features on a spreadsheet. It’s about fitting the right tool to your life. The best choice really hinges on your job, your health, your family's needs, and where you're headed financially.

Let's walk through a few real-world examples. Seeing how these accounts work for different people can help you figure out which path makes the most sense for you.

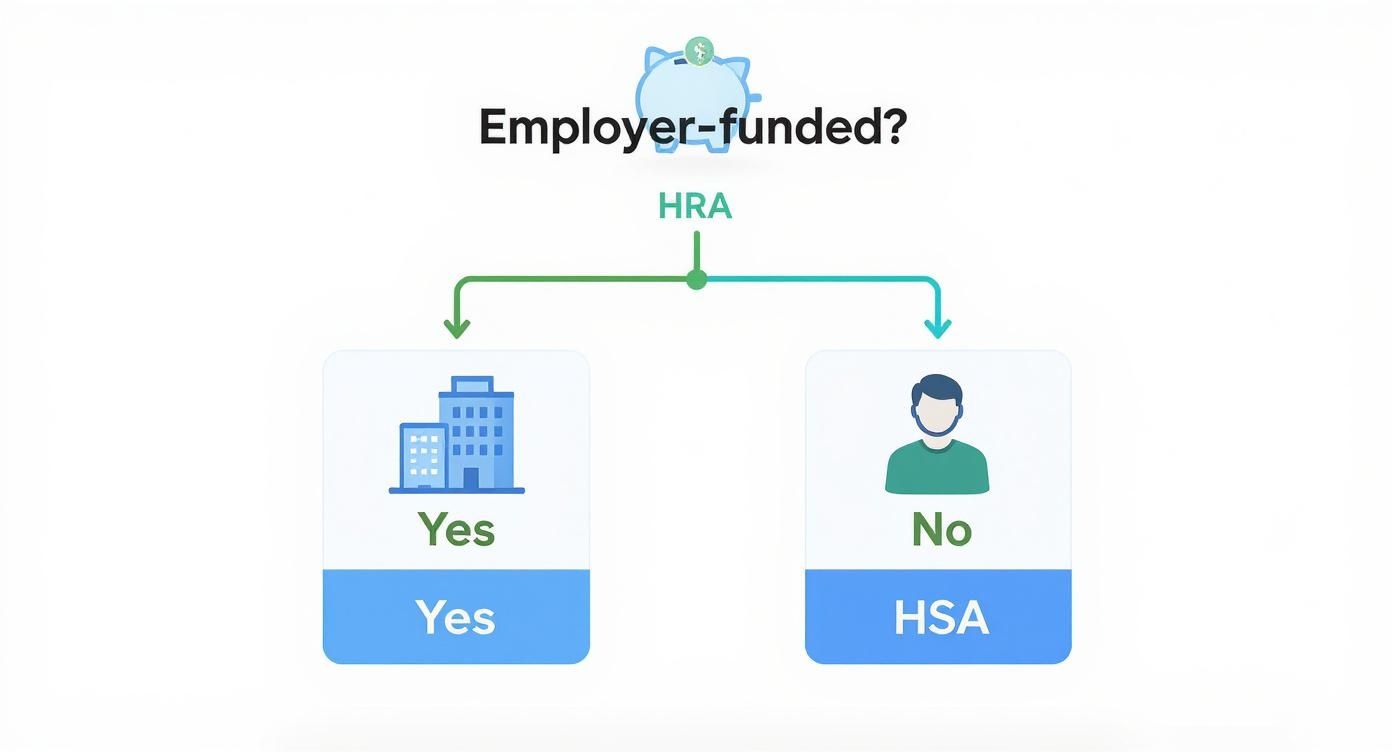

To get started, this decision tree boils it down to the most fundamental question: who is funding the account?

As you can see, if the account is entirely funded by your employer, you’re in HRA territory. If it's an account you own and contribute to, you’re looking at an HSA.

The Small Business Owner Offering Benefits

Meet Sarah. She runs a graphic design agency with 12 employees and wants to offer health benefits to keep her team happy and attract new talent. But the unpredictable costs of a traditional group plan are just too much for her budget.

For her, a Qualified Small Employer HRA (QSEHRA) is a game-changer.

A QSEHRA lets Sarah set a fixed, predictable amount for health benefits each year. She can offer a solid allowance that her employees can use to buy their own health insurance or pay for medical expenses, completely tax-free.

For a small business, an HRA provides budget stability and a competitive edge without the administrative headache of a group plan. It’s a win-win, giving employees flexibility while the owner keeps total control over costs.

This gives her team the freedom to pick plans that work for their individual lives—a huge perk. Sarah gets to sidestep the complexity and rising premiums of group insurance, making the QSEHRA the perfect way to start offering great benefits.

The Healthy Young Professional Building Wealth

Now, let's look at Alex, a 28-year-old software developer. He's healthy, rarely sees a doctor, and his employer offers a High-Deductible Health Plan (HDHP) paired with an HSA. He's smart about it and maxes out his contributions every year.

Alex isn't just thinking about today's copays; he's playing the long game. He’s using his HSA as a powerful investment vehicle. After setting aside a small cash buffer for minor medical needs, he invests the rest of his HSA funds in low-cost index funds.

Thanks to the HSA's triple-tax advantage—tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses—his account is growing way faster than a normal investment account. For him, the HSA isn't just a health account; it's a secret retirement fund.

The Family with Predictable Medical Costs

Next up is the Miller family. With two young kids, they have a steady stream of pediatrician visits, urgent care trips, and asthma medication to pay for. Their employer provides a good group health plan, but the deductible and copays still add up fast.

Their company also offers a Group Coverage HRA (GCHRA) that works with their health plan. This HRA gives them $2,000 a year to help with out-of-pocket costs.

For the Millers, that GCHRA is a financial lifesaver. It bridges the gap between what their insurance covers and what they actually spend, reimbursing them for the copays and prescriptions they know are coming. The HRA makes their high-quality plan truly affordable for their family's budget.

The Freelancer Managing Their Own Healthcare

Finally, there’s Maria, a freelance writer who manages her own health insurance and retirement. She bought an HDHP on the marketplace and immediately opened an HSA. For anyone who's self-employed, this combo is a brilliant financial move.

Maria's income can be unpredictable, so the HSA's flexibility is everything. When she has a great month, she contributes more. When things are tight, she can scale back. The tax deduction she gets from her contributions is a huge win, as it directly lowers her taxable income. If you're a freelancer looking for similar strategies, our guide on healthcare for the self-employed offers more great insights.

Her HSA is her personal safety net for medical bills, but it’s also another pillar of her retirement plan. It gives her the control and portability she needs as an independent worker, ensuring her health savings go wherever her career takes her.

Putting Your Plan into Action

Knowing the difference between an HRA and an HSA is one thing. Actually putting that knowledge to work for your wallet is the real goal.

Whether you're an employer looking to design a great benefits package or an employee ready to open an account, the next steps are surprisingly simple once you have a clear plan.

For Employers: Setting Up an HRA

Implementing an HRA starts with a few key decisions. First, you have to choose the right type of HRA for your company—like a QSEHRA if you're a small business or an ICHRA if you want more flexibility. After that, you'll want to partner with an HRA administrator to handle the legal documents and make sure everything stays compliant.

Once you have an administrator on board, the fun part begins: designing the plan.

- Set the Allowance: Decide how much you'll reimburse each employee every year. This is your biggest lever for budget control.

- Define Eligible Expenses: Will the HRA just cover insurance premiums? Or will it also help with deductibles, copays, and dental visits? You decide.

- Communicate Clearly: Roll out the new benefit with simple, clear instructions. Your team needs to know exactly how to submit claims and get reimbursed so they can actually use and appreciate their new benefit.

For Employees: Making the Most of Your HSA

If you're an employee, getting your HSA started means picking a provider. Your employer might have a preferred partner, but you’re free to open an HSA at most banks or investment firms.

With your account open, it's time to put it to work. The easiest way to save is by setting up automatic contributions straight from your paycheck. It's a "set it and forget it" strategy that builds your balance without you having to think about it.

Once your balance grows, keep an eye on the investment threshold, which is usually around $1,000. Investing your HSA funds is the secret to unlocking its powerful long-term growth potential.

Staying organized is non-negotiable when managing an HRA or HSA. Check out some effective methods for organizing business receipts to make sure you can always back up your claims and withdrawals without any headaches.

Finally, stay on top of important deadlines. Understanding what open enrollment means and when it happens is critical for making smart, timely decisions about your health plan and HSA contributions for the year ahead. Taking these steps will move you from just knowing the difference between an HRA and HSA to truly benefiting from the account you choose.

Answering Your Top HRA and HSA Questions

When it comes to HRAs and HSAs, the details can feel a bit tangled. But getting clear, straightforward answers is key to using these accounts with confidence. Let's tackle some of the most common questions people ask.

Can I Have Both an HRA and an HSA at the Same Time?

This is one of the biggest points of confusion, and the short answer is: it depends. Generally, having a standard HRA that covers a wide range of medical bills will make you ineligible to contribute to an HSA. The IRS has strict rules to prevent this kind of "double-dipping."

But there's an important exception. If your employer offers a Limited-Purpose HRA (LPHRA), you absolutely can pair it with your HSA. An LPHRA is designed to cover only specific expenses like dental and vision care. This setup leaves your HSA funds untouched and available for other qualified medical costs, keeping you fully compliant.

Portability and Ownership: Who Really Owns the Money?

What happens to your funds if you leave your job? This is where the fundamental difference between an HRA and an HSA really shines through. It's a game-changer.

An HRA is owned and funded by your employer. Think of it as a benefit tied directly to your current job. If you leave the company, you almost always lose access to any money left in the account. It’s not a personal asset you can take with you.

On the other hand, an HSA is 100% yours and completely portable. The account and every dollar in it belong to you, no matter where you work. You can take your HSA from job to job, and even into retirement. Your health savings are always under your control.

The rule of thumb is simple: HRA funds are a temporary benefit tied to your employer, while HSA funds are a permanent asset you own for life. This distinction is crucial for long-term financial planning.

If you're choosing an HSA provider, make sure to compare their fees, investment options, and how easy their platform is to use. Look for low monthly maintenance fees and a good variety of low-cost investment funds to really maximize your long-term growth.

Navigating your health benefit options can be complex, but you don't have to do it alone. The experts at My Policy Quote are here to help you find the perfect insurance plan to pair with your HRA or HSA. Find your ideal health plan today!