Figuring out if you qualify for Medicaid comes down to a few key things: your Modified Adjusted Gross Income (MAGI), how many people are in your household, your age, and whether you have a disability.

Since Medicaid is a team effort between the federal government and each state, the exact rules can look a little different depending on where you call home. The whole process is basically about matching your personal and financial situation to the guidelines your state has set.

Breaking Down Medicaid Eligibility Basics

Medicaid is a lifeline, a public health program designed to cover millions of Americans. It’s not just for one type of person; it helps low-income adults, kids, pregnant women, seniors, and people with disabilities get the care they need.

As of early 2025, Medicaid was covering around 71.4 million people. That number alone shows just how vital it is to the country's healthcare fabric.

It’s important to remember that Medicaid isn't a private insurance plan you buy. It’s a public benefit. To really get a handle on how it works, it can be helpful to understand some general insurance concepts first. This context makes it clearer why the application process is so thorough—it’s designed to make sure the program helps the people it was created for.

Core Qualification Factors

Qualifying for Medicaid isn't a one-size-fits-all thing. Your application is reviewed based on a mix of factors, not just one.

Here’s what they’ll look at:

- Your Income: How much you earn is the biggest piece of the puzzle. It’s measured against the Federal Poverty Level (FPL).

- Your Household Size: The more people you have in your family, the higher the income limit. It’s just common sense—supporting more people costs more.

- Special Categories: Sometimes, you can qualify based on your situation, like if you're pregnant, a child, or a senior. These groups often have different rules.

- Where You Live: Every state runs its own Medicaid program. Some states expanded their programs, which means their income rules might be more flexible than others.

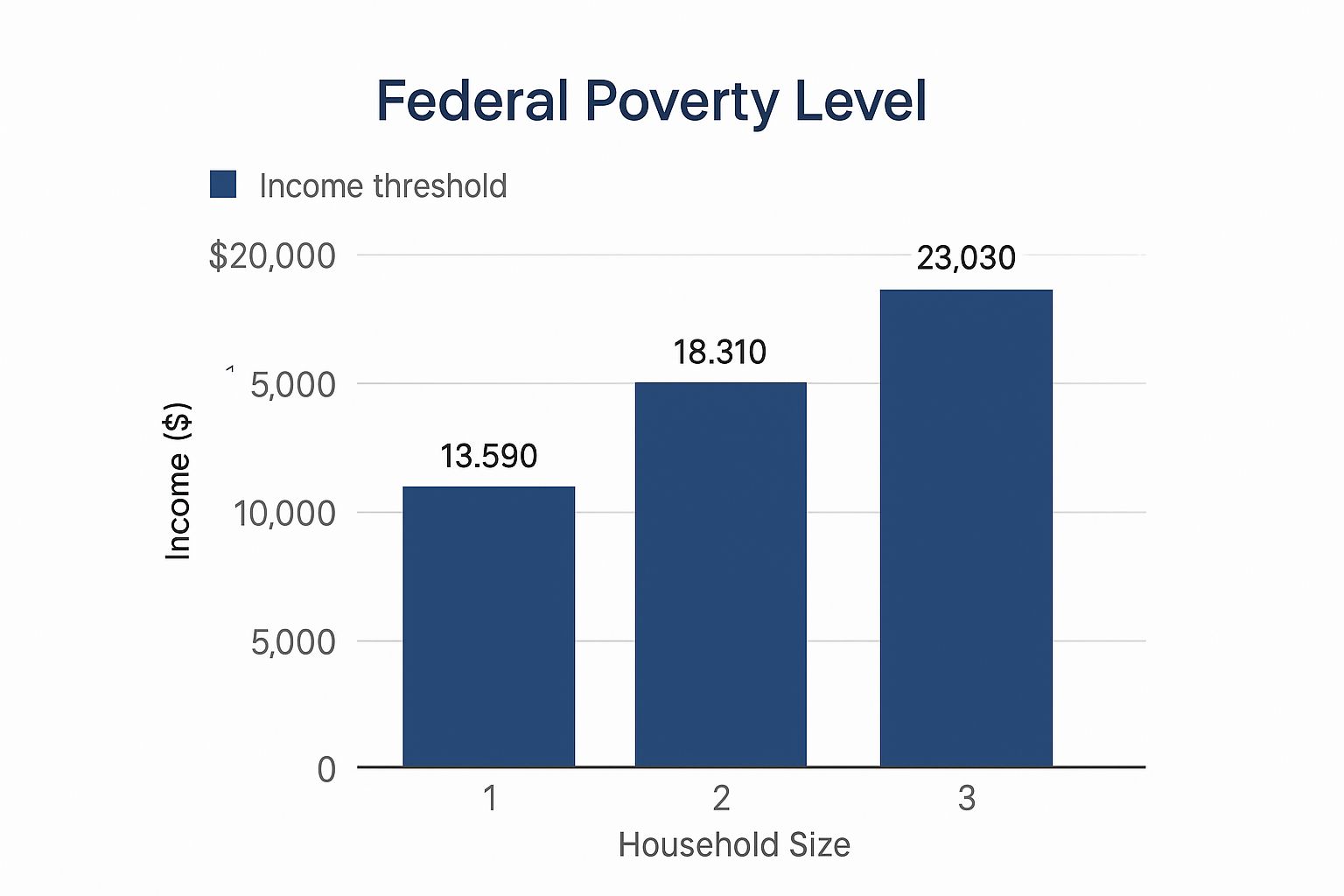

This chart gives you a good visual of the annual income thresholds based on the Federal Poverty Level for different family sizes.

As you can see, the income limit goes up with each person in the household to account for the reality of family expenses. If your income is a bit too high to qualify, don't lose hope. There are other low-cost health insurance options out there that could be the perfect fit for you.

Understanding Medicaid's Financial Rules

Let's be honest: the financial side of Medicaid is where most people get stuck. It can feel confusing, but once you understand the core concepts, it becomes much clearer. The key term you’ll hear over and over is Modified Adjusted Gross Income, or MAGI.

Think of MAGI as the specific lens Medicaid uses to look at your household income. It’s not just your take-home pay; it’s a standardized formula that includes most of your taxable income sources but also accounts for certain deductions. This ensures everyone—from pregnant women to low-income adults—is evaluated fairly.

What Counts as Income for Medicaid

First things first, we need to figure out what money Medicaid actually looks at. For the most part, they’re interested in your taxable income, but there are some critical exceptions to know.

Typically, your countable income will include:

- Wages, salaries, and tips you earn from a job.

- Net income from any freelance work or a small business.

- Money from unemployment compensation or Social Security benefits.

- Pensions, retirement income, and any alimony you receive.

On the flip side, some money is often excluded from the calculation. Things like child support payments, most veteran’s benefits, and Supplemental Security Income (SSI) usually don't count toward your limit.

If your hours and paychecks change month to month, don't worry—there are specific ways to calculate an average income. If you're navigating variable earnings, our guide on health insurance for low income workers offers some extra strategies.

The Role of Household Size

Your income is never looked at in a vacuum. It’s always weighed against the number of people in your household. Defining your "household" for Medicaid can be a little tricky, but it usually means the person filing taxes, their spouse, and any dependents they claim.

Here’s a real-world example: Imagine you're a single mom with one child, working part-time. Your household size is two. Medicaid will compare your total income to the Federal Poverty Level (FPL) for a two-person household in your state. In a state that expanded Medicaid, if your income is at or below 138% of the FPL, you’ll likely be approved.

Key Takeaway: It’s not just about how much you make. It’s about how that income stacks up against the cost of supporting your family. A bigger household gets a higher income limit.

Medicaid Income Limits vs Federal Poverty Level (FPL) Examples

Because states have flexibility, income limits can vary quite a bit. The table below gives you a general idea of how your household size relates to income thresholds in states that did and did not expand Medicaid.

| Household Size | 100% FPL (Annual Income) | 138% FPL (Medicaid Limit in Expansion States) | Typical Limit in Non-Expansion States (Example) |

|---|---|---|---|

| 1 | $15,060 | $20,783 | Varies widely, often much lower |

| 2 | $20,440 | $28,207 | Varies widely, often much lower |

| 3 | $25,820 | $35,632 | Varies widely, often much lower |

| 4 | $31,200 | $43,056 | Varies widely, often much lower |

Note: These figures are based on 2024 FPL guidelines and are for illustrative purposes. Always check your state's specific limits.

As you can see, where you live makes a huge difference. As of mid-2025, these thresholds change based on age, marital status, and whether you need services like long-term care.

When Assets Come into Play

Here’s some good news. For most people applying for Medicaid under the MAGI rules—like adults under 65—there is no asset limit. That means the money in your bank account, the car you drive, or the home you own won't disqualify you.

However, the rules are different for other groups. If you're applying for Medicaid because you are 65 or older, blind, or have a disability, your assets will be counted. These "non-MAGI" pathways have very strict limits on things like cash, stocks, bonds, and any property besides your primary home.

Even if you find yourself just over the income or asset limit, don't give up hope. You may be able to use a strategy involving Medicaid spend down rules, which allows you to subtract medical bills from your income to help you qualify.

More Than Just Your Paycheck: Other Ways to Qualify for Medicaid

While your income is a huge piece of the puzzle, qualifying for Medicaid isn't always about the numbers on your bank statement. For many people, the door to coverage opens through what are called "non-financial pathways."

This just means that your age, health, or family situation can make you eligible, even if your income doesn't perfectly match the standard limits. These pathways exist for a reason—Medicaid was built to protect some of our most vulnerable neighbors, recognizing that certain life events create a much greater need for solid healthcare.

Who Are the Key Eligibility Groups?

Beyond the income rules expanded by the Affordable Care Act (ACA), Medicaid has several long-standing eligibility categories. You might fit into one of these groups, and they often come with their own unique guidelines.

Here are the most common non-financial categories:

- Pregnant Women: States often provide Medicaid to pregnant individuals at income levels well above the standard limits. This ensures access to the prenatal and postnatal care that’s so critical for a healthy start.

- Children: Between the Children’s Health Insurance Program (CHIP) and Medicaid, nearly 40% of all children in the U.S. get their health coverage. The income limits are intentionally higher to help support working families.

- Seniors (Aged 65 or Older): Many seniors who are on Medicare also rely on Medicaid. It helps cover the significant costs that Medicare doesn't, like long-term nursing home care.

- Adults with Disabilities: If you receive Supplemental Security Income (SSI), you're often automatically eligible for Medicaid. Others can qualify by meeting their state's definition of disability.

Think about it this way: a pregnant woman in a family that earns a bit too much for standard Medicaid might still get coverage for her entire pregnancy and for a while after giving birth. It’s a safety net designed to protect both mother and baby.

Similarly, understanding the specific health insurance options for people with disabilities can uncover unique paths to eligibility you might not have known existed.

How the ACA Changed Everything with Medicaid Expansion

The Affordable Care Act was a game-changer, especially for low-income adults. Before the ACA, most states wouldn't give Medicaid to an adult without children or a qualifying disability, no matter how little they earned.

Medicaid expansion fixed that by creating a whole new eligibility group: adults under age 65 with incomes up to 138% of the Federal Poverty Level.

As of early 2025, the vast majority of states have adopted Medicaid expansion. This one decision has thrown a critical lifeline to millions of working adults who used to be stuck in a coverage gap—they earned too much for traditional Medicaid but not nearly enough to afford a private plan.

If you live in a state that expanded Medicaid, the process is often much simpler. Your eligibility is based almost entirely on your income and household size, cutting through a lot of the old red tape.

The Ground Rules: Citizenship and Residency

Finally, there are a couple of requirements that apply to everyone, no matter how you qualify. These are the non-negotiables.

To get Medicaid, you must be:

- A resident of the state where you’re applying for coverage.

- A U.S. citizen or a lawfully present immigrant who meets certain rules.

For many lawfully present immigrants, like green card holders, there’s often a five-year waiting period after getting their qualified immigration status before they can enroll in Medicaid. However, there are important exceptions. This waiting period might not apply to refugees or asylees. In some states, pregnant women and children who are lawfully residing can also be exempt from the wait.

How to Prepare Your Medicaid Application

Knowing you probably qualify for Medicaid is a huge weight off your shoulders. But now comes the most important part: putting together an application that’s clear, complete, and easy to approve. Think of it this way—the easier you make it for the state agency to verify your info, the faster you’ll get that approval notice.

First things first, you need to track down the official application. This part is a little different for everyone, since it depends on your state. Some states run their applications through the federal Health Insurance Marketplace at HealthCare.gov. Others will have you apply directly on their own state Medicaid agency website.

A quick search for “[Your State] Medicaid application” is usually the fastest way to get to the right place.

Assembling Your Essential Documents

This is the single most important thing you can do to make the process smooth. Trust me, scrambling to find a missing pay stub or birth certificate while you’re in the middle of filling out forms is a recipe for stress and mistakes. Get everything together before you start.

You’ll need to provide proof for a few key areas of your life. While the exact list can shift a bit from state to state, here are the core documents you should have ready to go:

- Proof of Identity: A driver’s license, state ID card, or passport usually works perfectly.

- Proof of Citizenship/Immigration Status: This could be a U.S. birth certificate, naturalization papers, or other valid immigration documents.

- Proof of Residence: Grab a recent utility bill, your lease agreement, or a bank statement showing your current address.

- Proof of Income: Recent pay stubs, W-2 forms, or last year's tax return will do the trick.

- Social Security Numbers (SSNs): You’ll need the SSN for every single person in your household who is applying for coverage.

Want a deeper dive into why these documents are so critical? Our guide on the documents you need to get insurance breaks it all down for you.

To make this even easier, I've put together a quick checklist you can use as you gather your paperwork.

Essential Documentation Checklist for Your Medicaid Application

Having everything organized in one place before you begin can save you a massive headache. Here’s a simple table to guide you.

| Document Category | Examples of Required Documents | Pro Tip |

|---|---|---|

| Identity & Citizenship | Driver's License, State ID, Birth Certificate, Passport | Keep these important documents in a secure folder, both physically and digitally. |

| Residency | Utility Bill (gas, electric), Lease Agreement, Mortgage Statement | Use a bill from the last 30-60 days to ensure it's considered current by the agency. |

| Income | Pay Stubs (last 30 days), W-2 Form, Recent Tax Return | If your income fluctuates, gather several months of pay stubs to show a realistic average. |

| Household Information | Social Security Cards, Birth Certificates for all applicants | Double-check that all names and numbers are an exact match to what's on the official cards. |

| Assets (If Applicable) | Bank Statements, Vehicle Titles, Property Deeds | This is more common for seniors or those with disabilities. Not all Medicaid programs count all assets. |

Getting these items ready ahead of time is the best way to ensure your application moves through the system without any unnecessary hiccups.

Avoiding Common Application Pitfalls

So many applications get delayed or denied because of simple, honest mistakes. Knowing what they are ahead of time can help you sail right past them.

One of the biggest trip-ups is misreporting your household size. For Medicaid, "household" has a very specific tax-based definition—it's usually the person filing taxes, their spouse, and anyone they claim as a tax dependent. It’s not necessarily everyone living under your roof.

Another frequent problem is guesstimating your income, especially if your hours change week to week. Don't guess. Use your recent pay stubs to calculate a solid monthly average. Underestimating could lead to a denial, and overestimating might make you look ineligible when you actually qualify. Be precise.

What Happens After You Apply

Once you hit that "submit" button, your application goes into a verification phase. The state agency cross-references the information you provided with various state and federal databases, which is why accuracy is so non-negotiable.

So, how long does it take? It really varies. If your situation is straightforward and all your info is verified electronically without a hitch, you might get a decision in just a few days.

However, for more complex cases—like if you're applying based on a disability—it can take anywhere from 45 to 90 days. You’ll get an official notice in the mail or in your online portal with the final decision.

Navigating State Work Requirements

In some states, there’s another layer to keeping your Medicaid coverage: work requirements. This rule means certain adults have to spend a set number of hours each month on approved activities to stay insured. It can sound a little intimidating, but getting familiar with the rules is the best way to stay ahead of the game.

The goal behind these policies is to encourage employment, but for many people just trying to figure out how to qualify for Medicaid, it’s a major new hurdle.

A big federal policy shift is bringing this issue front and center. Starting in July 2025, a new rule kicks in for people aged 19 to 64 who are part of the ACA Medicaid expansion. They’ll need to participate in work, education, or community service to maintain their benefits. While it’s meant to boost workforce participation, it also creates new challenges for beneficiaries. You can learn more about the specifics of these national Medicaid work requirements to see exactly how they might affect you.

Who Is Typically Affected

The good news? These rules don’t apply to everyone on Medicaid. States that have them usually focus on a specific group: able-bodied adults under the age of 65 who don’t have dependent children.

Important Note: If you're the main caregiver for a young child, are pregnant, or have a disability that keeps you from working, you are almost always exempt. The system is not designed to create hardship but to connect those who can work with qualifying activities.

The exact age range and hours can differ by state, but a common benchmark is around 80 hours per month spent on approved tasks.

What Counts as a Qualifying Activity

"Work requirements" sounds a lot narrower than it actually is. It doesn’t just mean you need a traditional 9-to-5 job. States usually allow a whole range of activities to count toward your monthly hours, which gives you more flexibility.

Here’s a look at what often qualifies:

- Employment: This covers both full-time and part-time jobs.

- Education: Taking classes at a college or vocational school usually counts.

- Job Training: Participating in a skills program is another great way to meet the requirement.

- Community Service: Volunteering your time at an approved non-profit is a very common option.

The most important thing is to track your hours perfectly. Your state will have a system for reporting your activities each month, so keeping a detailed log is absolutely essential. Think of it like a timesheet for your eligibility—if it’s accurate and consistent, you’ll avoid any hiccups in your healthcare coverage. Always, always check your state's specific list of approved activities and find out their exact reporting procedures.

A Few Common Questions About Medicaid

As you get deeper into the Medicaid process, you’re bound to have questions pop up. It’s completely normal. Let's walk through some of the most common ones we hear. Getting these cleared up can remove some serious roadblocks and give you the confidence to keep going.

Can I Qualify If I Own a Home or a Car?

This is a huge source of anxiety for so many people, but the answer is usually a relief. If you're qualifying based on your income under the Affordable Care Act (ACA) rules, there’s typically no asset limit.

That means your primary home and one vehicle are almost always considered exempt. They won't be counted against you.

But the rules can shift if you're applying because you're 65 or older, or you have a disability and need long-term care. In those situations, asset limits are much stricter. Your home might still be exempt up to a certain value, but other things like extra properties or large savings accounts could be an issue. Always, always double-check your state's specific guidelines for these programs.

What Happens If My Income Changes?

Life happens, and income isn't always stable. If you're on Medicaid and your income changes, you absolutely must report it to your state agency. Most states require you to do this within 10 to 30 days.

If your income goes up and you're no longer eligible for Medicaid, don't panic. This change actually triggers a Special Enrollment Period. It opens a window for you to sign up for a new health plan on the Health Insurance Marketplace, where you'll likely qualify for subsidies to lower your monthly premium.

Key Takeaway: An income increase doesn't leave you stranded without coverage. It's simply a transition from Medicaid to another affordable insurance option.

What Should I Do If My Application Is Denied?

Getting a denial notice is tough. It can feel incredibly discouraging, but it’s not the final word. The very first thing you need to do is read that notice carefully. It will tell you exactly why you were denied.

You have a legal right to appeal the decision. The letter itself will explain how to file an appeal and the deadline to do it. It's so important to act fast. You can represent yourself, or you can often get free help from a local legal aid organization. Gather any new documents that support your case—like recent pay stubs or proof of your household size—to make your appeal as strong as possible.

How Long Does the Application Process Take?

Honestly, the timeline can be all over the place. It really varies from state to state. If your case is straightforward and your details can be verified electronically, you might get an approval in just a few days.

On the other hand, if your situation is more complex—say, you're applying based on a disability—it will take longer. You're probably looking at a timeline between 45 and 90 days. The single best thing you can do to speed things up is to submit a perfect application from the get-go, with every single required document included.

Navigating healthcare options can be complex, but you don't have to do it alone. At My Policy Quote, we specialize in helping people find the right coverage for their needs and budget. Explore your options today.