For most Americans, the magic number for Medicare eligibility is 65. Think of it as a major life milestone, right up there with getting your driver's license or buying your first home. It’s the age when health coverage often shifts, tying in with retirement plans and Social Security benefits.

The Milestone Birthday: What Age Does Medicare Start?

So, why 65? It’s not just an arbitrary number. This threshold was set way back in 1965, intentionally linked to the Social Security retirement age at the time. The whole idea was to create a smooth, logical transition, ensuring older Americans had a reliable healthcare safety net as they left the workforce.

Today, that foundation is still a core part of our healthcare system. The numbers speak for themselves. Of Medicare's 67.7 million enrollees, a staggering 90% are age 65 or older. That’s nearly 61 million Americans in this age group who count on Medicare for their primary health coverage. You can dig deeper into Medicare age statistics to see just how massive this program really is.

Automatic Enrollment vs. Taking Action

Now, here’s where things can get a little tricky. How you actually get enrolled isn't the same for everyone, and knowing the difference is key to avoiding penalties or a dreaded gap in your coverage.

-

Automatic Enrollment: If you're already getting Social Security or Railroad Retirement Board (RRB) benefits at least four months before your 65th birthday, you can relax. You’ll be automatically enrolled in Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). Your red, white, and blue Medicare card will just show up in your mailbox—no action needed.

-

Manual Enrollment: Still working and haven't started taking retirement benefits yet? Then the ball is in your court. You will need to actively sign up for Medicare yourself during your specific enrollment window.

To make this easier to digest, here's a quick breakdown of who needs to do what.

Quick Guide to Medicare Eligibility at Age 65

This table simplifies the most common scenarios for people turning 65.

| Scenario | Eligibility Status | Enrollment Action Needed |

|---|---|---|

| Receiving Social Security or RRB benefits 4+ months before turning 65. | Eligible | None. Enrollment is automatic for Part A and Part B. Your card will arrive by mail. |

| Not receiving Social Security or RRB benefits (e.g., still working). | Eligible | Yes. You must manually enroll during your Initial Enrollment Period to avoid penalties. |

| Have group health coverage from a current employer (or spouse's employer). | Eligible | Maybe. You have options. You might delay Part B to avoid paying the premium. |

| Live in Puerto Rico and receiving Social Security benefits. | Eligible | Partial Automatic. You get Part A automatically but must sign up for Part B. |

Remember, this is just a starting point. Your personal situation dictates the right move.

The most important thing to remember is this: Don't just assume you're covered because your birthday is coming up. If those Social Security checks aren't hitting your bank account yet, the responsibility to sign up for Medicare is yours.

Ignoring this can lead to lifelong penalties and a stressful scramble to get coverage later. Knowing which camp you're in is the first—and most critical—step to a smooth transition into Medicare.

Qualifying for Medicare Before Age 65

Most people think of 65 as the magic number for Medicare. It’s the birthday that opens the door to health coverage for millions of seniors. But what if you’re facing a serious health condition long before then?

It’s a common myth that you have to wait. The truth is, Medicare was designed with a critical safety net for younger Americans who are seriously ill or disabled. It’s not a loophole—it’s a lifeline for those who need it most.

Understanding these exceptions is especially important if a medical condition keeps you from working. The main path to getting Medicare early is through Social Security Disability Insurance (SSDI).

Qualifying Through Disability

If you're approved for SSDI, you’re automatically enrolled in Medicare Parts A and B after a 24-month waiting period.

This is a crucial detail. The clock starts ticking from the month you’re entitled to your disability benefits, not necessarily from the day your disability began. So, if your SSDI benefits kicked in during June 2023, you could expect your Medicare coverage to start in June 2025.

That two-year gap can feel like an eternity when you need care. It’s essential to have a plan for that time. Our guide on securing health insurance before Medicare walks you through practical steps to stay covered. And if you're exploring options outside of disability, like preparing for early retirement, managing finances is just as key.

The 24-month waiting period for disability recipients is a key detail. Many people are surprised by this delay, so planning ahead for interim health coverage is absolutely essential to avoid a lapse in care.

Fast-Track Eligibility for Specific Conditions

For a few severe medical conditions, the wait is over before it begins. Medicare waives the 24-month waiting period, recognizing that some health challenges are too urgent to delay.

Two specific diagnoses grant this fast-track eligibility:

- Amyotrophic Lateral Sclerosis (ALS): Also known as Lou Gehrig's disease, an ALS diagnosis qualifies you for Medicare the very same month your SSDI benefits begin. There’s no waiting, giving you immediate access to the care you need.

- End-Stage Renal Disease (ESRD): This is permanent kidney failure that requires regular dialysis or a kidney transplant. For ESRD, Medicare typically starts on the first day of your fourth month of dialysis. It can begin even sooner if you’re in a home dialysis training program.

These exceptions reveal something fundamental about Medicare: while age is the main ticket in, urgent medical need is just as powerful.

The numbers tell the same story. Beneficiaries under 65 have more complex and costly health needs. In 2021, this group made up just 12.5% of everyone on Medicare but accounted for 17.4% of the program's total spending. The average cost per person was $20,885—a huge jump from the $12,230 spent on those aged 65–74. It’s a clear sign of the vital role Medicare plays for those facing significant health battles.

Navigating Your Medicare Enrollment Window

Knowing the magic number is 65 is just the first step. The real test is knowing exactly when to sign up. This isn't like forgetting to renew a magazine subscription; missing your personal deadline can lead to lifelong financial penalties and scary gaps in your health coverage.

Think of it as your one-time pass to get on board. This period is called your Initial Enrollment Period (IEP). It’s a seven-month window perfectly centered around your 65th birthday. It kicks off three months before the month you turn 65, includes your birthday month, and runs for three months after.

For example, if your birthday is in July, your IEP window is open from April 1 all the way to October 31. This is your golden opportunity to enroll without any headaches. Nailing this timeframe ensures your coverage starts right on time and you dodge any late fees.

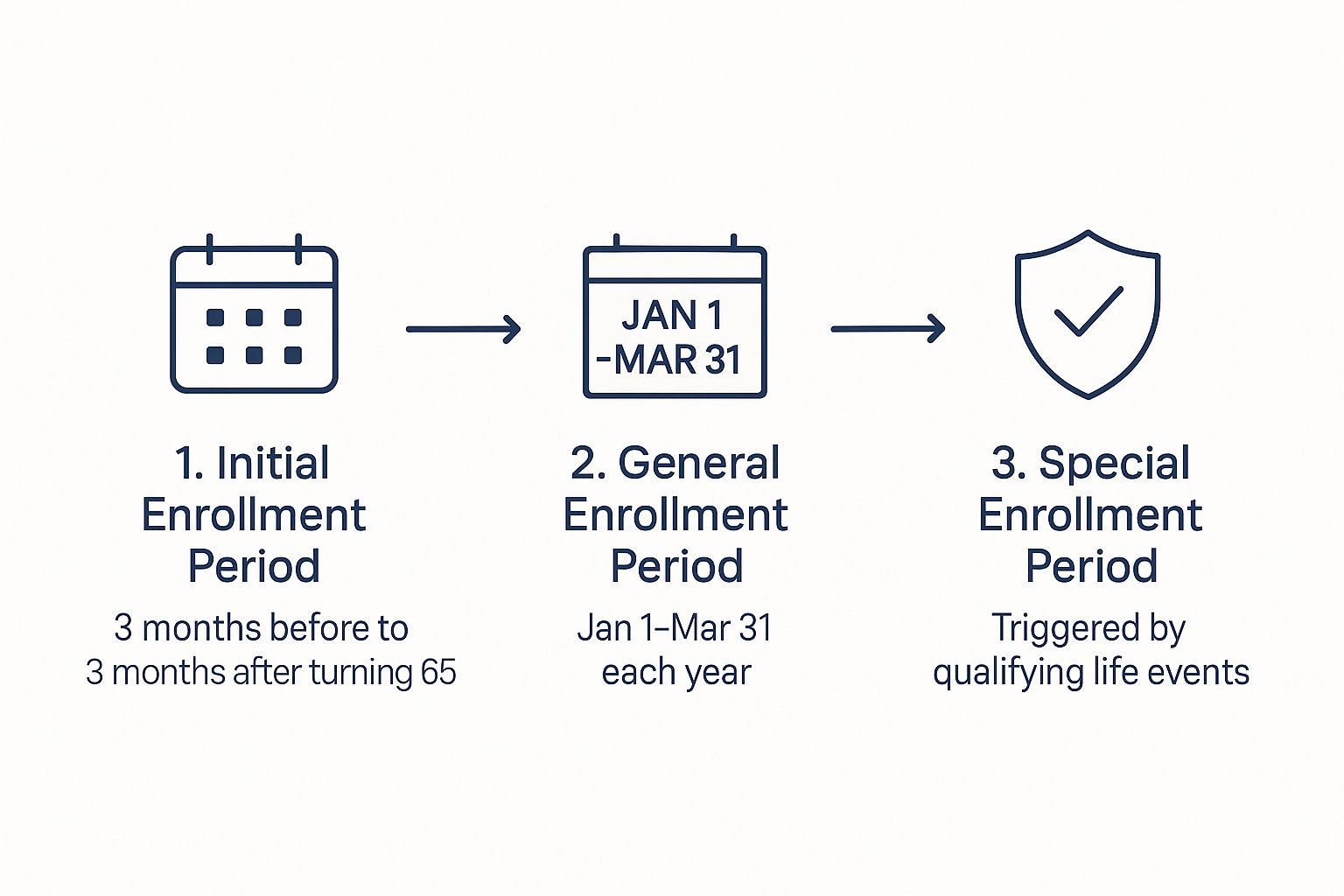

As you can see, your first shot—the Initial Enrollment Period—is the most straightforward path. The other periods are important safety nets, but they’re designed for very specific situations.

Medicare enrollment can feel like a maze of acronyms and deadlines. To help clear things up, here’s a simple table breaking down the main enrollment periods.

Understanding Your Medicare Enrollment Periods

| Enrollment Period | When It Occurs | Primary Purpose |

|---|---|---|

| Initial Enrollment Period (IEP) | The 7-month window around your 65th birthday. | Your first and best opportunity to sign up for Medicare Parts A and B without penalty. |

| General Enrollment Period (GEP) | January 1 – March 31 each year. | A chance to sign up for Part B if you missed your IEP and don't qualify for an SEP. |

| Special Enrollment Period (SEP) | Varies based on life events (e.g., losing employer coverage). | Allows you to enroll outside of the standard periods without penalty due to specific circumstances. |

This table gives you a bird's-eye view, but the details for each period are what really matter for your personal timeline.

What Happens If You Miss Your Window

Life gets busy, and deadlines can slip by. If you miss your IEP and don’t have other qualifying health coverage (like from a current job), you aren't locked out of Medicare forever, but there are consequences. You’ll have to wait for the General Enrollment Period (GEP).

The GEP runs from January 1 to March 31 every year. But enrolling this way comes with two big downsides:

- Delayed Coverage: Your Part B coverage won't kick in until the month after you sign up. If you enroll in February, you'll have to wait until March 1 for your benefits to start.

- Lifelong Penalties: You will almost certainly face a late enrollment penalty. This isn't a one-time fee; it’s a permanent price hike added to your monthly Part B premium for as long as you have Medicare.

A Second Chance with Special Enrollment Periods

There's a really important exception to these strict deadlines, built for people who keep working past 65. If you (or your spouse) have health coverage from a current employer with 20 or more employees, you qualify for a Special Enrollment Period (SEP). This lets you delay signing up for Part B without getting hit with a penalty.

Your SEP gives you an eight-month window to enroll in Part B. This window starts the month after your employment ends or your group health plan coverage ends—whichever happens first. This flexibility is a game-changer for a smooth transition from your job's insurance to Medicare.

Getting these timelines right is a cornerstone of smart retirement planning. For a deeper dive into making this transition seamless, our comprehensive Medicare planning guide offers checklists and insights to make sure you're ready. A little planning now prevents big, costly mistakes down the road and gives you real peace of mind.

Decoding the Different Parts of Medicare

Once you know when you can get Medicare, the next big question is… what are you actually signing up for? It’s a common point of confusion. Medicare isn’t just one plan; it’s a system with different "Parts," each handling specific types of care.

Think of it like building your ideal healthcare coverage. Each part is a crucial component, and you can put them together in a way that makes sense for you. This "alphabet soup" of Parts A, B, C, and D is a lot less intimidating once you see how they all fit.

The Foundation and Framework: Parts A and B

At the very core is Original Medicare, the program run by the federal government. It's made up of two essential building blocks: Part A and Part B.

-

Part A (Hospital Insurance): This is the foundation of your coverage. If you’re admitted to a hospital or need care in a skilled nursing facility, Part A is what helps cover those major inpatient costs. For most people who’ve worked and paid Medicare taxes for at least 10 years, Part A comes with a $0 premium.

-

Part B (Medical Insurance): This is the framework that supports your day-to-day health. It covers things like doctor visits, outpatient care, preventive screenings, and durable medical equipment. Part B does have a monthly premium, which for most people in 2025 is $185.00.

Together, Parts A and B give you a solid base of coverage, but they don't cover everything. This is where you start customizing your plan to fill in the gaps.

Key Takeaway: Original Medicare (Parts A and B) is your starting point, covering major hospital and medical expenses. However, it leaves you with out-of-pocket costs and doesn't include prescription drug coverage.

Expanding Your Coverage: Parts C and D

To get more complete protection, you can either add to your Original Medicare foundation or choose an all-in-one alternative. These options come from private insurance companies that are approved by Medicare.

Part D (Prescription Drug Coverage): Think of this as the utility hookup for your healthcare house. Original Medicare doesn’t cover most prescription drugs you take at home. To get help paying for your medications, you’ll need to add a standalone Part D plan.

Part C (Medicare Advantage): This is like buying a bundled, all-in-one home package from a private builder. These plans combine your Part A and Part B benefits—and usually Part D drug coverage—into a single, convenient plan. Many also include extra perks not covered by Original Medicare, like dental, vision, and hearing services.

While Original Medicare paired with a supplement provides incredible protection, many people love the simplicity and extra benefits of a single Medicare Advantage plan.

To see how Medicare fits into a broader retirement strategy, especially for federal employees, this detailed federal retirement health benefits guide is a fantastic resource. Deciding which path to take is a big deal, and understanding what each part covers is the first step toward finding the best Medicare supplement plan for your health and your budget.

Is the Medicare Eligibility Age Going to Change?

While the number 65 feels like a permanent fixture in the American healthcare system, it’s not as set in stone as you might think. For years, the question of when Medicare should start has been a hot-button issue for policymakers, with frequent proposals to raise the eligibility age to 67.

The main argument for pushing it back is almost always financial. With people living longer and healthcare costs on the rise, proponents say a later start date would help keep the Medicare trust fund solvent for future generations. The logic is simple: fewer people on the program at any given time means lower costs for the government.

The Real-World Impact of a Two-Year Delay

But this debate isn’t just about numbers on a spreadsheet; it’s about real people and their health. For millions of Americans, raising the eligibility age to 67 would create a dangerous two-year gap in coverage.

Think about it. Many people plan their retirement around turning 65, the exact moment they expect to leave their employer-sponsored health insurance and seamlessly transition to Medicare. A delay would leave them scrambling to find new, often expensive, private insurance—or worse, going uninsured right when they may need care the most. This is the heart of the opposition's argument: the potential savings aren't worth the risk to public health.

This isn't just a hypothetical problem. Forcing 65- and 66-year-olds onto the private market could leave millions without affordable coverage, directly threatening their health and financial stability.

The consequences could be severe. A 2024 study projected that raising the Medicare age to 67 would leave an additional 9,646 Americans uninsured every single year. The researchers even estimated this gap could lead to thousands of preventable deaths annually due to lack of access to care. You can dive deeper into these findings in the study published by Yale University.

A Closer Look at Who Would Be Affected

The Yale study also included a powerful chart showing that a two-year delay wouldn't impact everyone equally.

As the data shows, the increase in uninsured rates would hit Hispanic and Black populations much harder than their white counterparts. This makes it clear that changing the Medicare start age isn't just a financial decision—it’s one with massive social and health equity implications. It also explains why the current age of 65 is so significant and so fiercely defended.

Frequently Asked Questions About Medicare Age

Trying to figure out Medicare can feel like learning a whole new language, especially when your life doesn't fit into a perfect, simple box. The age you start is often the first question, but life is rarely that black and white.

You’re not alone if you have questions about work, marriage, or those tricky enrollment deadlines. This section is here to give you direct, clear answers to those very real questions, so you can feel confident about the path ahead.

Do I Have to Sign Up for Medicare if I Am Still Working at 65?

This is one of the biggest questions people have, and the short answer is: probably not. It all comes down to the health coverage you have through your job.

If you (or your spouse) have health coverage from an employer with 20 or more employees, you can most likely delay signing up for Medicare Part B without getting hit with a penalty down the road. This lets you stick with your current plan and avoid paying the monthly Part B premium until you actually need it.

But here’s a tip: it's almost always a good idea to sign up for Medicare Part A anyway. Why? If you or your spouse paid Medicare taxes for at least 10 years, Part A is premium-free. It can also work behind the scenes as a secondary payer to your employer plan, which might help cover some hospital costs your main plan doesn't.

Key Takeaway: If you have solid coverage from a larger employer, you can hold off on Part B. But grabbing your premium-free Part A at 65? That's a smart move with no real downside.

Can I Get Medicare if I Never Worked?

Yes, you absolutely can. Even if you don't have a personal work history that qualifies you, Medicare has rules in place to account for a spouse's contributions. This is a huge relief for people who may have been stay-at-home parents or had other life situations that kept them out of the workforce.

You can often get premium-free Part A based on your spouse's work record if:

- You are at least 65 years old.

- Your spouse is at least 62 years old.

- You’ve been married for at least one continuous year.

If you check all those boxes, you can claim benefits on their work history, much like you would for Social Security. And if you don't qualify through a spouse and don't have the work credits yourself, you still have the option to buy into Part A—you'll just have to pay a monthly premium for it.

What Happens if I Miss My Initial Enrollment Period?

Missing your seven-month Initial Enrollment Period (IEP) can cause some serious, long-lasting headaches if you don't have another qualifying reason to sign up later. Think of your IEP as your one-time, "get-in-free" pass to enroll without any trouble.

If you let that window close without having other approved coverage, you can't just sign up whenever you feel like it. You'll have to wait for the General Enrollment Period (GEP), which only runs from January 1 to March 31 each year.

Enrolling during the GEP comes with two major drawbacks:

- A Coverage Gap: Your benefits won't start right away. Coverage will only begin the month after you sign up. So, if you enroll in March, you won't be covered until April 1.

- A Lifelong Penalty: This is the big one. You'll almost certainly get a late enrollment penalty for Part B. It’s not a one-time fee; it's an extra charge added to your monthly premium for the entire time you have Medicare.

Getting these rules right is so important. Our guide with more frequently asked questions about Medicare can help shed even more light on your specific situation.

Navigating all the moving parts of health insurance doesn’t have to be something you do alone. The team at My Policy Quote is here to offer clear, personal guidance to help you find the right coverage for your life and your budget.