When you're a gig worker, finding health insurance can feel like you’ve been left to figure it all out on your own. There’s no HR department to guide you. The good news? With a little know-how, you can absolutely get affordable, quality coverage. The key is understanding your options, especially through the ACA Marketplace, where subsidies can bring costs way down.

Let's break it down and turn that confusion into a clear, actionable plan.

The Freelancer's Dilemma Without Employer Coverage

Going freelance is one of the most liberating feelings in the world. You’re your own boss, you set your own hours, and you choose the work that inspires you. But that freedom comes with a huge trade-off: you're leaving the safety net of employer-sponsored health insurance behind.

Suddenly, an unexpected illness or a minor accident isn’t just a health crisis—it's a financial one that could threaten the business you've worked so hard to build. And with complex rules around employment status, like understanding IR35 rules for contractors, it's clear that traditional benefits aren't part of the gig economy package.

This isn’t a small problem. A shocking 35% of gig workers have no health coverage at all. Compare that to the national average of just 10.5%, and you can see how big the gap really is. It highlights just how urgently we need clear, accessible insurance solutions for the self-employed.

Think of it this way: traditional employer-sponsored insurance is like a pre-built bridge. Your company handled all the construction. As a gig worker, you have to build your own bridge, plank by plank. It takes more effort, but it also gives you the power to design a bridge that perfectly fits your life and your needs.

Your Path to Coverage

The best part? You can totally do this. Securing great health insurance as a freelancer is 100% achievable, and you don’t have to go it alone. You've got several solid pathways to explore.

Here's a quick look at your main options:

- ACA Marketplace Plans: This is the go-to for most freelancers. These plans are comprehensive, and you might qualify for subsidies that make them incredibly affordable.

- Private Insurance Plans: Buying directly from an insurance company can sometimes give you more flexibility with doctors and hospitals.

- Short-Term Health Insurance: Think of this as a temporary patch to cover you between other plans. It’s limited, but it's better than nothing.

- Spouse's or Parent's Plan: If you're eligible to join a family member's plan, this is often the simplest and most cost-effective route.

To help you see these paths more clearly, let's lay them out in a simple table.

Your Health Insurance Options at a Glance

This table breaks down the primary insurance pathways for gig workers, making it easier to see which one might be the right fit for your unique situation.

| Insurance Option | Best For | Key Consideration |

|---|---|---|

| ACA Marketplace | Freelancers with variable income who need financial assistance (subsidies). | Enrollment is limited to the Open Enrollment Period or a Special Enrollment Period. |

| Private Plans | Individuals who don't qualify for subsidies and want more network choices. | Premiums can be higher without financial aid. |

| Short-Term Insurance | People needing a temporary fix for a few months to bridge a coverage gap. | These plans don't cover pre-existing conditions and offer very limited benefits. |

| Spouse's/Parent's Plan | Anyone eligible to join a family member's employer-sponsored plan. | This is often the most stable and comprehensive option if it's available to you. |

Choosing one of these options is the first step toward building real financial security. The risks of going uninsured are just too high, and knowing what happens if you don't have insurance is a powerful motivator to get covered.

This guide will walk you through the entire process, helping you build that bridge to total peace of mind.

Navigating the ACA Health Insurance Marketplace

For most gig workers, the Affordable Care Act (ACA) Marketplace is your home base for finding health insurance. Think of it as a central hub where you can compare plans from different companies, see if you qualify for financial help, and sign up—all in one place.

The journey starts at HealthCare.gov. This is the federal website that will walk you through creating an account and filling out an application. If your state happens to run its own marketplace, the site will automatically send you there. This application is the most important step, as it’s what determines if you can get subsidies to dramatically lower your monthly bill.

Learning to navigate the marketplace is a must-have skill for any freelancer. The good news? Once you get the hang of it, the whole process feels much less intimidating. It really just comes down to knowing when you can sign up and what kind of plan you should be looking for.

Understanding Enrollment Periods

Here’s the thing: you can't just sign up for an ACA plan whenever you feel like it. To keep the insurance market stable, enrollment is limited to specific windows of time.

The main event is Open Enrollment. This is an annual period, usually from November 1st to January 15th, when anyone can apply for a new health plan for the coming year. This is your best and biggest opportunity to get covered.

But what if you miss it, or what if something big happens mid-year? That’s where a Special Enrollment Period (SEP) comes into play. An SEP is a 60-day window to enroll in a new plan that gets triggered by a "qualifying life event."

Common qualifying events include:

- Losing other health coverage (like if you leave a W-2 job or age off a parent’s plan)

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new ZIP code or county

- A major change in your household income

For example, if a freelance graphic designer moves from Austin to Denver, that move qualifies them for an SEP. It gives them a chance to enroll in a new plan that works in their new home.

Decoding the Metal Tiers

Once you start shopping on the marketplace, you’ll notice plans are sorted into metal tiers: Bronze, Silver, Gold, and Platinum. This can feel a little confusing at first, but a simple analogy makes it crystal clear.

Think of the metal tiers like gym memberships. A Bronze plan is your basic membership: you pay a low monthly fee, but you pay more each time you use the facilities (meaning higher deductibles and copays). A Platinum plan is the all-inclusive VIP package: the monthly fee is high, but almost everything is covered when you show up.

This system is all about helping you choose how you and the insurance company will share the costs of your care.

- Bronze: You’ll pay the lowest monthly premium, but you’ll also have the highest out-of-pocket costs when you need care.

- Silver: A good middle-ground option with moderate premiums and costs. Crucially, you must choose a Silver plan to get Cost-Sharing Reductions (CSRs) if you qualify. These are extra subsidies that lower your deductible and copays.

- Gold: You’ll pay a high monthly premium, but your out-of-pocket costs will be low.

- Platinum: This tier has the highest monthly premium and the lowest out-of-pocket costs.

Which one is right for you? It all depends on your health and your budget. If you’re young, healthy, and rarely see a doctor, a Bronze plan might save you money. But if you have a chronic condition or expect to need regular medical care, a Gold or Platinum plan could actually be cheaper in the long run.

For many gig workers, Silver plans hit the sweet spot. They offer a great balance of moderate premiums and access to powerful cost-saving subsidies, making them a popular and financially smart choice. Getting to know these plans is key, and you can learn more about the specifics of individual health insurance plans to build on this knowledge. Once you master these marketplace basics, you'll be ready to find the right health insurance for your freelance career.

How to Unlock Subsidies and Tax Credits

This is where the magic happens. For so many gig workers, the idea of truly affordable health insurance feels like a myth. It’s actually one of the main reasons freelancers go without coverage—the sticker shock is real.

Studies show that a staggering 63% of uninsured gig workers skip buying a plan because they think it’s too expensive. They’re often completely unaware of the powerful government help available. Making things worse, 85% of these workers don't claim any tax deductions when they apply, which can block them from getting the aid they deserve. You can find more great insights on this from the experts at Stride Health's blog.

But here’s the secret: subsidies and tax credits are your keys to unlocking affordable health coverage. Once you understand how they work, you can slash your monthly costs and make quality insurance a reality.

Premium Tax Credits: The Monthly Discount

The biggest piece of financial help you can get is the Premium Tax Credit, which most people just call a subsidy. Think of it as a government-funded discount coupon that gets applied right to your monthly health insurance bill.

When you fill out your Marketplace application, you'll give your best guess on your income for the year ahead. Based on that number, the Marketplace figures out your subsidy amount. You can have this credit sent directly to your insurance company each month, which instantly lowers what you owe.

For example, if a plan costs $450 per month and you qualify for a $350 subsidy, you’d only pay $100 out of your own pocket. It’s a game-changer that makes great plans accessible, even on a fluctuating income.

Cost-Sharing Reductions: Your VIP Pass for Care

While Premium Tax Credits knock down your monthly bill, Cost-Sharing Reductions (CSRs) lower your costs when you actually use your insurance. It’s an extra layer of savings for people with lower incomes who choose a Silver plan.

If a subsidy is your monthly discount coupon, think of a CSR as a VIP pass. It gets you a better deal on everything inside the club—like lower deductibles, copayments, and coinsurance.

This means with a CSR, your out-of-pocket costs for doctor visits, prescriptions, and hospital stays will be way less than what’s listed on a standard Silver plan. This protection is a lifeline for gig workers, giving you a crucial buffer against those scary, unexpected medical bills.

To get CSRs, you need to meet two simple rules:

- Your household income has to be in a specific range (usually between 100% and 250% of the federal poverty level).

- You must sign up for a Silver-level plan on the ACA Marketplace.

Estimating Your Income as a Gig Worker

Here’s the part that trips up almost every freelancer: estimating your annual income. When your earnings can swing wildly from month to month, trying to project a full year can feel like pure guesswork. But getting this estimate right is the key to getting the right subsidy.

Let's walk through a real-world example.

Scenario: A Rideshare Driver

- Jasmine, a full-time rideshare driver, needs to estimate her income. She starts by looking at her pay from the last three months: $3,000, $4,200, and $3,500.

- She figures out her average monthly income: ($3,000 + $4,200 + $3,500) / 3 = $3,567 per month.

- To project her annual gross income, she multiplies that by 12: $3,567 x 12 = $42,804.

- Next, she estimates her business expenses—gas, insurance, car maintenance—at about $12,000 for the year.

- She subtracts her expenses from her gross income to find her estimated net income: $42,804 – $12,000 = $30,804.

Jasmine will use $30,804 as her income estimate on her Marketplace application. It’s super important to update this number during the year if her income changes a lot—a few killer months or a slow spell can affect her subsidy.

The Self-Employed Health Insurance Deduction

Beyond the Marketplace, there's another powerful tool for saving money: the self-employed health insurance deduction. This lets you deduct the entire amount you pay in premiums from your taxable income.

This is an "above-the-line" deduction, which is a fancy way of saying you don't need to itemize to claim it. It directly lowers your adjusted gross income (AGI), which can shrink your overall tax bill. By paying for your own health insurance, you're not just getting coverage—you're also unlocking a valuable tax break that puts money right back in your pocket.

To get the full rundown, check out our guide on the self-employed health insurance deduction for all the details.

Choosing the Right Type of Health Plan

Okay, you've got a handle on the ACA Marketplace and how subsidies can save you money. The next piece of the puzzle is figuring out which type of plan to get. You'll see a lot of acronyms—HMO, PPO, EPO—and it can feel like you're trying to crack a secret code.

But it’s not as complicated as it looks. Think of it like picking a cell phone plan. Each one gives you a different mix of network freedom and monthly cost. Getting this right means you’ll have the coverage you need, where you need it, without paying a fortune for flexibility you’ll never use.

Decoding the Plan Types: HMO vs. PPO vs. EPO

Let's break down the three most common plans you’ll find. Each one is built differently, which directly affects where you can go for care and how much you'll pay out of your own pocket.

An HMO (Health Maintenance Organization) is like a budget-friendly phone plan. It offers great value, but you have to stay within its network map. Go "out-of-network," and you generally have zero coverage, except for a true, life-threatening emergency. HMOs also require you to pick a Primary Care Physician (PCP) who becomes your go-to for everything. Need to see a specialist? You’ll have to get a referral from your PCP first.

A PPO (Preferred Provider Organization) is your premium, all-access pass. It gives you the freedom to "roam," meaning you can see both in-network and out-of-network doctors. You'll always pay less if you stay in-network, but you still have coverage if you decide to go out. PPOs typically don't require a PCP, and you can see specialists without a referral. That freedom, however, comes with a higher monthly price tag.

Finally, an EPO (Exclusive Provider Organization) is a solid middle ground. Like an HMO, it only covers care from doctors inside its network (again, emergencies are the exception). But like a PPO, it usually doesn't force you to have a PCP or get referrals for specialists. It’s a hybrid that gives you more freedom than an HMO without the premium cost of a PPO.

To make it even clearer, here’s a simple table that lays out the key differences. This can help you quickly see which structure aligns with what you value most—be it cost, flexibility, or easy access to specialized care.

Comparing Health Plan Types HMO vs PPO vs EPO

| Feature | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) | EPO (Exclusive Provider Organization) |

|---|---|---|---|

| Out-of-Network Coverage | None, except for emergencies. | Yes, but at a higher out-of-pocket cost. | None, except for emergencies. |

| Primary Care Physician (PCP) | Usually required. Your PCP manages your care. | Not required. You can see any doctor you choose. | Not usually required. |

| Specialist Referrals | Required. You must get a referral from your PCP. | Not required. You can self-refer to specialists. | Not usually required. |

| Cost | Typically has the lowest monthly premiums. | Typically has the highest monthly premiums. | Moderate premiums, often lower than a PPO. |

| Best For | People who want predictable costs and don't mind a limited network. | People who want maximum flexibility and are willing to pay for it. | People who want direct specialist access but are okay with staying in-network to save money. |

Seeing it side-by-side really helps clarify things, right? The "best" plan isn't a one-size-fits-all answer; it's about what works for your life and your health needs.

Comparing Costs for Marketplace and Private Plans

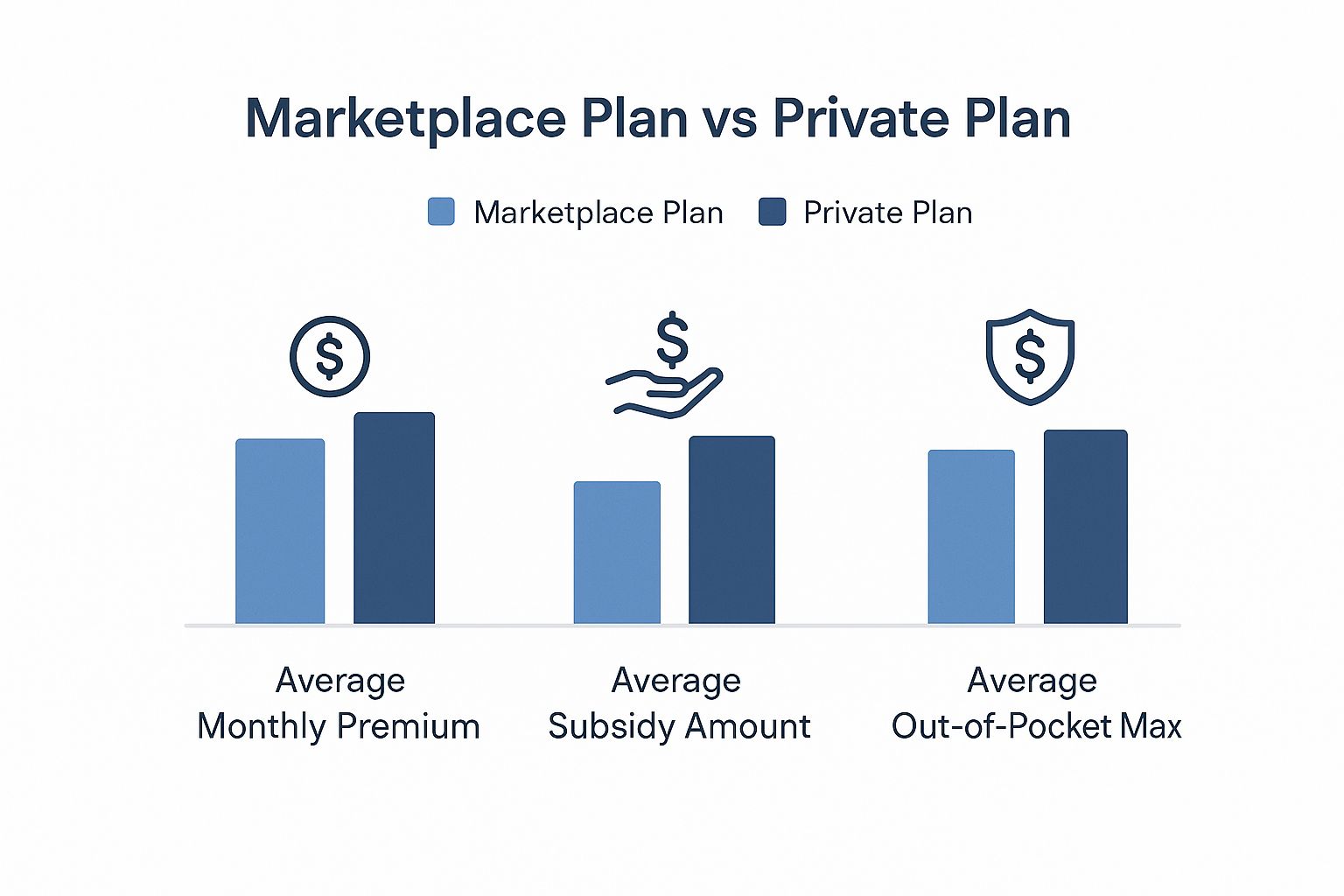

Of course, the monthly premium is a huge factor. The infographic below shows the difference in costs between ACA Marketplace plans (which come with subsidies) and private plans you'd buy directly from an insurance company.

As you can see, those subsidies can be a game-changer, making solid coverage genuinely affordable for freelancers and gig workers.

What Really Matters for a Gig Worker

As a freelancer, your decision comes down to your real-world needs. Forget the jargon for a minute and ask yourself these three simple questions. Your answers will point you straight to the right plan.

1. How important is keeping your current doctor?

If you have a doctor you absolutely love, the first thing you should do is find out which plans they accept. If they’re only in-network with a particular PPO, that might just make the decision for you.

2. Do you need to see specialists without a hassle?

If you manage a chronic condition and see a specialist regularly, the extra step of getting a referral every time with an HMO can be a real headache. A PPO or EPO lets you go directly, saving you time and stress.

3. How often do you travel or work in different places?

Are you a consultant who travels for projects? A rideshare driver who crosses county lines? An HMO's tight network could become a serious problem. A PPO gives you peace of mind, knowing you’re covered whether you're at home or on the road.

The right plan isn’t about finding the "best" one on paper—it's about finding the one that best supports your unique freelance lifestyle. It’s a balance between cost, flexibility, and predictable access to care.

By thinking through these personal factors, you can move beyond the confusing acronyms and pick a health plan that feels less like a burden and more like a tool built to protect your independence.

Exploring Alternative Coverage Solutions

While the ACA Marketplace is the best starting point for most gig workers, it’s not the only game in town. Sometimes, life throws you a curveball, or your timing is just off, and you need to look at other options.

Think of these alternatives as different tools in your financial toolkit. Each one is designed for a specific job, and knowing when to use them ensures you have a complete picture of the entire coverage landscape. Whether you need a temporary fix, can hop on a family plan, or are curious about new insurance models, understanding what’s out there will keep you protected.

Short-Term Health Insurance

Imagine you just missed Open Enrollment or you're between gigs, waiting for your new ACA plan to kick in. This is where short-term health insurance can be a lifesaver. These plans are exactly what they sound like: a temporary bridge, not a permanent solution. They provide a basic safety net for a few months to get you through a gap.

But—and this is a big but—it's critical to understand their limits. Short-term plans are not ACA-compliant. That means they can deny you coverage based on your health history.

The biggest catch? Short-term plans almost never cover pre-existing conditions. If you have an ongoing health issue, this type of plan likely won't pay a dime for it, making it a very risky choice for anything other than a brief, healthy transition period.

So, while they can be a helpful stopgap in a pinch, they are absolutely not a substitute for real, comprehensive health insurance.

Family and Spousal Plan Options

One of the most straightforward—and often most affordable—alternatives is simply joining a family member's plan.

If your spouse or partner has a health plan through their job, you can almost always be added during their company's open enrollment period. You can also join after a "qualifying life event," like getting married.

And for young freelancers just starting out, here’s a great option: if you're under the age of 26, you can stay on a parent's health insurance plan. It doesn't matter if you live with them, if you're financially independent, or even if you're married. For many, this is a fantastic and stable way to stay covered.

COBRA Coverage

Did you recently leave a traditional W-2 job to chase your freelance dream? You might be eligible for COBRA. This federal law lets you continue the exact same health coverage you had with your old employer for a limited time, usually up to 18 months.

The benefit is huge: you keep your doctors, your network, and your plan details, which can be invaluable during a transition.

The catch? It’s expensive. You are now on the hook for paying 100% of the premium, plus a small administrative fee. Since your old employer is no longer subsidizing the cost, the price tag can be a real shock. But if continuity of care is your top priority, it's an option worth considering.

Other Emerging Solutions

The insurance world is slowly waking up to the reality of the gig economy, and new ideas are starting to pop up.

Some companies are exploring things like Individual Coverage Health Reimbursement Arrangements (ICHRAs). This is a fancy way of saying an organization gives you tax-free money to go buy your own health plan. It offers way more flexibility than a one-size-fits-all group plan. You can find more insights on these emerging benefits for the gig economy on axiscapital.com.

You might also hear about Health Sharing Ministries. These are faith-based groups where members chip in monthly to help cover each other's medical bills. It’s vital to understand that these are not insurance. They don't guarantee payment for your medical bills and aren't regulated by the same laws that protect you under the ACA. Tread very carefully here.

Got Questions About Gig Worker Health Insurance? We’ve Got Answers.

Jumping into the world of health insurance always brings up a ton of questions, especially when you’re a gig worker. Your income isn't a straight line, and your needs are unique. Let's clear up some of the most common concerns so you can move forward with confidence.

What Happens If My Income Suddenly Changes?

This is the classic freelancer dilemma. One month you’re slammed with work, and the next is a ghost town. If your income swings wildly, it's absolutely crucial to update your information on the Health Insurance Marketplace right away.

Think of it like this: your subsidy is tied to your estimated income. If you start earning more, you'll likely qualify for a smaller subsidy. Updating your profile adjusts your premium, which saves you from getting a nasty surprise bill from the IRS during tax season.

On the flip side, if work dries up and your income drops, you might qualify for a much bigger subsidy. You could even become eligible for low-cost or free coverage through Medicaid or CHIP. Reporting that change means you get the financial help you’re entitled to, right when you need it most.

Can I Get Dental and Vision, Too?

Yes, you can—and you definitely should. When you're shopping on the Health Insurance Marketplace, you’ll see options to add standalone dental and vision plans. They’re separate from your main health plan and have their own monthly premium.

While some health plans include dental and vision for kids, coverage for adults is almost always an add-on.

Here's another great option: you can buy dental and vision insurance directly from an insurance company anytime. These plans don't have the strict open enrollment window that health insurance does, giving you the flexibility to sign up whenever you’re ready.

Are My Health Insurance Premiums Tax-Deductible?

For almost every self-employed person, the answer is a big, satisfying "yes." You can generally deduct the premiums you pay for medical, dental, and even long-term care insurance for yourself, your spouse, and your dependents.

This is a huge tax advantage called the self-employed health insurance deduction.

It's an "above-the-line" deduction, meaning you don’t have to itemize to claim it. It directly lowers your adjusted gross income (AGI), which can make a real difference in how much you owe in taxes.

Just one important rule: you can't deduct premiums for any month you were eligible for an employer-sponsored plan, like through a spouse's job. It’s always smart to chat with a tax pro to make sure you’re getting it right.

What if I Missed the Open Enrollment Deadline?

It happens. Life gets busy, and deadlines fly by. Don't panic—you might still have options. The first thing to do is check if you qualify for a Special Enrollment Period (SEP). Certain life events will open up a 60-day window for you to get a plan.

Common events that can trigger an SEP include:

- Losing other health coverage (like leaving a W-2 job or aging off a parent’s plan)

- Changes in your household (getting married, having a baby, or getting divorced)

- Moving to a new ZIP code or state

- A big change in income that affects your subsidy eligibility

If you don't qualify for an SEP, a short-term health plan could be a temporary safety net to protect you from catastrophic costs until the next Open Enrollment. You might also be eligible for Medicaid or CHIP, which you can enroll in at any time of year.

It’s a common myth that freelancers just go without insurance. A May 2025 Federal Reserve survey actually found that 88% of gig workers have health coverage. The secret is knowing where to find it.

Interestingly, 53% of those covered get their insurance from somewhere other than their gig work, like a spouse's employer. That makes perfect sense, especially since 51% of gig workers also hold a traditional W-2 job that often provides that benefits bridge. You can dive into the full report on the Federal Reserve's economic well-being study.

Ready to find a plan that fits your freelance life? At My Policy Quote, we specialize in helping self-employed professionals like you find clear, affordable health insurance options. Stop guessing and start getting covered. https://mypolicyquote.com