Losing your job is a gut punch, and the fear of losing your health coverage right after can feel overwhelming. But take a deep breath. You have options, and there are safety nets built into the system to protect you.

The most important thing to know is that losing your job counts as a Qualifying Life Event (QLE). Think of it as a golden ticket that opens a special door for you to get new health insurance, even outside the normal yearly sign-up period.

This QLE kicks off what’s called a Special Enrollment Period (SEP). It’s a 60-day window where you can’t be locked out of the market. During this time, you have the right to shop for a new plan and make sure you and your family aren't left with a dangerous gap in coverage. Your mission is to explore your choices and make a smart decision before that window closes.

Your Main Pathways Forward

When you lose employer-sponsored health insurance, you generally have three main routes you can take. Each one is designed for different situations and budgets, so understanding what makes them tick is key.

- COBRA: This lets you keep the exact same health plan you had with your old job. It’s great for continuity—you can keep your doctors and your plan benefits—but it comes at a steep cost because you're now paying the full premium yourself.

- ACA Marketplace: This is the government exchange (you’ve probably heard of HealthCare.gov) where you can shop for brand-new plans. Since your income just dropped, you might qualify for big discounts (subsidies) that make your monthly payments much more affordable.

- Medicaid/CHIP: If your monthly income is now very low, you could be eligible for these government-funded health programs, which are either free or very low-cost. Eligibility is based on what you’re making now, not your old salary.

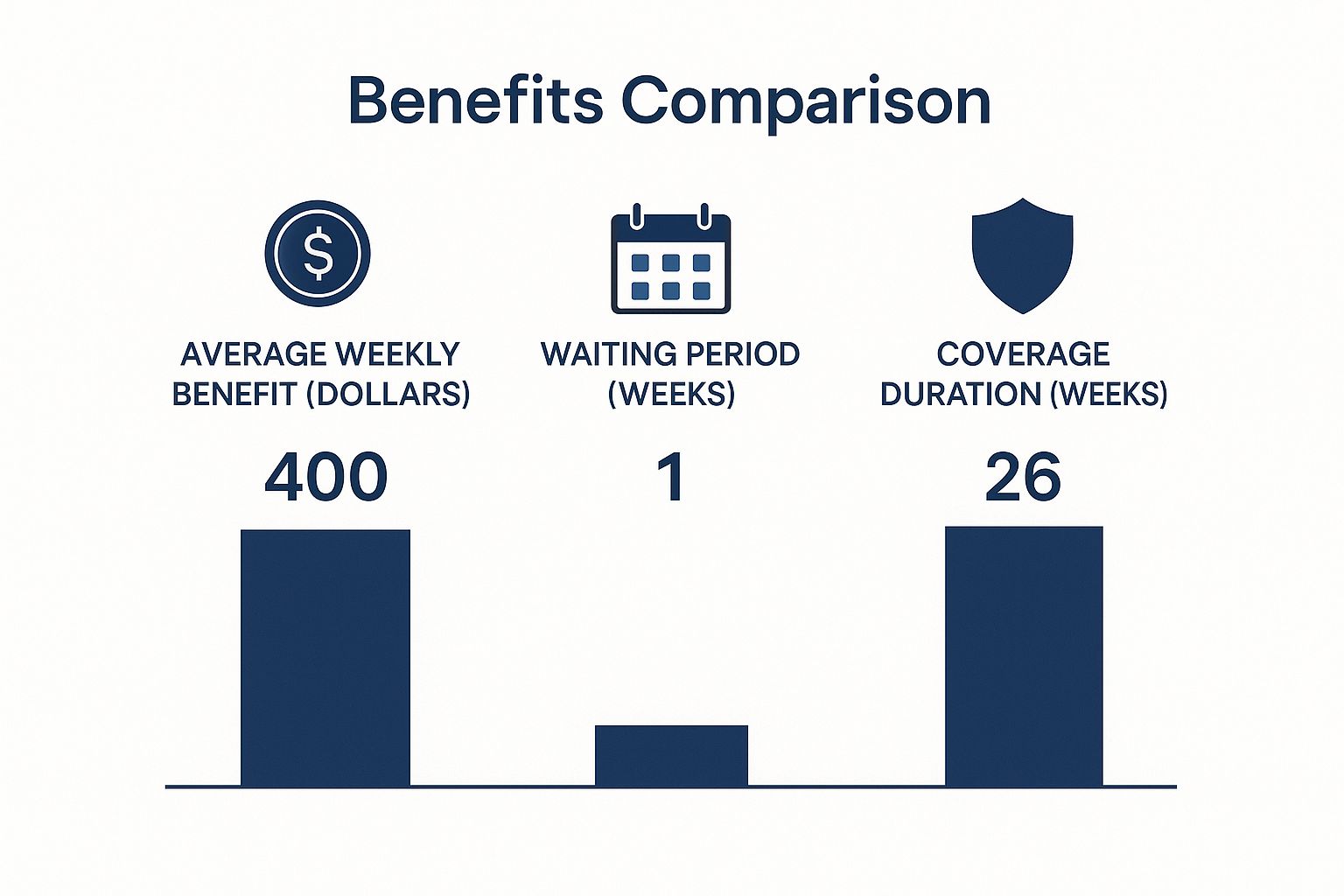

The image below breaks down some of the key things to think about as you navigate this transition.

As you can see, your decision really comes down to balancing cost, coverage needs, and how quickly you expect to be employed again.

Quick Comparison of Your Health Insurance Options

To help you see the differences more clearly, here’s a quick table breaking down your main choices. It’s a high-level look to get you started.

| Insurance Option | Who It's Best For | Typical Cost | Key Feature |

|---|---|---|---|

| COBRA | Someone who loves their current plan and doctors and can afford the high monthly premium. | High – Up to 102% of the full premium (employer and employee share). | Perfect continuity. Nothing about your coverage changes. |

| ACA Marketplace | Anyone with a reduced income who can get subsidies to lower their costs. | Varies – Can be very affordable or even $0/month with subsidies. | Flexibility and affordability with a wide range of plan options. |

| Medicaid / CHIP | Individuals and families with very low or no current monthly income. | Low or Free – Costs are minimal or non-existent. | Comprehensive coverage based purely on financial need. |

Ultimately, it’s a trade-off. COBRA gives you stability if you can handle the price. The ACA Marketplace offers affordability but might mean switching doctors. For younger folks figuring this out, our guide on health insurance for young adults has more specific tips.

While you're sorting out your health insurance, don't forget to focus on the next step in your career. You can find additional career advice and job search resources to help you land your next role.

Untangling Your First Option: COBRA

When you lose your job, COBRA is probably the first name you’ll hear. It’s well-known for one big reason: it lets you keep the exact same health insurance plan you had. Same doctors, same benefits, same everything. During a time when so much feels uncertain, that kind of stability is a huge relief.

So, how does it work? Think of it like this: while you were working, your company was paying a big chunk of your monthly health insurance premium. You only had to cover your share. With COBRA, you’re now on the hook for the entire bill yourself—plus a small administrative fee of up to 2%.

This is why COBRA gets a reputation for being so expensive. Suddenly, you’re not just paying your slice of the pie; you’re buying the whole thing.

Who Actually Qualifies for COBRA?

Not everyone is automatically eligible. Federal law typically limits COBRA to folks who worked at companies with 20 or more employees. If your company was smaller, don't lose hope—your state might have its own "mini-COBRA" laws that offer similar protection. It's always worth a quick check.

To qualify, your job loss has to be for the right reasons. A layoff or quitting your job both count. The main thing that would disqualify you is being fired for "gross misconduct."

And it’s not just for you. Your spouse and kids who were on your plan can also get COBRA, even if you decide it's not the right move for yourself.

The Deadlines Are Strict—Don't Miss Them

With COBRA, timing is everything. The law lays out a very clear timeline, and if you miss a deadline, you could lose your chance for coverage completely.

Here’s how it usually plays out:

- Your Employer Acts: Your former employer has 30 days after your last day to tell the health plan you're no longer an employee.

- You Get the Notice: The plan administrator then has 14 days to mail you a COBRA election notice with all the details and forms.

- You Have a Choice to Make: From the day your notice is sent (or the day your coverage ended, whichever is later), you get a 60-day window to decide if you want COBRA and send back the paperwork.

This 60-day period is a critical safety net. It gives you time to look into other options, like ACA Marketplace plans, without having to immediately commit to COBRA's high price tag. You can explore all your options by reading our guide on getting health insurance without a job.

Pro Tip: You don't actually have to pay for COBRA during that 60-day decision window. If you end up needing medical care, you can sign up retroactively, pay the back-premiums, and get your expenses covered. It’s a great fallback while you shop around.

How to Figure Out the Cost

So, what’s the damage going to be? The number you need is probably sitting on an old paystub.

Find the line showing the total monthly premium for your health plan, before your employer's contribution was subtracted. That number, plus that small 2% admin fee, is what you’ll pay each month.

Let's break it down:

- Imagine the total premium for your family's plan was $1,500 per month.

- Your employer paid $1,100, and you paid $400 out of your paycheck.

- Your new COBRA premium would be $1,500 + (2% of $1,500), which totals $1,530 a month.

That jump in cost is the number one reason people look for alternatives. Keeping your plan is great, but the price can be a dealbreaker.

Navigating the ACA Marketplace for Affordable Plans

While COBRA offers a sense of continuity, its price tag can be a real shock. That high cost sends a lot of people looking for a more wallet-friendly way to stay insured after a layoff. For many, the best answer is the Affordable Care Act (ACA) Marketplace, often just called HealthCare.gov.

Think of the Marketplace as an online shopping center just for health insurance. Instead of different stores, you get to browse plans from a variety of private insurance companies. But here’s the real game-changer: you might qualify for serious financial help to lower your costs—something COBRA just doesn't offer.

Your 60-Day Window to Act

Losing your job-based health insurance is a big deal, and it kicks off what’s called a Special Enrollment Period (SEP). This gives you a critical 60-day window to sign up for a new plan on the Marketplace.

If you let that deadline slip by, you’ll probably have to wait for the next annual Open Enrollment period. That could leave you and your family uninsured for months. This 60-day clock is firm, so it’s smart to start looking at your options as soon as you know you're being laid off.

The Power of Subsidies

The single biggest reason to choose the Marketplace is the availability of subsidies. These are designed to make health insurance truly affordable by tying the cost to your income. There are two main types of financial aid you could get.

- Premium Tax Credits: This is the most common kind of help. It’s like a monthly discount coupon from the government that directly lowers the amount you pay for your plan (your premium).

- Cost-Sharing Reductions (CSRs): These are extra savings that cut down on your out-of-pocket costs when you actually go to the doctor. That means lower deductibles, copayments, and coinsurance. To get these, you have to enroll in a Silver plan.

These subsidies are based on your household's estimated income for the year. Since you’ve just lost your job, your projected income is going to be much lower than your old salary. That’s exactly why you’re much more likely to qualify for big savings.

Figuring out your estimated income can feel a little tricky, but it’s the most important step. You’ll need to project your total earnings for the calendar year, which includes salary from your old job, any unemployment benefits you receive, and what you might earn at a new job. Getting this number right is key to getting the right amount of help.

Understanding the Metal Tiers

When you shop on the Marketplace, you’ll see plans organized into four "metal" tiers: Bronze, Silver, Gold, and Platinum. This isn't about the quality of the doctors or hospitals—it’s just a simple way to understand how you and your insurance company will split the costs.

Here’s an easy way to think about it:

| Metal Tier | How You Pay | Best For |

|---|---|---|

| Bronze | Low monthly payment, but you pay more out-of-pocket when you need care. | Healthy folks who want a safety net for a major medical event but don't plan on many doctor visits. |

| Silver | A middle-of-the-road monthly payment and moderate costs for care. Crucially, this is the only tier where you can get Cost-Sharing Reductions (CSRs). | People who qualify for CSRs or just want a good balance between their monthly bill and what they pay for treatment. |

| Gold | Higher monthly payment, but you pay less out-of-pocket. | Someone who knows they’ll use their insurance regularly and wants more predictable costs. |

| Platinum | The highest monthly payment, but the lowest costs when you need care. | Anyone with significant, ongoing health needs who wants the most comprehensive coverage for frequent medical expenses. |

For most people facing a job loss, a Silver plan is often the smartest place to start. It's the only way to access those powerful Cost-Sharing Reductions if your income is low enough. This can take your deductible from thousands of dollars down to just a few hundred, making healthcare feel truly accessible when you need it most.

When to Consider Medicaid or CHIP

When a job loss hits hard and your income drops to near zero, even subsidized ACA plans—let alone COBRA—can feel completely out of reach. This is exactly why Medicaid and the Children's Health Insurance Program (CHIP) exist. They are true safety nets, providing a stable source of health insurance when you need it most.

Here’s the key difference: COBRA and the ACA Marketplace often look at your projected annual income. Medicaid, on the other hand, cares about your financial reality right now. It focuses on your current monthly income, making it a powerful and immediate option for families in transition.

Best of all, you can apply for Medicaid or CHIP at any time. There are no enrollment windows to worry about, which offers incredible peace of mind when everything else feels uncertain.

How Eligibility Works for Medicaid and CHIP

Who qualifies? The answer depends entirely on your state, your household size, and your Modified Adjusted Gross Income (MAGI). The rules can be night and day depending on whether your state expanded its Medicaid program.

- In Medicaid Expansion States: The income limits are more generous. It’s much easier for single adults and childless couples with low incomes to qualify, with the cutoff often set around 138% of the federal poverty level.

- In Non-Expansion States: The rules are far stricter. Eligibility is usually reserved for specific groups like pregnant women, children, seniors, and adults with disabilities, all with very low income thresholds.

Understanding which camp your state falls into is step one. You can check your eligibility and apply directly through your state's Medicaid agency or via the HealthCare.gov Marketplace.

It’s all about your current situation. Even if you had a high salary for six months of the year, a sudden drop to zero monthly income could make you eligible for Medicaid today.

The Role of CHIP for Your Children

The Children's Health Insurance Program (CHIP) is Medicaid's partner, designed to make sure kids get the care they need.

In many states, CHIP covers children whose families earn too much to qualify for Medicaid but not enough to afford a private plan.

This is a huge deal. It means that even if you, as an adult, don't qualify for Medicaid, your children might still be eligible for comprehensive, low-cost coverage through CHIP. It’s a vital bridge that protects your kids’ health while you focus on finding a new job and figuring out your own health insurance gap between jobs.

These safety nets are more important than ever. The overall unemployment rate hovered around 4.9% in early 2025, but youth unemployment was a staggering 11.2%. Those numbers show how vulnerable younger workers are, making programs like Medicaid and CHIP absolutely essential.

Exploring Other Health Coverage Alternatives

While COBRA and the ACA Marketplace get most of the attention, they aren’t the only paths forward after a job loss. A few other routes exist, and knowing about them gives you the complete picture. You want to leave no stone unturned in your search for the right coverage.

Sometimes, the simplest and best solution is right there in your own household. These alternatives can be lifesavers, offering a quick and often more affordable way to stay insured while you figure out your next move.

Joining a Spouse's or Parent's Plan

Losing your job is considered a Qualifying Life Event (QLE), and this status is a powerful tool. It doesn't just affect you—it opens a door for your spouse or partner to add you to their employer-sponsored health plan. This is a huge deal.

Normally, your spouse would have to wait for their company's annual open enrollment to make any changes. But your QLE triggers a Special Enrollment Period for them, giving them a window—usually 30 or 60 days—to add you and any kids to their coverage. Frankly, this is often one of the most stable and affordable ways to secure insurance if you lose your job.

The same logic applies if you're under 26. You have the right to be on a parent’s health insurance plan, and your job loss creates a Special Enrollment Period for them to add you back on, even if you don't live at home.

A Closer Look at Short-Term Health Plans

You've probably seen ads for short-term health plans. Think of these as temporary, stopgap coverage—a bridge to get you from one side to the other. They're designed to provide a very basic safety net for a few months while you lock down a more permanent solution.

Their biggest draw is the price tag. The monthly premiums are often much lower than other options. But that affordability comes with some major trade-offs you absolutely have to understand.

Important Caveat: Short-term plans are not regulated by the Affordable Care Act. This means they don't have to cover essential health benefits like maternity care or mental health services. Most importantly, they can—and often will—deny you coverage for pre-existing conditions.

Because of these massive limitations, you need to approach short-term plans with serious caution. They might work for someone who is young, perfectly healthy, and just needs protection from a catastrophic accident for a very brief time.

Before you even consider this path, think about these points:

- Pre-Existing Conditions: If you have any ongoing health issues, a short-term plan will almost certainly not cover them.

- Limited Benefits: They often skip coverage for prescription drugs, preventive care, and other essentials you take for granted in a real health plan.

- Not a Long-Term Fix: This is not a substitute for comprehensive health insurance. It's meant to fill a very specific, very temporary gap.

At the end of the day, these alternatives add more tools to your toolkit. Joining a family member's plan is usually the most secure and cost-effective choice. Short-term plans, on the other hand, serve a very niche purpose, and only for those who fully understand the risks involved.

How to Choose the Right Plan for You

Okay, you've seen the options. From the familiar territory of COBRA to the fresh start of an ACA Marketplace plan, you know what’s out there. Now comes the most important part: turning all that information into a decision you feel good about.

Making the right choice isn't just about picking the cheapest plan. It’s about looking at your finances, your family's health, and the little details that can make or break your coverage. Think of it like this: you're building a safety net. You have the materials—all the plan details—and now you need to weave them together to create something strong enough to catch you, without costing a fortune.

The goal is to find that sweet spot where what you pay and what you get are perfectly balanced for your life.

Your Personal Action Checklist

To really compare apples to apples, you have to look past the monthly premium. Grab a notepad or open a new spreadsheet. It's time to put each plan to the test with these key questions. This simple exercise will show you which option delivers the best real-world value.

- Total Monthly Cost: What’s the bottom-line premium each month? If you're looking at an ACA plan, be honest with your income estimate to see what kind of subsidy you might get.

- Doctor and Hospital Network: This is a big one. Are your must-have doctors, specialists, and the local hospital covered? Stepping out-of-network is one of the fastest ways to get hit with a massive, unexpected bill.

- Prescription Drug Coverage: Don't just assume your meds are covered. Check the plan's formulary (its official list of covered drugs) to make sure your prescriptions are on it and find out what you'll pay.

- Out-of-Pocket Expenses: Look closely at the deductible, copays, and the out-of-pocket maximum. A plan with a low premium might look great, but if it has a $9,000 deductible, it won't help much if you actually need to use it.

Avoid These Common Pitfalls

Navigating this change has a few traps that are easy to fall into. Just knowing what they are is the best way to steer clear of a costly mistake or a terrifying gap in your coverage.

One of the biggest mistakes people make is guessing their income for an ACA subsidy. If you estimate too low, you could end up having to pay back a chunk of that tax credit come tax time. Estimate too high, and you're just overpaying every single month. Take the time to get this number right.

It's also worth remembering that the wider economy can impact these safety nets. For instance, some 2025 projections show that economic slowdowns are straining unemployment insurance systems, which could lead to deficits. This just underscores how important it is to secure your own coverage, because the broader systems can face stress, too. You can learn more about the financial outlook for these systems.

And if this job loss is pushing you to start your own business? That's a whole new ballgame for insurance. Be sure to check out our guide on health insurance for the self-employed to get ready for that exciting next step.

You’ve Got Questions, We’ve Got Answers

Losing your job is stressful enough without having to decipher the maze of health insurance. It's totally normal to have a ton of questions swirling in your head. Let's clear up some of the most common ones so you can move forward with confidence.

What If I Get a New Job Right Away?

First off, congratulations! Landing a new role quickly is a huge relief. But you're right to think about the insurance gap.

Most new jobs have a waiting period, usually 30 to 90 days, before your new health benefits kick in. You'll need something to bridge that time.

Here are a few smart moves:

- Keep COBRA in your back pocket. You can sign up for it retroactively if a big medical expense pops up during the gap.

- Grab a short-term health plan for some basic, just-in-case protection.

- Sign up for an ACA Marketplace plan and simply cancel it once your new work insurance starts.

Can I Still Get Insurance for My Family?

Yes, one hundred percent. The people who were covered on your old plan—your spouse, your kids—are eligible for the exact same options you are.

Losing your job-based coverage is what’s known as a Qualifying Life Event, and it applies to everyone on the policy. This means they can join you on a COBRA plan, be part of your ACA Marketplace application, or even enroll in CHIP if they qualify. It also opens a Special Enrollment Period for your spouse to add you and your dependents to their own work plan.

The moment your old health plan ends, a door opens for everyone who was on it. This Special Enrollment Period is your family’s ticket to getting new coverage without any scary gaps.

What Happens if My Income Changes Again?

Life doesn’t stand still, especially when you’re between jobs. If you’re getting help paying for an ACA Marketplace plan (through subsidies) and your income shifts, you have to report it.

Let's say you land a great new job or start a freelance gig. That extra income will likely lower the subsidy you qualify for. By updating the Marketplace right away, you'll adjust your premium tax credit and avoid a nasty surprise when you file your taxes.

Finding that next role is obviously top of mind during this time. As you navigate your career transition, you might find some great tips on how to find a remote job you'll love.

At My Policy Quote, we know how critical it is to have solid insurance when you're between jobs. Our experts are here to help you compare plans and find coverage that protects you and your family without breaking the bank. See what's out there for you at https://mypolicyquote.com today.