Trying to get life insurance when you have a pre-existing health condition can feel like hitting a brick wall. The endless questions, the medical exams, the constant fear of rejection—it's exhausting. But what if there was a way to get coverage without all that?

That’s exactly what guaranteed issue life insurance is for. Think of it as a safety net designed for those who might not qualify for other types of insurance. It offers a straightforward path to coverage, no matter your health history.

Unlocking Coverage with Guaranteed Issue Life Insurance

Applying for traditional life insurance can feel like an interrogation. For people dealing with health issues, it's a process that often ends in a "no." But guaranteed issue life insurance flips the script entirely. It's the "open door" policy of the insurance world.

The core promise is simple: you cannot be turned down for health reasons. As long as you fall within the right age group, your approval is a sure thing.

This type of insurance became popular as more people started looking for simple ways to cover final expenses. These policies typically offer smaller death benefits, usually between $5,000 and $25,000, which is often just enough to handle costs like a funeral or small leftover debts. If you want to dive deeper, EY offers a great global insurance outlook.

Key Features at a Glance

So, what makes this "no questions asked" policy tick? It really comes down to a few key features that set it apart. Let's take a quick look at the main components that make these policies unique.

The table below breaks down exactly what you can expect from a guaranteed issue policy.

Guaranteed Issue Life Insurance at a Glance

| Feature | Description |

|---|---|

| No Medical Exam | You won't have to visit a doctor or give any blood or urine samples. |

| No Health Questions | The application is simple, with no long questionnaires about your medical past. |

| Guaranteed Approval | Acceptance is guaranteed if you're in the required age range (often 50-85). |

| Graded Death Benefit | Payout is limited during the first 2-3 years, returning premiums plus interest if death is from natural causes. |

This structure makes it an accessible option, but it's that last point—the graded death benefit—that you really need to understand.

What Is a Graded Death Benefit?

This is the most critical feature to wrap your head around. A graded death benefit is a waiting period, typically lasting two to three years.

Here’s how it works:

-

If you pass away from natural causes (like illness) during this waiting period, your beneficiaries won't receive the full policy amount. Instead, they'll get back all the premiums you paid, usually with a bit of interest (around 10% is common).

-

However, if death is due to an accident—like a car crash—the full death benefit is paid out from day one.

Once the graded period is over, the full face value of the policy is payable for any cause of death. It’s a trade-off: in exchange for skipping the medical questions, the insurance company protects itself with this waiting period.

How a Guaranteed Issue Policy Actually Works

So, how does one of these policies really work, from the day you sign up to the day it pays out? Let's pull back the curtain.

Unlike traditional insurance, which can feel like an endless cycle of paperwork and medical exams, this path is built for speed and simplicity. The whole point is to get you covered without making you jump through hoops. The system is designed to balance the insurer's risk while making sure coverage is still on the table for you.

The application process itself is incredibly simple. You won’t find any long, invasive health questionnaires, and nobody is going to ask you to see a doctor. The only things that really matter are your age—usually between 50 and 85—and the state you live in. That's it. Your premiums are based on those factors and the coverage amount you choose, not your health history. This is a huge relief for self-employed folks who need clear, straightforward options. You can learn more about those needs in our guide to self-employment health insurance.

The Graded Death Benefit Explained

Here’s the most important part to understand: the graded death benefit. Think of it as a two-year waiting period. This feature is the trade-off for not having to answer a single health question, and it's how the insurance company protects itself from immediate claims on high-risk policies.

Let’s use a real-world example to see how it works.

Imagine John, age 65, buys a $15,000 guaranteed issue policy. His monthly premium is $80.

- Scenario 1: Death Within the First Two Years

If John passes away from a natural cause (like his pre-existing heart condition) just one year after getting the policy, his family wouldn't get the full $15,000. Instead, his beneficiary would get back all the premiums he paid, plus interest. If the insurer adds 10% interest, the payout would look like this:- Premiums Paid: $80/month x 12 months = $960

- Interest (10%): $96

- Total Payout: $1,056

But here's a critical exception: if John's death was accidental, his beneficiary would receive the full $15,000 death benefit, even if it happened on day one.

This setup is a compromise. It protects the insurer from immediate claims tied to known health issues, but it also ensures your family gets financial help no matter what. Plus, you’re fully covered for accidents from the moment your policy starts.

After the Waiting Period Ends

Once you’re past that two-year graded benefit period, everything changes. The policy matures and starts working just like any other life insurance plan.

- Scenario 2: Death After Two Years

If John passes away for any reason—natural or accidental—after his two-year anniversary with the policy, his beneficiary gets the full $15,000 death benefit, completely tax-free.

This simple, two-phase system is what makes it possible for people with serious health problems to still get meaningful coverage for their final expenses. It’s a predictable and reliable way to find peace of mind when you thought all the other doors were closed.

Who Is Guaranteed Issue Life Insurance Really For?

Guaranteed issue life insurance isn't a one-size-fits-all solution. Far from it. Think of it as a specialized tool—the perfect key for a very specific lock.

For some people, it’s an invaluable financial safety net. It’s for those moments when the doors to traditional life insurance have closed, offering one last opportunity to protect loved ones from financial burdens.

This type of policy is almost exclusively for people who’ve been turned down for other coverage because of significant health problems. It’s a way to secure peace of mind when you thought it was no longer possible.

The Ideal Candidates for This Coverage

So, who are the people who benefit most from this unique policy? If you see yourself in one of these situations, guaranteed issue might be exactly what you need.

-

Seniors Planning for Final Expenses: Many older adults aren't looking for a massive payout. They just want to know their funeral costs, lingering medical bills, and other small debts won't fall on their family. This policy offers a simple, straightforward way to cover those final expenses without any medical fuss.

-

Individuals with Serious Health Conditions: If a chronic illness like cancer, heart disease, or diabetes has resulted in denials from other insurers, this is your path to guaranteed approval. It’s designed for you.

-

Anyone Who Wants to Skip the Hassle: The application process is incredibly simple. No medical questions. No exams. No waiting for weeks on end. It appeals to anyone who wants to avoid the long, intrusive underwriting process of traditional life insurance.

It's critical to understand this isn't the right choice for younger, healthier people. If that's you, exploring options like life insurance for young adults will almost always get you more coverage for a much lower price.

Why It's Such a Critical Financial Tool

For a specific group of people, guaranteed issue life insurance is more than just a policy—it's a lifeline. It plays a vital role in providing security for those who can no longer qualify for standard coverage.

The numbers don't lie. U.S. insurance data shows that around 30 million Americans over 50 are underinsured, often because their health has locked them out of the market. These policies are essential for them. The average face amount is about $15,000, which is typically just enough to handle final expenses like a funeral and outstanding debts. You can learn more about this by checking out global insurance trends on Allianz.com.

By understanding who this policy is built for, you can better determine if it aligns with your personal financial strategy. It's about finding the right tool for the right job.

Understanding the Pros and Cons

Like any financial tool, guaranteed issue life insurance isn't a one-size-fits-all solution. It has some powerful advantages, but they come with a few trade-offs you need to understand.

Think of it as a crucial lifeline for people who might otherwise be left behind. But to know if it's the right lifeline for you, you have to look at both sides of the coin.

The biggest win here is simple: access. For anyone with significant health problems, the promise of guaranteed approval can be a massive relief. It cuts through the stress of medical exams and lengthy questionnaires, offering peace of mind when other doors have closed.

Of course, this accessibility has its price. To balance the risk of insuring someone without a medical deep-dive, these policies have higher premiums and a "graded" death benefit. Let's break down what that really means for you.

The Advantages of Guaranteed Approval

The most powerful "pro" is baked right into the name—it’s guaranteed. This feature alone opens up coverage to so many people who thought they were simply uninsurable.

Seniors often find this especially helpful, since managing healthcare needs and final expenses becomes a much more immediate concern with age. Our guide on health insurance for seniors dives deeper into these unique challenges.

Here are the key benefits you get:

- No Medical Exam or Health Questions: The application is refreshingly simple. No doctor's visits, no bloodwork, and no digging into your past medical history.

- Guaranteed Acceptance: If you’re in the right age range (usually between 50 and 85), you can't be turned down because of your health. Period.

- Peace of Mind: It’s a straightforward way to secure money for final expenses, so your family isn't left with a financial burden during a difficult time.

The Drawbacks to Consider

Now for the other side of the scale. The drawbacks are a direct result of the "no questions asked" approach. When an insurance company takes on a higher, unknown risk, the policy has to be built to reflect that.

The biggest limitations you need to know about are the higher cost and the waiting period. These aren't sneaky "gotchas"—they're just fundamental to how this type of insurance works.

The main cons include:

- Higher Premiums: You'll pay more for every dollar of coverage compared to a traditional policy that requires a medical exam. The price reflects the risk the insurer is taking on.

- Graded Death Benefit: This is a big one. If you pass away from natural causes during the first two to three years of the policy, your beneficiaries won't get the full death benefit. Instead, they’ll typically receive all the premiums you paid back, plus a bit of interest.

- Lower Coverage Amounts: These policies aren't designed to replace your income or pay off a mortgage. They're built for final expenses, so the face values are usually capped around $25,000.

To make it even clearer, let's look at the pros and cons side-by-side.

Pros vs. Cons of Guaranteed Issue Life Insurance

This table gives you a quick snapshot of the key benefits and drawbacks, helping you weigh your options at a glance.

| Pros (Advantages) | Cons (Disadvantages) |

|---|---|

| No medical exam required | Premiums are higher than other policy types |

| No health questions asked | Graded death benefit for the first 2-3 years |

| Guaranteed approval within the age limits | Lower coverage amounts (typically up to $25,000) |

| Fast and simple application process | Not designed for large financial needs |

| Provides peace of mind for final expenses | Cost per dollar of coverage is high |

By weighing these points, you can get a really clear picture of whether a guaranteed issue policy is the right safety net for your specific situation. It’s all about matching the tool to the job.

Comparing Guaranteed Issue With Other Insurance Types

To really get what guaranteed issue life insurance is all about, you have to see where it fits in the big picture. Life insurance isn't a one-size-fits-all product. Think of it like a spectrum, with some policies being incredibly selective and others having a completely open door.

Guaranteed issue has its own special place on that spectrum. It’s a solution designed for a very specific need, but it's important to remember it’s not your only option. Before you jump in, it’s always smart to see if you can qualify for a different policy—one that might give you more coverage for your money.

The Three Doors to Life Insurance

Imagine you’re trying to get life insurance coverage, and there are three different doors you can walk through. Each one has a different level of screening.

-

The First Door: Traditional (Fully Underwritten) Policies. This is the most thorough path. You’ll need a full medical exam, blood tests, and the insurer will take a deep dive into your health records. In exchange for all that information, you get access to the best rates and the highest coverage amounts. If you're in good health, this is your best bet.

-

The Middle Door: Simplified Issue Policies. This is the happy medium. You’ll have to answer a few health questions on an application, but you get to skip the medical exam entirely. Approval is way faster, though the premiums are a bit higher because the insurance company is working with less info.

-

The Last Door: Guaranteed Issue Policies. This is the "no questions asked" entrance. There's no medical exam and no health questionnaire. As long as you fall within the required age range, your approval is a sure thing. It’s the ultimate safety net for anyone who can’t get through the other two doors.

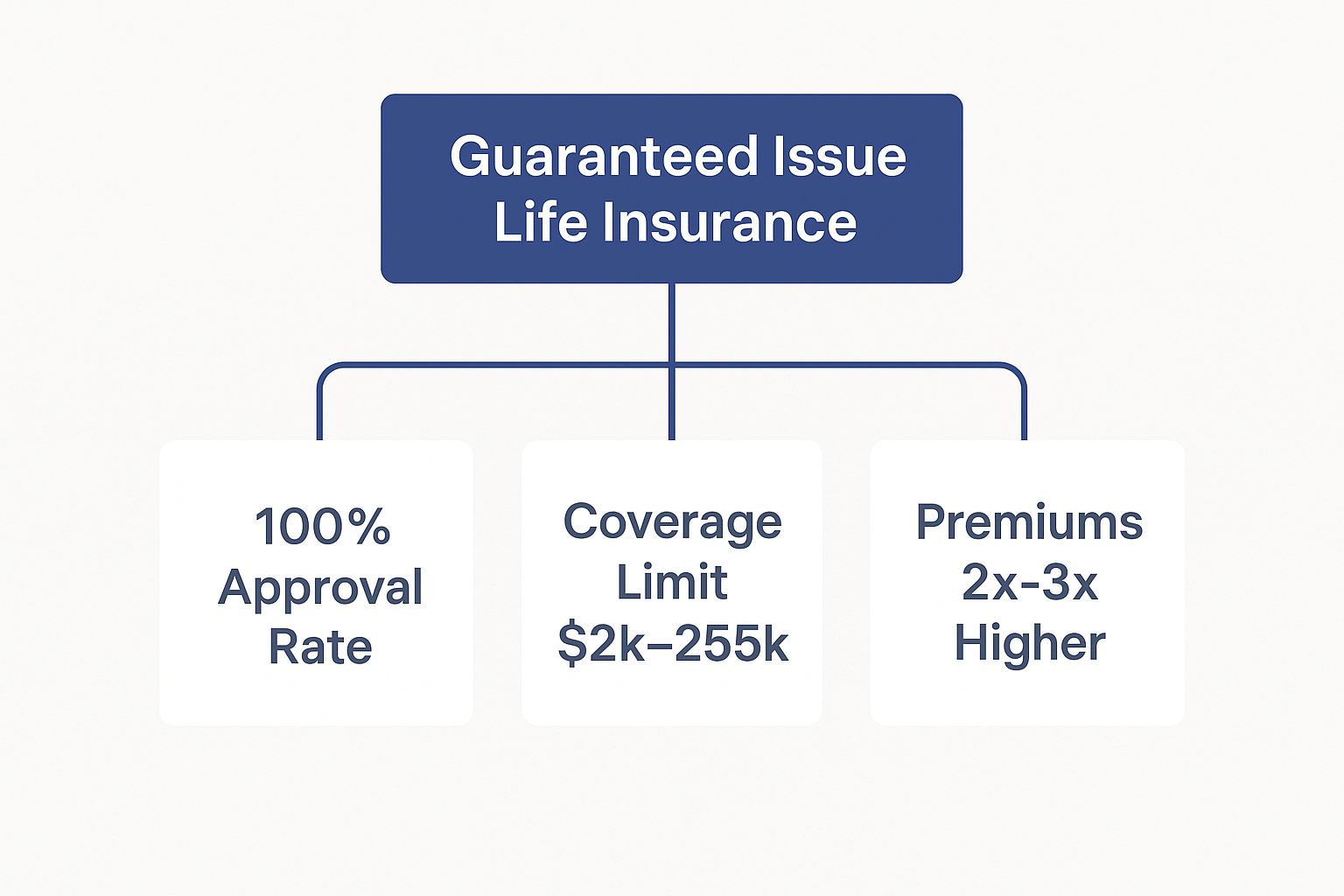

This visual breaks down what makes guaranteed issue stand out from the rest.

As you can see, that rock-solid certainty of approval comes with a trade-off: lower coverage limits and higher costs.

Making the Right Call for You

Understanding these differences is everything. The goal is always to find the best coverage you can get at a price that makes sense for you. That's why it's so important to try for a simplified issue policy first before settling on guaranteed issue. If you can get approved, you'll almost certainly save money.

The demand for life insurance is growing, and products like guaranteed issue are a big reason why—they open up access to more people. In fact, new life insurance premiums in the U.S. soared to a record $15.7 billion in 2023, which shows just how much people value this protection.

Guaranteed issue is a vital tool, but it's just one piece of the puzzle. To make a truly informed choice, it helps to compare it with other types of coverage, like Variable Universal Life (VUL) insurance. The more you know about the difference between term and permanent life insurance, the more empowered you'll be to find the perfect fit for your life.

Is This the Right Life Insurance for You?

Figuring out the right life insurance isn't about finding a magic bullet—it's about understanding who you are and what you truly need. Guaranteed issue life insurance is a powerful tool, but only when it's used for the right reasons. Think of it less as a one-size-fits-all solution and more like a specific key for a very particular lock.

This type of policy really shines for people who feel like they've run out of options. If you've been turned down for traditional life insurance because of your health, this is often the most straightforward way to get coverage. It’s designed to make sure final expenses don’t become a heavy weight for the people you love.

Making a Confident Decision

So, how do you know if this is your key? A few honest questions can point you in the right direction and show you if a guaranteed issue policy is a good fit.

- Have you been denied other life insurance? If health issues have closed other doors, this policy's guaranteed acceptance is its biggest strength.

- Is your main goal to cover final expenses? With coverage amounts usually falling between $5,000 and $25,000, it's perfectly sized for funeral costs, leftover medical bills, and other small debts.

- Are you in the right age bracket? Most companies offer these policies to people between 50 and 85 years old.

- Do you value simplicity more than a low premium? You'll pay more for the convenience of skipping a medical exam, but the peace of mind that comes with it can be invaluable.

If you found yourself nodding "yes" to these questions, then guaranteed issue life insurance is definitely a path worth looking into. It was created to provide a safety net when other options just aren't available.

Ultimately, this policy is a lifeline for a very specific group of people. Before you commit, take a moment for an honest self-check and maybe a chat with a trusted advisor. It’s the best way to feel confident you're making the right choice for your family's future.

Frequently Asked Questions

When you're looking into something like guaranteed issue life insurance, a few questions always seem to pop up. Let's get right to them, so you can feel confident about whether this is the right path for you.

Here are the straightforward answers to the questions we hear most often.

What Happens If I Pass Away During the Waiting Period?

This is probably one of the most important things to understand. If a person passes away from a natural cause, like an illness, during the policy's "graded benefit" period—which is usually the first two years—their family won't receive the full death benefit.

Instead, the insurance company returns all the premiums that were paid in. Most companies also add a bit of interest to that refund, often around 10%.

But here’s a critical exception: if the death is accidental, the full policy amount is paid out, even if it happens on day one.

Can I Be Denied for Any Reason at All?

While these policies are called "guaranteed issue" because you can't be turned down for health problems, there are a couple of simple, non-medical hurdles you have to clear. As long as you meet these two criteria, you're almost certain to be approved:

- Your Age: You need to be within the insurer's required age range, which is typically between 50 and 85 years old.

- Your Location: The policy has to be available in the state where you live. Not all insurance companies operate in every single state.

If you check both of those boxes, your health history won't stand in the way of getting covered.

The Bottom Line: "Guaranteed issue" is all about your health. It means you won't be rejected because of pre-existing conditions. You just have to be the right age and live in a state where the policy is offered.

Can I Own More Than One of These Policies?

Yes, you can, but there’s a catch. Insurers put a cap on the total amount of coverage you can hold with them.

For example, a company might let you "stack" a few smaller policies, but only as long as their combined death benefit doesn't go over a set limit, which is often around $25,000.

This is done on purpose. These policies are designed to help with smaller, final expenses, not to build a huge estate. The coverage limits are there to keep the focus on that specific goal.

At My Policy Quote, we believe everyone deserves the peace of mind that comes with being prepared. If you're ready to look at simple, no-hassle life insurance options, we’re here to make it easy. Find the right coverage for your needs by visiting https://mypolicyquote.com today.