Picking a number for life insurance often feels like a shot in the dark. So many people just take their salary and multiply it by ten, hoping for the best.

But this common shortcut is a huge gamble that can leave the people you love with massive financial gaps. A life insurance needs calculator is the tool that takes you from guesswork to certainty, helping you land on a coverage amount that’s based on your family's real story.

Why a Simple Guess on Life Insurance Fails

Choosing a policy based on what feels "affordable" or using a simple rule of thumb is one of the most common life insurance mistakes to avoid. While it might seem like a decent starting point, this approach completely ignores the unique details of your financial life.

It doesn’t factor in your specific debts, your big-picture goals for the future, or the day-to-day expenses your loved ones would have to cover without you.

The Real-World Consequences of Underinsurance

When your coverage falls short, the consequences hit hard. Your family might be able to handle the immediate bills, but what about their long-term stability?

Imagine them having to sell the family home just to pay off the mortgage. Or your kids realizing they can't afford to go to college. These are the painful, real-world outcomes of being underinsured.

This isn’t just a what-if scenario; it’s a widespread problem. The 2024 Insurance Barometer Study found that 42 percent of adults feel they don't have enough life insurance. Even among middle-income families—those earning between $50,000 and $149,999—a staggering 39 percent said they needed more coverage. The gap between knowing you need it and actually having it is huge. You can dig into more of these insights from Bankrate.

Guesswork just creates anxiety. A data-driven calculation, on the other hand, builds confidence. The goal is to replace that financial uncertainty with a concrete plan designed for your family.

Moving From Anxiety to a Concrete Plan

A life insurance needs calculator cuts through all the guesswork. It forces you to look at the complete financial picture by asking for the right inputs:

- Your annual income to figure out how much salary needs to be replaced.

- Outstanding debts like your mortgage, car loans, and student loans.

- Future expenses you want to fund, like college tuition for your kids.

- Existing savings and assets that can help offset the total need.

By plugging in these figures, you get a personalized number that actually reflects your reality. It turns an abstract idea into a tangible goal, giving you a clear target for the financial security your family deserves. This isn't just about crunching numbers; it's about building a solid foundation for the people you love most.

Gathering Your Financial Puzzle Pieces

Before you even touch a life insurance needs calculator, the real work begins. The number it gives you is only as good as the information you put in.

Think of it like putting together a puzzle. If you’re missing pieces, you’ll never see the complete picture. The key is to gather a few key details first, so you get a truly accurate snapshot of your family's financial needs.

A great starting point is pulling up your latest pay stub, your online banking portal, and your annual mortgage statement. Having these on hand will make the whole process much smoother.

Your Income and Debts

First things first, you need to know your gross annual income. This isn't the time to guess—pull the exact number from your pay stub. This figure is the foundation, as it helps determine how much of your salary would need to be replaced to keep your family’s lifestyle intact.

Next, it’s time to face the debts. Make a clear, honest list of everything you owe. And I mean everything, not just the big-ticket items.

- Mortgage: Jot down the total remaining balance, not just what you pay each month.

- Student Loans: Add up all federal and private loan balances.

- Auto Loans: Note the full amount left on your car payments.

- Credit Cards and Personal Loans: Tally up every last bit of consumer debt.

It's a common mistake to overlook smaller debts, but those can add up and leave a surprising gap in your coverage. Each one is a financial weight your life insurance policy should lift from your family’s shoulders.

Future Expenses and Current Assets

Now, let's look ahead. What major costs are on the horizon that you want to make sure are covered, no matter what?

For many, college for the kids is at the top of the list. Try to estimate the future cost of tuition and living expenses for each child. This is a huge piece of the puzzle for parents. If you're in this boat, our guide on life insurance for parents has some great strategies.

Finally, you’ll need to account for the financial resources your family already has. These are the assets that can be used to cover expenses, which helps lower the total amount of life insurance you actually need to buy.

Tally up your liquid assets—things like savings accounts, non-retirement investments, and any existing life insurance policies. Don't include your 401(k) or home equity, as these aren't easy to access quickly without facing major penalties.

Things like your age, gender, marital status, and how many dependents you have also play a massive role. The best calculators use these details to get a much clearer, more personalized recommendation of your unique financial responsibilities.

Putting the Calculator to Work: A Real-World Example

All the financial jargon in the world can make life insurance feel way more complicated than it needs to be. The best way to cut through the noise? Let's walk through a real-world scenario to see how a life insurance needs calculator actually works its magic.

Imagine the Miller family: a couple in their late 30s with two young kids, ages 5 and 7. They’ve got a mortgage, a couple of car loans, and a big dream of sending both children to college one day. By plugging their details into a calculator, we can turn all that financial data into a single, straightforward coverage number.

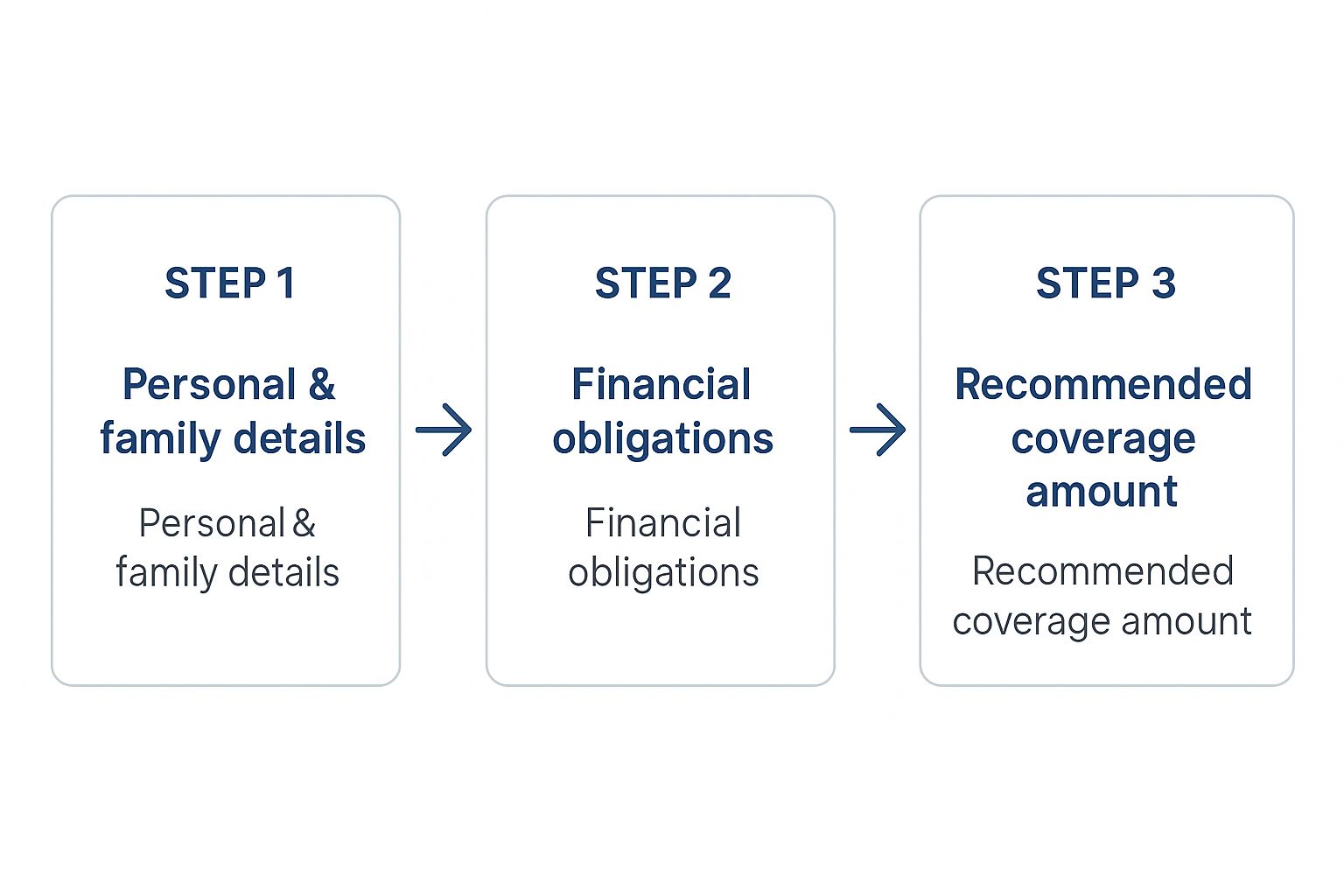

This simple graphic shows you the core steps—moving from your personal details to a final recommendation. It’s a logical flow.

As you can see, the calculator just gathers your info, analyzes your obligations, and produces a personalized coverage figure. It’s that simple.

Tallying Up the Financial Obligations

First things first, the calculator looks at all the expenses that would need to be covered if something happened. The whole point is to build a financial safety net that handles both immediate bills and long-term goals. This ensures your family can keep their standard of living without added financial stress.

Here’s a quick look at the Millers' key obligations:

- Income Replacement: The main breadwinner brings in $80,000 a year. To provide stability until the youngest child turns 18 (that's 13 years), they'll need $1,040,000 ($80,000 x 13 years).

- Mortgage: They still owe $275,000 on their house. Wiping this out means the family has a stable roof over their heads, no questions asked.

- Other Debts: Between car loans and a bit of credit card debt, they have another $35,000 to clear.

- College Fund: Planning for the future, they estimate a modest $100,000 per child for college, which adds $200,000 to the total.

- Final Expenses: A practical estimate of $15,000 is set aside for funeral costs and other end-of-life expenses.

Add it all up, and the Millers' total financial need comes to $1,565,000. This is the financial hole that would be left behind.

Key Takeaway: A good calculation isn't just about replacing a paycheck. It's about systematically erasing every major debt and funding future dreams to give your loved ones complete peace of mind.

Factoring in What You Already Have

Now for the other side of the coin. No calculation is complete without looking at the resources your family already has. These assets can offset the total need, which often means you don't have to buy as much coverage as you first thought. This step is absolutely crucial for getting an accurate—and affordable—recommendation.

To get the most precise number, you simply add up all the financial obligations and then subtract any liquid assets. As some experts on NerdWallet point out, we focus on liquid assets—things that can be accessed quickly without penalty, like savings. This means we don't count things like home equity or retirement funds that are harder to tap into.

Here’s a breakdown of the Millers' existing assets:

- Savings Account: $40,000

- Investments (Non-Retirement): $25,000

- Existing Group Life Insurance: The primary earner has a $100,000 policy through work.

Their total liquid assets add up to $165,000.

With this final piece, the calculator can deliver its recommendation. We just subtract their assets from their total need:

$1,565,000 (Total Need) – $165,000 (Existing Assets) = $1,400,000

To show this a bit more clearly, let's put it all into a table.

Sample Calculation for a Family of Four

This table breaks down the entire calculation for our hypothetical family, showing how each piece of the puzzle contributes to the final life insurance recommendation.

| Financial Component | Calculation/Value | Subtotal |

|---|---|---|

| Income Replacement | $80,000/year x 13 years | $1,040,000 |

| Mortgage Payoff | Remaining balance | $275,000 |

| Other Debts | Car loans, credit cards | $35,000 |

| College Savings | $100,000 x 2 children | $200,000 |

| Final Expenses | Estimated funeral costs | $15,000 |

| Total Financial Need | Sum of all obligations | $1,565,000 |

| Savings Account | Liquid asset to subtract | -$40,000 |

| Investments | Liquid asset to subtract | -$25,000 |

| Existing Insurance | Liquid asset to subtract | -$100,000 |

| Total Existing Assets | Sum of all assets | -$165,000 |

| Recommended Coverage | Need minus Assets | $1,400,000 |

Based on this real-world example, the Millers need a life insurance policy with a $1.4 million death benefit to make sure their family is fully protected.

Making Sense of Your Coverage Number

Getting that final number from a life insurance calculator can be a weird mix of relief and sticker shock. One minute, you have a vague idea that you need coverage. The next, you’re staring at a very specific, and often very large, number.

So, what do you do with it?

First, don't see it as an intimidating final bill. Think of it as your ideal financial safety net. It’s the amount of money your family would need to be completely okay if you were gone—debts cleared, goals funded, and your income replaced. It's your target, not a demand.

Now, the real work begins: turning that target into a smart, affordable plan.

Term vs. Whole Life: What’s the Right Fit?

That big number you just calculated is more than just a dollar amount; it's a powerful clue that points you toward the right kind of life insurance for your family.

Here’s how it helps you decide between the two main options:

-

Term Life Insurance: This is your straightforward, budget-friendly choice. You get coverage for a specific period—a "term"—like 10, 20, or 30 years. If your goal is to protect your family during your most financially vulnerable years (think paying off a 30-year mortgage or raising kids), term life is almost always the answer. A big number, like the $1.4 million from our example, is actually achievable with a term policy because it's so cost-effective.

-

Whole Life Insurance: This is permanent coverage that lasts your entire life and builds cash value over time. It’s a great tool, but it's also much more expensive. People typically use whole life for permanent needs, like covering final expenses, complex estate planning, or leaving a guaranteed inheritance for their heirs.

For most families I work with, a term policy that matches their calculated need is the most practical and powerful solution. You get maximum protection when you need it most, without breaking the bank.

The number from your life insurance needs calculator isn't just about the 'how much.' It’s a powerful clue that helps you decide 'what kind' of protection makes the most sense for your family's specific journey.

Your Roadmap From Calculation to Coverage

Okay, you have your target number and a good idea of which policy type makes sense. Now you can move forward with real confidence. Here’s what comes next to turn that number into a real policy that protects the people you love.

- Shop for Quotes: Never, ever take the first offer. You need to compare quotes from several different insurance companies. You’d be surprised how much rates can vary for the exact same coverage amount and term.

- Get Ready for the Application: The application will ask about your health and lifestyle. It’s pretty detailed. You’ll also likely need a simple medical exam—think a quick visit from a nurse to check your height, weight, and blood pressure, and take small blood and urine samples. It's painless and usually quick.

- Talk to a Pro: This is a step I can't recommend enough. Review your results with a licensed insurance agent or a financial advisor. They can look over your numbers, confirm your logic, and suggest strategies you might not have thought of. For instance, they can help you figure out if it makes sense to look into having two life insurance policies to cover different needs.

This whole process removes the guesswork and anxiety. You're not just buying a policy; you're building a thoughtful, data-driven plan based on what your family truly needs to be secure.

Common Traps That Skew Your Calculation

A life insurance needs calculator is an incredibly powerful tool. But it has one big vulnerability—it's only as accurate as the numbers you feed it.

Small oversights can easily lead to a final coverage amount that looks right on the surface but is actually built on a shaky foundation. That's a risk your family can't afford.

Garbage in, garbage out, as they say. Even with the best intentions, it’s easy to stumble into a few common traps that can throw off your final number. Avoiding them is the key to getting a result you can actually trust.

Underestimating the Silent Threat of Inflation

One of the most frequent mistakes I see is people completely forgetting about inflation. The $100,000 you earmark for your child’s college education today might only have the buying power of $70,000 by the time they’re packing their bags for campus.

Your calculation has to account for the rising cost of living over the long haul.

A simple fix is to build a "cushion" into your future expenses. A good rule of thumb is to inflate those long-term goals—like college funding or income replacement—by 2-3% for every year down the road. This helps ensure your policy's value doesn't get eroded over time.

Forgetting about smaller debts is another classic error. It's easy to remember the mortgage but overlook the $12,000 personal loan or the last two years of car payments. Those debts don’t just vanish; they become your family’s problem to solve. Be meticulous and list out every single liability, no matter how small it seems.

Your goal is to leave a clean slate for your loved ones. A truly accurate calculation accounts for every single dollar of debt, ensuring nothing gets left behind to cause more stress during an already difficult time.

The Miscalculation of Assets and Contributions

It’s tempting to list every asset you own to try and lower your calculated need, but this can backfire spectacularly. So many people make the mistake of including non-liquid assets in their calculations.

- Your Home's Equity: It’s a huge asset, but your family can't use it to pay for groceries. Accessing that equity would mean selling the house—the very last thing you’d want them to do while grieving.

- Retirement Accounts: Cashing out a 401(k) or IRA early triggers a painful hit from taxes and penalties. These funds should be left untouched to serve their original purpose: providing for your surviving spouse's retirement.

When you're totaling up assets, stick to what's easily accessible, like savings accounts, checking accounts, and non-retirement investment portfolios. To get a better feel for how a policy is built to handle these specific needs, you can learn more about what exactly does life insurance cover in our detailed guide.

Finally, one of the biggest traps of all is only planning for the primary breadwinner. Think about it: a stay-at-home parent provides enormous financial value through childcare, home management, and a dozen other roles. Replacing those services would cost tens of thousands of dollars a year.

Both partners, regardless of who earns the bigger paycheck, need their contributions factored in to get a true and complete picture of your family's financial needs.

Your Questions About Life Insurance Needs Answered

You ran the numbers through the calculator, and now you have a figure staring back at you. It’s a huge first step, but what comes next? Let’s clear up a few of the most common questions that pop up right after that "aha" moment.

How Often Should I Revisit This Calculation?

Life insurance isn’t a “set it and forget it” kind of thing. Your life is always moving, and your coverage should keep up.

A good rule of thumb is to run the numbers again every 3 to 5 years. But more importantly, you need to reassess anytime something big changes in your life.

- Getting married or divorced: Your financial promises to a partner change in a big way.

- Having a child: This is the big one. Suddenly, you have a tiny human who depends on your income for the next two decades.

- Buying a home: A new mortgage is a massive debt. Your policy needs to be big enough to cover it.

- A major salary jump: As your income grows, so does your family's lifestyle. Your income replacement needs to grow right along with it.

What if the Recommended Coverage Is Too Expensive?

Seeing a recommendation for a million-dollar policy can definitely feel overwhelming, especially when you think about the monthly premium. If that ideal number feels out of reach, don't just walk away.

The goal is to get protected, because having some insurance is infinitely better than having none at all.

You have a few smart ways to make coverage more affordable:

- Choose a longer term. A 30-year term policy will have a lower monthly payment than a 20-year one for the same amount of coverage.

- Start smaller and add on later. Buy a policy you can comfortably afford right now. You can almost always apply for more coverage down the road as your income increases.

- Layer multiple policies. This is a great strategy. You could get a large 20-year policy to cover the years your kids are at home and a smaller 30-year policy just for the mortgage.

Your first policy doesn't have to be your last. The most important thing you can do is get a foundational layer of protection in place for your family today.

Should My Spouse Also Calculate Their Needs?

Yes. Absolutely. This is a critical step that so many families miss.

Both partners bring enormous value to the family, whether that’s through a paycheck or by managing the home. Each person should use a life insurance needs calculator to figure out their individual coverage needs.

It's a huge mistake to undervalue the financial contribution of a stay-at-home parent. If they were to pass away, the surviving partner would suddenly have to pay for childcare, cooking, cleaning, and managing the household. Those costs can easily stack up to tens of thousands of dollars a year, creating a massive financial hole.

Putting a real dollar value on that work is essential for building a truly complete protection plan for your family.

At My Policy Quote, we make it easy to find a policy that fits the number you calculated and your budget. You can compare personalized quotes in just a few minutes and build the financial security your family deserves.

Start your free quote at https://mypolicyquote.com.