Thinking about switching from a Medicare Advantage plan to Medigap? You absolutely can, but it’s not as simple as flipping a switch. It requires careful timing and a solid grasp of the rules.

Most people make this move for one big reason: they want more freedom to choose their doctors and more predictable out-of-pocket costs. It’s a trade-off—giving up the bundled extras of an MA plan for the wide-open network that comes with Original Medicare and a Medigap policy.

Why People Change from Medicare Advantage to Medigap

The decision to leave a Medicare Advantage (MA) plan for Original Medicare with a Medigap supplement almost always comes down to healthcare freedom.

MA plans are popular because they often have low premiums and throw in perks like dental or vision coverage. But the catch is their restrictive provider networks. For a lot of people, that works out just fine—at first.

But life happens. A new diagnosis might mean you need to see a specialist who isn’t in your plan’s network. Or maybe your trusted family doctor suddenly drops out of the network. These limitations can become a real roadblock to getting the care you need, which is exactly why so many people start looking into a switch.

The Appeal of Broader Access and Predictability

Medigap plans, when paired with Original Medicare, offer a completely different feel. Instead of being stuck in a limited network, you can see any doctor or visit any hospital in the U.S. that accepts Medicare. That kind of flexibility is a huge draw, especially if you travel or just want total control over who manages your health.

On top of that, Medigap policies are designed to cover the “gaps” in Original Medicare, like your deductibles and coinsurance. This structure makes your out-of-pocket costs incredibly predictable and protects you from getting hit with a massive, unexpected bill after a hospital stay. You can dig deeper into finding the best Medicare supplement plan for your situation in our detailed guide.

To help you see the differences at a glance, here’s a quick comparison of how these two paths stack up against each other.

Medicare Advantage vs Medigap Quick Comparison

| Feature | Medicare Advantage (Part C) | Original Medicare + Medigap |

|---|---|---|

| Provider Choice | Limited to a specific network (HMO or PPO) | Any doctor/hospital in the U.S. that accepts Medicare |

| Premiums | Often low or $0, but you still pay the Part B premium | Monthly premium for Medigap + your Part B premium |

| Out-of-Pocket Costs | Can be unpredictable; varies with copays and coinsurance | Highly predictable; most "gaps" are covered |

| Extra Benefits | Often includes dental, vision, hearing, and prescriptions | Does not include extra benefits; requires separate plans |

| Referrals | Usually required to see specialists | Not required |

| Travel Coverage | Limited to network area; emergency-only outside | Covers you anywhere in the U.S. |

As you can see, the choice really boils down to what you value most: the all-in-one convenience of an MA plan or the freedom and cost stability that Medigap provides. There's no single right answer, just the one that's right for you.

The core trade-off is clear: Medicare Advantage bundles benefits within a managed network, while Medigap prioritizes provider choice and cost stability at a higher monthly premium.

Understanding the Market Trends

Even with the explosive growth of Medicare Advantage—enrollment hit a staggering 32.8 million in 2024—Medigap still holds its own.

Research shows that while more than 7% of people on traditional Medicare switched over to MA plans in 2021, a smaller but dedicated group always moves in the other direction. These are the folks who decide unrestricted provider access is their top priority, no matter what.

This just goes to show how diverse the needs of the Medicare population are. There really is no one-size-fits-all solution when it comes to your health coverage.

Finding Your Window to Switch Plans

Timing is everything when you decide to change from Medicare Advantage to Medigap. This isn't like your first go-around with Medicare; you can't just make a switch whenever you feel like it. Your ability to move between plans is tied to very specific enrollment periods and life events.

Getting these dates right is the first, and most important, step. If you miss your window, you could find yourself waiting another full year or, worse, facing medical underwriting. That's when insurance companies can dig into your health history, and it can make getting a Medigap policy a lot tougher.

Key Enrollment Periods Explained

Two main periods come into play for switching, and it’s surprisingly easy to mix them up. Both allow you to drop your Medicare Advantage plan, but what you can do next is very different.

- Annual Election Period (AEP): This is the one most people know. It runs from October 15 to December 7 every year. During AEP, you can leave your Medicare Advantage plan and go back to Original Medicare. It's also your chance to enroll in a standalone Part D prescription drug plan.

- Medicare Advantage Open Enrollment Period (MA OEP): This window runs from January 1 to March 31. If you're already in a Medicare Advantage plan, you can use this time to either switch to a different MA plan or drop your current one and return to Original Medicare.

Here's the critical difference: neither of these periods gives you an automatic right to buy a Medigap policy without answering a long list of health questions. For that, you need something much more powerful.

The Power of Guaranteed Issue Rights

Your "golden ticket" for making a clean switch is something called guaranteed issue rights. These are special circumstances that legally require insurance companies to sell you a Medigap policy, no medical underwriting allowed. That means they can't turn you down or jack up your rates because of your health history.

A guaranteed issue right is your best friend when switching from Medicare Advantage. It takes the risk out of the equation, ensuring you can get a Medigap policy even with pre-existing conditions. It makes the whole process smooth and certain.

So, what triggers these game-changing rights? They aren’t tied to a calendar. They’re tied to specific life events.

You might get a guaranteed issue right if:

- You move out of your plan’s service area. Say you move from Florida to Arizona. Your Florida-based MA plan won't cover you there, which opens a door for you to buy a Medigap policy.

- Your Medicare Advantage plan leaves Medicare or stops serving your area. If your insurer pulls out of your county, you're protected and get a chance to switch.

- You were misled by the company or agent who sold you the plan. This one is less common, but it's an important consumer protection.

- You’re in a "trial right" period. This applies if you tried a Medicare Advantage plan when you first turned 65 and decide within the first year that it's not the right fit for you.

Each of these situations opens up a special 63-day window to apply for a Medigap plan with guaranteed acceptance. Planning around these events is key, and our comprehensive Medicare planning guide can help you see them coming. Knowing your rights is what makes the difference between a simple switch and a complicated headache.

How To Make The Switch Successfully

Deciding to change from Medicare Advantage to Medigap is one thing. Actually navigating the process is another beast entirely. If there's one piece of advice to take away, it's this: secure your Medigap policy first, before you even think about disenrolling from your Medicare Advantage plan. That specific order is non-negotiable.

Why? Applying for Medigap isn't always instant, especially if you have to go through medical underwriting. If you drop your MA plan first, you could create a dangerous gap in your coverage. Imagine going weeks—or even months—without comprehensive health insurance. It’s a financial gamble no one should ever have to take.

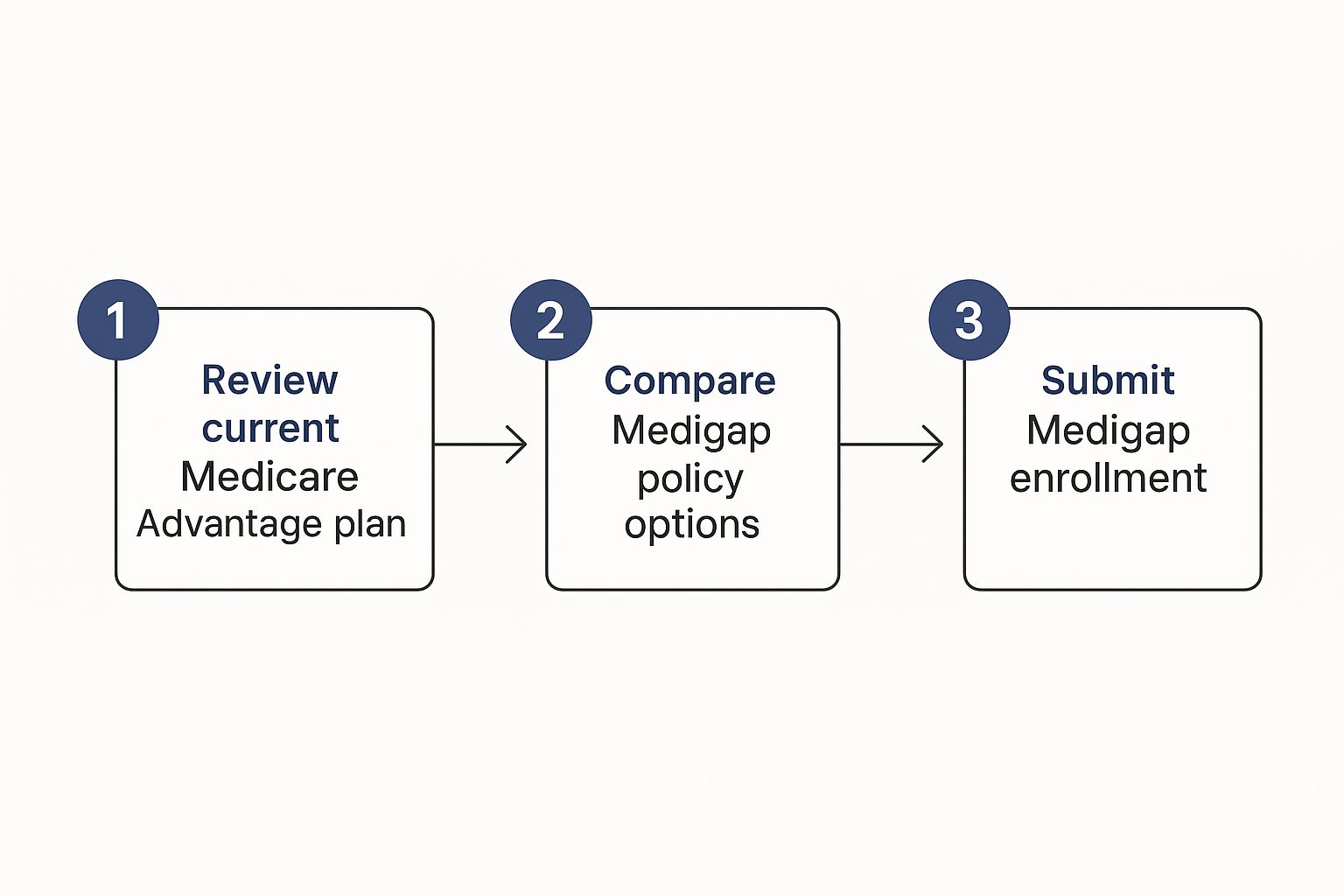

This flow chart breaks down the core sequence for a smooth transition.

It always starts with a careful review of your current plan and a deep dive into your new options, which leads you right to that Medigap application.

Lock In Your Medigap Policy First

Once you’ve landed on the Medigap plan that fits your life, it's time to submit the application. Just be ready for the underwriting process if you don't have a guaranteed issue right. The insurance company will need to look at your health history to figure out your eligibility and premium.

Only move on to the next step when you have a written approval letter with a confirmed effective date in your hands. That letter is your green light—it’s proof that your new coverage is locked in and ready to roll.

How to Disenroll From Your Medicare Advantage Plan

With that Medigap approval secured, you can now safely leave your MA plan. You've got a couple of straightforward ways to do this during a valid enrollment period (like the AEP or MA OEP).

- Call Your Plan Directly: You can get in touch with your Medicare Advantage plan’s member services or send them a written request to disenroll. They’ll walk you through their specific steps.

- Join a Standalone Part D Plan: This is often the easiest route. The moment you enroll in a new standalone Medicare Part D prescription drug plan, you are automatically disenrolled from your Medicare Advantage plan.

That second option is incredibly efficient. Since you're going back to Original Medicare, you're going to need prescription coverage anyway. Signing up for a Part D plan knocks out two essential tasks at once.

Crucial Tip: Always confirm the exact dates your old plan ends and your new ones (Medigap and Part D) begin. You're aiming for a seamless handoff where the new coverage kicks in the day after the old one stops—for instance, an MA plan ending December 31 and the new policies starting January 1.

Why Medigap Is Still a Strong Contender

While Medicare Advantage has seen explosive growth, a steady stream of people still make the switch back to Medigap. In 2021, only about 1.2% of MA enrollees moved to traditional Medicare with Medigap, but this number represents a very deliberate choice for more freedom.

The Medigap market, with 9.4 million members just among the top companies, shows a consistent demand for plans that fill Original Medicare’s gaps without network handcuffs. You can dive deeper into these trends by exploring the latest research on Medicare Advantage enrollment. Ultimately, the choice comes down to balancing the all-in-one benefits of MA plans against the broader access and predictability that Medigap offers.

Grappling With Medical Underwriting and New Costs

Let's get real about the biggest hurdle you'll face when you want to switch from Medicare Advantage to Medigap without a guaranteed issue right: medical underwriting.

This is just the insurance company's process for reviewing your health history. They use it to decide if they’ll offer you a policy and what it will cost. It sounds intimidating, but it's mostly a detailed health questionnaire. Your answers are what matter.

The goal for them is to figure out their risk. If you have some significant pre-existing conditions, an insurer might charge a higher premium. In other cases, they could impose a waiting period for that specific condition or, if the risk is too high, they might have to deny the application.

What Insurers Are Really Looking For

When you go through medical underwriting, the insurance company wants a clear snapshot of your health. The questions they ask can get pretty specific.

They'll usually zoom in on a few key areas:

- Recent Hospitalizations: Have you been admitted to a hospital, skilled nursing facility, or similar care center in the last couple of years?

- Chronic Conditions: Are you managing ongoing conditions like diabetes, COPD, heart disease, or rheumatoid arthritis?

- Upcoming Treatments: Are you waiting on a surgery, a big diagnostic test, or still waiting for a doctor's final opinion on something?

- Prescription History: The medications you take paint a very clear picture of the conditions you're actively managing.

Understanding this process is key. It's a bit different than other financial planning. For instance, you might ask, "can you have two life insurance policies?", but with Medigap, the goal is to get approved for one solid plan that fits your health profile. That's the main event.

This is exactly why you should always apply for a Medigap policy before you even think about dropping your Medicare Advantage plan. It’s your safety net. This way, you're not left scrambling without any coverage if your application gets turned down.

Budgeting for Your New Monthly Costs

Making the move to Medigap also means your monthly healthcare budget is going to look different. Your costs won't be bundled into one MA plan premium anymore. Instead, you'll have a few separate, but very predictable, monthly expenses.

Your new budget will break down into three main parts:

- The Medicare Part B Premium: This is the standard amount everyone on Original Medicare pays directly to the government. For 2024, the standard premium is $174.70, but it can be higher depending on your income.

- Your Medigap Policy Premium: This is what you'll pay your private insurance company each month for your supplemental plan. These costs can vary a lot based on the plan you pick (Plan G is different from Plan N), where you live, your age, and the results of your medical underwriting.

- Your Part D Prescription Drug Plan Premium: Medigap plans don't cover prescriptions, so you'll need a separate Part D plan. Premiums for these can be anywhere from less than $20 to over $100 a month, all depending on the specific drugs the plan covers.

Let's put it into a real-world context. A healthy 65-year-old might see a monthly budget that looks something like this: $174.70 (Part B) + $150 (a competitive Medigap Plan G) + $40 (a decent Part D plan). That comes out to $364.70 per month.

The big difference? You now have a clear, stable number for your healthcare costs, which is a huge shift from the unpredictable copays you often find with an MA plan.

Choosing Your Ideal Medigap and Part D Plans

When you make the change from Medicare Advantage to Medigap, you’re essentially unbundling your coverage. Instead of one all-in-one plan, you now get to pick two separate policies: a Medigap plan to fill the gaps in Original Medicare and a Part D plan for your prescriptions.

Think of it as building your healthcare dream team. This is your chance to hand-pick a combination that truly fits your health needs and financial comfort zone.

Selecting the Right Medigap Plan for You

The first big step is choosing the right Medigap policy. The good news is that these plans are standardized by the federal government, which makes them much easier to compare.

A Plan G from one company has the exact same core benefits as a Plan G from another. The only things that really change are the monthly premium and the company's reputation for customer service.

For most folks new to Medicare today, the choice usually boils down to two heavy hitters: Plan G and Plan N. Plan F, while incredibly comprehensive, is no longer available to anyone who became eligible for Medicare after January 1, 2020.

- Medigap Plan G: This is the go-to option for new enrollees, and for good reason. It covers just about everything Original Medicare doesn't, leaving you with only the annual Medicare Part B deductible to pay.

- Medigap Plan N: A fantastic alternative with a lower premium. It still provides very solid coverage but asks you to chip in with small copays for some doctor visits (up to $20) and ER trips (up to $50).

So, how do you decide? It really comes down to your personal tolerance for out-of-pocket costs. If you crave predictability and want to avoid surprise bills, Plan G is an excellent choice. But if you're in good health, don't mind the occasional copay, and want to save on premiums, Plan N is definitely worth a serious look.

Medigap is a popular choice for a reason. With 12.5 million people holding a policy, it’s clear that predictable costs and the freedom to see any doctor are top priorities. The market shows a strong preference for Plan G, now the leading choice for new policies. You can explore these trends in more detail in this in-depth KFF analysis.

Don't Forget Your Prescription Drugs

Once you've got your Medigap policy lined up, you absolutely must enroll in a standalone Medicare Part D plan. Skipping this crucial step can trigger a late enrollment penalty that sticks with you for life.

When you're comparing Part D plans, don't just look at the monthly premium. The most important thing to check is the formulary—that's the official list of drugs the plan covers.

The best way to do this is by using Medicare’s Plan Finder tool. You can enter your specific medications, dosages, and even your favorite pharmacy. The tool will then calculate which plans cover your drugs at the lowest total annual cost. A few minutes doing this can literally save you thousands of dollars and prevent major headaches at the pharmacy counter.

And if you're curious about the nuts and bolts of how insurance companies approve applications, our guide on what is underwriting in insurance explains the process in simple terms.

Still Have Questions About Switching to Medigap?

Even with all the facts, making a big change like switching from Medicare Advantage to Medigap can leave you with a few lingering "what ifs." That's completely normal.

Let's walk through some of the most common questions people have. Think of this as our final chat to clear up any last-minute worries before you move forward.

What Happens if My Medigap Application Is Denied?

This is a big one, especially if you're applying outside of your initial enrollment window and have to go through medical underwriting. It’s a valid concern.

But here’s the most important thing to remember: you are still enrolled in your Medicare Advantage plan.

Because you wisely applied for Medigap before dropping your MA plan, you haven’t created any coverage gaps. A denial simply means you stick with your current plan. Nothing changes. You can then reassess your options during the next enrollment period.

Will I Lose My Dental and Vision Benefits?

Yes, this is probably the biggest trade-off. Original Medicare and Medigap policies don’t cover routine dental, vision, or hearing services. These are the extra perks often bundled into Medicare Advantage plans.

But losing them doesn’t mean you have to go without. You can simply buy separate, standalone insurance plans for your dental and vision needs. There are plenty of great, affordable options out there that give you the freedom to build a benefits package that works for you.

"A common misconception is that switching to Medigap means giving up essential benefits forever. In reality, it just means unbundling them. You gain total provider freedom with Medigap, and then you can purchase standalone dental or vision plans that often offer broader network choices than the MA plans did."

Can I Switch Back to Medicare Advantage Later?

Absolutely. Nothing is set in stone.

If you move to Original Medicare with Medigap and find it’s not the right fit after a year or two, you can always switch back to a Medicare Advantage plan during the Annual Election Period (AEP).

This window runs from October 15 to December 7 each year. Any change you make will take effect on January 1. This flexibility means you can always adapt your coverage as your life, health, or budget changes.

Navigating all these moving parts can feel complex, but you don’t have to figure it out on your own. The experts at My Policy Quote are here to offer clear, unbiased guidance and help you find the perfect fit for your needs.