Let's be honest: talking about the long term care insurance cost isn't exactly fun. But it’s a conversation that matters. For a healthy couple in their mid-50s, a policy might run around $2,000-$2,500 per year. Wait until your 60s, though, and that number can easily double.

Why Planning for Long Term Care Is Essential

You’ve worked your whole life to build a nest egg, save for retirement, and create a legacy. Now, imagine watching it all disappear in a matter of years to cover unexpected medical needs. It’s a harsh reality, but it’s one that countless families face without a real plan.

The truth is, most of us will need some help as we get older. Statistics show that roughly 70% of adults over 65 will eventually need long-term care services—assistance with everyday things like getting dressed, eating, or bathing.

This isn’t some far-off “what if.” It’s a very likely part of life, and it comes with a massive price tag. Long-term care insurance (LTCi) is designed to be your financial shield when that time comes.

What Does Long-Term Care Actually Cover?

When people hear "long-term care," their minds often jump straight to nursing homes. But that’s just one small piece of the puzzle. Modern care is all about giving you choices and letting you get support in a place where you feel comfortable and respected.

A good LTC insurance policy can cover a wide range of services, including:

- In-Home Care: Getting help from a nurse or health aide right in your own home. You keep your independence, and your family gets peace of mind.

- Assisted Living Facilities: Living in a community setting that provides daily support but also encourages an active social life.

- Nursing Home Care: For when you need more intensive, round-the-clock medical supervision and skilled care.

- Adult Day Care: A place for seniors to socialize and receive care during the day, which also gives family caregivers a much-needed break.

Without insurance, every one of these bills comes straight from your pocket. Your savings, your investments, even the family home could be at risk. A lot of people think Medicare will handle it, but that’s a common and costly mistake. Medicare typically only pays for short-term, skilled care after a hospital stay—not the ongoing daily assistance most people actually need. And other plans, like health insurance for the self-employed, don't cover these specialized services.

The core purpose of long-term care insurance is to protect your assets and give your family choices instead of burdens. It ensures decisions about your care are based on your needs, not just what's financially possible at the moment.

At the end of the day, understanding the potential long term care insurance cost is the first step toward protecting your future. It's a strategy that keeps you in control of your life and ensures the legacy you built is there for you and your loved ones.

The Staggering Cost of Care Without a Plan

Before we even talk about insurance, let's get real about what you're up against. The out-of-pocket cost for long-term care isn't just expensive—it's financially devastating. It has the power to wipe out a lifetime of careful saving in just a couple of years.

Think of your retirement savings as a reservoir you've spent decades filling. An unexpected need for care is like a massive crack opening at the bottom. Without a plan to patch it, that reservoir can empty with terrifying speed, leaving very little behind for your future or your family.

The numbers don't lie. This isn't a minor expense you can just absorb; it's a monumental challenge that demands serious thought.

Understanding the National Averages

Across the country, the price tag for care keeps climbing higher and higher. While the exact numbers change depending on where you are, the trend is crystal clear: care is expensive, and it’s only getting more so.

The median monthly cost for a semiprivate nursing home room hit $8,641 in 2024. Need a private room? That’ll be $9,872. Fast-forward to 2040, and those figures are projected to jump to $13,867 and $15,841, respectively. That's a reality check that makes planning feel urgent.

Waiting doesn't just delay the decision; it makes the potential financial hit that much worse.

Without a dedicated insurance plan, the full weight of these costs falls directly on your personal assets. This includes your retirement accounts, home equity, and any inheritance you hoped to leave behind.

It’s a massive gamble to assume you can cover these costs on your own. It's a gamble that affects not just your quality of life but also places an incredible amount of stress on the people you love most.

To put these rising costs in perspective, here’s a look at what families are facing now and what they can expect in the coming years.

Projected Monthly Long-Term Care Costs in the U.S.

This table shows the current and projected median monthly costs for different types of long-term care, illustrating the significant financial burden families may face.

| Care Type | Median Monthly Cost (Current) | Projected Monthly Cost (2030) | Projected Monthly Cost (2040) |

|---|---|---|---|

| Nursing Home (Semiprivate) | $8,641 | $10,245 | $13,867 |

| Nursing Home (Private) | $9,872 | $11,706 | $15,841 |

| Assisted Living Facility | $5,511 | $6,535 | $8,844 |

| In-Home Health Aide | $6,481 | $7,686 | $10,402 |

These projections aren't just numbers on a page; they represent a growing crisis for unprepared families. The sooner you have a plan, the better you can protect your assets from these escalating expenses.

How Location Dramatically Affects Care Costs

Just like a house in one city costs far more than the same house in another, the cost of long-term care is all about location, location, location. Your zip code plays a huge role in what you’ll pay, with differences that can add up to tens of thousands of dollars a year.

For example, a state like Texas has some of the more manageable costs, with a semiprivate nursing home room running about $5,600 a month.

But head up to Alaska, and you’re looking at a completely different world. The same care there can cost a shocking $34,434 per month.

This massive difference is exactly why a "one-size-fits-all" approach to planning just doesn't work. You have to know the costs where you live—or where you plan to retire. Understanding your specific risks is the key to creating a solid plan and helps you stop overpaying for insurance and other protections.

Comparing Different Types of Care

The cost also shifts dramatically depending on the type of care you need. Not everyone ends up in a nursing home, but the other options still come with hefty price tags.

- Assisted Living Facilities: These communities offer help with daily activities and have a national median cost of $5,511 per month. That's over $66,000 a year.

- In-Home Health Aide: Want to stay in your own home? Hiring a professional aide for 44 hours a week costs a median of $6,481 a month.

- Adult Day Health Care: This option offers social engagement and gives family caregivers a break, costing a median of $2,123 per month.

Each of these services meets a different need, but they all represent a serious, ongoing financial drain. Seeing these numbers makes it easier to understand why a predictable insurance premium can feel like a much smarter—and safer—alternative to facing these costs all on your own.

How Insurers Calculate Your Premium

Figuring out the cost of long-term care insurance can feel like trying to solve a complicated puzzle. But it's not random. Insurers don't just pull a number out of a hat; they use a specific set of factors to figure out your premium. It's a lot like how a car insurance company looks at your age, driving record, and the type of car you drive before giving you a quote.

In the same way, long-term care insurers look at a few key things about you and the policy you want. Once you understand what they're looking at, you can see exactly what's driving the cost. Better yet, you can figure out which parts you can adjust to build a plan that protects you without wrecking your budget.

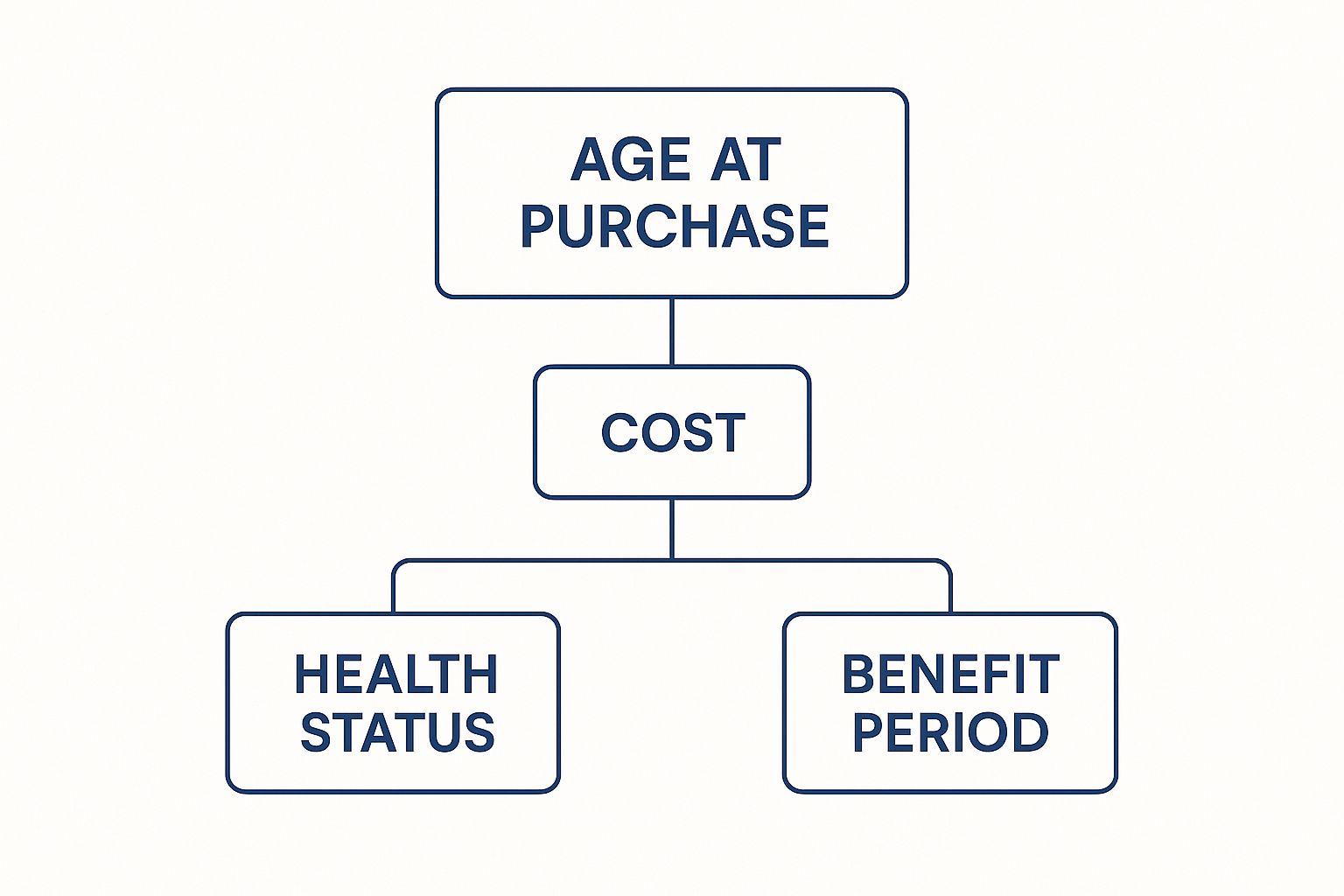

This image breaks down the most important factors that go into your premium. As you'll see, nothing impacts the price more than your age when you first sign up.

While your age is the biggest piece of the puzzle, your health and the kind of benefits you choose are also a huge part of the final cost.

Your Age and Health Profile

When it comes to the cost of long-term care insurance, your age is the single most powerful factor. The younger you are when you apply, the lower your premiums will be—and they'll stay that way for the life of the policy. Insurers give the best rates to younger folks because, statistically, they are healthier and many years away from needing care.

Even waiting a few years can make a huge difference. For example, a healthy 55-year-old might pay around $950 a year for a solid policy. But if that same person waits until they're 60, the cost could easily jump to $1,200 or more for the exact same coverage. Why? Because the risk of developing a health condition goes up with every birthday.

Your overall health is the next big thing insurers look at. They'll review your medical history carefully when you apply. If you have a clean bill of health, you could qualify for the best "preferred" rates available.

On the other hand, pre-existing conditions might raise your premium or, in some cases, even get your application denied. This is exactly why it’s so important to apply while you’re still in good health.

The best time to buy long-term care insurance is almost always years before you think you'll need it. Locking in a lower rate in your 50s can save you tens of thousands of dollars over the lifetime of your policy compared to waiting until your 60s or 70s.

Finally, being married can come with a nice perk. Many insurers offer big discounts—often called spousal or partner discounts—if you and your partner apply together. That's because studies show that couples often care for each other at home first, which can delay the need for professional services and lower the insurance company's risk.

Your Policy Design and Benefit Structure

After looking at your personal profile, the next thing that shapes your premium is the policy itself. The good news is, you have a lot of control here. Think of it like customizing a new car—you can add all the luxury features, or you can stick to the basics to keep the price down.

These are the main dials you can turn to adjust your coverage and cost:

- Benefit Amount: This is the maximum your policy will pay, usually shown as a daily or monthly limit (like $150 per day or $4,500 per month). The more you want it to pay, the higher your premium will be.

- Benefit Period: This is how long your policy will pay out benefits—it could be three years, five years, or even your entire lifetime. A longer period gives you more security, but it also costs more.

- Elimination Period: This is like a deductible, but for time. It’s the number of days you have to pay for your own care before the insurance starts paying. A typical range is 30 to 90 days. Choosing a longer elimination period can seriously lower your premium.

- Inflation Protection: This is a crucial feature that automatically increases your benefit amount over time, so your coverage keeps up with the rising cost of care. It adds to your initial premium, but it makes sure your policy is still useful decades from now.

By carefully adjusting these four levers, you can design a plan that gives you real protection without being a financial burden. For example, simply choosing a 90-day elimination period instead of a 30-day one can lead to big savings, making great coverage much more affordable.

Comparing Average Premiums by Age and Insurer

Knowing the factors that drive long term care insurance cost is one thing. Seeing the actual numbers is another. It makes the decision real. So, how much should you actually plan to spend? The answer really boils down to two things: your age and the company you choose.

Think of it like buying a plane ticket. Two different airlines can offer seats on the exact same route, but the prices can be worlds apart. Long-term care insurance works the same way. Two A-rated insurers might quote you wildly different premiums for nearly identical coverage. That's why shopping around isn't just a suggestion—it's essential.

Let's break down some real-world numbers to see how this actually plays out.

The Impact of Age on Annual Premiums

Your age when you apply is, without a doubt, the single biggest factor determining what you’ll pay. Insurers give the best deals—and lock-in rates—to younger, healthier applicants. It’s that simple.

Here’s a quick look at typical annual premiums for a solid policy starting with a $165,000 benefit pool that’s designed to grow over time:

- Single Male (Age 55): You can expect to pay around $950 per year.

- Single Female (Age 55): Because women tend to live longer, their premiums are often higher, averaging closer to $1,500 per year.

- Couple (Both Age 55): Applying as a couple usually comes with a nice discount, bringing the combined premium to an average of $2,080 per year.

Now, let's see what happens if you put it off for just five years. For that same policy, a couple who is 60 years old would see their combined premium jump to an average of $2,600 per year. That's a pretty significant price hike for a short delay.

The Critical Role of Insurer Comparison

While age sets the starting line, the insurer you pick can save—or cost—you thousands of dollars every year. The price difference between companies for the same coverage can be genuinely shocking. This isn't just a minor variation; it’s the number one reason why getting multiple quotes is non-negotiable.

For example, fresh data for 2025 shows this gap perfectly. A couple, both aged 55, looking for identical coverage ($165,000 initial benefit growing at 3% compounded) will see huge price swings. The lowest premium among the top insurers is $5,018 per year, but the highest is $6,325. Just by choosing the wrong company, you could pay 26% more every single year. You can discover more insights about these 2025 long-term care facts and see the cost differences for yourself.

This price gap isn't about one policy being "better" than another. It's about how different A-rated insurers calculate risk. One company might view you as a safer bet than another, and that's reflected directly in your premium.

The difference gets even more dramatic as you get older. For a couple aged 65, premiums for the exact same policy can range from $7,137 all the way up to $12,250 a year. That’s a potential difference of over $5,000 annually for the same peace of mind.

This data highlights a crucial truth: the "average" long term care insurance cost is just a guide. Your actual cost will be found through smart comparison shopping.

Sample Annual Premiums for Couples by Age

To really see how much you can save by being a savvy shopper, take a look at this table. It shows just how much premiums can vary between top-tier insurance companies.

| Age of Couple | Lowest Premium (Top Insurer) | Highest Premium (Top Insurer) | Potential Annual Savings |

|---|---|---|---|

| 55 | $5,018 | $6,325 | $1,307 |

| 60 | $6,125 | $8,410 | $2,285 |

| 65 | $7,137 | $12,250 | $5,113 |

As you can see, the financial hit for not comparing quotes gets bigger and bigger with age. Finding the right policy from the right provider isn't just a good idea—it's the most powerful way to manage your long-term care insurance cost.

Proven Strategies to Reduce Your Insurance Premium

Knowing what drives the long term care insurance cost changes everything. It puts you in the driver’s seat, turning you from a passive buyer into a smart planner who can shape a policy around your budget. When you understand the moving parts, you can pull the right levers to make your coverage much more affordable without sacrificing real protection.

Think of it like designing a custom-built tool instead of buying one off the shelf. By making a few key adjustments, you can craft a plan that gives you strong protection at a price you can actually live with. These aren't secrets or loopholes; they're the practical, common-sense strategies we use every day to help people find that perfect fit.

Let’s walk through the most powerful ways to bring your premium down.

Act Early to Lock In Lower Rates

The easiest and most effective strategy is the one you can control right now: apply when you're younger and healthier. This isn't just a small discount; it's the single best way to secure the lowest possible premium for the rest of your life. Insurers offer their best rates to applicants in their 50s because, statistically, the risk is lower.

Wait until your 60s or 70s, and you’re guaranteed to face higher premiums. Even more important, you run the risk of developing a health issue that could disqualify you from coverage altogether. Acting early is like buying a valuable asset before its price inevitably shoots up.

Leverage Significant Spousal Discounts

If you're married or in a long-term partnership, getting coverage together is a huge financial win. Most insurers offer major spousal or partner discounts that can slash your combined premium by 15% to 30%. This is one of the biggest price breaks you can get.

Why the generous discount? Because insurers know partners often care for each other at home first, which can delay or even prevent the need for paid professional help. This lowers the insurance company’s risk, and they pass those savings straight to you. It’s a win-win that makes planning as a couple incredibly smart.

Strategically Customize Your Policy Features

Your policy isn’t a one-size-fits-all package. You have direct control over its design, and tweaking its core features can bring your premium down dramatically.

- Extend the Elimination Period: This is like your policy's deductible, but it’s measured in time, not money. It's the number of days you'll pay out-of-pocket before your benefits start. Switching from a 30-day to a 90-day waiting period is a very popular way to see significant savings.

- Adjust the Benefit Amount: You don’t have to insure for the absolute most expensive care in your area. You can pick a daily or monthly benefit that covers most of the cost, then plan to supplement the rest with savings or income.

- Select a Shorter Benefit Period: Lifetime benefits offer ultimate peace of mind, but they come with a premium price tag. The reality is that most long-term care claims last for two to three years. Choosing a three- or five-year benefit period gives you a solid safety net at a much more manageable cost.

By fine-tuning these policy elements, you can tailor your coverage to what you truly need and can afford. It's about finding the perfect balance between robust protection and a sustainable long term care insurance cost.

Explore Modern Hybrid Policies

Traditional long-term care insurance has a "use it or lose it" problem. If you never need care, all those premiums you paid are simply gone. That’s a big reason why many people hesitate. Today, there's a popular alternative: the hybrid life/LTC insurance policy.

These plans combine a life insurance death benefit with a long-term care rider. Here’s the simple version:

- If you need long-term care, you can tap into the death benefit while you're alive to cover your expenses.

- If you never need care, your beneficiaries get the full, tax-free death benefit when you pass away.

This structure gets rid of the fear of paying for something you might never use. You get a guaranteed benefit one way or another. While a hybrid policy might have a higher upfront premium, the certainty it provides is something many people are looking for. Finding affordable health insurance that works for you means looking at all the modern options, and these plans are definitely part of that conversation.

The Future of Funding Long Term Care

Understanding what long-term care insurance costs is just one piece of the puzzle. To really get it, you have to look at the bigger picture—how this kind of care is actually paid for in the first place. It’s a mix of personal responsibility and government programs, and things can get complicated.

Most people rely on a blend of their own savings, investments, and private insurance. But a surprising number of us think that public programs will just swoop in and cover everything. That’s a dangerous assumption, one that can lead to some serious financial pain down the road.

Public vs. Private Funding Sources

The main government program for long-term care is Medicaid. But here’s the critical thing to understand: Medicaid is designed for people with extremely limited money and assets. It's a safety net, not a first resort.

To even qualify, you have to “spend down” almost everything you own. We’re talking about draining your life savings and selling off property until you meet strict poverty-level requirements. For families who’ve worked their entire lives to build a nest egg, relying on Medicaid means losing it all. This is exactly where private planning comes in.

Private long-term care insurance acts as a firewall. It protects your hard-earned assets from the crushing costs of care, letting you get the help you need without having to become impoverished first.

The Growing Global Market

This isn’t just a local issue; it's a global conversation. As people live longer all over the world, countries are looking for better ways to fund long-term care. And that has fueled a rapidly growing insurance market.

The global long-term care insurance market was valued at about $32.25 billion in 2024. By 2032, it’s expected to hit $45.89 billion. While government funding still plays a big role, private insurance is becoming an essential part of a solid financial plan.

This growth points to a clear trend: more and more, people are taking control of their own future care needs. It’s a proactive step toward keeping your financial stability and independence, no matter what happens next. For those planning ahead, exploring different health insurance options for early retirees can also help create a more complete financial strategy for the future.

Common Questions About LTC Insurance Costs

Thinking about the cost of long-term care insurance usually brings up a few key questions. It’s smart to get these sorted out early, so you can feel confident about the decisions you’re making for your future.

Let’s tackle some of the most common concerns people have.

Are Premiums Tax-Deductible?

Yes, they can be. A portion of your long-term care insurance premiums may qualify as a tax-deductible medical expense. The exact amount you can deduct changes based on your age and is adjusted by the IRS each year.

Since everyone’s financial picture is unique, it’s always best to chat with a tax professional to see how this benefit applies to you.

Can My Rates Increase Over Time?

It’s possible, but not in the way you might think. Your premiums aren't set in stone forever. Insurers can ask for rate increases, but they have to do it for an entire group of policyholders at once—not just you.

Plus, any increase has to be approved by state insurance regulators. They can’t single you out because of a change in your health after you’ve bought the policy. This is why picking a financially strong, reputable insurance company from the get-go is so important. It’s one of the best ways to keep future rate hikes in check.

Key Takeaway: Rate increases can happen for an entire class of policies, but they are regulated. Your individual health changes won't trigger a premium hike on their own.

What If I Stop Paying My Premiums?

Life happens, and sometimes budgets change. If you stop paying your premiums, your standard coverage will eventually end. But you don't necessarily lose everything you've paid in.

Many modern policies come with something called a non-forfeiture benefit. It's a fantastic safety net. This feature ensures that if you can no longer afford the payments, you still get to keep a smaller, paid-up pool of benefits based on the premiums you've already contributed.

At My Policy Quote, we believe finding the right insurance shouldn't feel complicated. Our experts are here to help you compare quotes and design a policy that protects your future without breaking your budget. Start your free quote today.