Life insurance for young adults is more than just a piece of paper—it's a strategic financial move that can protect your future while saving you a ton of money.

Think of it like planting a tree. The earlier you put it in the ground, the stronger its roots will grow and the more shade it will provide later on. It’s not just for people with kids and a mortgage. It's one of the foundational building blocks for a healthy financial life.

Why Life Insurance for Young Adults Is a Smart Move

Let's get right to the big question: why on earth should you think about life insurance right now? For most people in their 20s or early 30s, it feels like something to worry about way, way down the road. But honestly, that’s a huge misconception that causes people to miss out on the single best time to get covered.

The main benefit is refreshingly simple: locking in low rates for life. Insurance premiums are calculated based on two main things: your age and your health. Right now, you're likely the youngest and healthiest you'll ever be, which means your policy will be incredibly cheap. Securing one now lets you lock in that low monthly payment for decades, protecting your future self from much higher costs later.

Protecting Loved Ones From Debt

One of the most immediate, practical reasons to consider life insurance for young adults is to handle any co-signed debt. Did a parent or another family member co-sign your private student loans or your car loan? If so, they would be left holding the bag for that entire debt if something happened to you.

A life insurance policy acts as a financial safety net. It ensures the people you love most aren't stuck with your bills during an already heartbreaking time. It's an act of responsibility that brings incredible peace of mind to everyone.

Building a Foundation for the Future

Even if you're single with zero dependents today, life has a funny way of changing. You might get married, buy a house, or start a family sooner than you think. A life insurance policy bought today can become the cornerstone of the financial plan you'll need tomorrow.

Think of it this way: You're not just buying a policy for the person you are today; you're securing an affordable financial tool for the family you may have tomorrow.

Despite these clear advantages, a surprising number of young people go without coverage. Data shows that only about 40% of Gen Z adults (ages 18-26) have a life insurance policy, a stark contrast to the 58% of Baby Boomers who are covered. You can dig into more of these generational trends over at Choice Mutual.

As you think it over, you might still be asking yourself if it’s the right call for your specific life situation. Our in-depth guide can help you figure out if life insurance is worth it if you're young.

To make it even clearer, here's a quick look at the top reasons to get a policy on your side while you're young.

Top Reasons for Young Adults to Get Life Insurance

| Reason | Why It Matters for You |

|---|---|

| Lowest Possible Premiums | Your age and health are at their peak, guaranteeing the most affordable rates you'll ever get. |

| Covering Co-Signed Debt | Protects parents or family from being liable for your private student loans or other debts. |

| Future Insurability | Locks in coverage while you're healthy, before any potential future health issues make it expensive or impossible to qualify. |

| Building a Financial Asset | Permanent policies can accumulate cash value, creating a supplemental source of funds for the future. |

Securing a policy early is one of the smartest, simplest ways to set your future self up for success. It’s an investment in responsibility, financial stability, and peace of mind.

Decoding Term vs. Whole Life Insurance

Trying to understand life insurance can feel like you're learning a whole new language. But really, it all comes down to two main paths. Getting a handle on the difference is the single most important step you can take to pick a policy that fits your life today and where you want to go tomorrow.

Honestly, the best way to think about it is with an analogy you already know by heart: renting versus buying a home.

Think of term life insurance as renting an apartment. It's simple, it's affordable, and it protects you for a specific amount of time—a "term"—that you get to choose, usually 10, 20, or 30 years. If you pass away during that term, the people you named as beneficiaries get a tax-free payout. It's built for pure protection, making it the most popular and cost-effective life insurance for young adults.

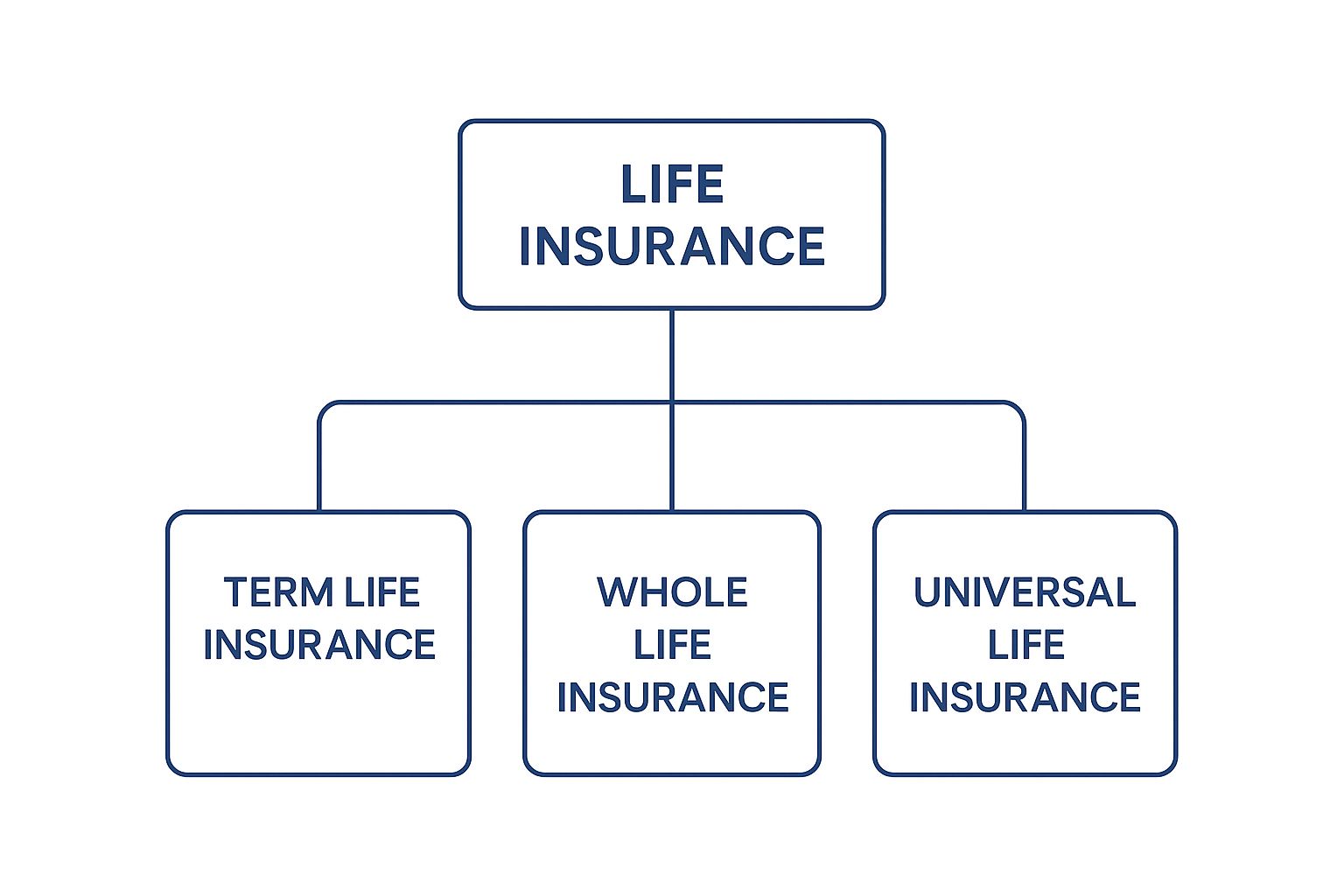

This quick visual breaks down the main types of life insurance to help you see the big picture.

As you can see, the major split is between temporary coverage (Term Life) and permanent coverage (Whole and Universal Life). Each one is designed to do a very different job for your finances.

The Simplicity of Term Life Insurance

The biggest win for term life is just how affordable it is. Because it only covers you for a set number of years and doesn't have any complicated investment features attached, the premiums are way lower than other types of insurance. This makes it a no-brainer when your main goal is to cover financial responsibilities that have a clear finish line.

So, what is a term policy perfect for?

- Co-signed Debts: It can cover things like private student loans or a car loan, so your parent or co-signer isn't left holding the bag.

- Mortgage Protection: It ensures your partner or family could keep up with the mortgage payments if you weren't around.

- Income Replacement: It provides a safety net for young kids until they're old enough to be financially independent.

Once the term is over, the coverage stops. You can often renew the policy, but fair warning—the premiums will be much higher because they’ll be based on your new, older age. For a lot of people, the goal is to not even need the coverage by then because the kids are grown and the house is paid off.

The Long-Term Value of Whole Life Insurance

On the flip side, whole life insurance is like buying a home. It's a lifelong commitment that costs more at the start but comes with a huge benefit: it builds equity. As long as you keep paying your premiums, the policy stays active for your entire life and includes a savings part called cash value.

A piece of every premium you pay gets funneled into this cash value account. It grows at a fixed rate, tax-deferred. You can actually borrow against this cash value or even surrender the policy to get the funds, turning it into a real financial asset.

This feature makes whole life more than just a safety net; it becomes a piece of your long-term financial puzzle. But this extra benefit comes at a much higher price. Premiums for whole life can be 5 to 15 times more expensive than a term policy with the exact same death benefit.

Choosing the Right Path for You

So, which one is the better choice? The answer really comes down to your personal situation and what you're trying to achieve financially.

- Choose Term Life if: Your number one priority is getting the most protection for the lowest cost. You want to cover specific debts or provide for your family for a set period. Budget is a major factor.

- Choose Whole Life if: You have a higher budget, have already maxed out other retirement accounts (like a 401(k) and IRA), and you want lifelong coverage that also acts as a conservative financial tool.

For most young adults, term life insurance is the clear winner. It gives you a ton of protection at a price that fits comfortably into a younger person’s budget. You can get a much deeper look into how to weigh these options in our guide comparing term versus whole life insurance. This is how you secure your financial future without putting a strain on your wallet right now.

What Life Insurance Actually Costs for Young Adults

Let’s be honest. The biggest thing that stops most people from even thinking about life insurance is the assumed price tag. We build it up in our minds to be another massive monthly bill, right up there with rent or a car payment.

The good news? It’s not even close. The reality is far more affordable than you probably believe.

And that’s not just a hunch. A revealing study found a huge gap between perception and reality for people aged 18 to 30. When asked to guess the cost of a standard $250,000 20-year term life insurance policy, young adults overestimated the actual premium by an incredible 10 to 12 times. You can read more about these surprising findings on life insurance perceptions from LIMRA.

This one statistic says it all. The idea of the cost is often the biggest hurdle, even when the actual price is surprisingly low. So, let’s pull back the curtain and see what really goes into your premium, so you can understand why life insurance for young adults is such a bargain.

What Determines Your Premium

Think of an insurance premium like a custom price quote. The company looks at a few key things about you to figure out what to charge. For life insurance, the formula is refreshingly simple and transparent.

These are the three main pillars that set your monthly rate:

- Your Age: This is the big one. The younger you are when you apply, the lower your premium will be—and you get to lock in that low rate for decades.

- Your Health: Insurers look at your overall health profile, including your family medical history and any pre-existing conditions. They also factor in lifestyle choices, like whether or not you smoke.

- Your Policy Details: This covers the policy type (term is way cheaper than whole), the coverage amount (how big the payout is), and the term length (how long you want the coverage to last).

Because you’re in your prime, you have a massive advantage in the first two categories. This is exactly why getting a policy now is a strategic financial move that can save you a fortune over your lifetime.

Your health and age are your greatest assets when buying life insurance. Right now, they combine to give you access to rock-bottom prices that will never be available to you again in the future.

Real-World Cost Examples

Sometimes, just seeing the numbers in black and white makes all the difference. To show you just how affordable this protection can be, we’ve put together some real-world estimates.

Sample Monthly Premiums for a Healthy 25-Year-Old

The table below shows estimated monthly premiums for a healthy, non-smoking 25-year-old looking for a 20-year term policy. These aren't just hypotheticals; they reflect what you can actually expect to find on the market today.

| Coverage Amount | Estimated Monthly Premium |

|---|---|

| $250,000 | $15 – $20 |

| $500,000 | $20 – $28 |

| $1,000,000 | $35 – $45 |

Think about that for a second. A six-figure, or even a seven-figure, policy is likely well within your current budget. For the price of a couple of coffees or a single takeout meal, you can put a powerful financial safety net in place for the people you care about most.

This isn't a luxury item. It’s one of the most cost-effective financial tools you can own.

How to Find an Affordable Life Insurance Policy

Okay, so you know that life insurance for young adults is more affordable than you thought. That’s a great first step. But actually sifting through all the options to find the right policy? That can feel like a mountain of a task.

The good news is, it doesn't have to be. With a clear game plan, you can lock in fantastic protection without blowing up your budget.

Shopping for life insurance isn't about finding the one "best" company out there—it's about finding the company that's best for you. Every insurer views your life and health through a different lens. The secret is to see who gives you the most credit for being you.

Think of it like booking a flight. You wouldn’t just check one airline, right? You’d use a comparison tool to see who has the best deal for your specific trip. Life insurance works the same way. Getting multiple quotes is the single most effective move you can make to avoid overpaying.

The Power of Comparing Quotes

Comparing quotes isn't just about saving a few bucks here and there. It's about finding the right fit. One insurer might give a great rate to a marathon runner with a perfect health record, while another is surprisingly friendly to someone who has a health condition under control. You'd never know who sees you most favorably unless you compare.

Some companies even specialize in great rates for people with specific lifestyles or health histories. This is why getting at least three to five quotes is such a smart move. It gives you a real feel for the market and where you stand.

Getting multiple quotes empowers you to make a decision based on data, not just advertising. It ensures the price you pay is competitive and fair for your specific circumstances.

For example, an analysis from MoneyGeek found Nationwide can be a strong contender for young adults, with average monthly premiums around $12 for a $250,000 10-year term policy. Need more? Even a $1 million policy can average a surprisingly low $23 per month. That's serious peace of mind for less than the cost of a few fancy coffees. You can see how other top insurers compare for young adults to get a clearer picture.

Working With an Independent Agent

Another fantastic strategy is teaming up with an independent insurance agent. Think of them as your personal life insurance shopper. Unlike a "captive" agent who only sells policies for one company (like State Farm), an independent agent partners with dozens of insurers. Their job is to find you the best deal, period.

This is a game-changer for a few reasons:

- Expert Guidance: They know the ins and outs of each company—who’s tough on certain health issues and who is more lenient.

- Time Savings: Instead of you filling out application after application, they do the heavy lifting for you.

- Complex Cases: If you have a unique health history or a high-risk hobby, an agent's expertise is gold. They know exactly where to go to get you approved.

Best of all, their service is usually free to you. They get paid by whichever insurance company you end up choosing, so their loyalty is to you, not one specific brand.

Pro Tips for Lowering Your Premium

Beyond shopping around, there are a few insider tricks to help you shave even more off your premium. It's all about presenting yourself as the lowest possible risk to an insurer.

1. Time Your Application Strategically: Did you recently quit smoking or lose a lot of weight? That’s amazing! But don't apply for insurance tomorrow. Insurers love to see consistency. Wait until you've hit the one-year mark with your new healthy habit. It can make a huge difference in your rate.

2. Opt for a Shorter Term: A 20-year policy is always cheaper than a 30-year one. If you’re just trying to cover student loans that will be gone in 15 years, you probably don’t need a 30-year term. Match the policy length to your actual financial timeline.

3. Pay Annually: If you can swing it, paying your premium once a year instead of monthly can save you money. Many insurers tack on small administrative fees for monthly billing, and paying annually helps you skip them entirely.

Ready to put these strategies to work? For a deeper look at top-rated companies, check out our complete guide to the best life insurance for young adults.

Here is the rewritten section, crafted to sound like an experienced human expert while adhering to all specified requirements.

The Life Insurance Application Process Explained

Applying for life insurance might sound intimidating, but I promise it’s much simpler than it looks. Forget the old days of endless paperwork and confusing jargon. Today, especially with so many online-first insurers, the whole thing is surprisingly quick and straightforward.

Think of it less like a scary test and more like a conversation. The insurance company just needs to get to know you to figure out how they can best protect you. We’ll walk through it step-by-step, from starting the application to getting your final approval.

Kicking Off Your Application

The first step is a breeze. You’ll fill out an initial application, which usually takes just 15-20 minutes online. It’s mostly basic questions about who you are and what kind of coverage you’re looking for.

To make it go even faster, it helps to have this info handy:

- Personal Information: Your name, address, date of birth, and Social Security number.

- Beneficiary Details: The full name and date of birth of the person (or people) you want to receive the policy’s payout.

- Lifestyle Questions: They’ll ask about your job, hobbies (especially adventurous ones like skydiving), and whether you use tobacco.

- Basic Health Information: Just the basics, like your height, weight, and a general overview of your health.

This initial form gives the insurer a first look at your story and helps them begin to understand your needs.

Understanding the Underwriting Stage

Once you hit “submit,” your application moves into a phase called underwriting. That’s just the industry term for the review process. The insurance company takes a closer look at the information you provided to confirm everything and determine your final rate. It’s their way of doing their homework.

During underwriting, they’ll typically review a few key things:

- Your Application: They’ll go over all the answers you gave.

- Medical Information Bureau (MIB): This is a shared database that logs previous applications for life or health insurance.

- Prescription History: They can look at your prescription records to get a clearer picture of your health history.

- Motor Vehicle Report: Your driving record also plays a role in assessing your overall risk.

The underwriting process is all about one thing: risk. The healthier and safer your lifestyle, the lower your premium. That’s why honesty is absolutely critical on your application—it’s the foundation of the entire process.

The Medical Exam: What to Expect

For many policies, a medical exam is a standard part of underwriting. Don't stress—it's free, and they come to you. A medical professional will visit your home or office to do a quick check-up, which usually involves measuring your height and weight, taking your blood pressure, and collecting a small blood and urine sample.

But here’s some great news: many modern insurers now offer no-exam life insurance, especially for young and healthy applicants. These policies use what’s called "accelerated underwriting," relying on data and algorithms to assess your risk without a physical exam.

This makes getting life insurance for young adults incredibly fast—you can sometimes get approved in a matter of hours, not weeks. It’s a huge perk and one of the best reasons to lock in your coverage now.

Your Next Steps Toward Financial Security

We’ve walked through a lot of information, but the biggest takeaway is simple. Life insurance for young adults isn’t the complicated hassle you might think it is. It’s actually one of the smartest, most affordable ways to start building a truly secure financial future—on your own terms.

Think of it as a gift to your future self. By taking action while you're young and healthy, you’re locking in the lowest possible rates for life. It’s a decision that saves you a massive amount of money over the long haul for powerful protection.

Seizing the Moment

This is about more than just a safety net for the unexpected. It’s about being proactive. You’re essentially laying a financial cornerstone that will support you through all of life's biggest moments, whether that’s buying your first home or starting a family. It’s a move that delivers instant peace of mind.

Most importantly, it puts you in the driver's seat. Financial wellness doesn't just happen by accident; it's built one smart choice at a time. And securing an affordable life insurance policy is one of those foundational moves that pays you back in confidence for decades.

Don't let paralysis by analysis or common myths hold you back. The single biggest mistake is waiting until life gets more complex and more expensive. A small, simple action today can secure your financial well-being for years to come.

Your Simple Action Plan

You've got the knowledge. Now it’s time to move forward with confidence. The next step doesn't have to be a massive commitment. In fact, it can be as simple as taking ten minutes to see what’s out there.

Here are a few easy, no-pressure things you can do right now:

- Calculate Your Needs: Use an online calculator to get a quick estimate of how much coverage makes sense for you. This helps turn abstract numbers into something real.

- Get a Quick Quote: Spend just a few minutes on a site like My Policy Quote to see real-time premium estimates. You’ll probably be surprised at just how affordable it is.

- Talk to an Expert: Consider a quick, no-obligation chat with an independent agent. They can answer your specific questions and clear up any confusion.

The path to financial security is a marathon, not a sprint. By taking one of these small steps, you’re already heading in the right direction and building the secure future you deserve.

Common Questions About Life-Insurance for Young Adults

It’s totally normal to have questions, even after you’ve got the basics down. When you’re talking about something as important as your financial future, you deserve crystal-clear answers. Let's tackle some of the most common "what ifs" and scenarios we hear from young adults just like you.

Our goal is to cut through the noise and give you the straightforward information you need to move forward with confidence.

Do I Need Life Insurance If I'm Single with No Kids?

This is, without a doubt, the question we get asked most often. And it’s a great one. The myth is that life insurance is only for the family breadwinner, but that’s a really limited way of looking at it.

Think about any debt you have with a co-signer. A private student loan, for instance, doesn't just vanish if you pass away. The person who co-signed for you—maybe a parent or grandparent—is suddenly on the hook for the entire balance. A simple term life policy can cover that debt, protecting your loved ones from a devastating financial blow.

But beyond debt, there’s a massive strategic advantage here. Getting a policy now, while you’re young and healthy, means you lock in the lowest possible rates for decades. It's one of the smartest money moves you can make to prepare for the family you might have one day, ensuring they’ll have affordable protection when the time comes.

Can I Change My Life Insurance Policy Later On?

Absolutely. Life insurance isn't a "set it and forget it" decision that you're stuck with forever. Your policy can—and should—grow with you as your life unfolds.

Many term policies are designed with flexibility built right in. One of the most powerful features you can look for is a conversion rider. This option lets you convert your term policy into a permanent one (like whole life) down the line, without having to take another medical exam.

A conversion rider is your ticket to future flexibility. It guarantees your right to upgrade your coverage later, regardless of any health issues you might develop.

You can also just buy more coverage as your needs change. Get a mortgage? Have a baby? Land a big promotion? You can simply add another policy to your financial safety net. It’s a strategy known as "laddering," and it's a fantastic way to keep your protection perfectly synced with your life's biggest moments.

What Happens If I Miss a Premium Payment?

Life gets busy, and insurers get it. If you miss a payment, your policy doesn’t just disappear overnight. Every insurance company is required by law to offer a grace period, which is usually 30 or 31 days.

As long as you get that payment in during the grace period, your coverage continues without a single hiccup. No penalties, no problems.

If you miss the grace period, your policy will lapse, which means your coverage ends. But even then, most insurers have a reinstatement process. You can often get your original policy back within a specific window (sometimes up to a few years), though you might have to pay the missed premiums and answer a few health questions. The most important thing is to just call your insurer if you think you’ll have trouble making a payment.

Of course, it's always best to avoid these issues from the start. For more tips, check out our guide on the common life insurance mistakes to avoid when you're first getting set up.

Ready to take the next step toward financial peace of mind? At My Policy Quote, we make it easy to compare rates from top insurers and find a policy that fits your life and your budget. Get your free, no-obligation quote today at https://mypolicyquote.com.