When you're self-employed, you quickly realize you're the CEO of everything—including your own benefits package. And let's be honest, health insurance is often the most important benefit you don't automatically get. Unlike a traditional job, the responsibility for finding and funding your coverage rests entirely on your shoulders.

But here's the good news: getting excellent, affordable health insurance when you're your own boss is more achievable than ever. It all starts with knowing where to look—primarily the Health Insurance Marketplace and some key tax advantages designed for people just like you.

Your First Steps to Finding Coverage

Stepping into the world of health insurance on your own can feel like trying to navigate a maze in the dark. The terms are confusing, the choices seem endless, and the sticker shock is very real. But what if there was a clear, direct path forward? For the vast majority of freelancers, consultants, and small business owners, that path begins at the Health Insurance Marketplace.

Think of the Marketplace (also known as the ACA Exchange or Obamacare) as a one-stop shop built specifically for individuals and families without employer coverage. It isn't just a website to buy plans; it’s a system designed to make them affordable. This is where you can find plans from major insurance carriers, often with a significant helping hand.

Understanding Your Financial Advantages

The most powerful tools you have on the Marketplace are subsidies. These aren't complicated loopholes; they are financial aids built right into the system to lower your costs.

- Premium Tax Credits (PTC): This is the big one. It directly lowers your monthly insurance payment (your premium). The amount is based on your estimated income for the year, and for many self-employed people, it can bring the monthly cost down to $10 or even less.

- Cost-Sharing Reductions (CSRs): These are extra savings that lower what you pay out-of-pocket when you actually use your insurance—things like deductibles and copays. They’re exclusively available if you choose a Silver-level plan on the Marketplace.

To give you a better overview, here's a quick breakdown of where you can start your search.

Key Health Insurance Options for the Self Employed

| Insurance Option | Best For | Key Consideration |

|---|---|---|

| Marketplace (ACA) Plans | Individuals and families needing financial assistance (subsidies) based on income. | This is the only place to get Premium Tax Credits and Cost-Sharing Reductions. |

| Private Plans (Off-Exchange) | Those who don't qualify for subsidies but want more plan choices from specific carriers. | You'll pay the full price, as no income-based financial aid is available here. |

| Short-Term Health Insurance | People needing temporary coverage to bridge a gap, like between jobs or waiting for open enrollment. | These plans offer limited benefits and don't cover pre-existing conditions. |

| Health Sharing Ministries | Individuals who share a common ethical or religious belief and are looking for a lower-cost alternative. | This is not insurance; there's no guarantee that medical bills will be paid. |

This table shows that while you have several paths, the Marketplace is often the most logical and financially sound starting point.

The Self-Employment Coverage Gap

The challenge for independent workers is real. In 2023, about 26% of the self-employed population was uninsured—a rate that's way higher than the national average. Without an employer chipping in, the average monthly premium of around $525 can feel like a heavy burden. You can dive deeper into this data in a comprehensive report from S&P Global.

The key takeaway is this: Don’t ever assume you have to pay the full "sticker price" for a health plan. The Marketplace was created to bridge this exact affordability gap for independent workers.

By starting your search there, you immediately put yourself in a position to see if you qualify for these powerful cost-saving measures. This one move transforms an overwhelming task into a structured, manageable process. Our full guide can walk you through every option in detail. Learn more about the nuances in our full guide on self-employment health insurance.

This approach turns uncertainty into a clear plan, proving that great health insurance is completely within your reach, even when you're the one in charge.

Decoding Your Health Insurance Plan Options

When you’re self-employed, choosing the right health insurance can feel like trying to crack a code. You’re hit with a barrage of acronyms—HMO, PPO, EPO—and it's easy to feel completely lost. But picking a plan that works for you doesn't have to be so complicated.

Think of it like choosing a cell phone plan. Each one offers a different mix of network access, flexibility, and, of course, price. Your job is simply to find the one that fits your life, your health needs, and your budget.

Understanding the Main Plan Types

As you start shopping, you’ll mainly run into three types of plans. Each one is built differently, which affects which doctors you can see and how you get your care. Let's break them down into simple terms.

-

HMO (Health Maintenance Organization): This is your no-frills, local carrier. An HMO plan requires you to use doctors, hospitals, and specialists within its network. You’ll also need a Primary Care Physician (PCP) to manage your care and give you referrals for specialists. In return for these rules, HMOs usually come with lower monthly premiums.

-

PPO (Preferred Provider Organization): This is more like a premium, nationwide carrier. A PPO plan gives you a lot more freedom. You can see doctors both inside and outside the network, and you don’t need a referral to see a specialist. That flexibility comes at a price—PPOs typically have higher monthly premiums, and you’ll pay more if you go out-of-network.

-

EPO (Exclusive Provider Organization): Think of an EPO as a blend of the other two. Like an HMO, it asks you to stay within its network for care (except for true emergencies). But like a PPO, it usually doesn't make you get a referral from a PCP to see a specialist. It strikes a middle ground on both cost and flexibility.

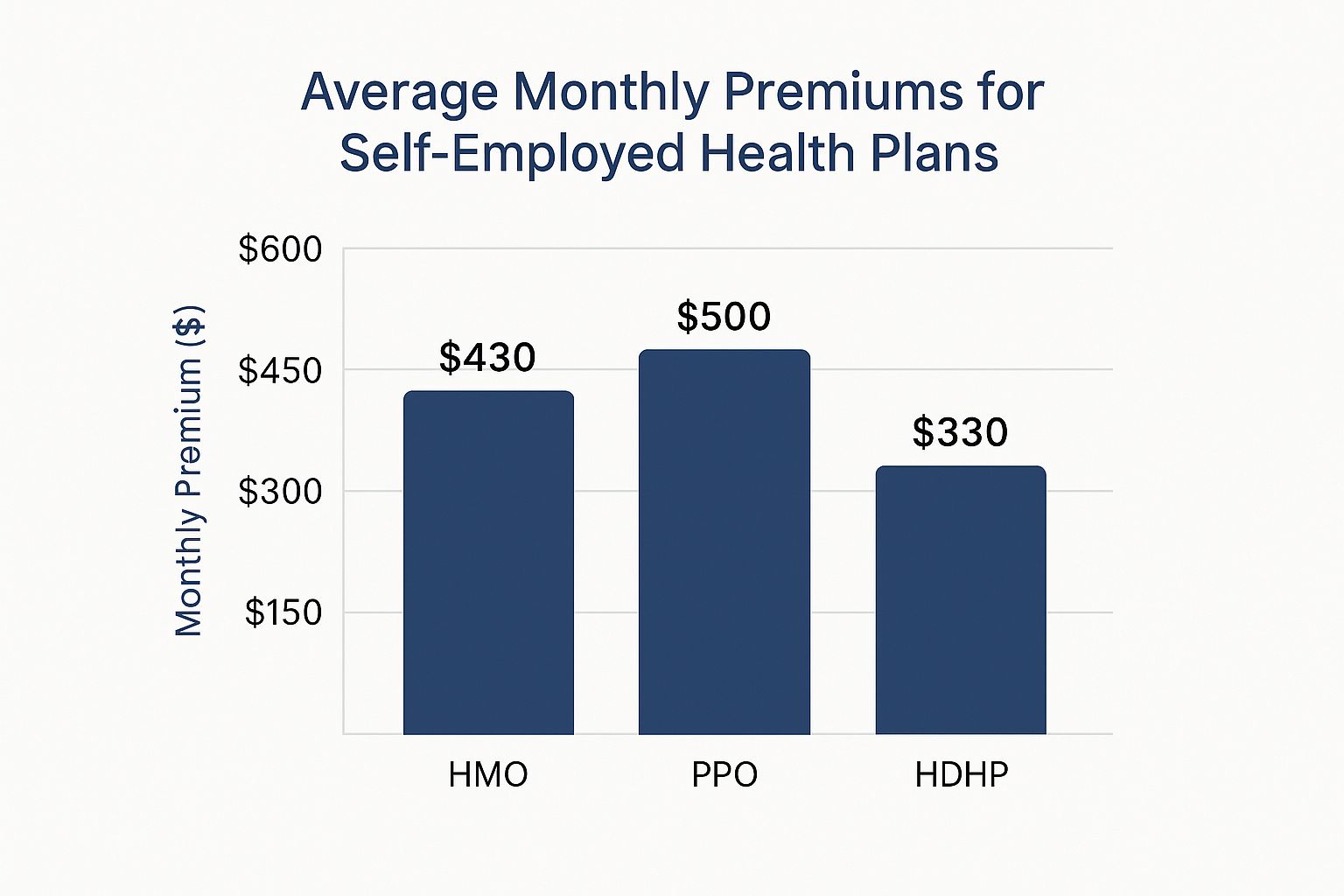

The plan type you select will directly impact your monthly costs. This chart gives you a quick visual of what you might expect to pay for different plans.

As you can see, plans with tighter networks like HMOs generally have lower average premiums. On the flip side, the freedom of a PPO often comes with a higher monthly bill.

HMO vs PPO vs EPO Plans At a Glance

To make the choice even clearer, here’s a simple side-by-side look at how these common health insurance plans stack up. This table breaks down the key features to help you find the right fit.

| Feature | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) | EPO (Exclusive Provider Organization) |

|---|---|---|---|

| PCP Required | Yes, you must have a Primary Care Physician. | No, you can see any doctor without one. | No, a PCP is generally not required. |

| Referrals to Specialists | Yes, your PCP must provide a referral. | No, you can see specialists directly. | No, referrals are typically not needed. |

| Out-of-Network Care | Not covered, except in true emergencies. | Covered, but at a higher out-of-pocket cost. | Not covered, except in true emergencies. |

| Best For | People who want lower premiums and don't mind staying within a specific network. | People who want maximum flexibility and are willing to pay more for it. | People who want the cost savings of an HMO network but without the referral requirement. |

This quick comparison should give you a solid starting point. Now you can weigh what matters most to you—cost, flexibility, or a balance of both.

This need for reliable coverage is growing everywhere. The global private health insurance market, valued at USD 1.2 trillion in 2023, is projected to nearly double by 2032. This shows just how vital this financial protection is becoming, especially for self-employed people who have to cover their own medical bills. You can see the full projections from DataIntelo.com on the private health insurance market.

The best plan isn't always the one with the lowest monthly payment. It's the one that balances cost with real access to the doctors and hospitals you actually trust.

Before you make a final decision, always, always check if your favorite doctors are in the plan’s network. A cheap premium won’t do you any good if you have to pay 100% out-of-pocket just to see your trusted physician. It’s a crucial step to make sure your plan truly works for you.

Ultimately, you're trying to find the right balance between your monthly premiums, what you might have to pay out-of-pocket, and the freedom to choose your own doctors. This can feel like a tough call, and it might even make you wonder if your personal savings could work as a backup. For a closer look at that very question, check out our guide comparing health insurance vs personal savings. Taking the time now to understand these trade-offs is the key to finding a plan that gives you both security and value down the road.

Navigating the Health Insurance Marketplace

For most self-employed folks, the hunt for health insurance begins and ends in one place: the Health Insurance Marketplace. You might know it as the ACA Marketplace or even Obamacare. It’s an online exchange built specifically for people who don't get health coverage through a traditional job. Think of it as your main hub for finding, comparing, and signing up for a plan that actually fits your life.

This isn't just another website. It’s a structured system designed to make private health insurance both accessible and affordable. It pulls together plans from major insurance carriers, letting you see all your options side-by-side. Most importantly, it's the only place you can get financial help like premium tax credits, which can seriously lower your monthly payments.

Here’s a look at the homepage for the federal Marketplace, HealthCare.gov.

From here, you can start an application or just browse plans and see potential savings by plugging in some basic info like your zip code and income. It's a great way to get a feel for your options without committing.

Mastering Enrollment Windows

When it comes to getting a Marketplace plan, timing is everything. You can't just sign up whenever the mood strikes; there are specific windows when you’re allowed to enroll.

- Open Enrollment: This is the main event. It’s the period each year when anyone can sign up for a health plan, typically running from November 1 through January 31 in most states. This is your biggest opportunity to get covered for the year ahead.

- Special Enrollment Period (SEP): Life happens, and it doesn't always stick to a calendar. If you go through a big life change, you might qualify for a 60-day window to enroll outside the standard period. These are called Qualifying Life Events and include things like getting married, having a baby, moving, or losing other health coverage.

Accurately Estimating Your Freelance Income

Here’s the biggest hurdle for self-employed people: estimating your income. When your earnings bounce around month to month, predicting the future can feel like guesswork. The trick is to make your best, most honest estimate of your Modified Adjusted Gross Income (MAGI) for the coming year.

Your MAGI is basically your net self-employment income—what’s left after you subtract your business expenses from your gross revenue. It's the number the Marketplace uses to figure out what financial help you qualify for.

To get a solid estimate, follow these steps:

- Look Back: Check out your profits from the last year or two. This gives you a realistic baseline.

- Look Forward: Do you have new contracts lined up? Are you expecting a slow season? Factor in what you know is coming.

- Do the Math: Estimate your total revenue for the year, then subtract all your expected business expenses (like software, supplies, or your home office deduction). That final number is the core of your MAGI.

Don't forget to update the Marketplace if your income changes significantly during the year. If you end up earning more than you estimated, you might have to pay back some of your tax credit. But if you earn less, you could get even more savings.

Understanding the Metal Tiers

Once you start browsing plans, you’ll see them grouped into "metal tiers": Bronze, Silver, Gold, and Platinum. It’s easy to think this is about the quality of care, but it’s not. It’s all about how you and your insurance company split the costs.

- Bronze: You’ll pay the lowest monthly premium, but you'll have the highest costs when you actually need care (think high deductibles).

- Silver: This is the middle ground, with moderate monthly premiums and moderate costs for care. Critically, you must pick a Silver plan to get extra Cost-Sharing Reductions (CSRs) if your income is low enough. These lower your deductibles and copays.

- Gold: You'll pay a higher monthly premium, but your costs will be low when you see a doctor.

- Platinum: This tier has the highest monthly premium, but the lowest costs when you need care.

Think of it this way: A Bronze plan is great for someone who wants a safety net for major emergencies but doesn't expect to use their insurance often. A Gold plan is a better fit for someone who knows they'll need regular medical care and wants predictable, low costs. This simple system helps you turn a potentially overwhelming website into a tool you can use with confidence to lock in your health coverage.

Unlocking Subsidies to Lower Your Costs

For most self-employed professionals, the biggest hurdle to getting great health insurance isn't finding a plan—it's affording one. That sticker shock can be intimidating.

The good news? You rarely have to pay that full price. The system is designed with powerful financial tools to make coverage genuinely affordable for freelancers, gig workers, and entrepreneurs.

Think of these tools not as loopholes, but as built-in discounts you're entitled to. Mastering them is the key to turning a daunting expense into a manageable one. The two most important programs are the Premium Tax Credit (PTC) and Cost-Sharing Reductions (CSRs), both available exclusively through the Health Insurance Marketplace.

The Premium Tax Credit: Your Monthly Discount

The Premium Tax Credit, or PTC, is the single most impactful subsidy out there. It’s a tax credit you can use right now to lower your monthly health insurance payment (your premium). The amount you get is tied directly to your estimated annual income.

And this isn’t just a small discount. For many self-employed people, the PTC can slash their monthly premium to $10 or even less.

How it works: Imagine you’re a freelance consultant who estimates your net income will be $45,000 for the year. Based on that number, the Marketplace determines you qualify for a PTC of $350 per month. If you choose a plan that costs $420 per month, you’ll only have to pay the remaining $70. The government sends the $350 directly to your insurer each month.

You have a choice in how you receive this credit. You can take it in advance to lower your monthly bills—which is what most people do—or pay the full premium all year and get the credit back as a lump sum when you file your taxes.

Cost-Sharing Reductions: The Hidden Savings in Silver Plans

While the PTC lowers your monthly bill, Cost-Sharing Reductions (CSRs) lower your out-of-pocket costs when you actually use your insurance. This means reduced deductibles, copayments, and coinsurance. It's an extra layer of savings that makes healthcare more affordable when you need it most.

But there's one crucial rule: to get CSRs, you must enroll in a Silver-tier plan on the Marketplace.

These "Enhanced Silver" plans are special. They give you the cost-sharing benefits of a Gold or Platinum plan but at a Silver plan price. This makes them one of the best values in health insurance for anyone who qualifies.

The Ultimate Tax Advantage: The Self-Employed Health Insurance Deduction

Beyond Marketplace subsidies, there's another game-changing benefit: the Self-Employed Health Insurance Deduction. This is one of the most valuable tax deductions available to independent workers, hands down.

It allows you to deduct 100% of the health and dental insurance premiums you paid for yourself, your spouse, and your dependents. This isn't just an itemized deduction; it's an "above-the-line" deduction that directly reduces your adjusted gross income (AGI), which can lower your overall tax bill by thousands.

To qualify for this powerful deduction, you just need to meet two main criteria:

- You must have a net profit from your business for the year.

- You cannot be eligible for an employer-sponsored health plan, either from your own part-time job or through a spouse's employer.

Here’s a quick example of how this all comes together:

- You pay $70 per month for your Silver plan after your PTC is applied.

- Your total annual premium cost is $70 x 12 = $840.

- You can deduct that entire $840 from your income when you file your taxes.

This multi-layered approach—combining PTCs to lower monthly costs, CSRs to reduce service costs, and the tax deduction to cut your tax bill—makes comprehensive health insurance for self employed workers a reality. If you're looking for guidance on how to navigate the application process and secure these benefits, you might want to review our article on how to get quality health insurance fast.

Exploring Alternatives to Marketplace Plans

While the Health Insurance Marketplace is a fantastic starting point for most self-employed professionals, it’s not the only road you can take. Your personal situation, family needs, and even your comfort with risk might lead you to explore other paths that could be a better fit—or even save you money.

As a business owner, thinking creatively about your coverage is just another part of managing your finances well. Let's walk through some of the most common alternatives to a standard Marketplace plan.

Considering Short-Term Health Plans

It's easy to be drawn in by the rock-bottom monthly premiums of short-term health plans. They're designed to be a temporary fix—a stopgap to cover you for a few months between jobs or while you're waiting for the next Open Enrollment period.

But that low cost comes with some serious trade-offs.

- Limited Coverage: These are not comprehensive plans. They often skip essential health benefits like maternity care, mental health services, or prescription drugs.

- No Pre-existing Condition Coverage: This is the big one. A short-term plan can legally refuse to pay for anything related to a health issue you had before the policy began.

Think of a short-term plan like a flimsy umbrella in a hurricane. It might offer a little protection from a sudden downpour, but it's not the sturdy roof you need to feel truly safe. It’s built for temporary gaps, not for long-term security.

Because of these gaps, short-term plans are a risky bet for your main health insurance for self employed people. They're best used only for what they were made for: bridging a brief, known gap in your coverage.

Understanding Health Sharing Ministries

Another option you'll likely come across are Health Sharing Ministries. These are groups where members, often united by shared religious or ethical beliefs, contribute monthly payments into a shared pot. That money is then used to help pay for other members' medical expenses.

It is absolutely crucial to understand that health sharing ministries are not insurance. They aren't regulated by state insurance departments, and there's no legal guarantee your bills will be paid. While they can be a lower-cost choice for some, you're ultimately relying on the goodwill of the community, not a binding contract.

Joining a Spouse or Partner's Plan

For many freelancers and entrepreneurs, the most stable and straightforward alternative is simply joining a spouse's or partner's employer-sponsored health plan. If your partner has access to a group plan through their job, this is often the easiest and most affordable route to take.

Getting married or losing your previous coverage are both considered Qualifying Life Events. This means you can usually be added to their plan right away, even outside of the normal open enrollment window.

It's also worth noting how virtual care is changing the game. Telemedicine has become a core part of healthcare, and by 2025, it's expected to be even more integrated. For entrepreneurs working from home, plans with strong telehealth benefits can be a huge win, offering convenience and savings by cutting down on in-person visits. To see how this trend is shaping employer-sponsored plans, you can learn more about top healthcare trends from The-Alliance.org.

Ultimately, weighing these alternatives against Marketplace options requires a clear look at your own needs. For more help making that call, take a look at our guide on how to choose health insurance for smart coverage.

Answering Your Top Insurance Questions

When you're self-employed, figuring out health insurance brings up a lot of the same big questions. It's completely normal. Getting clear, straightforward answers is the only way to feel confident about the plan you choose.

Let’s walk through the most common concerns we hear from freelancers and entrepreneurs just like you.

What Do I Do About My Fluctuating Income?

For anyone who’s self-employed, trying to predict your annual income can feel like guessing next month’s weather. It’s tough. The key is to give the Marketplace your best, most honest estimate of your Modified Adjusted Gross Income (MAGI)—that’s your business profit after you’ve subtracted all your business expenses.

It’s also crucial to update your income as it changes during the year. Did you just land a huge project? Let the Marketplace know. This adjusts your subsidy right away so you don’t get hit with a bill to repay credits at tax time. On the flip side, if business suddenly slows down, reporting it could mean you qualify for more financial help when you need it most.

How Can I Use a Health Savings Account (HSA)?

A Health Savings Account (HSA) is one of the absolute best financial tools out there for the self-employed, but it doesn't work with just any plan. To open and contribute to an HSA, you first need to be enrolled in a specific type of plan: a High-Deductible Health Plan (HDHP).

Think of an HSA as a personal savings account for healthcare, but with incredible tax perks. Your contributions are tax-deductible, the money inside grows tax-free, and any money you take out for qualified medical costs is also tax-free. It’s a triple tax advantage you can't find anywhere else.

Pairing an HDHP with an HSA is a smart strategy. You get to pay a lower monthly premium for your insurance while building up a tax-free fund to cover future medical needs.

Can I Deduct My Insurance Premiums on My Taxes?

Yes, absolutely. In most situations, you can. The self-employed health insurance deduction is a powerful tax break that lets you deduct 100% of the premiums you paid for health, dental, and long-term care insurance for yourself, your spouse, and your dependents.

This isn't just any old deduction; it's an "above-the-line" one. That means it lowers your adjusted gross income directly, which can make a real difference in how much tax you owe. To take it, you just need to show a net profit from your business for the year and confirm you weren't eligible to get on a spouse's employer-sponsored plan.

What if I Missed the Open Enrollment Deadline?

Life happens. If you missed the Open Enrollment window (which usually runs from November 1 to January 31), don't panic—you aren't automatically stuck without coverage for the rest of the year. You might be able to enroll during a Special Enrollment Period (SEP).

An SEP is triggered by what’s called a Qualifying Life Event. These are major life changes, including things like:

- Losing your previous health coverage (like a COBRA plan ending)

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new zip code or county

If one of these happens to you, it typically opens a 60-day window for you to sign up for a new health plan.

Getting the right answers and finding the right plan is what My Policy Quote is all about. We specialize in helping self-employed professionals like you find affordable, quality coverage that actually fits your life.