Life happens, and sometimes you find yourself in a gap between health insurance plans. Maybe you're between jobs, waiting for new employer benefits to kick in, or you just aged off your parents' plan. Whatever the reason, going without coverage—even for a short time—can feel like walking a tightrope without a net.

This is where short-term health insurance comes into play. Think of it as a temporary financial safety net, designed to catch you if a major, unexpected medical event occurs. It’s not meant for your annual check-up, but it could be a lifesaver if you have a sudden illness or serious accident.

Understanding the Basics of Temporary Coverage

Let's paint a picture. You've landed a fantastic new job, but there's a catch: a 90-day waiting period before your health benefits start. An accident during that time could be financially devastating. This is the exact scenario short term health insurance was created to address.

Also called temporary or gap coverage, these plans offer a limited shield for a specific timeframe. It's crucial to understand they are not a substitute for comprehensive plans that comply with the Affordable Care Act (ACA). Their sole purpose is to protect your savings from the staggering costs of an unforeseen injury or illness.

What It Is and What It Is Not

The biggest difference comes down to the scope of coverage. An ACA-compliant plan is built to cover a broad spectrum of healthcare needs, from preventive screenings and mental health services to managing pre-existing conditions. A temporary plan, on the other hand, is laser-focused. It's really only concerned with new medical problems that pop up while you're covered.

Here's a helpful analogy: Think of it like car insurance. You have comprehensive coverage for major accidents, but you don't file a claim for an oil change. Short-term health insurance is for the big "collisions" in your health journey, not the routine maintenance.

This distinction is everything. If you sign up for a short-term plan thinking it will cover your regular prescriptions or a chronic condition like asthma, you’re setting yourself up for a nasty surprise. These plans use medical underwriting, which means the insurance company will review your health history. They can—and often do—deny coverage for conditions you had before the policy started.

To give you a clearer picture, here’s a quick overview of what you can typically expect from these plans.

Short Term Health Insurance At a Glance

| Feature | Typical Characteristic |

|---|---|

| Primary Purpose | Emergency coverage for unexpected illness or injury. |

| Duration | Limited to a few months (typically a 3-month initial term). |

| Pre-Existing Conditions | Generally not covered. |

| ACA Compliance | Does not meet ACA requirements for essential health benefits. |

| Enrollment | Available year-round, often with next-day coverage. |

| Cost | Usually lower monthly premiums than ACA plans. |

| Network | May have a limited network of doctors and hospitals. |

This table highlights the trade-offs: you get lower premiums and fast approval in exchange for less comprehensive protection.

A Growing Market for Flexible Solutions

It’s no surprise that the demand for this kind of stopgap coverage is on the rise. With a more fluid job market and changing life circumstances, more people need flexible options. In fact, the global market for these plans is projected to grow from $204.16 billion in 2025 to $317.01 billion by 2032, according to recent market analysis. You can explore more on this trend and its drivers by checking out the latest market insights from Data Insights Market.

Because these plans don't follow ACA rules, they are regulated differently. To reinforce their role as a truly temporary solution, federal regulations have been updated. For new policies issued on or after September 1, 2024, the initial term is now generally limited to just three months. Any renewals can't extend the total coverage period beyond four months.

Who Is Temporary Health Coverage Designed For?

Thinking about temporary health coverage in the abstract can be confusing. It’s much easier to understand who these plans are really for by looking at real-life situations. Short term health insurance isn't a catch-all solution; it's a specialized tool built for people navigating very specific transitions in their lives.

Let's start with a classic example: the recent college grad. Picture Sarah, who just landed her first job. She’s excited to start, but there's a 90-day waiting period before her company's health benefits kick in. While she's healthy, she knows a slip on the stairs or a sudden illness could spell financial disaster. For Sarah, a short term plan is the perfect safety net to bridge that three-month gap.

Or consider Mark, a consultant who just wrapped up a big project. His next contract doesn't start for another two months. He could pay for COBRA, but the high premiums would eat into his savings. A temporary plan offers a much more affordable way to get catastrophic coverage until his new benefits start.

Specific Scenarios Where Temporary Plans Make Sense

Beyond those common situations, several other scenarios make temporary coverage a smart move. Each one highlights a need for a flexible, stopgap solution instead of a permanent, all-inclusive plan.

You might be a good candidate for this type of coverage if you find yourself in one of these situations:

- Waiting for New Employer Benefits: Just like Sarah, many new employees face a waiting period of 30, 60, or even 90 days. A temporary plan ensures you're not left unprotected during that time.

- Missed Open Enrollment: If you missed the annual window to sign up for an ACA plan and don't qualify for a Special Enrollment Period, a short term policy can be your only coverage option until the next enrollment season.

- Early Retirement Before Medicare: Imagine retiring at 63. You're still two years away from Medicare eligibility. A temporary plan can provide a layer of financial protection, though it's crucial to understand its limitations, especially regarding pre-existing conditions.

- Aging Off a Parent's Plan: When you turn 26, you're no longer covered by your parents' insurance. While this event lets you enroll in an ACA plan, a short term policy can provide immediate coverage while you figure out the best long-term option.

Understanding Who Does Not Qualify

It's just as important to recognize who these plans are not designed for. Insurers use medical underwriting, which means they review your health history and can deny your application.

For instance, someone with a chronic condition like diabetes or heart disease will likely be denied coverage. These plans are designed for the healthy individual who needs protection against new and unforeseen medical issues, not for managing ongoing health concerns.

These plans also aren't a good fit for anyone needing comprehensive benefits. If you need coverage for maternity care, mental health services, or regular prescription drugs, you'll find these are almost always excluded.

Finally, certain immigration statuses can impact eligibility. If this applies to you, you can get more specific details by reading our guide on health insurance for immigrant families.

At the end of the day, temporary health insurance is a strategic tool for very specific circumstances. It's for the healthy person caught in a coverage gap who just needs a safety net for major, unexpected medical events.

Comparing Costs of Short Term vs ACA Plans

When you’re shopping for health coverage, the price tag is usually the first thing you look at. And on the surface, short term health insurance almost always seems like the winner, with monthly premiums that can be dramatically lower than what you’d find on the ACA Marketplace. But that initial savings comes with some major trade-offs—trade-offs that could have huge financial consequences if you actually need to use your insurance.

It's a bit like buying a car. You can get a bare-bones model with no airbags or modern safety features for a much lower sticker price. It's cheap upfront, but if you get into an accident, the cost could be devastating. In the same way, the low premiums on short-term plans are a direct reflection of their limited coverage and their use of medical underwriting, a process where your health history can get you denied or charged a higher price.

Dissecting the Monthly Premiums

The most obvious difference you'll see is that monthly premium. Short term plans often cost a fraction of what ACA plans do, mainly because they don't have to cover the ten essential health benefits mandated by law. Things like maternity care, mental health services, and even routine preventive visits are typically excluded. Insurers can also legally deny your application or charge you more based on your age, gender, or pre-existing conditions—something that’s strictly forbidden for ACA plans.

While the premium for an ACA plan might give you sticker shock, it's crucial to remember that most people don't pay that full price. Thanks to financial assistance, about 92% of Marketplace enrollees in 2024 received premium tax credits, bringing their average monthly payment down to just $74. Short term plans are never eligible for these subsidies. What you see is what you get.

Key Takeaway: You can't compare the premium of a short term plan to an ACA plan in an apples-to-apples way. The lower price directly reflects fewer benefits, zero coverage for pre-existing conditions, and a lack of critical consumer protections.

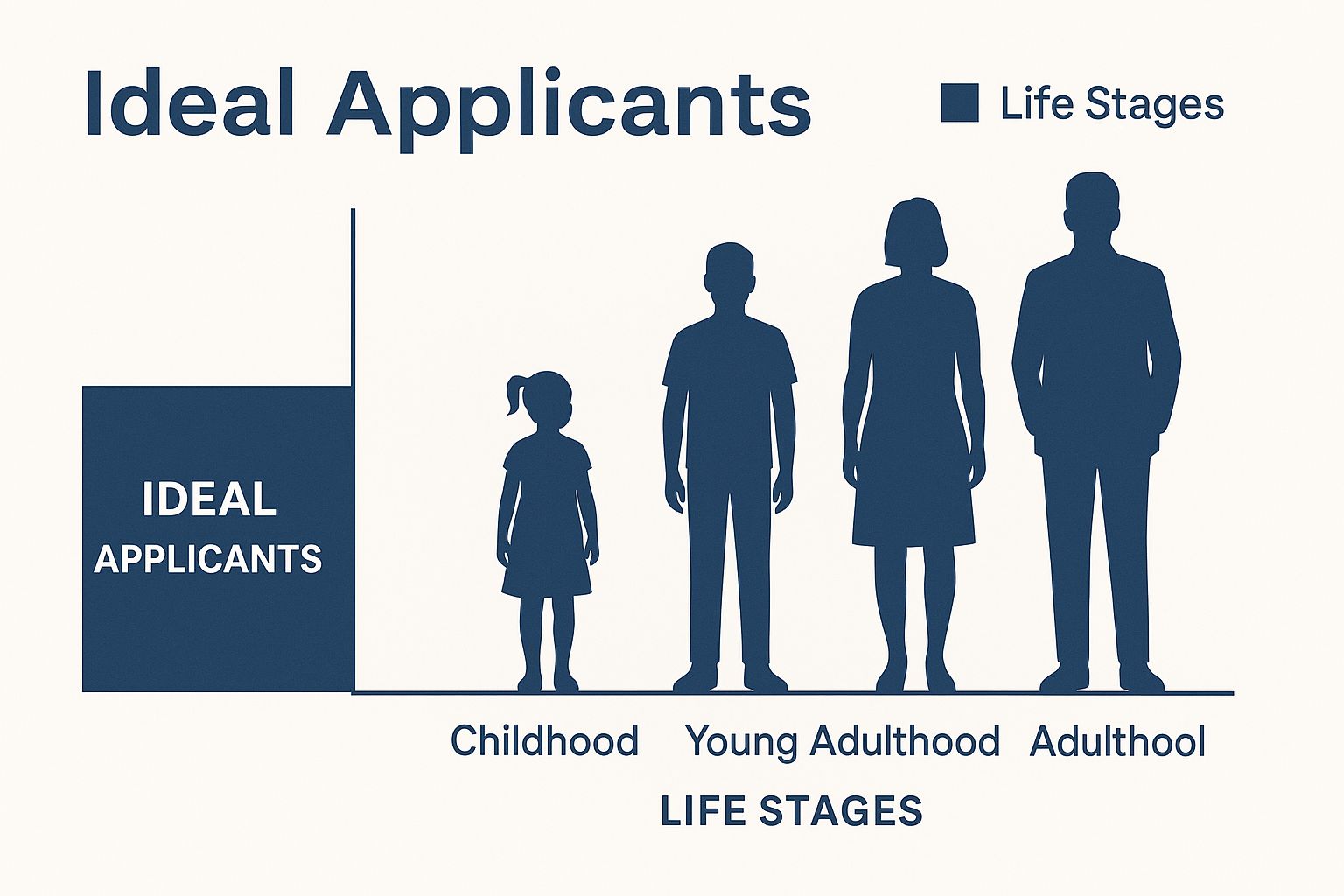

The image below gives a good visual of the types of people who might find these trade-offs acceptable for their specific situation.

As you can see, these plans are really designed for healthy folks in a temporary bind—like if you're between jobs or a recent grad waiting for your new benefits to kick in.

Beyond the Premium Deductibles and Out-of-Pocket Maximums

Once you look past that monthly bill, the true financial risk of a short term plan starts to become much clearer. It’s all in the cost-sharing details.

- Deductibles: Short term plans are famous for their sky-high deductibles. It’s not uncommon to see them climb over $10,000 or even $15,000. You have to pay every penny of that yourself for covered services before the insurance company even thinks about chipping in.

- Out-of-Pocket Maximums: This is a big one. ACA plans have a legal cap on how much you can be forced to spend in a year, protecting you from financial ruin. Short term plans have no such protection. Instead, they might have a benefit cap, meaning the plan will only pay up to a certain dollar amount (say, $250,000) for your care. Anything beyond that is 100% on you.

This structure means that while you’re saving a little each month on premiums, a single unexpected medical event—a bad car accident or an emergency surgery—could saddle you with tens of thousands of dollars in medical debt, even though you have "insurance." That's a gamble that simply doesn't exist with an ACA-compliant plan. For certain groups, like those doing temporary work, understanding these risks is vital. You can dive deeper into this in our guide on health insurance for seasonal workers.

Cost and Coverage Comparison Short Term vs ACA Plans

To make things crystal clear, let's put the two options side-by-side. The table below breaks down the key financial and coverage differences you need to know.

| Feature | Short Term Health Insurance | ACA Marketplace Plan |

|---|---|---|

| Monthly Premium | Generally lower, but no subsidies are available. | Can be higher, but premium tax credits are available for most. |

| Deductible | Often very high (e.g., $5,000 to $15,000+). | Varies by plan tier (Bronze, Silver, Gold), but is often lower. |

| Pre-Existing Conditions | Not covered. | Covered by law. |

| Essential Benefits | Does not cover the ten essential health benefits. | Must cover all ten essential health benefits. |

| Out-of-Pocket Maximum | No federal limit; may have a benefit payout cap. | Legally capped each year to protect consumers. |

| Provider Network | Can be very restrictive with limited choices. | Typically offers a broader network of doctors and hospitals. |

At the end of the day, the right choice really boils down to your personal tolerance for risk and your current life circumstances. An ACA plan offers comprehensive, predictable protection for a higher upfront cost (that's often subsidized). A short term plan, on the other hand, is a low-cost, minimal safety net—best used only by healthy people who need to bridge a very specific, very brief gap in coverage.

Here is the rewritten section, designed to sound completely human-written and natural.

What These Plans Actually Cover and Exclude

Let’s get into the nuts and bolts of what you're actually buying with a short term health insurance plan. Getting this part right is absolutely critical to avoid a nasty, and expensive, surprise later on.

Think of it this way: a short term plan isn't your all-purpose multi-tool for healthcare. It's more like a specialized emergency kit. Its entire purpose is to be a financial safety net for a sudden, major medical disaster—the kind of thing that can happen out of the blue. It’s not built for managing your day-to-day wellness. It’s for when things go sideways, fast.

These policies are laser-focused on handling big, unforeseen medical crises. They provide a financial backstop for those situations that could otherwise saddle you with crippling debt.

What Is Typically Covered by Short Term Plans

While every policy is different—and you absolutely must read the fine print—most short term plans stick to covering services for new injuries or illnesses that pop up after your coverage starts. The goal is to shield you from the high-cost, unpredictable events you simply can't plan for.

Here’s a look at what you can generally expect to be covered:

- Emergency Room Visits: For a sudden accident or a life-threatening condition, your temporary plan should help with the ER bill.

- Hospital Stays: If you get admitted for a covered condition, this helps pay for your room, board, and related services.

- Urgent Care Visits: A good option for less severe problems that still need immediate attention, like a nasty sprain or a sudden high fever.

- Surgical Procedures: Covers unexpected, medically necessary surgeries that arise while you're on the plan.

- Certain Prescription Drugs: This is a tricky one. Coverage is usually limited to drugs needed to treat a new, covered illness or injury—not your ongoing maintenance medications.

It's so important to read the policy documents. Some plans have different deductibles for different services, or they might cap how much they’ll pay for a specific type of care.

I often tell people to think of short term insurance as being for the "breakdowns," not the "tune-ups." It's there to fix a sudden, serious problem, but it won’t pay for routine maintenance like an annual physical or your cholesterol meds.

This focus on just emergencies is precisely what makes these plans so much cheaper. By stripping out coverage for routine and predictable care, they can offer a financial shield against worst-case scenarios at a fraction of the cost. This trade-off is what makes them an affordable, though limited, bridge between other coverage options.

The Critical List of Common Exclusions

Knowing what's not covered is just as important—if not more so. The list of exclusions is long, and it's the main reason these plans are no substitute for comprehensive, ACA-compliant health insurance. The single biggest exclusion, without a doubt, is pre-existing conditions.

An insurer simply will not pay for anything related to a health issue you had before your policy began. This isn't just about diagnosed conditions like asthma or diabetes. It also includes symptoms you experienced but never got checked out. If it existed before day one of your policy, it's on you.

Beyond that, you'll find a whole host of essential services that are almost always excluded:

- Preventive Care: Forget about annual physicals, routine cancer screenings, or immunizations. Those are out.

- Maternity and Newborn Care: Anything related to pregnancy, from prenatal visits to labor and delivery, is typically not covered.

- Mental and Behavioral Health Services: Treatment for depression, anxiety, or substance abuse is a standard exclusion.

- Dental and Vision Care: These are always considered separate forms of insurance and aren't part of a temporary medical plan.

- Chronic Disease Management: If you need ongoing care for something like high blood pressure or arthritis, that won't be covered.

Because of these major gaps, you have to be crystal clear on what you're buying. You are purchasing peace of mind against a catastrophic accident or a sudden, new illness—and that's it. Understanding this distinction is the key to making a smart decision and ensuring a short term plan is actually the right fit for your situation.

How to Enroll in a Temporary Health Plan

So, you've decided a temporary plan makes sense for your situation. Great. Now, how do you actually get one? Unlike the formal, scheduled open enrollment for ACA Marketplace plans, the process for short term health insurance is much more direct. It's designed to be fast, and you can often get coverage starting as soon as the very next day.

The easiest way to start is by looking at plans directly from insurance companies or using a private online marketplace that pulls together different options. This lets you see everything in one place, which is key to making a smart choice. At My Policy Quote, we can walk you through this comparison process.

The Application and Medical Questionnaire

The most critical part of the entire application is the medical questionnaire. Your answers here will determine everything—whether you get approved and how much you'll pay each month.

You'll need to answer detailed questions about your health history, usually going back a few years. Insurers want to know about pre-existing conditions, past treatments, hospital visits, and even symptoms you've had. Be completely honest. If you try to hide something, you risk having your policy canceled or your claims denied right when you need the coverage most.

Think of it this way: The insurer is using the questionnaire to gauge its risk. They are looking for people who are healthy right now and aren't likely to need care for an issue they already know about.

Once you hit submit, the review process is incredibly quick. You can often get an approval decision in minutes and have your coverage start almost immediately.

Comparing Your Plan Options

Before you pull the trigger and enroll, take a moment to compare the plans on your shortlist. Just picking the cheapest one is a classic mistake that can end up costing you a lot more down the road.

Here’s what you need to look at closely when comparing temporary health plans:

- Check the Provider Network: Do you have a doctor or hospital you prefer? Make sure they are in the plan’s network. With most short-term plans, going out-of-network means you’ll be paying for 100% of the bill yourself.

- Scrutinize the Policy Documents: This is where the truth lives. Dig into the fine print to find the list of exclusions, benefit caps, and any other limitations. Don't just glance at the summary brochure.

- Understand the Cost-Sharing Structure: Get a clear picture of the deductible, coinsurance, and out-of-pocket maximum. A plan with a $15,000 deductible means you have a big financial hurdle to clear before the insurance starts paying for anything.

Finalizing Your Enrollment and Getting Proof of Coverage

Once you’ve been approved for the plan you want, the last step is making that first premium payment. This is what officially locks in your coverage.

You’ll then receive your policy documents and an insurance card, either by email or in the mail. Keep this information handy. It has your policy number and the phone numbers you'll need if you have to file a claim. With that, you've successfully set up a crucial safety net to protect you from major medical bills while you're between long-term plans.

Critical Factors to Check Before You Buy

Alright, before you pull the trigger on a short term health insurance plan, it's time for one last, careful look. Think of this as the final walkthrough before you get the keys. Getting these details right from the start is what separates a reliable safety net from a policy that could leave you with surprise bills and a lot of headaches.

What we're doing here is pulling together the most important points into a final checklist. Trust me, spending a few extra minutes on this now can save you from a policy that fails you when you need it most.

State Regulations and Availability

First things first: where you live matters. A lot. Short term health insurance is not the same product everywhere in the U.S. While federal guidelines provide a general framework, each state gets to make its own rules—and many of them are much stricter.

For example, 14 states and the District of Columbia don't allow these plans to be sold at all. In other states, you might find that the maximum coverage period is much shorter than the federal limit. The plan you can get—or if you can get one at all—can change just by crossing state lines. Always start by confirming what's actually available where you live.

The Fine Print on Renewability

Next, you absolutely need to understand if you can extend your coverage. Federal rules suggest an initial term of up to 90 days, which can often be renewed for a total coverage period of up to four months. But here's the catch: insurance companies don't have to offer that renewal.

It's a classic mistake to just assume your plan is renewable. Some insurers sell policies that are strictly one-and-done. If your need for coverage lasts longer than you expected, you could suddenly be uninsured, forced to reapply with a new company and go through the whole medical underwriting process again.

Before you commit, find the exact renewal terms in the policy documents.

Reconfirming the Big Deal-Breakers

Now, let's quickly go over the major limitations one more time. These are the aspects of short term plans that most often catch people off guard and lead to frustration and unexpected costs.

Before you sign anything, double-check these three areas:

- Pre-existing Conditions: This is the big one. Remember, if you’ve been diagnosed, treated, or even just had symptoms of a condition before your policy starts, it is not covered. That’s the fundamental trade-off you make for the lower premium.

- Provider Network: Never assume your doctor is covered. You need to actively check if your preferred doctors, specialists, and local hospitals are in the plan’s network. Step outside that network, and you're likely paying 100% of the bill yourself.

- Prescription Drug Coverage: If a plan even offers prescription benefits, it's almost always limited to drugs for a new sickness or injury that happens while you're covered. Your regular, maintenance medications won't be part of the deal.

These limitations aren't small details; they're the core of what you're buying. This is especially crucial for those who are self-employed and trying to balance costs and benefits. For more on that, you can dive into our specific guide on health insurance for the self-employed. Taking a moment to confirm these points protects your health and your wallet.

Frequently Asked Questions

It's natural to have questions when you're exploring something like short-term health insurance. Let's tackle some of the most common ones that pop up, so you can feel more confident about your decision.

Can I Cancel My Short Term Plan?

Yes, you can. These plans are built for flexibility, so you aren't locked in. If you land a new job with health benefits or qualify for an ACA plan unexpectedly, you can typically cancel your short-term policy without getting hit with a penalty.

Just know that you won't get a refund for the premium you've already paid for that month. It's always a good idea to double-check your specific policy documents for the exact steps to cancel, as it can vary slightly between insurance companies.

One thing to remember: if you cancel and later decide you need another short-term plan, you'll likely have to go through the whole health screening process again. There's no guarantee you'll be approved a second time.

What Happens If I Get Sick on a Temporary Plan?

This is probably the most important question of all. If you come down with a new sickness or have an accident after your plan is active, it's designed to kick in and help with major costs like hospital stays or ER visits once you've paid your deductible.

Here's the catch, though. If that illness is eventually traced back to a pre-existing condition—even one you weren't aware of when you signed up—the insurance company can refuse to pay the claims. This is the biggest risk you take with this type of coverage.

Do These Plans Count as Health Insurance for Tax Purposes?

In a word, no. Short-term health plans don't meet the "minimum essential coverage" requirements set by the Affordable Care Act (ACA). The old federal tax penalty for not having insurance is gone, but a few states have their own rules. A temporary plan won't satisfy those state-level requirements.

Because these plans aren't ACA-compliant, you generally can't deduct the premiums from your taxes. If you want to dive deeper into how insurance affects your tax situation, our guide on health insurance tax benefits is a great resource.

Can I Be Denied Coverage?

Absolutely. This is a key difference from ACA Marketplace plans, where you can't be turned away. Short-term insurers use medical underwriting, which is just a fancy way of saying they screen you based on your health history.

They can, and often do, deny applications for various reasons. Some common examples include:

- Chronic conditions like diabetes or heart disease

- A past diagnosis of cancer or stroke

- Ongoing medical treatments or even certain lifestyle choices

The health questionnaire you fill out is incredibly important. Insurers use it to decide whether to offer you a policy, and they will deny coverage to avoid taking on predictable medical costs.

Navigating your health coverage options can be tricky, but you don't have to do it alone. The experts at My Policy Quote can help you compare plans and find the right fit for your unique situation. Explore your options with us today!