Let's be honest, talking about life insurance can feel a little heavy. But when you strip away all the jargon, it’s actually one of the most straightforward and caring financial decisions you can make for your family.

At its core, life insurance is a promise. You agree to pay a regular amount (a premium) to an insurance company. In return, they promise to pay a lump sum of money (a death benefit) to the people you love when you're no longer around to provide for them. It’s that simple. It’s a safety net for their future.

What Is Life Insurance Really For?

Think of a life insurance policy as a backup plan you put in place today for life's biggest "what-ifs." It’s a formal agreement, sure, but it’s really about peace of mind. Your consistent payments keep that promise alive, ensuring that your beneficiaries—whether it's your spouse, kids, or even a business partner—get a tax-free payout when they need it most.

This isn't some abstract financial product; it’s a practical tool that gives your family stability during an incredibly difficult time. That death benefit can be used for anything, helping them stay on their feet.

- Covering daily life: From groceries and utility bills to the car payment, it helps maintain their standard of living without interruption.

- Wiping out major debts: It can pay off the mortgage, giving your family the security of staying in their home.

- Funding big dreams: The money can ensure your kids still go to college or help your spouse retire without financial strain.

- Handling final expenses: It takes care of funeral costs and leftover medical bills, which can add up faster than anyone expects.

Understanding The Core Components

Getting comfortable with life insurance is much easier once you know the key players and terms. It’s less about complicated formulas and more about a simple, powerful exchange.

Think of it like a financial firefighter. Imagine your income is what keeps your family’s financial house standing strong. If a fire (an unexpected tragedy) strikes, life insurance is the firefighter who shows up with a massive supply of water (the death benefit) to put out the financial flames and keep everything from collapsing.

This idea is resonating with more people every day. The global life insurance market was recently valued at around USD 7.55 trillion and is expected to grow quite a bit over the next decade. This isn't just a random statistic; it shows a growing awareness of just how vital this kind of financial protection is. For a deeper dive into these trends, you can explore the latest analysis from industry experts. Find out more about global life insurance market projections on Precedence Research.

To make things even clearer, let's break down the essential terms you'll see in any guide to life insurance.

Life Insurance Key Terms at a Glance

Getting started with life insurance is all about understanding the language. Here’s a quick-reference table with the most important terms you’ll encounter.

| Term | Simple Explanation |

|---|---|

| Policyholder | That's you! The person who owns the policy and pays for it. |

| Premium | The regular payment you make (usually monthly or yearly) to keep your coverage active. |

| Death Benefit | The tax-free, lump-sum payment your loved ones receive when you pass away. |

| Beneficiary | The person, people, or even an organization you choose to receive the death benefit. |

Think of these terms as the building blocks of your policy. Once you know them, the rest starts to fall into place.

Ultimately, choosing life insurance is a profound act of love. It’s about making sure the people who matter most won't have to worry about money while they're grieving. It gives them the space to heal, and that’s a gift that’s impossible to put a price on.

Choosing Your Path: Term vs. Permanent Insurance

Okay, so you get why life insurance is a good idea. Now, let’s get into the what. Life insurance isn’t a one-size-fits-all product. It comes in two main flavors, and each one is built for different goals and different stages of life. The two main paths you can take are term life insurance and permanent life insurance.

I like to think of it like deciding between renting an apartment and buying a house. Renting is usually more affordable month-to-month and gives you a place to live for a specific period. Buying a house is a much bigger commitment, costs more upfront, but it builds equity and becomes a permanent asset you own.

Neither one is flat-out "better" than the other. The right choice is the one that fits your family's needs, your budget, and where you're headed in the long run.

The Case for Term Life Insurance

Term life insurance is the "renting an apartment" option. It’s simple, it’s affordable, and it’s temporary. You choose a specific period of time, or term—usually 10, 20, or 30 years. If you pass away during that time, your family gets the payout. If the term ends and you're still here, the policy simply expires. That’s it.

This makes it a fantastic tool for covering temporary but very high-stakes financial responsibilities. It’s a perfect fit for:

- Young families on a budget: It gives you the biggest possible death benefit for the lowest monthly cost, making sure your kids are protected while they're growing up.

- Covering a mortgage: You can match the policy’s term to the length of your home loan. That way, your family won’t have to worry about losing the house.

- Replacing your income: If you’re the primary breadwinner, a term policy can replace your salary for a set number of years, giving your loved ones time to get back on their feet financially.

The whole point of term insurance is to get maximum protection when your financial obligations are at their highest. It has one job—providing a huge safety net for a specific amount of time—and it does that job incredibly well.

For instance, a healthy 30-year-old could probably lock in a $500,000 policy for a 20-year term without breaking the bank. This ensures their family is covered until the kids are out of the house and the mortgage is nearly paid off.

The Case for Permanent Life Insurance

If term life is like renting, then permanent life insurance is like buying the house. Just like the name says, it’s designed to last your entire life as long as you keep paying the premiums. It’s definitely more expensive than term insurance, but it comes with a powerful feature: a savings component called cash value.

With each premium payment, a portion goes into this cash value account, where it can grow over time on a tax-deferred basis. This turns your policy into a financial asset you can actually use while you're still alive. You can borrow against it, take out some of the cash, or even surrender the policy for its value.

This makes permanent insurance, often sold as whole life insurance, a great match for different kinds of goals:

- Lifelong financial needs: It can cover final expenses, like funeral costs or leftover medical bills, which are guaranteed to happen eventually.

- Estate planning: It can provide the cash needed to pay estate taxes, ensuring your heirs get to keep the assets you wanted them to have.

- Building extra wealth: The cash value can become another source of money for retirement or other major life events down the road.

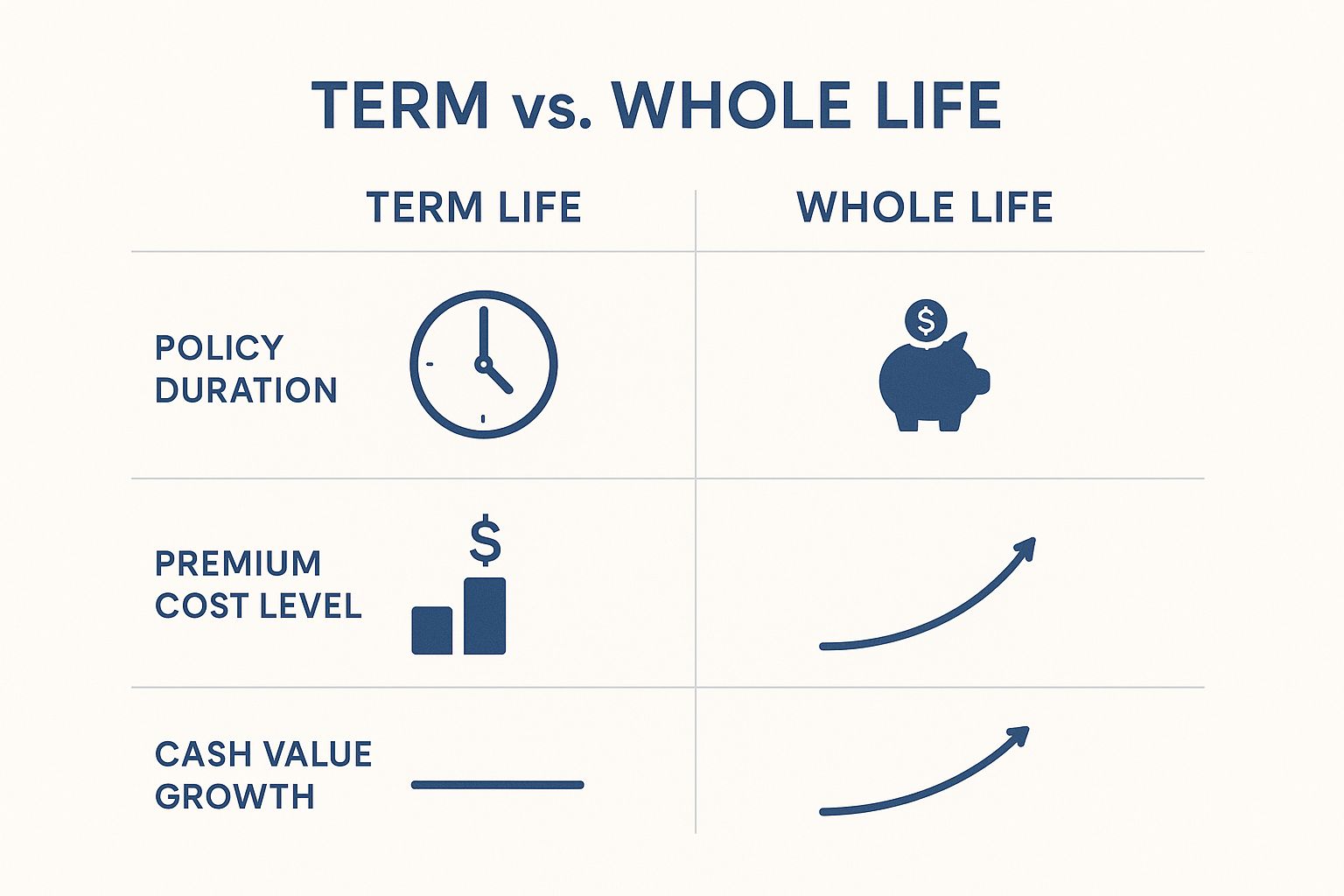

This image gives you a quick visual of how these two types stack up.

The choice between these two is a big deal, and it’s a decision millions of people make every year. In fact, the global insurance industry has shown huge growth, with total premium income recently hitting EUR 7.0 trillion. Life insurance is the biggest slice of that pie, with premiums reaching EUR 2,902 billion, proving just how fundamental it is to personal finance.

To help you see the differences more clearly, here’s a straightforward comparison.

Term Life vs. Whole Life Insurance Comparison

This table breaks down the key features of Term and Whole Life insurance side-by-side to help you figure out which path makes more sense for you.

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Policy Duration | A fixed period (e.g., 10, 20, 30 years) | Your entire lifetime |

| Primary Goal | Income replacement, debt coverage (mortgage, etc.) | Final expenses, estate planning, wealth building |

| Premiums | Lower and fixed for the term | Higher and typically fixed for life |

| Cash Value | No, it’s pure insurance | Yes, builds a tax-deferred savings component |

| Flexibility | Less flexible; expires at the end of the term | More flexible; you can borrow against or withdraw cash value |

| Best For | Young families, temporary needs, tight budgets | Long-term needs, estate planning, high-net-worth individuals |

As you can see, the "right" choice really comes down to what you need the policy to do.

Which One Is Right for You?

Deciding between term and permanent isn't about which one is better in a vacuum; it’s about which one fits your life and your financial philosophy right now.

A young couple with two kids and a new 30-year mortgage will probably get the most peace of mind from a 30-year term policy. It’s affordable and covers their biggest risks. On the other hand, someone with a large estate might use a whole life policy to leave a tax-efficient inheritance. For a more detailed breakdown, check out our guide on the difference between term and permanent life insurance.

Ultimately, the best policy is the one that's actually in place when your family needs it most. Whether you’re "renting" your protection for a while or "buying" it for a lifetime, you're taking a powerful step to secure their future.

How Much Coverage Do You Actually Need

Figuring out the right amount of life insurance can feel like you're being asked to solve a complex puzzle. You’ve probably seen online calculators with dozens of questions that leave you more confused than when you started. But it doesn’t have to be that complicated.

There’s a simple, memorable way to cut through the noise and land on a realistic number. It's the perfect starting point if you're new to this. The acronym to remember is DIME.

Understanding The DIME Method

The DIME method helps you calculate what you need by focusing on the four biggest financial holes your family would have to fill if you were gone. It’s an easy-to-remember acronym for Debt, Income, Mortgage, and Education.

By adding these four areas together, you get a clear, practical picture of the financial gap your life insurance needs to cover. This isn't just a guess; it's a personalized estimate built from your actual life circumstances.

Let’s break down each letter so you can start figuring out your own number.

- D is for Debt: This covers everything except your mortgage. Think about car loans, outstanding credit card balances, student loans, or any personal loans you have. Just add up the total it would take to wipe those debts clean.

- I is for Income: How much of your annual income would your family need to replace, and for how many years? A good rule of thumb is to multiply your yearly salary by 10, but feel free to adjust this based on your family’s unique situation and your spouse's ability to earn.

- M is for Mortgage: What’s the remaining balance on your home loan? Paying off the house is often the single biggest relief you can give your family. It ensures they have a stable roof over their heads without the stress of a monthly mortgage payment.

- E is for Education: If you have kids, what’s a realistic estimate for their future college or trade school costs? Look at what tuition costs today and project forward to get a ballpark figure for each child.

Add those four numbers up, and you’ll have a solid, comprehensive estimate of the coverage you need.

Putting DIME Into Practice

Let's walk through a quick, real-world example. Meet Mark, a 35-year-old with a spouse and two young kids.

Here’s how his DIME calculation looks:

- Debt: He has $25,000 in combined car loans and credit card debt.

- Income: He earns $70,000 a year and wants to provide 10 years of income replacement. ($70,000 x 10 = $700,000)

- Mortgage: Their remaining mortgage balance is $250,000.

- Education: He estimates college will cost about $100,000 per child. ($100,000 x 2 = $200,000)

By adding it all together, Mark gets his total coverage target:

$25,000 (Debt) + $700,000 (Income) + $250,000 (Mortgage) + $200,000 (Education) = $1,175,000.

That number might seem huge at first, but it gives him a clear goal. Mark now knows to look for a term life policy with a death benefit around $1.2 million. This amount would empower his family to clear all debts, stay in their home, live comfortably for a decade, and fund their kids' education.

Of course, this calculation is a starting point. Your personal situation might be different. For instance, older individuals often have different priorities. You can explore those unique needs in our article on life insurance for people over 50.

The goal here is simple: protect the people you love without overpaying for coverage you don’t need. The DIME method helps you move past the confusion and land on a number you can feel confident about.

What to Expect from the Application Process

Applying for life insurance can feel like a huge, intimidating task, but I promise you, it's much more straightforward than it looks. The whole process is really just a series of predictable steps designed to give the insurance company a clear picture of who you are. The goal here isn't to trick you; it's to make sure you get the right coverage at a fair price.

Think of it less like a final exam and more like an open-book quiz where you already know all the answers. It’s just a conversation about your life and health. Being prepared just helps it all go smoothly.

From getting your first quotes to finally holding the policy, each step has a clear purpose. It's all about making sure you and the insurer are on the same page, so you can feel confident in the protection you’re putting in place for your family.

The Initial Steps: Getting Quotes and Submitting an Application

Your journey starts with the easiest part: gathering quotes. This is where you get a first look at what your coverage might cost from different companies. Once you find a carrier and a policy that feels right, you’ll move on to the formal application.

This form will ask for some basic information, including:

- Personal Details: Your name, address, date of birth, and Social Security number.

- Lifestyle Information: Questions about your job, hobbies (especially risky ones like skydiving), and whether you use tobacco.

- Financials: Your approximate annual income and net worth.

- Policy Specifics: How much coverage you want (the death benefit) and who your beneficiaries will be.

It is so important to be completely honest here. Even small, unintentional mistakes could create major headaches down the road if your family needs to file a claim. This application is the foundation for everything that follows.

The Phone Interview and Medical Exam

After you submit your application, the next step is usually a quick phone interview. It’s a short call, typically 20-30 minutes, where someone from the insurance company will go over your answers to confirm everything and maybe ask for a bit more detail about your health history.

Following the interview, most traditional policies require a simple medical exam. Don't let this part stress you out; it's incredibly routine. A certified medical professional will come right to your home or office, whenever it’s convenient for you.

The medical exam is typically free and just involves measuring your height and weight, taking your blood pressure, and collecting a small blood and urine sample. It’s quick, easy, and a key part of how the insurer confirms your health status.

For most people, this is the most hands-on part of the whole process. Once it’s done, your work is pretty much finished, and the insurance company takes over from here.

The Underwriting Phase: Where the Magic Happens

Now we get to the behind-the-scenes part. Underwriting is when the insurance company’s team dives into all your information—your application, the interview notes, your medical exam results, and sometimes medical records from your doctor. They’re essentially assessing the level of risk involved in insuring you.

Underwriters use this complete picture to place you in a specific risk category, which is what ultimately determines your final premium. This process can take a few weeks, so a little patience is key. Once they're done, you'll receive your official offer, telling you if you’ve been approved and exactly what your premium will be.

This kind of financial protection has become more important than ever. While the average annual premium has grown by about 3% over the last decade in the U.S., the recent global health crisis really shined a light on the need for it. This awareness led to a huge jump in both sales and the number of policies, hitting growth rates not seen in over 40 years. You can discover more insights about the U.S. individual life insurance market on LIMRA.com, which really shows how vital people feel this protection is.

Finally, you’ll accept the offer, sign the policy documents, and make your first premium payment. And just like that, your coverage is active. Your promise to protect your family is officially in place. To get a better sense of what that promise entails, read our guide on what exactly life insurance covers.

The Real Factors That Determine Your Rates

Ever wonder what goes on behind the curtain when an insurance company calculates your premium? It might feel like a mystery, but it’s actually a very logical process based on one simple idea: risk.

In short, the insurer is trying to figure out how likely it is they will need to pay out your policy.

Think of it like being a lender for a car loan. Before handing over the money, you’d want to know about the driver's history and the car’s condition to understand your risk. Life insurance companies do the same thing. But instead of evaluating a driver, they're looking at your life expectancy based on a handful of key factors.

Understanding what they look for is empowering. It helps you see why they ask certain questions and shows you how positive lifestyle choices can directly lower your costs.

The Big Two: Age and Health

When it comes to your life insurance rates, nothing matters more than your age and your health. These two factors paint the clearest picture of your risk and form the foundation of every premium calculation.

The logic is simple: the younger and healthier you are, the lower your premium. That’s because, statistically, you have a longer life ahead of you, giving the insurer more years to collect premiums before a potential payout. This is exactly why financial advisors often say to buy life insurance when you’re young—you can lock in a much lower rate for the entire life of the policy.

Your health profile is the other side of the coin. Insurers will look at:

- Your medical history: Including any past surgeries or chronic conditions.

- Your family’s medical history: To spot any potential hereditary risks.

- Your current vitals: This is info from your medical exam, like blood pressure, cholesterol, and your height-to-weight ratio.

The single best way to get an affordable life insurance rate is to apply when you are young and in good health. Waiting just a few years can cause a noticeable jump in your annual premium, even if your health stays the same.

Lifestyle Choices and Other Key Influences

While age and health are the headliners, your daily habits and personal details also play a big part. These choices give insurers a more complete view of your risk profile beyond just the medical charts.

One of the most impactful lifestyle choices is tobacco use. Smokers and other tobacco users should expect to pay significantly more for the same coverage—often two to three times as much as non-smokers. This is simply due to the well-documented health risks that come with smoking.

Other factors the insurance company will consider include:

- Your Driving Record: A history of DUIs or reckless driving signals higher risk.

- High-Risk Hobbies: Activities like skydiving, rock climbing, or scuba diving may lead to higher premiums.

- Your Occupation: A dangerous job, like being a pilot or logger, can impact your rate.

- The Policy Itself: The type of policy (term vs. permanent) and the size of the death benefit you choose directly affect the cost.

Ultimately, your life insurance premium is a personalized price tag based on your unique life. By understanding what insurers are looking for, you can appreciate the logic behind it all and see how healthy, responsible choices translate directly into financial savings for you and your family.

Jumping into life insurance can feel like a huge step, and it's easy to make a wrong turn. The good news? You can learn from the folks who’ve already walked this path. Understanding their common slip-ups ahead of time is like getting a cheat sheet to secure the right protection for your family, minus the regrets.

The single biggest mistake is simply waiting too long. It’s so tempting to think, "I'll get it next year when I have more money," or "I'm young, I don't need it yet." But here’s the reality: life insurance is never cheaper than it is right now. With every birthday, your potential premiums can tick up. Procrastination is a surprisingly expensive decision.

Believing Cheapest Is Always Best

Everyone loves a good deal, but fixating only on the lowest price tag is a classic rookie error. That super-cheap policy might look great on paper, but it could be from a company with a reputation for awful customer service or a claims process that puts your family through the wringer. Even worse, it might lack the flexibility you'll need later, like the option to convert a term policy into a permanent one.

Your goal shouldn't be to find the cheapest policy, but to find the best value. That means getting the right amount of coverage from a solid, reliable company, with features that fit your life—all at a price that makes sense.

Not Being Fully Honest

It can be tempting to shave a few details off your application to get a better rate. Maybe you don't mention that you smoke socially or you downplay a minor health issue from a few years back. This is a massive mistake. Insurance companies are experts at verifying information, and if they find inconsistencies, they have the right to jack up your rates or deny your application altogether.

The real danger comes later. If a lie is discovered after you’re gone, the insurer can legally refuse to pay your family’s claim, leaving them with absolutely nothing. When it comes to your application, honesty isn't just the best policy—it's the only policy. To see more ways people get tripped up, you can review our list of the most common mistakes when buying life insurance.

Forgetting to Update Your Policy

Finally, life insurance isn't a "set it and forget it" kind of deal. Your life is going to change in big ways, and your coverage needs to keep up.

Think about these milestones:

- You get married or, down the road, divorced.

- You welcome another child into your family.

- You buy a new home with a bigger mortgage.

- You land a major promotion with a significant salary boost.

Each of these events shifts your financial landscape. That’s why it’s so important to pull out your policy every few years, dust it off, and make sure your beneficiaries and coverage amount still match your life’s reality. It's the only way to ensure your safety net truly works when it matters most.

Of course. Here is the rewritten section, crafted to match the human-written, expert tone and style from the provided examples.

Still Have Some Lingering Questions?

Even after you get the basics down, it’s totally normal for a few “what if” questions to pop into your head. Life insurance is a big decision, and you deserve to feel completely clear about it before moving forward.

Let's walk through some of the most common questions people ask. My goal is to clear up any final doubts so you can take your next steps with confidence.

Can You Get Life Insurance with Health Issues?

Yes, in most cases, you absolutely can. Having a pre-existing condition doesn't automatically close the door on getting covered, though it might change your options or affect your premium.

Insurance companies all look at risk a little differently, so it pays to shop around. Some insurers even specialize in covering people with specific health challenges. The golden rule? Be 100% honest on your application. Hiding a condition can give the company a reason to deny a claim down the road, and that’s the last thing your family needs.

What If You Outlive Your Term Policy?

Honestly, this is a great problem to have! If you outlive your term life insurance, the policy simply expires. You stop making payments, and the coverage ends. You don't get a refund on your premiums, because they were busy protecting your family all those years.

When this happens, you have a few choices:

- Apply for a new policy, but expect it to be more expensive since you're older.

- If your policy had a conversion rider, you might be able to switch it to a permanent policy without needing another medical exam.

- Decide you no longer need coverage. Maybe your kids are independent, your mortgage is paid off, and you've reached financial security.

Think of it this way: the whole point of term insurance was to guard your family during their most vulnerable financial years. Outliving it usually means you did your job, and everyone has landed on their feet. That’s a win.

How Does Your Family Get the Money?

After you pass away, your beneficiary will need to start the claims process with the insurance company. It usually involves sending in a certified copy of the death certificate and filling out a claim form.

The company will review everything and, once approved, pay out the death benefit. In nearly all cases, this payout is delivered as a tax-free, lump-sum payment. It gives your loved ones immediate access to the funds they need, right when they need them most.

Ready to put these answers into action? At My Policy Quote, we believe finding the right life insurance should be simple and clear. Get a personalized, no-obligation quote today and take that first step toward securing your family’s future.