Jumping into the world of self-employment health insurance can feel like you've been asked to navigate a maze in the dark. If you're a freelancer, contractor, or solo entrepreneur, you're suddenly on your own. It's a huge shift from the simple, pre-selected options you'd get at a traditional job. This guide is here to be your flashlight, showing you a clear path to a plan that protects both your health and your hard-earned business.

Why Does Health Insurance Feel So Overwhelming When You Work for Yourself?

If you feel lost, take a deep breath. You're not the only one. Finding the right health plan when you're self-employed is like being handed the keys to a ship without a map. You know where you want to go—to great, affordable coverage—but the open sea looks intimidating.

That feeling isn't just in your head. It’s built into how the healthcare market works for individuals. When you have an employer, the HR team does all the heavy lifting. They research insurers, compare the fine print, and hand you a few solid choices.

But when you're self-employed? You become your own HR department, benefits expert, and financial advisor, all rolled into one.

The Three Big Hurdles

That anxiety you're feeling? It usually boils down to three core challenges every solo professional runs into. Knowing what they are is the first step to overcoming them.

- The Shock of High Costs: Without an employer chipping in, the full monthly premium lands on your shoulders. It can feel like a tidal wave hitting your budget.

- The Fog of Confusion: Suddenly, you’re drowning in jargon. Deductibles, copays, coinsurance, networks… It's easy to get lost in the details and miss what really matters.

- The Fear of a Bad Decision: Choosing the wrong plan is a real risk. It could mean surprise bills that drain your savings or finding out your favorite doctor isn't covered right when you need them most.

This pressure is real, and it’s getting more intense. Medical costs are climbing for everyone. In fact, employer health benefit costs are expected to jump by 5.8% in 2025. For smaller businesses, that number could be as high as 9%. As a self-employed person, you feel that pinch directly.

Finding Your Way Forward

Think of this guide as your compass. We're going to cut through the noise and give you clear, practical steps to follow. You'll learn how to figure out what you really need, compare your options without getting overwhelmed, and make a choice you can feel good about.

This is about more than just avoiding a financial nightmare. It’s about securing peace of mind. By the time you're done reading, you'll have the confidence to turn this source of stress into just another smart part of running your business. You can find a plan that works for you. You can learn more about these healthcare trends and what to expect.

Understanding Your Core Health Insurance Options

When you’re your own boss, figuring out health insurance can feel like stepping into a maze. With so many choices, where do you even start? It’s overwhelming, but I promise it’s simpler than it looks.

Think of it this way: you have four main paths to take. Each one is built for a different kind of journey, a different budget, and a different set of priorities. Let's walk through them together so you can see which one feels right for you and your business.

ACA Marketplace Plans: The Regulated Supermarket

The Affordable Care Act (ACA) Marketplace, which you can find at Healthcare.gov, is your one-stop shop for regulated health insurance. It’s like a giant, well-organized supermarket where all the products (the plans) have to meet certain quality standards. You’ll find a huge variety of "brands" (insurers) and different tiers of coverage, like Bronze, Silver, and Gold.

The biggest draw here? The discounts. The government offers Premium Tax Credits to help lower your monthly payments based on what you expect to earn. For many freelancers and small business owners, these subsidies are a game-changer, making great coverage truly affordable. I’ve seen people get solid plans for as little as $10 per month.

Direct Private Insurance: The Boutique Shop

Another option is to go directly to an insurance company or use a broker to buy a private plan. I like to think of this as shopping at a boutique. You might find plans here that aren't on the main "supermarket" shelves, sometimes with unique doctor networks or different perks.

These "off-exchange" plans still have to follow key ACA rules, so they’ll cover pre-existing conditions and essential benefits. The crucial difference? You can't use those government subsidies (the Premium Tax Credits) to pay for them. This path usually makes the most sense if your income is too high to qualify for help on the Marketplace, but you still want a comprehensive, ACA-compliant plan.

The Bottom Line: The biggest difference between buying on the Marketplace versus going private is your access to subsidies. If your income makes you eligible for financial help, the Marketplace is almost always the smarter, more affordable choice for the same quality of coverage.

Short-Term Plans: The Temporary Rental

Short-term health plans are exactly what they sound like—a temporary fix. Imagine you're between homes and you rent a furnished apartment for a few months. It gets the job done for a little while, but you wouldn’t want to live there forever.

These plans are designed to bridge short gaps in coverage, like if you're waiting for your new ACA plan to kick in. Their super-low monthly premiums can be tempting, but they come with some serious risks you need to know about:

- They can and will deny you for pre-existing conditions.

- They often skip coverage for essentials like maternity care, mental health services, or even prescription drugs.

- They can put a cap on how much they'll pay for your care, which could leave you on the hook for massive medical bills.

Because they offer such limited protection, I only recommend them for their intended purpose: bridging a true, short-term gap.

Health Care Sharing Ministries: The Member Co-op

This last option is a whole different ballgame. Health care sharing ministries are not insurance. Think of them more like a members-only co-op, where people (often with shared religious beliefs) pool their money together to help pay for each other's medical bills.

You make a monthly contribution, or a "share," and when a medical need pops up, you can ask for help from the group's funds. The low monthly cost is the main attraction, but the risk is huge. These ministries aren't regulated by state insurance departments, so there's no guarantee of payment. They can refuse to share costs for pre-existing conditions or for lifestyle choices that don’t align with their principles. While it might work for some, you're giving up the legal protections that come with a real insurance plan.

To help visualize these paths, the table below breaks down the key differences at a glance. It’s a great way to see how they stack up side-by-side.

Comparing Your Top Self-Employed Health Insurance Options

| Insurance Option | Best For | Typical Cost | Key Pro | Key Con |

|---|---|---|---|---|

| ACA Marketplace | Individuals/families needing comprehensive coverage and potential financial help. | Varies; can be as low as $10/month with subsidies. | Access to subsidies; guaranteed coverage for pre-existing conditions. | Can be expensive without subsidies. |

| Direct Private Plan | Those with higher incomes who don't qualify for subsidies but want an ACA-compliant plan. | Generally higher than subsidized Marketplace plans. | May offer different network or plan options not on the Marketplace. | No access to government subsidies. |

| Short-Term Plan | Bridging a temporary gap in coverage (e.g., between jobs or waiting for open enrollment). | Very low monthly premiums. | Inexpensive and easy to enroll in quickly. | Doesn't cover pre-existing conditions; limited benefits; no payment guarantee. |

| Health Sharing Ministry | Healthy individuals who align with the ministry's beliefs and are comfortable with financial risk. | Low monthly "shares." | Very low monthly costs. | Not insurance; no guarantee of payment; can exclude many conditions. |

Ultimately, choosing the right plan comes down to balancing cost, coverage, and your personal comfort with risk.

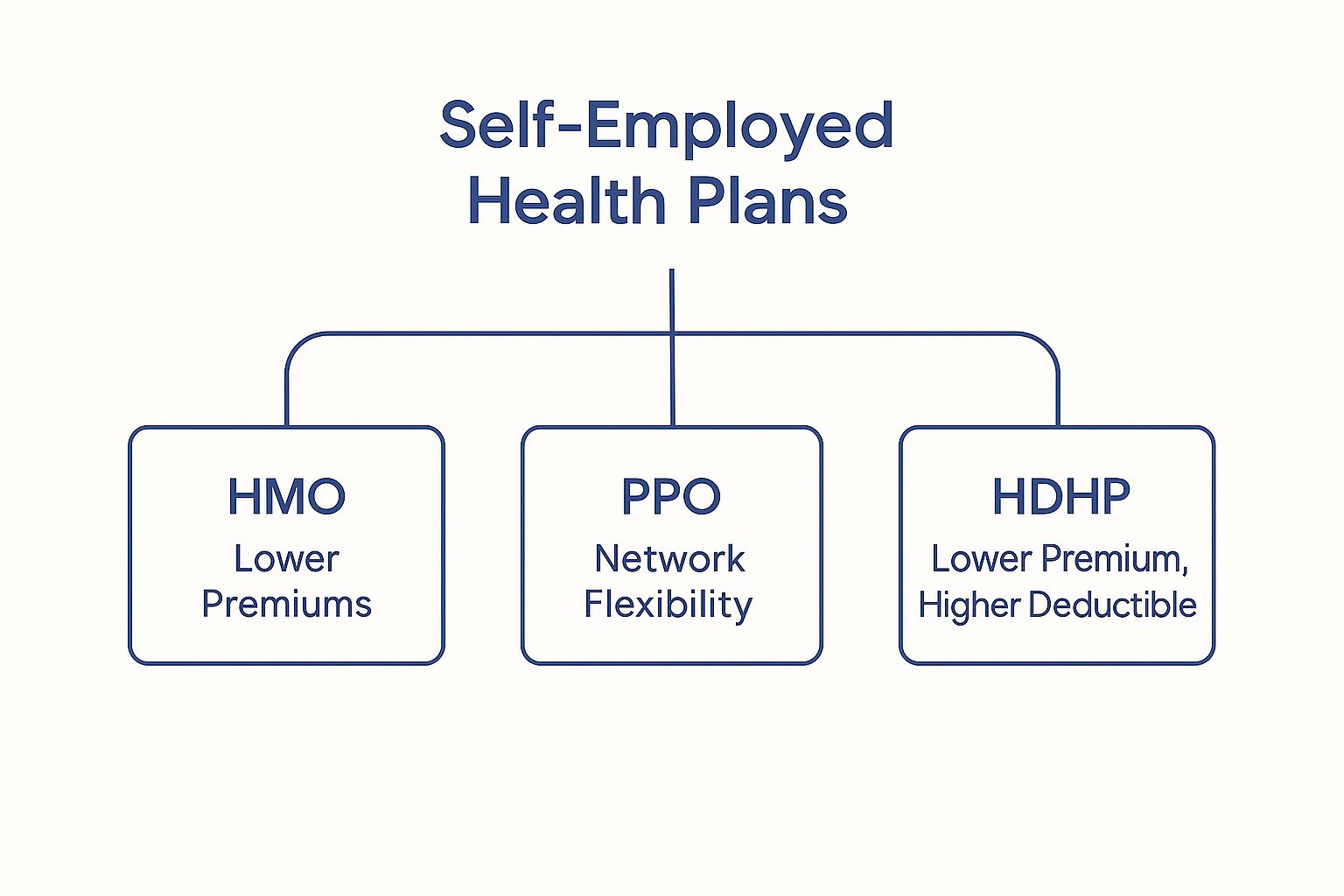

This diagram helps show the trade-offs you'll encounter, like paying less for an HMO with a smaller network versus paying more for the flexibility of a PPO.

Picking your path is the most important first step. For a deeper look at how to weigh these choices for your specific needs, check out our guide on the best health insurance for the self-employed. For most freelancers and entrepreneurs I talk to, the protections and potential savings of an ACA Marketplace plan make it the strongest foundation for their health and financial security.

A Step-by-Step Guide to the Health Insurance Marketplace

For most of us flying solo in the business world, the Health Insurance Marketplace is the best place to start looking for coverage. You'll find it over at Healthcare.gov, and it was built specifically to be a one-stop shop for individual health insurance. More importantly, it offers financial help and protections you just can't find anywhere else.

Let's walk through the process together. It might seem intimidating, but once you break it down, it's just a series of simple, manageable steps.

Step 1: Know When You Can Enroll

When you work for a company, you usually sign up for benefits right after you're hired. The Marketplace is a bit different—it has specific times when you can enroll. The main window is called Open Enrollment, and it happens once a year, typically in the fall.

But as a freelancer, you know life doesn't always stick to a neat schedule. That’s where a Special Enrollment Period (SEP) comes in. If you lose your current health coverage, get married, have a child, or even move to a new zip code, you could qualify. An SEP gives you a 60-day window to get a new plan, even if Open Enrollment is months away.

Step 2: Project Your Business Income Accurately

Okay, this is the most important step for any self-employed person, so lean in. Your eligibility for major cost-saving subsidies, officially called Premium Tax Credits, is tied directly to your estimated Modified Adjusted Gross Income (MAGI) for the coming year.

I know, estimating income when you're a freelancer can feel like reading tea leaves. But it's so important to get this as right as you can. Pull up last year's net profit. Look at your current projects and what’s in the pipeline. Then, make your best, most honest projection of your expected income and business expenses.

Pro Tip: If you're going to be off, it's better to slightly overestimate your income. If you end up earning more than you projected, you might have to pay back some of your subsidy when you file taxes. But if you earn less, you'll get that extra money back as a credit. Check in on your income every few months and update your Marketplace application if anything big changes.

Getting this estimate right is the key to unlocking truly affordable self-employment health insurance. It’s not uncommon for people to find a great plan for $10 or less per month after these credits kick in.

Step 3: Understand the Metal Tiers

Once you’re browsing the Marketplace, you’ll notice plans are sorted into four "metal" tiers: Bronze, Silver, Gold, and Platinum. Don't let the names fool you—the quality of medical care is exactly the same across all of them. The only difference is how you and your insurance plan split the costs.

Think of it like this:

- Bronze: This is your "catastrophe" plan. You pay a low monthly premium, but your deductible will be high. It’s perfect for protecting you from a major, unexpected medical event, but you'll pay for most routine stuff out of your own pocket.

- Silver: This is the "happy medium" and often the best bang for your buck. It balances moderate monthly premiums with moderate deductibles. Here’s the secret, though: Silver is the only tier where you can get extra cost-sharing reductions (if your income is in the right range) that lower your deductibles, copays, and coinsurance.

- Gold & Platinum: These are your "premium" plans. You'll pay a much higher monthly premium, but the plan starts covering its share a lot sooner because of the low deductibles. If you know you'll need regular medical care, one of these could be a smart choice.

Step 4: Look Beyond the Monthly Premium

That monthly premium is just one number. It’s an important one, but it doesn't tell the whole story. To find a plan that actually works for you, you have to look at all the out-of-pocket costs. Always check the plan's deductible, copayments, coinsurance, and the all-important out-of-pocket maximum.

For a deeper dive into what these terms really mean for your wallet, our simple guide on how to choose health insurance for smart coverage breaks it all down.

Just as critical is the plan’s provider network. Before you commit, make absolutely sure your favorite doctors, local hospitals, and any specialists you see are "in-network." If they aren't, you could be on the hook for much, much higher bills. Checking the network is a non-negotiable step to avoid painful financial surprises down the road.

Unlocking the Self-Employed Health Insurance Deduction

When you're running your own business, paying for health insurance can feel like one of your biggest hurdles. But there’s some seriously good news hidden in the tax code. The IRS offers a powerful tool to take the sting out of that expense: the self-employed health insurance deduction.

Think of it less like a complicated tax rule and more like a reward for taking charge of your own benefits. This deduction lets you subtract 100% of what you pay in health insurance premiums right off your income, which can make a huge difference in how much you owe come tax time. It’s one of the best tax breaks out there for entrepreneurs.

Who Qualifies for This Powerful Deduction?

Now, the IRS is pretty specific about who gets to claim this. The rules are there to make sure it benefits genuine solo business owners and small partnerships. You’ll need to check a few boxes to qualify.

First, you have to be officially self-employed. This typically means you're a:

- Sole proprietor filing a Schedule C with your taxes.

- Partner in a business partnership.

- Member of an LLC that's taxed like a partnership.

- Shareholder in an S corporation who owns more than 2% of the company and gets health insurance coverage through it.

Just as important, your business must have turned a net profit for the year. You can’t deduct more than what your business earned, so this deduction can't be used to create a business loss on paper.

Here's the most critical rule, the one that trips people up: You are not eligible if you could have been covered by an employer-sponsored plan. That includes a plan offered by your spouse's job. If you were eligible to join their plan—even if you said no thanks—you can't take this deduction.

What You Can Actually Deduct

This isn't just about your main health plan. The deduction is surprisingly broad, letting you turn a whole range of healthcare costs from personal expenses into business-related write-offs.

You can deduct the premiums you pay for:

- Medical Insurance: This is the big one—the monthly payments for your primary health plan.

- Dental Insurance: Those separate dental policies for you and your family count, too.

- Qualified Long-Term Care Insurance: The IRS sets age-based limits on how much of this you can deduct, but it's still a fantastic and often overlooked part of the benefit.

Best of all, this deduction applies to premiums for yourself, your spouse, and your dependents up to age 27. As you shop for a plan, it's smart to check out our top tips for finding budget-friendly health coverage to see how this deduction can make even better plans more affordable.

How the Deduction Reduces Your Taxable Income

So, what does this look like in practice? The magic of the self-employed health insurance deduction is that it's an "above-the-line" deduction. That’s tax-speak for something truly great: you don’t have to itemize to claim it.

It directly lowers your Adjusted Gross Income (AGI). A lower AGI is a huge win because it can unlock other tax credits and deductions that have strict income caps.

Here’s a real-world example:

Let's say you're a freelance graphic designer who had a great year, earning $70,000 in net profit. Over that same year, you paid $6,000 in premiums for a Marketplace health plan for your family.

When you claim the self-employed health insurance deduction, you simply subtract that $6,000 from your income. Your AGI drops from $70,000 to $64,000. Just like that, you’ve lowered your tax bill and potentially qualified for other benefits, turning a major expense into a major financial win.

Actionable Strategies to Reduce Your Healthcare Costs

Getting your self employment health insurance sorted is a huge win. But your power to control costs doesn't stop once you pay that first monthly premium. It’s about making your plan work smarter for you all year long.

This means shifting your mindset from just paying bills to actively managing your health spending. These aren't complicated theories—they're practical, proven ways to keep more of your hard-earned money without skimping on quality care.

Embrace the Power of a Health Savings Account

If you have a high-deductible health plan (HDHP), the Health Savings Account (HSA) is one of the most powerful financial tools you can get your hands on. Think of it as a special savings account just for healthcare, but with a unique triple tax advantage you can't find anywhere else. It’s a game-changer.

- Tax-Deductible Contributions: The money you put in is 100% tax-deductible. This directly lowers your taxable income for the year, just like a traditional IRA contribution.

- Tax-Free Growth: Any funds in your HSA can be invested, and they grow completely tax-free.

- Tax-Free Withdrawals: When you need to pay for qualified medical expenses, you can pull money out without paying a dime in taxes.

This powerful trio makes an HSA an incredible way to save on immediate medical bills and build a nest egg for the future. The money rolls over every single year, so if you don't use it, it can even become a secondary retirement fund.

Make Telemedicine Your First Call

Why spend time and gas driving to a doctor's office for a minor issue, only to sit in a waiting room and pay a high copay? Telemedicine puts convenient, affordable care right on your phone or computer.

For everyday concerns like a cold, a skin rash, or a simple prescription refill, a virtual visit can save you a surprising amount of time and money. Many insurance plans now offer telemedicine services with low or even $0 copays. Before you book that in-person appointment for anything non-urgent, always check your plan's virtual care options first. It’s a simple switch that can easily save you hundreds over the year.

This strategic thinking is more critical than ever. Global healthcare costs are projected to climb by 10.2% in 2025, a jump from the previous year. As a self-employed person, you feel the full weight of these price hikes. You can learn more about the economic forces driving these costs on pwc.com.

Become a Savvy Healthcare Shopper

Finally, you can find huge savings by treating your healthcare like any other major purchase. Don't just blindly accept the first price you're quoted for a prescription or a medical procedure. Getting involved can unlock serious discounts.

Practical Cost-Cutting Tips:

- Use Prescription Discount Apps: Services like GoodRx and SingleCare often provide coupons that are cheaper than your insurance copay. Always compare the app price with your insurance price before you pay.

- Question and Negotiate Medical Bills: Billing errors happen more often than you’d think. Always request an itemized bill after a procedure and scan it for mistakes or services you never received. If you find something wrong or a charge seems way too high, don't hesitate to call the billing department to question it or even negotiate a lower price.

- Maximize Your Preventive Care: Thanks to the ACA, all Marketplace plans must cover a long list of preventive services at 100%. This means no copay and no deductible for annual check-ups, flu shots, and various health screenings. Using these free services helps you stay healthy and catch problems early, which is the best way to avoid bigger, more expensive treatments down the line.

When you start using these strategies, you stop being someone who just pays the bills and become an empowered manager of your own healthcare finances. You may also want to explore other ways you might be overpaying on insurance and how to fix it.

Your Top Questions About Self-Employment Health Insurance, Answered

Once you get the hang of the basics, it’s the tricky “what if” questions that pop up. These are the details that can feel overwhelming when you're a freelancer, contractor, or solo business owner. Let's clear them up with some straightforward answers.

What Happens If My Income Jumps Around During the Year?

This isn’t just a “what if”—it’s the reality for almost every self-employed person. One month you’re slammed with work, and the next is crickets. It’s normal.

When you sign up for an ACA Marketplace plan, you give your best guess for your yearly income. This estimate is what determines if you qualify for a Premium Tax Credit to lower your monthly costs.

Because your income isn’t a steady paycheck, you have to stay on top of that estimate. Think of it like adjusting the thermostat. When the weather outside changes (your income goes up or down), you have to tweak the dial inside (your Marketplace application) to stay comfortable.

If you land a huge project and your income spikes, report it right away. Yes, your subsidy might go down, but it saves you from a nasty surprise bill when you file your taxes. On the flip side, if things slow down, updating your application could mean you qualify for a bigger subsidy, dropping your monthly premium when you need it most.

A Simple Habit: Every quarter, take a look at your net profit. Is it way off from your original guess? If so, log in to your Healthcare.gov account and update it. This one small step is your best defense against tax-time headaches.

Can I Still Get Insurance If I Have a Pre-Existing Condition?

Yes. Absolutely. This is one of the most critical protections you have.

Thanks to the Affordable Care Act (ACA), every single plan sold on the official Health Insurance Marketplace must cover you, no matter what your medical history looks like.

This means an insurance company can't:

- Deny you a plan because you have diabetes, asthma, or a past cancer diagnosis.

- Jack up your rates and charge you more than a healthy person your age.

- Refuse to pay for essential care related to your pre-existing condition.

This guarantee is the bedrock of ACA-compliant plans. But here's a crucial warning: this protection does not apply to everything out there. Short-term health plans and health care sharing ministries don't play by these rules. They can, and often will, deny you or refuse to cover treatments for pre-existing conditions. For most people, an ACA plan is simply the safest and most reliable choice.

Should I Use My Spouse's Plan or Get My Own?

This is a classic money question that really boils down to two numbers. First, find out the exact dollar amount it would cost to add yourself to your spouse's health plan at their job. Don't just look at the "family" rate; you need the specific price for adding just one more adult.

Next, compare that cost to what you'd pay for a similar plan on the ACA Marketplace. Don’t forget to factor in any subsidies you might get based on your household income.

But there’s a piece of the puzzle people often miss: the self-employed health insurance deduction. You cannot deduct your health insurance premiums if you have the chance to get on a subsidized plan through your spouse’s employer. This is true even if you turn down their offer and buy your own plan anyway.

- Scenario A: If your spouse’s plan is affordable, it’s often the simplest and smartest financial move.

- Scenario B: If adding you to their plan is crazy expensive, you can say no and buy your own. Just know you’ll lose the ability to deduct those premiums from your taxes.

Are Health Care Sharing Ministries the Same as Insurance?

No. And getting this distinction right is absolutely vital for your financial security.

Health care sharing ministries are not insurance. They are faith-based, non-profit groups where members pitch in monthly "shares" to help cover each other's medical bills.

While the low monthly cost looks great on paper, they exist completely outside of insurance laws and regulations. That means:

- They have zero legal requirement to pay your medical claims.

- They often have annual and lifetime limits on how much they’ll pay.

- They frequently refuse to cover pre-existing conditions and things like mental health care.

Think of it like this: A real insurance plan is a legal contract. It’s a guarantee that they will pay for covered services. A health care sharing ministry is more like a community support fund—it runs on trust, not legal promises. While that can work for some, it leaves you incredibly exposed if a big medical bill gets denied.

Trying to figure out your insurance options can feel complicated, but you don’t have to do it alone. The experts at My Policy Quote are here to help you compare plans, see what savings you qualify for, and find the right coverage for your life. Explore your options at https://mypolicyquote.com today.