If there's one number to remember when it comes to your child's health insurance, it’s 26. The Affordable Care Act (ACA) created a rule that lets young adults stay on a parent's health plan until their 26th birthday, offering a crucial bridge during a time often filled with big life changes.

The Age 26 Rule: Your First Question Answered

Before 2010, the landscape for dependent coverage was a confusing mess. The rules varied wildly by state, employer, and insurance company. Graduating from college, moving out, or even just turning 19 could mean getting kicked off your parent's plan. The Affordable Care Act swept all that away and established a single, straightforward standard for the entire country.

At its core, this federal law simply requires health plans that offer dependent coverage to make it available to children until they turn 26. It's a powerful and refreshingly simple protection designed to keep young adults from falling through the cracks of the healthcare system. The effect was immediate and profound.

Unpacking the Federal Mandate

The real genius of the age 26 rule is its clarity. It cuts through the old, confusing eligibility requirements that used to trip families up. Many people still mistakenly believe that certain life milestones will disqualify a young adult, but the ACA is very clear on this.

Under this federal mandate, your child’s eligibility is protected regardless of their personal circumstances. It creates a consistent floor of coverage that families can rely on.

This protection holds true even if your child:

- Gets married

- Isn't financially dependent on you

- Lives in a different house or even another state

- Is eligible to enroll in their own employer’s health plan

- Is no longer a student

To make it even clearer, here’s a quick breakdown of how the federal rule works.

Key Conditions of the ACA Age 26 Rule

This table summarizes the core provisions of the federal law allowing young adults to stay on a parent's health insurance plan until age 26.

| Condition | Does It Affect Eligibility Under the ACA? | Explanation |

|---|---|---|

| Marital Status | No | A young adult can remain on a parent's plan even if they get married. Their spouse, however, cannot be added. |

| Financial Dependency | No | Eligibility is not based on whether the parent claims the child as a tax dependent. |

| Residency | No | The child can live at a different address, even in another state, and still be covered. |

| Student Status | No | Being a student is not a requirement. They can stay on the plan whether they are in school or not. |

| Employment | No | Even if the child has a job that offers health insurance, they can choose to stay on their parent's plan instead. |

As you can see, the federal guidelines are designed to be as inclusive as possible, removing nearly all the old barriers.

This provision completely reshaped insurance for young people. Almost overnight, the number of uninsured young adults plummeted. Studies showed a 5.3 percentage point increase in dependent coverage and an estimated 716,000 more insured young adults within the first few months alone. It’s a testament to how vital this rule became for maintaining continuous healthcare.

Of course, once a dependent turns 26, they "age out" of this provision and will need to secure their own coverage. To see what comes next, you can check out our guide on health insurance for a 26-year-old. The good news is that aging out is a qualifying life event, which opens up a Special Enrollment Period. This gives them a window to sign up for a new plan without having to wait for the annual Open Enrollment.

How the ACA Reshaped Young Adult Health Coverage

Before the Affordable Care Act (ACA), the road to health insurance for young adults was notoriously rocky. It was common for a 19th birthday or a college graduation to trigger a sudden loss of coverage, pushing millions off their parent's health plan each year. This created a dangerous "coverage cliff" that many fell over.

The old system was a messy patchwork of different state laws and employer rules. Some plans would drop a dependent at age 19 unless they were a full-time student; others had their own arbitrary cutoffs. This instability made young adults aged 19 to 25 one of the most uninsured demographics in the country, as they were often just starting out in low-wage jobs with no benefits.

Building a Bridge to Adulthood

The ACA's age 26 rule wasn't just a minor tweak—it fundamentally rebuilt the insurance landscape for American families. Think of it as a bridge, spanning that uncertain gap between childhood dependency and full adult independence. All at once, young adults gained a reliable safety net during a time of major life transitions.

This simple change allowed them to focus on finishing school, launching a career, or just getting on their feet without the constant fear of a single medical bill causing financial ruin. It bought them time and stability, ensuring an accident or illness wouldn't derail their future before it even began.

The impact was immediate and profound. The uninsured rate for this age group dropped dramatically, offering clear proof that the policy was working. It acknowledged a simple truth: the path to a stable, full-time job with benefits is rarely a straight line.

This provision is a cornerstone of modern employer-sponsored health coverage. Its success is visible in the sheer number of young people who rely on it today for continuous, stable access to healthcare.

The numbers really tell the story. Today, approximately 56% of young adults between 18 and 25 are covered under an employer-sponsored plan. A staggering 72% of that group are enrolled as dependents on a family member's policy, a figure that shows just how essential the dependent coverage rule has become.

Covering the Vulnerable Years

So, why was this age group so vulnerable to begin with? It's a time of immense transition. Young adults are often caught in a tough spot, maybe:

- Working part-time or entry-level jobs that don’t offer health benefits.

- Still in school and not yet part of the full-time workforce.

- Technically independent but not yet earning enough to afford a good individual plan.

The age 26 rule met these realities head-on, replacing the old, unpredictable system with a simple, consistent one. This one change brought peace of mind to families everywhere, letting parents keep their kids covered during these formative years.

This foundational support is crucial for getting a healthy start in life. For a deeper look at the specific challenges and options, our comprehensive guide on health insurance for young adults offers more strategies for this unique life stage. It shifts the question from "How do I avoid being uninsured?" to "Which coverage option is right for me?"

When Does Coverage Actually End After Turning 26?

A lot of people think their child’s health insurance vanishes the moment they blow out the candles on their 26th birthday cake. That’s a common—and potentially costly—misconception. Assuming coverage ends on the birthday itself can create a dangerous gap, leaving you on the hook for major medical bills from what should have been a routine check-up.

The good news is that the cutoff isn’t so abrupt. The actual date coverage ends is determined by the specific insurance plan, not just the calendar. Most policies build in a grace period, giving you a little breathing room. The key is to figure out exactly how your plan handles this transition so you can avoid any surprises.

Two Common Scenarios for Coverage Termination

When a dependent hits the age limit, most health insurance plans follow one of two straightforward rules. Coverage will either run through the end of the birth month or extend all the way to the end of the calendar year.

- End of the Birth Month: This is the most frequent policy. Here, the dependent stays fully covered for the entire month they turn 26, no matter which day their birthday lands on.

- End of the Calendar Year: Some plans, especially those from larger companies, are even more generous. In this case, coverage continues until December 31st of the year the dependent turns 26.

Let’s use a quick example. Say your son, Alex, has a birthday on April 10th.

- If your plan follows the month-end rule, his coverage is secure until midnight on April 30th.

- If your plan has a calendar-year rule, he's covered until midnight on December 31st.

That difference can add up to eight extra months of coverage—a huge advantage when you're shopping for a new plan.

The Single Most Important Takeaway: Never, ever assume the termination date. The only way to be sure is to verify it directly with your insurance provider. A wrong guess can leave you uninsured when you need it most.

How to Find Your Plan's Specific Rule

So, how do you nail down your plan's exact rule? Don't guess. The information is out there if you know where to look.

A great starting point is the Summary of Benefits and Coverage (SBC) or other official plan documents. You can usually find these on your insurance company's website or through your employer's HR portal. Scan for sections on "dependent eligibility" or "coverage termination."

If the paperwork is confusing, the most reliable method is to just pick up the phone. Call the number on the back of your insurance card or get in touch with your HR department. Ask them for the specific date coverage ends for a dependent turning 26. A simple five-minute call can save you a world of trouble.

Knowing that exact date is empowering. It gives you a clear deadline to find new coverage and make a seamless transition. This is critical because losing coverage qualifies you for a Special Enrollment Period, but that window doesn't stay open forever. Our guide on Open Enrollment explains what it is and why it matters, and it's a must-read to understand how these timelines work. Acting quickly is the name of the game.

Exploring State Rules That Extend Coverage Beyond 26

While the federal age 26 rule provides a solid foundation, you should really see it as the floor, not the ceiling. The Affordable Care Act sets the national minimum, but it absolutely does not prevent states from offering more generous protections for young adults.

It works a lot like the federal minimum wage; states are always free to set a higher local standard. Several have done just that, creating laws that provide an extra safety net for young adults who might otherwise fall into a coverage gap. These state-specific rules, often called "young adult options," can push the dependent age limit well past a 26th birthday, though usually with a few strings attached.

States With Young Adult Options

A handful of states have stepped up, passing laws that let young adults stay on a parent's health insurance plan until age 29, 30, or even 31. These extensions are a huge help for those still getting on their feet financially.

Some of the states with these extended coverage options include:

- New York: Allows unmarried young adults to remain on a parent's policy until they turn 30.

- New Jersey: Offers a similar extension for unmarried dependents up to age 31.

- Florida: Permits unmarried children without dependents of their own to stay on a parent's plan until age 30.

- Pennsylvania: Provides coverage for unmarried children up to age 30.

It’s important to know that these state-level extensions don't follow the exact same rules as the federal mandate. For example, while the ACA rule applies regardless of cost, these state options often require the family to pay the full premium for the extended coverage. The dependent also usually needs to be a resident of that state and can't be eligible for their own employer-sponsored health plan.

The Critical Disability Exception

Beyond these state-specific age laws, there is a far more widespread and vital exception to the age limit. Almost every state and the vast majority of insurance plans have a provision for continuing coverage for a disabled dependent, no matter their age. For families caring for adult children who are unable to support themselves, this rule is a lifeline.

The principle is straightforward: if a child is incapable of self-support because of a mental or physical disability, they can remain on their parent's health plan indefinitely. This ensures they never lose access to the medical care they need.

This provision is one of the most important exceptions to the dependent health insurance age limit. It acknowledges that some individuals will always need the support of their family’s health plan, and it prevents them from being forced off of it simply because they’ve reached a certain age.

To qualify for this exception, a few key conditions usually need to be met.

How to Qualify for a Disability Extension

Getting a disability extension approved involves providing clear proof to your insurance company. While the fine print can vary a bit from one insurer to another, the general requirements are pretty consistent across the board.

Here's what you'll typically need to show:

- Timing of the Disability: The disability must have begun before the child reached the standard age limit of 26 (or the state-specific limit). You can't, for instance, add an adult child back onto a plan if their disability occurs at age 35.

- Inability to Self-Support: The child must be primarily dependent on you (the parent) for financial support due to their condition.

- Proof of Disability: You will need to submit documentation from a physician. This paperwork must clearly state the nature of the disability and confirm that it prevents the dependent from holding a job to support themselves.

Don't be surprised if your insurer requires you to recertify the disability from time to time, sometimes annually, by providing updated medical records. The best thing you can do is contact your insurance provider or HR department well before your child's 26th birthday. This gives you time to understand their specific process and get the necessary paperwork started, ensuring there are no scary interruptions in their vital health coverage.

Your Action Plan for Finding New Health Coverage

Alright, now that we've covered the rules, it's time to talk strategy. As your child gets closer to their 26th birthday, you’ll want to shift from understanding the "why" to knowing the "how." Making the leap from a parent's health plan doesn't have to be a mad scramble. With a solid game plan, you can ensure they land softly with no scary gaps in coverage.

The key to this whole transition is something called a Special Enrollment Period, or SEP. Think of it as a golden ticket that lets your child sign up for a new plan outside of the usual once-a-year Open Enrollment window. Aging out of a parent's plan is what’s known as a “qualifying life event,” and it’s what unlocks this opportunity.

This SEP gives your child a 60-day window to pick and enroll in a new health plan. That clock starts ticking on the day their old coverage ends, so it's absolutely vital to know that termination date. If they miss this window, they’re stuck waiting for the next Open Enrollment period, which could leave them uninsured for months.

Navigating the Four Main Pathways

Once that Special Enrollment Period begins, your child is standing at a crossroads with four main paths to choose from. There’s no single "right" answer here; the best choice really boils down to their personal situation—their job, income, and what they need from a health plan.

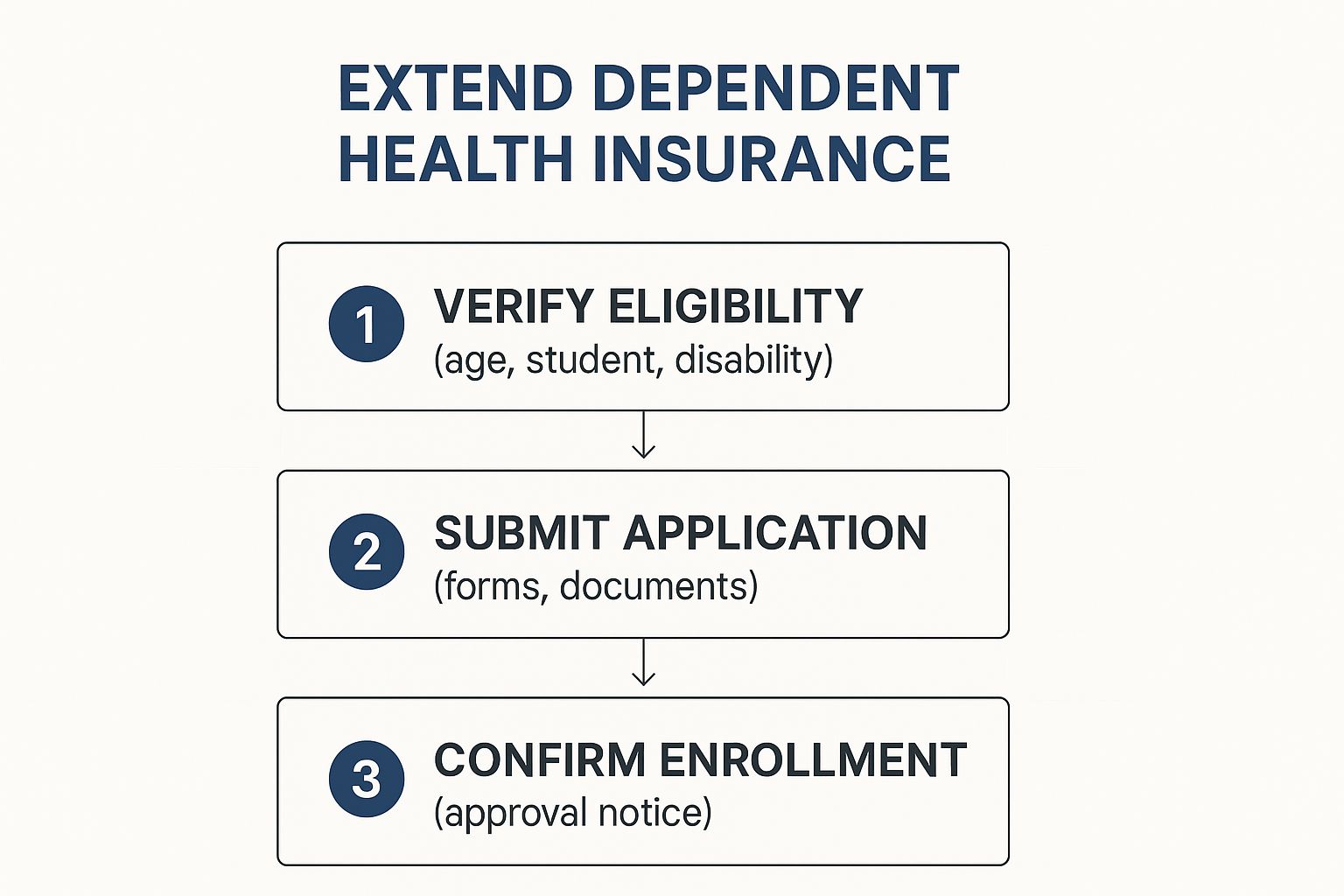

The infographic below gives a bird's-eye view of the process, whether you're extending coverage through state laws or a disability exception.

As you can see, it all comes down to taking proactive steps—from checking eligibility and gathering paperwork to formally enrolling. It’s a process, but a manageable one.

Let’s walk through the four main options for getting new coverage after turning 26.

1. Getting A Plan Through Their Own Job

If your child has a job that offers health benefits, this is almost always the most direct route. Employer-sponsored plans are often a great deal because the company pays a big chunk of the premium.

- Pros: Lower monthly payments, usually solid benefits, and the convenience of having premiums deducted right from their paycheck.

- Cons: You get what they offer—plan choices can be limited. And, of course, the coverage is tied to the job.

2. Buying A Plan On The Health Insurance Marketplace

The Health Insurance Marketplace (you can find it at HealthCare.gov) was created by the ACA to be a one-stop shop for insurance. It lets your child compare dozens of plans from different private insurers all in one place.

The biggest perk of the Marketplace? Income-based financial help. If your child's income is modest, they could get a Premium Tax Credit to slash their monthly bill or Cost-Sharing Reductions to lower out-of-pocket costs like deductibles.

This is where you can find some powerful savings that aren't available anywhere else. For a deeper dive, check out our guide on the top tips for finding budget-friendly health coverage to make the most of these options.

3. Continuing Coverage With COBRA

COBRA—short for the Consolidated Omnibus Budget Reconciliation Act—is a law that lets your child temporarily keep the exact same health plan they had under you. It sounds great in theory, but there's a huge catch: you have to pay 100% of the premium yourself, plus an administrative fee of up to 2%.

That means you're now on the hook for the part your or your spouse's employer used to cover, and that can get very expensive, very fast. Still, for someone who is between jobs or really needs to keep their specific doctors for a short time, it can be a useful, albeit pricey, bridge.

4. Enrolling In Medicaid or CHIP

If your child's income is quite low, they might be eligible for Medicaid or the Children's Health Insurance Program (CHIP). The exact income rules are different in every state, but these government programs offer comprehensive health coverage for very little or even no cost.

You can apply for Medicaid anytime—no need to wait for a Special Enrollment Period. If their financial situation fits the criteria, it’s an incredible safety net for affordable healthcare.

Who Actually Qualifies As a Dependent?

When we talk about the dependent health insurance age limit, the first question is always the same: who even counts as a "dependent"? The answer is broader than most people think. It's not just about your biological kids living at home.

The Affordable Care Act (ACA) intentionally expanded this definition to match how real families look today. This wider net ensures the age 26 rule gives young adults a stable bridge to independence.

Who Is Covered Under the ACA?

Under the ACA's federal rules, what really matters is your relationship to the child. This inclusive approach means you can add several types of dependents to your health plan, which is a huge help for all kinds of family structures.

Generally, you can cover:

- Biological Children: Your son or daughter. It doesn’t matter if you’re married to the other parent.

- Stepchildren: The children of the person you’re currently married to.

- Adopted Children: This includes children you've legally adopted and kids who have been placed with you for adoption.

- Foster Children: Any child officially placed in your care by a court or an authorized agency.

At its core, the rule focuses on providing a stable, loving home—not just a traditional family tree. It cuts through a lot of the old confusion and makes it simpler for parents and guardians to secure essential health coverage.

Real-World Factors That Change the Game

While the law gives you a clear framework, life often has other plans. The age 26 rule provides the option for coverage, but staying on a parent's plan isn't always the automatic choice.

For instance, a young adult who gets married or lands a great job with its own fantastic health plan might jump ship early. They might want the independence that comes with their own insurance, or maybe their new employer's plan simply offers better benefits or lower costs.

The ACA did a great job of letting young adults stay insured longer, but personal choices and life events really dictate how long they actually remain on a parent's plan.

On the flip side, things like being a full-time student, earning a lower income, or working a job that doesn't offer benefits are powerful motivators for staying on a parent's plan right up until the last minute. Research has shown that while the ACA cut the risk of young adults losing their insurance by 35%, their personal situation is the deciding factor.

It turns out that married or full-time employed young adults are much more likely to get their own coverage sooner, while students tend to hang on to their parents' plans longer. You can explore the full research on how these factors impact coverage duration to dig into the demographic trends. It’s a perfect example of how the dependent health insurance age limit is just one piece of a much bigger puzzle.

Frequently Asked Questions

Even when you think you have a handle on the rules, specific questions about the dependent health insurance age limit always seem to pop up. Let's walk through some of the most common ones to clear up any confusion and help you feel confident about your family’s coverage.

Can My Child Stay On My Plan If They Get Married Before 26?

Yes, they absolutely can. Thanks to the Affordable Care Act, whether your child is married or not has zero impact on their eligibility to stay on your health plan. As long as your plan offers dependent coverage, your married child can stay enrolled right up until they turn 26.

It's important to remember one key detail, though: this coverage doesn't extend to their new spouse. Your policy's dependent coverage only applies to your child, not their new family.

What If My Child Can Get Insurance Through Their Own Job?

They can still stay on your plan if that's what works best for your family. The ACA rule holds firm even if your young adult has a health insurance offer from their own employer. This flexibility is a huge benefit, allowing you to choose the most practical option.

My advice? Sit down and compare the two plans side-by-side. Look closely at the monthly premiums, annual deductibles, copays, and especially the network of doctors to figure out which plan provides better value and access to the care they need.

The ability to choose between a parent's plan and an employer's plan is a key feature of the ACA's age 26 rule. It empowers young adults to select the coverage that best fits their health needs and budget without being forced into a single option.

Does My Child Have to Be a Student or Live With Me?

Nope. Federal law was specifically written to get rid of those old-school requirements. Factors like student status, where they live, or whether they're financially dependent on you are no longer considered for eligibility under the age 26 rule.

This means your child is covered on your plan whether they are:

- Enrolled in college full-time or not a student at all.

- Living in your basement, an apartment across town, or even a different state.

- Completely financially independent and filing their own tax return.

Are Dependents with Disabilities Covered Beyond Age 26?

In most situations, yes. This is one of the most important exceptions to the standard age limit. Almost every state and the vast majority of insurance plans have provisions to continue covering a dependent over 26 if they are physically or mentally unable to support themselves.

The crucial part here is that the disability must have begun before they turned 26. You'll need to provide medical documentation of their condition to your insurance company to get this vital extension approved and ensure their coverage continues without a gap.

Navigating these rules can feel complicated, but you don't have to figure it all out alone. At My Policy Quote, we specialize in helping families find the right health insurance solutions for every stage of life. Find your personalized quote today and secure the peace of mind you deserve.