Yes, you absolutely can get health insurance with a pre-existing condition. In fact, it's illegal for most major health plans to turn you away or charge you more because of your health history.

Thanks to the Affordable Care Act (ACA), conditions like diabetes, asthma, or heart disease no longer disqualify you from getting comprehensive coverage. This is a game-changing protection that has opened the door to healthcare for millions.

What Exactly Is a Pre-Existing Condition?

Let's cut through the jargon. In the world of health insurance, a "pre-existing condition" is simply any health issue you had before your new coverage begins. It could be something chronic like hypertension, a past injury that needed surgery, or even a condition you were born with.

Before the ACA, insurance companies saw these conditions as huge risks. Trying to get coverage was like buying car insurance after you’d already been in an accident. They could legally deny you, charge sky-high premiums, or slap an exclusion on your policy, refusing to cover anything related to your condition. This left countless people in a bind, either completely uninsured or holding a policy that was full of holes.

How the Rules Changed for the Better

The Affordable Care Act flipped the script. It put powerful consumer protections in place that made it illegal for ACA-compliant health plans to discriminate based on your medical past. This was a massive shift that guaranteed access to care for everyone, no matter their health status.

This protection is incredibly broad and covers a huge range of health issues, including:

- Chronic illnesses like diabetes, asthma, and COPD

- Serious conditions such as cancer or heart disease

- Mental health conditions like depression or anxiety

- Even pregnancy is considered a pre-existing condition that must be covered right from day one

This means an insurer can't peek at your application, see a high blood pressure diagnosis, and then reject you or triple your rates. Everyone is evaluated on the same playing field, based on factors like age and location—not their health. You can dive deeper into this topic in our guide to health insurance for chronic conditions.

The core idea is simple but powerful: your health history, no matter how complex, cannot be used as a roadblock to getting essential coverage under an ACA-compliant plan.

Understanding the Scope of Protection

Now, here’s a critical detail: these protections apply specifically to ACA-compliant plans. These are the plans you’ll find on the Health Insurance Marketplace, get through your employer, or buy directly from an insurer that meets all federal standards.

Other types of coverage, like short-term health insurance or certain fixed indemnity plans, don't have to play by these rules. They can—and often do—deny coverage or refuse to pay claims based on pre-existing conditions. We’ll break down those differences later, but the biggest takeaway for now is this: reliable, comprehensive insurance for pre-existing conditions isn't just a possibility; it's a legally guaranteed right when you choose the right kind of plan.

Your Health Coverage Rights Under the ACA

The Affordable Care Act (ACA) is more than just a piece of legislation—it's a shield. It was designed to protect you from being penalized or shut out just because of your health history. Before the ACA, getting health insurance with a pre-existing condition could feel impossible. Insurers could legally see your health as a red flag, which often led to flat-out denials or premiums so high they were completely out of reach.

Thankfully, those days are over for most health plans. The law put several non-negotiable rights in place that completely changed the game for insurance for pre existing conditions. Think of them as the new rules of the road, ensuring everyone gets a fair shot at coverage.

The Power of Guaranteed Issue

The single most important protection is a rule called guaranteed issue. It’s simple but powerful: if you apply for an ACA-compliant plan during an open enrollment period, the insurance company must offer you a policy.

It doesn’t matter if you have diabetes, are a cancer survivor, or are managing a heart condition—they can’t turn you away. This was a massive shift from the old days when insurers could cherry-pick the healthiest applicants. Now, your eligibility is tied to things like your age, income, and where you live, not your medical chart.

No More Premium Penalties

Just as important, the ACA outlawed the practice of charging you more because of your health. An insurer can no longer look at your asthma diagnosis and decide to hike up your monthly premium compared to someone without it. This practice, once known as health status rating, is now illegal for ACA plans.

Instead, your premium is based on a community-wide standard. This means everyone in your area of a similar age pays a similar base rate, preventing insurers from punishing you financially for a chronic illness.

Before the ACA, an estimated 18% of non-elderly adults were denied coverage in the individual market due to pre-existing conditions. Today, guaranteed issue ensures that door is always open for ACA-compliant plans.

This simple rule ensures a freelance designer managing a chronic illness pays the same base premium as their healthy neighbor of the same age. Your medical history no longer dictates the price of your health security.

Mandated Coverage for Essential Health Benefits

The ACA didn’t just make sure you could get a plan; it also set a baseline for what those plans have to cover. Every ACA-compliant plan must include a package of essential health benefits (EHBs), which is a set of ten core service categories considered fundamental to good healthcare.

This is a huge deal, especially if you're managing a pre-existing condition. These benefits include critical services like:

- Prescription Drugs: So you have coverage for the medications you rely on.

- Hospitalization: Covering inpatient care if you need surgery or treatment.

- Chronic Disease Management: Services designed to help you manage ongoing conditions.

- Mental Health Services: Ensuring therapy and other behavioral treatments are covered.

- Rehabilitative Services: Helping you get back on your feet after an illness or injury.

This mandate prevents insurers from selling you a "junk" plan that seems cheap but doesn’t actually cover your cancer treatments or the medication you need. It guarantees a standard of quality, so you can trust your insurance will be there for you when it matters most. You can dive deeper into these categories by reading our guide on what essential health benefits include.

By combining guaranteed issue, fair pricing, and required benefits, the ACA created a true safety net. It gives people the confidence of knowing their health history won't stand between them and the quality care they deserve.

Finding the Right Health Insurance Plan

Knowing your rights under the Affordable Care Act is a huge first step. Now it’s time to turn that knowledge into action. That means digging into the different types of health insurance to find a plan that actually protects you and your pre-existing conditions.

The market can feel like a maze. Some plans flash deceptively low monthly payments but leave you dangerously exposed when you actually need care. The single most important thing to understand is the difference between an ACA-compliant plan and one that isn't.

One is legally required to cover you. The other can, and often will, deny your claims. Getting this right is everything for your health and your finances.

Sticking with ACA-Compliant Insurance Options

When you need insurance for pre existing conditions, your safest bet is always a plan that follows ACA rules. These plans guarantee you can't be turned away and offer solid, comprehensive benefits.

You can find these plans in a few key places:

- Health Insurance Marketplace Plans: You've probably heard this called "Obamacare." These are plans sold on government sites like HealthCare.gov or your state's own exchange. It's the go-to spot for individuals and families, especially if you qualify for income-based help to lower your costs.

- Off-Exchange ACA Plans: You can also buy an ACA-compliant plan straight from an insurance company or with the help of a broker. These plans give you all the same core protections and benefits, but you buy them outside the official marketplace. The one catch? You can't get premium tax credits with these plans.

- Medicaid and CHIP: These are lifesavers. They're government programs that provide free or low-cost coverage to millions of eligible low-income adults, kids, pregnant women, and people with disabilities. Your income is the main factor, and if you qualify, all your pre-existing conditions are covered from day one.

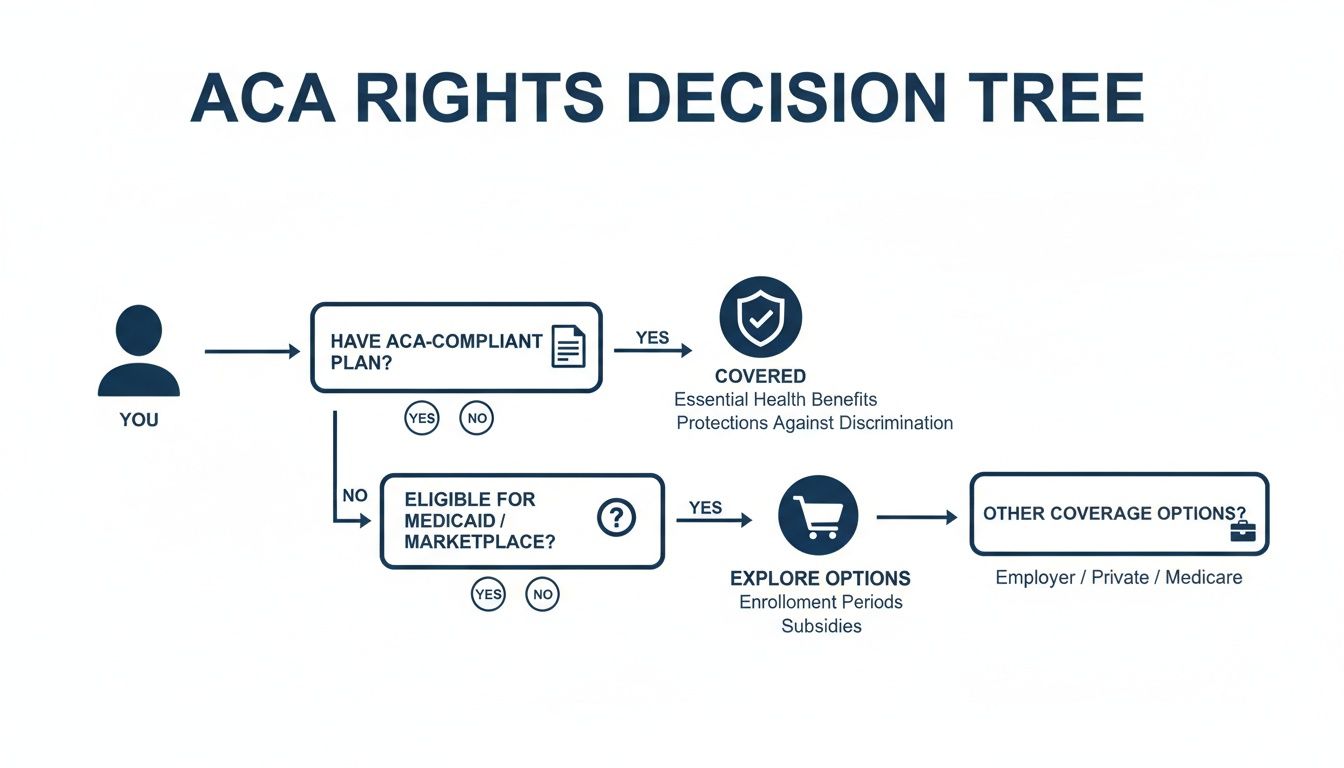

This decision tree shows just how simple the protection is when you stick with an ACA plan.

The main takeaway here is simple: choosing a plan that meets ACA standards means your pre-existing conditions are automatically covered. No exceptions.

Plans That Often Leave You Uncovered

While ACA plans are a true safety net, you'll see other types of coverage out there that don't play by the same rules. They might look tempting with their low prices, but they come with massive risks.

Short-term health insurance is a perfect example. It was created to be a temporary band-aid for coverage gaps. These plans don't have to follow ACA rules, which means they can flat-out deny you because of your health history. Or, they might approve you but refuse to pay for anything related to a condition you had before you signed up.

If a plan seems too good to be true, it probably is. A rock-bottom premium is often a red flag that the plan is missing the essential protections you need, especially if you have ongoing health concerns.

Comparing Your Coverage Choices

To make a smart decision, you have to understand the real-world differences between these plans. It’s not just about numbers on a page. For an early retiree managing diabetes or a freelancer who needs reliable coverage, picking the wrong plan can be a financial nightmare.

Here’s a side-by-side look at how these plans stack up when it comes to pre-existing conditions.

Comparing Health Plans for Pre-Existing Conditions

This table breaks down the essentials, showing you where you're safe and where you might be taking a gamble.

| Plan Type | Covers Pre-Existing Conditions? | Best For… | Key Considerations |

|---|---|---|---|

| Marketplace Plan | Yes, Guaranteed | Individuals, families, and self-employed people needing subsidies. | Must enroll during Open Enrollment or a Special Enrollment Period. |

| Off-Exchange ACA Plan | Yes, Guaranteed | Individuals who don't qualify for subsidies but want ACA protections. | No access to premium tax credits, but offers more plan choices. |

| Medicaid | Yes, Guaranteed | Low-income individuals and families who meet state eligibility criteria. | Enrollment is year-round for those who qualify. |

| Medicare | Yes, Guaranteed | Adults 65 or older and younger people with specific disabilities. | Coverage is comprehensive but may require supplemental plans. |

| Short-Term Insurance | No, Typically Excluded | Healthy individuals needing temporary gap coverage for a month or two. | High-risk option that can deny claims and coverage for health history. |

As you weigh your options, think about both today's costs and tomorrow's security. If you’re getting close to retirement or helping an older parent, having continuous, reliable care is non-negotiable. For a loved one hoping to stay in their home, a solid aging in place checklist can be invaluable, especially when it comes to lining up the right health coverage.

At the end of the day, an ACA-compliant plan is your best strategy for getting meaningful insurance for pre existing conditions. If you’re ready to see what’s out there, you can learn how to compare health insurance plans in our detailed guide.

Managing the Cost of Your Health Coverage

Getting the right insurance is a huge first step. But for most of us, the next question is always: “Can I actually afford this?”

Let’s be honest—managing a chronic condition can get expensive, and those costs are a big reason healthcare spending keeps going up. But this is exactly why good insurance is so important. It acts as a financial shield, protecting you and your family from medical bills that could otherwise be devastating.

Think of your monthly premium as a financial firewall. It contains the wild, unpredictable costs of treatments, medications, and hospital visits that come with a pre-existing condition. Without that protection, one medical emergency could throw your family’s entire future off track.

This is more true now than ever. Global healthcare costs are expected to jump by 10.3% in 2026, a trend driven largely by chronic illnesses. Insurers point to cancer as the single biggest cost, with cardiovascular disease and mental health challenges right behind it. Having solid coverage isn’t just a nice-to-have; it's an absolute must.

How Marketplace Subsidies Make It Affordable

The Health Insurance Marketplace doesn’t just guarantee you can get a plan—it offers real, powerful help to pay for it. These subsidies are designed to put quality coverage within reach, whether you're self-employed, part of a working family, or an early retiree.

There are two main ways the Marketplace helps you save:

- Premium Tax Credits (PTCs): This is the most common kind of help. It’s a subsidy that lowers your monthly insurance bill right away. The amount you get depends on your estimated household income and the cost of plans where you live.

- Cost-Sharing Reductions (CSRs): If your income is within a certain range, you might get these extra savings, too. CSRs lower what you actually pay when you see a doctor—like your deductible, copayments, and coinsurance.

These subsidies aren't a one-size-fits-all deal. They work on a sliding scale. The less you make, the more financial help you’re likely to get. It’s that simple.

Understanding a little about how insurers handle payments, like with automated claims processing, can also help you make sense of your bills and see how your plan is working for you.

Do You Qualify for Financial Help?

Whether you can get these subsidies mostly comes down to your Modified Adjusted Gross Income (MAGI) and how many people are in your household. Generally, you’ll qualify for premium tax credits if your household income is between 100% and 400% of the federal poverty level (FPL).

For example, a freelance graphic designer who expects to make $45,000 this year would likely get significant tax credits. We're talking about savings that could cut their monthly premium by hundreds of dollars, making great coverage practical, not just possible.

When you apply for a plan on the Marketplace, the system walks you through estimating your income. It’s important to be as accurate as you can. This ensures you get the right amount of help and don’t have to pay anything back at tax time. These tools are there to make healthcare a manageable part of your budget, not a source of stress.

Securing Travel Insurance with a Pre-Existing Condition

Hitting the road with a health condition means you’ve got an extra layer of planning to do. While your ACA-compliant plan has your back at home, you need to know that travel insurance plays by a completely different set of rules.

Most standard policies have a huge catch: they won’t cover anything related to a pre-existing condition.

This can leave you in a really tough spot. Imagine a flare-up of a chronic illness while you're overseas. Without the right coverage, you could be staring down a mountain of medical bills. The financial risk of a medical emergency abroad is no joke, which makes finding the right travel policy non-negotiable.

How to Get Your Condition Covered

The secret to protecting yourself is getting a pre-existing medical condition exclusion waiver. This is an add-on to your policy that basically tells the insurer to ignore the exclusion for your known health issues. If a medical emergency tied to that condition happens on your trip, you’re covered.

Think of it as upgrading your policy from standard to essential. But getting this waiver isn't a given—it all comes down to timing and your health status when you buy the plan.

To get the waiver, you usually need to check three boxes:

- Buy your policy fast. You have to purchase the insurance within a specific timeframe, typically 14 to 21 days after you make your first trip payment (like booking that flight or hotel).

- Be medically stable. When you buy the policy, you must be medically cleared to travel. This means no new symptoms, treatments, or changes to your medication for that condition.

- Insure your whole trip. You have to insure the full, non-refundable cost of your trip.

This timing is everything. If you wait too long after booking your trip to buy travel insurance, you’ll probably miss your chance to get the waiver, leaving a massive hole in your safety net.

Understanding the Costs and Benefits

More and more people are realizing they need this protection. In the U.S., travel insurance sales have skyrocketed, now covering nearly 87 million people. While the average cost of a medical travel plan is about $5 per day, the price tag does go up with age—a big deal for early retirees.

The average cost is $105 for travelers aged 60-69 and jumps to $144 for those 70 and older. Coverage limits also play a role; a policy with $50,000 in emergency medical coverage runs about $90, but that increases to $139 for a more solid $250,000 limit. For a deeper dive into the numbers, check out the travel insurance statistics from Emergency Assistance Plus.

For self-employed professionals and pre-Medicare adults who love to see the world, getting this waiver brings incredible peace of mind. It means you can explore without the fear of a medical issue becoming a financial nightmare. You can find more tips in our guide on health insurance for frequent travelers.

Common Mistakes to Avoid When Getting Covered

Navigating the world of insurance for pre existing conditions can feel like walking through a minefield. One wrong step, and what seemed like a manageable process can quickly turn into a financial nightmare. Let's walk through the most common pitfalls so you can secure coverage that actually has your back when you need it.

The Temptation to Hide Your History

It might seem tempting to omit a past health issue on an application, especially for something like travel or life insurance. But this is one of the most dangerous mistakes you can make. While the ACA protects you from being denied a compliant health plan, other types of insurance don't have those same rules.

Being upfront isn't about airing out the past; it's about making sure your policy is valid. If an insurer discovers an undisclosed condition later, they can deny your claims or even cancel your policy altogether. This is called rescission, and it leaves you uninsured and holding all the medical bills. It completely defeats the purpose of having coverage in the first place.

The Lure of a "Cheap" Plan

Another major trap is choosing a plan based only on its low monthly price tag. Short-term health plans and other non-compliant options look great on paper, but that low cost comes with a massive catch: they aren't bound by ACA rules.

This means they can, and almost always will, refuse to pay for anything related to a pre-existing condition. You could pay your premiums faithfully for months, only to have your claim denied when you're hospitalized for a chronic illness you've managed for years.

A cheap, non-compliant plan offers a false sense of security. It’s like buying a fire extinguisher that’s filled with water—it looks like protection, but it’s useless when you actually need it.

Why Full Disclosure is Non-Negotiable

Failing to declare a condition isn't a minor slip-up; it can completely void your policy. This is especially true with travel insurance, where a shocking number of people take huge risks.

A recent analysis found that 17% of people with known health issues plan to travel abroad with no insurance at all. Even more concerning, 25% of UK travelers admit they don't declare all their conditions. This is a gamble that can leave families with catastrophic medical bills in a foreign country. Insurers can legally deny any claim tied to a health problem you didn't tell them about. You can see the full breakdown of these scary travel insurance findings at Insurance-Edge.net.

To avoid these costly mistakes, always be transparent and stick to ACA-compliant plans for your primary health coverage. Read your policy documents, ask questions, and never, ever assume a low price tag means you're protected. Making careful, informed choices is your best defense against unexpected medical debt.

A Few Common Questions, Answered

Let’s be honest—navigating health insurance can feel like a maze, especially when you’re already managing a health condition. Here are some straightforward answers to the questions we hear most often.

"Can they really not deny me for my heart condition?"

That's right. Thanks to a powerful protection in the Affordable Care Act (ACA) called “guaranteed issue,” an insurance company can’t legally turn you down or charge you a higher premium just because you have a pre-existing condition like heart disease. This is a non-negotiable rule for any ACA-compliant plan sold on the Health Insurance Marketplace.

The key phrase here is ACA-compliant. This protection does not extend to plans like short-term health insurance, which can—and often do—reject people based on their medical history.

"I’m self-employed. When can I sign up for a plan?"

If you're self-employed, you follow the same enrollment schedule as everyone else. Your main chance to enroll is during the annual Open Enrollment Period, which happens every fall.

But life doesn’t always stick to a schedule. You might also get a Special Enrollment Period (SEP) if you go through a major life event, such as:

- Losing other health coverage (like when you leave a W-2 job to start your business)

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new zip code

Making the leap from a traditional job to self-employment is a very common reason people qualify for an SEP.

"What’s the real difference between an HMO and a PPO for someone with my condition?"

It really boils down to two things: how much flexibility you want and what you’re willing to pay for it.

An HMO (Health Maintenance Organization) usually comes with lower monthly premiums, but the trade-off is that you have to use doctors, specialists, and hospitals within its network. You’ll also typically need a referral from your primary care doctor to see a specialist.

A PPO (Preferred Provider Organization) gives you more freedom. You can see specialists and out-of-network doctors without a referral, though you’ll save the most money by staying in-network. If you have a specific specialist you trust who isn’t in many local networks, a PPO might be the better choice.

"I’m not 65 yet. What are my best options before I can get Medicare?"

If you're an early retiree between the ages of 60 and 64, an ACA Marketplace plan is almost always your safest and smartest move. Your coverage is guaranteed, no matter what pre-existing conditions you may have.

The best part? Depending on your retirement income, you could qualify for big subsidies, like premium tax credits, that can seriously reduce your monthly insurance bill.

Whatever you do, steer clear of short-term plans during this critical time. They can leave you with massive bills right before you’re eligible for Medicare, putting both your health and your finances at risk.

Finding the right plan when you have a pre-existing condition isn’t about luck—it’s about knowing your rights and choosing coverage that gives you real security. My Policy Quote is here to help you compare ACA-compliant plans that fit your life and your budget.

Visit us at https://mypolicyquote.com to get started.