When you're self-employed, you're not just the CEO—you're also the entire HR department. That can feel a little daunting, especially when it comes to health insurance. Without a company plan to fall back on, it's on you to build a financial safety net that protects your health, your family, and your business.

It’s a huge responsibility, but it's also a chance to create a personalized benefits package that actually works for you.

Building Your Financial Safety Net

The world of work has changed. The gig economy isn't a small niche anymore; it's a massive part of our workforce. In fact, projections show that by 2025, over 40% of the U.S. workforce—that's around 70 million people—will be freelancers or independent contractors. That means millions of us are figuring out how to get great benefits on our own.

This guide is here to cut through the confusion and show you how to assemble your own insurance toolkit, piece by piece.

Your Primary Insurance Toolkit

Think of your insurance strategy like building a team. You don't just hire one person to do everything; you bring in specialists for different roles. Your insurance should work the same way, with each policy playing a distinct, vital part in your overall protection.

Here are the three core players you need on your team:

- Health Insurance: This is your MVP, your everyday protector. It's what covers your doctor visits, prescriptions, and those unexpected medical emergencies. Having a solid health plan is what keeps a sudden illness from turning into a full-blown financial crisis.

- Disability Insurance: This is your income's bodyguard. If you get sick or injured and can't work for a while, disability insurance steps in to replace a portion of your lost income. It makes sure you can still pay your bills while you focus on getting better.

- Health Savings Account (HSA): This is your secret weapon for managing healthcare costs. When you pair an HSA with a high-deductible health plan, you can set aside money for medical expenses pre-tax, let it grow tax-free, and withdraw it tax-free for qualified costs. It's an incredible tool for both today's expenses and tomorrow's savings.

To give you a clearer picture, here's a quick breakdown of the most common paths freelancers and solopreneurs take.

Quick Comparison of Your Top Insurance Choices

Deciding where to start can be the hardest part. This table lays out the most popular choices, helping you see at a glance which one might be the best fit for your situation.

| Insurance Option | Best For | Typical Cost | Coverage Level |

|---|---|---|---|

| ACA Marketplace Plan | Individuals needing comprehensive coverage, especially with subsidies based on income. Great for covering pre-existing conditions. | Moderate to High (before subsidies) | Comprehensive |

| Spouse's/Family Plan | People with an eligible partner or parent whose employer offers dependent coverage. Often the simplest and most stable option. | Varies by Employer | Comprehensive |

| COBRA | Anyone who recently left a W-2 job and wants to keep their exact same employer-sponsored plan for up to 18 months. | High (You pay the full premium + admin fee) | Comprehensive |

| Short-Term Plan | Healthy individuals needing temporary coverage to bridge a gap, like between jobs or waiting for open enrollment. | Low | Limited (Does not cover pre-existing conditions) |

| Association/PEO Plan | Freelancers in specific industries (e.g., writers' guilds) or those who join a Professional Employer Organization for group benefits. | Moderate | Varies |

Each of these options has its own set of pros and cons, which we'll dive into throughout this guide. The goal isn't just to pick one, but to understand which combination gives you the most security for your unique journey.

By getting familiar with these core options, you can move forward with confidence, knowing you’ve built a safety net that truly supports your entrepreneurial life.

When you're self-employed, finding health insurance can feel like you've been left to figure it all out on your own. But there’s a solid starting point for almost everyone in this boat: the Health Insurance Marketplace, also known as the ACA Marketplace.

Think of it as a centralized online hub where private insurance companies compete for your business. It was built to make comparing and buying health insurance a whole lot more straightforward, especially when you don't have an employer handling it for you.

Without a company plan, you’re in the driver's seat. The Marketplace hands you the keys, ensuring you can't be turned away for pre-existing conditions and that every plan covers the basics—from prescriptions to emergency room visits.

Understanding the ACA Metal Tiers

As you browse the Marketplace, you'll see plans organized into four "metal" tiers: Bronze, Silver, Gold, and Platinum. This isn't about the quality of doctors or hospitals. It’s simply a way to show how you and your insurance company will split the costs.

It helps to think of them like cell phone plans:

- Bronze Plans: This is your basic data plan. You pay the lowest monthly premium, but your out-of-pocket costs (like your deductible) will be the highest when you actually need medical care. It's a great fit if you're healthy and just want a safety net for major, worst-case-scenario events.

- Silver Plans: This is the most popular, middle-of-the-road option. The monthly premiums are moderate, and so are your costs when you see a doctor. Silver plans are also the only ones eligible for extra savings called Cost-Sharing Reductions (CSRs), which can seriously lower your deductible and copays if your income qualifies.

- Gold & Platinum Plans: These are the "unlimited everything" premium plans. You’ll pay a much higher monthly bill, but your insurance picks up a much bigger chunk of the tab when you need care. If you expect to have frequent medical needs or just want more predictable costs, these are for you.

To make it even clearer, here’s a quick breakdown of how the tiers balance your monthly payment with your out-of-pocket costs.

ACA Metal Tiers at a Glance

| Plan Tier | Monthly Premium | Out-of-Pocket Costs | Who It's Good For |

|---|---|---|---|

| Bronze | Lowest | Highest | Healthy individuals who want a safety net for major emergencies. |

| Silver | Moderate | Moderate | Those who want a balance and may qualify for extra cost-sharing savings. |

| Gold | High | Low | People who expect to need regular medical care and want predictable costs. |

| Platinum | Highest | Lowest | Individuals with significant, ongoing health needs who want maximum coverage. |

Choosing the right tier really comes down to anticipating your needs for the year and deciding where you'd rather spend your money—on the fixed monthly premium or on costs when you receive care.

The Power of Subsidies for the Self-Employed

Here’s the single biggest reason the ACA Marketplace is a game-changer for freelancers: subsidies. Based on your income, you can get financial help that makes comprehensive coverage truly affordable.

The main form of help is the Premium Tax Credit, which directly lowers what you pay for your monthly premium. For many self-employed people with incomes under 400% of the federal poverty level, this can mean saving hundreds of dollars every month. A freelance designer with a modest income, for example, might find a great Silver plan costs them only a fraction of the full price.

Key Takeaway: Your eligibility for these savings is all based on your estimated Modified Adjusted Gross Income (MAGI) for the upcoming year. For freelancers, that means getting your income projection right is a huge part of the process.

Navigating Variable Income as a Freelancer

Okay, so how do you estimate your income when it’s anything but predictable? It might seem tricky, but the Marketplace was designed with this in mind. It just takes a bit of planning.

Here’s a simple way to approach it:

- Start with Last Year's Numbers: Your net income (profit after business expenses) from the previous year is your best baseline.

- Project for the Year Ahead: Think about what’s coming up. Did you land a big new client? Lose an old one? Adjust your baseline up or down to create a realistic, good-faith estimate.

- Update as You Go: This is the most important part. If you have a killer quarter or a really slow month, you must report that income change to the Marketplace.

Keeping your income updated ensures you’re getting the right amount of financial help. If you underestimate your income, you might have to pay back some of the credit at tax time. But if you overestimate, you could be missing out on savings all year long.

For a deeper dive into how this all works, check out our guide on the Premium Tax Credit. The Marketplace isn’t just a place to buy insurance—it’s a resource that makes high-quality health coverage a sustainable part of being your own boss.

Beyond the Marketplace: Your Other Health Insurance Options

While the ACA Marketplace is a fantastic resource for freelancers and business owners, it's not the only game in town. Depending on where you are in your journey, a few other paths might offer the flexibility or safety net you need right now.

Think of these alternatives as different tools for different jobs. They aren't a one-size-fits-all solution, but for the right person at the right time, they can be a game-changer. Let's break them down so you have the full picture.

COBRA: Your Bridge After Leaving a Job

Just left a 9-to-5 to chase your dream? The leap can feel like stepping off a cliff. COBRA is your parachute. It's a federal law that lets you keep the exact same health insurance you had with your old employer for a limited time, usually up to 18 months.

The biggest win here? No surprises. You keep your doctors, your deductible progress can carry over, and you don't have to stress about finding a new plan while you're busy getting your business off the ground.

But that convenience comes with a hefty price tag. Your old company was likely paying a big chunk of your premium. With COBRA, you're on the hook for 100% of the cost, plus a small administrative fee (usually 2%). It's often the most expensive option, but it's an incredible "coverage bridge" that guarantees you won't have a gap in care.

Short-Term Plans: The Temporary Fix

What if you just need to cover a few months? Maybe you're between big projects or waiting for the next Open Enrollment period. This is where short-term health plans come in. They’re designed to be a temporary, just-in-case safety net.

Think of a short-term plan as a bandage, not a long-term cure. They aren't regulated by the ACA, which means they come with some serious trade-offs:

- They usually don't cover pre-existing conditions. This is a huge difference from Marketplace plans.

- Essential benefits aren't guaranteed. Things like maternity care, mental health, or prescription drugs might not be included.

- Coverage limits are common. You could hit a cap on how much the plan will pay out in a year or over your lifetime.

These plans are a popular way to bridge coverage gaps, typically lasting from 3 to 12 months at a much lower cost than an unsubsidized ACA plan. Despite the drawbacks, more people are using them, which points to a real need for flexible, temporary insurance options. You can see more about recent trends in the global insurance market to understand these shifts.

Private and Association Health Plans

Finally, there are two more avenues worth looking into if you want to explore all your options.

Private Health Insurance (Off-Exchange)

You can always buy a plan directly from an insurance company or through a broker, completely outside of the government Marketplace. These plans are still ACA-compliant, so they cover essential benefits and pre-existing conditions. Why do this? It's mainly for people whose income is too high for subsidies but who find an off-exchange plan with a doctor network that fits their needs perfectly.

Heads Up: If you buy a plan off-exchange, you can't get any Premium Tax Credits or other savings. You'll be paying the full, unsubsidized price.

Association Health Plans (AHPs)

These plans are all about group power. By joining a professional organization—like a freelancers' union, a designers' guild, or a local chamber of commerce—you might get access to group health insurance. The idea is simple: by pooling lots of self-employed people together, the association can negotiate better rates and benefits than you could alone. The quality varies a lot by industry and state, so you'll need to do some digging to see what's available to you.

Using a Health Savings Account (HSA) for Your Business

When you’re self-employed, every financial tool counts. But a Health Savings Account (HSA) isn’t just another tool—it’s a powerhouse. Forget thinking of it as just a rainy-day fund for medical bills. An HSA is more like a supercharged savings account that turns your health expenses into a strategic asset for your business and your future.

What makes it so special? It’s all about the rare triple tax advantage, which is a game-changer when you’re managing your own finances. First, every dollar you put in is tax-deductible, which directly lowers your taxable income for the year. Second, the money inside your account grows completely tax-free. And third, when you take it out for qualified medical expenses, those withdrawals are also 100% tax-free.

Qualifying for and Using Your HSA

So, how do you get one? To open an HSA, you first need to be enrolled in a specific type of insurance: a High-Deductible Health Plan (HDHP). These plans usually come with lower monthly premiums, but you’ll pay more out-of-pocket before your insurance kicks in. The idea is to take the money you save on premiums and funnel it into your HSA, creating a dedicated, tax-free pool of cash for those medical costs.

Once you’ve got money in your HSA, you can use it for a massive range of expenses your health plan might not even touch.

- Medical Care: This covers your deductibles, copayments, and coinsurance for doctor’s visits or hospital stays.

- Dental and Vision: Need new glasses, contact lenses, or a filling? Pay for it with pre-tax dollars.

- Prescriptions: Cover the cost of your medications without feeling the full sticker shock.

- And So Much More: The list of qualified expenses is surprisingly long, covering everything from acupuncture to chiropractic care.

A Powerful Tool for Long-Term Growth

Here’s where the HSA really shines for a business owner. Unlike a Flexible Spending Account (FSA), the money in your HSA is yours. Forever. It rolls over year after year, and you never lose it, even if you change health plans. This simple feature transforms it into an incredible long-term investment vehicle.

Many HSA providers even let you invest your balance in mutual funds, stocks, and other assets once you hit a certain amount. Because all that growth is tax-free, it can compound in a huge way over time, creating a serious nest egg for the future.

Example in Action: Imagine a freelance graphic designer who needs significant dental work. Instead of paying with her after-tax income, she uses her HSA. Later that year, she contributes the maximum allowed, invests it in a low-cost index fund, and just lets it grow as a supplemental retirement account—all while getting a nice tax deduction on her contributions. For a more detailed look into how HSAs and HRAs compare, you can learn more in our article about these health accounts.

Maximizing Your Contributions

The IRS sets limits on how much you can contribute each year. For 2024, those limits are $4,150 for an individual and $8,300 for family coverage. If you’re 55 or older, you can even add an extra $1,000 as a “catch-up” contribution.

As a self-employed person, maxing out your HSA is one of the most direct ways to lower your tax bill. It’s a smart move that fits perfectly into broader strategies for managing your taxable income and building a secure financial future.

Protecting Your Income Beyond Health Coverage

When you're self-employed, true financial security goes way beyond just covering doctor's visits. Think about it: what's your most valuable business asset? It’s not your laptop, your website, or even your client list. It's you. It's your ability to show up, create, and get the job done every single day.

If an unexpected illness or injury takes that ability away, your income stops cold. That’s why a real safety net isn't complete with just health insurance. You have to protect your paycheck itself. This means adding a few more layers of coverage to your financial toolkit, so one bad break doesn't derail everything you've worked so hard to build.

Let's walk through the key policies that create this crucial shield for your income, your family, and your business.

Disability Insurance: Your Paycheck Protection

Think of disability insurance as paycheck protection. It’s that simple. If a serious illness or injury keeps you from working, this policy steps in and replaces a big chunk of your lost income. It's what lets you keep paying the mortgage, buying groceries, and handling bills while you focus on recovery.

This coverage is especially critical when you work for yourself. Did you know self-employed people are 2.5 times more likely to be without disability insurance? Yet a staggering 90% of long-term disabilities come from illnesses like cancer or heart disease, not freak accidents. A typical policy will pay out about 60% of your pre-disability income, giving you a lifeline when you need it most.

You'll generally see two types:

- Short-Term Disability: This kicks in quickly and covers you for a shorter period, usually three to six months. It’s perfect for bridging immediate income gaps.

- Long-Term Disability: This is for the more serious situations. It can provide income for several years—or even all the way to retirement age—if you can’t go back to your profession.

Pro Tip: If you're a specialist—a consultant, programmer, designer, or artist—look for a policy with an "own-occupation" clause. This is huge. It means your policy pays out if you can't do your specific job, not just any job. It’s a vital distinction that protects the value of your unique skills.

Life Insurance: Protecting Your Legacy

While disability insurance protects your income while you're living, life insurance protects the people who depend on you after you're gone. If you have a family, a business partner, or outstanding business loans, this coverage is absolutely non-negotiable.

A life insurance policy provides a tax-free, lump-sum payment to your beneficiaries. This money can be a true gift, allowing them to:

- Replace your lost income to cover daily expenses.

- Pay off the mortgage and other major debts.

- Fund your kids' education.

- Let a business partner buy out your share of the company, ensuring the business you built can continue.

For a closer look at what makes sense for you, check out our guide on how to choose disability insurance for self employed professionals.

Liability Insurance: Shielding Your Assets

Finally, every single self-employed professional needs to think about liability. If your work—or a mistake in it—causes financial harm or an injury to a client, they could sue you. Without an employer to stand behind you, that lawsuit comes straight for your personal assets. Your home, your savings, everything.

General liability insurance and professional liability insurance (often called errors and omissions or E&O) create a firewall between your business risks and your personal life. This coverage handles legal defense costs and potential settlements, making sure one client complaint doesn't lead to personal financial ruin. It’s a fundamental cost of doing business that protects everything you own.

How to Choose the Right Insurance Plan

Alright, you’ve learned about all the different insurance options out there. Now comes the most important part: moving from knowing to choosing. This is where we pull everything together into a clear, straightforward process. It all starts by looking inward.

Before you even glance at a single plan, you need a solid handle on your own situation. There’s no such thing as the "best" plan—only the best plan for you.

Start by getting real about three key areas:

- Your Health Needs: Are you someone who rarely sees a doctor? Or are you managing a chronic condition that means regular visits and prescriptions are a part of your life?

- Your Budget: Look at your cash flow. How much can you genuinely afford for a monthly premium without stressing your finances? Just as crucial, how much could you cover out-of-pocket if a real emergency hit tomorrow?

- Your Risk Tolerance: Are you the type who sleeps better at night with predictable costs, even if it means a higher monthly premium? Or are you okay with a lower monthly bill in exchange for a higher deductible you’d have to pay if something goes wrong?

Answering these questions honestly acts like a filter. It instantly cuts through the noise and narrows down the massive list of options to a handful that actually make sense for your life and your business.

Putting It All Into Practice

Let's walk through a few real-world examples. Seeing how different people with different priorities make their choices can really help clarify which of the insurance options for self employed people fits you best.

Scenario 1: The Healthy Freelance Writer Starting Out

This person is young, in great health, and their income is still a bit unpredictable. Their main goal is keeping those fixed monthly bills as low as possible while still being protected from a worst-case scenario.

For them, a Bronze ACA plan paired with a robust HSA is probably the smartest move. The low premium is perfect for a fluctuating budget. On good months, they can stash money in the HSA, building up a tax-free fund for any future medical expenses.

Scenario 2: The Established Consultant with a Family

This consultant has a stable, higher income and a couple of young kids. That means frequent check-ups and the inevitable urgent care visit for a sprained ankle or mystery fever. For them, predictability is everything.

A Gold or Platinum ACA plan makes the most sense here. The higher premium is a manageable business expense, and in return, they get a low deductible and small copays. No more surprise bills after every trip to the pediatrician. That kind of peace of mind is priceless.

Scenario 3: The Tradesperson with Higher Physical Risk

Think of a self-employed plumber or carpenter. Their work carries a higher daily risk of injury. The top priority isn’t just covering a doctor’s visit; it’s making sure an injury doesn’t completely shut down their income.

This person needs to think bigger. A Silver ACA plan provides a good balance of premium and coverage for health needs. But their most critical investments are disability insurance to replace lost income and liability insurance to protect their business assets.

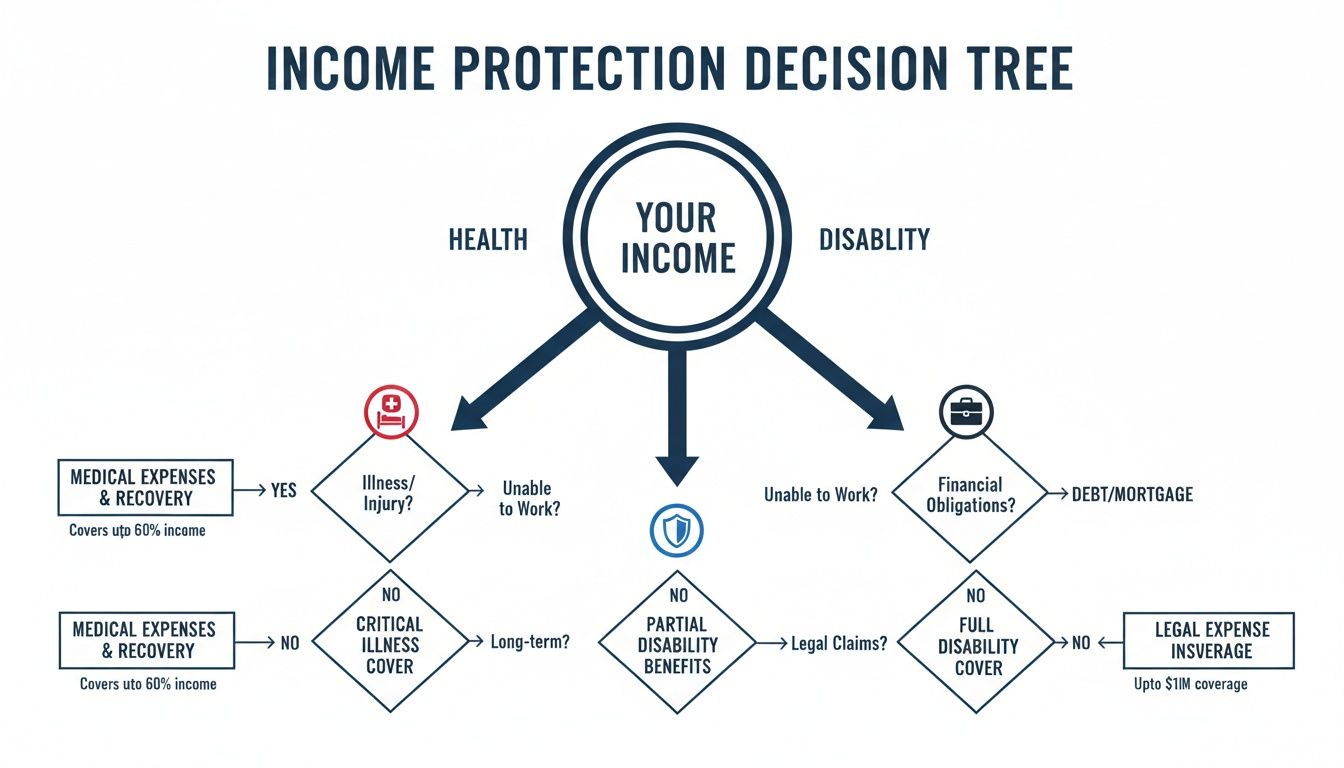

This decision tree helps visualize how different types of insurance work together to protect your income from all angles—not just your health.

As you can see, protecting your ability to earn a living is about more than just one health plan. It’s a strategy. With the number of freelancers expected to hit 86 million by 2027, figuring this out is absolutely essential for long-term financial stability. If you want to dive deeper, you can explore more insights on global insurance trends from industry experts.

For more hands-on advice, check out our guide on how to pick the best health insurance plan.

Your Top Questions, Answered

When you’re striking out on your own, health insurance can feel like a maze. It’s totally normal to have questions pop up along the way. Let’s tackle some of the most common ones that freelancers and entrepreneurs run into.

“What If I Have a Pre-existing Condition? Can I Still Get Covered?”

Yes. One hundred percent. This is a huge one, and the answer is a firm yes. The Affordable Care Act (ACA) made it illegal for any Marketplace plan to turn you away or hike up your rates because of a pre-existing condition. Asthma, diabetes, a past surgery—it doesn’t matter.

But here’s the catch you need to watch out for: this protection does not cover every type of plan. Short-term health insurance, for example, can and often will deny you for past health issues. So, if you need guaranteed coverage that won’t hold your history against you, an ACA Marketplace plan is your safest and best option.

“How on Earth Do I Estimate My Income When It’s Never the Same?”

Welcome to the freelancer life! Estimating your income is probably one of the trickiest parts of applying for a subsidy. The goal is to make your best, most honest guess for the entire year.

A good starting point is to look at last year’s net income. From there, think about what’s changed. Did you land a big new client? Lose a regular gig? Factor in those ups and downs to come up with a realistic number.

Super Important Tip: The Marketplace knows your income will fluctuate. That’s why you can—and should—update your income projection whenever things change. If you have a killer month or a surprisingly slow one, hop into your profile and adjust it. This keeps your subsidy accurate and saves you from a nasty surprise (like having to pay it back) come tax time.

“Does My Health Plan Cover Dental and Vision, Too?”

Usually, no. It’s a common misconception, but the health plans you find on the Marketplace or buy directly from an insurer typically don’t include dental and vision for adults. Some might cover it for kids, but adult coverage is almost always a separate purchase.

The good news is that you can easily add stand-alone dental and vision policies. You can even find them on the ACA Marketplace right alongside the health plans or buy them directly from an insurer. It’s an extra step, but it’s how you build a complete benefits package that truly rivals what you’d get at a traditional job.

Finding the right insurance is a massive step toward building a stable, successful business on your own terms. At My Policy Quote, we live and breathe this stuff, helping self-employed pros just like you find clear, affordable coverage that actually fits their life. Explore your options and get a personalized quote today at mypolicyquote.com.