Of course. Here is the rewritten section, crafted to sound completely human-written and natural, following all your specific instructions and examples.

Yes, you absolutely can get health insurance without a job. Losing your employer’s plan feels like a rug has been pulled out from under you, but it doesn't mean you have to go without coverage.

Think of it this way: you've just exited one highway, but there are several other major routes ready to take you where you need to go. Options like the ACA Marketplace, Medicaid, and COBRA are all designed for moments just like this.

Why Your Health Insurance Matters Now More Than Ever

Losing a job is stressful enough. The last thing you need is the added worry of a medical bill you can't pay. For most of us, our job and our health coverage are tied together, so when one goes, the other feels like it's gone too.

The reality is, not having a job puts you at a much higher risk of being uninsured. It’s a tough spot to be in.

In 2024, a staggering 14.7% of U.S. adults between 19 and 64 who weren't working were also uninsured. That's a huge jump from the 8.8% uninsured rate for full-time workers. This statistic isn't just a number; it highlights how vulnerable you can feel without that employer safety net. You can find out more about recent health coverage trends and statistics right here.

This guide is your roadmap. We’re here to walk you through your options, clear up the confusion, and help you find a quality, affordable plan that protects both your health and your finances.

Understanding Your Options At a Glance

Before we get into the nitty-gritty, let's look at the big picture. When your job-based insurance ends, you aren't stuck with just one choice. You actually have several different paths you can take, and each one has its own rules, costs, and perks.

To make it simple, we've put together a quick summary of your main options. This table shows you what's available, who it's generally best for, and what makes each one unique.

| Health Insurance Options Without a Job at a Glance | ||

|---|---|---|

| Insurance Option | Best For | Key Feature |

| ACA Marketplace | Individuals needing financial help based on their income. | Income-based subsidies that can dramatically lower your monthly bill. |

| Medicaid | Individuals and families with very low or no income right now. | Provides full health coverage for little to no cost. |

| COBRA | Those who love their current plan and want to keep their doctors. | Lets you continue your old employer's plan, but you pay the full price. |

| Spouse's or Parent's Plan | People with a family member who has their own group coverage. | Can be a really stable and affordable way to get insured if it's an option. |

| Short-Term/Private Plans | Healthy folks who just need a temporary safety net. | Lower monthly costs, but they don't cover much and exclude pre-existing conditions. |

Seeing it all laid out like this helps you start thinking about which path might be the right one for your situation.

The most important thing to remember is this: losing your job-based health insurance is a Qualifying Life Event. This is a huge deal because it opens up a 60-day window called a Special Enrollment Period, letting you sign up for a new plan without having to wait for the annual open enrollment.

Now that you have the lay of the land, we’ll dive into each of these options so you can make a choice that feels right for you.

So, Where Do You Start? The ACA Health Insurance Marketplace

When your job-based health insurance is gone, the first place you should look is the Health Insurance Marketplace, often called the ACA Marketplace. It’s not some single, clunky government plan. Think of it more like an Amazon for health insurance—a regulated online hub where you can compare private plans from different companies side-by-side.

Just like you’d shop for a new phone by comparing features and prices, the Marketplace lets you see exactly what you’re getting. You can check deductibles, networks, and monthly costs all in one place. It’s designed to make a complicated decision much, much simpler, especially when you’re navigating the stress of being between jobs.

But its real power isn’t just the shopping experience. It’s the financial help that’s built right in. This is what makes good health insurance a reality for millions of people who don't have it through an employer.

How Subsidies Bring Your Costs Way Down

The secret to making Marketplace plans affordable is subsidies. These aren't just tiny discounts; they can slash your monthly premium, sometimes dramatically. The whole system is designed to connect what you pay to what you actually earn this year.

It’s almost like the government gives you a personalized coupon for your health insurance. There are two types you’ll want to know about:

- Premium Tax Credits: These are the big ones. They directly lower your monthly premium. When you fill out your application, the Marketplace figures out the credit you qualify for. You can have that amount paid directly to your insurance company each month, so you only have to worry about paying the much smaller remaining balance.

- Cost-Sharing Reductions (CSRs): These are an extra layer of savings for people with lower incomes (usually below 250% of the Federal Poverty Level). If you qualify and pick a Silver plan, CSRs will lower your out-of-pocket costs like deductibles, copayments, and coinsurance. It means you pay less when you actually go to the doctor.

The amount of help you get is based on your income, or what’s officially called your Modified Adjusted Gross Income (MAGI). If you want to get into the weeds, you can learn more about how the premium tax credit is calculated.

Let's Look at a Real-World Example

Okay, let's make this real. Imagine a single person just lost their job and figures they’ll make about $30,000 for the rest of the year. A decent Silver plan might have a sticker price of $450 per month. Ouch.

But because their income is $30,000, they could qualify for a premium tax credit of around $350 per month. Suddenly, that $450 plan only costs them $100 a month out of their own pocket. On top of that, they’d likely get cost-sharing reductions, which could drop their deductible from something like $5,000 down to just $800.

That’s the entire point of the ACA Marketplace. It makes sure that the cost of your health insurance is based on your current financial situation, not the full, intimidating retail price of the plan. It levels the playing field.

How to Sign Up After Losing a Job

Normally, you have to wait for the annual Open Enrollment period in the fall to get a Marketplace plan. But losing your job-based coverage is a big deal, and the system recognizes that. It’s called a Qualifying Life Event.

This event opens up a Special Enrollment Period (SEP) for you. This is your window of opportunity. You have 60 days from the day your old coverage ends to sign up for a new plan on the Marketplace. If you miss that 60-day deadline, you’re out of luck until the next Open Enrollment, and nobody wants to be uninsured for that long.

Starting at HealthCare.gov (for most states) is the way to go. The site will walk you through entering your info to see exactly what plans and subsidies you can get. The most important thing is to act fast and not let that 60-day window close.

Qualifying For Medicaid And CHIP

If the ACA Marketplace is the shopping mall of health insurance, think of Medicaid as the essential public safety net. For anyone wondering, “can I get health insurance without a job?”—especially if your income is very low or gone entirely—Medicaid is often the most direct and affordable answer.Unlike almost every other option, Medicaid isn’t tied to your work history. It’s all about your current financial reality. The key factors are your Modified Adjusted Gross Income (MAGI) and household size. It's built from the ground up to provide comprehensive, low-cost (and often free) coverage to those who need it most.

How Medicaid Eligibility Really Works

The Affordable Care Act completely changed the game for Medicaid by allowing states to expand their programs. In states that opted in, eligibility grew to include adults under 65 with a household income up to 138% of the Federal Poverty Level (FPL).

This one change opened the door for millions of single adults, childless couples, and low-wage workers who never would have qualified before. It busted the old myth that Medicaid was only for specific groups like pregnant women or people with disabilities. Today, in most states, it’s simply an income-based program. You can find more details in our complete guide on how to qualify for Medicaid in your state.

Another common misconception? That you have to be unemployed. That's not true. The system only cares about your income level, not whether you're working a part-time job or have sporadic gig work.

Let’s make it real. A single person who just lost their job and has no monthly income would almost certainly fall below that 138% FPL line, making them eligible for Medicaid in an expansion state. It’s that straightforward.

For an individual in 2025, that 138% FPL cutoff is around $21,597 a year. Programs like Medicaid are critical in preventing a health issue from turning into a financial catastrophe. This isn't just a U.S. issue; it's a global one, as the WHO's 2025 report on universal health coverage shows billions still face similar risks.

What If My Children Need Coverage?

This is exactly where the Children’s Health Insurance Program (CHIP) steps in. Think of it as Medicaid’s sister program, specifically designed for families who earn a little too much to qualify for Medicaid but still can't afford a private plan.

CHIP provides comprehensive, low-cost coverage for kids and, in some states, pregnant women. It ensures children get the care they need to grow up healthy, covering all the essentials.

- Routine check-ups to track their growth and development.

- Immunizations to protect them from preventable diseases.

- Doctor visits for those inevitable colds and fevers.

- Prescriptions when they need medication.

- Dental and vision care, which are crucial for overall health.

It’s the bridge that ensures your kids don’t fall through the cracks if your income is just a bit too high for Medicaid.

Applying For Medicaid And CHIP

Here’s one of the best parts about these programs: you can apply any time. There are no restrictive open enrollment periods. If your income drops tomorrow and you suddenly qualify, you can apply tomorrow and get covered right away. Life changes, and Medicaid is built to change with it.

The application process is also designed to be as simple as possible. You can typically apply right through your state’s Health Insurance Marketplace or directly with your state's Medicaid agency. There are plenty of resources out there, including step-by-step guides on how to apply for Medicaid. Just have your recent income information ready, and you can see if you qualify in minutes.

Considering COBRA To Continue Your Old Plan

Losing a job is stressful enough without having to worry about losing your health insurance, too. Thankfully, a federal law called COBRA acts as a safety net, letting you keep your old health plan for a while.

Think of it like this: you get to continue "renting" your old coverage even after you've left the company.

The biggest upside to COBRA is continuity. You don't have to scramble to find new doctors, your network doesn't change, and any money you've already paid toward your annual deductible travels with you. This is a massive relief, especially if you're in the middle of medical treatment or just don't want the headache of starting over with a new plan.

But all that convenience comes at a very steep price.

Understanding The True Cost Of COBRA

When you were working, your employer was likely paying a huge chunk of your monthly health insurance premium behind the scenes. With COBRA, that support is gone. You're now on the hook for the entire bill—the part you paid and the much larger portion your employer used to cover.

On top of that, you’ll also pay a 2% administrative fee. This is why so many people get "sticker shock" when they see their first COBRA bill. The cost can be staggering, particularly when you no longer have a paycheck coming in. For a full breakdown, check out our guide on how much COBRA typically costs.

Job-based insurance is the most common coverage in the U.S., covering around 178 million people in 2023. With average family premiums climbing to nearly $27,000 in 2025, an employee might only pay 15-35% of that. But on COBRA, you’re responsible for 102% of that total premium, making it one of the most expensive ways to stay insured. You can learn more about the affordability of job-based coverage to see the full picture.

Who Is Eligible And For How Long

Not every job qualifies for COBRA. The law generally applies to group health plans at private companies with 20 or more employees. If you worked for a smaller business, this might not be an option, though some states have "mini-COBRA" laws that offer similar protections.

To be eligible, you need to have a specific "qualifying event" that caused your coverage to end. The most common ones are:

- Losing your job, whether you quit or were laid off (as long as it wasn't for "gross misconduct").

- A reduction in your work hours that makes you ineligible for benefits.

The bottom line is this: COBRA is best used as a temporary bridge, not a permanent fix. It’s a valuable safety net that keeps you covered while you figure out a more affordable, long-term solution, like a plan from the ACA Marketplace.

In most cases, COBRA coverage lasts for 18 months after you lose your job. In certain situations, like a disability, that period can be extended. You’ll have a 60-day window after your old plan ends (or from the day you get the COBRA notice) to decide if you want to enroll. That gives you some breathing room to compare its high cost against other, more affordable options.

Exploring Alternative Paths To Coverage

While the ACA Marketplace, Medicaid, and COBRA are the main highways to health coverage, there are several other roads that can get you where you need to go. The right choice really comes down to your unique situation—your age, your family, your finances. It's worth looking at all of them so you don't miss an easy solution that's right under your nose.

For a lot of people, the simplest path forward is joining a family member's plan. It’s often the most stable and affordable way to stay insured when you're between jobs.

Leveraging Family Health Plans

Losing your job-based health insurance isn't just a stressful event; it's what's known as a Qualifying Life Event. This is a critical term to know. It triggers a Special Enrollment Period (SEP), giving you and your family a special window to sign up for coverage outside the standard open enrollment season.

This opens up a couple of powerful possibilities:

- Joining a Spouse's Plan: If your spouse has health coverage through their work, your job loss gives them a green light to add you. They'll typically have 30 to 60 days from the day your old coverage ends to make the change. It's always a good idea to compare the cost, but this is often a very competitive option.

- Joining a Parent's Plan: If you're under the age of 26, the ACA lets you stay on a parent's health insurance plan. It doesn't matter if you live at home, are financially independent, or even married. Your loss of coverage is the SEP you need to get added back on.

These family-based options are a great first place to look. They provide a sense of continuity and are usually much more affordable than footing the entire bill for a plan on your own.

Short-Term Health Insurance: A Temporary Fix

What if you only expect to be uninsured for a couple of months? Maybe you already have a new job lined up. In that case, a short-term health plan might look tempting.

Think of these plans as a temporary patch, not a long-term solution. They’re built to give you a basic safety net against a catastrophic medical event, not for handling your day-to-day healthcare needs.

The biggest draw is the low monthly premium. But that lower price tag comes with some serious trade-offs you absolutely need to understand before you commit.

Short-term plans are not regulated by the ACA. This means they don't have to cover essential health benefits, can turn you down because of your health history, and almost never cover pre-existing conditions.

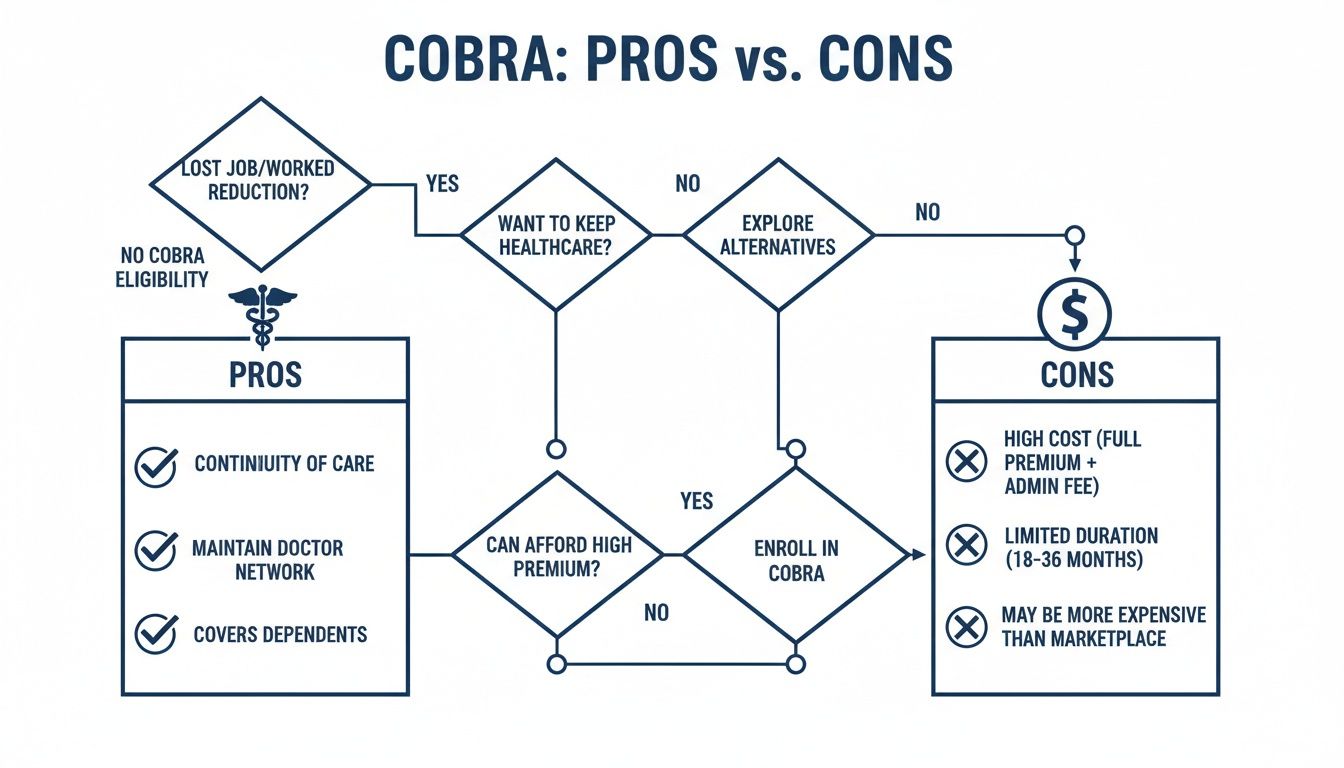

The flowchart below gives you a quick snapshot of the pros and cons you'd face if you were thinking about sticking with your old plan through COBRA instead.

As you can see, the core trade-off is clear: you get to keep your doctor and your network, but it's going to cost you. While temporary plans can be a bridge, you can learn more about what they do and don't cover in our guide on short-term health insurance policies.

Here’s a quick comparison to help you weigh these alternative options side-by-side.

Comparison of Alternative Health Insurance Options

This table breaks down the key alternative insurance types to help you quickly see which one might be the best fit for your situation based on cost, how long you need coverage, and other important factors.

| Option | Best For | Typical Cost | Key Consideration |

|---|---|---|---|

| Spouse/Parent Plan | Young adults under 26 or married individuals. | Varies, but often the most affordable option. | You can only enroll during a Special Enrollment Period triggered by job loss. |

| Short-Term Plan | Healthy individuals needing a temporary bridge between jobs. | Low premiums, but high out-of-pocket costs. | Does not cover pre-existing conditions and is not ACA-compliant. |

| Private Plan | Those with higher incomes who don't qualify for subsidies. | Can be expensive; you pay 100% of the premium. | You lose access to any government financial assistance (subsidies). |

| Student/Retiree Plan | Enrolled students or early retirees from specific employers. | Often very affordable and comprehensive. | Highly specific eligibility; not available to everyone. |

Looking at the options this way can make it easier to narrow down what makes the most sense for you right now.

Private Health Plans Off The Marketplace

Another route is buying a health insurance plan directly from an insurance company, sometimes called an "off-exchange" plan. You might find a wider variety of plans this way, with different doctor networks or benefits than what's listed on the ACA Marketplace.

But there's a huge financial catch you need to know about.

You cannot get any income-based subsidies for these plans. No Premium Tax Credits, no financial help whatsoever. You'll be on the hook for 100% of the premium out of your own pocket. If your income is low enough to qualify for subsidies, the ACA Marketplace is almost always the smarter financial move.

Special Options For Students And Others

Finally, some situations come with their own built-in coverage solutions. It's always worth checking to see if you fall into one of these groups.

- Student Health Plans: If you're a student at a college or university, check with your school. They likely offer a student health plan, which are often strong, ACA-compliant policies designed for the student body.

- Retiree Health Plans: If you're retiring early, your former company might offer retiree health benefits. This is becoming less common, but some large companies and public sector employers still have them. It never hurts to ask your old HR department.

By taking the time to explore every single alternative, you can build a complete picture of what's available. This is how you find the most secure and affordable way to get covered when you don't have a job.

Your Action Plan To Get Covered

Knowing your options is the first step. But turning that knowledge into a real, active health insurance plan is what truly matters.

Think of it as a simple checklist. Follow these steps, and you’ll move from uncertainty to being covered.

Step 1: Gather Your Information

Before you start clicking around and comparing plans, get your ducks in a row. Having these details ready will make everything go so much smoother.

- Income Documents: Grab your most recent pay stubs, any unemployment benefit statements, or other documents that show your current estimated yearly income. This is key for subsidies.

- Household Details: Jot down who is in your household and their ages. This directly impacts your eligibility for both Medicaid and Marketplace savings.

- Coverage Loss Date: This one is critical. Find the exact date your old health insurance from your job officially ended.

Step 2: Compare All Your Options

Now it’s time to shop around. Don’t just settle on the first thing you see—explore every avenue to find what genuinely fits your health needs and your wallet.

- Check the ACA Marketplace: Head over to HealthCare.gov and run the numbers. The site will guide you through the process and instantly show you if you qualify for those income-based subsidies we talked about.

- Investigate Medicaid Eligibility: Visit your state’s Medicaid website. Since eligibility is often based on your current monthly income, you might qualify now even if you didn't in the past. It’s worth a look.

- Price Out COBRA: Call your old HR department and ask for the COBRA election paperwork. It will lay out the full, unsubsidized monthly premium. Be prepared for a little sticker shock, but at least you'll know the cost.

Step 3: Watch The Clock

In the world of health insurance, timing is everything. Missing a deadline after losing your job can mean waiting months for the next Open Enrollment period, leaving you completely uninsured.

Remember, losing your job-based plan triggers a Special Enrollment Period (SEP). You have exactly 60 days from the date your old coverage ended to enroll in a new ACA Marketplace plan or join a spouse’s plan. Don't let this window close.

Step 4: Choose And Enroll

Okay, you’ve done the research. Now it’s decision time. It's tempting to just pick the plan with the lowest monthly premium, but that can be a trap.

Look deeper. A cheap plan with a sky-high deductible could end up costing you a fortune if you actually need to use your insurance. Consider the plan’s deductible, copays, and doctor network to make sure it’s a good fit for you.

Once you’ve found a plan you feel confident about, finish the enrollment process. That final step is what secures your coverage and, more importantly, your peace of mind.

Your Top Questions, Answered

Losing a job and figuring out health insurance brings up a lot of "what if" scenarios. Let's tackle some of the most common questions head-on to give you the clarity you need to move forward.

What If I Have No Income Right Now?

If your income has suddenly dropped to zero, your first and best move is to check your Medicaid eligibility.

In states that expanded their programs, having no income almost always qualifies you. The income limit is typically set at 138% of the Federal Poverty Level, making it a lifeline for those in a tough spot.

The best part? Medicaid enrollment is open all year round. You don't have to wait. You can apply the moment your situation changes and get comprehensive coverage, often with zero monthly cost.

How Do Self-Employed People Get Covered?

When you're self-employed or a 1099 contractor, you're basically the CEO of your own small business. The good news is the ACA Health Insurance Marketplace was built with people like you in mind.

You'll simply estimate your net self-employment income for the coming year when you apply. Based on that projection, you can qualify for the very same subsidies—known as Premium Tax Credits—that help millions of others lower their monthly insurance payments. It’s a system designed to make sure your coverage is affordable based on what your business actually brings in.

Don't Forget the Clock is Ticking: That 60-day window after losing your job-based health plan is a critical Special Enrollment Period (SEP). If you miss that deadline, you can't sign up for an ACA plan until the next Open Enrollment period, which could leave you without coverage for months.

What’s the Real Difference Between ACA Plans and Short-Term Plans?

This is a big one, and it's vital to understand the distinction. An ACA-compliant plan from the Marketplace is real, comprehensive health insurance. It’s legally required to cover the essentials (like hospital stays, prescriptions, and mental health) and can't turn you away because of a pre-existing condition.

A short-term plan, on the other hand, is more like a temporary bandage. It’s not regulated by the ACA, which means it’s full of coverage gaps. These plans can—and often do—reject you or refuse to pay for any health issues you already have. They look cheaper upfront, but they offer very little genuine protection and are no substitute for proper insurance.

It's a lot to sort through, but you don't have to figure it all out on your own. At My Policy Quote, we specialize in walking people through these exact situations. We'll help you find the right plan that fits your life and your budget, ensuring you have the protection and peace of mind you deserve.