Tax season can feel like a scavenger hunt for papers, and Form 1095 is one of the most important clues. It’s the official proof that you had health insurance, which you’ll need to file your taxes correctly. But figuring out which 1095 you need—and where on earth to find it—can be a real headache.

Let's clear that up.

Generally, you'll either get your Form 1095 in the mail automatically or find it waiting in an online portal. If you have Marketplace coverage, you’ll want to log into your Healthcare.gov account. For employer-provided insurance, your company’s benefits portal or a quick call to HR is the way to go. For everything else, your insurance provider is your best bet.

Your Quick Guide to Finding Form 1095

Think of the different 1095 forms as receipts for different kinds of health coverage. Each one tells the IRS who was covered under your plan and for how many months. The version you get depends entirely on how you got your health insurance last year.

Pinpointing Your Specific 1095 Form

There are three flavors of Form 1095, and you only need to worry about the one that matches your situation.

Here’s a quick rundown:

- Form 1095-A: This one’s for anyone who bought a health plan through the Health Insurance Marketplace (like Healthcare.gov). It's absolutely essential for figuring out if you got the right amount in premium tax credits.

- Form 1095-B: You'll get this form from your insurance provider if you were covered by a government program like Medicare, a small business plan, or a private policy you bought directly from an insurer.

- Form 1095-C: If you work for a large company (usually one with 50 or more full-time employees), they’ll send you this form. It spells out the details of the health coverage they offered you, even if you didn't take it.

To make things even simpler, the table below gives you a clear roadmap. It breaks down each form, tells you who sends it, and shows you the fastest way to get your copy so you can get back to your life.

Which 1095 Form Do You Need and Where to Get It

| Form Type | Who Provides It | Who It Is For | How to Get It |

|---|---|---|---|

| 1095-A | Health Insurance Marketplace | Individuals with Marketplace plans | Log in to your Healthcare.gov or state marketplace account. |

| 1095-B | Insurance provider or government program | Individuals with private plans, Medicare, or small employer coverage | Contact your insurance provider directly; often available online. |

| 1095-C | Large employers | Employees of companies with 50+ full-time workers | Contact your employer's HR department or check your benefits portal. |

Knowing which form to look for is half the battle. With this breakdown, you can quickly track down the right document and move one step closer to finishing your taxes with confidence.

Understanding the Difference Between 1095 Forms

Tax season is confusing enough without a pile of look-alike forms. When it comes to proving you had health insurance, not all 1095s are the same. Think of them as different keys for different doors on your tax return.

The specific version you need—A, B, or C—depends entirely on how you got your health coverage last year. Figuring out which one applies to you is the first step to a smoother, faster filing process.

Form 1095-A: The Marketplace Essential

If you’re a freelancer, gig worker, or bought your own health plan, Form 1095-A, Health Insurance Marketplace Statement, is your go-to document. This one is specifically for anyone who enrolled in coverage through Healthcare.gov or a state-based exchange.

This form isn’t just a simple proof of coverage; it’s a critical tool for your taxes. It breaks down the monthly premiums you paid and, most importantly, any premium tax credits (subsidies) the government paid for you.

You'll use your 1095-A to fill out Form 8962, Premium Tax Credit. This is how you "reconcile" the subsidy you received based on your estimated income with the amount you actually qualified for based on your final, reported income. Getting this right is a big deal—the IRS notes that around 10-20% of filers claim these credits incorrectly, often because they misplaced this form.

Form 1095-C: Coverage Offered by Large Employers

For anyone working at a larger company, Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, is the one you’ll see in your mailbox. If your employer has 50 or more full-time (or equivalent) employees, they're required by law to send you one.

The 1095-C acts as your employer's official record to the IRS, showing they offered you qualifying health coverage. It details things month-by-month, including:

- Proof that your employer offered you a health plan.

- The premium for the lowest-cost individual plan available to you.

- Which months you were actually enrolled in their health plan.

Here’s a key point: you’ll get a 1095-C even if you turned down your employer’s offer. It’s their way of proving they met their obligation under the ACA. If you're scratching your head over the codes and terms, our health insurance glossary can help clear things up.

Form 1095-B: Proof of Minimum Essential Coverage

Last but not least is Form 1095-B, Health Coverage. This form is more of a catch-all. It’s sent by insurance providers to people who had coverage through sources other than the Marketplace or a large employer.

You’ll likely get a 1095-B if your insurance came from:

- A small business with under 50 employees.

- A government program like Medicare Part A, Medicaid, or CHIP.

- A plan you bought directly from an insurer, outside of the Marketplace.

The main job of the 1095-B is to confirm you had "minimum essential coverage." While the federal penalty for going uninsured is gone, some states still have their own mandates. In those places, this form is still important for filing your state taxes correctly.

Actionable Steps to Get Your 1095 Form

Knowing which 1095 form you need is the first hurdle. Now for the real part—actually getting it in your hands.

The good news is that tracking down your form is usually pretty straightforward, whether it’s buried in an online portal or requires a direct request. The method just depends on where your health coverage came from.

If you have a Marketplace plan, the process is built for quick digital access. But if your coverage comes from your job or another provider, you might need to be a little more proactive. Let's walk through the exact moves for each scenario so you can get your 1095 without the usual tax season headache.

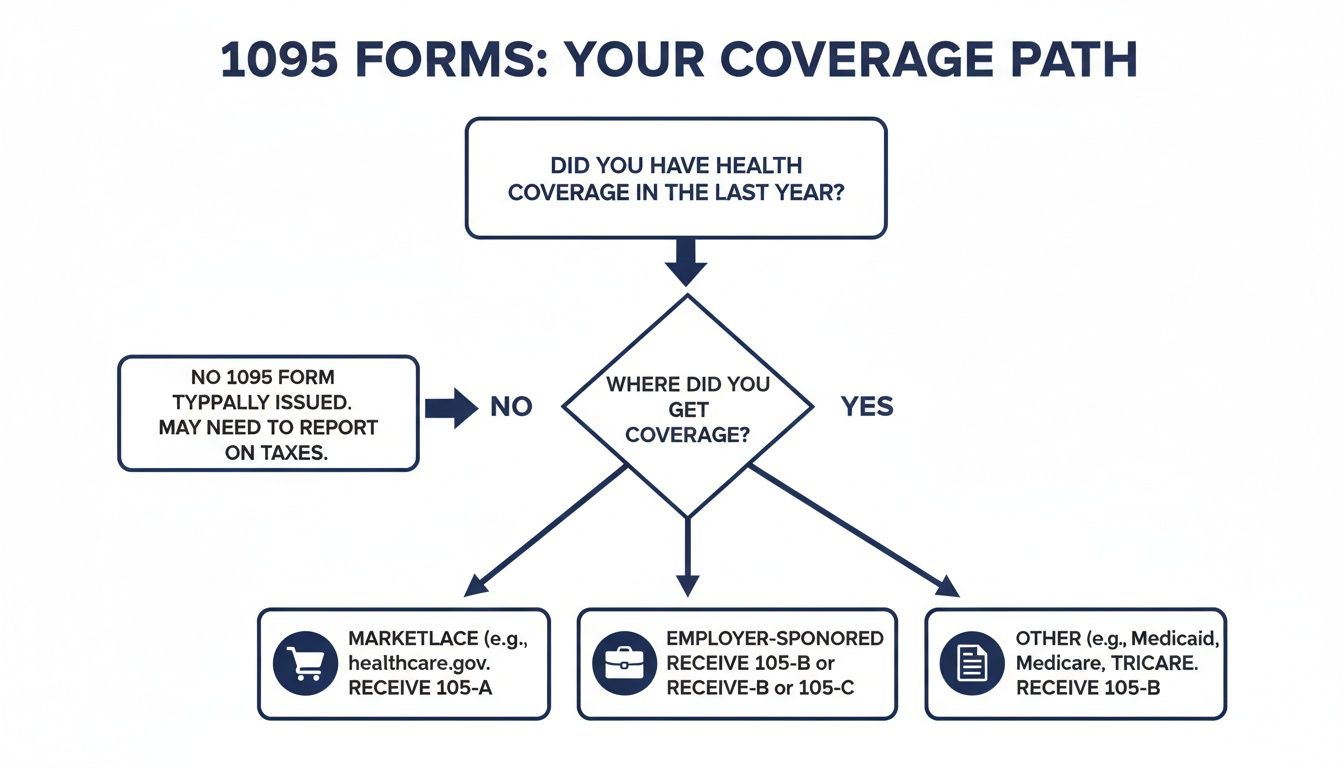

This simple decision tree can help you figure out which path to take.

As you can see, your health plan—Marketplace, employer, or another insurer—points you directly to the right 1095 form and tells you where to start looking.

Accessing Your 1095-A from the Marketplace

Did you have a health plan through Healthcare.gov or your state’s exchange? Getting your Form 1095-A is typically the easiest of the bunch. The Marketplace is required to send it to you, and it’s almost always available by mail and online.

Your online account is the fastest way to get it. Just log in to your Healthcare.gov or state marketplace account, head to your tax forms or documents section (often labeled "My Inbox"), and download the PDF for the right tax year. Simple as that.

Pro Tip: Don't wait for the mail to show up. Your 1095-A is usually available online long before the January 31 deadline. Checking your account early gives you a nice head start on your taxes.

Requesting Your 1095-B or 1095-C

For Forms 1095-B and 1095-C, things have changed a bit. Thanks to new rules, many employers and insurance providers don't have to mail these forms automatically anymore. Instead, they just have to make them available upon request. That means the ball is in your court—you might have to ask for it.

For a 1095-C from a large employer:

- Start by checking your company's employee benefits portal or intranet. Lots of companies upload tax documents there for you to grab anytime.

- Can't find it online? Your next stop is the Human Resources (HR) department. A quick email or phone call is usually all it takes.

When you reach out, be direct. Something like, "Hi, I'm working on my taxes and need a copy of my Form 1095-C for last year. Could you let me know how I can get it?" works perfectly. By law, they have to provide it within 30 days of your request. For a deeper dive on your rights and how to prove you had coverage, our guide on how to verify insurance coverage is a great resource.

For a 1095-B from an insurer or government program:

- Log in to your member account on your insurance provider's website. Look for a "Documents" or "Tax Statements" section.

- If it’s not there, just call the member services number on the back of your insurance card.

- For coverage from programs like the VA, you'll need to contact them directly to request the form.

If you receive a paper copy of your 1095, it's a smart move to create a digital backup. It's easy to convert scanned documents to PDF for your records. This gives you a secure, accessible copy you can file away with your other tax documents, ensuring it's always there when you need it.

What to Do If Your 1095 Form Is Missing

Tax day is getting closer, and you realize a key document is missing from your pile of paperwork: your Form 1095. First, don't panic. This is a super common hiccup, and you have several clear options to move forward without derailing your entire tax filing.

Before you start making calls, double-check your digital spaces. It’s becoming more and more common for employers and insurance providers to post these forms online instead of mailing physical copies. Log into your employee benefits portal or your insurer's member website. Look for a "Tax Documents" or "My Account" section—it’s probably waiting for you there.

Filing Without the Form in Hand

So, what if you've looked everywhere and still can't track down your 1095-B or 1095-C? Good news—you can almost always file your federal return without the physical form. The IRS gets a copy directly from the issuer, so they use these forms more for their own information reporting than for you to attach to your return.

You can simply use other records to confirm your coverage details. Think of things like:

- Insurance cards or coverage confirmation letters

- Explanation of Benefits (EOB) statements

- Year-end statements from your health insurer

- W-2 forms showing your health insurance premium deductions

These documents are usually enough to prove you had qualifying health coverage for the year, which is the main point. This is very different from a situation where your life circumstances change your coverage needs. You can learn more about those situations in our guide on what is a qualifying event for health insurance.

Crucial Distinction for Form 1095-A

If you're missing a Form 1095-A from the Health Insurance Marketplace, you have to stop what you're doing and get it. Filing without this form is a non-starter. Its information is absolutely essential for completing Form 8962, which reconciles your premium tax credits. Trying to file without it will cause major delays and could even trigger a repayment demand from the IRS.

Correcting an Inaccurate 1095 Form

What if you have the form, but the information is just plain wrong? Maybe your name is misspelled, a dependent is missing, or the months of coverage are incorrect. This needs to be fixed, and fast.

You’ll need to contact whoever issued the form to request a correction.

- For a 1095-A: Call the Marketplace Call Center.

- For a 1095-B: Get in touch with your insurance provider directly.

- For a 1095-C: Reach out to your employer’s HR or benefits department.

Explain the error clearly. By law, they have to investigate and send you a corrected form, which should be clearly marked as "CORRECTED" and will replace the original. If you've already filed your taxes using the bad info, you'll likely need to file an amended return (Form 1040-X) once you get the new, accurate 1095.

Why Your 1095 Form Still Matters

The federal penalty for not having health insurance is a thing of the past, so you might be tempted to just shred your Form 1095 the moment it arrives.

Hold on. Tossing that form could be a mistake.

While its main job has changed, this document is still a critical piece of your financial life. Think of it as your official, IRS-stamped proof of health coverage—something you’ll definitely want to have on hand in a few key situations.

The 1095-A Is Non-Negotiable

If you got health insurance through the Marketplace and received a premium tax credit (a subsidy) to help pay for it, your Form 1095-A is absolutely essential. This isn’t a friendly suggestion; you literally need it to file your taxes correctly.

The information on this form is required to fill out Form 8962, which is how you "reconcile" the subsidy you received with the amount you were actually eligible for based on your final income.

Skipping this step will bring your tax return to a screeching halt. The IRS will flag it, and your refund could be delayed for weeks or even months. Worse, if it turns out you were paid too much in subsidies, you'll have to pay it back.

Your 1095-A is your key to a smooth tax filing season. Ignoring it is asking for a headache and a potential tax bill you didn't see coming.

State Mandates Still Require Proof of Coverage

Even though the federal government stepped back, several states have their own health insurance mandates. If you live in a place like California, Massachusetts, New Jersey, Rhode Island, or Washington D.C., you still need to prove you had qualifying health coverage for the year.

This is where your 1095-B or 1095-C comes in. These forms are your official proof. When you file your state tax return, you’ll use the information from them to show you followed the law and to avoid a state-level penalty. It’s also a good document to have when you're looking into other health insurance tax benefits you might qualify for.

Why the 1095-C Matters for Employees

The Form 1095-C is the one you get from a large employer—typically a company with 50 or more full-time employees. It’s the company's way of reporting to the IRS that they offered you health coverage that was considered affordable and met minimum standards.

Think of it as your employer’s report card. It proves they held up their end of the bargain under the ACA's employer mandate. For you, it serves as an official record of the coverage offered to you, which can be useful if you ever need to document your health insurance history. It’s a valuable piece of paper to keep in your files.

Common Questions About Form 1095

Once you’ve finally hunted down your 1095 forms, a few more questions usually pop up. The world of tax documents is confusing, but a few straightforward answers can clear up any lingering doubts about what to do next.

Let's walk through the most common questions people have. This will help you tackle any odd situations and feel confident you’ve handled everything correctly.

Do I Have to Attach My 1095 to My Tax Return?

This is easily the biggest point of confusion. The short answer is no, you don’t need to attach your Form 1095-B or 1095-C to your federal tax return.

Think of those forms as your personal proof of health coverage. They’re important for your records, but the IRS already gets its own copy directly from your insurer or employer.

The big exception here is Form 1095-A. If you got this form, you absolutely must use the information on it to fill out and file Form 8962, Premium Tax Credit. This isn’t an optional step if you received subsidies through the Marketplace.

What Should I Do If My 1095 Form Has an Error?

Finding a mistake on your 1095—like a misspelled name, wrong address, or incorrect coverage dates—can be frustrating. Don't just ignore it, because it could cause problems with the IRS down the line.

Your first move is to get in touch with whoever sent you the form.

- For a 1095-A: Contact the Health Insurance Marketplace directly.

- For a 1095-B or 1095-C: Reach out to your insurance company or your employer’s HR department.

They are legally required to look into the error and send you a corrected form. If you already filed your taxes with the wrong information, you’ll likely need to file an amended tax return once you get the updated 1095.

Why Did I Get More Than One 1095 Form?

It's actually pretty normal to get multiple 1095 forms in the same year. This usually happens when you had a change in your health coverage. No need to panic.

For instance, say you started the year with a Marketplace plan but then got a new job with health benefits in June.

In that scenario, you would rightly receive two forms:

- A Form 1095-A covering the months you were on the Marketplace plan.

- A Form 1095-C from your new employer for the rest of the year.

Each form just covers a specific chunk of the year. You’ll need to use the information from all of them to report your health coverage accurately for all 12 months.

Navigating health insurance options can be complicated, but you don't have to do it alone. At My Policy Quote, we specialize in finding the right coverage for your unique needs, from self-employed plans to family policies. Explore your options and get a free quote today!