The Premium Tax Credit (PTC) can feel like a complicated government term, but it's actually one of the most powerful tools for making health insurance affordable. Think of it as a helping hand from the government, specifically designed to bring down the monthly cost of health plans you buy through the Health Insurance Marketplace.

Its main job is simple: to make sure you don't have to break the bank just to stay covered.

How the Premium Tax Credit Works for You

At its heart, the Premium Tax Credit is all about bridging the gap between what a health plan costs and what you can genuinely afford to pay. This financial boost is only for plans purchased on a public exchange, like the federal Marketplace or your state's own version.

When you sign up, you'll give the Marketplace your best guess for your household's income for the upcoming year. They take that number and figure out the credit you're eligible for. From there, you get a really important choice.

Two Ways to Receive Your Credit

You have two options for how you get this financial help, giving you the flexibility to choose what works best for your budget.

- Advance Premium Tax Credit (APTC): This is by far the most common choice. The Marketplace pays your credit amount directly to your insurance company every single month. This instantly lowers your monthly health insurance payments, making your bills much more predictable and manageable.

- Lump-Sum Credit: If you prefer, you can pay the full, unsubsidized premium each month and then claim the entire credit when you file your taxes. This could lead to a bigger tax refund or a lower tax bill at the end of the year.

Most people go with the advance payments because they provide immediate relief. It’s what makes health insurance feel affordable month after month, not just once a year at tax time. To dig deeper into finding a plan that fits your budget, check out our guide on how to find affordable health insurance.

Here’s a quick summary to help you remember the key points.

Premium Tax Credit at a Glance

| Key Aspect | Brief Explanation |

|---|---|

| What It Is | A refundable tax credit to help lower your monthly health insurance premiums. |

| Who It's For | Eligible individuals and families who buy insurance on the Health Insurance Marketplace. |

| How You Get It | Either in advance each month (APTC) or as a lump sum on your tax return. |

| Main Goal | To cap your insurance costs at an affordable percentage of your income. |

Ultimately, the choice between advance payments and a lump-sum credit comes down to your personal cash flow and tax situation.

The key takeaway is that the Premium Tax Credit is designed to cap your health insurance premium payments as a percentage of your income, ensuring that coverage remains within reach for millions of Americans, including self-employed professionals and early retirees.

How Enhanced Subsidies Changed the Game

For a long time, the Premium Tax Credit had a frustratingly strict income limit. If your household earnings were even one dollar over 400% of the Federal Poverty Level (FPL), you’d fall right off the “subsidy cliff.” Suddenly, you were on your own, facing the full price of health insurance. This left a lot of people—middle-income families, 1099 contractors, and early retirees—completely locked out of affordable coverage.

Then, everything changed. The American Rescue Plan Act, which rolled out in March 2021, gave the premium tax credit a major boost, making ACA Marketplace plans far more accessible. The biggest shift? It completely eliminated that subsidy cliff.

Removing the Income Cliff

The most important update was getting rid of the 400% FPL income cap for eligibility. In its place, the new rules made a simple promise: no one has to pay more than 8.5% of their household income for a benchmark silver plan. This single change opened the door to affordability for millions who used to earn just a little too much to get any help.

The results have been incredible. By 2024, people eligible for these credits were saving an average of around $700 a year on their premiums. In fact, an amazing four out of five federal marketplace customers found a plan for $10 or less per month. That just shows how powerful these enhancements have been. You can dive deeper into these impacts by checking out insights from the Kaiser Permanente Institute for Health Policy.

This new approach creates a much smoother and more predictable sliding scale. Your financial help is now tied directly to what you can actually afford, not some arbitrary income line. It's a game-changing update that has made comprehensive health coverage a real possibility for so many more Americans.

Think about it like this: a family of four earning $110,000 might have faced full-price premiums of over $1,500 a month. With the enhanced subsidies, their monthly payment could be capped around $780, saving them thousands every single year.

What This Means for You

The people who feel this impact the most are those who were always just outside that old eligibility window. If you're self-employed with an income that goes up and down, or an early retiree managing investments, this new flexibility is huge. You can finally get covered without worrying that a small income bump will suddenly make you lose all your financial assistance.

This enhanced support is currently set to last through 2025. It’s so important to understand how these subsidies work when you're shopping for a plan, especially during the main enrollment periods. To get ready, you might want to check out our guide that explains what open enrollment in health insurance is and how to make it work for you. Knowing the rules is the best way to lock in a great plan at the lowest possible cost.

Who Is Eligible for the Premium Tax Credit

Figuring out if you qualify for the premium tax credit can feel like navigating a maze, but the rules are more straightforward than they might seem. Think of it like a checklist from the government to see who gets this incredibly helpful financial boost. Meeting these criteria is your ticket to significantly lower monthly health insurance costs.

At its heart, eligibility boils down to a handful of key factors that paint a picture of your financial and household situation.

Core Eligibility Requirements

To get the premium tax credit, you generally have to meet all of the following conditions. Each one plays a critical role in whether you qualify.

-

Purchase a Marketplace Plan: This is a big one. Your health insurance has to come from the official Health Insurance Marketplace, either the federal platform or your state's own exchange. Plans you buy directly from an insurance company (“off-exchange”) won't qualify for this credit.

-

Meet Income Guidelines: Your household income, specifically your modified adjusted gross income (MAGI), needs to fall within a certain range. Thanks to recent changes, this is now a sliding scale designed to ensure your premiums never cost more than 8.5% of your income.

-

Not Have Access to Other Affordable Coverage: You generally can't be eligible for affordable, minimum-value health coverage from another source. This includes most plans offered by an employer, Medicare, or Medicaid.

-

File Taxes Correctly: You must file a federal income tax return for the year you use the credit. You also can’t file using the "Married Filing Separately" status, except in very rare cases.

If your income is on the lower end, you might want to look into other programs, too. Our guide explains how to qualify for Medicaid, which provides excellent coverage for many low-income individuals and families.

Do You Qualify for the Premium Tax Credit?

Not sure where you stand? Use this quick checklist to see if you might be eligible. Just read each requirement and see if it applies to your situation.

| Requirement | What It Means for You | Check If This Applies |

|---|---|---|

| Marketplace Plan | You must enroll in a health plan through HealthCare.gov or your state’s official marketplace. | ☐ |

| Income Level | Your household income must be within the specified federal poverty level (FPL) range. | ☐ |

| No Other Affordable Coverage | You can’t be offered affordable health insurance through a job, Medicare, or Medicaid. | ☐ |

| Tax Filing Status | You must file a federal tax return and cannot use the "Married Filing Separately" status (with few exceptions). | ☐ |

| Citizenship/Immigration Status | You must be a U.S. citizen or be lawfully present in the United States. | ☐ |

If you checked off most or all of these boxes, there’s a good chance you can get help paying for your health insurance.

Real-World Scenarios

Let’s see how this plays out for different people. A freelance designer with a fluctuating income can qualify by giving their best estimate of what they'll earn for the year. An early retiree who no longer has coverage from a job can also become eligible. Same goes for a family whose workplace insurance is considered "unaffordable" by Marketplace standards.

An employer's plan is typically considered "unaffordable" if the employee's share of the premium for just their own coverage costs more than a specific percentage of their household income. This percentage is adjusted every year.

This whole system is built to help the people who need it most—from self-employed professionals to families piecing together coverage outside of a traditional 9-to-5. By checking these boxes, you can confidently figure out if this powerful credit is for you.

How Your Credit Is Calculated and Reconciled

Figuring out your premium tax credit isn't as complicated as it sounds. It's a two-part process: a smart estimate at the beginning of the year, followed by a simple check-in when you file your taxes. The whole system is designed to be flexible and adjust to your life.

First off, you get to choose how you receive the credit. Most people go with advance premium tax credit (APTC) payments. This is where the government sends your subsidy straight to your insurance company every month. The result? Your monthly bill is lower right away. It’s instant savings.

The other option is to pay your full premium each month and then claim the entire credit as one lump sum on your tax return.

The Benchmark Plan and Your Subsidy

So, how does the Marketplace land on your specific credit amount? It all comes down to something called the benchmark plan.

Think of the benchmark plan as a measuring stick. It’s the second-lowest-cost silver plan available in your area. The government uses its price to figure out the maximum subsidy you can get. The goal is to make sure that this specific plan won't cost you more than 8.5% of your estimated household income.

Here’s a quick look at how the math works:

- Find the Benchmark Cost: The Marketplace looks up the monthly premium for that second-lowest-cost silver plan in your zip code.

- Calculate Your Contribution: It then figures out what you're expected to pay, which is capped at a percentage of your income (never more than 8.5%).

- Determine Your Credit: Your premium tax credit is simply the difference between the benchmark plan's cost and what you're expected to contribute.

Let's say the benchmark plan costs $500 a month, and based on your income, your contribution is set at $200 a month. Your tax credit would be $300 per month. The best part? You can apply that $300 to almost any Marketplace plan, not just the benchmark one.

Reconciling Your Credit at Tax Time

Life happens. You get a raise, change jobs, or your income takes an unexpected dip. That’s why the final step—reconciliation—is so important.

When you file your federal income taxes, you’ll fill out Form 8962, Premium Tax Credit. This is where you square up the advance payments you got all year with the credit you were actually eligible for based on your final, real income.

Reconciliation is just the official term for comparing your estimated credit with your actual credit. Getting this right helps you avoid surprises when you file your taxes.

What happens next depends on how your income changed:

- If you earned less than you estimated: Good news. You probably received less credit than you were owed. You’ll get that difference back, which could mean a bigger tax refund or a smaller tax bill.

- If you earned more than you estimated: You may have received too much credit in advance. In this case, you’ll likely have to pay back some or all of the excess amount with your taxes.

This is exactly why you should report big life changes—like a new job, a marriage, or a new baby—to the Marketplace as soon as they happen. Updating your application keeps your advance payments accurate and saves you from a surprise bill at tax time. It’s like updating your GPS to make sure you stay on the right financial road.

The Future of Enhanced Healthcare Subsidies

Those enhanced subsidies that made health insurance more affordable for millions of Americans? They’re currently set to expire at the end of 2025.

This creates a ton of uncertainty for anyone who relies on the Health Insurance Marketplace for their coverage—from self-employed professionals to families trying to make their budget work.

Without new action from lawmakers, the rules could snap back to how they were before 2021. This would bring back the dreaded "subsidy cliff," where earning just one dollar over 400% of the Federal Poverty Level could mean losing all your financial help. It’s a huge issue to keep an eye on, as the outcome will hit household budgets all across the country.

What’s Really at Stake Financially?

Let’s be clear: the expiration of these enhanced premium tax credits is a major threat to affordable health coverage. Projections show that millions could face massive premium hikes, forcing them to make some really tough decisions about their healthcare.

An analysis from the Kaiser Family Foundation estimates that if these subsidies end, average premium payments for Marketplace coverage could jump by a staggering 114%.

That translates to an extra $1,016 per year for the average person enrolled. For those with household incomes over 400% of the FPL—the very people who just gained eligibility—average premiums are projected to spike by more than $2,900 annually. You can play around with the numbers and see how it might affect you with these findings on enhanced premium tax credits.

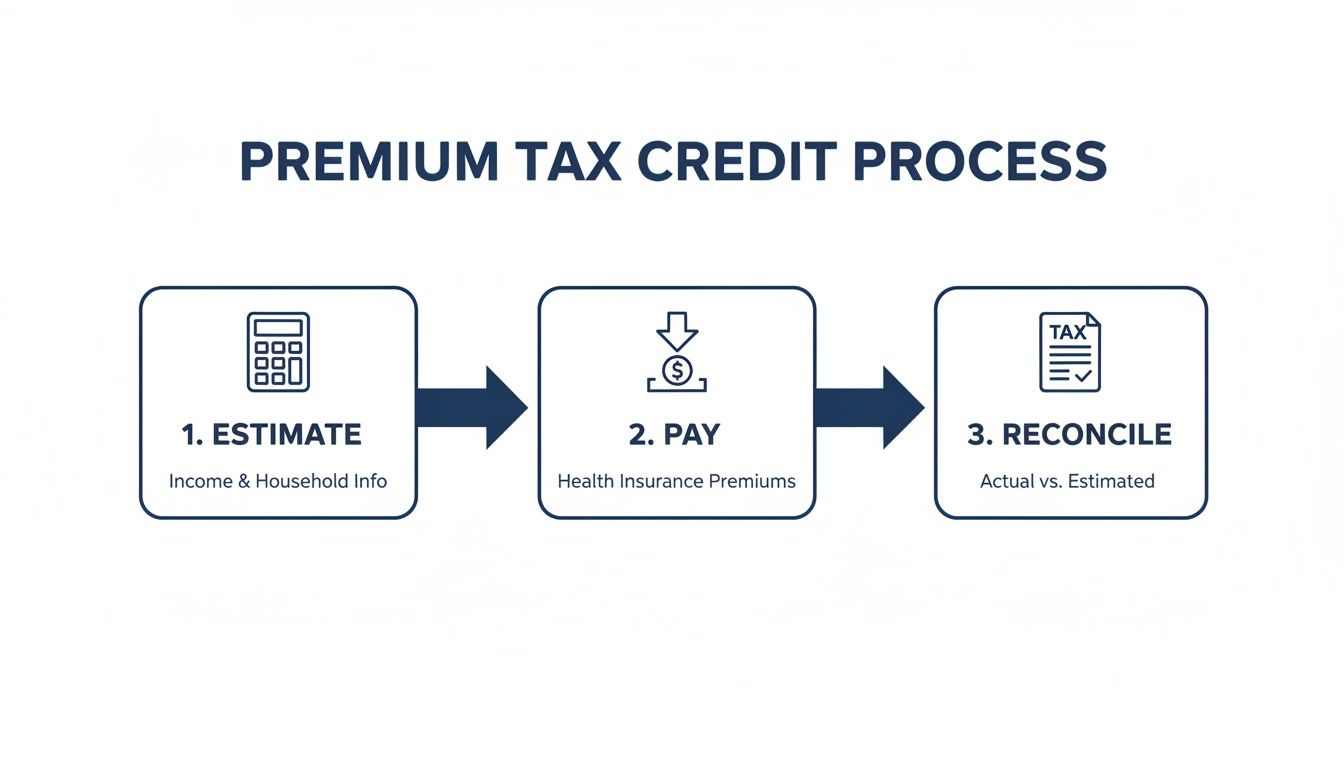

This diagram gives a simple breakdown of how the premium tax credit process works, from the initial estimate to the final reconciliation at tax time.

It really highlights why estimating your income correctly is so important. Getting it right helps you receive the correct advance payments and avoid a nasty surprise when you file your taxes.

Why You Absolutely Need to Stay Informed

Understanding what is premium tax credit is just step one. Staying on top of potential policy changes is just as critical for your financial planning. You can bet the debate over extending these subsidies will be a hot topic for lawmakers.

For anyone managing their own health insurance, this isn't just a news headline—it's a massive line item in your budget. Here’s what’s on the line:

- Affordability: Without the enhanced credits, many plans could become financially out of reach, especially for middle-income households.

- Coverage Gaps: Rising costs might force some people to drop their coverage entirely, which would increase the number of uninsured Americans.

- Rural Impact: These subsidies have been a lifeline for people in rural areas, where insurance options are often limited and premiums tend to be higher.

The potential expiration of enhanced subsidies isn’t just about numbers; it's about the real-world challenge of maintaining access to quality, affordable healthcare for millions of individuals and families.

By staying informed about what’s happening, you can better prepare for potential changes to your healthcare costs. A little proactive planning will be key to navigating this shifting landscape and making sure you and your family stay covered, no matter what.

What Happens if the Rules Change?

With the current, more generous subsidies scheduled to end, all eyes are on Washington D.C. The big question is whether lawmakers will extend them. What they decide will directly affect the wallets of millions of Americans, so it’s something every family and financial planner should be watching closely.

Lawmakers are looking at a few different options, mostly short-term extensions designed to prevent a massive price hike on health insurance premiums overnight. It's a classic balancing act—keeping coverage affordable for people versus the impact on the federal budget. Each proposal offers a different solution to that puzzle.

A Tale of Two Timelines

The main debate boils down to how long the extension should last. Two key proposals really highlight the trade-offs. One idea is a quick, one-year extension. Think of it as a temporary patch to keep costs down for now. The other is a two-year extension, which would give families more breathing room and stability, but it comes with a bigger price tag for the government.

The numbers tell a clear story.

Let's look at the one-year option. Extending the enhanced Premium Tax Credits (PTCs) for just one year would add $23.4 billion to the federal deficit in 2026. In exchange, an estimated 2 million more people would be able to keep their health insurance. The majority of that financial help would go to individuals and families earning less than $200,000 a year. If you want to dive deeper into the numbers, the Bipartisan Policy Center's analysis of PTC extensions breaks it all down.

On the flip side, a longer, two-year extension would offer more security for everyone relying on these subsidies.

This approach would increase the deficit by an estimated $55.3 billion over two years, but it would also help around 3.5 million more people get or keep their health coverage.

This really gets to the heart of the policy debate: how do you weigh the cost of the subsidies against the benefit of insuring more people? For anyone whose budget depends on the premium tax credit, the answer to "what is a premium tax credit?" is tied directly to what happens next in Congress. The best thing you can do is stay informed—it’s the only way to be ready for whatever changes are coming to your healthcare budget.

Common Questions About the Premium Tax Credit

The Premium Tax Credit is a game-changer, but the rules can feel a little tricky. Let's clear up some of the most common questions we hear from people trying to get the most out of their health plan.

What Happens If My Income Changes Mid-Year?

Life happens. A new job, a raise, or even a sudden layoff can change your financial picture in an instant.

If your income changes, you need to report it to the Health Insurance Marketplace right away. Why? Because your subsidy is tied directly to what you earn. If your income goes up, your tax credit might shrink. If it goes down, you could qualify for more help.

Keeping your profile updated is the best way to avoid a nasty surprise at tax time. A sudden job loss might even qualify you for a Special Enrollment Period, giving you a chance to switch to a more affordable plan.

Can I Get the Credit If My Job Offers Insurance?

This is a big one. Typically, the answer is no.

You generally aren't eligible for the tax credit if your employer offers a health plan that is considered both affordable and provides minimum value. A plan is usually seen as "affordable" if your share of the premium for just your own coverage is less than a certain percentage of your household income.

But there are always exceptions to the rule. It's always a smart move to double-check the exact cost and coverage details of your employer's plan before you assume you don't qualify.

Is Filing Taxes Required to Get the Credit?

Yes, absolutely. This part is non-negotiable.

To get the Premium Tax Credit, you must file a federal income tax return for the year you had coverage. This is how the IRS squares up the advance payments you received with the final credit amount you actually earned based on your real income.

If you don't file, you’ll likely have to pay back every dollar of the advance credit you received. You'll also be locked out of getting any future assistance. Don't skip this step!

Navigating these rules can feel like a maze, but you don't have to figure it out alone. The experts at My Policy Quote are here to help you find the right health plan and make sure you’re getting every dollar in savings you deserve. https://mypolicyquote.com