That first medical bill lands like a punch to the gut. The number seems impossible, the categories are vague, and the panic starts to set in. I’ve seen it happen countless times.

But here’s a secret from inside the industry: that first bill is almost never the final word. It’s an opening offer, and you have every right to question it.

Your First Move When the Medical Bill Arrives

When you’re staring at a huge, unexpected medical bill without insurance, it feels deeply personal and financially terrifying. The most important thing you can do in that moment is to breathe and shift your mindset. You are no longer just a patient; you are a consumer, and you have the right to audit what you’re being asked to pay for.

Your power comes from knowing what to do next.

Don't Pay Anything Yet—Request an Itemized Bill

Before you even think about payment plans or how you'll cover the cost, your immediate action is to call the hospital's billing department and ask for a detailed, itemized statement.

A summary bill isn't good enough. It lumps services together under confusing labels, making it impossible to see what you’re actually paying for. You need a line-by-line breakdown of every single service, medication, and supply. This document is the key to unlocking any negotiation.

Here’s a simple, effective script to use over the phone or in an email:

"Hello, my name is [Your Name], and my account number is [Your Account Number]. I've received a summary bill dated [Date of Bill], and I need a complete, itemized statement with CPT codes for every charge before I can proceed with payment. Can you please send this to my address on file?"

This simple request does two things: it signals that you’re going to be thorough, and it buys you valuable time. You aren’t legally required to pay a bill you can’t verify.

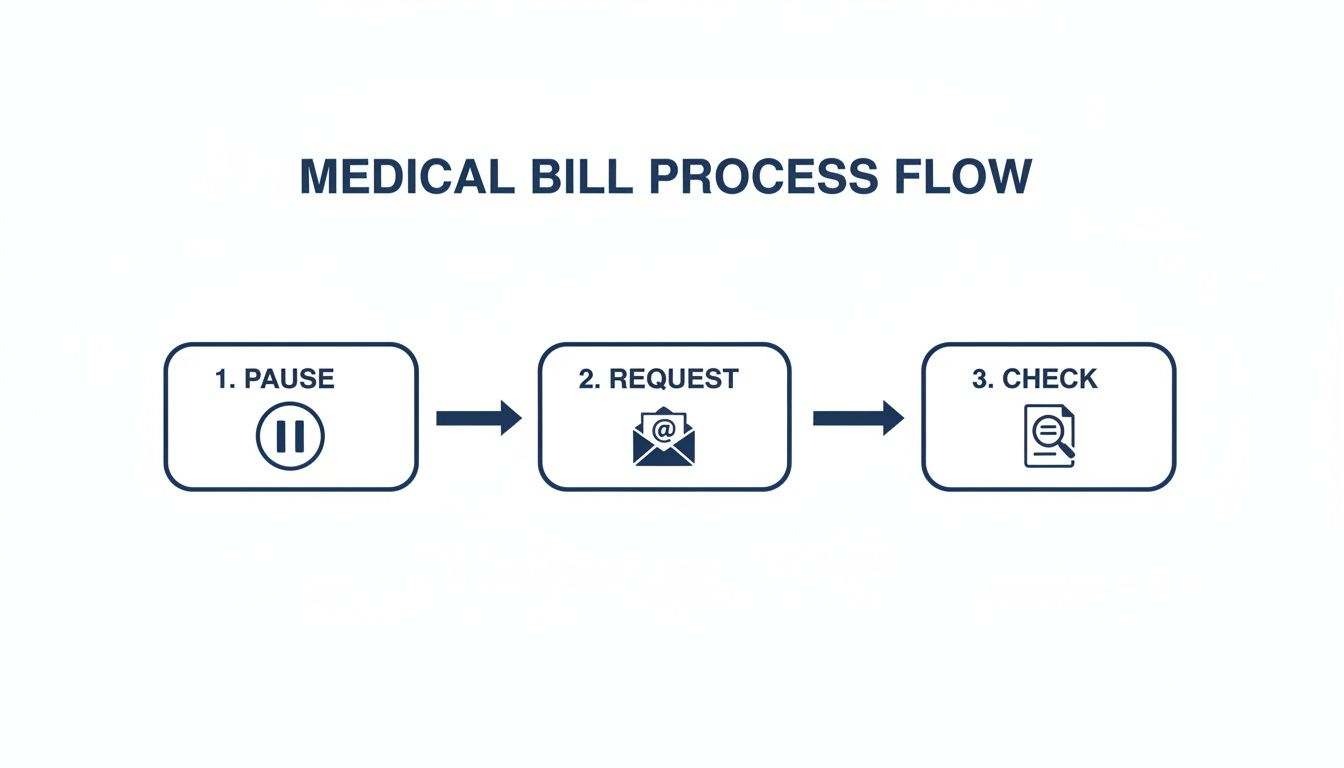

This "Pause, Request, Check" approach stops you from making a panicked decision and puts you back in control. To help you stay organized from the very beginning, here's a quick checklist of what to do the moment that bill arrives.

Initial Action Plan Checklist

This table breaks down the immediate steps to take. It's your quick-reference guide to starting the process on the right foot.

| Action Step | Why It Matters | Example Action |

|---|---|---|

| Do Not Pay | Paying anything can be seen as accepting the total charges, making negotiation harder. | Put the bill aside and add a calendar reminder for the due date. |

| Request Itemized Bill | This is your primary tool for finding errors and unfair charges. | Call billing and ask for "a detailed, itemized statement with CPT codes." |

| Confirm the Delay | Asking for the bill pauses the payment clock, giving you time without penalty. | Ask the representative, "Does this place a hold on my account until I receive and review it?" |

| Start a Communication Log | Documentation is critical. It protects you and keeps your facts straight. | Create a simple notebook or spreadsheet to track every call, name, and date. |

By following these initial steps, you've already laid the groundwork for a successful negotiation without feeling overwhelmed.

Why the Itemized Bill Is Your Most Powerful Tool

Every hospital uses something called a "chargemaster"—a master price list for everything they do. These prices are often wildly inflated and are not what insurance companies pay. Insurers negotiate huge discounts, and as a self-pay patient, you have the right to ask for a much fairer price, too.

Feeling intimidated? Don't be. Success is more common than you might think. A national survey found that 90% of people who negotiated their medical bills were able to lower them. This is especially crucial when you’re facing the fallout from medical emergencies without insurance that can ruin you financially.

The itemized bill is where you’ll find the ammunition for your negotiation. Look for common—and costly—errors like:

- Duplicate Charges: Getting billed twice for the same medication or service.

- Incorrect Services: Seeing a charge for a procedure you never had.

- Phantom Items: Finding supplies on your bill that were never used.

- Upcoding: When a service is billed with a code for a more expensive treatment.

It’s also smart to get a clear picture of who is responsible for what. For instance, understanding who pays medical bills in various situations, such as after an accident, can reveal other pathways for getting the bill covered.

Finding Billing Errors and Researching Fair Prices

Once you have that itemized bill, the real work starts. This document might look like a mess of confusing codes and medical terms, but it’s exactly where you’ll find the leverage to bring your costs down. Think of yourself as a detective, and this bill is your crime scene.

This isn’t just about catching obvious mistakes, like getting charged twice for the same MRI. Medical billing is a notoriously complex system, and errors are shockingly common. In fact, studies show a huge percentage of medical bills contain mistakes, which is a powerful reason to review yours with a fine-tooth comb.

Decoding Your Bill and Spotting Costly Errors

First, scan for the easy stuff. Did they bill you for a private room when you were in a shared one? Are there medications on the list you know you never took? These are the low-hanging fruit and quick wins.

Next, it’s time to dig into the more subtle—and often more expensive—problems. Keep an eye out for these classic billing tricks:

- Upcoding: This is when a provider bills for a more expensive service than what you actually received. For instance, you had a simple, quick consultation, but the bill has a code for a complex, hour-long exam.

- Unbundling: Some procedures are meant to be billed as a single package, or a "bundle." Unbundling is when they bill for every single part of that package separately, which almost always costs more. It's like buying a value meal but getting charged individually for the burger, fries, and drink.

- Incorrect CPT Codes: Every medical service has a specific Current Procedural Terminology (CPT) code. A simple typo can turn a routine blood test into a much more expensive diagnostic panel.

To check these codes, just do a quick online search for "[CPT code number] description" and see if it matches the service you remember. If it doesn’t, flag it. While you’re at it, understanding the structure of these documents can be a huge help. Our guide on how to read an explanation of benefits has some great tips that apply here, too.

Researching the Fair Price for Your Care

After you’ve rooted out any errors, the next step is to figure out what a fair price is for the services you actually received. That "chargemaster" price on your bill? It’s an inflated number nobody is meant to pay. Your goal is to find out what insured patients or Medicare would typically pay for the exact same service in your area.

This research is your single most powerful negotiation tool. It completely changes the conversation from, "I can't afford this," to "This charge is unreasonable based on what the market rate is."

Luckily, you don’t have to guess. Several free online tools can do the heavy lifting for you:

- Healthcare Bluebook: A fantastic resource for searching procedures to see the "Fair Price" in your zip code—which is what an insurance company usually pays.

- Fair Health Consumer: An independent nonprofit with a massive database of insurance claims. It gives you realistic, data-backed price estimates.

- MDSave: While it’s mainly a marketplace for buying medical procedures, MDSave also shows you what competitive, upfront cash prices look like. It’s another great benchmark.

Real-World Example: Sarah, a freelance graphic designer, went to the ER for a deep cut that required stitches. The hospital sent her a bill for over $2,800. She got the itemized bill, used Fair Health Consumer, and found that the CPT code for her procedure had an average local cost of around $950. Armed with this data, she calmly called the billing department, presented her research, and negotiated the bill down to $1,100.

By putting in a little time, you go from being a passive bill-payer to an empowered, informed advocate for yourself. This evidence-based approach gives you the credibility—and the confidence—to successfully negotiate.

Building Your Negotiation Strategy and Script

Alright, you’ve done the hard part. You’ve combed through that itemized bill, done your homework on fair pricing, and now you’ve got the facts on your side. This is where you shift from detective work to direct action.

Successful negotiation isn’t about picking a fight. It’s about telling a clear, logical story backed by solid proof. Think of this next step as organizing your evidence so you can walk into that phone call with unshakable confidence.

You’re not just begging for a discount—you’re showing them why a lower price is the right price.

Organizing Your Key Talking Points

Before you even think about dialing, get your thoughts on a single page. This isn't just a to-do list; it's your game plan, keeping you focused and on track when you're on the line.

Your one-page summary should have:

- Your Account Info: Full name, date of birth, and that all-important account number.

- The Starting Number: The original total on the bill.

- The Error List: A simple bulleted list of every duplicate charge, unbundled service, or anything else that looked off.

- Your Fair Price Data: The average local cost for the main services you found on sites like Healthcare Bluebook or Fair Health Consumer.

- Your Opening Offer: The first number you’re going to put on the table.

Having this in front of you is a game-changer. It stops you from getting flustered or forgetting a key detail. When the billing rep asks why you’re disputing the charge, you can calmly and confidently lay out your case, point by point. It proves you’re serious.

Crafting Your Negotiation Script

A script isn’t about sounding like a robot. It’s about building confidence. You can—and should—go off-script as the conversation unfolds, but starting with a solid framework makes all the difference. Using the right words can open doors you didn’t even know were there.

Kick off the call with a tone that’s polite but firm. Remember, the person on the other end is just doing their job. A little courtesy can go a very long way.

How to open the conversation:

"Hello, my name is [Your Name], and I'm calling about my bill, account number [Your Account Number]. I've gone over the itemized statement and have a few questions. As an uninsured patient, I'm ready to pay a fair amount today to get this resolved, but the current total seems much higher than expected."

How to present your case:

"I found a few things that might be errors, like [mention a clear example, like being charged twice for the same lab test]. On top of that, my research on Fair Health Consumer shows that the typical price for [Procedure Name] in this area is around [Your Researched Price], not the [Billed Amount] I was charged."

This approach immediately frames you as an informed and prepared patient, not just a disgruntled one. The secret is tying every request back to data.

Your power in this conversation comes from preparation. When you can cite specific errors and reference fair market prices, you shift the dynamic from asking for help to proposing a reasonable business transaction.

And the data backs this up. A 2011 study found that when patients negotiated their out-of-network bills, they successfully lowered their costs 56% of the time. The success rate jumped even higher—to 63%—when they dealt directly with the provider’s office. It just goes to show how important it is to focus your energy on the hospital's billing department. You can see the negotiation research findings for yourself here.

Using Key Phrases That Work

Some words and phrases are like cheat codes in the world of medical billing. Dropping them into the conversation can trigger standard procedures and discounts that the billing department is already authorized to give.

Here’s a quick breakdown of powerful phrases to use during your call and what they signal to the person on the other end.

Key Negotiation Phrases and What They Mean

| Phrase to Use | What It Signals | When to Use It |

|---|---|---|

| "What is the self-pay rate?" | You know uninsured patients often get a lower rate than the inflated "chargemaster" price. | Use this early in the call to establish a better starting price point. |

| "Can you offer a prompt-pay discount?" | You are offering immediate cash payment in exchange for a reduction, which is valuable to the provider. | Use this when you are ready to make a payment and want to secure a final discount. |

| "My research indicates a fair price is X." | You have done your homework and are negotiating based on data, not just what you can afford. | Use this after presenting billing errors to propose a specific new total. |

| "I'd like to settle this account today." | This signals you are serious about closing the matter and avoiding collections. | Use this phrase to create urgency and move toward a final agreement. |

Using these phrases shows you understand the system and are serious about finding a fair resolution.

Keep in mind, the first person you talk to might not have the authority to give you a big discount. If you feel like you've hit a wall, don't give up. Politely ask, "Is there a manager or supervisor I can speak with who has more flexibility on this account?" Escalating the call isn't being difficult—it's a standard part of the process.

For more tips on managing healthcare costs without coverage, our guide on a no-insurance doctor visit provides more helpful context on self-pay pricing.

Uncovering Financial Assistance and Charity Care Programs

While negotiating directly is a great strategy, there’s another path that can slash your medical debt or even wipe it out completely. So many people struggling with medical bills have no idea that a powerful safety net is already in place, often required by law.

This is the world of hospital financial assistance, also known as "charity care."

Thanks to the Affordable Care Act (ACA), every non-profit hospital in the U.S.—and that’s most of them—must have a written Financial Assistance Policy (FAP). This isn't just a nice gesture; it’s a legal obligation for them to keep their tax-exempt status. It’s their rulebook for providing free or discounted care to patients who qualify.

Locating the Hospital's Financial Assistance Policy

Here’s the catch: hospitals don't exactly advertise these programs on their homepage. They’re often buried deep in their websites, so you’ll have to do a little digging.

Start by searching the hospital’s website for a few key phrases:

- Financial Assistance Policy (or FAP)

- Charity Care

- Patient Financial Services

- Billing and Insurance

If you come up empty, just pick up the phone. Call the billing department and say, "Can you please email me a copy of your Financial Assistance Policy and the application form?" They have to give it to you. This document is your roadmap.

Understanding Eligibility and the Federal Poverty Level

Got the policy? Great. Now it’s time to see if you qualify.

Eligibility almost always comes down to your income and household size, which are measured against the Federal Poverty Level (FPL). A hospital’s policy will spell out exactly what percentage of the FPL they use to determine who gets help.

For instance, a policy might offer:

- 100% free care for households with incomes at or below 200% of the FPL.

- A sliding scale discount for those with incomes between 201% and 400% of the FPL.

The big takeaway here is you don't have to be in dire straits to qualify. Many middle-income families, especially larger ones, fall right into the eligibility window for massive discounts. We’re talking a bill reduced by 50-75% or more.

If your income is on the lower side, it’s also a good idea to look into government programs. You can learn more in our guide on how to qualify for Medicaid, since its income rules can overlap with charity care.

Navigating the Application Process

Applying for charity care feels a bit like applying for a loan—it’s all about the paperwork. Getting your documents in order ahead of time will make everything go much more smoothly.

You’ll probably need to have copies of these on hand:

- Proof of Income: Recent pay stubs, W-2s, or your latest tax return will work. If you're out of work, a letter from the unemployment office is perfect.

- Proof of Household Size: Your tax return showing your dependents is usually all they need.

- Recent Bank Statements: Some hospitals ask for these to get the full financial picture.

Treat the application with care. Fill out every single line and attach every document they ask for. The number one reason applications get denied is because they’re incomplete. Send everything in at once, then follow up to make sure they received it and ask what to expect next.

Don’t Pay a Dime Until It’s in Writing

You did it. You negotiated a lower bill, and you can practically feel the relief. Reaching that verbal agreement over the phone feels like crossing the finish line, but hold on. There's one final, absolutely critical step you cannot skip.

A spoken promise is not enough. Before you send a single dollar, you must get the new agreement in writing. This is non-negotiable. Without it, the billing department could later claim the conversation never happened, leaving you right back where you started—on the hook for the original, higher amount.

Think of this written confirmation as your financial armor. It’s what makes the deal legally binding and prevents any future "misunderstandings" or surprise bills down the road.

Lock in Your Deal Before You Pay

I’ll say it again: never make a payment until you have that written confirmation in your hands (or your inbox). That document needs to be crystal clear on three key details:

- The New Total Balance: It should show the exact dollar amount you've agreed to pay. No ambiguity.

- The "Paid-in-Full" Clause: The agreement must explicitly state that your payment will settle the account in full, leaving you with a $0 balance. This is the magic phrase.

- Payment Plan Specifics (If Applicable): If you arranged a payment plan, it needs to detail the amount of each payment, the due dates, and the total number of payments.

The easiest way to get this is to shoot a polite but direct follow-up email to the representative you just spoke with. This puts the ball in their court and instantly creates a digital paper trail.

A Simple Email to Seal the Deal

Here’s a straightforward template you can adapt. Send it to the billing department representative you negotiated with, and if you can, copy a general billing email address as well.

Subject: Confirming Our Agreement for Account #[Your Account Number]

Hi [Representative's Name],

Thanks so much for your help today, [Date].

I'm writing to confirm the agreement we reached over the phone for my account, #[Your Account Number], regarding the services on [Date of Service].

As we discussed, you agreed to accept $[New Negotiated Amount] as payment in full to settle this account.

Could you please reply to this email to confirm this is correct? As soon as I receive your written confirmation, I'll send the payment right over.

Thank you again for all your help.

Best,

[Your Name]

[Your Phone Number]

This email is professional, clear, and makes your next move (paying them) dependent on their written confirmation. It works like a charm.

What If They Won't Put It in Writing?

Occasionally, a billing department gets cagey about putting a settlement in writing. If they push back, stay calm but be firm.

Explain that you simply can't responsibly make a payment without a written record of the new agreement. It’s a reasonable request.

If they refuse to email you, you have another powerful option: send them a certified letter. Draft a letter outlining the exact terms you discussed and mail it via certified mail. This provides you with a receipt proving they received it, creating a strong form of documentation. Don't forget to keep a copy for yourself.

And, of course, keep updating your communication log with every single interaction. Meticulous records are your best defense.

A Quick Warning About Medical Credit Cards

During your talks, especially if you’re in the billing office in person, you might be offered a medical credit card. They'll pitch it as an "easy" way to handle the bill.

Be extremely careful.

These cards are almost always third-party financial products loaded with high, deferred interest rates. If you miss a payment or don’t pay off the balance inside a short promotional window, you could get slammed with crushing interest charges. A manageable debt can quickly spiral into a financial nightmare.

A direct payment plan with the hospital, documented in writing, is always the safer, more transparent choice. It keeps you in control and avoids the hidden risks of high-interest credit from outside lenders.

Finalizing your agreement the right way is just as important as the negotiation itself. By getting everything in writing, you ensure your hard work actually pays off. Then you can finally put the stress of that medical bill behind you—for good.

Still Have Questions? Let's Clear Things Up

Navigating the world of medical billing can feel like you’re trying to read a foreign language. It's totally normal to hit a roadblock or have a specific question pop up, even when you have a solid plan. Here are some direct answers to the common challenges people face when trying to lower their medical bills without insurance.

What if My Bill Was Already Sent to Collections?

That letter from a collection agency is designed to be intimidating. But it doesn't mean the fight is over. In fact, you might actually have more leverage now than you did before.

Why? Collection agencies usually buy medical debt for pennies on the dollar. That means they’re often willing to settle for a much lower amount just to close the account.

Your first move is to send a debt validation letter via certified mail. This forces them to legally prove they own the debt and have the right to collect from you. Once they've validated it, you can start negotiating directly with the agency.

Start low but keep it reasonable—think 25-50% of the balance. The goal is to land on a settlement that works for you. And here’s the most important part: get any agreement in writing before you send a single penny. It’s also smart to push for a "pay-for-delete" deal, where they agree to remove the negative mark from your credit report after you've paid.

How Big of a Discount Should I Ask For?

There’s no magic number here, but a great starting point is to aim for what an insurance company would pay. Once you've done your homework on fair prices, you can open the conversation with confidence.

Try saying something like, "My research shows the fair market rate for this service is X. Can you match that price?"

Another great tactic is to ask for standard, common-sense discounts. Here are a couple of phrases that work wonders:

- "What is the self-pay rate?" This is almost always lower than the inflated "chargemaster" price they initially send.

- "Do you offer a prompt-pay discount?" This shows them you’re ready to pay right now in exchange for a reduction. That’s music to their ears. A prompt-pay discount can often knock off 20-40%.

A good rule of thumb is to start with an offer that’s lower than what you’re actually willing to pay. This gives you some wiggle room to negotiate up and still land on a number that feels fair and affordable.

Can I Still Negotiate If I Already Made a Payment?

It’s definitely best to negotiate before paying anything, but it’s not impossible to do it after the fact. The tricky part is that making a partial payment can signal that you agree to the full price. It doesn't, however, completely shut the door.

If you’re in this spot, call the billing department and explain what happened. You could say, "I made that first payment in good faith, but after reviewing my finances, I've realized I simply cannot afford the rest of the balance due to financial hardship."

From there, you can pivot to a settlement offer. Propose a specific amount you can pay immediately to resolve the entire remaining debt. Most providers would rather get a guaranteed smaller payment now than risk you defaulting on a much larger balance down the road. For more in-depth answers and insights, you can find additional guidance on medical bill negotiation from legal experts.

At My Policy Quote, we believe that understanding your options is the first step toward financial security. While negotiating a medical bill is a powerful tool, having the right insurance coverage provides peace of mind before you ever need care. Explore your health insurance options with us today at https://mypolicyquote.com.