Let's be real—the rising cost of healthcare is enough to make anyone's head spin. If you're a freelancer, an early retiree, or just trying to find a solid plan for your family without breaking the bank, the pressure is immense. It can feel like you're navigating a maze blindfolded.

This guide is designed to turn the lights on and show you the clearest paths forward.

Global healthcare costs are climbing at an alarming rate. Projections show the worldwide average medical trend is set to jump by 10.3% in 2026. This isn't a fluke; it follows a pattern of sharp increases, with costs rising 10% in 2025 and 9.6% in 2024. For self-employed pros and 1099 contractors who have to buy their own coverage, those numbers translate directly into higher monthly premiums.

So, where do you even start?

Finding Your Main Avenues for Coverage

Before you get lost in the weeds of policy details, you need to figure out which road is even right for you. Your income, your job, and your family situation will point you in the right direction.

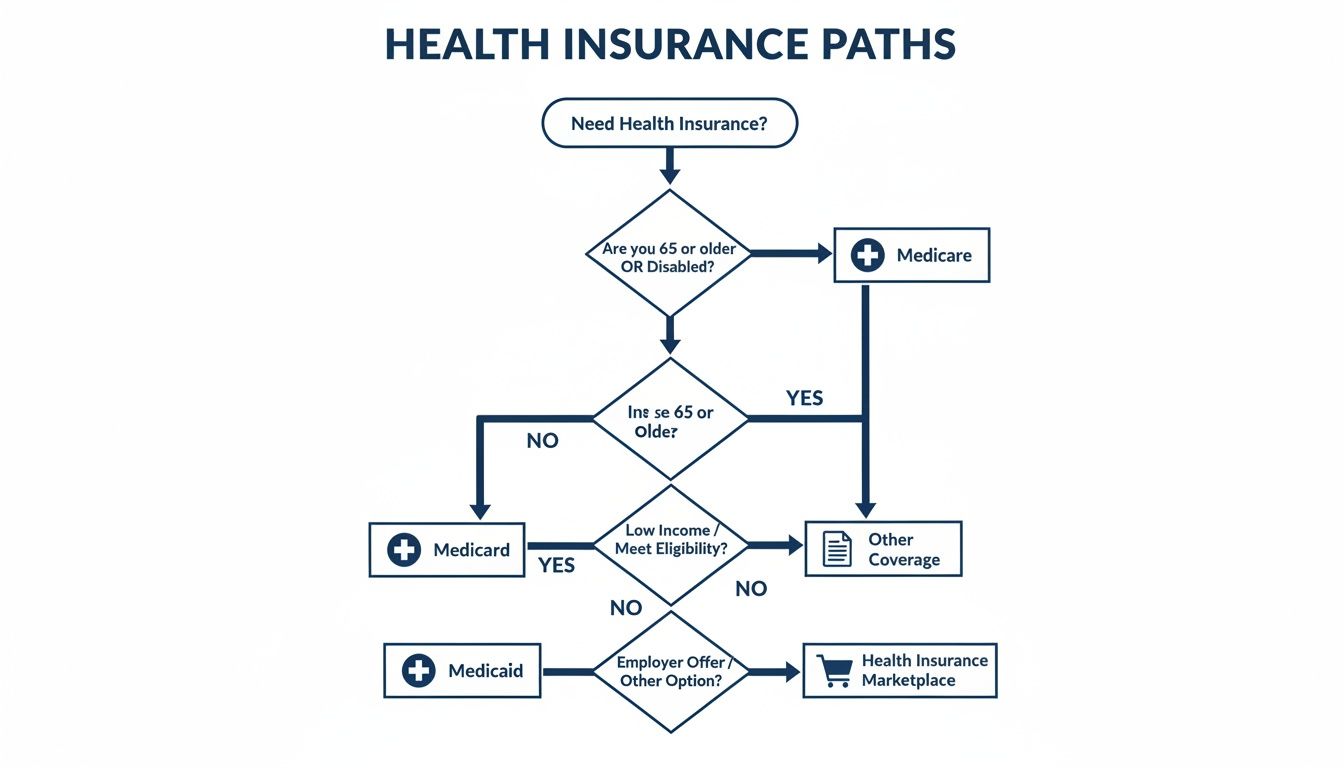

This flowchart gives you a quick visual to help you see the main routes to getting covered.

As you can see, your journey usually starts with one big question: do you qualify for help through the ACA Marketplace or Medicaid? From there, other specialized plans come into play as alternatives. It all comes down to your personal circumstances.

Your Primary Pathways to Affordable Health Insurance

Here’s a quick look at the main avenues for finding affordable coverage, who they're best for, and what makes them unique.

| Coverage Pathway | Best For | Key Feature |

|---|---|---|

| ACA Marketplace | Individuals & families without employer coverage | Income-based subsidies (tax credits) that lower monthly costs. |

| Medicaid | Low-income adults, children, and people with disabilities | Provides free or very low-cost comprehensive health coverage. |

| Other Specialized Plans | Those with specific needs (e.g., job transitions) | Includes short-term plans, COBRA, and association health plans. |

Let's break down what each of these really means for you.

The Core Pathways Explained

Understanding the basic purpose of each option will help you narrow your search and save a ton of time.

- ACA Marketplace: This is the starting point for most people who don't get insurance through a job. It's the only place where you can get income-based subsidies, also known as premium tax credits, which can seriously slash your monthly payments.

- Medicaid: This is a government program that offers free or low-cost health coverage to millions of Americans. Eligibility is typically based on income, but it also covers specific groups like children, pregnant women, older adults, and people with disabilities.

- Other Specialized Plans: This is a catch-all for everything else. Think short-term insurance to fill a temporary gap, COBRA to keep your old employer's plan after you leave, or association health plans for small business owners.

Navigating these choices is a huge part of your overall financial health. Understanding how your health insurance fits into your comprehensive financial planning is key to managing costs and building long-term security.

Ultimately, the goal is to find a plan that balances what you pay every month with the coverage you can actually use. A super-low monthly bill might look great at first, but it won't feel affordable if your deductible is so high that you avoid going to the doctor. It's crucial to learn what is an insurance premium and how it fits into the bigger picture of your total healthcare costs.

Pinpointing Your Actual Healthcare Needs and Budget

Diving into health insurance options without knowing what you need is like going to the grocery store hungry and without a list. You’re almost guaranteed to overspend and walk out without the essentials.

Before you even glance at a single plan, the first real step is to look inward. An honest self-assessment is the bedrock of a smart financial decision. It’s all about you.

So, let's get real about your health. Are you someone who basically just sees a doctor for an annual check-up? Or are you managing a chronic condition, like asthma or diabetes, that means regular appointments and prescription refills? Your answers right there will point you toward certain kinds of plans.

A healthy, self-employed graphic designer in her late 20s might lean toward a plan with a low monthly premium and a high deductible. She’s betting on her good health to keep fixed costs down. But a family with two young kids—who seem to collect ear infections like trading cards—needs predictable copays and a lower deductible, even if that means a higher monthly payment.

Looking Beyond Doctor Visits

Your healthcare needs are more than just office visits. To do this right, you need to take a full inventory of what your medical life might look like over the next year.

Grab a notepad and jot down a few things:

- Prescription Drugs: Are you on any regular medications? List them out, including the dosage. A plan that doesn't cover your specific prescriptions can turn an "affordable" policy into a financial nightmare overnight.

- Specialist Care: Do you see a chiropractor, a therapist, or another specialist? You'll want to make sure they're in-network for any plan you consider. If they aren't, you'll be paying a lot more out-of-pocket.

- Planned Procedures: Are you expecting a baby, planning a knee surgery, or anticipating any other major medical event? These big-ticket items absolutely must be part of your calculation, as they almost guarantee you'll hit your out-of-pocket maximum.

Thinking through these details is a huge part of learning how to pick the best health insurance plan for your needs, because it makes sure your choice actually fits your life.

Building a Realistic Healthcare Budget

Once you have a handle on your needs, it’s time to talk numbers. Your budget is what separates a "cheap" plan from a truly "affordable" one.

Start with your monthly income and subtract all your non-negotiable expenses—rent, groceries, gas. Whatever is left over is your starting point for what you can realistically spend on healthcare. But don't stop at the premium. You have to factor in those potential out-of-pocket costs, too.

Key Takeaway: A truly "affordable" plan is one where you can cover the monthly premium and the deductible and potential copays without going into debt. A low premium means nothing if a single trip to the ER would bankrupt you.

As you map out your budget, it's also wise to understand your backup options. Knowing how to get medical treatment without insurance can offer some perspective and a safety net, which only highlights how important it is to find a policy you can actually sustain.

Let's look at how this plays out for two different people.

- Scenario One: The Early Retiree: A 62-year-old who just retired needs coverage to bridge the gap to Medicare. He takes medication for high blood pressure and sees a cardiologist twice a year. His priority is finding a plan with a solid prescription list and a network that includes his trusted doctor. He'll probably look at a "Silver" or "Gold" plan, accepting a higher premium for lower, more predictable costs when he actually uses his insurance.

- Scenario Two: The Gig Worker: A 35-year-old freelance driver has an income that swings up and down. She needs her fixed monthly costs to be as low as humanly possible. A "Bronze" plan or a high-deductible health plan (HDHP) paired with a Health Savings Account (HSA) could be her best move. This approach keeps her premium low while letting her save tax-free money for any medical bills that pop up.

When you take the time to assess your health and build a real budget, you turn this confusing search from a guessing game into a strategic process. You’ll be ready to find a plan that not only fits your wallet but gives you genuine peace of mind.

Get Your Fair Share: Making the ACA Marketplace Work for You

For millions of people, the key to unlocking affordable health insurance isn't a secret—it’s the Affordable Care Act (ACA) Marketplace. This is more than just a website to compare plans; it's the only place you can get financial help from the government to lower your costs.

These subsidies can be a game-changer, turning a premium that feels out of reach into one that comfortably fits your budget. Let’s break down how it works.

Premium Tax Credits: Your Monthly Discount on Health Insurance

The most common type of help is the Premium Tax Credit (PTC). Think of it as an instant discount that slashes your monthly insurance bill. When you apply for coverage on HealthCare.gov or your state’s exchange, you'll provide an estimate of your household income for the upcoming year. The system uses that number to figure out how much of a tax credit you qualify for.

You have a choice in how you get this money:

- Lower Your Monthly Bill: Most people choose to have the credit sent directly to their insurance company each month. This is called an "advance premium tax credit," and it means you pay less right away.

- Get It at Tax Time: You could also pay the full premium every month and then claim the entire credit as a lump sum when you file your federal income taxes.

The size of your PTC is directly linked to your income and the price of a standard "Silver" plan in your area. The whole point is to make sure you don't have to spend more than a certain percentage of your income to stay covered.

Before you even fill out an application, you can use the official window shopping tool on HealthCare.gov to see what kind of savings you might get. It’s a great way to preview plans without any commitment.

The Real Game-Changer: Cost-Sharing Reductions

But wait, there's more. The second type of subsidy is called Cost-Sharing Reductions (CSRs), and this is where the savings can get really powerful.

These aren't about your monthly premium. Instead, CSRs lower your out-of-pocket costs—your deductible, copayments, and coinsurance. If you qualify for a PTC and your income is up to 250% of the federal poverty level, you could be eligible for these extra savings.

Here's the critical part: You must enroll in a Silver plan to get cost-sharing reductions. They aren't available on Bronze, Gold, or Platinum plans. This makes Silver plans an incredible value for those who qualify, often giving you the low out-of-pocket costs of a Gold plan for the price of a Silver one.

For a family with active kids or anyone managing a chronic condition, these reductions can easily save you thousands of dollars a year.

The Freelancer's Dilemma: How to Estimate Your Income

If you're a gig worker, freelancer, or have an income that goes up and down, estimating your annual earnings can feel like you’re trying to predict the future. But getting this number right is so important.

If you estimate too low, you might have to pay back some of your tax credit when you file your taxes. If you estimate too high, you’ll end up overpaying for your insurance all year long.

Here’s a down-to-earth approach:

- Start with the Past: Look at what you earned over the last 12-24 months. This gives you a realistic baseline.

- Look at What's Ahead: Do you have signed contracts or projects already lined up? Add that in.

- Be Honest About Changes: Are you planning to raise your rates? Expecting a slow period? Adjust your estimate accordingly.

- Keep It Updated: Life happens. If you land a huge project or lose a major client, report that income change to the Marketplace right away. It will adjust your subsidy and save you from a nasty surprise at tax time. If you’ve recently lost a job, our guide on how to get health insurance with no job can offer more targeted advice.

It's also smart to keep an eye on what's happening in the larger healthcare world. Some insurers are proposing ACA Marketplace premium hikes of 26% on average for 2026. The situation could get even tougher if the enhanced federal tax credits expire, which might cause monthly payments to more than double for a lot of people. It’s worth taking a moment to learn more about these potential ACA premium increases to see how your budget could be affected down the road.

Health Insurance Options Beyond the Marketplace

The ACA Marketplace is a fantastic tool, but it’s definitely not the only game in town. Depending on your income, job situation, or even if you just need temporary coverage, looking at the alternatives can unlock the truly affordable health insurance you've been searching for.

Thinking outside the exchange box reveals a whole new set of possibilities that might be a much better match for your life.

Sometimes the best deal is the one you didn't know existed. From government programs to private plans built for specific scenarios, it pays to understand the entire landscape before you lock anything in. Let’s explore some of the most valuable options available beyond the standard Marketplace.

Medicaid and the Children's Health Insurance Program (CHIP)

For low-income individuals and families, Medicaid is an absolute lifeline. This isn't a Marketplace plan; it's a joint federal and state program offering free or extremely low-cost health coverage. Eligibility is mostly about your income (specifically, your Modified Adjusted Gross Income or MAGI), but it also covers certain groups like pregnant women, seniors, and people with disabilities.

CHIP is a similar program but designed just for children (and sometimes pregnant women) in families who make a bit too much for Medicaid but still can't afford a private plan. Both programs provide comprehensive benefits, often covering things many private plans won't touch.

The best part? You can apply for Medicaid or CHIP any time of year—no waiting for a special enrollment window. Just fill out an application on the Health Insurance Marketplace. The system will automatically see if you’re eligible and walk you through what to do next.

Short-Term Health Insurance

What if you just need to bridge a gap in coverage? Maybe you’re between jobs or waiting for your new benefits to kick in. This is exactly what short-term health insurance was made for. Think of it as a temporary safety net, built to protect you from a catastrophic medical bill for a limited time.

The biggest plus is their super low premiums. But that affordability comes with some major catches you absolutely have to know about.

Crucial Warning: Short-term plans do not have to follow ACA rules. This means they aren’t required to cover essential health benefits. More importantly, they can deny you coverage or refuse to pay for anything related to a pre-existing condition.

These plans are really a last resort for healthy people who need temporary, major medical protection and have no other choice. Read every single word of the fine print before you even think about signing up.

COBRA: Continuing Your Employer Coverage

If you recently left a job where you had health insurance, COBRA might be on the table. This federal law (the Consolidated Omnibus Budget Reconciliation Act) lets you and your family stay on your old employer’s health plan for a limited time, usually 18 months.

The main benefit here is continuity. You keep the exact same plan, same doctors, and same deductible, which is a huge relief if you’re in the middle of treatment. The major downside? The cost. You suddenly have to pay the entire premium—your part, your former employer's part, and a small admin fee. It often makes COBRA one of the priciest options out there.

Still, for someone with serious, ongoing health needs, that high COBRA price tag might actually be more "affordable" in the long run than starting over with a new plan, a new network, and a brand-new deductible to hit.

Association Health Plans (AHPs)

For small business owners, freelancers, and 1099 contractors, Association Health Plans (AHPs) can be a game-changer. These plans let small businesses and self-employed people team up based on their industry or location to buy insurance like they’re one big company.

By creating a larger group, AHPs can often negotiate better rates and stronger benefits than a freelancer or a tiny business could ever get alone. It’s a way to get the kind of buying power that’s usually reserved for huge corporations.

- Who they're for: Small business owners, gig economy workers, and independent contractors.

- How to find them: Check with your professional organizations, local chamber of commerce, or freelance unions.

- The benefit: Potentially lower premiums and richer benefits than what you’d find on the individual market.

Finally, don’t forget you can always buy a policy directly from an insurance company, completely separate from the government exchange. Exploring these off-exchange health plans can sometimes reveal policies not listed on the Marketplace, giving you even more choices to compare.

How to Compare Plans and Enroll with Confidence

You’ve done the research and narrowed down your options. Now for the moment of truth: picking the final plan. The single most important skill you can learn here is to look past the monthly premium. That sticker price rarely tells the whole story.

A real cost-benefit analysis means digging into the details that determine what you'll actually pay when you need care. This is where you go from just finding a plan to finding the right plan for your life.

Decoding the Language of Cost

Health insurance policies are famous for their confusing jargon, but it all comes down to how and when you pay for services. Getting these three key concepts down is non-negotiable.

- Deductible: This is what you have to pay out-of-pocket for covered services before your insurance plan starts chipping in. If your deductible is $3,000, you're on the hook for the first $3,000 of your medical bills.

- Copay & Coinsurance: Once you've met your deductible, you'll start sharing the cost. A copay is a flat fee (like $40 for a specialist visit), while coinsurance is a percentage (like 20% of a hospital bill).

- Out-of-Pocket Maximum: This is your financial safety net. It's the absolute most you will have to pay for covered care in a single year. Once you hit this number, your insurance covers 100% of everything else. It's what prevents a medical crisis from becoming a financial catastrophe.

The Details That Make or Break a Plan

Beyond the big three costs, two other elements can make a plan a perfect fit or a costly mistake. Ignoring them is one of the most common blunders people make.

First, you absolutely must check the provider network. A plan is only "affordable" if your favorite doctor, go-to specialist, and local hospital are actually in it. Step outside that network, and you could be facing massive, unexpected bills that your insurance won't touch.

Second, always review the drug formulary. This is just the plan's official list of covered prescription drugs. If you take medication regularly, you need to confirm it’s on the list—and at what price. A cheap plan that doesn't cover your $500 monthly prescription is no bargain at all.

A plan's true value isn't its price tag; it's how well it covers your specific needs. A "Gold" plan might seem expensive, but if it covers your doctor and medication with low copays, it could save you thousands compared to a "Bronze" plan that covers neither.

Navigating Your Enrollment Window

Timing is everything. You can't just sign up for health insurance whenever you feel like it. You have to enroll during specific, designated periods.

The main event is the annual Open Enrollment Period (OEP), which typically runs from November 1 to January 15 in most states. This is the one time of year when pretty much anyone can sign up for a new plan, no questions asked.

But what if you lose your job in June or have a baby in March? That's where a Special Enrollment Period (SEP) comes into play. Certain "qualifying life events" open up a 60-day window for you to get covered outside of the OEP.

Common qualifying events include:

- Losing your job-based health coverage

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new zip code or county

Missing these windows can leave you uninsured until the next Open Enrollment rolls around, so it's critical to act fast when your life changes.

Your Final Comparison Checklist

Once you have your top two or three plans, it's time for a final, side-by-side showdown. This last check will give you the confidence that you're making a fully informed decision based on your unique situation.

Use this simple table to make the comparison crystal clear.

| Feature to Compare | Plan A | Plan B | Your Best Fit? |

|---|---|---|---|

| Monthly Premium | |||

| Annual Deductible | |||

| Out-of-Pocket Max | |||

| Primary Doctor in Network? | Yes / No | Yes / No | |

| Specialist(s) in Network? | Yes / No | Yes / No | |

| Prescriptions Covered? | Yes / No | Yes / No |

When you methodically work through these steps, you take the guesswork out of the equation. You'll be able to enroll with complete confidence, knowing you've truly found the most affordable and effective health insurance for you.

Your Questions on Affordable Health Insurance Answered

Even after you've done all the research, a few nagging questions can make you hesitate. It's totally normal. Let's walk through some of the most common—and tricky—scenarios people run into when trying to find affordable coverage. We'll get you clear, direct answers so you can move forward with confidence.

This process almost always brings up a few "what if" situations that feel like deal-breakers. Let's clear those up right now.

What if I Earn Too Much for Subsidies?

This is an incredibly frustrating spot to be in, often called the "subsidy cliff." You're stuck. You don't qualify for financial help, but the full price of a plan feels completely out of reach. It’s a real financial squeeze, but you aren't out of options.

Your first move should be to explore off-exchange plans. These are policies sold directly by insurance companies, and sometimes they offer plans you won't find on the official Marketplace.

You also have a few other powerful strategies to consider:

- High-Deductible Health Plan (HDHP): When you pair an HDHP with a Health Savings Account (HSA), you get the best of both worlds. The HDHP keeps your monthly premium low, and the HSA lets you set aside money for medical expenses 100% tax-free. It's a huge financial advantage.

- Association Health Plans (AHPs): Are you part of a professional organization or your local chamber of commerce? An AHP might give you access to group rates that are way more affordable than what you'd find on your own.

An independent insurance broker can be your best friend here. They can quickly compare all these different routes to find the most cost-effective path for your specific income.

Can I Get Coverage with a Pre-existing Condition?

Yes. Absolutely. This is one of the most critical protections offered by the Affordable Care Act (ACA). Every single plan sold on the Health Insurance Marketplace is legally required to cover your pre-existing conditions from day one.

Insurers cannot charge you more or flat-out deny you coverage because of your health history. It doesn't matter if you have asthma, diabetes, or a past cancer diagnosis—you are protected.

One word of caution, though: be careful with plans sold outside the Marketplace, like short-term insurance. These plans usually do not cover pre-existing conditions and aren't required to follow ACA rules. For guaranteed protection, an ACA-compliant plan is your safest bet.

What Is the Real Difference Between an HMO and a PPO?

Honestly, the choice between an HMO and a PPO boils down to one thing: flexibility versus cost. Getting this right is the key to picking a plan that actually fits your life and your wallet.

An HMO (Health Maintenance Organization) usually comes with a lower monthly premium. The trade-off is that you have to use its specific network of doctors and hospitals. You'll also need a referral from your primary care physician (PCP) before you can see any specialists.

A PPO (Preferred Provider Organization) gives you much more freedom. You can see providers both in and out of your network without a referral, though you’ll pay a lot less if you stay in-network. That flexibility, of course, comes with a higher monthly premium.

- Choose an HMO if: You want to save money, your favorite doctors are already in the network, and you don’t mind getting referrals to see a specialist.

- Choose a PPO if: You value choice, want to see specialists on your own terms, or need the freedom to see providers who are out-of-network.

Making the right call here means your plan will actually work for you when you need it most.

Navigating the world of health insurance can feel complicated, but you don't have to do it alone. The experts at My Policy Quote are here to help you compare plans, understand your options, and find the coverage that truly fits your life and budget. Visit My Policy Quote today to get a free, no-obligation quote and take the first step toward peace of mind.