When you’re looking at health insurance, the acronyms can start to blend together. HMO, EPO… what’s the real story? At their core, both plans are built around a network of doctors to help control costs. But how you use that network is where things get interesting.

Think of it like this: An HMO (Health Maintenance Organization) is like having a dedicated tour guide for your health. You choose a Primary Care Physician (PCP) who coordinates everything for you, and you need a referral from them to see a specialist. It’s structured, predictable, and often cheaper.

An EPO (Exclusive Provider Organization), on the other hand, gives you more freedom to explore on your own—as long as you stay within the approved travel zones. You don’t need a referral to see a specialist, giving you direct access. It’s more flexible but might come with a slightly higher price tag.

HMO vs EPO A Quick Comparison to Guide Your Choice

Choosing between an HMO and an EPO often comes down to a simple trade-off: Do you prefer lower costs and a coordinated approach, or are you willing to pay a bit more for the freedom to manage your own care?

The biggest split between these two plans really boils down to two things: whether you need a Primary Care Physician (PCP) to act as your "gatekeeper" and whether you must get a referral before seeing a specialist.

This choice directly shapes how you access medical services, what you’ll pay out-of-pocket, and how streamlined your healthcare experience feels. The right decision is deeply personal and depends on your health needs, your budget, and how you prefer to interact with the medical system. For a wider view, check out our guide on how to compare health insurance plans.

To make it even clearer, let’s put them side-by-side.

HMO vs EPO Key Differences at a Glance

This table cuts through the noise and lays out the fundamental differences, giving you a quick snapshot of how each plan works in the real world.

| Feature | HMO (Health Maintenance Organization) | EPO (Exclusive Provider Organization) |

|---|---|---|

| Out-of-Network Coverage | None, except for true emergencies. All routine care must be in-network. | None, except for true emergencies. All routine care must be in-network. |

| Primary Care Physician (PCP) | Required. Your PCP is your main point of contact and manages your overall care. | Not required. You can self-direct your care and see any in-network doctor. |

| Specialist Referrals | Required. You must get a referral from your PCP before seeing any specialist. | Not required. You can book appointments directly with in-network specialists. |

| Typical Monthly Premiums | Generally lower, thanks to the structured network and "gatekeeper" PCP model. | Often somewhere between an HMO and a PPO, balancing flexibility with network limits. |

Ultimately, both plans require you to stay within their network for your care to be covered. The main difference is how you navigate that network. One gives you a guide, and the other gives you a map.

HMO vs. EPO: What's the Real Difference?

To really get the difference between an HMO and an EPO, you have to look past the acronyms and see the philosophy behind them. They're two totally different ways of approaching healthcare, each trying to find that sweet spot between cost, freedom, and access to doctors.

A Health Maintenance Organization (HMO) is all about coordinated care. Think of it like having a team captain for your health—your Primary Care Physician (PP).

This "gatekeeper" model is the heart and soul of an HMO. Your PCP isn't just for your yearly physical; they're your first call for almost everything. Need to see a heart specialist or a dermatologist? You have to go through your PCP first to get a referral. This system is designed to keep care coordinated and make sure specialist visits are truly necessary, which helps keep costs down for everyone.

The EPO: A Different Approach

On the other hand, an Exclusive Provider Organization (EPO) works on a more direct-access model. It takes the network rules of an HMO but gives you the freedom you’d normally find in a PPO.

With an EPO, you don't need a PCP to act as a gatekeeper, and you don't need referrals to see specialists. If your knee is acting up and you want to see an orthopedic surgeon in your network, you just make the appointment. It’s a huge plus for convenience. But that freedom comes with a very important catch. While some plans feel similar, you can read our guide to understand what POS means in health insurance and see how it fits into the mix.

The big trade-off with an EPO is this: you get the freedom to manage your own care, but you take on all the financial risk if you step outside the network. Go to an out-of-network provider by mistake for anything other than a true emergency, and you could be stuck with 100% of the bill.

You can see this play out in the real world. A KFF survey in 2023 showed that while PPOs are still the most common employer-sponsored plan, HMOs make up about 13% of the market. EPOs have become a popular middle ground—they ditch the referrals like a PPO but hang on to the strict network of an HMO. For a family used to having direct access to specialists, an EPO can feel totally normal, right up until a wrong turn out-of-network leads to a shocking bill.

A Detailed Breakdown of HMO vs EPO Features

When you dig into the difference between HMO and EPO plans, you move past the basics and get into the details that actually shape your healthcare experience. It's all about the real-world trade-offs you make between network access, how you get care, and what you pay. Let's put these core features side-by-side to see how they really stack up.

Network Size and Flexibility

The first thing to look at—and maybe the most important—is the provider network. Both HMOs and EPOs are built around a simple idea: use a curated list of doctors and hospitals to keep costs down. But how they build those lists can be quite different.

HMO networks often feel more local and can be smaller, usually built around a specific hospital system or medical group. This tight-knit setup is what makes their coordinated care model work so well.

EPO networks, on the other hand, might give you a broader selection of providers over a larger geographic area. It's a nice perk, but the rule is the same: you absolutely must check that every single doctor, lab, or specialist is in-network before you go.

Out-of-Network Coverage Rules

This is where both plans are identical—and it's a huge financial risk if you're not paying attention. For anything other than a true life-or-death emergency, both HMO and EPO plans offer zero coverage for out-of-network services.

Let that sink in. If you see a doctor or go to a hospital outside your plan’s approved list, you are on the hook for 100% of the bill. The only time this rule doesn't apply is in a genuine medical emergency, where your plan has to cover care at the nearest facility that can help you.

This strict in-network rule is the backbone of both HMOs and EPOs. It’s how they control costs, but it puts all the responsibility on you. You have to be the one to confirm a provider's network status before every single visit. No exceptions.

PCP and Referral Requirements

Here’s where the two plans really diverge. The way you get to a specialist is a major difference, pitting the HMO "gatekeeper" model against the EPO's more direct approach.

With an HMO, you choose a Primary Care Physician (PCP) to be your healthcare quarterback. Need to see a cardiologist or a dermatologist? You have to get a referral from your PCP first. It’s a system designed to coordinate care, but honestly, it can sometimes slow things down.

An EPO flips the script. You don't need a PCP, and you don't need referrals. If you wake up with a skin issue and want to see a dermatologist, you just find one in your network and book the appointment yourself. That freedom is a massive plus for anyone who wants to take the reins of their own healthcare.

Comparing Access Models

- The HMO Way: Your PCP is your guide.

- Step 1: You feel sick, so you make an appointment with your in-network PCP.

- Step 2: Your PCP checks you out and agrees you need a specialist, so they issue a referral.

- Step 3: You can now call and schedule with the approved, in-network specialist.

- The EPO Way: You're in the driver's seat.

- Step 1: You decide you need to see a specialist.

- Step 2: You pull up your plan's directory and find an in-network specialist that fits your needs.

- Step 3: You call their office and book the appointment directly. Simple as that.

Cost Structures Compared

While your exact costs will depend on your state and insurer, there are some common patterns you'll see with HMO and EPO plans. It’s also important to understand the relationship between different out-of-pocket costs, like coinsurance vs copay.

HMOs are famous for their lower monthly premiums. You're trading the flexibility of an open network for that affordability. They also tend to have predictable, flat copayments for things like doctor visits and prescriptions.

EPOs often come with slightly higher premiums than HMOs, which is the price for getting direct access to specialists. Their costs might also lean more on deductibles and coinsurance, meaning you pay a percentage of the bill yourself after hitting your annual deductible.

How Each Plan Impacts Specialist Access and Care Coordination

The rules around referrals and having a Primary Care Physician (PCP) aren't just extra paperwork—they completely shape how you manage your health. This is where the real-world difference between HMO and EPO plans truly comes to life, especially when you need to see a specialist or manage ongoing treatment. Each plan offers a totally different experience, with its own set of trade-offs.

An HMO is built around the idea of coordinated care, with your PCP as your central point person. This "gatekeeper" system is designed to make sure all your care is connected and truly necessary. For someone managing a chronic condition like diabetes or heart disease, this structure can be a huge plus, since one doctor has the full picture of your treatment plan.

But this system can also feel restrictive. If you need to see a specialist, you have to get a referral from your PCP first, and that extra step can sometimes slow things down.

The HMO Gatekeeper Model

- The Upside: Your PCP knows your entire health history, which leads to more connected, holistic treatment. This is gold for long-term health issues.

- The Downside: That referral process is an extra hoop to jump through. You have to book a PCP visit before you can even think about scheduling with a specialist.

- The Cost Angle: By making sure specialist visits are medically necessary, the gatekeeper model helps keep a lid on overall healthcare costs—which in turn helps keep your premiums down.

An EPO, on the other hand, puts you in the driver's seat. You get the freedom to direct your own care and book appointments straight with any in-network specialist you want. This direct access is a massive draw for people who feel confident navigating their own healthcare journey and want to skip the extra steps.

The risk? Fragmented care. Without a PCP coordinating everything, your specialists might not be talking to each other. That can lead to conflicting advice or duplicate tests. You become the one responsible for making sure your cardiologist knows what your endocrinologist prescribed.

The core trade-off is control versus coordination. An HMO offers a guided, integrated experience that can be ideal for complex health needs, while an EPO provides the autonomy to build your own care team, demanding more personal involvement.

This isn't just theory; the data backs it up. One major study showed that HMO members generally have fewer specialist visits, with their care focused within a smaller, connected group of providers. EPOs borrow the strict network rules from HMOs to control costs, but they empower you with direct access, which creates a completely different pattern of care. You can explore more about these utilization findings to see how a plan's design directly influences patient behavior.

Which Plan Fits Your Life? Real-World Scenarios

The technical details of HMOs and EPOs are one thing, but how they actually work in your life is what really matters. The best plan isn't about a list of rules; it's about how those rules fit your health needs, your budget, and your day-to-day reality.

Let's walk through a few common situations to see how the difference between HMO and EPO plans plays out in the real world.

For the Healthy Self-Employed Professional

Picture a freelance graphic designer. You're generally healthy, and your doctor visits are mostly for annual check-ups. Your biggest priority? Keeping monthly business costs down, which means finding a health plan with a low premium. You're organized and don't mind a little extra legwork if it keeps more money in your pocket.

For you, an HMO is likely the better fit.

- Lower Premiums: The biggest win here is the lower monthly bill, which is a huge deal for managing your business cash flow.

- Predictable Copays: Routine visits come with simple, flat fees. No guesswork, just straightforward budgeting.

- Minimal Hassle: Since you’re not juggling specialist appointments, the primary care physician (PCP) referral process isn't a big deal.

When your healthcare needs are predictable and cost is king, the structured, budget-friendly nature of an HMO just makes sense.

For the Early Retiree Managing Multiple Conditions

Now, let's think about someone in their early 60s who just retired. They're actively managing a few chronic conditions, like arthritis and high blood pressure, and regularly see a cardiologist and a rheumatologist. The most important thing for them is sticking with these specific doctors without jumping through hoops. Cost matters, but not as much as direct, easy access to their trusted care team.

In this case, an EPO often makes more sense.

- Direct Specialist Access: They can just call up their in-network specialists and book an appointment. No waiting for a PCP referral means no delays in care.

- Care Team Continuity: As long as their favorite doctors are in the EPO network, they can keep those important relationships going strong.

When you're coordinating with multiple specialists, the freedom to manage your own care is a massive advantage. The critical first step, though, is to confirm that every single one of your doctors is in that EPO network before you sign up.

The choice between an HMO and an EPO isn't always about what you'd prefer—it's often about what's available. The individual health insurance market has shifted almost entirely to these types of managed care plans, forcing people to decide which kind of network restriction works best for them.

The numbers don't lie. In the 2023 individual market, a staggering 82% of all available plans were either HMO or EPO designs. For most people buying their own insurance, the question isn't if they'll accept a narrow network, but which style they can live with: the HMO's "gatekeeper" model or the EPO's direct-access approach. You can dig deeper into this trend in this McKinsey analysis of the individual insurance market.

For a Young Family with Kids

Finally, imagine a working-class family with two little ones. Kids get sick. It means unexpected trips to the pediatrician, sudden fevers, and sometimes, a visit to an allergist or an ear, nose, and throat (ENT) doctor. This family needs a smart balance between affordability and getting fast access to care when a child is unwell.

The choice here can be tricky, but an EPO often has the edge.

When your child has another ear infection, being able to go straight to an in-network ENT without waiting for a PCP referral is a huge relief for a worried parent.

While an HMO's lower premium is tempting, that referral process can add a layer of stress and delay you just don't need when your kid is sick. The slightly higher premium for an EPO might be a small price to pay for quicker, more direct access to the pediatric specialists your family needs.

Making Your Final Decision with Key Questions to Ask

Choosing the right health plan really comes down to what fits your life. The true difference between HMO and EPO plans gets crystal clear when you start asking honest questions about your health, your budget, and how you prefer to get care.

Before you lock anything in, it can be a huge help to consult with insurance agents who can walk you through the fine print. But you can get a great head start by thinking through these points on your own.

Questions for Your Final Checklist

- Are my doctors on the list? Don't just assume. Make a list of every single doctor, specialist, and hospital you and your family count on. Then, check their network status for each plan you're considering. This is non-negotiable.

- How much freedom do I need to see a specialist? Think about your health needs. Is waiting for a referral from a primary care physician (PCP) just a minor inconvenience, or is it a genuine barrier to getting the care you need quickly? Be honest with yourself.

- What’s the real total cost going to be? It’s so easy to get fixated on the monthly premium, but that's only one piece of the puzzle. You have to look at the deductibles, copays, and especially the out-of-pocket maximum to understand what your worst-case financial scenario looks like.

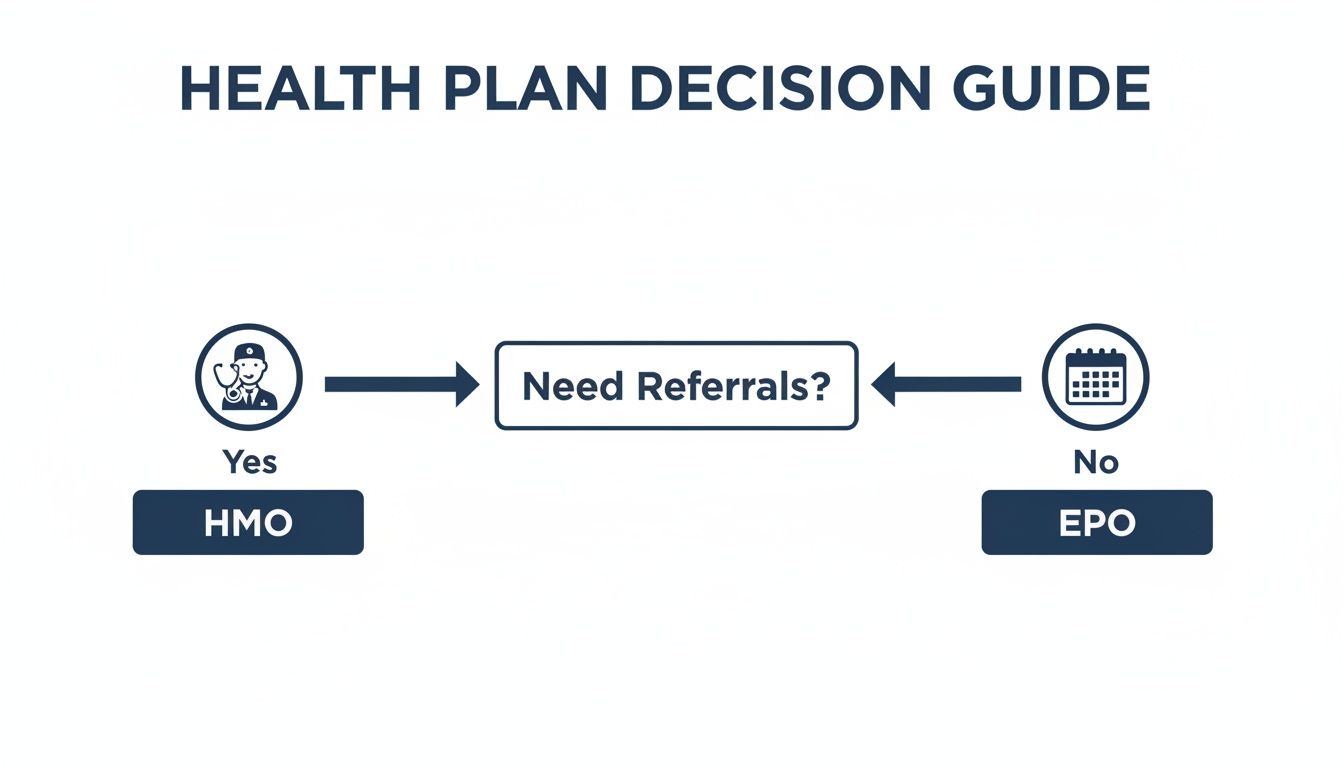

This simple chart boils the main choice down to one key difference: referrals.

As you can see, if you value the coordinated, "gatekeeper" style of care from a PCP, an HMO is your most direct path. Answering these questions for yourself is the first step in learning how to pick the best health insurance plan for your needs.

Your Top HMO vs. EPO Questions Answered

Even after laying out the basics, a few real-world questions always pop up. Let's tackle some of the most common ones to clear up any lingering confusion between HMO and EPO plans.

Can I Ever Get Out-Of-Network Care Covered?

For the most part, both plans operate on a simple rule: stay in-network. This is the core of how they keep costs down. The only real exception is a true medical emergency.

If you’re facing a life-threatening situation, your job is to get to the nearest hospital, period. Your plan is legally required to cover that emergency care, regardless of network status. But for anything else? You’ll likely be paying 100% of that bill yourself.

What if My Favorite Doctor Leaves the Network?

This one’s tough, and it can feel incredibly stressful. If a doctor you trust leaves your plan's network in the middle of the year, you’ll have to find a new, in-network provider to keep your care covered.

It’s always worth calling your insurance company right away. Some plans offer a short "continuity of care" exception, especially if you're in the middle of active treatment for a serious condition. They can walk you through your specific options.

When you’re making this choice, it’s not just about rules on a page—it's about how you live your life. Ask yourself: Do I prefer the structured, coordinated care of an HMO, or does the direct-access freedom of an EPO feel like a better fit for me?

To help you sort through these personal priorities and compare plans side-by-side, a comprehensive health insurance selection form can be a great tool. It helps you organize your thoughts and make a decision you feel confident about.

At My Policy Quote, we’re here to make the complicated world of health insurance feel simple. Get a free, no-obligation quote today and let's find the plan that truly fits your life.