Picking the right health insurance isn't about finding some magical, one-size-fits-all plan. It’s about striking the perfect balance between what you pay each month and the coverage you’ll actually use when life happens.

The process boils down to taking a clear, honest look at your health, getting comfortable with a few key insurance terms, and then comparing plans based on your financial reality.

How to Start Your Health Insurance Search with Confidence

Let's be real—choosing a health insurance plan can feel like a total nightmare. But with the right approach, you can turn that confusion into clarity. Instead of just diving into an endless sea of plans, the first step is always to look inward.

This guide is built for people in the real world. Maybe you're a freelancer with an income that goes up and down, a family trying to plan for the future, or an early retiree navigating those tricky pre-Medicare years. We’re going to skip the jargon and give you a practical framework to work from.

First, Understand the Bigger Picture

Before we get into the nuts and bolts of U.S. plans, it helps to see how healthcare works elsewhere. For anyone with international ties or experience with the UK system, understanding those differences is a great place to start. A detailed look at Private Healthcare vs NHS a UK Comparison can give you a fresh perspective on how different countries handle care, which is great context for making your own decision.

Why does this matter? Because your choice isn’t just about a policy—it’s about protecting your financial future.

One of the biggest signals to watch for is how fast medical costs are climbing. Globally, medical inflation has often been two to three times higher than general inflation. So, if everything else costs 3% more this year, your medical care might be jumping 6–9%.

This trend tells us one thing loud and clear: prioritizing your out-of-pocket maximum and the depth of your coverage over a rock-bottom premium is almost always the smarter long-term move. You can dig deeper into these global health insurance market trends on inubesolutions.com.

The goal isn't just to buy insurance; it's to buy the right insurance. That means creating a financial safety net that protects both your health and your wealth from unexpected shocks.

Decoding the Language of Health Insurance

Before you can find the right health insurance plan, you need to speak the language. The world of insurance is packed with acronyms and terms that can feel like a foreign dialect, but they're much simpler once you connect them to your own life and wallet.

Getting a handle on these core concepts is the first real step toward making a choice you can feel good about.

At its core, a health insurance plan is defined by its network—the group of doctors, hospitals, and clinics it has a contract with. This single factor determines how much freedom you have to choose your providers and whether you need a referral to see a specialist.

The Alphabet Soup of Plan Types

The three most common plan types you'll run into are HMOs, PPOs, and EPOs. Each one strikes a different balance between what you pay and how flexible your coverage is. Let's break them down.

-

HMO (Health Maintenance Organization): These plans usually come with lower monthly premiums but require you to stick to doctors and hospitals within their network. You'll also choose a Primary Care Physician (PCP) who becomes your main point of contact for care and provides referrals for any specialists you need to see. An HMO can be a fantastic, budget-friendly choice if you're generally healthy and comfortable coordinating your care through a single doctor.

-

PPO (Preferred Provider Organization): PPOs are all about flexibility. You don’t need a PCP, and you can see any doctor you want—in or out-of-network—without a referral. That freedom comes at a cost, though. PPOs typically have higher premiums, and your costs will be much lower if you stick with their "preferred" network providers. For instance, if you have a cardiologist you’ve trusted for years, a PPO makes it easier to keep seeing them, even if they aren't in-network.

-

EPO (Exclusive Provider Organization): Think of an EPO as a hybrid. Like an HMO, it requires you to use providers within its network (except in true emergencies). But like a PPO, it usually doesn't require a PCP or referrals to see specialists. This can be a great middle ground if you want direct access to specialists but are okay with staying inside a specific network to keep your costs down.

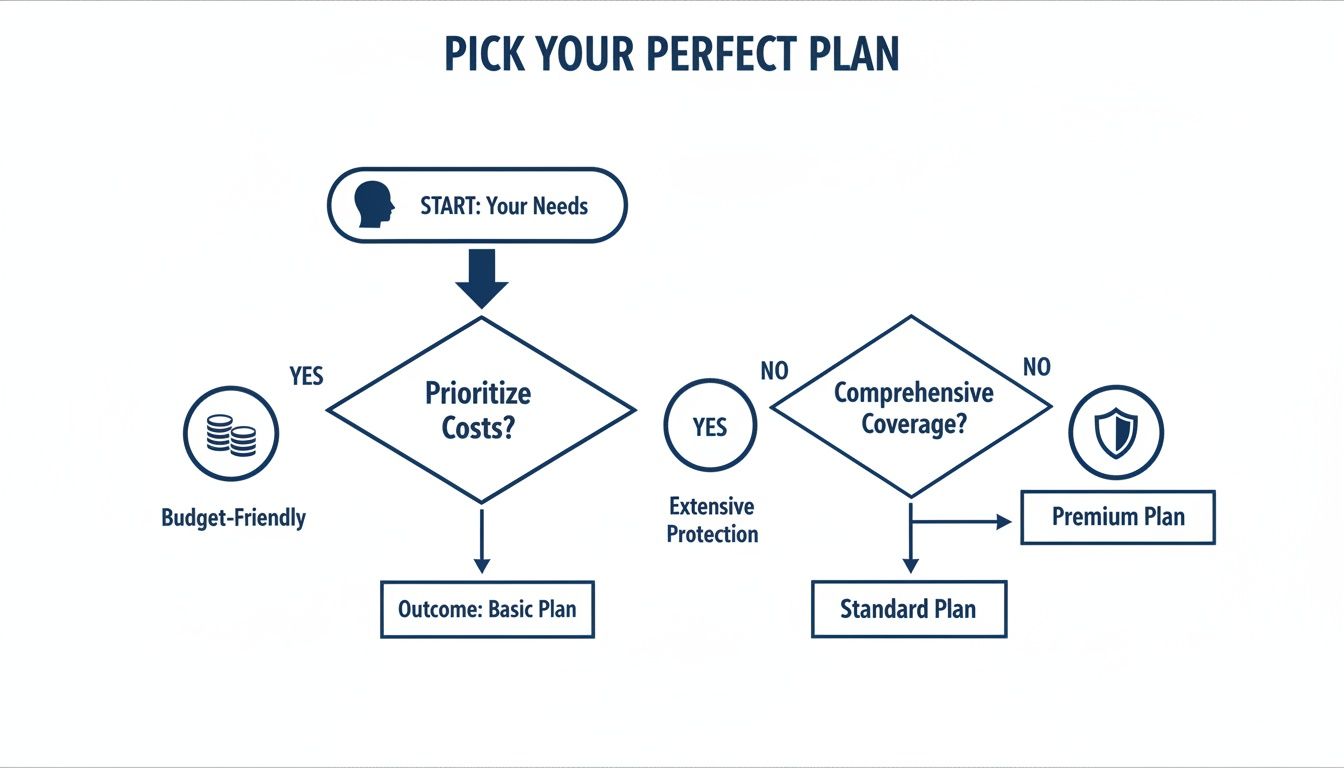

To help you see how your priorities for cost and coverage can point you toward the right plan, check out this flowchart.

As the visual shows, your personal needs—whether that’s managing costs or making sure you can see a specific doctor—are what really drive this decision.

To help simplify this even further, here's a quick side-by-side look at how these common plan types stack up.

HMO vs PPO vs EPO At a Glance

| Feature | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) | EPO (Exclusive Provider Organization) |

|---|---|---|---|

| PCP Required? | Usually Yes | No | No |

| Referrals Needed? | Yes, for specialists | No | No |

| Out-of-Network Coverage? | No, except for emergencies | Yes, but at a higher cost | No, except for emergencies |

| Best For | People who want lower premiums and are comfortable with a managed care approach. | People who want maximum flexibility and are willing to pay more for it. | People who want a balance of lower costs and direct specialist access, but don't need out-of-network care. |

Choosing the right structure is the first big piece of the puzzle. Now, let’s talk about the money.

Translating the Financial Terms

Beyond the plan type, four key financial terms will dictate how much you actually pay when you need care. Understanding how these work together is critical to picking a plan that truly fits your budget.

Deductible

This is the amount you have to pay out-of-pocket for covered medical services before your insurance plan starts chipping in. Think of it as your initial share of the cost. If your plan has a $3,000 deductible, you're on the hook for the first $3,000 of your medical bills that year.

Copay

A copay is a simple, fixed amount you pay for a specific covered service, usually after your deductible is met. For example, you might have a $30 copay for a regular doctor’s visit or a $50 copay for seeing a specialist.

Coinsurance

This is your share of the costs for a covered service, expressed as a percentage, that you pay after you've met your deductible. If your plan's coinsurance is 20% and a hospital stay costs $10,000, you would pay $2,000 (plus any of your remaining deductible). Your insurance company would cover the other 80%.

Your out-of-pocket maximum is the absolute most you will have to pay for covered services in a single year. Once you hit this amount through your deductibles, copays, and coinsurance, your health plan pays 100% of the costs for covered benefits. This number is your ultimate financial safety net.

These terms can get tangled up pretty quickly, so having a good resource on hand helps. For a deeper dive into these and other key phrases, you can always check out a comprehensive health insurance glossary.

Let's walk through a real-world example. Imagine your plan has a $2,000 deductible, 20% coinsurance, and a $5,000 out-of-pocket max. You need a $7,000 surgery.

First, you'd pay your $2,000 deductible. After that, you'd pay 20% of the remaining $5,000 bill, which comes out to $1,000. Your total cost for the surgery is $3,000. Since you’ve now spent $3,000 toward your out-of-pocket max, you only have $2,000 left to pay for any other covered medical care for the rest of the year.

Creating Your Personal Healthcare Profile

Let’s be honest: the "best" health insurance plan doesn't actually exist. At least, not as a one-size-fits-all solution.

The real secret to finding the right coverage is to stop searching for what's best for everyone else and start figuring out what's best for you. That process begins with a simple, honest look at your own healthcare needs. Think of it as creating your personal healthcare profile.

This profile is your North Star. It’s the single most powerful tool you have for cutting through marketing fluff and comparing plans on the things that actually matter to your life. Without it, you're just guessing.

Mapping Your Medical Landscape

Before you even glance at a single plan, you need a clear picture of how you and your family use healthcare. Don't just rely on memory—grab a notebook or open a new doc and start jotting things down. The more detail you include, the easier this whole decision will be.

First, look back over the last 12-18 months. Think about every single doctor visit, specialist appointment, urgent care trip, and prescription filled. This isn't just a list; it's a powerful clue to your baseline needs.

Next, think about the year ahead. What do you see coming?

- Growing Your Family? If you're planning on having a baby, maternity and newborn care are huge factors. Coverage can vary dramatically from one plan to another.

- Planned Procedures? Is a knee replacement or wisdom tooth extraction on the horizon? You'll want to make sure your surgeon and hospital of choice are definitely in-network.

- Managing a Condition? If you or a family member deals with something ongoing like diabetes, asthma, or heart disease, consistent access to specific doctors and medications is your top priority.

By getting all of this down on paper, you’re creating a practical checklist to measure plans against. It turns a vague, overwhelming choice into a concrete comparison.

Your Non-Negotiables List

Everyone has healthcare "non-negotiables." These are the doctors, hospitals, and prescriptions that are essential to your well-being. Having to switch a provider you trust is disruptive and stressful, so it's critical to confirm they're included in a plan's network from the very start.

Make a simple list with three columns:

- Must-Have Doctors: Write down every physician, pediatrician, specialist, and therapist you refuse to part with. Be specific with names and clinic locations.

- Preferred Hospitals & Clinics: Note your local hospital, go-to urgent care, and any specialty facilities you rely on.

- Current Prescriptions: List the exact name and dosage of every medication you and your family take regularly. A plan might seem cheap, but if it doesn't cover your high-cost prescription, you've saved nothing.

This list isn't just about preference; it's a financial filter. A plan can look great on paper, but if your trusted cardiologist is out-of-network, you could be on the hook for thousands in unexpected bills. Verifying your non-negotiables is one of the smartest things you can do.

Bringing It to Life with Scenarios

So, how does this work in the real world? The "best" plan looks completely different for different people.

Scenario 1: The Gig Worker

Maria is a freelance graphic designer. Her income can be unpredictable, and while she's healthy, she needs a safety net for a true emergency. Her profile shows she rarely goes to the doctor but needs financial predictability. For her, a High-Deductible Health Plan (HDHP) paired with a Health Savings Account (HSA) could be a perfect match. The lower monthly premium helps with her fluctuating cash flow, and the HSA lets her save tax-free for any future medical costs.

Scenario 2: The Early Retiree

David is 62 and just retired to travel. He has a chronic heart condition that requires regular visits with a specific cardiologist and two daily prescriptions. His profile screams "robust network" and "strong drug coverage." A PPO plan would probably be his best bet, giving him the flexibility to see his specialist without referrals and covering him even when he's traveling out of state.

Scenario 3: The Young Family

The Chens have two little kids, ages three and six. Their healthcare profile is a flurry of pediatrician visits for check-ups, fevers, and vaccinations. Their biggest priorities? Strong pediatric care and low, predictable costs for all those routine visits. An HMO or EPO plan with low copays for primary care would likely serve them best, keeping their frequent-but-small medical bills from getting out of control.

Each of these people found the right fit by starting with themselves. Once your personal healthcare profile is done, you're not just shopping for insurance anymore—you're looking for a specific solution that fits your life.

Comparing Plan Costs and Provider Networks

Alright, you’ve done the self-assessment and know what you need. Now comes the part that trips most people up: figuring out what a plan really costs and if your doctors are even on it.

Let's be clear: the monthly premium is just the sticker price. It's not the full story. A plan is only as good as the doctors you can actually see without getting hit with a massive, unexpected bill. This is where you need to put on your detective hat.

Calculating the True Annual Cost

The number you see on the front page—the monthly premium—is just the starting line. To really understand the financial impact, you have to look at the out-of-pocket maximum. Think of it as your financial safety net for the year. It's the absolute most you'll pay for covered services, no matter what happens.

Let's break it down with a real-world example. Imagine you're choosing between two plans for your family:

- Plan A (Low Premium): Costs $400 a month. It has a $7,000 family deductible and a $15,000 out-of-pocket maximum.

- Plan B (High Premium): Costs $700 a month. It has a $2,500 family deductible and a $9,000 out-of-pocket maximum.

If your family is young and healthy, Plan A looks tempting. That low premium saves you money every month. But what if someone needs a planned surgery or develops a chronic condition? You could blow past that $7,000 deductible fast and be on the hook for thousands more. In a high-use year, Plan B would actually be the cheaper choice, saving you a significant amount of money.

The smartest way to pick a plan is to model two scenarios: a "good year" with low healthcare needs and a "bad year" where you hit your out-of-pocket max. Calculate the total cost for both (premiums + max-out-of-pocket). The plan that protects you best in that worst-case scenario is often the one that lets you sleep at night.

For a deeper dive into this math, our guide on how to compare health insurance plans walks through more detailed examples.

Verifying Your Provider Network

A plan's "network" is simply the list of doctors, hospitals, and specialists who have agreed to its payment rates. Staying in-network is the single most important thing you can do to control your costs. If you have an HMO or EPO and go out-of-network, insurance might pay nothing. Zero.

Don't ever assume your doctor is covered. You have to check.

- Use the Insurer's Online Tool: Before you even think about enrolling, go to the insurance company's website and use their "Find a Doctor" search. Look up every single one of your must-have providers—your primary care doc, your kids' pediatrician, your preferred hospital.

- Call the Doctor's Office Directly: This is the most important step. Online directories can be wrong. Call your doctor's billing office and ask this exact question: "Do you participate in the [Exact Plan Name] network?" Get confirmation from a human.

- Check Your Prescriptions: Find the plan's formulary (its list of covered drugs). Make sure your medications are on it and see which "tier" they fall into. This determines your copay, and the difference can be huge.

Yes, this takes time. But it will save you from the nightmare of discovering your trusted doctor is out-of-network after you’ve already signed up.

Network Quality in a Modern World

These days, a small, local network just doesn't work for everyone. Life is more mobile, and your health plan needs to keep up.

Think about these situations:

- The Remote Worker: You live in Texas, but your company is in California. You need a plan with a solid national network.

- The Frequent Traveler: If you're a consultant who's always on the road, you need to know you can find in-network care wherever your job takes you.

- Parents of College Students: Your kid is going to college three states away. Does your plan have in-network doctors and urgent care clinics near their campus?

This is a big deal, and the insurance industry knows it. The global health insurance market has hit about $1.8 trillion, and the international health segment is growing by 9.1% each year. Why? Because people are demanding broader access. According to research from Allianz, buyers are rewarding plans with wider networks, especially those who travel or have family spread out.

So when you compare plans, don't just look at the price. Look at the map. The size and reach of the network is a critical piece of the puzzle.

Evaluating Digital Tools and Member Support

Beyond deductibles and networks, a health plan's real value often shows up when you actually need it. Let’s be honest, in our connected world, the quality of an insurer's app and member support can be the difference between a huge headache and a sigh of relief.

A clunky website or an app that crashes isn't just a minor annoyance; it’s a barrier standing between you and your care. You deserve a plan that invests in a modern, easy-to-use experience, making it simple to manage your health right from your phone.

What to Look for in a Plan's Digital Experience

When you’re checking out an insurer, think like a customer. A good plan should offer a digital "front door" that makes complicated tasks feel simple. Before you sign on the dotted line, hunt for screenshots of their app or member portal. See if they have any demo videos.

Your goal is to find tools that simplify your life, not make it more confusing.

Key features to look for include:

- Digital ID Cards: Instant access to your insurance card on your phone. No more fumbling for a physical card at the doctor's office.

- Easy Claims Tracking: A clear, simple dashboard where you can see the status of claims, view your explanation of benefits (EOBs), and track how close you are to hitting your deductible.

- Telehealth Integration: The ability to find and schedule virtual appointments directly through the app is a massive convenience, especially for minor illnesses or mental health support.

- Provider Search & Cost Estimates: A well-designed tool that helps you find in-network doctors and gives you a ballpark idea of what a procedure might cost.

While you're at it, make sure the insurer follows strict HIPAA compliance standards. This is non-negotiable for protecting your sensitive health information.

Beyond the App: Member Support That Matters

Digital tools are fantastic, but sometimes you just need to talk to a real person. A plan's member support system can be a total game-changer, especially when you're managing a complex health issue or trying to figure out a confusing bill.

Look for services that offer real value. For instance, a 24/7 nurse hotline can be an incredible resource for a parent with a sick kid in the middle of the night. It gives you immediate advice on whether you need to rush to the ER or if you can wait until morning.

Don't underestimate the value of responsive, human-centered support. When you’re stressed about a health concern, a quick and helpful answer from a knowledgeable professional is worth its weight in gold.

Other crucial support features include dedicated case managers for chronic conditions or clear, transparent tracking for prior authorizations. The easier it is to get answers and approvals, the better your experience will be. For more on this, our article on how to verify insurance coverage has some extra tips.

Digital access and service quality are more than just perks now—they are essential criteria for choosing the best health insurance. Facing a projected global shortfall of 10 million health workers by 2030, insurers are leaning on technology to manage care more efficiently. In a recent Deloitte outlook, over 80% of health system leaders said AI and digital tools will be a huge part of their future.

Plans with strong apps, automated claims, and responsive support are simply better prepared to navigate these challenges and keep you healthy. You can read more about these transformative healthcare trends on deloitte.com.

Making Your Final Decision and Enrolling

You’ve done the heavy lifting—the research, the comparisons, the late-night cost calculations. Now it’s time to pull the trigger. But before you hit that final "enroll" button, let's take a moment for one last sanity check.

This is your chance to turn a good choice into a great one. It’s all about catching the small details now that could turn into major headaches later. Think of it as making sure the plan that looks perfect on paper will actually work for you in the real world.

Your Final Checklist Before Enrolling

Time to go back to your notes and confirm a few non-negotiables. This isn’t about starting over; it’s about making your decision with 100% confidence.

- Confirm Your Network (For Real): Don’t just trust the online directory—they can be notoriously out of date. Pick up the phone and call your most important doctor's office. Ask them one simple question: "Do you participate in the [Insert Exact Plan Name Here] network?" A real-life "yes" is the only confirmation that matters.

- Double-Check Your Prescriptions: Pull up the plan’s formulary (its official drug list) one more time. Find your specific medications. Are they covered? And just as important, what tier are they on? That little detail will determine your copay every single time you go to the pharmacy.

- Understand the True Max: Look at that out-of-pocket maximum again. Seriously. If the absolute worst happened this year, could your family financially handle that number? This isn’t just a random figure; it’s your ultimate financial safety net.

The whole point of this final check is to eliminate surprises. You want to move from hoping you made the right choice to knowing you did.

Once you’ve ticked these boxes, you're ready. The enrollment process itself is pretty straightforward. For a detailed guide on what papers you’ll need and the key deadlines to watch out for, our walkthrough on how to apply for health insurance has you covered.

Just make sure you have your Social Security numbers, recent income info, and any current policy details handy. It’ll make everything go that much faster.

Still Have Questions? Let's Clear Things Up

Even after you’ve narrowed down your choices, a few nagging questions can pop up. It’s completely normal. Let's tackle some of the most common ones that people get stuck on.

HSA vs. FSA: What's the Real Difference?

Think of a Health Savings Account (HSA) as your personal health savings fund that you own forever. It’s paired with a high-deductible plan, and here’s the best part: the money you put in rolls over every single year. If you switch jobs, that money comes with you. It’s yours.

A Flexible Spending Account (FSA) is different. It's an account owned by your employer that you fund with pre-tax dollars. The catch? It's usually a "use it or lose it" deal. You have to spend the money within the plan year, though some companies let you roll over a small amount.

Can I Switch Plans Whenever I Want?

Usually, no. You can only enroll or change your health insurance during the annual Open Enrollment Period. But life happens, and the system accounts for that with something called a Special Enrollment Period (SEP).

Big life changes—like getting married, having a baby, moving, or losing your job-based coverage—are considered qualifying life events. These events open a short window, typically 60 days, for you to pick a new plan outside the normal schedule.

How Do I Know If My Prescriptions Are Covered?

This is a big one. Every insurance plan has a list of covered drugs called a formulary. Before you even think about signing up, you need to find this document on the insurer’s website.

Checking the formulary is non-negotiable. It will tell you if your specific medications are covered and, just as importantly, which cost "tier" they fall into. That tier dictates your copay, directly shaping how much you'll actually pay at the pharmacy counter.

Navigating all the details of health insurance can feel like a chore, but you don't have to figure it out alone. At My Policy Quote, we help people and families find clear, affordable coverage that actually fits their lives.

Ready to see what's out there? Explore your options and get a personalized quote today.