Open enrollment is that specific time of year when you can sign up for, change, or cancel your health insurance plan. Think of it as the one guaranteed window you have to make sure your coverage for the coming year is exactly what you need.

It's your annual opportunity to get things right.

Your Annual Window for Health Insurance Decisions

Imagine your favorite store only opened its doors for a few weeks each fall. That’s pretty much how open enrollment works. It’s a dedicated period when anyone can shop for a health plan, switch to a different one, or make adjustments without needing a special reason.

This system keeps the insurance market stable. By having a set enrollment time, it prevents people from waiting until they get sick to buy a policy, which helps keep premiums more affordable for everyone. If you miss this window, you’ll likely have to wait a full year to make changes unless you have a major life event.

The Importance of This Annual Check-In

During open enrollment, millions of Americans lock in their healthcare for the year ahead. It’s a big deal. In a recent period, the Centers for Medicare & Medicaid Services reported that nearly 950,000 new people signed up for Marketplace coverage, and over 4.8 million existing members actively renewed their plans. You can read the full report on recent enrollment trends on CMS.gov to see just how crucial this time is.

This annual period is your single best opportunity to ask, "Does my current health plan still fit my life?" Your health, finances, or family size can change in a year, making this review absolutely essential.

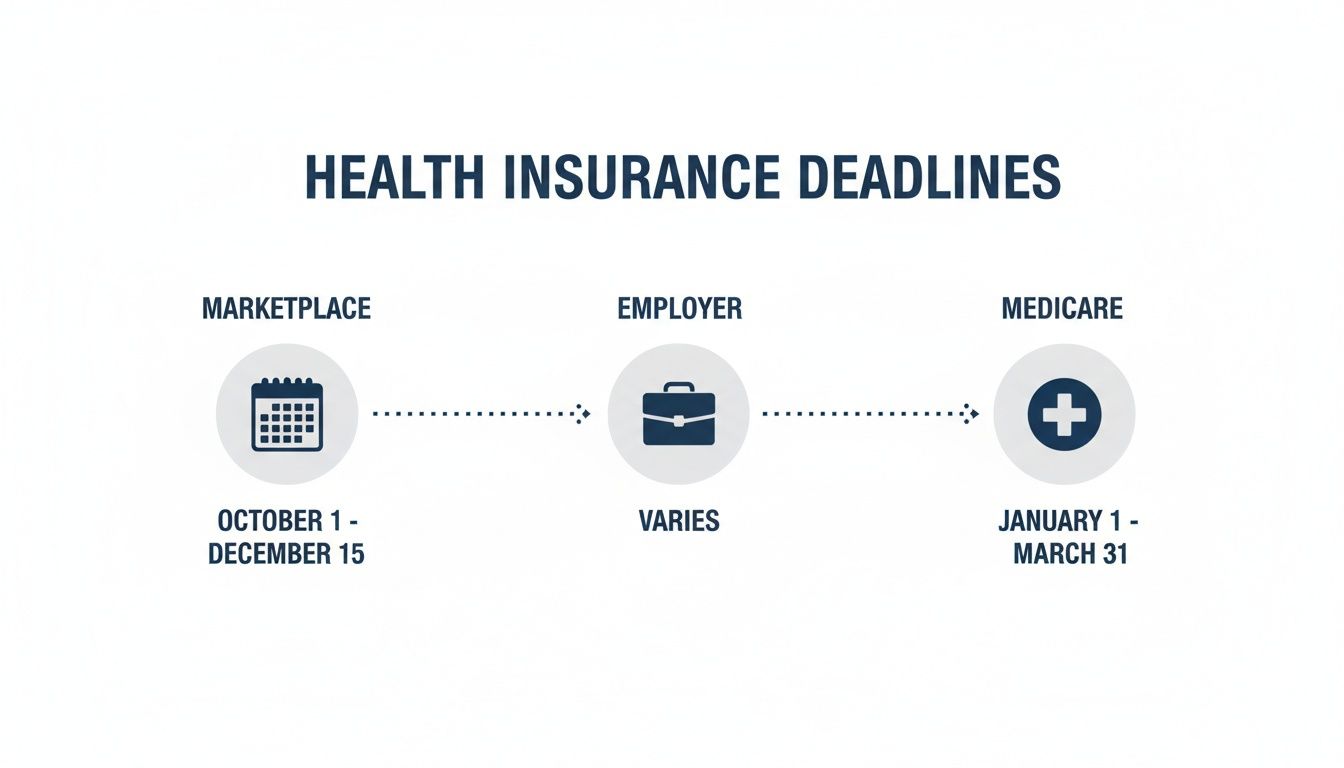

To help you get oriented, here’s a quick look at the main types of open enrollment periods. Knowing which one applies to you is the first step toward understanding your options and deadlines.

Open Enrollment At a Glance

The table below breaks down the most common open enrollment types, who they’re for, and when they typically happen.

| Enrollment Type | Who It's For | Typical Timeframe |

|---|---|---|

| ACA Marketplace | Self-employed, unemployed, or those without job-based coverage | Usually Nov 1 – Jan 15 |

| Employer-Sponsored | Employees of companies that offer health benefits | Varies, often in the fall |

| Medicare | Individuals aged 65 or older, or those with certain disabilities | Oct 15 – Dec 7 |

Getting this right is crucial for both your health and your financial security. For a deeper dive into making the best choice, check out our guide on how to choose health insurance for smart coverage.

Finding Your Path Through Different Enrollment Types

Knowing what open enrollment is in health insurance is step one. Step two is figuring out which road is actually yours to take. The term isn't a one-size-fits-all deal. Instead, it’s more like three separate systems, each with its own map, rules of the road, and specific travelers in mind.

Think of it like getting to a destination. Are you driving your own car, taking the company shuttle, or using a senior bus service? Each one gets you there, but the journey—and the process—is totally different. Let’s break down these three main routes to getting health coverage.

ACA Marketplace: Your Route for Individual Coverage

The Affordable Care Act (ACA) Marketplace, sometimes just called the exchange, is the main hub for individuals and families who can’t get insurance through a job. This covers a whole lot of people, from freelance graphic designers and gig workers to early retirees who aren't old enough for Medicare yet.

The Marketplace was built to make shopping for health insurance simpler by letting you compare plans right next to each other. But its biggest feature is the financial help it offers.

Based on your income and the number of people in your household, you could qualify for premium tax credits (subsidies) that can dramatically lower what you pay each month. This is the only place you can get these government subsidies.

For example, a self-employed consultant making $55,000 a year might find that a subsidy knocks their monthly premium down from $450 to just $200. That makes quality coverage feel a lot less like a luxury and more like a reality.

Employer-Sponsored Plans: The Company-Provided Option

For millions of Americans, open enrollment is something that happens at work. Employer-sponsored plans are the group health insurance policies a company offers to its employees and their families. For most people, this is how they get their health coverage.

Sometime in the fall, your company will kick off its open enrollment period, and you’ll get a packet of information outlining your choices. These usually include a few different types of plans, like:

- HMOs (Health Maintenance Organizations): These often come with lower monthly premiums but require you to stick with doctors inside their network.

- PPOs (Preferred Provider Organizations): These give you more freedom to choose your doctors and specialists, often without needing a referral first.

Picture a family of four whose employer offers both an HMO and a PPO. They’ll have to weigh whether the lower cost of the HMO is worth being limited to a smaller network, or if the flexibility of the PPO is a better fit for their family's needs. To really dig into how these plans work, you can learn more about what is employer-sponsored health insurance in our guide.

Medicare's Annual Election Period for Seniors

Finally, we have Medicare. For anyone aged 65 and older, or for younger people with certain disabilities, the open enrollment equivalent is called the Annual Election Period (AEP). This window typically runs from October 15 to December 7 every year.

During the AEP, people on Medicare can make some really important changes to their coverage. It’s their one chance each year to:

- Switch from Original Medicare to a Medicare Advantage Plan (or go back the other way).

- Choose a different Medicare Advantage Plan.

- Sign up for, drop, or switch a Medicare Part D prescription drug plan.

Choosing the right path—Marketplace, employer, or Medicare—is the most critical decision you'll make during this time. Each system is designed for a different stage of life and work, ensuring nearly everyone has a route to getting covered.

The Deadlines That Define Your Coverage for the Year

Missing your open enrollment window is a bit like missing a flight. Once that gate closes, you’re stuck waiting for the next one—which could be a whole year away.

These deadlines aren’t flexible suggestions. For most people, they are strict and non-negotiable, which is why knowing your timeline is absolutely critical. Forgetting these dates can mean going without health insurance, leaving you and your family completely exposed to staggering medical costs.

Think of it as a crucial annual appointment for your financial and physical well-being. Letting these dates slip by could mean you’re automatically re-enrolled in a plan whose costs or network have changed. Or worse, you could be left with no coverage at all. Planning ahead is your best defense against last-minute stress.

Key Enrollment Timelines to Remember

Every type of health insurance runs on its own schedule. While your exact dates might shift a little—especially with employer plans—these are the standard windows you’ll want to circle on your calendar:

- ACA Marketplace: This window typically runs from November 1 to January 15. It’s the time for individuals and families who don’t have job-based coverage to sign up.

- Employer-Sponsored Plans: These dates vary from company to company, but they usually happen in the fall for a few weeks, often in October or November. Your best bet is to always check with your HR department for the exact timing.

- Medicare Annual Election Period: This is a firm one: October 15 to December 7. It’s the key time for seniors to review and make changes to their Medicare Advantage or Part D prescription drug plans.

The consequences of missing these dates are real. Unless you have a Qualifying Life Event, you generally can't sign up for a new comprehensive health plan until the next open enrollment period. This isn't just an inconvenience; it's a major financial risk.

The sheer number of people enrolling shows just how important this period is. During a recent open enrollment, a staggering 21,310,538 people signed up for ACA marketplace plans—including over 5 million brand-new consumers. These numbers show how vital this window is for millions of Americans, from gig workers to early retirees. You can discover more insights about these enrollment statistics from KFF to see the full picture.

Understanding what open enrollment in health insurance really means is all about respecting these deadlines. By planning ahead, you can use tools like My Policy Quote to compare your options, skip the frantic last-minute rush, and confidently pick a plan that protects you all year long.

How a Special Enrollment Period Can Help When Life Changes

Life rarely sticks to a schedule. Big moments—a new job, a new baby, a new home—don’t always line up with the annual open enrollment window. If you miss the deadline or something unexpected happens, you're not necessarily out of luck.

This is where a Special Enrollment Period (SEP) comes in. Think of it as a crucial safety net, giving you another chance to get covered when life throws you a curveball.

What Triggers a Special Enrollment Period?

So, what exactly unlocks this second chance? Not just any change will do. The rules point to specific, major life shifts known as Qualifying Life Events (QLEs). These are moments significant enough to alter your healthcare needs or your eligibility for coverage.

Most of these events fall into a few key categories:

- Changes in your family: Getting married, having a baby, or adopting a child.

- Loss of other health coverage: Maybe you lost a job, aged off a parent’s plan at 26, or are no longer eligible for Medicaid.

- A change of address: Moving to a new zip code or county, especially if your old plan isn't offered in your new area.

This infographic lays out the standard timelines, which really shows why an SEP is so vital if you find yourself outside these fixed windows.

As you can see, each type of insurance has its own strict calendar, making SEPs a critical exception to the rule.

Common Qualifying Life Events for Special Enrollment

To make it clearer, here’s a breakdown of common life events that can open up a Special Enrollment Period for you.

| Qualifying Life Event | Description | Typical Enrollment Window |

|---|---|---|

| Getting Married | You and your spouse can enroll in a new plan together. | 60 days from the marriage date. |

| Having a Baby | Your new baby needs coverage, and you can change your existing plan. | 60 days from the date of birth. |

| Losing Job-Based Coverage | You left a job, were laid off, or your hours were reduced. | 60 days from the loss of coverage. |

| Moving to a New Area | You moved to a new zip code or county with different plan options. | 60 days before or after your move. |

| Aging Off a Parent's Plan | You turned 26 and can no longer stay on your parent’s insurance. | 60 days around your 26th birthday. |

Remember, this isn't an exhaustive list, but it covers some of the most frequent reasons people qualify for an SEP.

Acting Quickly Is Essential

When a QLE happens, the clock starts ticking immediately. You typically have just 60 days from the date of the event to enroll in a new health plan. Miss that window, and you'll likely have to wait until the next open enrollment period comes around.

It's a true use-it-or-lose-it opportunity. Waiting too long could leave you uninsured for months, right when you need coverage the most.

Whether you're a recent grad who just lost your parent's plan or a newlywed couple ready to merge your lives and policies, an SEP is the bridge that keeps you protected. It’s designed to make sure life’s biggest milestones don’t create a healthcare crisis.

You can dive deeper into the rules and what to do in our guide on the Special Enrollment Period (SEP). Knowing how this works gives you peace of mind, so you can focus on what matters most.

Your Action Plan for a Stress-Free Enrollment

Knowing when Open Enrollment is happening is only half the battle. The other half? Turning that knowledge into a clear, simple plan. A little bit of prep work can transform a stressful chore into a straightforward process, letting you choose a plan with total confidence.

Let’s break it down into four simple stages. Think of it as a roadmap to making a smart decision that truly fits your life, not just your monthly budget.

Stage 1: Review Your Past and Future Needs

First, take a look back at the past year. How often did you actually see a doctor? Did you need any specialist appointments or trips to urgent care? Make a quick list of your regular prescriptions, because their coverage can change dramatically from one plan to another.

Now, think about what’s ahead. Are you planning any major medical events, like a surgery? Is a new baby on the way? Anticipating these needs helps you pick a plan with the right level of coverage, saving you from a world of financial headaches later.

Stage 2: Get Your Paperwork Ready

Nothing slows you down like having to hunt for documents. Before you sit down to enroll, grab these items for yourself and anyone else on your application:

- Personal Info: Social Security numbers and birth dates for everyone you plan to cover.

- Income Verification: Recent pay stubs, W-2s, or tax returns. This is key for estimating your household income to see if you qualify for subsidies.

- Current Plan Details: Keep your existing policy info handy, especially if you’re thinking about switching.

One of the most common mistakes is guessing your income. An accurate estimate is absolutely essential for getting the correct premium tax credits. If you overestimate, you could miss out on savings. Underestimate, and you might have to pay back subsidies when you file your taxes.

Stage 3: Compare Plans Beyond the Price Tag

That super-low monthly premium can be tempting, but it’s rarely the whole story. A plan that looks cheap upfront might have a sky-high deductible, meaning you’ll pay thousands out of pocket before your insurance even starts to kick in for major costs.

When you’re comparing options, you have to look at the full picture:

- Deductible: How much you pay before your insurer pays its share.

- Copayments & Coinsurance: What you’ll owe for each visit or service.

- Doctor Network: Make sure your favorite doctors, specialists, and hospitals are in-network. This is a big one.

- Prescription Formulary: Double-check that your essential medications are on the plan’s approved list.

Stage 4: Submit Your Application with Confidence

Once you’ve landed on the perfect plan, the final step is submitting your application. For a detailed walkthrough, our guide on how to apply for health insurance can give you that extra support. While you're at it, it’s a good time to think about your financial health more broadly by understanding the process of reviewing your insurance coverage.

With My Policy Quote, you can compare plans and get quotes side-by-side, which simplifies this whole process. By following these steps, you’re not just picking a health plan—you’re making an informed, powerful decision for your health and your financial future.

Common Missteps to Avoid During Open Enrollment

Open enrollment can feel like a maze, and one wrong turn can leave you with a year's worth of headaches. The single biggest mistake? Doing nothing at all.

Just letting your plan auto-renew is tempting—it's easy, after all. But it’s a gamble. Insurance plans change constantly. Your favorite doctor might suddenly be out-of-network, a prescription you rely on could disappear from the formulary, or your deductible could sneak up by thousands. A quick review is the only way to avoid a nasty surprise right when you need care.

Focusing Only on the Monthly Premium

Another common trap is getting tunnel vision on the monthly premium. A plan with a rock-bottom upfront cost often hides much bigger expenses, like a massive deductible or steep copays. It’s a classic bait-and-switch that can leave you functionally uninsured for anything less than a medical catastrophe.

Imagine choosing a plan for $300 a month with an $8,000 deductible over one for $400 with a $2,500 deductible. If you end up needing a major procedure, that "cheaper" plan will cost you thousands more out-of-pocket before your insurance even starts to help. You have to look at the whole picture.

Overlooking the Details

The devil is truly in the details. Beyond premiums and deductibles, people often forget to check if their trusted primary care doctor or specialists are still in their plan’s network. One out-of-network visit can mean you’re on the hook for the entire bill.

Miscalculating your household income is another widespread error for those on the ACA Marketplace. If you estimate too low, you might get more financial assistance than you’re eligible for—and end up having to repay thousands of dollars at tax time.

Even when you do everything right, rising costs are a real challenge. One survey found that while 77% of Americans were happy with their plan choices, the average out-of-pocket maximum still jumped 8% in a single year, climbing from $5,760 to $6,240. You can dig deeper into health insurance costs and consumer satisfaction on PR Newswire.

Taking the time to sidestep these common mistakes is everything. By reviewing what’s changed, assessing your total potential costs, and verifying the small-but-critical details, you can choose a plan that gives you true peace of mind for the year ahead.

Still Have Questions About Open Enrollment?

It’s completely normal for questions to pop up, even when you feel prepared. Let's tackle some of the most common worries people have, so you can move forward with total confidence.

What Happens If I Miss the Open Enrollment Deadline?

Life gets busy, and deadlines can slip by. But if you miss your open enrollment window and don't have a Qualifying Life Event, you generally can't buy an ACA-compliant health plan until the next open enrollment period.

This is a big deal. It could leave you uninsured for the year, meaning you’d be on the hook for 100% of your medical costs—from a simple check-up to a major emergency. While some short-term plans might be available, they just don't offer the same consumer protections or comprehensive coverage you get from a Marketplace plan.

I Like My Current Plan. Should I Bother Looking at Others?

Absolutely, yes. Think of it as an annual financial check-up. Just because your plan was a great fit last year doesn’t guarantee it will be this year. Insurance companies can—and often do—change plan details every single year.

Keep an eye out for changes to:

- Your monthly premium and annual deductible.

- The network of doctors, specialists, and hospitals.

- Coverage for your specific prescription drugs.

Taking a few minutes to compare ensures you aren’t being automatically re-enrolled into a policy that no longer fits your life or your budget. It’s the easiest way to avoid a nasty surprise when you actually need to use your insurance.

A proactive review is your best defense against unexpected costs. Even a plan you love can change significantly from one year to the next, making an annual check-in essential for your financial health.

How Do I Know If I Can Get a Subsidy?

Financial help, or a subsidy, can make a huge difference in your monthly premium. Eligibility is based on just two things: your household size and your estimated income for the upcoming year. The only way to get these cost-saving subsidies is by enrolling through the official Health Insurance Marketplace.

The best way to see what you qualify for is to use a quoting tool or the official calculator on HealthCare.gov. The key is to provide the most accurate income estimate you can. It helps you get the right amount of assistance and avoids any headaches when you file your taxes.

Navigating all of this is so much easier when you have the right support. My Policy Quote helps you compare plans side-by-side and get quotes from top carriers, finding the perfect fit for your needs and your budget. Take the first step and visit My Policy Quote to get started.