It’s easy to get "beneficiary" and "dependent" mixed up. They sound similar, but in the world of financial planning, they play very different roles.

The simplest way to think about it is this: a beneficiary is someone you choose to receive your assets, like a life insurance payout or the money in your 401(k). A dependent is someone who relies on you financially day-to-day.

So, your dependent can absolutely be a beneficiary—in fact, they often are. But a beneficiary doesn't have to be a dependent.

Understanding the Core Difference Between Beneficiary and Dependent

Getting this distinction right is the foundation of a solid financial plan. A beneficiary is a designated heir. A dependent is defined by financial reliance.

Think about your young child. They are your dependent because you provide their housing, food, and clothes. It's only natural you'd also name them the beneficiary of your life insurance policy.

But what about your financially independent brother? He’s not your dependent, but you could still name him as a beneficiary for your retirement account. The roles are separate, even when they apply to the same person.

Key Functional Distinctions

In life insurance, the beneficiary is simply the person or entity you name to get the death benefit when you pass away. There's no requirement for them to have been financially dependent on you.

A dependent, on the other hand, is someone who counts on your income to live. This is usually a spouse or a minor child. Their reliance on you is what gives them an "insurable interest," a key concept in insurance.

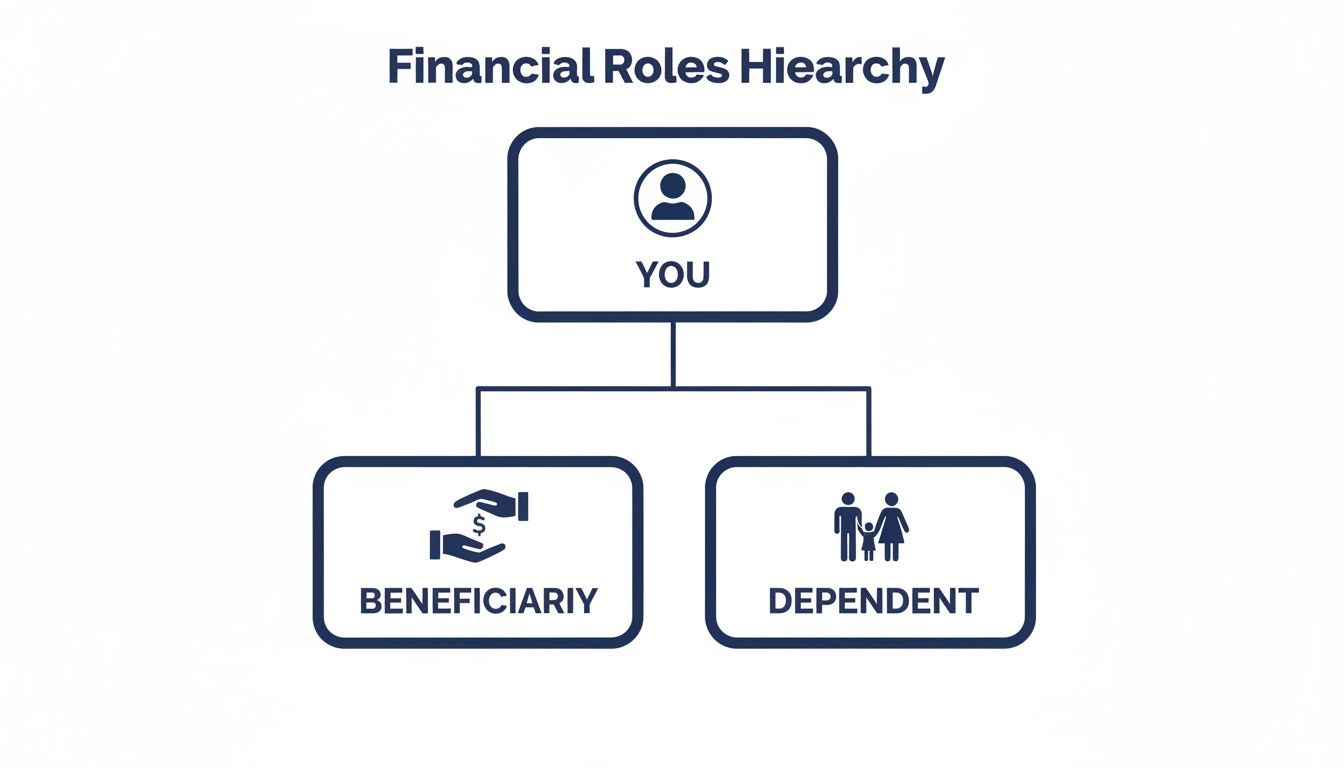

This chart breaks down the relationship visually.

As you can see, both roles are branches of your financial world, but they serve two totally different needs. One is about distributing assets after you're gone, and the other is about who you support while you're here.

To make it even clearer, here’s a quick table that puts the two roles side-by-side.

Beneficiary vs Dependent At a Glance

The table below offers a straightforward look at how these roles function in different contexts. While we often think of children as dependents, the situation with a spouse can be more complex. Understanding the specific rules on claiming a spouse as a dependent really highlights the technical differences between these terms.

| Attribute | Beneficiary | Dependent |

|---|---|---|

| Primary Function | To receive assets from a will, trust, insurance policy, or retirement account. | To receive ongoing financial support for daily living expenses (housing, food, etc.). |

| Legal Standing | A legal designation giving the right to inherit assets. | A legal and tax status based on financial reliance, age, and relationship. |

| Financial Context | Primarily used for estate planning, insurance, and retirement accounts. | Primarily used for taxes, health insurance coverage, and Social Security benefits. |

| Requirement | Anyone can be named; no financial dependency is required. | Must meet specific IRS criteria for financial support and relationship. |

Knowing these differences is crucial, especially when your loved ones are involved. For instance, naming a child has specific legal hurdles you need to be aware of.

It’s important to get the details right. If you’re thinking about naming a minor, our guide on https://mypolicyquote.com/2025/07/04/can-minors-be-life-insurance-beneficiaries/ is a must-read.

Comparing Roles in Life and Health Insurance

When you're sorting out your finances, terms like beneficiary and dependent get thrown around a lot. In the world of insurance, they aren't just details—they define who gets what, and when. Understanding the difference is crucial, especially when it comes to life and health insurance, because they play completely different roles. One determines who gets paid when you're gone, while the other decides who gets care while you're here.

Think of it this way: life insurance is built around your beneficiary, and health insurance revolves around your dependent. This isn't just semantics; it's a fundamental split that dictates who has access to benefits.

Life Insurance: The Central Role of the Beneficiary

With life insurance, the beneficiary is everything. This is the person, trust, or even an organization you officially name to receive the death benefit—that tax-free lump sum—after you pass away.

Here’s a key point that often gets missed: a beneficiary doesn't have to be financially dependent on you at all. You have a ton of flexibility. You could name:

- A financially stable adult child to help them pay off their home.

- A business partner to keep the company running smoothly.

- A close friend or sibling you want to leave a gift for.

- A charity you’ve always wanted to support in a big way.

So where does a dependent fit in? Their role is more behind-the-scenes. Having dependents is what gives you insurable interest—the legal reason for buying a policy in the first place. It proves that someone would face financial hardship if you were gone, which is the whole point of life insurance.

Key Takeaway: For life insurance, your dependent provides the "why" (the insurable interest), but your beneficiary determines the "who" (the one who gets the money). They can be the same person, but the jobs they do are totally separate.

Health Insurance: It's All About the Dependent

Now, let's flip over to health insurance. Here, the word that matters is dependent. This term defines who can actually get covered under your health plan and use the medical benefits right now.

The word "beneficiary" has no real meaning here. Your spouse isn't a "beneficiary" when they go for a check-up; they're added as a dependent. This is a critical distinction because it’s about accessing living benefits, not a payout down the road.

For health insurance, dependents get to use your plan's benefits immediately. This usually includes a spouse and children up to age 26, thanks to the Affordable Care Act (ACA). It's a stark contrast to a life insurance beneficiary, who has no access to anything until after your death and doesn't need to be a dependent. A helpful government report outlines some of these out-of-pocket considerations for those covered.

Knowing who qualifies as a dependent is a must for families. For a closer look at the rules, especially around age limits, check out our guide on the dependent health insurance age limit.

Comparing the Functions Side-by-Side

To really drive the point home, let's put the two roles next to each other.

| Feature | Role in Life Insurance | Role in Health Insurance |

|---|---|---|

| Primary Label | Beneficiary | Dependent |

| Purpose of Role | Receives a one-time, tax-free death benefit after you're gone. | Gains access to ongoing medical coverage while you're alive. |

| When Are They Active? | Only after the policyholder’s death. | During the policyholder's life. |

| Who Qualifies? | Any person, trust, or organization. Financial reliance is not required. | Usually a spouse, domestic partner, or children who meet specific criteria. |

| Example Scenario | You name your sister (who doesn't rely on you financially) to receive your $500,000 life insurance payout. | You add your 22-year-old son to your health plan so he can have medical coverage while in college. |

This clear separation of duties makes sure your financial safety net works the way you intend. Your life insurance beneficiary is there to take care of loved ones after you're gone, while your health insurance dependents get the care they need today. Confusing these roles could leave your family without protection right when they need it most.

Navigating Retirement Accounts and Employee Benefits

When you start planning for the future, the words beneficiary and dependent pop up everywhere. They might seem similar, but in the world of retirement accounts and employee benefits, they play completely different roles. Life and health insurance are for today’s protection, but your 401(k) and IRA? That’s about building a legacy.

And when it comes to that legacy, your beneficiary designation isn't just a suggestion—it’s a legally binding command. It tells your financial institution exactly where your life’s savings should go when you're gone.

This designation is incredibly powerful. When you name a beneficiary on a retirement account, the money typically goes straight to them, skipping the long, complicated, and often expensive probate court process. It’s a direct path that gives your loved ones faster access to funds when they need it most.

The Beneficiary's Role in Retirement Plans

Think of the beneficiary of your 401(k) or IRA as the designated heir to that account. Their role only kicks in after you pass away, and it doesn't matter if they rely on you financially or not. You can name anyone—a child, a friend, a charity, or even a trust.

However, if you're married, federal law steps in. The Employee Retirement Income Security Act of 1974 (ERISA) usually requires your spouse to be the primary beneficiary on your 401(k). If you want to name someone else, like a child from a previous relationship, your spouse has to sign a formal written waiver giving their consent. This law is there to protect a spouse's claim to retirement savings built during the marriage.

A beneficiary designation on your retirement account is one of the most powerful estate planning tools you have. It's a direct contract that overrides anything you've written in your will for that specific account.

The Dependent's Role in Employee Benefits

While a beneficiary inherits your assets, a dependent gets to access your living benefits through your job. Your dependent status is what gets you on your employer's health insurance plan while you're still working. But it's often more than just health coverage.

Many companies offer extra perks that extend to dependents, like:

- Dependent Life Insurance: A small life insurance policy for a spouse or child.

- Family Dental and Vision Plans: Coverage for the whole family, not just the employee.

- Flexible Spending Accounts (FSAs): Lets you use pre-tax money for a dependent's medical expenses.

In these cases, being a dependent means getting immediate access to care and financial support. The term beneficiary only matters if, for example, a dependent life insurance policy has to pay out.

The Cost of Getting It Wrong

The difference between these two roles becomes painfully clear when things are overlooked. Picture this: someone gets divorced and remarries but forgets to update their 401(k) beneficiary. No matter what their will says, the money legally goes to the ex-spouse named on the form. Their current, dependent family could be left with nothing from that account.

This is why you have to keep your designations up to date. Beneficiaries on retirement accounts claim the assets after death—with 100% of 401(k) funds going to the person named—and they don’t need to prove they depended on you. A dependent, on the other hand, gets living benefits like health coverage. You can dig deeper into these distinctions by checking out expert insights on the beneficiary and dependent roles.

It really boils down to this: a beneficiary protects your financial legacy for the future, while a dependent gets immediate support and care today. Making sure you've correctly assigned each role across your benefit plans is the only way to guarantee your financial strategy works exactly as you planned for the people you love.

Essential Tax and Estate Planning Implications

When it comes to your money, the words "beneficiary" and "dependent" are not interchangeable. Far from it. Understanding the difference is at the very heart of smart tax strategy and solid estate planning.

One role gives you financial relief right now. The other ensures your assets go to the right people, smoothly and without a fuss, when you're gone. Getting them confused can cost you—and your family—dearly.

A dependent is all about the here and now. Claiming a dependent on your taxes can unlock some pretty powerful credits and deductions, directly lowering what you owe Uncle Sam each year. It’s a tool for reducing your current tax bill.

A beneficiary, on the other hand, plays the long game. Naming someone as a beneficiary on an account doesn’t do anything for your taxes today. Their role is all about inheritance—who gets what when you pass away.

Tax Benefits Tied to Dependents

The IRS offers real financial relief for those who financially support others. If someone officially qualifies as your dependent, you could be eligible for some significant tax breaks designed to ease that burden.

Think of it as a thank-you for taking care of your loved ones. The most common benefits include:

- Child Tax Credit: This is a big one. It's a hefty credit for each qualifying child that slashes your tax bill directly.

- Credit for Other Dependents: For dependents who don't qualify for the Child Tax Credit, like an aging parent or an adult child, this credit still helps.

- Child and Dependent Care Credit: This helps you offset the high cost of daycare or other care expenses so you can work.

- Head of Household Filing Status: If you qualify, this filing status gives you a higher standard deduction and more favorable tax brackets than filing as Single.

These advantages can add up to thousands of dollars in savings each year, making dependent status a cornerstone of family financial planning. Beneficiaries? They don't unlock any of these perks for you.

How Beneficiaries Streamline Estate Planning

So, if dependents help with taxes, where do beneficiaries shine? Estate planning. This is their moment.

When you name a beneficiary on accounts like life insurance policies, 401(k)s, and IRAs, you're creating a powerful legal shortcut. It’s like giving those assets a VIP pass to your loved ones.

This simple designation allows the funds in those accounts to go directly to the person you named, completely bypassing the probate process.

Probate is the court-supervised legal process of validating a will and distributing a deceased person's assets. It can be a lengthy, public, and expensive ordeal, often taking months or even years to resolve.

Using beneficiary designations means your loved ones get the money quickly and privately, without lawyers and judges getting involved. This is a world away from assets passed down through a will, which must go through probate—even if the person inheriting is your dependent. Good strategic legacy and estate planning is all about using these tools to protect what you’ve built.

A Real-World Example: The Cost of Confusion

Let’s look at a simple scenario. Imagine a single mother with two children, both of whom are her dependents. She has a $250,000 life insurance policy and a $150,000 retirement account.

- Scenario A (Smart Planning): She carefully names both children as equal beneficiaries on both the life insurance and the retirement account. When she passes away, the kids receive the full amount from both accounts directly, usually within a few weeks. No courts, no delays.

- Scenario B (Poor Planning): She names the kids on the life insurance but completely forgets to fill out the beneficiary form for her retirement account. The life insurance payout is swift, but the $150,000 from her retirement account gets stuck. It becomes part of her estate and has to go through probate, tying up the money for a year or more and racking up thousands in legal fees.

This shows you the incredible power of a simple form. Both children were dependents, but that status meant nothing when it came to avoiding probate for the mismanaged account. It’s a crucial reminder that keeping your beneficiaries up-to-date is non-negotiable, a topic we dive into deeper in our guide on what happens with life insurance without a will. It's the only way to guarantee your money goes where you intended, when it's needed most.

Putting It All Together: Real-World Scenarios

Knowing the dictionary definitions of beneficiary versus dependent is one thing. Seeing how those roles play out in real life is where it really clicks. Let’s walk through a few common situations to show you how these choices can protect the people you love most.

Each scenario has its own unique challenges, but the solution always comes back to one core idea: understanding who needs immediate support (dependents) and who is set to inherit your assets (beneficiaries).

Scenario 1: The Self-Employed Contractor

The Situation: Alex is a 42-year-old self-employed graphic designer. He's married to Jamie, and they have a 10-year-old son, Sam. Alex has a term life insurance policy and a SEP IRA. He needs to make sure Jamie has funds for the mortgage right away and that Sam’s college education is covered if something happens to him.

The Breakdown: We’re looking at two different needs here. Jamie is both a spouse and a dependent, relying on Alex’s income to keep the household running. Sam is a minor dependent, completely reliant on Alex financially. The goal isn’t just to leave money behind; it's to get the right money to the right person at the right time.

The Solution:

- Life Insurance Beneficiary: Alex names Jamie as the 100% primary beneficiary on his life insurance. This is a crucial move because it ensures the money goes directly to her, fast. It bypasses the courts and probate, so she can use it immediately for the mortgage and bills.

- Contingent Beneficiary: Alex names Sam as the 100% contingent (secondary) beneficiary. But there's a catch—Sam is a minor. To avoid legal headaches, Alex works with an attorney to set up a simple trust (like one under the Uniform Transfers to Minors Act, or UTMA). The trust becomes the official contingent beneficiary, with a trusted relative managing the funds until Sam is an adult.

- SEP IRA Beneficiary: Alex also names Jamie as the primary beneficiary of his SEP IRA. As his spouse, she has special rollover options. She can move the funds into her own IRA, letting the money continue to grow tax-deferred for her own retirement.

This setup is smart. It uses the beneficiary designation to provide immediate cash and long-term security, all while recognizing the different needs of his dependents.

Scenario 2: The Early Retiree

The Situation: Maria, 62, just retired. Her two kids are grown and financially independent. She also has a soft spot for her local animal shelter and wants to leave them a gift. She has a sizable 401(k) and a life insurance policy she took out years ago.

The Breakdown: Maria doesn't have any dependents. Her children are beneficiaries by choice, not out of financial need. Her goal is all about asset distribution and leaving a legacy. This is classic estate planning, where beneficiary designations are a powerful tool for directing your wealth and supporting causes you care about.

The Solution:

- Life Insurance for Charity: Maria changes the primary beneficiary of her life insurance policy to the animal shelter. The payout goes straight to the non-profit, tax-free, and completely avoids probate. It’s a simple, powerful way to make a difference.

- 401(k) for Children: She designates her two adult children as 50/50 primary beneficiaries on her 401(k). The money will transfer to them directly, avoiding court delays. They'll have to follow specific withdrawal rules (like the 10-year rule from the SECURE Act), but it's a straightforward process.

By splitting her assets this way, Maria makes sure her kids get the retirement funds efficiently while her gift to the shelter is fulfilled without a single complication. It's a perfect example of how a beneficiary can be an organization, not just a person.

Scenario 3: The Young Family

The Situation: Ben and Sarah just had a baby. They have health insurance through work and are shopping for life insurance for the first time. They're feeling a little lost about how to set everything up to protect their new, growing family.

The Breakdown: This family is at a critical crossroads: they need immediate health coverage for their baby and long-term financial security in case the unthinkable happens. Their new baby is a dependent for health insurance but will be a beneficiary for life insurance. It’s so important to get both roles right.

The following graphic from Voya perfectly illustrates why thinking through these choices is a central part of protecting your family's future.

This visual drives home the point: selecting beneficiaries isn't just paperwork; it’s a foundational act of love that directly impacts the security of the people who rely on you, like Ben and Sarah's new baby.

The Solution:

- Health Insurance Dependent: First things first, Ben and Sarah add their baby to their employer’s health insurance plan as a dependent. This gives their child access to medical care from day one. This is the classic dependent role—all about living benefits.

- Life Insurance Beneficiaries: They each buy a life insurance policy. Ben names Sarah as his primary beneficiary, and she names him on hers. This ensures the surviving spouse will have the money needed to raise their child and keep the household afloat.

- Contingent Beneficiary Strategy: For the contingent beneficiary, they name their baby—but just like Alex in the first scenario, they set up a trust to hold the money. It's the safest way to guarantee the funds are protected for their child's future if both of them were to pass away.

By understanding the baby's dual roles—a dependent for today's healthcare and a beneficiary for tomorrow's security—they built a complete financial safety net for their family.

A Practical Guide to Managing Your Designations

Knowing the difference between a beneficiary and a dependent is a great start, but it's only half the job. The real work—and the real protection for your loved ones—comes from actively managing who you’ve named. Life is always changing, so your financial plan has to keep up.

A little proactive attention here prevents huge, heartbreaking mistakes down the road—like an ex-spouse accidentally inheriting your 401(k). The key is to treat your beneficiary forms with the same care and attention you give your will. They're just as powerful.

Conduct a Regular Beneficiary Audit

Outdated designations are almost always caused by major life events. That’s why it’s so important to review and update your beneficiaries as soon as things change.

Think of it as a "beneficiary audit." A regular check-in ensures your money goes where you want it to, no questions asked. Here’s when you should always pull out those forms:

- Marriage or Divorce: A new spouse needs to be added, and an ex-spouse almost always needs to be removed.

- Birth or Adoption of a Child: Your new dependent should be added to your list of potential beneficiaries.

- Death of a Beneficiary: You have to name a replacement to keep the asset out of your estate.

- A Minor Child Becomes an Adult: You might be able to remove a custodian or trust and name them directly.

This simple review can be the one thing that keeps your legacy out of probate court, a notoriously slow and expensive process.

Your beneficiary designation is a direct contract with the financial institution. In most cases, it will legally override any conflicting instructions in your will for that specific account.

Primary vs. Contingent Beneficiaries

When you fill out a beneficiary form, you’ll see spots for both primary and contingent beneficiaries. Your primary beneficiary is your first choice—the person who gets the asset.

A contingent, or secondary, beneficiary is your backup. They only inherit if your primary beneficiary has already passed away or can't accept the asset for some reason. For total peace of mind, you should always name both. Structuring these designations correctly is a huge part of how to read an insurance policy and making sure your wishes are actually carried out. It's a simple step that creates a critical fallback plan.

Got Questions? We've Got Answers

When it comes to financial planning, the details matter. It's totally normal to have questions as you sort through the specifics. Here are some quick, clear answers to the most common things people ask about beneficiaries and dependents.

Can My Dependent Also Be My Beneficiary?

Yes, absolutely. In fact, that’s one of the most common and logical arrangements.

Your dependent—like a spouse or child who relies on your income—is often the very reason you have a life insurance policy to begin with. Naming them as your beneficiary is how you ensure they get the financial support you’ve planned for them. The two roles simply serve different purposes at different times.

What Happens If I Don’t Name A Beneficiary?

This is a scenario you really want to avoid. If you don't name a beneficiary for assets like a life insurance policy or a 401(k), the money gets paid to your estate.

That might not sound so bad, but it means the funds have to go through probate court. That process can be time-consuming, expensive, and completely public.

By failing to name a beneficiary, you lose control. The asset gets tangled up in legal red tape, delaying your loved ones' access to critical funds and often shrinking the final amount they receive due to court and attorney fees.

Can I Name A Trust As A Beneficiary?

You sure can, and it's a very smart move in certain situations. Naming a trust is a powerful strategy, especially if your heirs are minors or have special needs.

This approach lets you set clear rules for how and when the money is distributed. It puts a responsible trustee in charge of managing the funds, making sure your loved ones are cared for exactly how you intended.

Do I Have To Name My Spouse As My 401(k) Beneficiary?

For the most part, yes. Federal law (ERISA) gives your spouse first rights to your 401(k). If you’re married, they are automatically considered the primary beneficiary.

If you want to name someone else—say, a child from a previous marriage—your spouse has to formally sign a written waiver. This legal document confirms they agree to give up their claim to those retirement funds.

Getting these distinctions right is the key to building a secure financial future for the people you love. At My Policy Quote, we’re here to help you find the right insurance coverage to protect your dependents and provide for your beneficiaries.

Take the next step. Explore your options and get a personalized quote today.