Life happens. A bill gets misplaced, a paycheck is late, or an unexpected expense throws your budget off track. We’ve all been there. When it comes to something as important as your insurance, a simple slip-up could be disastrous.

But there's a built-in safety net for these moments: the insurance grace period.

What Is an Insurance Grace Period and Why It Matters

Think of the grace period as a short, contractually-guaranteed window of time after your payment due date. During this window, you can catch up on your premium without your policy being canceled. It’s a crucial buffer that keeps your coverage active even if you’re a little late.

Without it, a missed payment could mean an immediate loss of benefits, leaving you exposed just when you need protection the most.

Imagine your insurance coverage is a shield. You pay a regular fee—your premium—to keep it up. If you forget to pay for a streaming service, you just miss out on a show. But if you forget to pay for your insurance, your entire financial shield could disappear. That’s a risk no one wants to take.

The grace period is that financial breathing room. It’s a short-term, interest-free extension designed to handle life’s curveballs.

The Purpose of a Grace Period

This feature isn't just a courtesy; it's a fundamental part of consumer protection built into most insurance contracts. It's there to prevent what the industry calls "adverse selection"—where people might only buy a policy right before a big claim and then drop it. The grace period provides a fair window for honest mistakes while keeping the system stable for everyone.

This protective window ensures your coverage continues, which is vital for a few key reasons:

- Peace of Mind: Knowing you have a buffer can reduce a ton of stress during tight financial months.

- Preventing Lapses: It helps you avoid the headache and higher costs of having to reapply for a new policy after it cancels.

- Maintaining Eligibility: With health and life insurance, a lapse could mean losing coverage for pre-existing conditions or having to go through medical underwriting all over again.

The grace period is more than a convenience; it's a contractual right. It’s your chance to keep your financial safety net intact without any interruption.

Understanding the Financial Mechanics

This concept is tied directly to your regular payments. When you learn about what is an insurance premium, you understand it's the price you pay for protection. The grace period is the insurer’s promise not to cut off that protection the second a premium is late.

It's important to know this isn't "free time." You still owe the premium for the time you were covered during the grace period. If you need to file a claim during this window, the insurance company will typically just subtract the overdue premium from whatever they pay out.

Ultimately, this feature is an essential tool for keeping your financial life on track in an unpredictable world.

To help you see how this applies across different types of coverage, here’s a quick breakdown.

Grace Period Quick Guide

This table summarizes how the grace period acts as a safety net for various policy types, ensuring you don't lose protection over a minor payment delay.

| Insurance Type | What the Grace Period Does | Key Takeaway |

|---|---|---|

| Life Insurance | Gives you 30-31 days to pay, preventing a policy lapse and the need for new medical underwriting. | Your long-term financial security for loved ones remains protected. |

| Health Insurance | Provides a 90-day window (for ACA plans with subsidies) to catch up before coverage is terminated. | Critical for maintaining access to healthcare without interruption. |

| Auto Insurance | Offers a shorter window, often 3-10 days, to avoid a lapse that could lead to legal and financial trouble. | Acts as an urgent, short-term buffer to keep you legally on the road. |

Understanding these differences is the first step toward using this feature wisely and safeguarding your future.

How Grace Periods Change Depending on Your Policy

The term "grace period" isn't a one-size-fits-all rule. It’s more like a set of house rules that change from one policy to the next. The buffer you get for your health insurance is a world away from the one for your car insurance. Understanding these differences is the key to keeping yourself protected.

These rules aren't random—they’re shaped by the kind of risk involved, state laws, and even federal regulations. For instance, because an uninsured driver is an immediate public safety risk, auto insurance grace periods are incredibly short. On the other hand, health and life insurance, which are designed for long-term well-being, often come with a more forgiving window.

Let's break down what this means for you.

Health Insurance Grace Periods: Your Critical Safety Net

When it comes to your health, the grace period rules are especially important—and often more generous. This is particularly true for plans purchased through the Affordable Care Act (ACA) Marketplace, where the idea of a safety net really comes to life.

If you receive a premium tax credit (a subsidy), the ACA gives you a 90-day grace period. But there’s a catch. For the first 30 days, your insurer has to keep paying your claims. After that, they can hold off on paying for any care you receive in the second and third months until you’re all caught up.

Here’s how that 90-day window works:

- Month 1: Your coverage is active, and claims get paid just like always.

- Months 2 & 3: You're still technically covered, but your insurer can put any new claims on hold. If you pay what you owe by day 90, they’ll process those claims. If not, the policy gets terminated, and you could be on the hook for those bills.

Now, if you have a health plan without a subsidy, the rules are different. Your grace period is typically set by state law and is usually much shorter—often around 31 days. For a deeper dive into how these coverages differ, check out our guide comparing life insurance vs health insurance.

Life Insurance Grace Periods: Protecting Your Legacy

Life insurance is a long-term promise, often lasting for decades. Because of that, policies are built with a stable, predictable grace period to prevent an accidental lapse that could put a family’s future at risk.

Most life insurance policies come with a standard grace period of 30 or 31 days. In most states, this is a legal requirement designed to give you a fair chance to make a late payment without losing your coverage.

During this window, your policy is still fully active. If the insured person were to pass away during the grace period, the death benefit would still be paid to the beneficiaries, minus the overdue premium. It’s a foundational feature that provides continuous protection during life's little hiccups.

It's also good to know that your payment schedule can sometimes play a role. While 30 days is the norm for annual or quarterly payments, some policies paid monthly might have a shorter 15-day period. Always read your policy documents to be sure. To get a better sense of how payments work across the board, you can explore different payment solutions tailored for the insurance industry.

Auto Insurance: The Shortest Leash

Auto insurance grace periods are by far the strictest, and for good reason. Driving without insurance is illegal almost everywhere. The risk of an accident is immediate and the potential liability is huge, so insurers and state governments have very little patience for lapses.

As a result, the grace period for auto insurance can be as short as a few days—or even nonexistent. It might be anywhere from 3 to 10 days, but many insurers have the right to cancel your policy the day after a missed payment.

Here’s why it’s so tight:

- Legal Mandates: States require drivers to maintain continuous liability coverage.

- High Risk: A car accident can happen in a split second, leading to massive, instant claims.

- Public Safety: Uninsured motorist laws are there to protect everyone on the road.

If you have an accident during your auto insurance grace period, your insurer will likely demand you pay your premium before they’ll cover the claim. But if that period ends and you still haven't paid, you're officially uninsured. Get behind the wheel at that point, and you could face fines, a suspended license, and total personal liability for any damages.

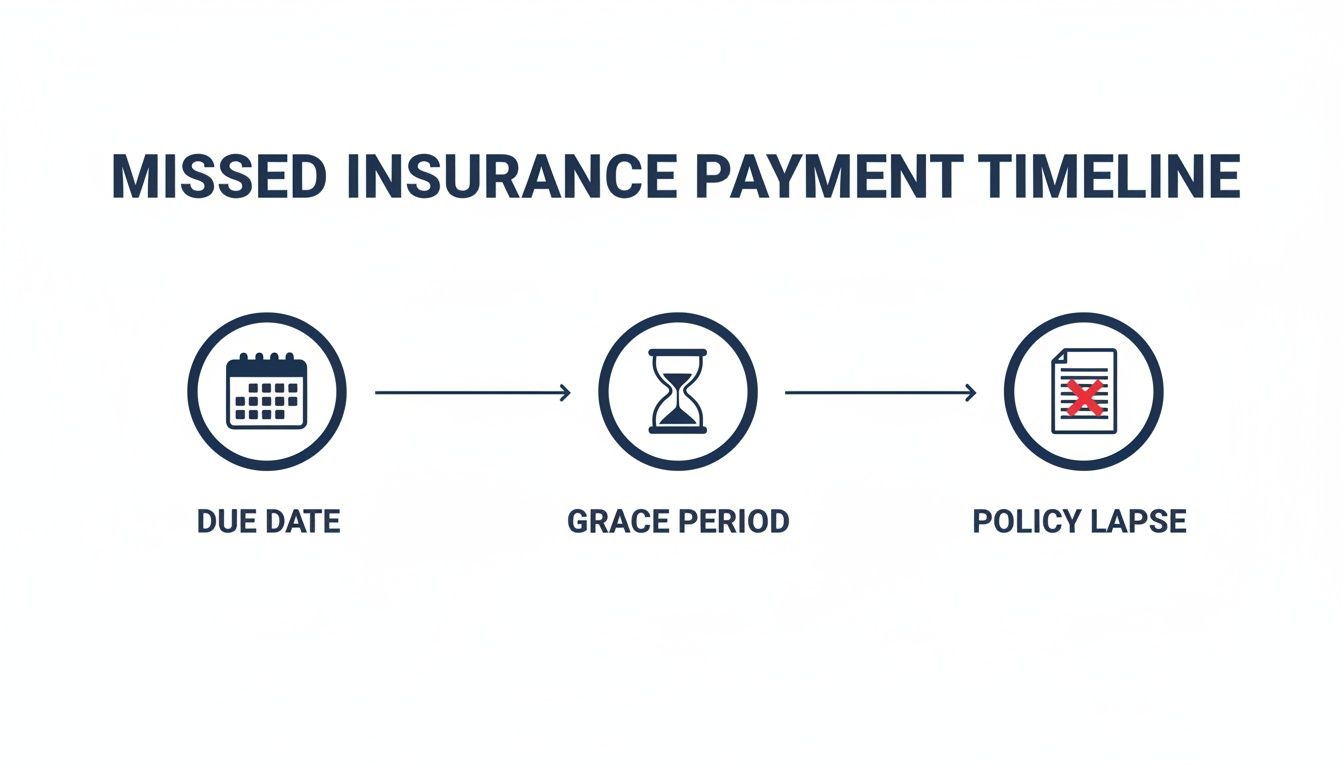

The Timeline After You Miss an Insurance Payment

The moment you miss an insurance payment, a clock starts ticking. It’s not an immediate catastrophe, but a predictable sequence of events is set in motion. Knowing this timeline is the key to staying in control and protecting your coverage. Let’s walk through what happens from the due date to the final deadline, so you know exactly what to expect.

This whole process isn't meant to be a punishment; it's a structured system designed to give you a fair chance to catch up. The first step is simple: the payment due date passes, and your account shows a balance. Your coverage is still active, but you have officially entered the insurance grace period.

Day 1: The Grace Period Begins

The day after your premium was due, your policy’s built-in safety net activates. You are now in the grace period, a window where your coverage remains in full effect even though you haven't paid. You won't get a scary cancellation notice on this day. Instead, the insurer's automated system usually starts its work.

You can expect to hear from them through a few different channels:

- Email Reminders: An initial, friendly email letting you know the payment is past due.

- Text Alerts: A quick SMS message if you've opted into mobile notifications.

- App Notifications: A push notification from your insurer’s mobile app.

These first few messages are typically gentle nudges. The goal is simply to remind you of the oversight before it becomes a bigger deal. During this time, it's a good idea to check your policy status. Our guide on how to verify insurance coverage walks you through the steps to confirm your policy is still active and in its grace period.

Mid-Grace Period: The Reminders Get More Serious

After a week or two, the tone and frequency of the communications will likely change. The reminders become more direct, clearly stating the final date you must pay by to avoid a policy lapse. You might even receive a formal letter in the mail, which serves as an official paper trail of the insurer’s attempt to collect the premium.

This is a critical point in the timeline. Your coverage is still active—if you have a car accident or a medical emergency, you are still protected. But there's a catch: if you were to file a claim, the insurer would almost certainly deduct the outstanding premium from your payout.

Key Takeaway: The insurance grace period is your active window of opportunity. Your coverage is intact, but the clock is ticking. Acting within this timeframe is the easiest way to fix the problem without long-term consequences.

The length of this period can vary a lot. For instance, most life insurance policies globally offer a 30-day window for annual or quarterly payments, but this can shrink to just 15 days for those who pay monthly.

The Final Deadline and Policy Lapse

As the grace period nears its end, you'll receive a final notice. This is often called a "Notice of Intent to Cancel," and it will spell out the exact date and time your policy will terminate if payment isn't received. This is your last chance to act.

If you miss this final deadline, your policy will officially lapse. A policy lapse is different from other types of cancellations; it’s a termination specifically because of non-payment. The moment your policy lapses, your coverage ends. Period.

Here’s what that really means:

- No More Protection: Any event that happens after the lapse date is not covered.

- Claims Will Be Denied: Any claims for incidents that happened during the grace period may now be denied if the premium was never paid.

- The Reinstatement Clock Starts: You're no longer dealing with a simple late payment. Now, you have to go through a more complex reinstatement process, assuming that's even an option.

Understanding this timeline removes the anxiety and uncertainty. By knowing each step, you can confidently take action before a simple missed payment spirals into a major financial headache.

The Real Consequences of a Lapsed Policy

Letting a policy lapse is way more than a minor hiccup. It’s a decision that can set off a chain reaction of serious financial and legal headaches. That insurance grace period isn't just a friendly reminder from your carrier—it's your last chance to stop things from going sideways. Once that window slams shut, the protective shield you’ve been paying for completely disappears.

The most immediate blow is the total loss of coverage. It’s that simple. If your auto insurance lapses on a Tuesday and you have an accident on Wednesday, you're on the hook for every penny of the damages. That could mean tens of thousands of dollars in repairs and medical bills coming straight out of your pocket.

This timeline shows just how quickly a missed payment can escalate into a full-blown policy lapse.

As you can see, the grace period is the only thing standing between a simple late payment and the heavy consequences of having zero protection.

The High Cost of Starting Over

Beyond the immediate danger of being uninsured, a lapsed policy makes it much harder—and more expensive—to get coverage again. Insurers see a lapse as a red flag, a sign of high risk, and that perception will hit you right in the wallet when you ask for a new quote. You're no longer just renewing; you’re applying from scratch as a riskier customer.

This almost always leads to a few painful outcomes:

- Significantly Higher Premiums: Get ready for your rates to jump, sometimes by a lot. You’ve lost your track record of continuous coverage, which is a huge factor insurers use to set prices.

- New Underwriting: For life or health insurance, you might have to go through the whole medical underwriting process all over again. If your health has changed since you first got your policy, you could be flat-out denied or offered a plan with major exclusions.

- Loss of Grandfathered Benefits: Many older life insurance policies have fantastic terms that you just can't get anymore. A lapse means you forfeit that original contract and have to accept whatever terms are on the table today.

Legal and Financial Domino Effects

The fallout from a lapsed policy doesn't stop with the insurance company. Depending on the type of coverage you lost, you could be facing serious legal and financial penalties that can complicate your life for years.

A major consequence is a denied claim. If this happens, it's critical to know what to do when an insurance claim is denied to understand what options you have.

For Auto Insurance:

Driving without insurance is illegal in nearly every state. Period. A lapse can lead to fines, a suspended license, and even having your vehicle impounded. If you cause an accident while uninsured, you can be sued personally, putting your savings, your home, and other assets on the line.

For Life Insurance:

If you have a permanent life insurance policy with a cash value component, a lapse can be financially devastating. You could lose the entire cash value you've built up over years, or even decades. The consequences can be complex, and our article on what happens if I stop paying my life insurance dives much deeper into this specific scenario.

A policy lapse erases your history of responsible premium payments. It forces you back to square one, often facing higher costs, stricter qualifications, and the daunting risk of being completely uninsured.

At the end of the day, that grace period is an incredibly valuable lifeline. It gives you one final shot to make things right and avoid the costly, stressful, and often permanent consequences that follow a policy lapse.

A Practical Guide to Reinstating Your Coverage

So, you missed a payment and your grace period expired. It's a sinking feeling, and it’s easy to think you've hit a dead end. But don’t panic just yet. In many cases, you can still get your coverage back on track without having to start all over again.

The process is called reinstatement, and it’s your lifeline to reactivating a lapsed policy.

Think of it this way: a missed payment during the grace period is just a minor detour. A policy lapse feels more like a roadblock. Reinstatement is how you get that roadblock cleared. It’s a bit more involved than just catching up on a late bill, but it's often a much smarter move than applying for a completely new policy.

The very first step is always the same: contact your insurance agent or company immediately. Time is not on your side here. Most insurers have a limited window for reinstatement, sometimes just a few weeks or months after the policy lapses.

The Steps to Reinstate Your Policy

Getting your policy reinstated isn't a mystery. It's a clear, structured process. While the exact details can change depending on your insurer and the type of policy, the core steps are pretty consistent. Knowing what to expect makes everything feel less stressful.

Here’s the roadmap you'll most likely follow:

-

Submit a Reinstatement Application: This is your formal request to bring the policy back to life. It’s usually shorter than a brand-new application, but it’s crucial to be honest and fill it out carefully.

-

Pay All Back Premiums: You’ll need to settle up. This means paying for every premium you missed, from the first one that was late right up to the present. Some companies might add a small administrative fee or interest, too.

-

Provide a Statement of Health (If Required): For life and health insurance, this is a big one. You'll likely have to sign a document confirming your health hasn't taken a turn for the worse since the policy lapsed. A new, serious diagnosis could make reinstatement tricky.

-

Undergo New Underwriting (In Some Cases): If a lot of time has passed, or if it's a high-value policy, the insurer might want to take a closer look. This could mean a new medical exam for a life policy or a review of your recent driving record for auto insurance.

Crucial Insight: At its core, reinstatement is about proving you’re still the same risk the insurer originally agreed to cover. The more you can do to show that nothing significant has changed, the smoother the process will be.

Reinstatement vs. Buying a New Policy

It’s easy to think, "Why not just get a new policy?" But reinstating your old one and buying a new one are two very different paths with very different financial outcomes. It's important to understand the trade-offs.

Reinstatement is about restoring your original contract. A new policy means creating a brand-new agreement based on who you are today. This is especially critical for life insurance. When you first bought your policy, your rates were locked in based on your age and health at that time. A new policy would be priced based on your current, older age and any health issues that have popped up since, which almost always means a higher premium.

To make it clearer, let’s look at how they stack up.

Reinstatement vs. New Policy Comparison

Understanding the key differences between reinstating a lapsed policy and applying for a brand new one.

| Factor | Reinstating an Old Policy | Buying a New Policy |

|---|---|---|

| Premiums | Restores your original, lower premium rates. | Calculated based on your current age and risk profile, likely higher. |

| Underwriting | May require a statement of health or limited underwriting. | Requires a full new application and complete underwriting process. |

| Contestability Period | The original two-year period usually does not restart. | A new two-year contestability period begins. |

| Waiting Periods | Original waiting periods are already satisfied. | Any new waiting periods for specific coverages will restart. |

Choosing to reinstate often protects the favorable terms you secured years ago. While buying new is always an option, it essentially resets the clock, which can cost you more in the long run.

Proactive Strategies to Avoid Missing Payments

The best way to handle an insurance grace period is to never need one. Think of it as a safety net—it’s great to have, but you don't want to find yourself relying on it. Depending on that buffer can be stressful and risky.

The real power move is prevention. When you build solid payment habits, you keep your coverage secure, your finances predictable, and you ditch the anxiety of a looming cancellation. A few simple, proactive steps can turn your premium payments from a monthly worry into a background task you barely have to think about.

Automate and Align Your Payments

The single most effective strategy? Set up automatic payments. This "set it and forget it" approach ensures your premium gets paid on time, every time, right from your bank account or credit card. It takes human error—like a forgotten due date or a misplaced bill—completely out of the equation.

You can even take it a step further:

- Match Due Dates with Paydays: A quick call to your insurer might be all it takes to adjust your billing cycle. Aligning your premium due date with when you get paid is a simple cash-flow hack that makes sure the funds are always there when you need them.

- Use Digital Calendar Reminders: If you’d rather handle payments manually, your phone is your best friend. Set up recurring alerts on your digital calendar a few days before the due date. That little buffer makes all the difference.

Communicate Before There Is a Problem

Life happens. If you know you’re heading into a tough month and might struggle to pay your premium, the worst thing you can do is go silent. So many people overlook this, but reaching out to your insurer is a surprisingly powerful tool.

Contacting your insurance provider before you miss a payment can open up options that disappear once you're in the grace period. Many companies have hardship programs or can offer a temporary extension if you just explain your situation.

We saw this during the pandemic when many states put grace period extensions in place. Interestingly, even with these protections available, most insurance companies reported that very few customers actually used them. This tells us two things: people are incredibly resilient about making payments, but also that those who need help might not be asking for it. You can dig into these policyholder protection trends to see the data for yourself.

By putting these simple strategies into play, you take back control of your policy and your peace of mind. Consistent, on-time payments are the foundation of a strong financial safety net, letting your insurance do what it does best: protect you without interruption.

Your Top Questions, Answered

Grace periods can feel a little confusing, and it's normal to have questions about the fine print. Let's clear up some of the most common concerns so you can feel confident about your coverage.

Does a Late Payment During the Grace Period Hurt My Credit Score?

Nope. Paying during the grace period won't directly ding your credit score. Insurance companies just don't report your day-to-day premium payments—whether they're on time or a little late—to the big credit bureaus like Experian or TransUnion.

The real risk isn't a hit to your credit report, but the chance of your policy lapsing and leaving you completely uninsured. However, there can be indirect consequences. For example, if your auto insurance cancels and you get a state-mandated fine for driving uninsured, that fine could end up with a collections agency and damage your credit.

Can I Still File a Claim During the Grace Period?

Generally, yes—but there's a catch. You can absolutely file a claim for something that happens during the grace period, but only if you pay the overdue premium before the deadline hits. Once you pay up, your coverage is considered continuous, as if you were never late at all.

Here’s a quick look at how it works:

- For auto and life insurance, your policy is still active. If you get into a car wreck or a death benefit needs to be paid, the insurer will typically cover the claim. They'll just subtract the premium you owe from the final payout.

- For ACA health insurance, the rules are a little more specific. Insurers have to pay claims filed within the first 30 days of your 90-day grace period. After that, they can put your claims on hold until you're fully paid up.

If you miss that final payment deadline, any claim you filed during the grace period will almost certainly be denied. You'll be on the hook for the entire cost.

The bottom line is simple: to be covered for an event during your grace period, you must make the premium payment before time runs out. The claim is valid, but the payment is what validates your coverage.

Will My Rates Go Up if I Use the Grace Period a Lot?

Simply using the grace period won’t cause your premiums to spike. Your insurance rates are based on your risk profile—your driving record, health, age, and location. Paying a few days late doesn't change those core factors.

The real financial danger comes from letting the grace period expire. If your policy lapses because you didn't pay, you lose your locked-in rate. When you go to get a new policy, you’ll be starting from scratch, and the insurer will re-evaluate you based on your current age and any new health or driving issues. This almost always leads to a higher premium. A history of lapses can also flag you as a higher-risk customer.

What Should I Do if I Know I’m Going to Miss a Payment?

Be proactive. Don't just let the due date slide by. The minute you think you might have trouble paying, pick up the phone and call your insurance agent or the company directly. Honest, early communication is your best friend here.

Many insurers are surprisingly willing to work with people facing a temporary tight spot. By reaching out before you're behind, you might find they can offer a solution, like:

- Setting up a temporary payment plan.

- Giving you a short, one-time extension.

- Moving your due date to line up better with your payday.

Explaining your situation shows you're responsible and gives them a chance to help you keep your valuable coverage without any interruption.

Navigating insurance can be complex, but you don't have to do it alone. At My Policy Quote, we specialize in finding clear, affordable insurance solutions that fit your life. Whether you need health, life, or auto coverage, our experts are here to help.