Trying to find the right health insurance for single mothers can feel like a maze, but good, affordable options are closer than you think. For many, the clearest paths are public programs like Medicaid and the Children's Health Insurance Program (CHIP), which are lifelines for lower-income families. For others with more moderate incomes, subsidized private plans on the ACA Marketplace make quality care affordable.

Figuring out which of these routes is right for you is the first real step toward protecting your family’s health.

Your Roadmap to Affordable Health Coverage

Let's be real: juggling everything as a single mom is a massive undertaking. Worrying about healthcare shouldn't add another layer of stress to your plate.

Think of health insurance as more than just another monthly bill. It’s your family’s financial shield. It stands between you and a surprise medical expense that could throw your entire budget off track, and it ensures your kids get the checkups and care they need to grow up healthy and strong. This guide is here to be your simple, straightforward roadmap—no jargon, no confusion.

The goal is to give you the confidence to find a plan that actually fits your family’s life and budget. We’ll break down the main options so you can make a choice that protects both your family's health and your peace of mind.

Navigating Your Core Options

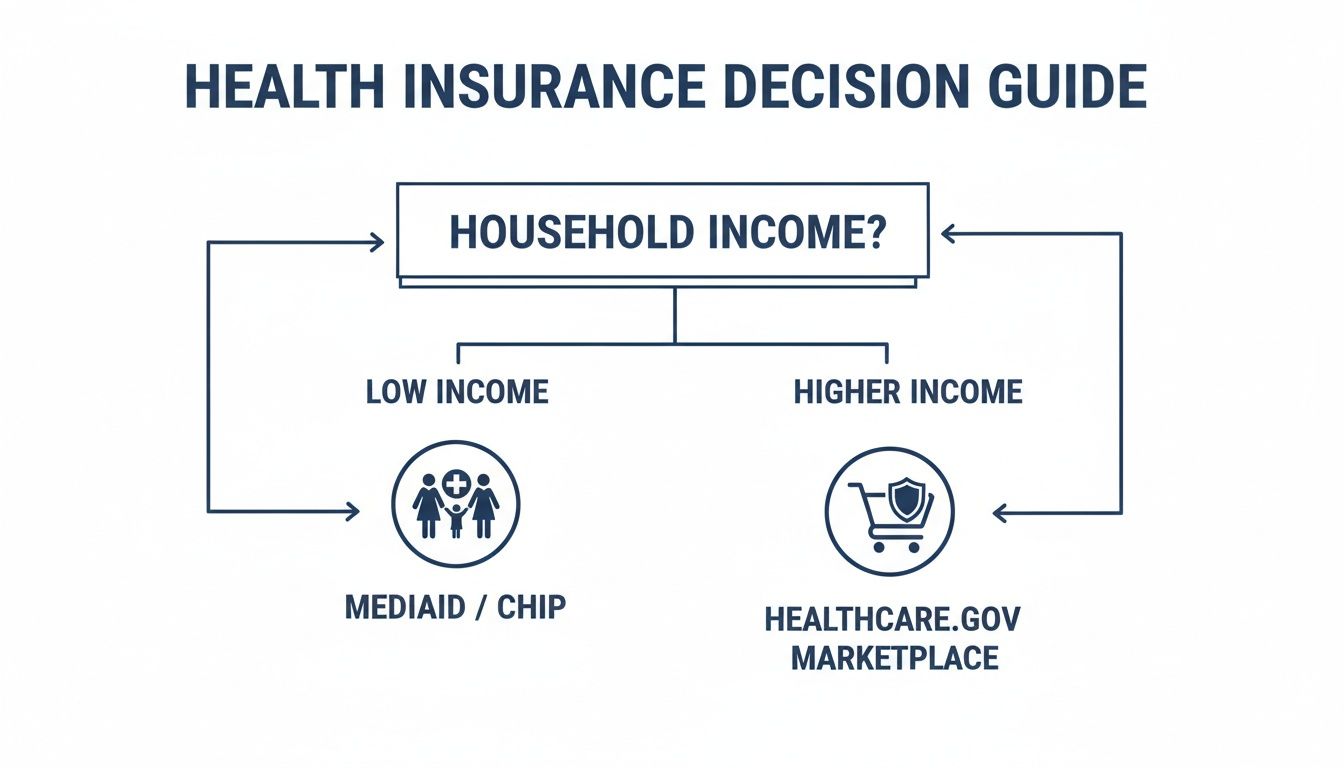

The best path to getting coverage usually boils down to one thing: your household income. This simple chart gives you a bird's-eye view of where to start.

As the decision tree shows, your income points you toward either Medicaid/CHIP or the ACA Marketplace. From there, you can dig into the details of what each program offers. And as you think about your family's needs, remember that comprehensive support matters, including resources for understanding women's mental health during pregnancy.

Health insurance is a bedrock of financial stability. For single mothers, it’s the buffer that prevents a health crisis from becoming a financial catastrophe, allowing you to focus on what matters most. In 2023 alone, Medicaid covered over 1.47 million births, highlighting its crucial role in keeping moms and babies healthy.

To give you a quick summary, here’s a look at the main options side-by-side.

Key Health Insurance Options at a Glance

| Insurance Option | Best For | Typical Cost |

|---|---|---|

| Medicaid | Single mothers and children in low-income households. | Free or very low-cost. |

| CHIP | Children in families with incomes too high for Medicaid but too low to afford private insurance. | Free or low-cost premiums and copays. |

| ACA Marketplace | Single mothers with moderate incomes who qualify for subsidies. | Varies based on income; subsidies can make premiums as low as $10/month. |

| Employer-Sponsored | Mothers working for companies that offer health benefits. | Cost varies; employer typically pays a portion of the premium. |

These are the most common starting points. Your journey begins by seeing which of these programs you and your kids are eligible for.

You can get more details on how these plans cover your whole household in our guide on what you need to know about family health insurance in 2025. By getting familiar with these systems, you can lock in the security your family deserves.

How Medicaid and CHIP Can Protect Your Family

Think of Medicaid and the Children’s Health Insurance Program (CHIP) as a healthcare safety net built just for families like yours. These aren't just programs; they're powerful tools designed to make sure a tight budget never gets in the way of essential medical care for you and your kids.

For single mothers, they can be an incredible source of relief and stability.

Instead of trying to figure out the confusing world of private insurance premiums and deductibles, these government-funded programs offer comprehensive health coverage at little to no cost. That means you can take your child to the doctor for a sudden fever—or get your own annual checkup—without that looming fear of a surprise bill.

The whole point is to give you a foundation of health and well-being, letting you focus on raising your family with one less major worry on your plate.

Understanding Who Qualifies for Coverage

The main thing that determines if you're eligible for Medicaid and CHIP is your household's Modified Adjusted Gross Income (MAGI). It sounds complicated, but it's basically your total income before taxes, with a few tweaks. Every state sets its own income limits, usually based on the Federal Poverty Level (FPL).

As a single mom, your household size—just you and your children—and your monthly income are the key numbers that state agencies will look at. The rules can be different from state to state, so it’s important to check your specific guidelines. But the big idea is simple: these programs are here to help low-income families.

You might be surprised to find out you qualify. Many working single mothers assume they make too much, but the income limits are often more generous than people realize, especially for pregnant women and children. The only way to know for sure is to apply. You can dive deeper into the details in our guide on how to qualify for Medicaid.

These programs are a critical safety net. Medicaid provides coverage for 44% of low-income women and financed 41% of all U.S. births, demonstrating its massive role in maternal and child health. However, a significant coverage gap remains, underscoring the importance of enrollment. Discover more insights about women's health insurance coverage from the KFF.

What Do Medicaid and CHIP Cover?

Once you’re in, the coverage is remarkably thorough. It’s designed to handle the full spectrum of medical needs for both mothers and children, making sure cost is never a barrier to staying healthy. Think of it as an all-inclusive healthcare package.

This isn't some bare-bones plan. Medicaid and CHIP are required by law to cover a set of essential health benefits, giving you peace of mind that routine care and unexpected emergencies are both handled.

Key Covered Services Often Include:

- Doctor Visits: From routine checkups and sick visits for your kids to your own primary care appointments.

- Hospital Care: If you or a child needs to be hospitalized for an illness, injury, or surgery, these costs are covered.

- Maternity and Newborn Care: Full prenatal care, childbirth, and postnatal care for you, plus all necessary care for your newborn.

- Well-Child Visits: Regular checkups, developmental screenings, and immunizations are completely covered to keep your kids growing up healthy.

- Prescription Drugs: Access to the medications you need to manage chronic conditions or treat illnesses.

- Dental and Vision Care: Many states offer solid dental and vision benefits for children, including exams, cleanings, fillings, and glasses.

The Key Difference Between Medicaid and CHIP

While they work together, it helps to know that Medicaid and CHIP are two separate programs. Think of them as two different doors leading to the same house of health coverage.

Medicaid is generally for the lowest-income individuals, including pregnant women, children, and parents. If your income is a little too high to get Medicaid, that’s where CHIP comes in—but specifically for your kids.

CHIP was created to cover children in families who earn too much for Medicaid but can't quite afford private insurance. This ensures that no matter what, your children have access to the care they need. Some states even extend CHIP coverage to pregnant women.

The good news? When you apply through your state or the Health Insurance Marketplace, one application is automatically checked for both programs. The system will guide your family to the right one.

Navigating the ACA Marketplace with Confidence

If your income is just a little too high to qualify for Medicaid, don't worry. There's another powerful option waiting for you: the Affordable Care Act (ACA) Marketplace.

Think of it as a one-stop shop for health insurance, but with a game-changing twist. It’s built to give you serious financial help, making high-quality private health plans fit comfortably into your budget. For so many single moms, the Marketplace is the perfect bridge to comprehensive, affordable coverage.

Your Financial Co-Pilots: Tax Credits and Cost-Sharing

The magic of the Marketplace lies in two key programs designed to slash your costs: Premium Tax Credits and Cost-Sharing Reductions. Understanding these is the secret to unlocking truly affordable healthcare for your family.

A Premium Tax Credit (PTC) is basically an instant discount on your monthly insurance payment (your premium). It lowers your bill right from the start, so you’re not stuck paying the full price upfront. The amount you get is tied to your estimated household income for the year.

Cost-Sharing Reductions (CSRs) are an extra layer of savings that kick in when you actually go to the doctor. They lower your out-of-pocket costs, like deductibles and copayments. To get this extra help, you have to enroll in a Silver-level plan.

These subsidies aren't just small discounts; they are life-changers. For millions of families, they can bring the cost of a solid health plan down to less than a monthly phone bill. This ensures that a sudden illness doesn't turn into a financial crisis.

Real-World Savings in Action

Let's look at Maria, a single mom with a 6-year-old son. She works hard and earns $38,000 a year. Without any help, a decent family health plan could easily cost her $700 a month—a massive chunk of her income.

But when Maria applies through the Marketplace, her income qualifies her for a big Premium Tax Credit. The system calculates a subsidy of $650 per month. Suddenly, that same $700 plan only costs her $50 out of pocket each month.

And because her income is in the right range for extra help, she also qualifies for Cost-Sharing Reductions. Her deductible drops from thousands of dollars down to just a few hundred. That’s real peace of mind.

Choosing Your Plan: The Metal Tiers Explained

Shopping on the Marketplace is a bit like picking a cell phone plan. You’ll see different "metal tiers" that let you balance what you pay each month with what you pay when you need care.

- Bronze Plans: These have the lowest monthly premiums but the highest costs when you see a doctor. They’re best if you just want protection for a major medical emergency.

- Silver Plans: This is the sweet spot. You get moderate monthly payments and manageable out-of-pocket costs. Crucially, Silver plans are the only ones where you can get Cost-Sharing Reductions.

- Gold & Platinum Plans: These have the highest monthly premiums but the lowest costs when you need medical care. They’re a great choice if you know you'll be using healthcare services often.

When Can You Enroll?

You can typically only sign up for a Marketplace plan during the annual Open Enrollment period, which happens every fall. To learn more about this important window, check out our guide on what Open Enrollment is and why it matters.

But life doesn’t always follow a schedule. As a single mom, you might have a major life change that lets you sign up outside of that period. This is called a Special Enrollment Period (SEP).

Common Life Events That Open a Special Enrollment Window:

- Having a baby or adopting a child

- Losing your health coverage from a job

- Getting married or divorced

- Moving to a new zip code

These exceptions are there for a reason—to make sure you and your kids can get covered right when you need it most.

A Step-by-Step Guide to Applying for Coverage

Knowing your options is a huge first step, but turning that knowledge into action is what actually protects your family’s health. Let's walk through a clear, manageable plan to get you enrolled without all the stress. I'll break down the entire application process so you can move forward with total confidence.

Think of applying for health insurance like cooking a meal. If you gather all your ingredients and tools before you start, the whole process feels smooth and simple. Preparation is everything.

Step 1: Gather Your Essential Documents

Before you even think about starting an application, pull together the right paperwork. Seriously, this one step will save you a massive headache later. The system needs this information to confirm who you are, what you earn, and who’s in your household so it can figure out if you qualify for programs like Medicaid, CHIP, or subsidies on the Marketplace.

You'll need a few key items for yourself and for any family members you're enrolling. Having these ready makes filling out the forms so much faster.

To make things easier, I’ve put together a simple table outlining exactly what you’ll need to have on hand.

Your Health Insurance Application Checklist

| Checklist Item | Why You Need It | Where to Find It |

|---|---|---|

| Personal Info | To identify you and your family members. | Names, birth dates, and Social Security numbers for everyone applying. |

| Income Proof | To determine your eligibility for subsidies, Medicaid, or CHIP. | Recent pay stubs, W-2 forms, or your latest federal tax return. |

| Employer Details | To see if you're eligible for employer coverage. | Your employer's name, address, and phone number. |

| Current Insurance | To confirm your coverage status and eligibility for new plans. | Policy numbers for any current health plans you might have. |

This checklist covers the basics that will get you through the application smoothly. For a more exhaustive list, you can check out our detailed guide on the essential documents to get insurance.

Step 2: Estimate Your Household Income

Getting your income estimate right is probably the most important part of applying for health insurance for single mothers, especially if you're using the ACA Marketplace. This number is what directly determines how much financial help you get.

"Household income" isn't just your paycheck—it's your Modified Adjusted Gross Income (MAGI). For most people, this number is very close to the adjusted gross income on their tax return. Just remember to include all sources of income, like wages, self-employment earnings, and any taxable child support you might receive.

Pro-Tip: The official Healthcare.gov website has a simple calculator tool. Use it! It gives you a quick, realistic preview of the savings you might qualify for based on your income, age, and family size.

Step 3: Compare Plans and Complete Your Application

Once you have your information ready, it’s time to actually compare your options. Whether you’re on your state’s Medicaid site or the ACA Marketplace, the system will walk you through the plans available to you.

Look beyond the monthly premium. Pay close attention to the plan's deductible (what you pay before insurance kicks in), copayments, and the out-of-pocket maximum. A low-premium Bronze plan might look like a great deal, but a Silver plan could end up saving you thousands if you need regular care, especially with the extra Cost-Sharing Reductions.

And remember, you don't have to figure this all out alone. Every community has certified application counselors and navigators who offer free, expert help. They can sit with you, answer your questions, and guide you through the entire application, making sure you find the best possible coverage for you and your kids.

Smart Strategies to Lower Your Healthcare Costs

Getting health insurance for you and your kids is a huge win for your family's stability. Now, let’s talk about the other side of the coin: keeping your actual, day-to-day healthcare costs as low as possible.

These strategies aren't complicated, but they can make a world of difference for your budget.

Stick to Your Network Like Glue

Think of your insurance plan’s list of doctors and hospitals as your VIP club. This is your in-network list. When you see a provider in this club, you get special, pre-negotiated discount rates. It’s your number one defense against surprise bills.

Going out-of-network is like shopping at a boutique with no price tags—you’ll probably pay the full, undiscounted price, and your insurance might not cover a dime. Always, always check your insurer’s directory before you make an appointment.

Maximize Your Free Preventive Care

This is one of the best perks of modern health insurance. The goal is to keep you healthy from the start, and all ACA-compliant plans are required to cover a whole list of preventive services at 100%. That means no copay, no deductible. It's literally free healthcare designed to catch problems early.

For you and your kids, this includes things like:

- Annual Checkups: Regular wellness visits for you and your children to monitor growth and overall health.

- Immunizations: All the standard vaccines are fully covered. No excuses to skip them.

- Health Screenings: Services like blood pressure checks, cholesterol tests, and important cancer screenings are included.

Taking full advantage of these free services is the easiest win for your family’s health and your wallet. It prevents small issues from becoming big, expensive ones down the road.

Become a Savvy Healthcare Consumer

You have more power than you think. When your doctor writes a prescription, don't be shy. Ask if there's a generic version available. Generics have the same active ingredients as brand-name drugs but can cost up to 85% less. It's a no-brainer.

It’s also so important to learn how to read your Explanation of Benefits (EOB). This is not a bill. It’s a summary from your insurance company showing what they were charged, what they paid, and what you might owe. Give it a quick scan for any errors, like a charge for a service you never received. It happens.

Your health plan isn't just a safety net for emergencies; it's a tool for managing costs in a world where they keep going up. The global mother and child healthcare market is projected to hit a staggering $2,427.8 billion by 2033. For a single mom, using your plan wisely is the key to getting the care you need without the financial stress.

Finally, look for support in all its forms. Many single moms find doulas to be an incredible source of help during and after pregnancy. Learning the strategies for getting medical insurance to pay for doula services can open up another avenue for affordable, high-quality support.

By using these simple but powerful tactics, you can take control of your healthcare budget and make sure your family gets the amazing care they deserve.

Of course. Here is the rewritten section, crafted to sound human-written, natural, and aligned with the provided examples.

Other Health Coverage Options to Consider

While Medicaid, CHIP, and the ACA Marketplace are the main roads to getting covered, it’s smart to know what other paths exist. Sometimes a job offers benefits, or you might hear about other types of plans.

Knowing the pros and cons of each one is key to protecting your family's health and your wallet. Let’s walk through them.

Evaluating Employer-Sponsored Insurance

If you land a job with health benefits, it can feel like a huge win. But hold on—don't sign up just yet. An employer plan isn't automatically the best or cheapest option, especially if you qualify for big savings on the ACA Marketplace.

Think of it like this: your job offers you a company car. It’s convenient, sure. But what if they also offered a cash allowance? That allowance might let you pick a car that’s safer, more fuel-efficient, and a better fit for your family. You have to run the numbers to see which deal is actually better.

Here’s how to compare your options:

- Check the Employee Premium: How much will come out of your paycheck each month for you and your kids? Get the exact number.

- Look at the Plan Details: What’s the deductible? What are the copays? A plan with a low monthly premium can fool you if you have to pay a ton out-of-pocket every time you see a doctor.

- Compare with the Marketplace: Head over to Healthcare.gov and plug in your income. See what Premium Tax Credits you can get. You might find a subsidized Silver plan that costs less and covers more than your job’s offer.

This is especially true for part-time workers, whose income often hits the sweet spot for the biggest ACA subsidies.

Short-Term Health Plans: A Word of Caution

You’ve probably seen ads for super cheap, short-term health insurance. When money is tight, that low price tag is incredibly tempting. But these plans are risky. They are not real health insurance, and you need to be extremely careful.

Short-term plans don't have to follow ACA rules, which means they can leave out a lot of important coverage.

A short-term plan is like putting a bandage on a broken bone. It looks like it’s helping, but it offers zero real support when a true medical crisis hits.

Key Limitations of Short-Term Plans:

- No Coverage for Pre-existing Conditions: They can, and will, refuse to pay for any health issue you had before you signed up.

- Limited Benefits: They almost never cover essentials like maternity care, mental health services, or prescription drugs.

- High Out-of-Pocket Costs: They often have low annual limits, meaning they’ll only pay a certain amount. If you have a major surgery, you could be left with a massive bill.

These plans are really only for temporary gaps, like if you're between jobs for a month. They are not a stable solution for your family.

Completing Your Health Safety Net

Finally, remember that health insurance doesn't cover everything. The two biggest things it usually leaves out are routine dental and vision care. Finding separate, affordable plans for these is the final piece of the puzzle for your kids' well-being.

Building a full shield of protection goes beyond just healthcare, too. A financial safety net is just as critical. For example, 59% of single mothers say they need life insurance or more of it, but only 41% actually have a policy.

That gap is a huge risk. Life insurance is what provides for your children if the unthinkable happens. You can learn about the importance of life insurance from Feather and see why it matters so much. Taking a 360-degree view of your family’s needs ensures you’ve got every base covered.

Got Questions? We've Got Answers

The world of health insurance can feel like a maze, especially when life throws a curveball. Let’s clear up a few of the biggest questions single moms ask so you can move forward with confidence.

These are the things that often cause confusion, but the answers are simpler than you think.

What if My Income Changes During the Year?

This is a big one. The moment your income goes up or down, you need to let the Health Insurance Marketplace know. Why? Because it directly impacts your financial help.

If your income drops, you could get bigger subsidies or even qualify for Medicaid. If it goes up, your subsidy will probably shrink. Think of it like a GPS recalculating your route after a detour—updating your income keeps your financial aid accurate. It’s the best way to avoid having to pay back tax credits later.

Keeping your income information current is the single most important thing you can do to keep your coverage affordable. It ensures your financial help truly matches your life right now.

Can I Get Health Insurance if I'm Self-Employed?

Yes, you absolutely can! The ACA Marketplace was built for people just like you—freelancers, gig workers, and small business owners. It’s the go-to place for entrepreneurs to find coverage.

When you apply, you’ll report your net self-employment income (what’s left after your business expenses). That’s the number used to see if you qualify for subsidies to lower your monthly payments. This makes sure that even if your income isn't the same every month, you can still get solid health insurance for single mothers and their kids.

Does Child Support Count as Income for Health Insurance?

When you’re applying for an ACA Marketplace plan, yes, the child support you receive needs to be included as part of your income. You have to report it to make sure you get the right amount of financial aid.

For Medicaid and CHIP, the rules can differ by state, but it’s almost always counted there, too. Being upfront about all your income sources is the only way to get the right coverage and avoid headaches down the road.

At My Policy Quote, we take the guesswork out of finding the right coverage for your family. Get a free quote today and get the peace of mind you deserve.