This whole "do I legally have to get health insurance?" question used to have a simple answer. Now? It's a bit more complicated. While there’s no longer a federal rule forcing you to have coverage, the real answer depends entirely on where you live.

A handful of states have kept their own rules on the books, which means going uninsured could still lead to a penalty on your state tax return.

The Shift from Federal Rules to State Mandates

To really get what's happening today, we have to look back at a huge policy shift that changed everything. For years, the answer to this question was the same for everyone, no matter their zip code.

Back in 2010, the Affordable Care Act (ACA) introduced a rule called the "individual mandate." This federal law required most Americans to have health insurance or pay a penalty. But that all changed in 2019 when the federal penalty was officially dropped to $0, effectively ending the nationwide requirement.

Why State Rules Matter More Than Ever

When the federal penalty disappeared, a few states stepped in to create their own individual mandates. These places decided the original logic was still sound.

Currently, you'll find state-level requirements in:

- California

- Massachusetts

- New Jersey

- Rhode Island

- Vermont

- Washington, D.C.

The idea behind these laws is pretty simple: when everyone has insurance—both healthy folks and those who need more care—it creates a more stable, balanced insurance market. This helps keep premiums from skyrocketing for everybody.

Think of it like local traffic laws. There isn't a single national speed limit for every road in the country. Instead, each state and town sets its own rules. You follow the signs where you are to avoid a ticket. The same idea now applies to health insurance.

To make this crystal clear, here’s a quick breakdown of how things have changed.

Federal Mandate Vs State Mandates at a Glance

| Aspect | Former Federal Mandate (ACA) | Current State Mandates |

|---|---|---|

| Authority | Nationwide, applied to all U.S. residents | Varies by state; only applies to residents of that state |

| Penalty | A federal tax penalty, reduced to $0 in 2019 | A state tax penalty, with amounts set by each state |

| Enforcement | Handled by the IRS during federal tax filing | Managed by state tax agencies |

| Current Status | No longer enforced due to the $0 penalty | Actively enforced in a handful of states |

This table shows the clear handoff from a single federal system to a patchwork of state-level decisions.

What This Means for You

So, what's the bottom line? Your legal duty to have health insurance is now dictated by your state, not Washington D.C.

If you live in a state without its own mandate, you won’t get hit with a tax penalty for being uninsured. But if you call one of the states listed above home, choosing to go without coverage could mean a hit to your wallet come tax season.

This state-by-state system makes it critical to know your local rules before you make any decisions. For a deeper look at the financial pros and cons, our guide on if you truly need health insurance is a great next step.

How We Got Here: The Shift from Federal to State Rules

To really get a grip on today's health insurance landscape, you have to know the story of how we got here. The question, "do I have to get health insurance?" once had a straightforward, nationwide answer. But a series of major policy shifts flipped the script, handing responsibility from the federal government back to individual states.

It all kicked off with the Patient Protection and Affordable Care Act (ACA) back in 2010. One of the law's most crucial pieces was the individual mandate—a federal rule requiring almost every American to have at least basic health coverage. This wasn’t just a random rule; it was the bedrock designed to keep the entire insurance market stable.

The thinking was pretty simple: if everyone, both healthy and sick, is in the same insurance pool, the risk gets spread out. This massive participation helps keep premiums from skyrocketing for everybody, especially for people with pre-existing conditions who, thanks to the ACA, could no longer be turned away.

The Federal Mandate Loses Its Teeth

For years, the individual mandate was enforced with a federal tax penalty. If you decided to go without insurance, you’d face a fee when you filed your taxes. This penalty was the "stick" that nudged people into the health insurance marketplace.

But then came a huge change with the Tax Cuts and Jobs Act of 2017. While this law didn't technically erase the individual mandate, it did something just as powerful: it dropped the federal penalty for not having insurance to $0, starting in 2019.

With no financial penalty, the federal mandate was essentially defanged. It was like a speed limit sign with no police to enforce it—the rule was still there, but there was no consequence for ignoring it. This effectively marked the end of a nationwide requirement to have health insurance.

States Take the Reins

When the federal penalty vanished, a new problem popped up. Without the mandate pushing healthy people to sign up, states started to worry. They feared their insurance markets would spiral, with premiums climbing higher as the pool of insured folks became sicker and more expensive to cover.

In response, a handful of states decided to create their very own individual mandates. These states include:

- Massachusetts (which actually had a mandate before the ACA even existed)

- New Jersey

- California

- Rhode Island

- Vermont

- The District of Columbia

These states stepped up to fill the gap the federal government left behind, creating their own penalties for residents who don't have coverage. Their aim was to preserve the ACA's original goal: to keep their insurance markets stable, control costs, and make sure their residents stay covered. The maze of these different state rules really underscores why understanding insurance industry regulatory compliance is so important and how it directly impacts you.

This move from one federal rule to a patchwork of state laws is exactly why the answer to our original question now depends so much on your zip code. It's the direct result of a decade of policy changes, leaving us in a system where your state government often has the final word.

The True Cost of Going Without Health Insurance

When people ask if health insurance is legally required, they're usually thinking about tax penalties. But that’s a small part of a much bigger story. The real penalty for skipping coverage isn't a fee on your tax return—it's the massive financial gamble you take every single day.

Think about it like driving without car insurance. A simple fender-bender could cost you thousands out of pocket, completely derailing your budget. The same is true for your health, but the financial stakes are so much higher. One bad accident or one unexpected diagnosis can lead to life-altering debt.

This is where the conversation has to shift from a legal question to one of pure financial survival. The real "penalty" for being uninsured is the crushing cost of one bad day.

The Staggering Price of Common Medical Events

It's tempting to think, "I'm young and healthy, I'll be fine." But accidents and illnesses don't discriminate. Without insurance, the bills for even routine medical care can be absolutely astronomical.

Let's ground this in reality with a few examples of what you could be on the hook for:

- A Broken Leg: A quick slip on a wet floor can mean an ER visit, X-rays, a cast, and follow-up appointments. That seemingly simple injury can easily run you $7,500 or more.

- An Appendix Surgery: An appendectomy is a common, urgent procedure. But without insurance, the hospital stay, surgeon’s fees, and anesthesia could land you with a bill between $30,000 and $40,000.

- A Four-Day Hospital Stay: A serious illness like pneumonia could require a few days of hospital care. The average cost can blow past $20,000, and that's before factoring in special treatments or medications.

These aren't just numbers on a screen. They represent a kind of debt that can haunt you for years, maybe even decades. The financial wreckage from a single medical event can be devastating.

Medical Debt: The Silent Financial Crisis

The fallout from these high costs is real and widespread. In the United States, medical debt is a leading cause of personal bankruptcy. It wipes out savings, craters credit scores, and puts an unbearable strain on families.

When you have insurance, your plan negotiates lower, discounted rates with doctors and hospitals. After you meet your deductible, the insurance company covers the lion's share of the bill. Without that shield, you’re stuck paying the full, undiscounted "chargemaster" price—the highest possible rate a hospital can charge.

Think of health insurance as a financial shock absorber for your life. You hope you never need it for something big, but if you hit a massive pothole—like a sudden diagnosis or a serious injury—it keeps the impact from wrecking your entire financial future.

This is why, even in states without a legal requirement, the combination of high premiums and even higher medical costs creates a powerful incentive to stay covered. And it's not just a problem here. A 2022 WHO estimate showed that 2.1 billion people globally faced financial hardship from health spending, with 1.6 billion pushed into poverty by out-of-pocket costs. You can dig deeper into what’s driving these issues in a detailed analysis of the global health insurance market.

Beyond Financial Ruin: The Other Hidden Costs

The price of being uninsured isn't just measured in dollars. It also comes with serious health and opportunity costs that can affect your well-being for a lifetime.

Delayed or Forgone Care

Without the safety net of insurance, it's natural to avoid seeing a doctor for "minor" issues. That persistent cough or nagging pain gets ignored because you're afraid of the bill. The danger is that this allows small, easily treatable problems to snowball into serious, complex, and far more expensive conditions down the road.

Lack of Preventive Services

Health insurance plans are designed to keep you healthy, not just treat you when you're sick. Most plans cover a wide range of preventive services at no extra cost, including:

- Annual physicals and wellness visits

- Vaccinations and flu shots

- Screenings for cancer, high blood pressure, and cholesterol

These services are your first line of defense. They catch diseases early when they are most treatable and manageable. Skipping them because of cost means you lose your best chance to take control of your health proactively. The hard truth is that medical emergencies without insurance can ruin you financially, and avoiding preventive care only makes that gamble riskier over time.

At the end of the day, going without health insurance is a high-stakes bet. You might save a little on monthly premiums now, but you're leaving yourself completely exposed to financial and medical risks that can change your life in an instant. The true cost is so much greater than any state penalty.

Navigating State Mandates, Penalties, and Exemptions

Even though the federal penalty for not having health insurance is a thing of the past, that’s not the whole story. If you happen to live in a state with its own mandate, the answer to "is it required to have health insurance?" is a definite yes. And ignoring that requirement can hit you with a financial penalty right when you file your state taxes.

Think of it like a local parking rule. You might park for free in one town, but just a few miles down the road, the same spot could require you to feed a meter—or risk getting a ticket. State health insurance mandates operate much the same way; the rules change depending on where you live.

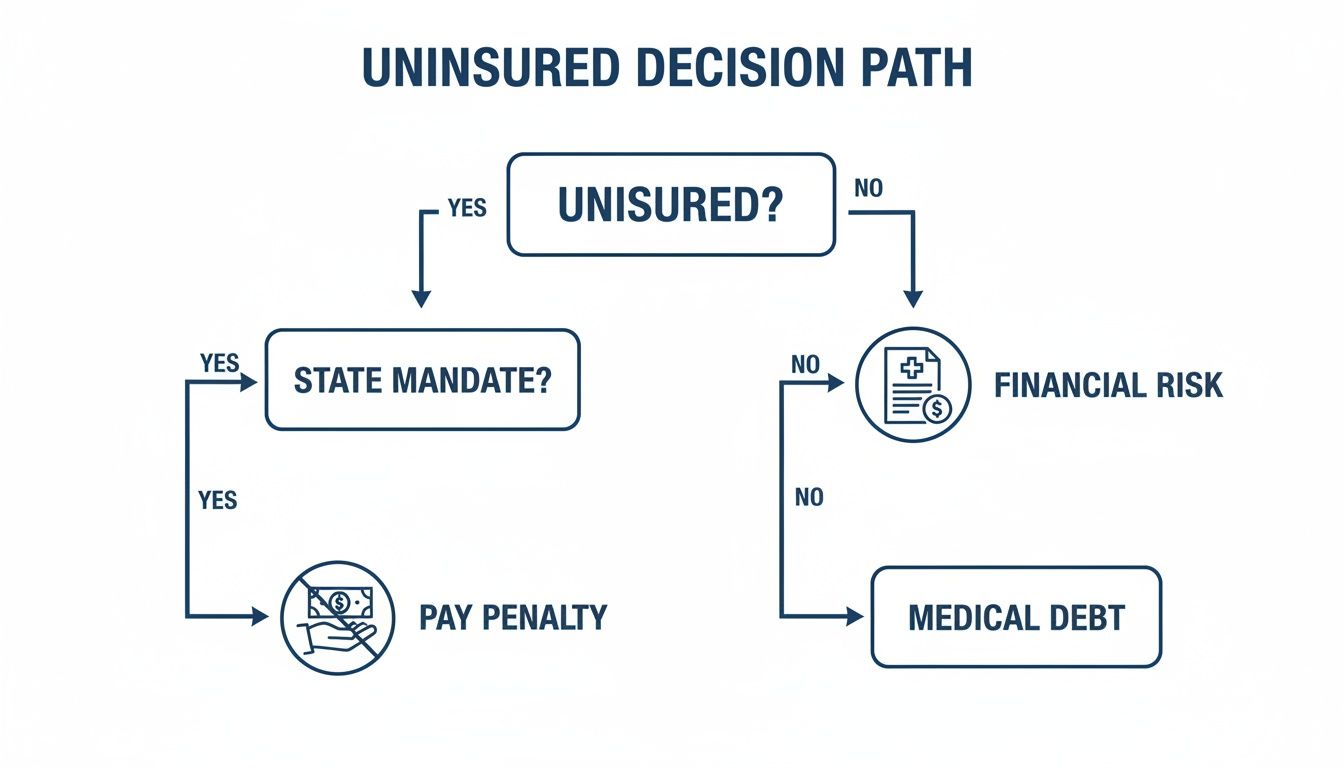

This flowchart lays out the two main paths you could face, all based on your state's laws.

As you can see, if your state has a mandate, you have a direct choice: get covered or pay the price. For everyone else, the risk is different but potentially far more devastating—the threat of crippling medical debt.

Understanding State Penalties

States that mandate health insurance have their own unique formulas for calculating penalties. They’re designed to be just uncomfortable enough to make getting insured the more attractive option.

This penalty, often called a "Shared Responsibility Payment" or something similar, is usually calculated in one of two ways. You’ll be charged whichever amount comes out higher:

- A Percentage of Your Household Income: This is a set percentage of your annual household income above the state’s tax filing threshold.

- A Flat Fee Per Person: A fixed dollar amount is charged for each uninsured adult and child in your household.

To put it in perspective, for the 2023 tax year in California, the penalty started at $900 per adult and $450 per child. A family of four could have easily faced a minimum penalty of $2,700 just for being uninsured.

To give you a clearer picture, here’s a quick look at the states with individual mandates and how their penalties are generally structured.

| State | Penalty Name | Penalty Calculation Method (General) | Common Exemptions |

|---|---|---|---|

| California | Individual Shared Responsibility Penalty | Greater of a flat per-person fee or 2.5% of household income. | Hardship, short coverage gap, low income, religious conscience. |

| District of Columbia | Individual Responsibility Requirement | Greater of a flat per-person fee or 2.5% of household income. | Hardship, short coverage gap, low income, religious conscience. |

| Massachusetts | Health Care Reform Penalty | 50% of the cost of the lowest-cost plan available through the state exchange. | Affordability, short coverage gap, religious conscience. |

| New Jersey | Shared Responsibility Payment | Greater of a flat per-person fee or 2.5% of household income. | Hardship, short coverage gap, low income, religious conscience. |

| Rhode Island | Individual Mandate Penalty | Greater of a flat per-person fee or 2.5% of household income. | Hardship, short coverage gap, low income, religious conscience. |

| Vermont | Individual Mandate | No financial penalty is currently assessed for non-compliance. | N/A (no penalty) |

This table is a general guide, and it’s always best to check with your state's official resources for the most up-to-date and specific information.

The point of these penalties isn't to punish people. It’s about keeping the insurance market stable. When more people are in the pool, the risk is spread out, which helps keep premiums more affordable for everyone in the state.

Common Reasons for an Exemption

Living in a state with a mandate doesn't mean a penalty is guaranteed if you're uninsured. States get that life happens, so they’ve created specific exemptions to waive the fee for people in certain tough situations.

While the exact list of exemptions varies a bit by state, they usually cover circumstances that make it genuinely difficult or impossible to get coverage. The key is that you have to apply for an exemption and get it approved to avoid the penalty.

Who Qualifies for a Waiver?

You might be able to get the penalty waived if you went through one of these situations during the year:

- Financial Hardship: This is a wide-ranging category that can include things like bankruptcy, eviction, or getting a utility shut-off notice. You might also qualify if the cheapest health plan available would cost more than a certain percentage of your income (often around 8%).

- Short Gap in Coverage: Most states are lenient about a brief period without insurance, usually less than three consecutive months. This helps people who are between jobs or switching plans.

- Low Income: If your income is so low that you don't have to file a state tax return, you’re typically exempt from the penalty. For those with very low income, learning how to qualify for Medicaid is a fantastic option that provides free or low-cost coverage, taking any penalty concerns completely off the table.

- Religious Conscience: Members of recognized religious groups with objections to accepting insurance benefits—both private and public, like Medicare—can often apply for this exemption.

- Incarceration: If you were incarcerated, you won't be penalized for the months you spent in jail or prison.

The best place to get the full list of exemptions and find the right application forms is your state’s official health insurance marketplace or department of revenue website. Being proactive is your best defense against an unexpected bill come tax time.

Your Action Plan for Finding Health Insurance

Knowing you need health coverage is one thing. Actually finding it is a whole different ballgame, and it can feel pretty overwhelming. Think of this section as your roadmap. We’ll break down the main paths to getting insured so you can figure out which one makes the most sense for you.

The good news? You have more options than you might realize. Whether you're a freelancer, an early retiree, or working a job that doesn't offer benefits, there’s a route for almost everyone.

Your Primary Pathways to Coverage

Finding health insurance is a bit like planning a trip—the best route depends on where you're starting from. Your job, income, and family situation all point you in a certain direction. Let’s look at the four main roads you can take.

-

Employer-Sponsored Health Insurance: This is how most people in the U.S. get their coverage. If your job offers a group plan, it’s usually the simplest and most affordable choice because your employer typically pays a big chunk of the monthly premiums.

-

Health Insurance Marketplace (Healthcare.gov): Created by the Affordable Care Act (ACA), this is the official one-stop shop for individuals, families, and self-employed folks who need to buy their own plan.

-

Medicaid and CHIP: These are joint federal and state programs offering free or low-cost coverage to millions of Americans. They're designed for eligible low-income adults, kids, pregnant women, seniors, and people with disabilities.

-

Private Plans (Off-Exchange): You can also buy a plan directly from an insurance company or through a broker. These plans still have to meet ACA rules (like covering pre-existing conditions), but you won't be able to get income-based financial help if you go this route.

Understanding these different avenues is the first step. Each one is built to serve different needs and financial realities.

Diving into the Health Insurance Marketplace

If you don't have coverage through a job, the Health Insurance Marketplace is your best friend. It’s an online platform where you can compare different health plans from multiple companies, all in one place—kind of like using a travel site to compare flights.

One of the biggest perks of the Marketplace is financial assistance. Depending on your household income, you might qualify for:

- Premium Tax Credits: These are subsidies that directly lower your monthly insurance payment. For many people, these credits make quality insurance surprisingly affordable.

- Cost-Sharing Reductions: If your income falls below a certain threshold, you could also get extra savings on out-of-pocket costs like deductibles and copayments when you pick a Silver plan.

These programs exist for one simple reason: to make sure a lower income doesn't lock you out of the healthcare you need.

Critical Timelines You Cannot Miss

When it comes to signing up for health insurance, timing is everything. You can't just enroll whenever you feel like it; there are specific windows you have to hit. If you miss them, you could be waiting a full year for another chance.

Open Enrollment Period: This is the main time of year when anyone can sign up for a new plan through the Marketplace. It usually runs from November 1 to January 15, though a few states have their own extended deadlines.

But what if you lose your job in March or have a baby in July? That’s where a Special Enrollment Period comes in.

Qualifying for a Special Enrollment Period

A Special Enrollment Period (SEP) is a 60-day window outside of the normal Open Enrollment when you can sign up for coverage after a major life change.

Common events that can trigger an SEP include:

- Losing your job-based insurance

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new zip code

- A major change in your income

These rules are a safety net, ensuring you're not left unprotected by things outside of your control. As you look at your options, it helps to understand the operational aspects of insurance companies, since it gives you a better sense of what to expect when you sign up and need support. Just remember to act fast—that 60-day clock starts ticking the day your life event happens.

No matter your situation, the first step is to start exploring. Whether you talk to your HR department, visit Healthcare.gov, or contact your state’s Medicaid agency, taking action is the only way to get the peace of mind that comes with being insured.

Common Questions About Health Insurance Requirements

Even after you get the hang of the rules, real life has a way of throwing curveballs. What happens if you're between jobs? What if you work for yourself? These are the kinds of practical, everyday questions that can leave you feeling stuck.

Let's clear up the confusion. Here are straightforward answers to the "what if" scenarios that pop up most often when you're sorting out your health insurance.

What Happens If I Have a Short Gap in Coverage?

This is a classic. You leave one job, but the health benefits at your new one don't start for a month or two. It’s a stressful spot to be in, especially if your state has a health insurance mandate.

The good news? Most of these states built in a little breathing room with a "short coverage gap" exemption. It’s designed for exactly this situation. Much like the old federal rule, it usually means you won't get hit with a tax penalty if you’re uninsured for less than three consecutive months.

But—and this is a big but—you absolutely need to check your state's specific rules. Definitions can vary. More importantly, an exemption doesn't protect your health or your wallet. Even a brief lapse leaves you 100% on the hook financially. A sudden accident during that gap could mean thousands in medical bills, which makes that tax exemption feel like cold comfort.

Do I Need Insurance If I Am Self-Employed?

Yep. If you live in a state that requires health insurance, the rules apply to everyone—freelancers, 1099 contractors, and small business owners included. Your employment status doesn't give you a pass on the legal requirement to have coverage.

For anyone who's their own boss, the Health Insurance Marketplace (Healthcare.gov) is your best friend. It was built specifically to help people who don’t get insurance through an employer find a solid plan.

Depending on your net income from self-employment, you could also qualify for some serious financial help:

- Premium Tax Credits to lower what you pay each month.

- Cost-Sharing Reductions to shrink your out-of-pocket costs, like deductibles and copays.

Plus, if you recently left a job with benefits, that counts as a qualifying life event. This opens up a Special Enrollment Period, giving you a 60-day window to get a new Marketplace plan, even if it's outside the normal Open Enrollment season.

Can an Insurer Deny Me for a Pre-existing Condition?

No. Absolutely not. This is one of the most powerful and life-changing protections created by the Affordable Care Act (ACA). An insurance company is legally forbidden from turning you down or jacking up your rates because of a health condition you already have.

This protection applies to all standard major medical plans, no matter where you get them:

- Through your job

- On the Health Insurance Marketplace

- Directly from an insurance company

This rule is a cornerstone of modern health insurance. It guarantees that the people who need care the most—whether for asthma, diabetes, cancer, or anything else—have the same access to coverage as everyone else.

It completely changed the game, tearing down a huge barrier that once left millions of Americans without any realistic options.

Do Short-Term Plans Count as Real Coverage?

In almost all cases, no. This is a critical detail that trips a lot of people up. Short-term health plans, often called temporary insurance, do not count as "minimum essential coverage" under the ACA.

What does that mean for you? If you live in a state with an individual mandate, having one of these plans won't save you from the tax penalty. They operate outside the ACA's rules, and that comes with some major trade-offs.

Understanding how the healthcare system operates behind the scenes can also shed light on why these plans fall short. For instance, the reliability of your coverage often depends on efficient back-end operations, and learning about automated claims processing in insurance and healthcare can give you a better appreciation for what makes a plan truly functional. Short-term plans often lack these robust systems.

Here are the key differences you need to know:

- Pre-existing Conditions: They can, and often will, refuse to cover anything related to a pre-existing condition.

- Essential Health Benefits: They aren't required to cover the 10 essential health benefits, like maternity care, mental health services, or prescription drugs.

- Coverage Limits: They can put a dollar cap on how much they'll pay for your care, either annually or over your lifetime.

Their low price tags are tempting, but these plans offer just a sliver of the protection you get from a real, ACA-compliant plan. Think of them as a temporary band-aid for a catastrophic injury, not as a substitute for true health insurance.

Sorting through these questions is the final step toward making a smart, confident decision. At My Policy Quote, we give you the tools and support you need to compare plans and find coverage that actually fits your life and budget. Explore your options with My Policy Quote today.