Your health insurance premium is the non-negotiable, fixed amount you pay every month to keep your health plan active. Think of it like your Netflix or gym subscription—you pay it whether you use the service or not.

This payment is your key to unlocking healthcare access. It’s what keeps your coverage in place, ready for you whenever you might need it.

Your Health Insurance Premium Explained

Getting a handle on your monthly premium is the first real step to mastering your healthcare budget. This is the bedrock of your coverage. As long as you pay it on time, you guarantee your access to the network of doctors, hospitals, and preventative care outlined in your policy.

It's important to remember that this is just the ticket that gets you into the game. It’s totally separate from the costs you pay when you actually use medical services, like a copay or deductible. These monthly payments are predictable and usually stay the same until your annual renewal, which makes them much easier to budget for than a surprise medical bill.

If you want to see how this idea applies to other kinds of coverage, you can check out our guide on what is an insurance premium.

Unfortunately, these costs have been climbing steadily. In 2025, for instance, the average yearly premium for a family health plan hit $26,993, a 6% jump from the year before. That breaks down to a monthly premium of around $2,250 for some families, a direct reflection of just how expensive medical care has become. You can dig into more of these health insurance cost trends to see the bigger picture.

Key Takeaway: Your premium is the fixed fee you pay to keep your health insurance policy active. It's not a down payment on future medical care and it absolutely does not count toward your deductible or other out-of-pocket costs.

Key Takeaways About Your Monthly Premium

Here’s a quick-glance table to help these concepts stick.

| Concept | What It Means for You |

|---|---|

| Fixed Monthly Cost | It's a predictable bill you can easily budget for each month. |

| Access Fee | Paying it ensures your coverage stays active, whether you're sick or healthy. |

| Not a Down Payment | It does not reduce the amount you'll owe for your deductible or copays. |

| Separate from Care Costs | It’s the cost of having insurance, not the cost of using it. |

In short, think of your premium as the cost of admission. It gets you in the door, but it doesn't cover the snacks once you're inside.

How Your Health Insurance Premium Is Calculated

Ever look at your monthly health insurance bill and wonder where that number comes from? It’s not just pulled out of thin air. Insurance companies use a specific formula to figure out what you’ll pay, and it’s all about balancing risk.

Think of it this way: they’re trying to predict how much medical care you might need. Once you understand the ingredients that go into that calculation, your premium stops being a mysterious charge and becomes a predictable part of your budget. Let's break it down.

The Main Factors That Set Your Price

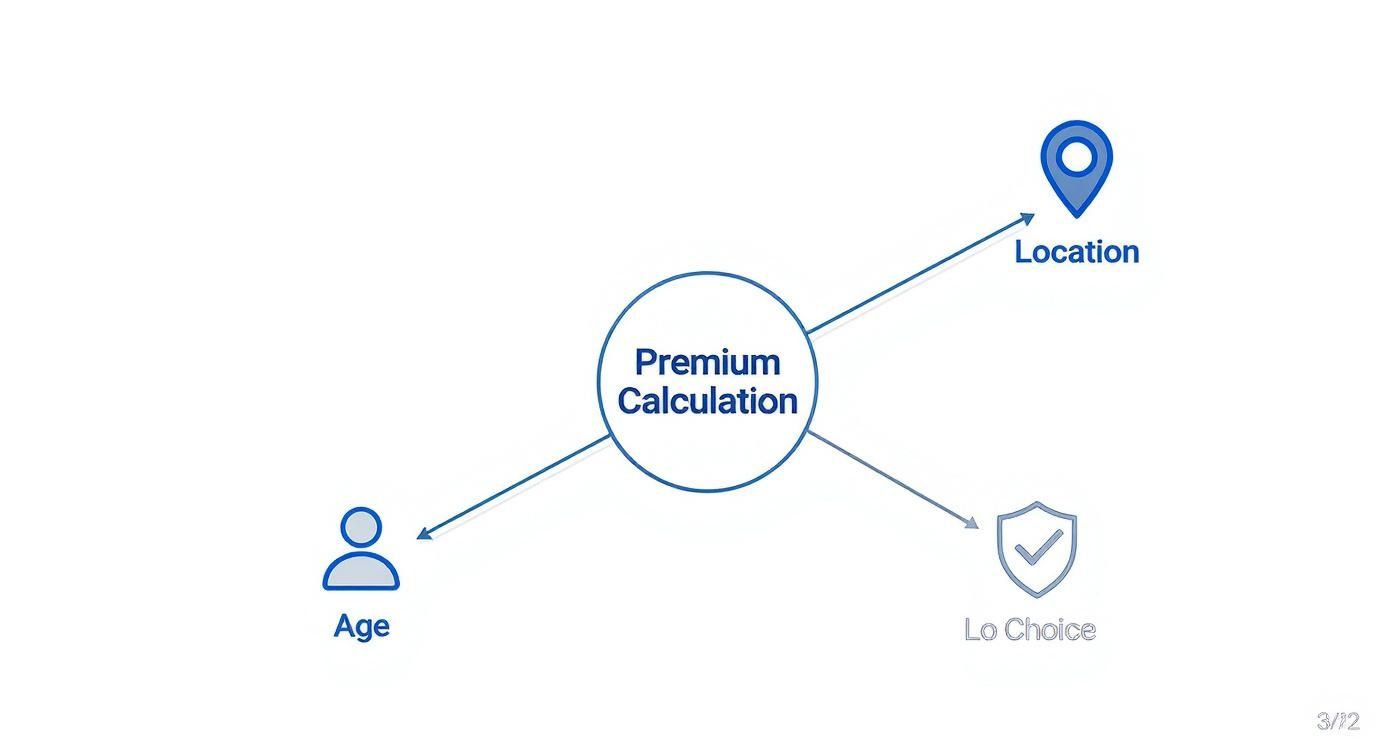

Insurers look at a few key personal details to set your monthly rate. While the Affordable Care Act (ACA) prevents them from using your health history against you, other factors play a huge role.

These are the big four:

- Your Age: It’s a simple fact that as we get older, we tend to need more medical care. Because of that, premiums generally go up with age.

- Your Location: Where you live really matters. Healthcare costs can vary wildly from one state—or even one county—to the next, and so will your premium.

- Tobacco Use: This one is a big deal. Insurers can charge tobacco users up to 50% more for their premium. It’s a direct reflection of the higher health risks linked to smoking.

- Plan Category: The "metal level" you pick—Bronze, Silver, Gold, or Platinum—is a major driver of your cost. Bronze plans have the lowest monthly premiums but make you pay more when you get care. Platinum plans are the opposite.

These variables are the building blocks insurers use to assess risk. When they set your premium, they’re really just trying to figure out how likely you are to need medical services. This whole evaluation process is known as underwriting in insurance, and it's the core of how they calculate your price.

The Role of the Risk Pool

Beyond your personal stats, your premium is also shaped by something called a risk pool. This is simply the group of everyone else enrolled in the same health plan as you.

The idea is to spread the risk around. The insurer takes the total expected medical costs of everyone in the group and divides it among all the members. If the pool has a lot of healthy people, their low costs help balance out the higher costs of members who need more frequent or expensive care.

This collective balancing act is what keeps insurance afloat and helps make premiums more stable for everyone. A healthier risk pool almost always means lower, more predictable premiums for you.

Premiums vs. Deductibles and Other Health Costs

Getting a handle on your monthly premium is a great start, but it's only one piece of the puzzle. The real "aha!" moment comes when you see how it works alongside the other costs you might run into. It’s easy to get these terms mixed up, but a simple analogy can make it all click.

Think of your health plan like a gym membership. Your monthly premium is the fixed fee you pay every month just to have access. It doesn't matter if you go once or thirty times—that payment is due no matter what. It keeps your membership active.

Breaking Down Your Out-of-Pocket Costs

Now, what happens when you actually use your health insurance? That's when other expenses, known as out-of-pocket costs, come into play. You pay these directly when you get medical care.

They show up in a few different ways:

- Deductible: This is the amount you have to pay for your medical care before your insurance plan starts chipping in. If your plan has a $3,000 deductible, you’re on the hook for that first $3,000 in bills. We have a full guide that explains what a deductible for health insurance is if you want to dive deeper.

- Copayment (Copay): This is that flat fee you pay for a specific service, like a doctor's visit or a prescription. For instance, you might pay a $30 copay to see your primary care physician.

- Coinsurance: This is where you and your insurance company share the cost after you've met your deductible. If your plan has 20% coinsurance, you’ll pay 20% of the bill for a covered service, and your insurer handles the other 80%.

The tricky part is figuring out the right balance between your fixed premium and these variable out-of-pocket costs.

As you can see, the type of plan you choose is a huge factor in how this all plays out. Generally, a lower premium means you'll pay more when you need care, and a higher premium means you'll pay less.

Here's a crucial point: Your monthly premium payments never count toward your deductible. Think of it this way: the premium is the price of admission, while your deductible, copays, and coinsurance are what you pay for the rides.

Comparing Your Health Insurance Costs

Seeing all these costs side-by-side really helps clarify the difference. Each one serves a unique purpose in your overall healthcare spending.

| Cost Type | What It Is | When You Pay It |

|---|---|---|

| Premium | The fixed fee to keep your plan active. | Every month, whether you use it or not. |

| Deductible | The amount you pay before insurance helps out. | When you receive medical care (before insurance pays). |

| Copayment | A flat fee for a specific service. | At the time of service (e.g., at the doctor's office). |

| Coinsurance | The percentage of costs you share with your insurer. | After you've met your deductible. |

Understanding this structure is the key to picking a plan that truly fits your life and budget. It helps you anticipate costs and avoid any nasty surprises down the road.

Why Your Monthly Health Premium Might Change

Ever open that annual renewal letter from your health insurance company and feel a pit in your stomach when you see the new, higher monthly premium? You’re definitely not alone.

These changes aren’t random, and they’re not personal. They’re a direct reflection of much bigger trends happening across the entire healthcare industry. Your premium is simply tied to the collective cost of care for everyone.

Think of it like your weekly grocery bill. When the cost of farming, gas for delivery trucks, and employee wages goes up, the price you pay for food at the checkout counter goes up, too. In the same way, powerful forces are driving up the cost of medical services nationwide, which directly impacts your bill.

The Big Picture Drivers of Premium Increases

So, what’s actually pushing healthcare costs—and your premium—upward? Understanding these key factors gives you the real story behind that number on your statement.

The major influences include:

- Rising Hospital and Provider Costs: Hospitals and clinics are businesses. As they invest in new technology, face higher operating expenses, and pay competitive salaries, they have to charge more for their services.

- Expensive New Medications: Breakthrough drugs, especially specialty medications for complex conditions like cancer or autoimmune diseases, can come with jaw-dropping price tags that add huge costs to the system.

- General Inflation: Just like everything else, the cost of medical supplies, equipment, and staff salaries goes up with inflation. Insurers have to account for this.

This isn’t just happening here, either. It’s a global issue. In fact, health insurance costs worldwide are projected to climb by about 10.3% in 2026, with North America expected to see a 9.2% increase. This trend of escalating medical expenses translates directly into a higher monthly premium in health insurance for people and employers everywhere. You can discover more insights about these global trends from WTW.

The Bottom Line: Your premium is part of a massive, interconnected financial system. When the costs inside that system rise, the price of your access—your monthly premium—has to be adjusted to keep the plan financially stable and capable of paying for everyone's future medical care.

Here’s the thing: the sticker price you see on a health plan isn't always what you'll end up paying. For a lot of people, government help can bring that monthly premium way, way down. This financial support usually comes through the Affordable Care Act (ACA) Marketplace.

This help is called a Premium Tax Credit (PTC). Think of it like a discount coupon from the government that gets applied directly to your premium each month. So instead of paying the full price, you just cover the rest.

The whole point of this credit is to make sure health insurance doesn’t take up too much of your income, keeping good coverage within reach.

How Do These Tax Credits Actually Work?

The size of your tax credit really comes down to two things: your estimated household income for the year and how many people are in your family. Generally, the lower your income is within a certain range, the bigger your subsidy will be.

You have two ways to get this credit:

- Advance Payments: This is what most people do. The Marketplace sends your credit straight to the insurance company every month, so your bill is lower from day one.

- Lump Sum: You can also choose to pay the full premium all year and then get the entire credit back as a refund when you file your taxes.

Here’s a quick example: Imagine a plan’s full premium is $500 a month. Based on your income, you qualify for a $350 tax credit. If you take the advance payments, you’ll only have to pay $150 each month. Simple as that.

This support is a huge deal, especially with insurers planning to raise premiums by an average of 26% for 2026. Without these credits, some folks could see their monthly costs more than double. KFF breaks down the full impact of these rising costs.

Understanding how subsidies work is a game-changer if you're trying to figure out how to find cheap health insurance. It can make a really solid plan finally feel affordable.

A Few Lingering Questions About Premiums

Even after you get the hang of the basics, a few practical questions always seem to pop up. And that's totally normal. Getting these details straight can save you a ton of money and stress down the road.

Let’s tackle some of the most common points of confusion head-on.

Does My Monthly Premium Count Towards My Deductible?

This is easily one of the biggest mix-ups, and the answer is a simple, firm no. Your monthly premium payments do not count toward your annual deductible.

Think of it like a gym membership. Your premium is the monthly fee you pay just to have access to the gym—to keep your membership active. Your deductible, on the other hand, is what you pay out-of-pocket for using the equipment (or in this case, medical services) before the gym's benefits (your insurance) kick in to help. They are two totally separate costs.

What Happens If I Stop Paying My Monthly Premium?

Life happens, and sometimes a payment gets missed. If you stop paying your premium, your coverage won’t just disappear overnight. You’ll enter what’s known as a grace period.

But not all grace periods are created equal:

- For ACA marketplace plans with subsidies: You usually get a three-month grace period to catch up. A word of caution, though: insurers may only cover claims from the first month.

- For plans without subsidies: The window is much shorter, often just 30 days.

If you don't settle up by the end of that period, your insurance company can and will terminate your coverage, leaving you completely uninsured.

Losing coverage means you are on the hook for 100% of your medical bills. It's so important to know your plan's specific grace period rules to avoid a gap in coverage, especially since you can't just sign up for a new plan until the next Open Enrollment period.

Can I Lower My Monthly Health Insurance Premium?

Yes, absolutely! You have more control than you think. You aren't just stuck with the first price you're quoted.

One of the quickest ways is to choose a plan with a higher deductible. The more you agree to pay for your care before insurance steps in, the lower your fixed monthly premium will be. It's a trade-off.

You should also see if you qualify for government help, like the Premium Tax Credit, which is designed to make marketplace plans much more affordable. Finally, never, ever skip the chance to shop around during Open Enrollment. Premiums for similar plans can vary wildly from one company to the next.

Finding that sweet spot between a monthly premium you can afford and out-of-pocket costs you can manage is what My Policy Quote is all about. We’re here to help you compare plans and find coverage that actually fits your life and your budget. Explore your options with us today at mypolicyquote.com.