A self-funded insurance plan is a bit of a game-changer. Instead of paying a fixed premium to an insurance carrier every month, your company takes on the direct financial risk for your employees' healthcare. You set aside your own funds to pay for medical claims as they come in.

In short, you become your own insurer.

Understanding Self-Funded Insurance Plans

Think about it like this: would you rather subscribe to a pricey, fixed-menu meal kit service or just buy the groceries you actually need each week?

With the meal kit, you pay the same amount whether you eat everything or not. But when you buy your own groceries, if you eat less one week, you save money. A self-funded plan brings that same "pay for what you use" logic to your company's health benefits.

This shift completely changes how you pay for healthcare. You move from the predictable, locked-in premiums of a fully insured plan to a variable-cost model. You're paying for the actual medical care your team receives, which gives you a direct window into where every dollar is going. And in a healthy year? The savings can be significant.

The Key Players in a Self-Funded Model

"Self-funded" sounds like you have to do everything yourself, but that's almost never the case. Businesses team up with specialized partners to handle the nitty-gritty. The most important of these is the Third-Party Administrator (TPA).

A TPA is your plan's operational backbone. They handle all the essential tasks an insurance company normally would, so you don't have to.

Here’s what a TPA typically does:

- Processes and pays employee medical claims, making sure everything is accurate and on time.

- Provides access to a network of doctors, hospitals, and specialists.

- Issues insurance cards and handles employee questions.

- Keeps the plan compliant with complex healthcare laws like HIPAA.

The TPA is the engine that keeps your self-funded plan running smoothly, freeing you up to focus on your actual business. Before we dive deeper, it helps to understand the whole insurance landscape, including the key differences between travel insurance and health insurance, since self-funding is one piece of that puzzle.

By stepping into the insurer's shoes, a business gets incredible control over its health plan design, data, and costs. This transparency allows for smarter, more strategic decisions about employee wellness and how benefits dollars are spent.

This model gives you a level of control and insight that’s just not possible with a traditional, fully insured plan. You get detailed (but anonymous) data on claims, which can reveal health trends in your workforce. If you need a refresher on the basics, our guide on what health insurance is and how it works is a great place to start.

This direct insight is powerful. It allows you to create targeted wellness programs that can genuinely improve employee health and, over time, lower your company's costs.

How Self-Funded Health Insurance Actually Works

To really get what a self-funded plan is all about, you have to look under the hood.

Picture this: your company sets up a special bank account just for employee healthcare. Instead of writing a big check to an insurance carrier every month, you put money into this account. When your employees have medical bills, you pay them directly from that fund. That’s the heart of self-funding—it’s a direct pay model.

The process is pretty straightforward, but you’ll need a few key partners to make it run like a well-oiled machine. Your company funds the account, your team gets medical care, and the bills get paid right from your funds.

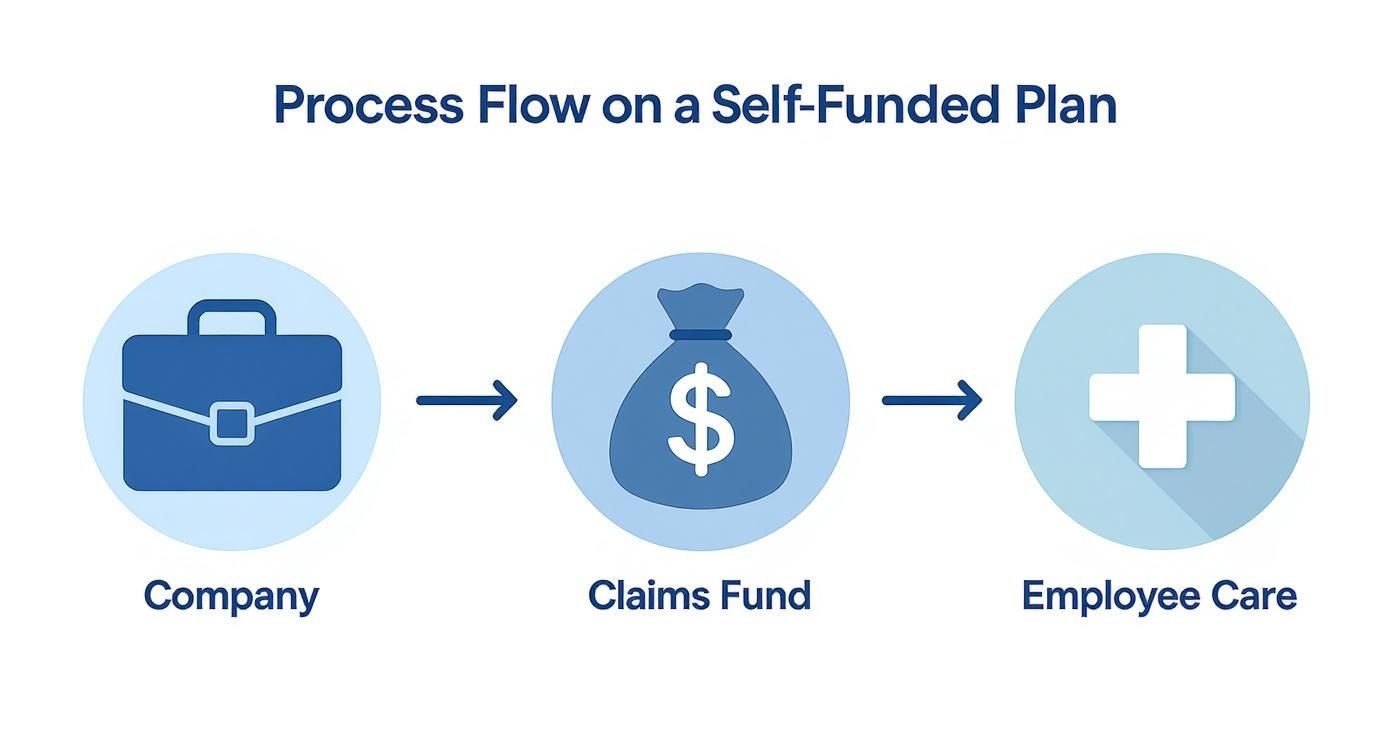

This diagram gives you a simple visual of how your company's money flows to cover your team's healthcare needs.

It highlights the direct line between your company’s dollars and your employees' care, cutting out the traditional insurance carrier as the middleman.

The Role of a Third-Party Administrator

Trying to manage all of this yourself would be a nightmare. That's where a Third-Party Administrator (TPA) steps in as your most important partner. Think of a TPA as the engine of your health plan—they handle all the nitty-gritty, day-to-day work so you don’t have to.

A TPA’s job usually includes:

- Claims Adjudication: They review every medical claim to make sure it’s accurate and covered by your plan.

- Provider Network Access: They connect your team to a network of doctors and hospitals, usually with pre-negotiated discounts.

- Customer Service: They’re the ones your employees call with questions about benefits or claims, just like they would with a big insurer.

- Compliance and Reporting: They help you navigate the tricky rules (like HIPAA) and give you anonymized reports on how your plan is performing.

In short, the TPA runs the show, letting you get all the benefits of self-funding without needing a PhD in insurance.

Your Financial Safety Net: Stop-Loss Insurance

The biggest question employers always ask is, "What if we get hit with a massive, unexpected medical bill?" It’s a totally valid fear. One catastrophic event, like a complex surgery or a round of specialty drugs, could really hurt your bottom line.

This is exactly why stop-loss insurance exists. It’s not health insurance for your employees; it’s insurance for your company. It acts as a financial backstop, shielding your business from shockingly high claims. This coverage is a must-have for almost all self-funded employers—in fact, 67% of workers in self-funded large firm plans are protected by it.

Setting these financial triggers is a form of risk management. If this is new territory for you, learning more about what underwriting in insurance is can help you understand how insurers calculate this risk.

There are two main types of stop-loss, and they work together to protect your company’s assets.

Key Takeaway: Stop-loss insurance is the safety net that makes self-funding a smart, manageable option. It caps your financial risk so you can enjoy the savings in a good year without being exposed to unlimited losses in a bad one.

Specific and Aggregate Coverage Explained

Stop-loss is designed to protect you from two different worst-case scenarios, giving you a complete financial shield.

-

Specific Stop-Loss: This protects you from one person having a huge, high-cost claim. You set a specific limit—let’s say $50,000. If an employee has a medical event that costs $200,000, your company pays the first $50,000. The stop-loss carrier pays the remaining $150,000. Simple as that.

-

Aggregate Stop-Loss: This protects you from a high volume of claims from your entire team. An "attachment point" is set for your total expected claims for the year—say, $500,000. If total claims go over that amount because of lots of smaller issues, the stop-loss carrier steps in to cover the excess.

Together, these two layers put a firm ceiling on what you could possibly spend on healthcare for the year. This gives you predictable budgeting while still letting you save a ton of money when claims are lower than expected. It’s this structure that gives business owners the confidence to leave traditional, fully-insured plans behind.

Self Funded vs. Fully Insured Plans Compared

Choosing between a self-funded and a fully insured plan is one of the biggest calls a company can make for its health benefits. These two models are built on completely different philosophies around risk, cost, and control. Picking the right one means really understanding how they stack up.

Think of a fully insured plan as a fixed-price subscription. You pay a set premium to an insurance carrier every month, and they take it from there—paying claims, managing the plan, and shouldering all the financial risk. It’s predictable, but that predictability often comes at a higher price, and you get very little say in how the plan is designed.

A self-funded plan, on the other hand, puts you in the driver's seat. You pay for your employees' actual medical claims as they happen, giving you a direct line of sight into your healthcare spending. This approach brings more variability but also opens the door to serious savings and customization.

Core Differences in How They Work

The biggest distinction comes down to one question: who holds the financial risk?

With a fully insured plan, the insurance company takes on 100% of the risk. If claims come in higher than expected, they eat the loss. If claims are lower, they pocket the profit. You just pay your fixed monthly premium, no matter what.

With a self-funded plan, your company assumes the risk. This means you get to keep the unspent funds when claims are low. But it also means you're on the hook if claims are higher than budgeted—which is exactly why stop-loss insurance is a non-negotiable part of the setup.

This single difference in risk ownership shapes everything else, from your costs to your compliance duties.

Self Funded Plans vs Fully Insured Plans at a Glance

To make the choice clearer, let's put these two models side-by-side and compare the things that matter most to business owners and HR leaders.

| Feature | Self Funded Plan | Fully Insured Plan |

|---|---|---|

| Cost Structure | Variable; you pay for actual claims plus fixed administrative and stop-loss fees. Potential for significant savings. | Fixed monthly premium paid to an insurance carrier. Predictable but often higher costs over time. |

| Plan Flexibility | High; you can customize benefits, provider networks, and wellness programs to fit your team's specific needs. | Low; you must choose from pre-packaged plans offered by the insurer with limited customization options. |

| Access to Data | Full access to anonymized claims data, offering insights into workforce health trends and cost drivers. | No access to claims data; the insurer owns the information, leaving you in the dark about spending. |

| Financial Risk | Employer assumes the risk for claims, mitigated by stop-loss insurance. Volatile but with high savings potential. | Insurance carrier assumes all risk. Stable costs but no opportunity to benefit from low claim years. |

| Regulatory Rules | Governed primarily by federal law (ERISA), which can offer more uniformity across states. | Governed by a mix of federal and state insurance laws, which can vary significantly by location. |

| Cash Flow | You hold onto your funds until claims are actually paid, improving company liquidity. | Premiums are paid upfront to the insurer, regardless of whether claims have been made. |

Ultimately, the decision is a trade-off. You're weighing the predictability of a fully insured plan against the control, transparency, and savings potential you get when you self-fund.

The move toward self-funding isn't just a passing trend; it's a strategic shift for companies wanting more financial control. The U.S. Department of Labor reported that by 2022, there were roughly 48,700 self-insured health plans in the country. This model is especially popular with larger employers—nearly 90% of firms with 5,000 or more employees choose to self-insure.

You can dig into more of the data by reviewing the full report from the Department of Labor.

The Real Pros and Cons of Self-Funding

Switching to a self-funded health plan is a big move. You’re essentially shifting from being a passive buyer of an insurance policy to an active manager of your company's healthcare spending. It’s a choice that comes with some serious perks, but you have to be just as clear-eyed about the risks.

The biggest draw for most companies? Cost savings. With a traditional, fully-insured plan, if your team has a healthy year with low medical claims, the insurance carrier simply pockets the extra premium you paid. With self-funding, that money stays with you. It’s your savings, not their profit.

The Upside: More Control, More Savings

When you start paying for actual medical claims instead of just a fixed monthly premium, you gain a lot more than just the potential for a good year's savings. You're now in the driver's seat of your entire benefits strategy.

Here’s what that really means:

- Better Cash Flow: You hold onto your money until it's actually needed to pay a claim. Instead of writing a huge check to an insurer every month, that capital stays in your business, working for you.

- Total Plan Flexibility: Forget off-the-shelf plans. You get to design a benefits package that genuinely fits your employees. Want to adjust deductibles, add a specific wellness program, or improve certain benefits? You can.

- Data-Driven Decisions: Self-funding unlocks access to your (anonymized) claims data. This is a game-changer. You can finally see exactly where your healthcare dollars are going and spot health trends within your team.

This level of control lets you build benefits that matter. For example, you could create a plan that offers more flexible and affordable home health care options for employees with aging parents—a level of customization almost impossible to find in a one-size-fits-all insured plan.

The Downside: Financial Swings and New Responsibilities

While the benefits are tempting, self-funding introduces the kind of unpredictability that fully-insured plans are built to avoid. The main risk is financial volatility. One single, catastrophic claim—or even just an unlucky year with higher-than-normal healthcare needs—can blow your budget out of the water.

This is where your plan's structure gets put to the test. Yes, stop-loss insurance is your safety net, but you’re still on the hook for every single claim up to that stop-loss attachment point. That can be a huge number.

The Bottom Line: Moving to a self-funded plan means you’re committing to actively managing risk. It’s a whole different ballgame from the “set it and forget it” approach of a traditional plan.

Beyond the financial exposure, there are a few other realities to prepare for:

- More to Manage: Even with a TPA handling the daily grind, your team is ultimately in charge of overseeing the plan, managing vendors, and staying on top of compliance.

- The Risk of a "Bad Year": A sudden spike in claims can strain your cash flow and wipe out the savings you built up over several good years. This model demands a long-term view and the financial strength to ride out the lows.

The growing popularity of self-funding shows a major shift in how employers are thinking about benefits. In 2025, about 67% of workers with employer-sponsored health plans are in self-funded arrangements. This isn't just a fad; it's a response to rising healthcare costs and a desire for more control. For a deeper dive, the latest government report on self-insured health plans offers more context.

Ultimately, making self-funding work means understanding both sides of the coin and learning how to reduce insurance premiums through smart, hands-on management.

How to Manage Risk with Stop-Loss Insurance

When you switch to a self-funded plan, you’re trading the predictable premium of a traditional plan for a shot at major savings. The catch? You’re also taking on the financial risk of your employees' health claims. The single most important tool you have to manage that risk is stop-loss insurance.

Think of it as a financial safety net for your company. It’s not health insurance for your employees—it's catastrophic coverage for your claims fund. It puts a firm ceiling on your financial liability, giving you the confidence to self-fund without the fear of one huge claim (or a wave of smaller ones) wrecking your budget.

It's your ultimate backstop in a world of ever-increasing healthcare costs.

Why Stop-Loss Is More Critical Than Ever

The reality of modern healthcare is a sharp rise in ultra-high-cost claims. We’re talking about specialty drugs, groundbreaking cancer treatments, and complex surgeries that can run into the millions. What used to be a rare, worst-case scenario is becoming more and more common, making stop-loss a non-negotiable part of any smart self-funded strategy.

This isn’t just a feeling; the numbers back it up. A recent survey of over a thousand plan sponsors revealed a massive jump in catastrophic claims.

In 2025, a staggering 49% of self-funded plans reported claims over $1 million. That’s nearly double the 23% from the year before. On top of that, 16% of plans saw claims shoot past the $2 million mark.

This trend makes the role of stop-loss crystal clear. Some experts are even saying that $3 million claims are the new $1 million. Trying to go without this protection is a gamble very few businesses can afford to take. You can dive deeper into the data in the 2025 Medical Stop-Loss Premium Survey.

Choosing the Right Deductible Levels

Setting the right stop-loss deductible—often called the "attachment point"—is a balancing act between cost and risk. A lower deductible gives you more protection but means a higher premium. Go with a higher deductible, and you’ll lower your premium but take on more of the initial risk yourself.

So, how do you find that sweet spot? It comes down to a few key factors:

- Company Size: Bigger companies with more employees can usually handle higher deductibles. Their risk is spread out. A smaller business, on the other hand, might want a lower deductible for more financial certainty.

- Financial Stability and Cash Flow: If your company has solid cash reserves, you might feel comfortable with a higher attachment point, knowing you can absorb a larger claim. But if cash flow is tight, a lower deductible is the smarter move to protect your liquidity.

- Risk Tolerance: This is all about your leadership's comfort level. Are you willing to embrace a bit more risk for the chance at greater savings? Or do you prefer the peace of mind that comes with stronger protection?

This isn’t a one-size-fits-all decision. Your TPA or benefits advisor will dig into your company’s claims history and financial health to recommend the right deductible for you, creating a strategy that aligns your coverage with your business goals.

Common Questions About Self Funded Plans

When business leaders and HR managers start exploring self-funding, a lot of practical questions come up. It's a big move, so it’s natural to want clear answers. Let's walk through some of the most common ones.

What Is the Ideal Company Size for Self Funding?

It used to be that only huge corporations could even think about self-funding. That’s just not true anymore. Thanks to creative solutions like group medical captives, companies with as few as 25 to 50 employees are successfully making the switch.

The real key isn't just headcount; it's financial stability. You need predictable cash flow to handle the monthly claims and enough in reserve to cover your end of the risk before the stop-loss insurance kicks in.

How Do We Transition from a Fully Insured Plan?

Making the switch isn't like flipping a switch overnight. It’s a structured, thoughtful process designed to get you from point A to point B without causing chaos for your team.

Here’s what it generally looks like:

- Feasibility Analysis: You’ll work with a benefits advisor who will dig into your claims history and risk profile. They'll help you figure out if self-funding actually makes financial sense for you.

- Partner Selection: This is a big one. You’ll choose a Third-Party Administrator (TPA) to handle the day-to-day claims and a stop-loss carrier to protect you from catastrophic costs.

- Plan Design: Now for the fun part. You get to customize your benefits package—setting deductibles, copays, and coverage levels that fit your budget and what your employees truly need.

- Employee Communication: You have to get this right. Clearly explain the new plan to your team, focusing on how it benefits them and what, if anything, is changing.

A smooth transition is everything. The goal is to move to a more flexible, cost-effective model without your employees feeling confused or disrupted in the process.

Who Handles HIPAA and Other Compliance Rules?

This is a huge worry for employers, and for good reason. But you’re not left to figure it out on your own. Your TPA is your go-to partner for navigating the maze of regulations.

They are the ones responsible for making sure the plan follows federal laws like ERISA and HIPAA, which means keeping sensitive patient data protected.

While your company always holds the ultimate fiduciary responsibility, the TPA manages the day-to-day compliance tasks, from processing claims securely to managing data. If you ever get stuck on the terminology, this health insurance glossary is an incredibly helpful resource.

Navigating your insurance options can be complex, but you don't have to do it alone. The team at My Policy Quote is here to provide clear, straightforward guidance to help you find the right coverage. Explore your options at https://mypolicyquote.com today.