Of course. It's perfectly legal—and often, a really smart financial move—to have more than one life insurance policy. In fact, it’s a common strategy people use to make sure their coverage keeps up with their life. Think of it as building a custom-fit financial safety net for the people you love.

So, Why Would You Need More Than One Policy?

Imagine you’re trying to pack for different trips. You wouldn't use a giant suitcase for a weekend getaway, right? You’d grab a smaller bag. Life insurance works the same way.

A single, massive policy might not be the most efficient solution. Instead, you can use different policies for different needs. For example, you might have a large term life policy that’s specifically there to cover your 30-year mortgage. At the same time, a smaller whole life policy could be set aside just to handle final expenses—a need that will always be there.

This isn't about being over-insured. It's about being precisely insured. It’s a way to match the right amount of coverage, for the right amount of time, to each of your financial goals.

The real magic behind having multiple policies is flexibility. As your income grows, your family gets bigger, or you take on new debts, you can add new coverage without messing with the policies you already have. This adaptability is the secret to true, long-term financial peace of mind.

Before we get into the nuts and bolts of managing multiple policies, it helps to know what’s out there. You can explore various life insurance plans to get a feel for the different options, from term to whole life.

A Smart Strategy That's Gaining Ground

Holding more than one life insurance policy isn't some niche trick; it's becoming a go-to strategy for savvy planners. This is especially true in the United States, which accounts for nearly 27% of all life insurance premiums paid worldwide.

The market gives you the freedom to mix and match different types of policies—like term, whole, and even group life insurance from your job—often from completely different companies. It all comes together to create a financial shield that’s tailored to you and is often more affordable than a single, one-size-fits-all plan.

Now, let's break down exactly why this might be the right move for you.

Why People Own Multiple Life Insurance Policies

Here’s a quick look at the most common reasons people choose to layer their life insurance coverage.

| Reason | Brief Explanation |

|---|---|

| Covering Different Needs | Using one policy for a temporary need (like a mortgage) and another for a permanent one (like final expenses). |

| Increasing Coverage Over Time | Adding a new policy when you get a raise, buy a home, or have children, without replacing your original one. |

| Laddering Policies for Cost-Effectiveness | Buying multiple term policies with different end dates to match decreasing financial responsibilities over time. |

| Separating Business and Personal Needs | Keeping a personal policy for your family and a separate one to protect your business (e.g., a key person policy). |

| Supplementing Group Coverage | Using a private policy to fill the gaps left by a basic employer-provided plan. |

As you can see, each reason is tied to a specific life stage or financial goal, making this a highly personalized approach to financial protection.

Strategic Reasons for Owning Multiple Policies

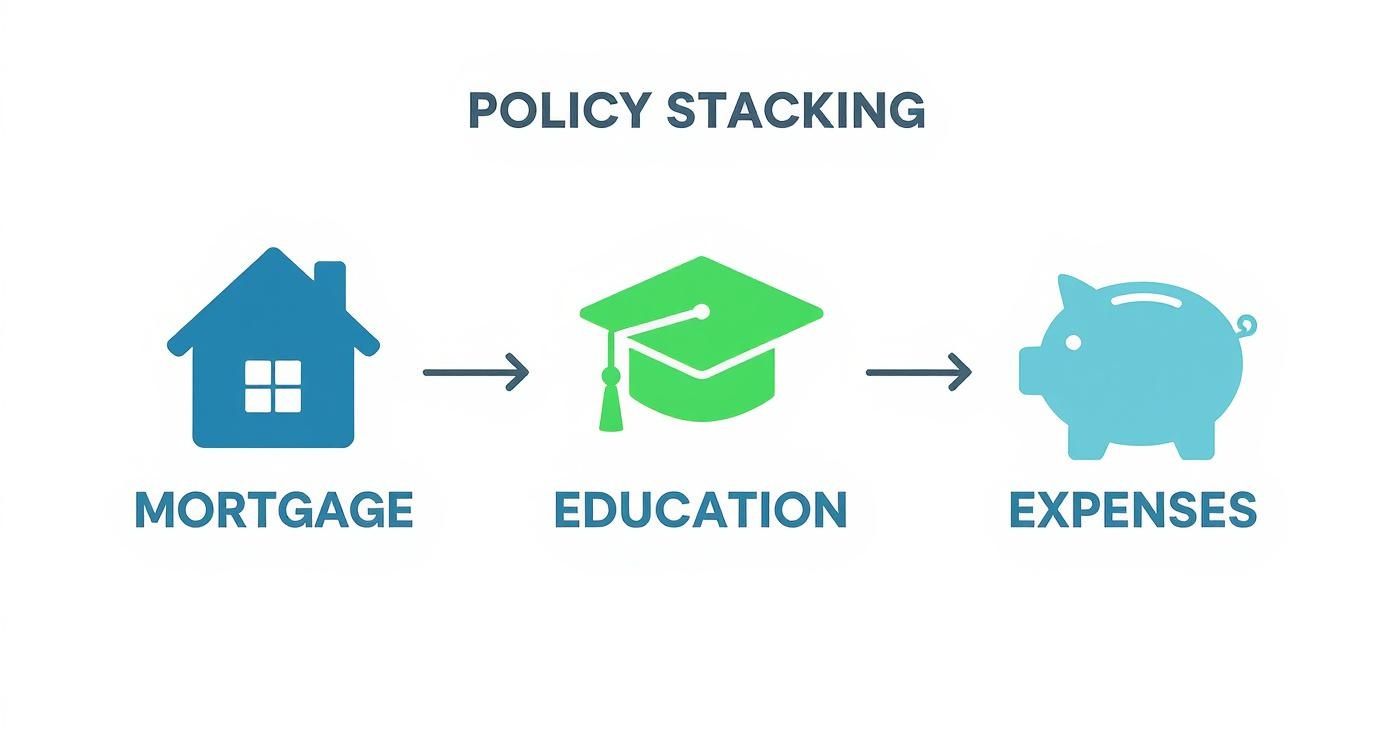

Now that you know having more than one policy is possible, let's get into the why. This isn't about just piling up coverage for the sake of it. Owning multiple policies is a smart strategy, often called policy stacking or laddering, that lets you build a financial shield that actually fits your life as it changes.

Think of your financial responsibilities like a series of mountains, each with a different size and timeline. A single, giant policy trying to cover them all would be clunky and expensive. Instead, you can match a specific policy to each "mountain," making sure you have exactly the right amount of protection at the right time.

For example, your biggest mountain might be a 30-year mortgage. You could use a large term life policy to cover it, set to expire right around the time you make that final house payment. At the same time, a smaller permanent policy can act as a lifelong safety net for final expenses—a need that never really goes away.

Customizing Your Financial Safety Net

One of the most common reasons people look into having 2 life insurance policies is to beef up an existing plan, especially one from work. Group life insurance through your job is a great perk, but let's be honest—it's usually not enough. Most plans only offer a death benefit of one or two times your annual salary.

For a family with a mortgage, college tuition on the horizon, and everyday bills, that base coverage just won't cut it. Instead of ditching your work plan, you can simply add a private term life policy right on top of it. This creates a solid financial cushion without messing with your workplace benefits.

A multi-policy strategy lets you tackle different financial timelines one by one. You can have a policy for temporary, high-cost needs and another for permanent, smaller ones. The result? A more efficient and cost-effective plan.

Another great strategy is layering policies to match your shrinking debts. As you pay down your mortgage or your kids graduate, your need for a huge death benefit goes down. Laddering lets you buy several term policies with different end dates. It might look something like this:

- Policy 1: A $500,000, 30-year term policy to cover the mortgage.

- Policy 2: A $250,000, 20-year term policy for college tuition.

- Policy 3: A $100,000, 10-year term policy to cover car loans or other short-term debts.

As each policy's term ends, your total premium drops, but you’re never left unprotected for the obligations you still have. Getting the amounts and timelines right is key, which is why using a good life insurance needs calculator can help you map everything out clearly.

Blending Term and Permanent Insurance

Finally, one of the most powerful moves is to combine the affordability of term insurance with the lifelong security of permanent insurance. Term life is perfect for covering your biggest needs—like income replacement and major debts—during your peak earning years. It’s cheap and covers you for a specific window of time.

But permanent policies, like whole or universal life, offer things term insurance can’t. They build cash value and provide a death benefit that never, ever expires. This combination gives you a complete financial shield. The term policy handles the big "what ifs" while you're working, and the permanent policy makes sure final expenses are covered and can even leave a legacy, no matter how long you live.

How Insurers Underwrite Multiple Policies

When you apply for another life insurance policy, the new company isn't making a decision in a vacuum. Insurers look at your entire financial picture to make sure the total coverage you’re carrying actually makes sense. It’s a critical step to prevent what’s known as over-insurance.

Think of it like applying for a loan. A bank won’t just hand you millions if your income is only $50,000 a year. In the same way, an insurance company won’t approve a massive death benefit that wildly exceeds your economic value to your family. They need to see a real, legitimate reason for the coverage.

Determining Your Total Insurable Value

This is where your total insurable value comes into play. Insurers calculate this cap based on things like your income, assets, age, and any debts you have. This number represents the absolute maximum amount of life insurance all companies combined will issue on your life.

Why do they do this? To ensure the death benefit is there to replace a genuine financial loss, not to create a lottery-style windfall for someone.

To figure this out, they need to know about every single policy you already have. This is why total honesty on your application is non-negotiable. Trying to hide an existing policy can cause serious headaches down the road, and could even lead to your beneficiaries' claim being denied.

Want to get a better sense of what underwriters are looking for? You can learn more in our detailed guide on the complete life insurance underwriting process.

The Role of Transparency in Applications

Insurance companies have ways of checking the information you provide. One of their most important tools is the MIB (Medical Information Bureau). It’s not a file with all your detailed medical records, but rather a secure database that tracks insurance applications.

When you apply for a new policy, the insurer can check the MIB to see if you've applied anywhere else and what you disclosed. If your new application tells a different story than a previous one, it throws up a huge red flag for the underwriters.

Full disclosure is your best policy. Trying to hide other policies or health conditions is a risky gamble that can void your coverage right when your family needs it most. Transparency ensures a smooth process and a reliable payout.

The infographic below does a great job of showing how different policies can be stacked to cover specific financial needs—a key reason underwriters need to see the whole picture.

As you can see, stacking allows you to line up coverage for big-ticket items like a mortgage, college tuition, and general living expenses. This is how you justify the need for multiple policies to an underwriter.

The Contestability Period Explained

Every life insurance policy has something called a contestability period. It’s usually the first two years after the policy kicks in. During this window, the insurance company has the right to investigate the information on your application if you pass away.

If they find you made a material misrepresentation—like forgetting to mention another $1 million policy—they can deny the claim entirely and just refund the premiums you paid. It’s the ultimate consequence of not being truthful.

Once those two years are up, it becomes much harder for an insurer to deny a claim. That’s why your upfront honesty is absolutely critical for your family’s protection.

Real-World Scenarios For Stacking Policies

Theory is one thing, but seeing how multiple policies work in real life makes the strategy click. Let's look at a few common situations where stacking policies isn't just a good idea—it's the perfect solution.

Think of these stories as a mirror. You might just see your own life reflected in them.

The Young Family with a New Mortgage

Meet Sarah and Tom. They're in their early 30s, with two young kids and a brand new 30-year mortgage. The group life insurance they get through work is a nice perk, but it only covers one year's salary each. Helpful, but not nearly enough to pay off a $400,000 home loan and make sure their kids are set for the future.

So, what do they do? They don't cancel their free work policies. They build on top of them.

They add a separate $500,000, 30-year term policy. This bigger, affordable policy is laser-focused on their largest debts: the mortgage and future college costs. It’s set to last exactly as long as they need that high level of protection, giving them peace of mind that their family can stay in their home, no matter what. Using life insurance to protect your child's education is one of the smartest moves a parent can make.

With this strategy, their coverage is layered:

- Work Policies: A safety net for daily living expenses for a year or so.

- Term Policy: Wipes out the mortgage and secures the college fund.

The Small Business Owner

Now, let's talk about David. He's a successful contractor and owns his own construction company. For his family, he has a personal whole life policy to cover final expenses and provide a legacy. But his business has a different kind of vulnerability.

His partner, a brilliant architect, is the creative force behind every project. If something were to happen to her, the business would be in serious trouble.

To protect his company, David takes out a completely separate key-person insurance policy on his partner. This policy is owned by the business, not David. If she were to pass away, the payout would give the company the cash it needs to hire a talented replacement and keep the doors open during a tough transition.

By separating his personal and business needs, David ensures a tragedy in one part of his life doesn't automatically sink the other. His family is protected, and his company is secure.

The Sandwich Generation Caregiver

Finally, there’s Maria. She’s in her late 40s, juggling her own teenage kids while also caring for her aging mother. She already has a term life policy in place to make sure her own family is financially stable if she’s not around.

But she has another worry. Her mother doesn’t have any savings set aside for funeral costs. Maria knows that burden would fall directly on her.

So, she buys a small final expense insurance policy for her mom. It’s a modest whole life policy with a low premium, designed specifically to cover a burial and any lingering medical bills. It’s not a huge policy, but it solves a very specific problem.

By holding two different policies, Maria addresses two completely separate financial risks with targeted, affordable solutions.

Evaluating the Pros and Cons of This Strategy

Deciding whether to have 2 life insurance policies—or even more—means taking a good, hard look at both sides of the coin. Stacking coverage can be an incredible move for some, but it's definitely not a one-size-fits-all solution. You need to be realistic about what it involves before committing to multiple premiums and plans.

The single biggest reason people do this? Flexibility. A multi-policy strategy lets you build a financial safety net that perfectly matches the different chapters of your life—from paying off the mortgage to getting the kids through college. You aren't locked into a single, rigid plan that may not fit you in ten years.

This approach can also be surprisingly cost-effective. A popular strategy called "laddering" involves buying term policies of different lengths to match debts that shrink over time. This often works out to be cheaper than one massive, long-term policy because you’re only paying for the highest levels of coverage when you actually need them.

The Upside of Multiple Policies

The benefits of stacking your coverage are pretty compelling, especially if your financial responsibilities are changing over time.

- Customized Coverage: You can earmark certain policies for specific goals. Think of it like this: a 20-year term policy covers the kids’ college fund, while a small permanent policy is set aside just for final expenses.

- Cost Efficiency: With a laddering strategy, your total premium payments can actually decrease over time. As your mortgage gets paid down or the kids become independent, the shorter-term policies expire, and so do their payments.

- Adaptability: Life happens. When your income grows or your family expands, you can simply add a new policy. There’s no need to mess with or replace the great rates you locked in on your existing coverage years ago.

The Downside and Potential Drawbacks

With that said, this strategy adds a layer of complexity you absolutely have to be ready for. The main drawback is the simple hassle of managing it all.

You’ll have multiple premium due dates to keep track of, likely with different insurance companies. Each policy might have its own beneficiaries or payout rules, which adds to the organizational headache. If you're not on top of your record-keeping, it's all too easy for a policy to accidentally lapse, or worse, for your loved ones to not even know it exists.

You can learn more about how these policies differ in our guide covering the different types of life insurance explained.

There’s also a real risk of creating redundant or overlapping coverage if you don’t plan things out. You could end up paying for more insurance than you truly need, which completely defeats the purpose of trying to save money.

A multi-policy strategy is perfect for people who are naturally organized and proactive with their finances. The customization is powerful, but it comes with the responsibility of staying on top of the details.

To help you weigh your options, here’s a straightforward comparison.

Advantages vs. Disadvantages of Multiple Life Insurance Policies

Deciding whether to own more than one life insurance policy comes down to a trade-off between customization and simplicity. This table breaks down the key benefits you gain versus the potential drawbacks you'll need to manage.

| Pros (Advantages) | Cons (Disadvantages) |

|---|---|

| Tailored protection for specific debts and goals. | More complex to manage multiple premiums and paperwork. |

| Potential for significant cost savings over time. | Higher risk of a policy lapsing due to missed payments. |

| Easily adaptable to major life changes. | Beneficiaries may need to file claims with several companies. |

| Diversifies your coverage across different insurers. | Potential for redundant coverage if not planned carefully. |

Ultimately, the right choice depends on your ability to handle the administrative side. If you're confident you can keep things organized, the flexibility and cost savings can be well worth the extra effort.

Managing Payouts And Tax Implications

Ultimately, life insurance is all about taking care of the people you love when you're no longer here. When it's time for your beneficiaries to make a claim, the process is pretty straightforward, even if you had multiple policies.

Each insurance company is a separate entity. This just means your loved ones will need to file a claim with each one individually, providing a certified copy of the death certificate for every policy. It’s a bit of paperwork, but it’s manageable.

The best part for your beneficiaries? Life insurance death benefits are almost always paid out 100% income-tax-free. It doesn’t matter if the total payout comes from one policy or five—that powerful tax advantage stays the same. The full amount goes right into their hands to cover debts, replace your income, and help them move forward.

More Policies Mean More Flexibility

Having more than one policy gives your loved ones incredible flexibility and control. They might get a large lump-sum payment from a term policy and decide to use it for big, immediate needs, like paying off the mortgage or wiping out student loans.

At the same time, a payout from a permanent policy could be used in a completely different way. For example, they could put it into an annuity to create a steady, predictable income stream for years to come. That combination of immediate cash and long-term stability is one of the biggest perks of having two or more life insurance policies.

While death benefits are free from income tax, they can be counted as part of your taxable estate. For very large estates, this could trigger federal or state estate taxes, potentially reducing the net amount your heirs receive.

A Smart Strategy for Estate Taxes

If you have a high net worth, the combined death benefits from several policies could push your estate's value over the federal estate tax exemption limit. But don't worry—there's a specialized tool designed for this exact situation.

An Irrevocable Life Insurance Trust (ILIT) is a trust you set up to legally own your life insurance policies. Since the trust owns the policies—not you—the death benefits aren't considered part of your estate when you pass away. This smart legal move ensures the full, untaxed payout goes directly to your beneficiaries, bypassing the headaches of probate and potential estate taxes.

A Few Lingering Questions

Even after covering the basics, a few questions might still be on your mind. Let's walk through some of the most common ones so you can feel confident in your strategy.

Do All My Policies Have to Be from the Same Company?

Not at all. In fact, it’s often smarter to mix and match. Shopping around with different insurers lets you find the best deal for each specific goal you have.

This way, you can build a truly customized (and more affordable) plan. Each company will do its own underwriting, completely separate from the others.

How Do I Keep Track of All This?

Good organization is your best friend here. Keep all your policy documents together in a safe place—a fireproof box or a secure digital folder works great.

Even more important, create a simple "master document" for your loved ones. It should list out each insurance company, the policy number, and the benefit amount. A quick review once a year is a great habit to get into.

The Bottom Line: While there's no magic number for how much coverage you can have, insurers will always look at your financial situation. They calculate your "human life value" based on things like your income and assets to make sure the coverage amount makes sense and isn't excessive.

When the time comes, your beneficiaries will simply file a claim with each company listed on your master document. It's a straightforward process.

At My Policy Quote, we make it easy to compare your options and build a life insurance strategy that actually fits your life. https://mypolicyquote.com