Navigating the world of life insurance after age 60 can feel complex, but securing financial protection for your loved ones is more achievable than ever. Many seniors seek policies to cover final expenses, leave a legacy, or supplement retirement income, yet worry that age or health conditions will be a barrier. The truth is, the market has evolved with specialized products designed specifically for seniors' needs, from no-exam term policies to guaranteed acceptance whole life plans. This guide demystifies the options, breaking down the pros, cons, and ideal use cases for each.

We'll explore the critical differences between term, whole, and final expense insurance, provide realistic cost expectations, and highlight the key features to look for. This roundup is designed to give you a clear, side-by-side comparison of the top providers and platforms in the market, helping you make an informed decision without the typical confusion. Each entry will provide actionable insights, screenshots, and direct links to simplify your search.

Beyond the financial protection life insurance provides, seniors often think about broader planning, including understanding end-of-life services. A solid life insurance policy is a key component of that comprehensive plan. Whether you're a healthy 65-year-old planning for the future or need guaranteed coverage for peace of mind, this roundup will equip you with the clarity needed to find the best life insurance for seniors and secure your family's financial well-being. Let's explore the top providers and policy types that deliver real value in 2025.

1. 12 Best Whole Life Insurance Policies for 2025

For seniors who prioritize efficiency and clarity, the "12 Best Whole Life Insurance Policies for 2025" roundup from My Policy Quote is an indispensable starting point. This guide distinguishes itself by moving beyond generic carrier lists, instead providing a curated and practical shortlist specifically tailored to the needs of older applicants. It’s an ideal resource for anyone seeking the best life insurance for seniors without the time or desire to sift through dozens of individual policy documents.

The primary strength of this roundup is its senior-centric focus. Rather than ranking policies on broad metrics, it hones in on the features that matter most to applicants over 60, such as simplified-issue underwriting (no medical exam required) and final expense plans designed for smaller coverage amounts. This targeted approach saves significant time and helps you quickly identify carriers that are more likely to approve your application.

Key Features and Practical Applications

This resource excels at translating complex insurance details into actionable insights. It presents a clear, comparative framework that allows seniors and their families to make informed decisions based on real-world factors.

- Underwriting Ease: The guide explicitly rates how "picky" each carrier's underwriting process is. This is crucial for seniors with pre-existing health conditions who may not qualify for a fully underwritten policy.

- Eligible Age Ranges: Each policy listed includes its specific age limitations, preventing you from wasting time on carriers whose cutoffs you've already passed.

- Typical Benefit Caps: You can quickly see the maximum death benefit offered, which helps align your choice with your financial goals, whether it's covering a small funeral or leaving a more substantial legacy.

The layout is designed for quick scanning, with key data points for each of the 12 policies presented consistently. This makes it easy to compare options side-by-side and understand the practical tradeoffs. For instance, you can weigh a policy with guaranteed acceptance against one that offers a higher death benefit but requires answering health questions.

Pros and Cons

| Strengths | Weaknesses |

|---|---|

| Time-Saving Curation: Narrows the field to 12 top-tier, senior-friendly whole life options. | Not Personalized: The guide offers general insights, but individual health and location will affect final quotes. |

| Senior-Focused Criteria: Highlights simplified-issue and final expense plans ideal for older ages. | Static Information: Carrier pricing and policy terms can change; always verify details before purchasing. |

| Clear, Comparative Data: Easy-to-scan details on age limits, benefit caps, and underwriting. | |

| Actionable Guidance: Connects policy types directly to common senior needs like funeral costs. |

How to Use This Resource Effectively

To get the most value from this guide, start by identifying your primary goal: are you looking for a small policy to cover final expenses, or do you need a larger death benefit for legacy planning? Use the roundup to create a shortlist of two to three carriers that align with your age, health profile, and coverage needs. From there, you can proceed to get personalized quotes, confident that you are focusing on the most suitable options. For those just beginning their research, the guide provides an excellent educational foundation.

This resource is particularly valuable for those exploring permanent coverage options for the first time. For a deeper understanding of the broader landscape, you may also want to explore our comprehensive guide on life insurance for people over 50.

Visit the Roundup on mypolicyquote.com

2. Policygenius

Policygenius is a leading online insurance marketplace that excels at simplifying the comparison process for seniors. Instead of visiting multiple insurer websites, users can view quotes from a wide range of top-rated carriers all in one place. This approach is particularly beneficial for seniors, as it significantly increases the odds of finding an affordable policy regardless of age or health history.

The platform’s real strength lies in its transparency and educational resources. Policygenius publishes detailed guides and sample rate tables specifically for older adults, showing realistic monthly premium estimates for various ages (60s, 70s, and 80s) and policy types. This data-driven approach helps manage expectations, ensuring you have a clear idea of potential costs before you even apply.

Why It Stands Out for Seniors

Policygenius acts as an independent broker, meaning their licensed agents work for you, not for a single insurance company. Their goal is to match you with the best carrier for your specific needs, whether that’s finding a term policy for a healthy 65-year-old or a guaranteed issue policy for someone with significant health concerns. This impartial guidance is invaluable when navigating the complexities of senior life insurance.

The user experience is streamlined and modern. You can get initial quotes online in minutes, and if you decide to proceed, a licensed expert will walk you through the application process by phone or online, ensuring all paperwork is handled correctly. If you're looking for a deeper understanding of how these platforms operate, you can learn more about Policygenius and similar quote comparison tools on My Policy Quote.

Key Features and Considerations

| Feature | Details |

|---|---|

| Marketplace Access | Compare quotes from over a dozen A-rated life insurance carriers. |

| Policy Types | Term, whole life, final expense, and guaranteed issue policies are available. |

| Cost to Use | The service is completely free; Policygenius is paid a commission by the insurer. |

| Support Model | Licensed, non-commissioned agents provide guidance and application support. |

Pros:

- Broad Carrier Selection: Increases your chances of getting approved at a competitive rate.

- Transparent Pricing: Senior-specific rate tables provide realistic cost expectations upfront.

- Expert Guidance: Licensed professionals help you navigate the application and underwriting process.

Cons:

- Carrier-Managed Service: Once your policy is active, all claims and customer service are handled directly by the insurance company you chose.

- Follow-Up Required: A full, formal quote requires submitting contact information, and follow-up calls from their agents are common.

For more information or to compare quotes, visit the official website: https://www.policygenius.com/

3. SelectQuote

SelectQuote is a national insurance agency that specializes in finding competitive rates by shopping your profile across dozens of highly rated insurers. It is particularly well-suited for seniors who prefer human guidance through the insurance buying process. After a single initial application, licensed agents compare over 50 carriers to pinpoint the best policy for your specific age, health, and financial goals.

The platform’s primary advantage is its agent-assisted model. While online tools provide initial quotes, the core of the service involves a dedicated agent who handles the comparison shopping, answers questions, and manages the application from start to finish. This hands-on approach can be a significant benefit for seniors with complex health histories or those who are less comfortable with fully digital, self-service platforms.

Why It Stands Out for Seniors

SelectQuote shines in situations where an agent's advocacy can make a real difference. For seniors with pre-existing conditions, specific medications, or other unique circumstances, a knowledgeable agent can navigate carrier underwriting guidelines to find the insurer most likely to offer a favorable rate. This personalized service is a key reason it is considered one of the best life insurance for seniors options.

The process is designed for efficiency. Instead of you having to fill out multiple applications, your agent does the legwork, presenting you with the top three to five options that best match your needs. This is especially useful for quickly comparing final expense policies or finding term coverage that fits a specific budget, all without any obligation to purchase.

Key Features and Considerations

| Feature | Details |

|---|---|

| Marketplace Access | Agents shop your profile with over 50 A-rated insurance carriers. |

| Policy Types | Term, permanent (whole life), and final expense policies are available. |

| Cost to Use | The quoting and agent support services are completely free to the consumer. |

| Support Model | Licensed agents provide one-on-one guidance by phone and online. |

Pros:

- Efficient for Complex Cases: Human agents advocate for applicants with medications or health conditions.

- No Obligation or Fees: Comparing quotes and receiving agent advice comes at no cost.

- Quick Final Expense Comparison: A good option for seniors looking to compare burial insurance options rapidly.

Cons:

- Heavier Phone Involvement: The process is less self-serve and typically requires phone calls with an agent.

- Limited Same-Day Options: No-exam policies may be less available for older seniors, often requiring traditional underwriting.

For more information or to connect with an agent, visit the official website: https://www.selectquote.com/

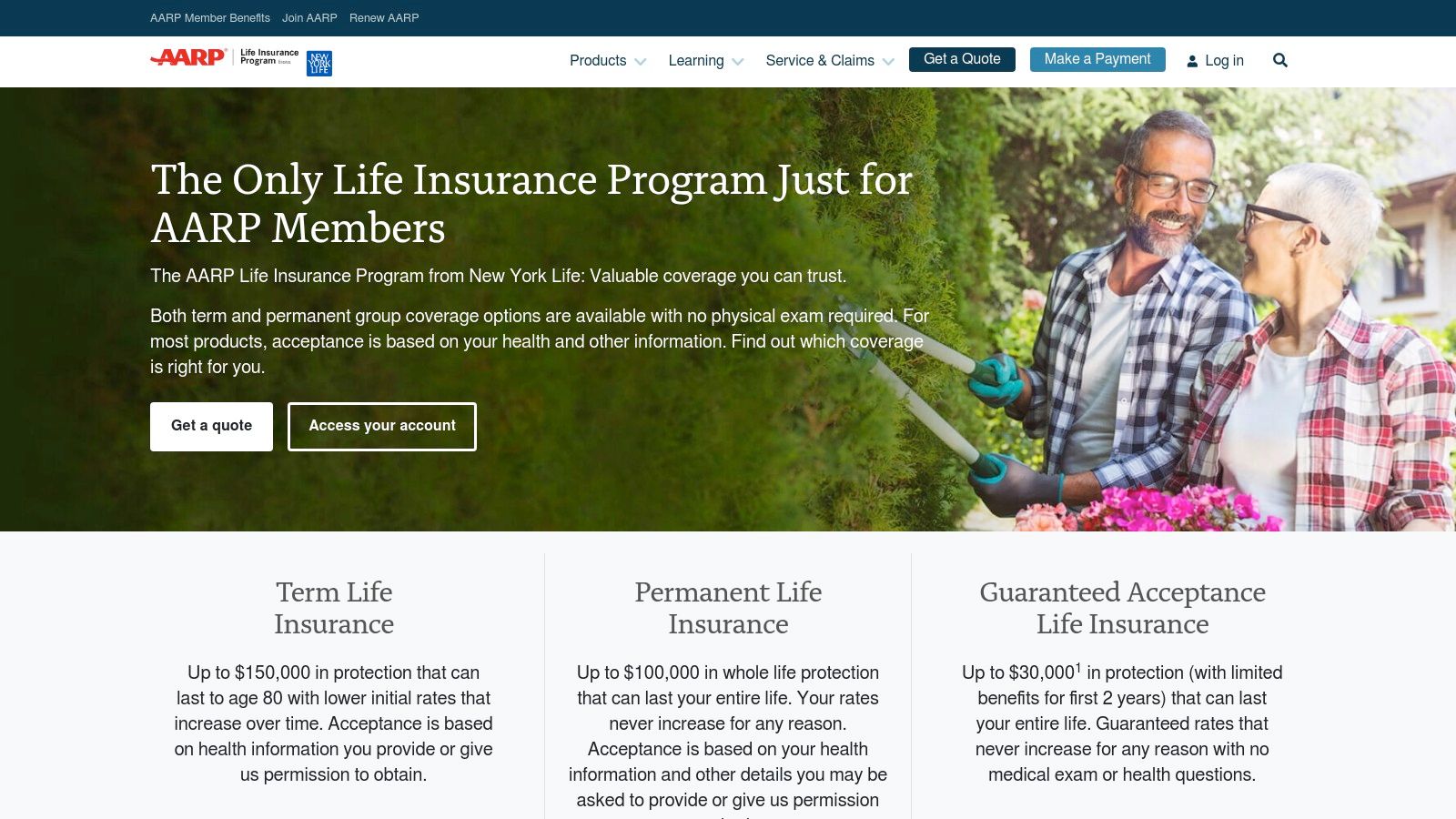

4. AARP Life Insurance Program (from New York Life)

The AARP Life Insurance Program, administered by industry giant New York Life, offers insurance products specifically designed for its members. This partnership leverages the trust and advocacy of AARP with the financial strength and reputation of New York Life, creating a straightforward option for seniors looking for reliable coverage from well-known brands. The program is built around simplicity, offering a focused selection of policies that cater directly to older adults.

The platform’s main appeal is its accessibility and senior-centric product design. AARP members can easily get quotes and, in many states, complete their application entirely online. The process is simplified to avoid the often-intimidating steps associated with traditional life insurance, making it a strong contender for those seeking a hassle-free experience. The products are designed to meet the most common needs of seniors, such as covering final expenses or leaving a small legacy.

Why It Stands Out for Seniors

This program stands out because it removes common barriers to obtaining coverage. None of the policies offered through the AARP program require a medical exam, a significant benefit for seniors who may have pre-existing health conditions or simply wish to avoid invasive medical tests. Its Guaranteed Acceptance Whole Life policy is particularly noteworthy, as it asks no health questions and provides a safety net for individuals who might otherwise be uninsurable.

This focus on guaranteed and simplified issue products makes it one of the best life insurance for seniors who prioritize approval over large death benefits. These policies are excellent tools for final expense planning, ensuring loved ones are not burdened with funeral costs and medical bills. If you want to understand these types of policies better, you can explore what is final expense insurance and how it can secure your family's financial future. The user experience is tailored for an older demographic, with clear language and an intuitive online flow.

Key Features and Considerations

| Feature | Details |

|---|---|

| AARP Membership | Access to the program is an exclusive benefit for AARP members. |

| Policy Types | Level Benefit Term (to age 80), Permanent Whole Life, and Guaranteed Acceptance Whole Life. |

| No Medical Exam | All products offered through the program do not require a medical exam for approval. |

| Insurer Strength | Policies are issued and backed by New York Life, a highly-rated, financially stable company. |

Pros:

- Guaranteed Acceptance Option: Seniors can get coverage without answering health questions or taking an exam.

- Brand Trust: Backed by the strong reputations of both AARP and New York Life.

- Simplified Process: Easy online quotes and applications are available in most states, designed for seniors.

Cons:

- Membership Required: You must be an AARP member to apply for these policies.

- Graded Death Benefits: Guaranteed acceptance policies have a two-year limited benefit period for non-accidental death.

- Coverage Caps: Policies, especially guaranteed issue, have lower coverage limits compared to medically underwritten plans.

For more information or to get a quote, visit the official website: https://www.aarp-lifeinsurance.com/

5. Mutual of Omaha

Mutual of Omaha is a household name in the insurance industry, particularly renowned for its strong focus on life insurance products tailored for older adults. The company has built a solid reputation by offering straightforward and reliable final expense and guaranteed whole life policies, making it a go-to choice for seniors seeking to cover end-of-life costs without the hassle of a medical exam.

The platform is particularly helpful for seniors who want predictable, lifelong coverage. Mutual of Omaha excels at providing policies with level premiums that never increase and death benefits that are guaranteed not to decrease. Their website offers valuable educational resources, including cost calculators and detailed guides that help seniors estimate their final expense needs and understand how different policies work, empowering them to make informed decisions.

Why It Stands Out for Seniors

Mutual of Omaha stands out due to its long history and expertise in the senior market. Their guaranteed issue whole life policies, offered through their subsidiary United of Omaha, are designed for older applicants who may have health issues that would disqualify them from other types of coverage. The application process is simplified, often requiring just a few health questions instead of a full medical exam, which is a significant advantage for those prioritizing convenience and guaranteed approval.

This direct-to-consumer approach, combined with a vast network of agents, allows seniors to choose how they want to learn and apply. Whether you prefer researching online using their quote tools or speaking directly with a licensed professional, Mutual of Omaha provides accessible pathways. This focus on simplified underwriting for smaller face amounts makes them one of the best life insurance for seniors options for covering funeral costs, medical bills, and other final debts.

Key Features and Considerations

| Feature | Details |

|---|---|

| Guaranteed Whole Life | No-medical-exam policies (often up to $25,000) are available for applicants aged 45-85. |

| Policy Types | Specializes in whole life and final expense insurance, with some term life options. |

| Educational Tools | Provides online calculators and guides to help estimate final expense needs and costs. |

| Financial Strength | Consistently receives high financial strength ratings (e.g., A+ from A.M. Best), ensuring reliability. |

Pros:

- Competitive Senior Pricing: Known for transparent and often affordable rates on final expense policies.

- Simple Underwriting: Many policies require no medical exam, making approval easier for seniors.

- Strong Reputation: A long-standing, trusted insurer with excellent financial stability.

Cons:

- Lower Coverage Limits: Guaranteed and graded policies are capped at modest amounts, typically $25,000 to $40,000.

- State Variations: Product availability and specific policy details can differ depending on your state.

For more information or to request a quote, visit the official website: https://www.mutualofomaha.com/

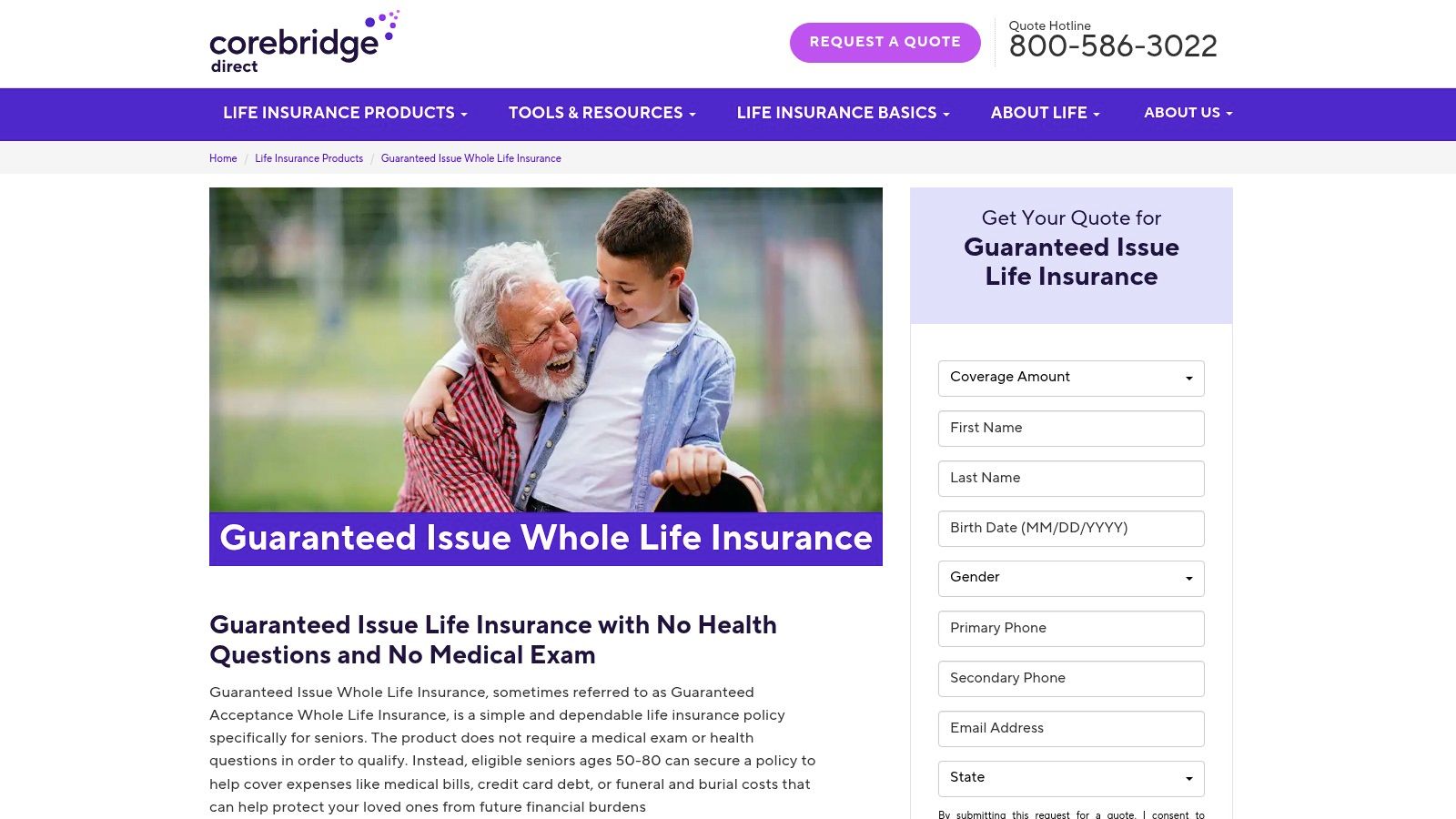

6. Corebridge Direct (Guaranteed Issue Whole Life)

Corebridge Direct, formerly known as AIG Direct, offers a straightforward solution for seniors who may not qualify for medically underwritten policies. Their Guaranteed Issue Whole Life Insurance is specifically designed for individuals between 50 and 80 who want the peace of mind of guaranteed acceptance without undergoing a medical exam or answering health questions. This makes it a powerful choice for those with pre-existing conditions.

The platform focuses on providing small, fixed-premium policies to cover final expenses like funeral costs, medical bills, or other end-of-life debts. The user experience is designed for simplicity, allowing seniors to get a quote and even complete the purchase entirely online. Corebridge Direct is transparent about its policy structure, including the graded death benefit, which is a common feature of guaranteed issue products.

Why It Stands Out for Seniors

Corebridge Direct’s main appeal is its accessibility. For seniors who have been denied coverage elsewhere, this platform provides a direct and reliable path to securing a policy. The guaranteed acceptance eliminates the stress and uncertainty of the traditional underwriting process. The inclusion of living benefits for chronic and terminal illness adds a layer of financial protection you can use while still living, which is a significant advantage.

This focused product offering is ideal for seniors who know exactly what they need: a modest death benefit with a locked-in premium. The online process is clear and efficient, from quoting to purchasing, making it one of the best life insurance for seniors options for those comfortable with digital tools. If you're new to this type of coverage, you can explore the fundamentals by learning more about what is guaranteed issue life insurance.

Key Features and Considerations

| Feature | Details |

|---|---|

| Acceptance | Guaranteed issue for ages 50 to 80; no medical exam or health questions. |

| Coverage Amounts | Policies typically range from $5,000 to $25,000. |

| Premiums | Level premiums that are guaranteed to never increase for the life of the policy. |

| Included Benefits | Comes with living benefits riders for chronic and terminal illness at no extra cost. |

Pros:

- Guaranteed Acceptance: Approval is guaranteed for applicants within the eligible age range.

- Simple Online Process: You can get a quote and purchase your policy entirely online.

- Transparent Policy Details: Clear information on the graded death benefit is provided upfront.

Cons:

- Low Coverage Maximum: The $25,000 cap is only suitable for final expenses, not income replacement.

- State Availability: Policy terms and availability can vary by state due to licensing.

- Graded Death Benefit: The full death benefit is not payable for non-accidental death during the first two years.

For more information or to get a quote, visit the official website: https://www.corebridgedirect.com/guaranteed-issue-whole-life-insurance

7. Ethos

Ethos is a modern, digital-first life insurance platform designed to eliminate the friction typically associated with buying a policy. For seniors who value speed and convenience, Ethos offers a streamlined online application that can often provide an approval decision in minutes rather than weeks. The company leverages technology and data to simplify underwriting, making it a strong contender for the best life insurance for seniors who are tech-savvy and prefer a self-service approach.

The platform is particularly noteworthy for its clear segmentation of products by age. While its popular term life policies are generally available for applicants up to age 65, Ethos offers whole life and guaranteed issue options specifically for seniors aged 66 to 85. This ensures that older adults can find suitable final expense or small whole life policies without navigating irrelevant product offerings.

Why It Stands Out for Seniors

Ethos stands out by prioritizing a fast, transparent, and almost entirely online experience. The website features a dedicated senior guidance page that clearly explains eligibility, provides sample rate ranges, and answers frequently asked questions. This educational focus empowers seniors to understand their options before committing, all within a user-friendly interface that avoids insurance jargon.

The application process is designed to be completed from home without lengthy phone calls or in-person meetings. For many applicants, no medical exam is required, and coverage can be secured quickly. While the process is digital, optional support from licensed agents is available for those who have questions or need assistance, blending modern convenience with traditional expert guidance.

Key Features and Considerations

| Feature | Details |

|---|---|

| Application Process | Entirely online with instant or very fast decisions for many applicants. |

| Policy Types | Term life (up to age 65), whole life, and guaranteed issue policies (ages 66-85). |

| Senior Resources | Dedicated senior page with sample rates and clear eligibility information. |

| Support Model | Digital-first experience with optional access to licensed agent assistance. |

Pros:

- Very Fast Application: The low-friction online process is one of the quickest available.

- Transparent Education: Clear information on costs, policy types, and eligibility for seniors.

- No Medical Exams: Many applicants can get coverage without a medical exam.

Cons:

- Modest Coverage Limits: Senior whole life policies often have coverage amounts of $30,000 or less.

- Limited Availability: Term life is not available for applicants over 65, and product options vary by state (not currently available in NY).

For more information or to get an instant quote, visit the official website: https://www.ethos.com/seniors/

7-Provider Whole Life Comparison for Seniors

| Option | Process & Complexity (🔄) | Speed & Efficiency (⚡) | Expected Outcomes / Impact (📊) | Effectiveness / Fit (⭐) | Ideal Use Cases & Tips (💡) |

|---|---|---|---|---|---|

| 12 Best Whole Life Insurance Policies for 2025 (My Policy Quote) | Low — curated shortlist; research-focused, no application engine | Fast to review; saves research time | Good for narrowing options; not personalized | ⭐⭐⭐ — strong screening tool for seniors | Best for initial comparison of simplified‑issue/final‑expense options; verify current quotes |

| Policygenius | Moderate — online quotes with licensed agent follow‑up | Moderate — instant sample rates; full quotes often need contact | High — broad carrier selection & transparent rate tables | ⭐⭐⭐⭐ — wide fit across health profiles | Use when you want many carriers and realistic pricing; expect follow‑up calls |

| SelectQuote | Higher — agent‑driven one‑application that shops many carriers | Moderate — efficient for complex cases but phone‑intensive | High for complex/medically‑challenging applicants due to agent advocacy | ⭐⭐⭐⭐ — strong for complex placements | Best if you prefer human guidance for complex health histories; no fee for quotes |

| AARP Life Insurance Program (New York Life) | Low — simple online flow for members; program administered by NYL | Fast — online quotes; many products require no exam | Reliable, brand‑backed options but coverage caps and graded periods apply | ⭐⭐⭐ — trusted and simple for moderate needs | Good for AARP members seeking brand strength and guaranteed‑acceptance options; check limits and waiting periods |

| Mutual of Omaha | Low–Moderate — direct insurer processes; simple underwriting paths | Moderate — online tools and calculators; issuance varies by product | Transparent senior pricing; suited to final‑expense/guaranteed whole life | ⭐⭐⭐ — dependable for funeral/final‑expense coverage | Use for straightforward final‑expense coverage; confirm state availability and caps |

| Corebridge Direct (Guaranteed Issue Whole Life) | Very low — guaranteed‑issue online purchase; no health questions | Fast — streamlined online purchase and clear eligibility | Guaranteed acceptance but low maximum coverage | ⭐⭐⭐ — best for guaranteed acceptance and simplicity | Best when health prevents traditional underwriting; not suited for larger coverage needs |

| Ethos | Low — fully digital application with instant/fast decisions for many | Very fast — instant decisions for qualifying applicants | Quick approvals; senior whole‑life amounts are modest | ⭐⭐⭐ — excellent for speed and simplicity | Ideal for tech‑savvy seniors seeking fast quotes; verify product/state availability |

Your Next Step: Getting a Personalized Quote

Navigating the world of life insurance can feel complex, but finding the right coverage is one of the most impactful financial decisions you can make for your family's future. Throughout this guide, we've explored a variety of the best life insurance for seniors, from comprehensive whole life policies to accessible guaranteed issue options and user-friendly comparison platforms. We've seen how providers like Mutual of Omaha excel in specific niches, while tools such as Policygenius and SelectQuote offer a broad market overview.

The key takeaway is that there is no single "best" policy for everyone. Your ideal coverage depends entirely on your personal circumstances. The right choice for a healthy 62-year-old early retiree will be vastly different from the best option for a 75-year-old with pre-existing health conditions seeking to cover final expenses.

Recapping Your Options and Key Considerations

Let's quickly revisit the core concepts to help you move forward with clarity. Remember that your decision should be a balance between your budget, your health, and your long-term goals.

- For Maximum Guarantees: Traditional whole life insurance offers a fixed premium, a guaranteed death benefit, and cash value accumulation. It's an excellent choice for those seeking lifelong stability and a legacy-building tool, but it comes with higher premiums.

- For Final Expense Coverage: Simplified issue and guaranteed issue policies, like those from Corebridge Direct or AARP, provide a straightforward path to securing funds for funeral costs and final debts. These are particularly valuable if you have health concerns that might disqualify you from other types of coverage.

- For Comparison Shopping: Platforms like Policygenius, SelectQuote, and Ethos are indispensable for modern consumers. They allow you to compare multiple offers at once, saving you time and ensuring you see a competitive range of rates for your specific profile.

Crucial Insight: The price you see in a generic online table is not a real offer. It is an estimate based on a perfect health profile. Your actual premium will be determined by your medical history, lifestyle, age, and desired coverage amount. The only way to know your true cost is to get a personalized quote.

Creating Your Action Plan

Armed with this information, you are now prepared to take the most important step: seeing what you personally qualify for. Don't let analysis paralysis stop you. The process is simpler than you might think and puts you in complete control.

- Define Your "Why": Before you get quotes, be clear on your objective. Is it to replace income, cover a mortgage, pay for final expenses, or leave a tax-free inheritance? Knowing your goal will help you determine the right coverage amount.

- Gather Your Information: Have basic details ready, such as your date of birth, an estimate of your height and weight, and a general understanding of your medical history and any medications you take.

- Use a Comparison Tool: Instead of visiting individual insurer websites one by one, leverage a comparison engine. This is the most efficient way to see how different carriers view your risk profile and what rates they can offer.

- Compare Apples to Apples: When you receive your quotes, make sure you are comparing similar policies. Look at the policy type (term vs. whole), the coverage amount, the carrier's financial strength rating (A.M. Best is a good resource), and any included riders or benefits.

Choosing the best life insurance for seniors is a proactive step toward securing your legacy and providing a financial safety net for those you love most. It’s an act of care that brings profound peace of mind. By moving from research to action, you can lock in your protection and ensure your family is supported, no matter what the future holds.

Ready to see your real rates? Use My Policy Quote to receive free, no-obligation quotes from multiple top-rated insurance carriers in minutes. Their simple tool makes it easy to compare the best life insurance for seniors and find the most affordable coverage for your unique needs.