At its core, an individual health plan is designed for one person. It’s the go-to choice for singles, freelancers, or anyone who doesn't have access to employer-sponsored coverage. A family health plan, on the other hand, bundles coverage for multiple people—like a couple or a family with kids—under a single, more streamlined policy.

The real difference isn't just who's covered; it's how the costs like deductibles and out-of-pocket maximums are structured. Getting this right is the key to protecting your finances.

Foundations of Health Insurance Choices

Figuring out the health insurance landscape is one of the most important things you can do for your financial security and well-being. It's a huge, growing part of the global economy for a reason. In 2024, the global health insurance market hit a value of about USD 2.14 trillion, and it's expected to more than double by 2032. That tells you just how much families are prioritizing good coverage.

The first big decision you'll face is choosing between an individual and a family health plan. This choice will shape both your monthly budget and how you access care when you need it most.

This screenshot from HealthCare.gov is the starting point for millions of Americans. It’s where you can compare plans side-by-side, see if you qualify for financial help, and get enrolled during the Open Enrollment Period. The whole site is built to make a complex process feel a lot simpler.

Key Plan Differences at a Glance

The best way to decide is to understand a few critical differences that affect your day-to-day coverage. If you want a refresher on the basics, our guide on https://mypolicyquote.com/2025/07/13/what-is-health-insurance-and-how-does-it-work/ is a great place to start.

Here’s a simple breakdown:

| Feature | Individual Plan | Family Plan |

|---|---|---|

| Coverage Scope | Just one person. | Multiple family members on one policy. |

| Deductible | Each person has their own separate deductible. | One shared, larger deductible for the whole family. |

| Premiums | One monthly payment for one person. | One combined premium for everyone. |

| Administration | Multiple policies to track if more than one person buys one. | One policy, one bill, one set of documents. Simple. |

The most significant practical difference is how the out-of-pocket maximum works. A family plan has a single cap on yearly medical spending for the entire household, offering a powerful financial safety net that individual plans cannot replicate for a group.

Both individual and family plans are designed to cover a wide range of medical needs. This often includes specialized treatments for mental health and substance abuse, like an Intensive Outpatient Program (IOP). Getting these fundamental differences down sets you up to make a confident, informed choice for your family.

A Head-to-Head Comparison of Plan Structures

Choosing between an individual and a family health plan feels like a huge decision, and it is. Both get you access to care, but how they handle costs, paperwork, and doctor networks can make a world of difference for your family’s budget and stress levels.

There’s no single "best" choice here. A family plan with a shared deductible can be a lifesaver if you know you’ll have a lot of medical appointments. But for families where everyone has different health needs, separate plans might actually save you money and give you more freedom.

Deductibles and Out-of-Pocket Maximums

This is where the two plans really differ. An individual health plan is simple: one person, one deductible, and one out-of-pocket maximum. If you and your spouse each have your own plan, you both have to hit your own separate financial targets before the insurance company starts paying the bigger share of the bills.

A family health plan pools everything together. It uses a shared, or "aggregate," deductible. This means every bill for every family member—from a child's ear infection to a parent's prescription—counts toward meeting one single, larger deductible. Once you hit that number, the plan’s benefits kick in for everyone.

The real power of a family plan is its single out-of-pocket maximum. Think of it as a hard financial ceiling for your family's medical bills for the year. It’s a critical safety net against a major health crisis that separate individual plans just can't offer in the same way.

Here’s a quick look at how the core features stack up against each other.

Individual vs. Family Health Plan Feature Comparison

| Feature | Individual Health Plan | Family Health Plan |

|---|---|---|

| Deductible | Each person has their own separate deductible to meet. | All family members contribute to a single, shared deductible. |

| Out-of-Pocket Max | Each person has their own out-of-pocket maximum. | All family members contribute to one combined out-of-pocket maximum. |

| Premium | One monthly premium payment per individual policy. | One consolidated monthly premium for the entire family. |

| Administration | Requires managing separate policies, payments, and documents for each person. | Streamlined with a single policy, bill, and set of documents. |

| Best For | Individuals, couples with different needs, or families where one member qualifies for subsidies. | Families who want simplified billing and a shared financial safety net. |

This table makes it clear: while family plans often have higher total premiums and out-of-pocket limits, their all-in-one structure can offer much more financial predictability for a group.

Premiums and Administrative Simplicity

From a pure budgeting and management standpoint, a family plan is just easier. You have one monthly premium, one set of documents to keep track of, and one insurance card for each person tied to the same account. It takes the headache out of juggling multiple policies.

On the other hand, buying separate individual health plans means you're managing different premium due dates, tracking separate deductibles, and keeping distinct policy papers organized. It’s more work, no question. But sometimes, it’s the cheaper route, especially if one person in the family qualifies for major subsidies on the Health Insurance Marketplace that others don’t.

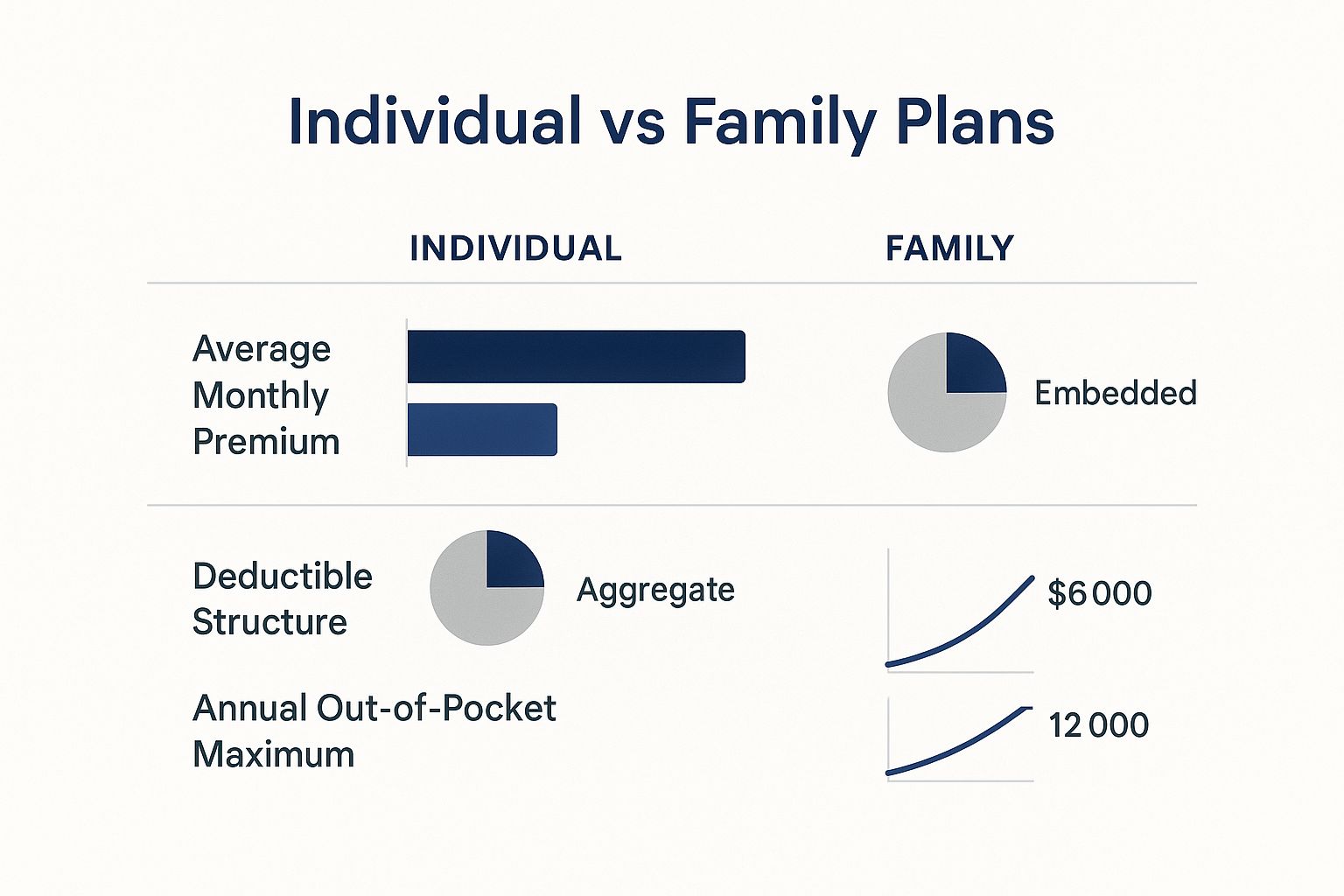

The chart below gives you a visual breakdown of how these key financial pieces differ.

Network and Coverage Flexibility

Flexibility is a huge factor. With a family plan, everyone is locked into the same network of doctors and hospitals. If that network works for everyone, great! But it can get tricky if, say, your teenager needs a specialist who happens to be out-of-network. The type of plan matters, too; you can learn more by exploring the difference between HMO and PPO plans.

This is where separate individual plans can be a game-changer. You can mix and match policies to build the perfect coverage quilt for your family's unique needs. For instance:

- A healthy parent and child could get a low-cost, high-deductible plan to save on premiums.

- A family member with a chronic illness could choose a more comprehensive plan with a lower deductible and access to the specific doctors they need.

"Unbundling" your coverage like this gives each person a plan that’s right for them, which can optimize both your costs and your access to care. The trade-off, of course, is the extra administrative work it takes to manage it all.

Decoding the Financial Impact on Your Budget

The monthly premium—that sticker price you see upfront—is just the tip of the iceberg. To really figure out which plan works for your wallet, you have to look deeper. It’s all about how individual and family health plans handle costs when you actually need care.

This is where things like deductibles and out-of-pocket maximums really come into play.

An individual plan is pretty straightforward. You have your own deductible, and once you hit it, your insurance starts kicking in more for your care. Simple enough.

But a family plan often works differently, using a shared, or "aggregate," deductible for everyone in the household. Think of it as one big pot of money that everyone’s medical costs chip away at. A child's check-up, a parent's prescription—it all goes toward meeting that one large deductible.

For families with a few members who need regular care, this can be a huge advantage. You’ll reach your cost-sharing limit much faster together than you ever would on separate plans.

Understanding Family Deductibles

Family plan deductibles usually come in two flavors, and the difference can make or break your budget. For a deeper dive, our guide on what is a deductible in insurance is a great place to start.

- Aggregate Deductible: This is the most common setup. The entire family deductible has to be met before the plan’s coinsurance kicks in for anyone.

- Embedded Deductible: This structure is a bit more flexible. It includes individual deductibles within the larger family one. Once a single person hits their individual limit, their coinsurance starts, even if the family total hasn't been reached yet.

But the real game-changer with a family plan is the single out-of-pocket maximum. This is your financial safety net. It’s an absolute ceiling on your medical spending for the year. No matter what, you will not pay more than this amount for covered services.

Imagine a family of four with a $15,000 family out-of-pocket max. Once their combined spending on deductibles, copays, and coinsurance hits that number, the plan pays 100% of covered costs for the rest of the year. It's powerful protection against a catastrophic medical event.

The Role of Subsidies and Tax Credits

For most of us, the final decision boils down to one thing: what can we actually afford? This is where Marketplace subsidies, also known as Premium Tax Credits, can make all the difference. These credits are based on your household income and can slash the monthly cost of an individual or family health plan.

Sometimes, it actually makes more sense to split a family onto separate individual plans. Let’s say one spouse has decent coverage through work, but adding the rest of the family is way too expensive. In that case, the other spouse and kids might qualify for big subsidies on their own Marketplace plan. Digging into the specific healthcare pricing details can reveal opportunities like this.

With insurance costs constantly on the rise, doing this math is essential. In 2024, the average annual premium for employer-sponsored single coverage hit $8,951, while family coverage soared to $25,572. Since employees foot a big chunk of that bill, exploring every avenue for savings isn't just smart—it's necessary.

When an Individual Health Plan Is the Smart Choice

A single family plan feels simple, but it’s not always the smartest or cheapest route. Sometimes, going with separate individual health plans for each person is a much better financial move. It lets you match the coverage to what each person actually needs and can unlock major savings.

This strategy is often called "unbundling." It means you’re ditching the one-size-fits-all approach. Yes, it takes a little more legwork to manage, but when the situation is right, the payoff is huge.

When One Partner Has Employer Coverage

This is probably the most common scenario. Imagine a couple where one person has a great, low-cost health plan through their job. The problem? The cost to add their spouse to that plan is often sky-high, since employers usually don't subsidize dependent coverage nearly as much.

In that case, the uncovered partner can go shop for their own individual health plan on the Health Insurance Marketplace. Depending on their income, they could qualify for big Premium Tax Credits that make their own policy way cheaper than jumping on the employer’s plan.

Here’s a real-world example:

- Partner A has a work plan that costs them $120/month.

- Adding Partner B to that plan would shoot the premium up to $600/month.

- But Partner B finds a solid Marketplace plan for $450/month and gets a $200/month subsidy, dropping their actual cost to just $250/month.

By splitting up, this couple saves $230 every single month. That's $2,760 a year back in their pockets, just for choosing two plans instead of one.

Customizing Coverage for Diverse Health Needs

Families aren’t all the same. Their healthcare needs can be completely different from one person to the next. A single family plan locks everyone into the same network and the same cost-sharing, which just doesn't work for everybody.

When you pick individual plans, you can be strategic. You can match the coverage directly to each person's unique health situation. That's a level of control you just can't get with a family plan, and it leads to better care and lower costs.

Think about a family of four. Maybe three of them are young and perfectly healthy, but one person is managing a chronic illness that requires a lot of specialist visits and pricey prescriptions.

This is where mixing and matching plans becomes a game-changer:

- For the healthy family members: A low-premium, high-deductible plan makes sense. It keeps their monthly payments low since they probably won’t need much medical care.

- For the person with chronic needs: A richer, low-deductible plan (like a Gold or Platinum plan) is the way to go. It gives them access to the specialists they need and puts a cap on their out-of-pocket drug costs.

This blended approach makes sure no one is overpaying for benefits they’ll never use, while the person who needs more support gets it. It’s a smarter way to think about coverage—one that puts both your finances and your family’s well-being first.

When a Family Health Plan Makes More Sense

For many families, keeping things simple is a top priority. When you’re managing a household, the idea of one single family health plan just feels right. It’s more than just convenience—it’s about pooling your resources and creating a unified financial safety net.

This is especially true for families with young kids or other dependents. Life is already a whirlwind of appointments, school runs, and unexpected fevers. Juggling multiple insurance policies on top of that is a headache no one needs. A family plan consolidates everything: one premium, one set of paperwork, and one number to call when you have a question. It cuts down on the mental clutter, big time.

The Power of a Single Family Deductible

Here’s where a family plan really shines: the shared deductible. Instead of each person having to meet their own separate deductible, every single medical expense—from your check-up to your child's ear infection—counts toward one single household deductible.

This is a game-changer for families who know they’ll be using their insurance. If you’re expecting regular doctor visits, therapy sessions, or prescription refills, you’ll hit that shared deductible much faster together. Once you do, the insurance company starts covering a much larger share of the costs for everyone on the plan. This simple feature can save you a ton of money over the year. You can learn more in our deep dive on family health insurance in 2025.

The real strength of a family plan is how it brings everyone under one financial umbrella. It gives you a clear, predictable path for your healthcare spending, offering peace of mind when life throws multiple curveballs in the same year.

This collective approach is a massive part of the global economy. In 2024, total insurance premium income hit about EUR 7.0 trillion, with a huge EUR 1,682 billion of that coming from health insurance. This shows just how vital these plans are for families everywhere. For more on this, check out the global insurance report on allianz.com.

Scenarios Where a Family Plan Excels

So, when does a family plan feel like the obvious choice?

- You're a growing family: Bringing home a new baby is chaotic enough. Adding them to one existing family plan is infinitely easier than setting up a brand-new individual policy.

- You have predictable medical needs: If a family member has a chronic condition or ongoing health needs, you can plan to meet that single deductible early and maximize your benefits for the rest of the year.

- You just want simplicity: If you value streamlined bills and less administrative hassle, the sheer convenience of a single plan is a huge win.

At the end of the day, a family plan is the right move when the benefits of a shared deductible and simplified management outweigh any need for highly customized, individual plans.

Getting Enrolled and Making the Final Call

Once you’ve got a handle on the differences between individual and family health plans, it’s time to actually get covered. The main time to do this is during the yearly Open Enrollment Period (OEP), which usually runs from November 1 through January 15. If you let that window close, you might have to wait until next year.

But life happens, and sometimes you can’t wait. Major life changes can open up a Special Enrollment Period (SEP), giving you a 60-day window to enroll outside of the OEP.

These qualifying life events include things like:

- Getting married or divorced

- Welcoming a new baby or adopting a child

- Losing your job-based health coverage

- Moving to a new zip code

A little prep work goes a long way. Getting your essential information together before you start shopping makes everything smoother. It’s the key to comparing plans without feeling rushed and making a final decision you can feel good about.

Your Enrollment Checklist

Before you head to the Health Insurance Marketplace, pull these details together. It'll make comparing your options faster and much more accurate.

- Estimate Your Household Income: Figure out what you expect to make for the upcoming year. This is crucial for seeing if you qualify for subsidies or tax credits that can lower your costs.

- List Your Doctors and Hospitals: Write down the names of your preferred doctors, specialists, and facilities. You’ll want to make sure they are in-network with any plan you're seriously considering.

- Note Your Prescription Meds: Make a quick list of all the medications you and your family take, including the dosages. You'll need this to check if they're covered under a plan's drug list (formulary).

- Gather Personal Info: Have Social Security numbers and birthdates ready for every single person who needs to be on the plan.

With all this info in hand, you can use the Marketplace filters to cut through the noise. It lets you zero in on the plans that actually fit your family's health needs and budget, turning a massive task into a simple, straightforward choice.

Your Top Questions, Answered

When you're sorting through health insurance options, a few common questions always seem to pop up. Let's clear up the confusion so you can move forward with total confidence.

Can My Spouse and I Be on Different Plans?

Yes, you absolutely can—and sometimes, it’s the smartest financial move you can make. It's completely fine for one partner to stay on an employer's plan while the other partner and kids sign up for a separate Marketplace plan.

Think of it as "unbundling" your coverage. This strategy works wonders when adding your whole family to a work plan costs a fortune. By splitting up, the family members getting their own plan might qualify for major subsidies, which could slash their monthly premiums.

What if We Have a Baby or Get Married?

Life changes things. A marriage, a new baby, or even losing other health coverage are all considered major life events. The good news? They kick off a Special Enrollment Period (SEP).

This gives you a 60-day window to adjust your insurance outside of the usual Open Enrollment season. During your SEP, you can merge two individual plans into a family one, add your newborn to your policy, or make any other changes that fit your new life.

Don’t wait on this. If you miss that 60-day window after a qualifying life event, you’re stuck. You’ll likely have to wait until the next Open Enrollment to make changes, which could leave a new family member uninsured.

Do These Plans Include Dental and Vision?

Probably not. Under the Affordable Care Act (ACA), dental and vision care for adults aren't considered "essential" benefits. While plans have to offer dental and vision for kids, coverage for adults almost always costs extra.

It’s safest to assume you’ll need to buy a separate, standalone policy for dental and vision unless you see it spelled out in the plan documents. Factoring this in from the start helps you create a much more realistic budget for your total healthcare costs.

Ready to stop guessing and start choosing? The experts at My Policy Quote are here to help you compare your options and find the perfect fit. Visit us today and let's get started!